2020 SPY TGIF PAYDAY! Trade Commentary

The trades below are for educational purposes only.

They are not recommendations to purchase any particular stock or options contract.

Note: they are suggested entry and exit points! disclaimer

|

Stock Information Updated 3/4/20 |

|

WEEKLY IV%: 36.61 MM +/- 7.84 VIX: 31.99 HIGH Long Term Bullish

|

|

Trade BIAS:

TGIF PAYDAY! BIAS: CALLS

HEDGE TRADE: PUTS

|

LIVE 2020 "REAL MONEY" Model Portfolio performance:

Risk Tolerance: VERY Aggressive 50% Compound Rate

Last Update: 4/22/20

Click HERE for full spreadsheet results.

NOTE: when applying a compound rate, you need to consider your tolerance to initial draw down until you start to capture winning trades.

Once you have profits building, you can survive multiple losing weeks and still keep building your contract loads into the hundreds and then thousands!

Beginner = Flat bet 1 - 2 contracts each week until you have 5 consecutive winners...then you start to compound your contract size.

Conservative = +1 contract ONLY after a winning trade.

Moderate = +1 contract with each weekly trade regardless of a fill or loss.

Aggressive = 25% of profits from last winning trade.

Very Aggressive = 50% of profits from last winning trade—the Model Portfolio

Any compounding method you choose has the potential to get you to land of 7-Figure profitability in 1-2 years, so be patient and CONSISTENT each week and I will see you there!

2020 SPY Trades / 2020 SPY Charts

2020 TGIF Main Navigation / 2020 Lotto Trades / 2020 AMZN Trades

|

THURSDAY 3/19/20 - Due to the Corona Virus events there have not been nor will there be any TGIF PAYDAY! trades for the foreseeable future. I will post updated trade ideas when the markets get back to a normal trend and continue the 1-2 year journey to the land of 7-Figure profitability!!

==================================================================================

WEDNESDAY 3/4/20 2:30 PM PST -

What a roller coaster the markets are on right now. Down 1K one day, then back up 1K the next, keeps traders frustrated not knowing what to do from day-to-day. The nice thing about trading the TGIF PAYDAY! Strategy is we never have to deal with all the fluctuations each day because we wait until Thursday to place orders and always make the trend our friend. Of course there is always the potential for a losing trade, but the formula works, and when we catch winning trades, the profits SOAR!

Ok, so this weeks BIAS is CALLS ; however, with the IV and VIX pumped up, all option strike prices are also going to be expensive. This means we cannot do the usual ITM or ATM options because there will be NO chance of getting filled at our MAX SPEND of $0.75; therefore, if you want to attempt to get in the game, then we will need to fish a little further OTM each week until the VIX comes back down; and I would be sure to take half off at any DoubleUP!.

Yesterday the Federal Reserve made an emergency rate cut of .50 basis points; and although it initially popped up the markets; they ended up getting sold down again by the close; because investors are beginning to realize this cut by the Fed was done to "patch" things up vs. easing monetary policy in light of an alleged strong economy.

The big fear here is if supply chains from China continue to get disrupted, the impact on our economy will compound and markets will continue to slide lower for months—in spite of any quantitative easing efforts by the fed to quash the panic selling from continuing....maybe.

Today, the news announced there was a coronavirus-linked death in California; and if this becomes a larger scale situation; then you can bet your bottom dollar on PUTS and clean up! On the other hand, any announcement of containment, vaccine or...and the rallies could be parabolic.

This is why we trade the strategy as proven, but definitely have those wild card Lotto Trades in place too—and the best strike targets are the SGB zones.

================================================================================================================================ MONDAY 3/2/20 1:30 PM PST - Friday was the washout drop and even though the markets had a nice snap back rally today, it was not enough to bring the 320 CALLS back to life, so I expired worthless on this wild card Lotto Trade.

What was a good strike(s) were 300-305 after the open today because they dipped and then rallied up to 10X; however, you have to have those fishing orders in place, and currently I do not have the capital in the LIVE model portfolio to apply the "tweaks" to the strategy at this time; however, when I am compounding at 100 contact loads, I will definitely be layering and we will catch a lot of these movements in the future.

Remember, it only takes a couple of winning weeks to wipe out multiple losing trades and begin to grow the account at an exponential rate.

I know it can be frustrating at times like these not making profits and having to take losses, but NO ONE can be 100% accurate and the keys to the kingdom are through the compounding process!

Profits Up!

Frank

====================================================================================================================== FRIDAY 2/28/20 1:30 PM PST - There were NO FILLS this week on the TGIF PAYDAY! trades; however, I did get filled on the 320 wild card Lotto CALLS for Monday expiration.

=================================================================================================================== WEDNESDAY 2/26/20 1:30 PM PST -

I am back in action this week now that I have finished moving and WOW, the markets got decimated over the weekend with the Corona Virus and political news. If you were following the formula and doing the hedge PUTS last week since I was unable to send out email due to technical difficulties, then you made HUGE profits on Monday when the $DJI was slammed from the corona virus and election news.

Investors are definitely on defense and the path is looking pretty scary with this virus stuff hanging around. The markets did NOT do the typical buy-the-dip move after Monday's 1k point drop; and then Tuesday the next shoe dropped taking the markets down another 1k points closing below the 200 MA. Today was the "bounce" and that now looks like a dead-cat-bounce scenario. The problem we have now is the IV is soooo pumped up with the VIX at 27, there will not be any cheap options to trade; and therefore this week’s TGIF PAYDAY! strikes will most likely NOT get filled this week.

What we do have is the potential for another BIG move in either direction, so I am looking to lay some wild card Lotto Trade orders this week. The markets have now dropped over 2k points, but has still not hit the 10% correction territory move; which puts the DJI down to around 26,600. The weekly chart has the 200 MA way down at 24,000, so there is still plenty of room to go lower if this current virus news keeps building and we get an outbreak in the USA.

What will impact this markets for the coming quarter is the slowdown in shipments from China; which could cause a global recession as supply chains get impacted and prices rise due to lack of inventory vs. demand. This can have a snowball effect and cause panic selling. In fact, we have already seen some of it beginning with stocks like: AAPL, BKNG, AMZN and others—the next quarterly reports will be interesting to say the least.

What is the wild card opportunity going forward is how the virus news continues to play out. Any announced "cure" or "vaccines" will have the typical knee-jerk reaction, so keeping some wild card Lotto Trade CALLS in play is something I plan to do on stock strikes up to 15% OTM with fishing orders at $0.10 or lower; however, when fishing on the SPY, you stick to strike prices up to 3% OTM.

TGIF PAYDAY BIAS is PUTS

It is always amazing to see that it takes but 1 week to wipe out multiple weeks of gains making PUTS the most profitable trading opportunities.

There is still a lot of downside possibilities with the SPY so let the SGB zones be your strike guides and also pick strikes "above" the major moving averages 89 or 200.

=====================================================================================================================

FRIDAY 2/14/20 2:30 AM PST - Sometimes I just want to shoot myself in the head instead of the FOOT! Of course, hindsight is always 20/20, but one thing I do know is if you just KISS this strategy, then you are going to get a lot more good feelings than disappointments. Had I not "reacted" to the futures when I checked them in the early morning session and changing the strike prices, then I/we would have woken up to a nice low end fill on the 337.50 CALLS and made a DoubleUP! yesterday; and if the momentum continues today, it SHOULD have been ANOTHER winning week for me/us....arrrgggghhhhh

Ok, so I am definitely NOT perfect, and when you trade with your brain (emotions), then you are assured to have a lot more volatility in your results vs. consistent and predictable results when trading a formula. If you trade like a ROBOT without fear or greed, then you are guaranteed unbelievable results based on what we all witnessed last year since I went live with this amazing strategy!

I am cancelling my SPY trades for this week and will reload the "LIVE" account with another $100 to begin the journey again—this time like a freaking ROBOT!

The model portfolio was filled on ALL the AMZN trades so let's see what happens today.

I see the low was $0.75 on the 336's and I had my MAX at $0.50, so maybe one or some of my subscribers were filled; which turned into a nice WINNER or at the very least a DoubleUP! today.

Here is what happened to the original strikes I posted:

==================================================================================================== WEDNESDAY 2/13/20 3:00 AM PST -

Another week of opportunities are upon us and with the unfortunate results from last week, I am looking for some redemption soon…hopefully Friday will get us back on track! If you were trading each week this year with a GTC order, then you are still at a nice YTD profit and should be on the compound journey. I on the other hand, have been sticking 100% to the “core” strategy; which means I was cancelling orders if not filled by 7:30 AM—and in my angst from that week, I made another executive decision last week to adjust my strikes and “chase” a trade; which is proof positive it is far better to “let” trades happen vs. “making” them happen. Of course, when you have compounded into the hundreds of contracts, then you have a ton of “tweaking” options to work your trades; however, since the “LIVE” model portfolio is just starting out, I am willing to approach each week with the all-or-nothing style of trading until I can get my compound on. Ok, so if you are closely following my trades, then taking the hits is part of the journey, and when the runs come, this aggressive style of trading the strategy will inevitably produce grand slams along kick starting the compounding in a much bigger way! However, if you do not have the tolerance to initial draw down, and want to let time work things out, then stick to the “core” strategy as taught; and when you arrive in the land of 7-Figure profitability; you will not care if it took an extra year or two. The daily chart had a very nice drop from the last SGB; and the bounce back was beginning to fail again; which makes this weeks “CALL BIAS” trade a bit of a quandary because yesterday produced another SGB—and we know that has proven to be more of a SHORT signal than a LONG signal. Last Friday, the markets were failing at that SGB zone, but over the weekend the president tweeted about his new budget “spending” plan and that created the surge on Monday killing the hedge PUTS; however, this weeks higher move has been on declining volume. Had that news not come out, those “hedge” puts would have most likely worked out and got us a pay back for last weeks failed CALLS—news can always affect momentum and it’s always better to be on the right side when it does…know what I mean? A couple of other things to notice is today was the 8th day since the last sell off bounce and we know the markets like to move in Fibonacci sequencing; which makes yesterday's SGB potentially more significant. If you are planning on doing the "hedge" PUTS, then get your orders on and I would also consider some wild card Lotto Trade PUTS at the 332 strike with 2/18/20 expiration. The KISS method has us trading CALLS this week, and that is the plan; however, this time I will NOT adjust strikes if not filled on Thursday and also stick to a conservative strike with a GTC order. NOTE: Whenever there are SGB’s, I would always have some HEDGE PUTS in place if you have the capital to buy them.

================================================================================================================== FRIDAY 2/7/20 6:00 PM PST -

What a bummer we could not achieve the breakout move on the better than expected unemployment report. The corona virus is keeping a lid on the upside action and the DJI / SPY took a slide to the downside. If you have the hedge PUTS on for Monday, we may get some relief and rebate profits to even out the losing week. What was the winning TGIF PAYDAY! trade this week was AMZN which proves yet again the strategy WORKS and once you are able to expand your trading to AMZN you can begin to multiply your results.

It is a bit frustrating to take a hit for "buying in" this week and not benefitting from that weeks winning action; however, depending on Monday's final results, the "live" model portfolio will still have its original $100 investment and I will just continue win, lose or no trade because the strategy is a journey and the end of the road will be 7-Figures in 12-24 months!

==================================================================================================================

THURSDAY 2/5/20 3:30 PM PST -

I was FILLED on all my adjusted orders today.

===============================================================================================

WEDNESDAY 2/5/20 4:00 PM PST -

Wow what a crazy week of trading so far, especially if you were trading in TSLA...OMG...it was the BIGGEST parabolic move I have seen since NFLX back in 2013. If you missed out (I did...and I am crying my eyes out) you can be assured IT WILL HAPPEN AGAIN; and in the future we will have the capital to just keep laying Lotto Trade orders every week; and will hook onto a Moby Dick Trade like that one in the future!

Today the Senate acquitted President Trump (as expected) and the markets rallied with a printed high of $333.09. I want to point out that when you see specific "hi or lo" prints and/or closing price on stocks, THAT HAS SIGNIFICANCE and should be an ALERT to you something is going to happen in the near future—as if "code" has been sent to the "insiders"...know what I mean ;-)

Interestingly enough, not only do we have a "code" number, notice how the SPY also closed DEAD ON to the previous SGB zone top!

Friday is the unemployment report, and with the impeachment fiasco FINALLY over, we could get that catapult bust out move or take it all back implosion if the numbers are bad.

This week the BIAS is CALLS but I am definitely buying some wildcard PUTS for next Monday expiration too.

As I outlined last week, I am going to place ALL of my TGIF PAYDAY! orders at GTC and if I am not filled by 7:30 AM, then I will adjust down my contract loads by 50% when compounding; otherwise, when just starting out with 1-2 contracts, it's all-or-nothing for me.

If you do not have the initial capital to absorb multiple losses until you get a compound started, then stick to the "core" strategy and cancel all orders by 7:30 AM PST when price opens higher than our MAX spend of $0.50 - 0.75—many times in the past, if the options are already priced well above the MAX and end up falling back in line by the end of trading Thursday, the "trend" momentum is typically lost and that results in a losing trade on Friday. That is why I would cut the contract load in half just in case; however, if you are in-it-to-win-it, then you can get a massive profit like the one that happened last week...especially when trading the PUT side with SGB's involved.

Until the VIX drops under the "red" line, the BULLS are still in control of momentum.

My LIVE account orders:

============================================================================================================================

FRIDAY 1/31/20 2:00 PM PST - Well, this week should have been another WINNER, but not for me because I cancelled my orders vs. leaving them on GTC into Friday. I hope some of you may have done just that (which is what I teach in the training module) but I managed to make a conservative decision and it COST ME this time.

Ok, so if you are starting out, then you should just make the spend and set your orders as GTC; and if not filled on Thursday, adjust them for lower entry prices on Friday morning— ESPECIALLY WHEN TRADING PUTS AND THERE ARE SGB'S INVOLVED!!

Starting next week, I am placing all my orders as GTC, and leaving them on into Friday.

I will initially place orders at a LIMIT of $0.20 and will increase my contracts based on the MAX spend of $0.50.

If I am not filled by 6:35 AM PST, and the options are trading at $0.50 or lower, then I will just BUY IN for my full contract load.

If they are trading higher than $0.75, then I will change the order to that price as well as cut the contract load back based on the $0.50 MAX spend.

If I am not filled on anything by 7:30 AM PST, then I will cut my contract load in half and adjust the LIMIT price to $0.50 for the rest of the day GTC.

If I am not filled on Thursday, then I will attempt to get filled at the Friday open for $0.25 or less on half my contract load.

If not filled by 7:00 AM PST Friday, then I will cancel all orders and wait until next week.

NOTE: Be sure to read through the training module so you understand how to lay the orders with respect to prices, time and quantity.

As we progress on this journey, we need to keep the pedal to the metal and get the compound going, then we can ease off and start the layering, multi-strike and expirations etc. to maximize our profits.

WEDNESDAY 1/29/20 6:00 PM PST -

Markets are skittish as traders head to the end of trading for January. Since I pointed out the SGB, the SPY has had a very strong move to the downside and until it can take out that SGB zone, my BIAS will remain to the PUT side of trading. Today was the first Federal Reserve meeting of the year and they made no rate hike decisions and affirms commitment to higher inflation returning to their "symmetric 2 percent objective." After the comments were summed up, the markets did pull back a little bit closing the day in the red; which makes the BIAS PUTS this week; however, I am also keeping some wild card CALLS in play too.

The impeachment trail is still going on but does not seem to have much influence on the markets. What has been showing influence is the Coronavirus "scare" news. Every couple years, there is some sort of "pandemic" virus story that gets over reported to "scare" people and this one could be the one to end us all...lol.

If the virus manages an outbreak directly in the US we could see a lot of selling pressure in the markets since investors typically overreact, so keeping some wild card LOTTO TRADE PUTS in place can make you some HUGE profits, but it requires you maintain them at all times until that happens.

As for this weeks TGIF PAYDAY! trades, the IV is pumped up and also the VIX so we most likely will not get filled tomorrow since the ATM/ITM options are already priced quite high.

Still, we lay those orders and see what happens.

========================================================================================================

TUESDAY 1/28/20 12:00 PM PST - Yesterday, the wild card Lotto Trade PUTS turned into a Moby Dick WINNER! Hope you were able to get in on some or all of that action!

Here were the Model Portfolio trades:

==========================================================================================================================

FRIDAY 1/24/20 2:00 PM PST - A WINNING WEEK!! I took profits early on the OTM strikes and my DoubleUP! on the BIAS strike. If you were able to hold longer or at least half, then you had HUGE GAINS this week.

The goal here is not to win the maximum each week, but to keep the profits coming in so the compounding can start. Then the layering and ultimately the 5 - 6 figure winning weeks in our future!

Here is what the future potential will be when we can layer orders for the Friday open and trades go our direction:

Here were my "LIVE" account trades:

See you next week as we continue the journey to the land of 7-Figure profitability!

Profits UP!

Frank

=====================================================================================================

WEDNESDAY 1/22/20 9:00 PM PST - A new week of opportunities and hopefully massive profits as we try to pop-the-clutch on this weeks trades with a multi-strike trade.

The BIAS is PUTS and I am going to layer a couple of strikes OTM this time in an attempt to get filled and hopefully kick start this journey. The wild card PUTS for next Monday are speculation things go bad over the weekend with the

Today was a SGB at the top of a 12-day UP trend indicating there is potential exhaustion building. With the Senate impeachment trial in full swing, and if there are NO decisions (acquittal expected) this week, we could see some more downside as investors position for a potentially negative out come of the POTUS.

Other stocks I follow had SGB's today too: AAPL, TSLA, GOOGL, DIS, FB 3 days ago QQQ to list a few.

If we get a market wide drop, the SGB's are the heads up signaling I have documented over the years as high-odds PUT plays. Of course, any positive news from the trial and we most likely just continue to climb higher; therefore, I am going to have some wild card Lotto Trades on for Monday expiration.

======================================================================================================================= SATURDAY 1/18/20 1:00 AM PST - There were no fills this week on the 329 strike; however, if we were fishing on Wednesday then it was a solid winner. BUT if we went 1-2 strikes OTM this week would have produced a triple. Starting next week I will begin to layer strikes; and hopefully pop-the-clutch so we can start moving on down the road to the land of 6-Figure profitability!

================================================================================================

WEDNESDAY 1/15/20 3:00 PM PST -

Today the president signed the "phase 1" deal with China and markets really did not care. Also, the Demolition squad is on the march to impeachment tonight serving their papers! It is currently expected the Senate will end the charade and acquit the president, but you just don't know until the end what the final outcome will be.

The VIX is LOW so that means wild card PUTS are in play; however, the BIAS is CALLS for this weeks TGIF PAYDAY! trade. I am a wee bit concerned that the markets have run out of steam because Monday was a huge UP day; however, AMZN did NOT participate?

So far the year has started off flat for the strategy but we just maintain the course and navigate the bumps in road as we head on down the journey to the land of 7-Figure profitability!

I will be placing fishing orders for $0.20, but I will have my "core" contract load in at $0.50 for the open.

Remember, we are ALWAYS spending the $0.50 on this strategy as that has proven to be the "sweet spot" for the trade. If you are "fishing" for the lower entry prices, then you either get the discount or, in my recommendation, you BUY MORE CONTRACTS based on the "spend" of $0.50.

NOTE: if you are not filled by 7:30 AM PST then I personally CANCEL the orders and wait until the next week—I do not make trades happen...I let them happen!

Because yesterday was a DOJI and Monday was a HOD close, I am not all that confident the momentum will continue higher, so I am definitely looking to buy some wild card PUTS with Monday 1/21/20 expiration but this is ALWAYS a "hedge" trade and not part of the TGIF PAYDAY! core strategy.

================================================================================================

Saturday 1/11/20 - NO FILLS this week on the SPY bias trade, so we on onto the next week to continue the journey!

==========================================================================================================

WEDNESDAY 1/8/20 3:00 PM PST -

Markets and investors are definitely on high anxiety and angst with the whipsaw moves this week. It seems to me today's move was nothing more than a short squeeze after President Trump announced no US or IRAQ casualties from the missile attacks and the US will seek diplomatic resolution vs. strong military actions. This has created a "CALL BIAS" this week, but since the markets did not close over that Jan 2 high today shows there are NO solid buyers up here...other than maybe the FOMC...lol....which I am sure is busy keeping their "quantitative easing" fingers on the buy, buy, buy trigger.

Earnings season has started and that will add more volatility in the coming weeks; also, I do not think the issues with IRAN are going to subside anytime soon; since the US has been in a battle with this country for decades; but for now, it appears cooler heads over there may prevail and relations between us could maybe stabilize?

If you are just starting out with the TGIF PAYDAY! strategy this year, then we simply follow the trend and take the wins with the occasional losses and move on down the road. If you are already compounding from last years massive gains, then keeping some wild card PUTS in place is a good idea—I would stick to strike prices at the SGB's between 319-322 and always FISH for better entry prices on the majority of your contracts since the IV is pumped up.

A couple things to take note of is this is the 8th trading day of 2020; and so far, the 5th UP week too—both of which are Fibonacci sequencing which can have impact on fund managers quant trading models and create some buy/sell movement.

Also, this week is the FULL MOON cycle which also has shown to have impact from time-to-time—big money managers and traders in general are known to be superstitious types; and I have seen some wild moves in the past when the they are on expiation Friday's.

Best of trading success this week!

Profits UP!

Frank

==================================================================================================================================

FRIDAY 1/3/20 1:00 PM PST - Congratulations...the first TGIF PAYDAY! trade was a success!

I had an order in for $1.50 at the open the options opened up at $1.20 and by the time I could get my order changed, I had to take a DbouleUP! on half and I held the rest all day to see what else I could get—I hope you did better than me and please send testimonials!

Overall, we made a profit today and will continue the journey next week.

Here were my trades this week;

Remember, once I get to 10+ contract loads, I will start applying "tweaks" to my trades including: layering multiple strikes, expiration dates, hedges and Lotto Trades but ONLY with profits and NEVER seed capital.

I want to build the "core" account up so I have a very large Money Tree in the land of 7-Figure profitability!

==============================================================================================================

THURSDAY 1/1/20 1:45 PM PST - I see that you could have been filled for a DoubleUP! today if you had the sell orders in place, but I did not because I am in this trade all-or-nothing since its just a 2-contract order. Once I get to 10 contracts, then I will start taking half off at a DoubleUP!; unless the options go triple or higher; then I will definitely take half off from that point.

Unfortunately, we are looking like the first trade of 2020 will be a negative result, but it's not over until the closing bell tomorrow.

I am on a single strike / trade until I compound to 10 contract loads, then I will start to apply layering, tweaks, hedges etc. as we get rolling down that road to the land of 7-Figure profitability!

================================================================================================================

THURSDAY 1/1/20 6:45 AM PST - I bought 2-contracts for $0.32 each. I am in this trade all-or-nothing into Tomorrow.

===================================================================================================================

WEDNESDAY 1/1/20 5:00 PM PST - HAPPY NEW YEAR!

I am so excited to see how we do this year with the LIVE Model Portfolio!

If we get similar results in the next 6-months that we had in the past 6-months, then I fully expect to reach 6-Figures by June; and maybe even 7-Figures by the end of the year!!!!

We can expect a lot of volatility this year with the presidential election cycle starting, so I plan to keep wild card Lotto Trades in place every week as I build TGIF PAYDAY! profits with this LIVE account.

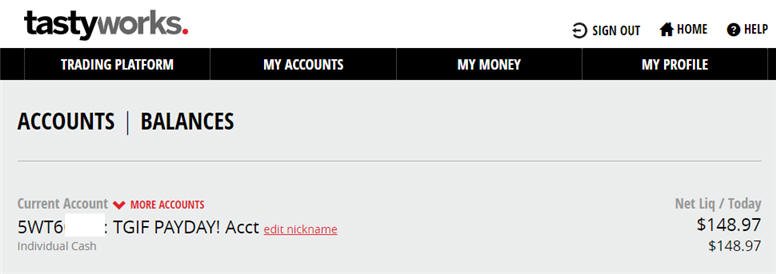

I am going to start this account with $100.00 at TastyWorks and apply the strategy like a ROBOT!

I will be trading the SPY starting with 1 contract and applying the aggressive 50% compound rate; and I will not stop compounding until I reach 2,000 contracts—ultimately looking to reach 5,000 contract loads with this account!

I will be placing my first orders at $0.20 for 3 contracts at the OPEN and then adjusting to 1 contract for $0.50 GTC if not filled; and will not cancel the order until Friday 7:30 AM PST.; however, if I get filled on more than 1 contract at the open, then I will place a GTC order to sell at least half for a DoubleUP! profit.

If I am only filled on 1 contract at $0.50, then I will hold it into Friday regardless of a DoubleUP! on Thursday (unless it goes parabolic) then I will put in profit stop at a DoubleUP! for the Friday open; otherwise, I will hold the position into Friday afternoon trading session all-or-nothing each week until I am compounding 10+ contracts...then its always half off at a DoubleUP! from that point forward plus adding "tweaks" like: Layering, Lotto Trades, Spreads etc. as we move on down the road to the land of 7-Figure profitability.

NOTE: As for trading AMZN, I will wait until the SPY has made enough profits to pay for at least 2 contracts of AMZN.

Ok, here we gooooooo...

Since the markets were closed today, we have a "mixed" BIAS to the PUT side, but since we are in such a strong bullish overall trend, I will have wild card Lotto Trades in place in my other account.

I suspected the markets would close the year at all-time-highs, but instead, we tested the double SGB's and they held...so far—my overall BIAS is CALLS over these double SGB zones and PUTS under for Lotto Trades.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

©1999-2024 www.OptionRadio.com All rights reserved.

Privacy Statement Terms of Service Disclaimer

|

|

© 1999-2024 OptionRadio.com All Rights Reserved.

Reproduction without permission is prohibited.

U.S. Government Required Disclaimer - No profitability nor performance claims of any kind are being made on this entire website, email distributions or recorded content. All information provided herein is for educational purposes only and should not be construed as investment advice. Site visitors are advised that trading is a high-risk, speculative activity and that generally expected customer results are that all traders will incur trading losses, regardless of the training they may receive and will not become profitable. You accept all liability resulting from your trading decisions; we assume no responsibilities for your trading results. All sales are final for all products and services sold and no refunds are offered. We are not an investment advisory service, nor a registered investment advisor. No individual advice nor trading management services of any kind are provided, therefore no member nor subscriber should assume that their participation in the services provided herein serves, nor is suitable as, a substitute for ongoing individual personalized investment advice from an investment professional chosen by the member/subscriber. Nothing in our website shall be deemed a solicitation or an offer to buy nor sell stocks, currencies, futures, options or any other instrument. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on our site. Also, the past performance of any trading methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Site visitors, email subscribers and customers hereby agree to all terms found in our complete disclaimer, terms of use and privacy policy pages. Every visitor to this site, and subscriber (or prospective subscriber or customer) acknowledges and accepts the limitations of the services provided, and agrees, as a condition precedent to his/her/its access to our sites, to release and hold harmless OptionRadio, its officers, directors, owners, employees and agents from any and all liability of any kind (including but not limited to his/her viewing of this sites' content, emails, subscription to services and/or purchase of any trader training product or service herein). Trade with discipline and you will have smarter, winning trades. |