5

|

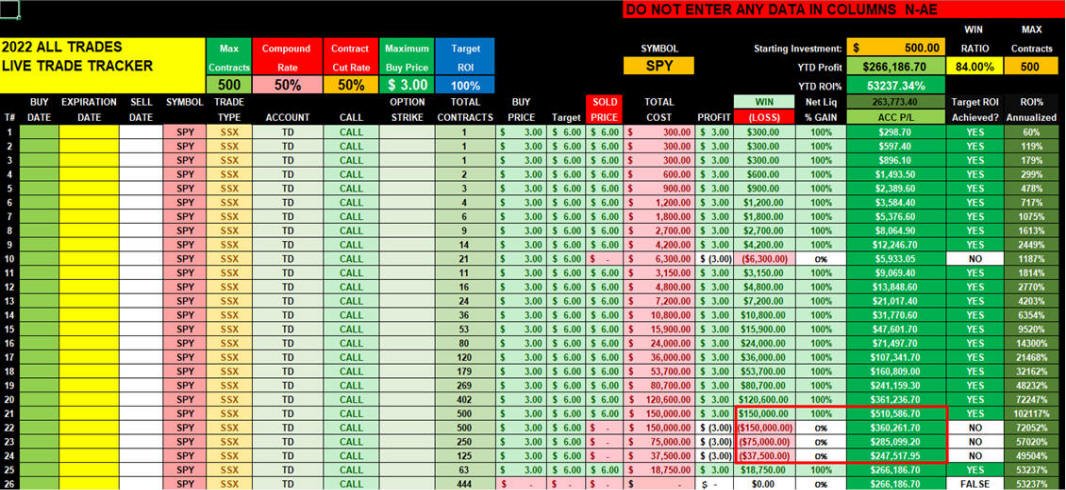

2022 SPREADSHEET TRAINING Last Update 7-21-22 3:00 PM PST

Greetings SC and SSX Traders!

Attached is the latest compounder spreadsheet to help you keep your compounding on track.

It is very important to use the spreadsheet vs. manipulating your contract loads from trade-to-trade as that will slow down your path to the land of 6-Figure profitability, create FOMO or activate GREED and you WANT TO AVOID THAT!

This spreadsheet is a bit complex, so you can easily break the formulas if you input data in the wrong columns; therefore, be sure to make a master copy just in case.

All the “red” outlined boxes and/or arrows are places you can input your parameters.

When you are trading the SC OR SSX strategies, I highly recommend you run the CALLS and PUTS on separate spreadsheets; as they will have their own compounding trajectory based on the winners and losers. The fastest path to the land of 6-Figure profitability is through a straight line; and if you are mingling CALLS with PUTS, then your road will be winding and rocky…apply the KISS method and you will get where you want to go much faster.

The “Test Page” is where you can try out some different compounding scenarios to discover what is “your” best parameters and desired goals should be; however, once you start trading, it is imperative that you stick to those parameters so the magic of compounding can accelerate your journey.

Lets discuss the data inputs:

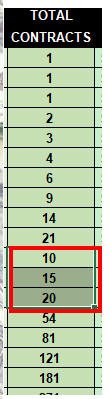

Once you have input your parameters, it is best practice to stick to these until you reach your MAX contract loads. I show 500 Max contracts because it gets exciting to see the potential; however, it takes quite a bit of moxie to invest up to $150k in a single trade; even if your are trading on profits; so you can make your MAX whatever amount of spend you can stomach. Although there is the potential to get filled on 500+ contracts, the algo system and/or market makers WILL manipulate your sell orders and fill you anywhere from 1 to 100 contracts in a single trade—I have personally been filled on 100 contracts in a single trade, but I have also been partially filled over multiple trades to get my 100 completed; however, I have seen more than 1,000 get filled on Time and Sales in one trade too; so I know it is possible to get pretty much any size I want to trade filled since the SPY is almost limitless on liquidity. The important thing to point out is getting to your MAX contract loads, because once you do that, any losing days take less of a bite out of your overall Accumulated P/L ;-).

For example:

If you are just starting to build contract loads to 20, and have a losing trade (inevitable), then your accumulated P/L does take a hit in the early stages; however, your Contract Cut Rate also lowers your next trade to compensate and slow the potential drawdown in your profits if you have more than one losing trade in a row—KEEP CLAM and TRADE ON!

Once you get to your MAX contract loads, losing trades have less of an impact on your profits growth trajectory:

When you start your trading, you can input your initial contracts in the first cell:

After that, the formula begins to calculate your compounding progress based on the “net” accumulated profits from the previous trades.

If you input your own contract loads lower than the suggested size on the next trade, the spreadsheet will resume compounding from there and extend your time to reach the MAX contract loads.

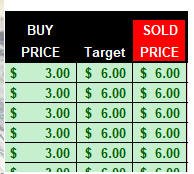

Ok, lets talk about MAX Spend and Target ROI.

The spreadsheet is designed to keep you on a constant upward trajectory, and if you want to get there as soon as you can, then you must stick to the parameters you started with. All of the compounding calculations are based on your MAX BUY price divided by your last accumulated profits total to get your next contract loads. If you are able to buy in at a cheaper price (which happens many times) than $3.00, you either stick to the suggested contract loads at that price you are paying or you can increase your contract loads to match the MAX SPEND for that trade.

For example: You are buying 10 contracts on your next trade for the MAX spend of $3.00 which is $3,000 dollars invested. If you can actually get filled for $2.50, then your spend is only $2,500, so if you were to divide the extra $500 into your current buy price, you can actually get an additional (2) contracts and keep on track with the spreadsheet MAX SPEND, or you can put in fishing orders for an even lower price and buy MORE contracts. Either way, you never spend more than the MAX and you are on a solid trajectory to accelerate your journey a little faster if you want to—just make sure you maintain your ROI target on the initial trade quantity, and then you can close out the extra contracts at a higher ROI on those parabolic days that will come!

Next we will discuss the 50% vs.100% vs. CALLS vs. PUTS.

If you are looking over the Model Portfolios, then you can see 2022 has been a massive success on the PUTS, but the CALLS have also produced nice gains too. This is why I strongly recommend that you do not switch sides week-to-week with profits from winners as that will no doubt slow your overall success dramatically when you have a losing week on a particular side and/or both sides. The initial strategy was based on a 100% ROI with 11-days to expiration, which gives you more opportunity with two weekends to catch market moving news and/or continued momentum! I started a 50% ROI to also show you what a shorter time (7-days) to expiration can produce; however, choosing any ROI model will get you to the land of 6-Figure profitability!! I prefer the 100% ROI because I have 11 days to get there vs. 7 days on the 50%; even though you typically get the 50% in 1-3 days, but as you can see on the Model Portfolios, the 100% ROI has the potential to make substantially more profits! Finally, what the spreadsheets do not do is calculate “layering” exits and that is where you can get to the land of 7-Figure profitability—especially when you catch the Moby Dick winners on a Friday or Monday…cha-CHING!$$! So what do I mean by layering? This is when you are compounding over 10 contracts or higher and you take some of the profits and begin another spreadsheet to keep track of your layered trades. The key here is to always maintain the original spreadsheet and trajectory so you have a guaranteed money-machine producing profits to pay for your layering without disrupting your path when they do not work out. Remember, you do NOT have to swing for fences with this strategy, all you have to do is maintain an consistent trajectory and let the magic of compounding contract loads take you all the way!!!

Profits UP!

Frank The don-Franko

PS. If you have any questions on using the spreadsheets just shoot me an email.

|

How

much of the profits from the accumulated winning trades you want to

reinvest into the next one.

How

much of the profits from the accumulated winning trades you want to

reinvest into the next one.  How

much you will reduce your next contract load if you have a losing trade.

How

much you will reduce your next contract load if you have a losing trade.

Your

maximum price you will pay with each trade.

Your

maximum price you will pay with each trade.  The

profit target profit you want to get with each winning trade.

The

profit target profit you want to get with each winning trade.