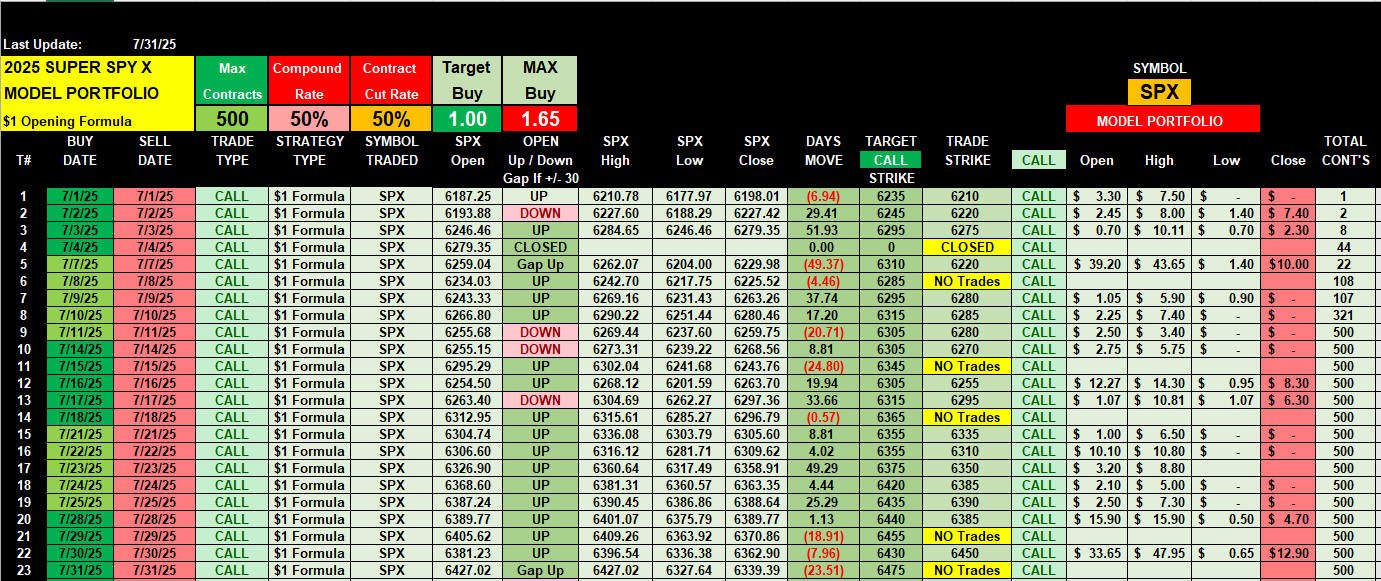

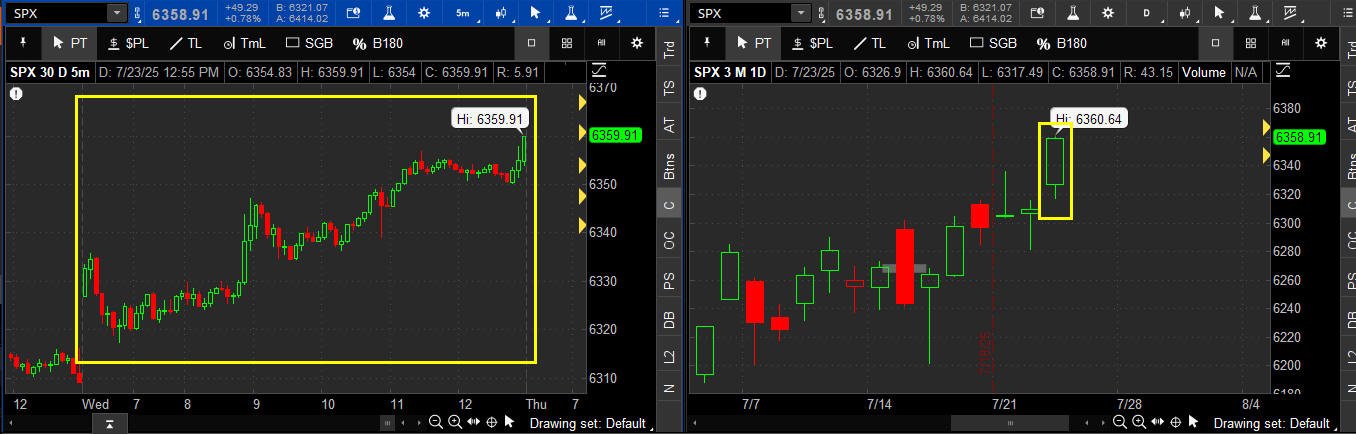

Updated 7-31-25

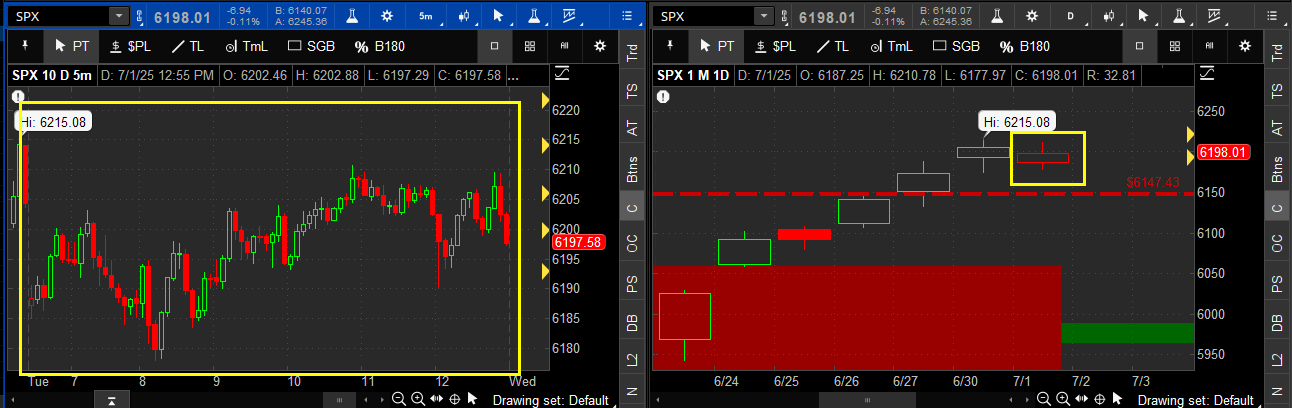

July 2025 Model Portfolio Spreadsheet Results

Here is the

CALL model

portfolio for the month of July 2025.

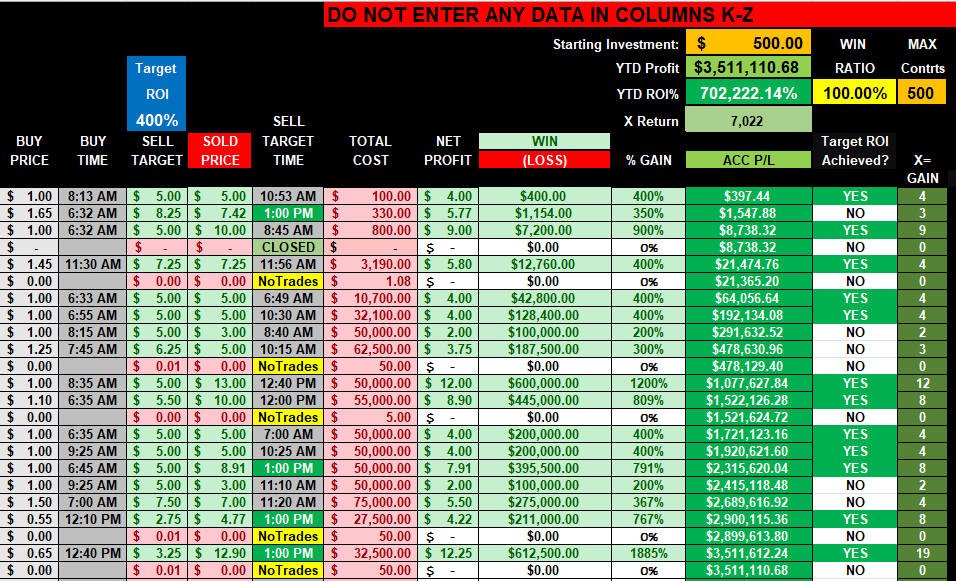

I started it with $100 dollars and it's produced a gross profit

up to $3.50 MILLION DOLLARS

in 21 days compounding to 500 contract loads!!!

Rules of the Trade:

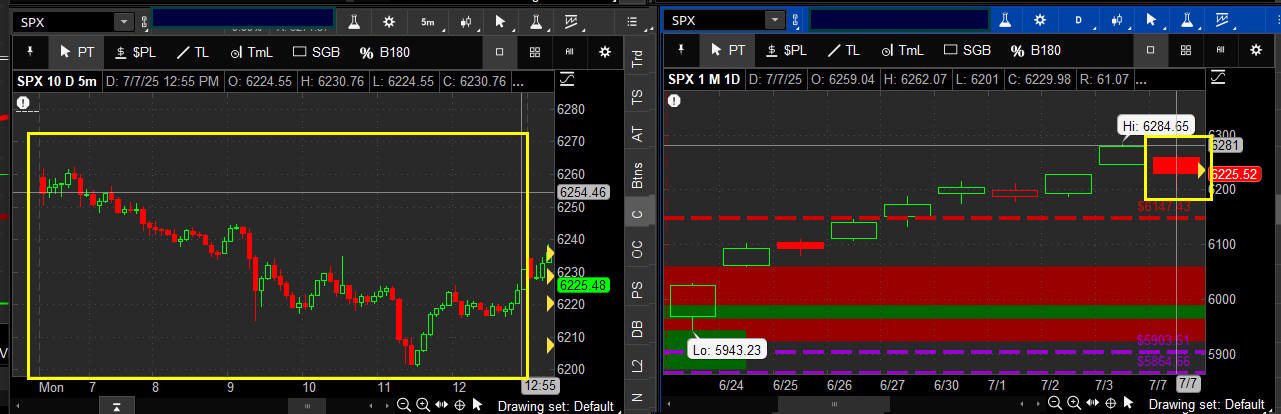

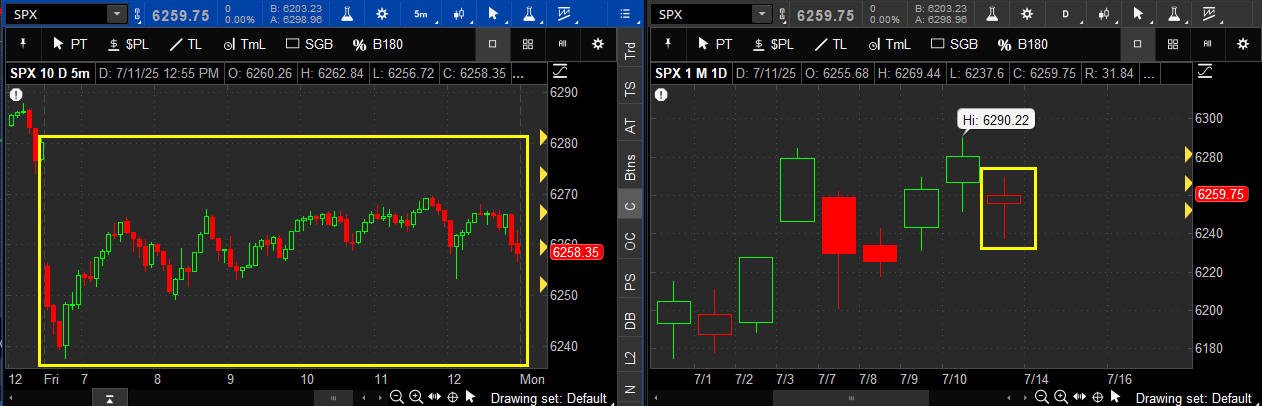

1. This was based solely on buying the CALL strike that was maximum 50 points

OTM (or lower) from the SPX opening price.

2. The target entry price is $1.00, but the maximum spend is up to $2.50

at the open, and if I could get any strike lower for $1.00, then I would

buy that strike.

3. I always start the strategy with NO stop loss (all-or-nothing) until

I start compounding at 10+ contract loads. Then if the option(s) bought

make at least 200% ROI in the first 30 minutes after the fill, I would

consider a stop loss at break even or end the trade at a 50% drawdown.

IMPORTANT: You should NEVER put in a

waiting

"stop" order when you initiate the trade because the broker system will

HUNT YOUR STOPS!—just do a mental stop and palce initiate the trade if the price

drops to your mental stop.

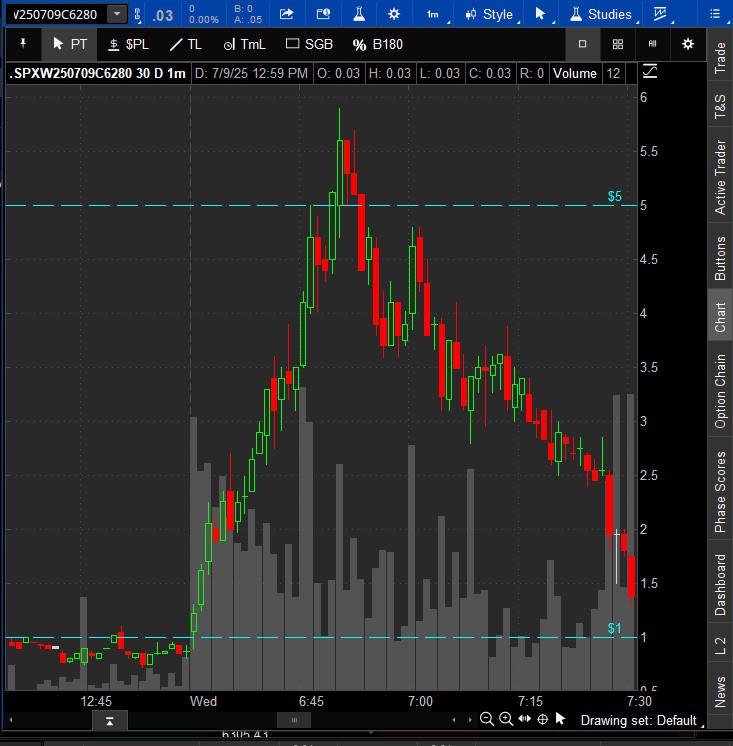

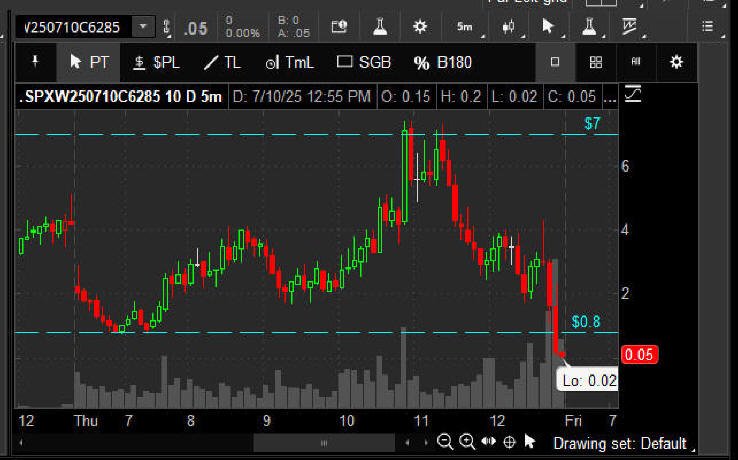

4. The target ROI was set at 400%, but monitored for the parabolic moves

that come along day-to-day so you can layer exits and increase the %

ROI.

5. Once the compounding begins (after you get to 10 contract loads), I would recommend

you layer exits at 50% of your contract load for 200% ROI, then another

half at 400% ROI, and let the rest ride for the potential parabolic

moves that happen several times a month; which greatly increases your

overall %ROI and accelerates your compounding journey!

6. If there were any failed trades, the compound cut rate was set at

50% to keep me from losing all previous accumulated profits.

NOTE: These amazing results do not take

into consideration multi-strikes and layering, which would make the

ProfitsUP! much higher than shown!!!

July 2025 $1 Formula CALL 400% ROI Model Portfolio achieved an amzing $3.50 MILLION in ProfitsUp!