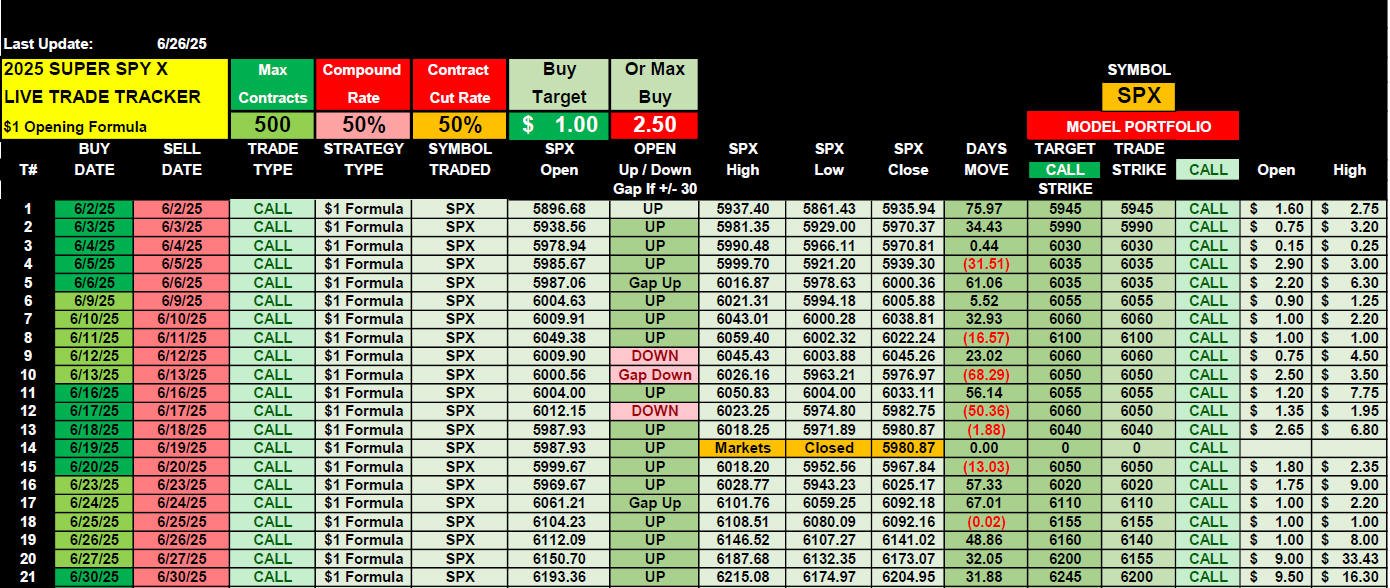

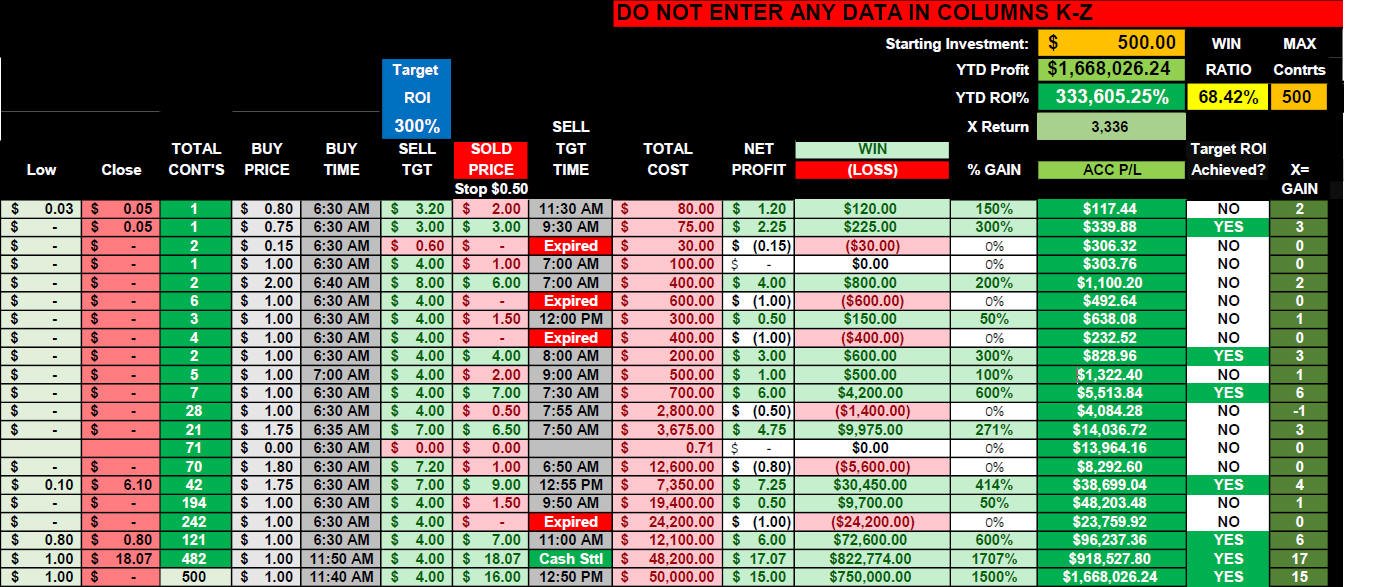

Updated 7-2-25

Here is the

CALL model

portfolio for the month of June 2025.

I started it with $100 dollars and it

produced a gross profit of $1.6 MILLION DOLLARS

in 30 days!!!!

Rules of the Trade:

1. This was based solely on buying the CALL strike that was 50 points

OTM (or lower) from the SPX opening price.

2. The target entry price is $1.00, but the maximum spend is up to $2.50

at the open of the strike price 50 points OTM (10 strikes higher).

3. If the option bought made at least 100% ROI in the first 30 minutes

after the fill, I would consider a stop loss at break even or end the

trade at $0.50.

IMPORTANT: You should NEVER put in a

"stop" order when you initiate the trade because the broker system will

HUNT YOUR STOPS!

4. The target ROI was set at 300% but monitored for the parabolic moves

that come along.

5. Once the compounding begins (after you get to 10), I would recommend

you layer exits at 50% of your contract load for 200% ROI, then another

half at 300% ROI, and let the rest ride for the potential parabolic

moves that happen several times a month, which greatly increases your

overall %ROI and accelerates your compounding journey!

6. I allowed for some failed trades to show how the compound cut rate at

50% works on the spreadsheet. As you can see, this had little impact on

the growth trajectory, and amazingly, with only a 67% win rate, it still

produced nearly $1 MILLION in ProfitsUP! for the month of June 2025!!!!

NOTE: These amazing results do not take

into consideration multi-strikes and layering, which would make the

ProfitsUP! much higher than shown!!!

June 2025 $1 Formula CALL 300% Model Portfolio is currently at $1 MILLION in ProfitsUP!