|

Collecting Rent (Covered Calls / Naked Puts) - 2009 - 2012 These are the results from trades suggested on our "Lotto Plays" list. Note: they are suggested entry and exit points! disclaimer Profits Up!! ---------------------------------------------------------------------------------------------------------------------------------------- LAST UPDATE: 5/21/11

----------------------------------------------------------------------------------------------------------------------------------------

5/21/11 - Profits booked! Nice rent play. Will look for the next entry to get some more rent money from this stock.

===================================================================================

5/16/11 - The covered call play is looking good for a nice rent payment at the end of this week.

5/1/11 - A good friend of mine told me he has 1k shares of CMG that he has been holding onto for some time now. He has enjoyed quite a nice ride in the land of profitability, but has no clue how to manage this much leverage to collect some easy rent money.

I told him I would start tracking this stock and posting my thoughts and trades to show him the light and give him better skills to manage his investment while reducing his cost basis in the overall portfolio value.

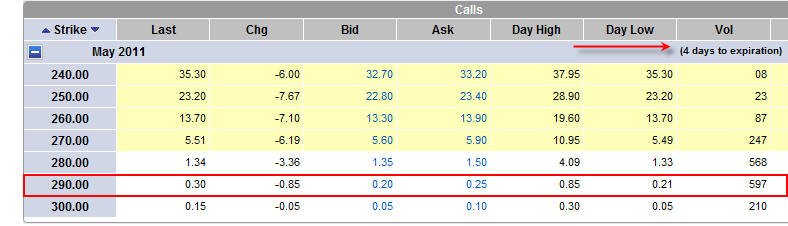

The stock has recently sold off quite a bit from its last earnings announcement, so I do not expect it to take out the recent all time high anytime soon. With that said, my first trade on this would be to sell the May 290 Covered Calls and collect some nice rent premium.

Had I been able to educate him sooner on this strategy, he would have been able to greatly diminish the portfolio value loss of $25k by selling covered calls last week and using that money to buy puts—he could have easily diminished his value loss by 50% or more.

This is going to be a nice object lesson for him and the rest of you as we go down the green bricked road to the land of profitability!

=========================================================================================

7/18/09 - We are going to start a couple of covered calls plays this weekend now that we are entering the new Jul/Aug options cycle. With the markets being on a nice rally for the past few weeks, I am looking for profit taking to kick in if the Dow does not take out 8900. I prefer the VIX to be on the upswing so we get some juicy premiums but currently this index has been heading to multi-year lows; which indicates we could be headed higher in the overall markets. Typically, Aug is a selling month once the bulk of the earnings releases are over, so we may get a nice pop this week in the VIX; which in turn makes for nice Covered calls plays.

|