----------------------------------------------------------------------------------------------------------------------------------------

Compounder Commentary for: NFLX

LAST UPDATE: 6/3/11

----------------------------------------------------------------------------------------------------------------------------------------

==============================================================================================================

6/3/11 - Wow, nice run to new all time highs the past couple of months. This stock is very popular and on track to keep on moving up the line. I did not get a chance to play this one because I had too many trades going with other plays and boy did I miss out on some huge gains. Going forward, I will start watching and playing this stock with the compounder and other profit opportunities.

==========================================================================================

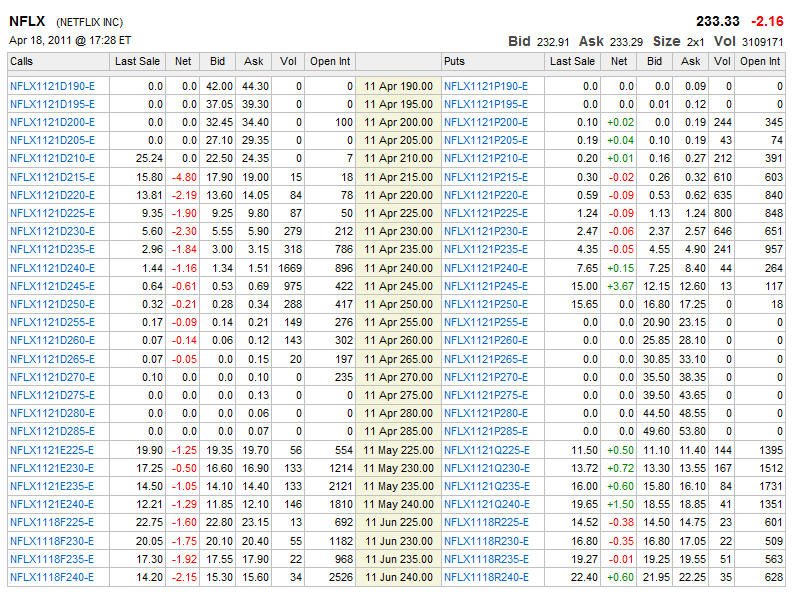

4/18/11 - Chart showing no clear decisions being made. Several DOJI candle patterns the past couple of weeks indicates there is not a lot buying interest. I much prefer to see elephant bars like we had last Tuesday, but with GOOG missing, things in the overall market have tapered off. The negative news today in the markets kept things down quite a bit; however, NFLX held its ground just above that elephant bar. I am liking the put potential on this one with a possible drop under $200 should they disappoint. I am definitely taking a straddle on this stock with a PUT first tomorrow then adding in calls later in the week if that elephant bar continues to hold up.

==============================================================================================

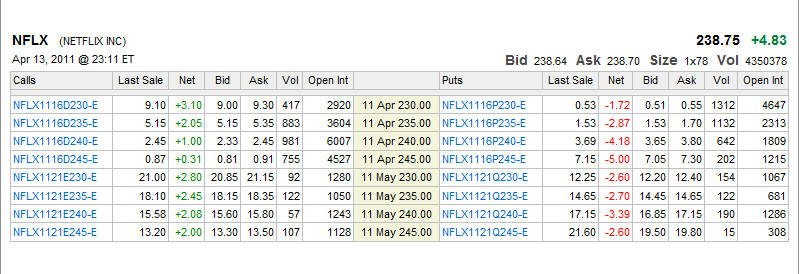

4/13/11 - Nice looking chart for a big breakout. Notice how the stock double topped and then had a few days of selling. Yesterdays solid reversal bar shows the big money is in the game to stay. This is a very good looking "elephant" bar that is the stop for any longs. If this bar is taken out, then shorts will get a very profitable trip back to the very large gap up back in Jan. This earnings report is going to be a very definitive conclusion for the the direction of this stock for the next few months. I will definitely have a straddle play going on this one.

Earnings are coming out on the 25th so I am looking to take my positions a couple of days before. I would go with some calls right now to get started but take the bigger position a couple of days before the actual earnings.

======================================================================================

3/31/11 - NFLX still hanging tough with three Doji daily candles in a row. The last time I saw this the stock shot up quite a bit so the big question of the day is will it do this again? The catalyst this time around is upcoming earnings but looking at the past couple of weeks worth of trading one could make an argument that the price action has been booked in and we are in wait and see mode. Tomorrow is Friday, so most likely there will be jockeying for positions more than upside improvement in my opinion.

Looking at the chart below, we can see the gap up back in Feb has now been tested, but it's definitely a weak test with low volume, so for now, any bets on direction are nothing more than pure speculation. I would say that so long as $230 holds, its a long, and below $230 its a short down to $200.

I am looking forward to a nice lottery play on this one in a couple more weeks.

===========================================================================================================

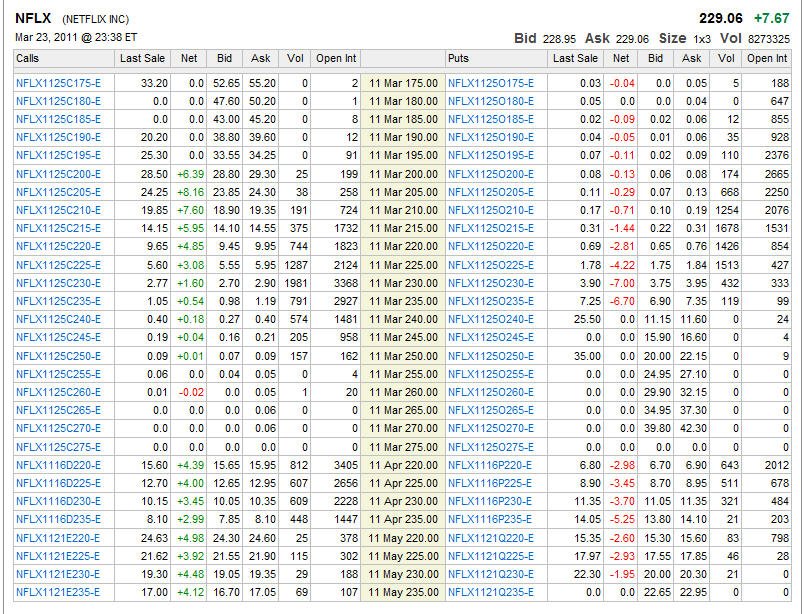

3/23/11

NFLX is HOT HOT HOT and even Cramer is liking this stock at these price levels. Notice how the gap from Jan was tested and held indicating the bottom of the price range will remain here. With earnings coming up in a month, I think NFLX will make a very strong attempt to take out it's all time high and if results are great, the sky is the limit. If results are a disappointment, it's going to be Christmas in April.

My next entry on this will be any pull back that holds onto $220 and should be get a gap up tomorrow I will jump in on any pull back that holds 55% or better of today's range.

============================================================================================================

1/19/11 - Things were going great...that is, until the CEO comes out and makes a move that will piss off a huge amount of his customer base. As I mentioned a few post before, NFLX raised their DVD prices and I cancelled my subscription. Well, now they restricting mailed DVD's and you cannot add new ones to your streaming queue.

Earlier this week, Netflix’s director of product management Jamie Odell announced that the company would be “removing the ‘Add to DVD Queue’ option from streaming devices.

This has enraged customers but it will be short lived. The reason most are probably upset is because the choices for streaming are pretty slim—for now—but Netflix is cutting Billion dollar deals with content providers to up the release of top run movies for their on demand streaming. Netflix has also cut deals with TiVo and DVD/BlueRay manufacturers as well as game counsels to incorporate their streaming technologies with their machines. In the short-term, this can impact the stock price and today is reflective of that, but not that much since the price barely took a hit; however, if their revenue projections and subscriber base has taken a hit this last quarter, you can bet the put side will get a nice pay day next week.

We were stopped out of our play at a 50% profit which is still a massive success since the compounder only seeks a 20% profit with each trade placed. I will be looking for the next entry on a different stock but will be definitely playing my straddle Lotto plays heading into earnings.

=============================================================================================

1/18/11 - NFLX is putting on some upside as we head into earnings season. AAPL knocked it out of the park today which bodes well for NFLX since Apple sold 1 million more iPads than projected. This means there are potentially tens of thousands more subscribers for NFLX on demand packages since the iPad can play streaming content on WIFI and/or G3. My compounder play is up over 100% to date and so we are off to a GREAT start for Jan. I will be putting on a straddle Lotto play just in case NFLX does not make the cut at earnings. And if they happen to miss, well, we should be in line to catch a lotta dough.

===================================================================================

1-14-11 - NFLX had a staggering week but finished up overall. With earnings coming and the market holding ground, I anticipate NFLX will start to push higher with buyer enthusiasm heading into earnings. The week of earnings release, I will pick up DOTM puts and calls for a Lotto Play potential.

The Feb 200's are showing some profits!

=================================================================================================

1/10/11 - Today the lagging stopped and NFLX put on some nice gains. There was a bullish report from Goldman Sachs analyst Ingrid Chung most likely giving fuel to the fire today.

Netflix earnings are set for Jan 26th after the close, so this could be the beginning of the earnings run. I am definitely going to get long with calls because the anticipation will be there with this news story and the 80 plus iPad type devices and tablets coming out of CES show in Las Vegas.

Even though Apple has the market cornered for the foreseeable future; on demand movie providers like NFLX will benefit as more and more people have the chance to access wireless broadband. The biggest question is will their servers and broadband providers be able to handle the bandwidth demands?

With more and more demand coming down the pike for streaming, NFLX will certainly be there to capture market share; however, competition will be coming on strong, so any slowdown in subscribers will have a very negative impact on this stocks already high price.

I am bullish in the short-term, but overall looking for that "lotto" put play in the future. My strategy is to trade with the trend and lay my nets for the future.

Today could be a possible elephant bar buy opportunity; however, I would have preferred to see volume much higher than the average which leads me to be cautious of any follow-through.

I would like to see some profit taking in the morning so I can get started on some call options but after hours was up .57 cents so we will have to see. There is now a lot of premium packed into any call options so do not get too crazy early on. Its much better to buy on dips so long as the stock holds onto $179.00.

Here was the action on the options from Friday and Today

Today 1/10/11

I am looking at the Jan 190's and Feb 200's

Friday 1/7/11

Ok, here is the compounder spreadsheet. Our first target profit is a minimum of $200 and if we get through the entire 20 trade compounder our $1k starting capital will be at $38k or higher.

==================================================================================================

1/7/11 - New year and NFLX is lagging with the market. Looking like it may make another attempt at the all time high since the bap from Nov is holding up; however, I am not a total fan of continued upside as competition continues to come on line. I even cancelled my subscription today because I am just movie burned out and they raised my rates to offset continued bandwidth demands with the online viewing. There are more and more movies coming on line to watch so we will have to see in the next earnings report if the price increase helped or hurt subscriptions. I can assure you that when subscriptions suffer this stock will pay us off with puts!!!

------------------------------------------------------------------------------------------------------------------------------------------

11/5/10 - Possible trend change coming if this gap is breached. Notice the volume appears to have peaked and now that earnings are completed, there is not a lot of catalyst to propel this stock higher; however, it's certainly plausible that it will continue higher with market support. As you may be aware, stocks love to move to higher milestones, and $200 a share is a magic number for this stock to achieve. My current bias is a gap test down to the low 150's and if we do not get a confirmation bearish candle then we could be off to the races towards $200.

=============================================================================================

9/13/10 - Wow, what a bummer for now. There is just so much love for this stock out there that we are are at a crossroads of sorts with our strategy for this stock.

I am just going to wait for a definite trend change so I can short this one because the fall will be far and hard when it comes.

In the meantime, I will keep my eyes open for upside opportunities until there is a definite trend change. We cannot predict how far a stock will rise, but we can be certain there will always be times of profit taking.

At this point, this compounder trade resulted in a ZERO, so we will start another one. Remember, it only takes one successful compounder strategy to erase several attempts and come out with a huge profit!

It's a marathon...not a race.

Profits Up!

The donFranko

=====================================================================================

8/25/10 - a little test of the last two days selling. I am still a firm believer the gap from July will be filled.

======================================================================================

8/24/10 - As predicted! Options are now in profitable territory. Once the 20% is locked in we will place the stop loss there and let it go onto, hopefully, a huge profit!

===========================================================================================

8/23/10 - Expiration Friday brought some temporary relief to NFLX but today the down trend looks to be resuming. Tomorrow should put the pressure on and if we get a down day in the market then I see this play getting back to b/e and we are on our way to our target 20% ROI.

==============================================================================================

Looks like the beginnings of a correction coming. I anticipate a gap fill down to $105 area over the next few trading days so I am suggesting the September 130 Puts.

============================================================================================

7/1/10 - Stopped out today at $7.50

=======================================================================================

6/30/10 - Back in the end zone. Stop in place at $4.75 so now lets see if we get back to a break even on this one and I am looking for the next play going forward.

I was correct about the DOJI but timing off on this play.

=====================================================================================

6/29/10 - Back in business and getting close to major support at $110.00

==========================================================================================

6/23/10 - Not much action today but another DOJI formed off the tops of the last ones. This could be the break I am looking for and if NFLX falls below $115 there will be some heavy selling pressure start up in my estimation.

================================================================================

5/22/10 - Second day of selling and this time market support too. Not much action in the put price so we have to see even more follow through this week to have a crack at a 50% overall stop loss. The target is those DOJI patterns at $110.00

=======================================================================================

6/21/10 - coming back to life! Selling kicked in big time today and its looking like these DOJI's are going to be reversal patterns to the downside. Anything can happen but we have some time for the selling to kick in and if this play gets back over 50% of the original price I will put in a stop.

======================================================================================

6/18/10 - Expiration Friday bought us yet another DOJI formation. This time the all time high from Monday was not taken out, so it's looking like we could get some retracement . After hours trading showed continued weakness so we are hopeful things might finally make a move back to support at $110. The only bummer is, our strike price on this trade is now so far out of the money, we need a miracle to make a profit. Trading DOJI formations are always extremely risky. If this play does not work out, we will just have to start another compounder and try again.

This strategy takes time to develop, but when it works out, it pays back for all the losses incurred getting it set up.

=================================================================================

6/17/10 - This could be the DOJI top I was expecting.

===========================================================================================

6/15/10 - A shot in the arm with a downgrade today! We could be in for some follow-through going forward and this pick could bring out of a deficit and at the least back to a break even.

========================================================================================

6/13/10 - Disaster on this play. At this point I am just going to see where it ends up and start looking for a new compounder play to start up a second attempt if this one goes bust.

============================================================================================

6/11/10 - This play is definitely not working out like I thought it was going to. We still have a month so lets see what next week brings. At this point it's going to take a miracle to get back to a break even and if this one busts us, we start another one.

===================================================================================

6/10/10 - This play is not working out so far, but we still have a lot of time left, and so I am sticking with it.

NFLX is now testing its all time high, so we will see if it's going to become the top.

======================================================================================

6/7/10 - Not much action today,

=============================================================================================

6/4/10 - getting a rough start on this play but I am confident this still will take a much needed break and with yesterdays and today's DOJI in face of a selling market shows there is some definite indecision on moving higher.

==============================================================================================

6/1/10 - Our next entry will be tomorrow morning looking for continued selling off heading into Summer doldrums.

==============================================================================================

5/10/10 - Our profit stop was hit, and we made some extra dough on this one.

==============================================================================================

5/7/10 - WE KILLED IT...AGAIN! Another whopper of a trade coming here. Profit stop in place at 14.00, so now lets see what we get on this ride.

=============================================================================================

5/6/10 - Sweet! We are in profit zone and our 20% is locked up with a profit stop. If today's deluge continues tomorrow, we could see a really nice profit build into this play.

=============================================================================================

5/5/10 - Back in the money and looking good for some more selling tomorrow. We should see our 20% profit starting tomorrow and then we will put in a stop loss locking that in.

=============================================================================================

5/3/10 - First day of the new month of trading and the markets put on some green as did NFLX; however, today's action is looking good for some selling pressure to start to work its way into this stock. This could be a quick trip and once the profit target is in place I will maintain a tight stop on this trade.

=============================================================================================

4/30/10 - COMPOUNDER COMMENTARY FOR: NFLX

It was a month end sell off adding to a week of overall selling and NFLX could not keep the love on this stock going, and when it failed to take out yesterday's high, I went short he puts—and almost have my 20% move to boot!

Target profit stop at $12.00, and if this stock picks up some steam, we could have yet another huge winner on our hands!!

=============================================================================================

4/29/10 - COMPOUNDER COMMENTARY FOR: NFLX

As I suspected, NFLX pulled out of the downturn and headed back over $100 today on above average volume. I did not initiate the play yet because I want to see it fail to hold the $100 area. In after hours the stock continued to edge higher so we will see what tomorrow brings. One thing for sure, our $105 puts are getting cheaper!

I am waiting to see if the small gap down back on Monday will hold. I do not like to start position on Friday's, so unless it's an overall market melt-down, I will wait until next week.

=============================================================================================

4/28/10 - COMPOUNDER COMMENTARY FOR: NFLX

The next play for the compounder series will be on Netflix. This stock has been running like the wind since the monster gap up back in Feb 2010, and it looks like the party is finally coming to a short term end. I really like this company (I'm a subscriber) and they have done some great things with their business model. Their tenacity with direct and internet marketing has made them a house-full name with consumers. They even have the love of DVD/Blu-ray manufactures who co-brand with them on their equipment offerings. Their major competition, Block Buster and Hollywood Video are almost out of business, and aside from a little competition from Kiosk vendors such as Red Box, they are still the kings of the hill in on demand/rental entertainment with close to 14 million subscribers. Eventually, I think the big cable companies will put the heat on in a very big way when they ramp up video-on-demand programming, but for now, this stock has the love of the investing public. What drives this stocks price is subscribers and unless NFLX keeps packing them on, the stock will take a sharp hit to the share price—and there is a lot of room to drop on this one.

Ok, lets look over the chart and see what opportunities await our coffers.

Daily: You could consider this a blow off parabolic top.

Weekly: Must get back over $100 to have another shot at the high.

Monthly: Climactic top with massive volume indicates a retest as low as the mid 70's could be coming soon.

=============================================================================================

Looking over this definition of a Parabolic Curve Pattern (courtesy of http://www.chartpattern.com/parabolic_curve.html ) we can see a very close likeness on the Daily chart

The Parabolic Curve is probably one of the most highly prized and sought after pattern. This pattern can yield you the biggest and quickest return in the shortest possible time. Generally you will find a few of these patterns at or near the end of a major market advance. The pattern is the end result of multiple base formation breaks.

=============================================================================================

As earnings season winds down, and summer doldrums begin, I just do not see NFLX taking off to new all time highs especially after these past few days of massive jumps in share price. There will no doubt be the hope-traders trying to capture the next breakout, but we know that Ma and Pa investors do not move a stock—Institutional Fund manager do, and they are about to step on the brakes and take some profits.

The OTM options activity today give us some clues into the upcoming direction of this stock.

Notice the Open Interest on the put side is considerably larger than the call side and the volume today was over 6:1. The markets have been shaky these past couple of days with world financial events, so I do not see much catalyst to keep buying pressure on this stock and more likely there will be continued selling into the weekend.

THE PLAY:

My play is going to be on the PUT side if NFLX cannot move back over $100 and stay there with some heavy volume. I will open the trade by buying the JUNE 105 or 100 strike price. I prefer the 105's because we know ATM options are the most expensive. Since NFLX has had two down days, the implied volatility has been pumped up on the puts side, so I would prefer a little rise back over $100, and if $106 cannot be taken out, I will be all over the $105's; however, if the selling continues tomorrow, I will jump on board.