|

2/23/14

- The markets came roaring back but stopped short twice at the SGB

short signals that started the big drop. If the SPY manages a move over

the SGB's that will be the line in the sand for the Bears to try and

pull it all down. I plan to continue holding my safety net strategy with

Puts on the SPY from week to week because I know that the next turn for

the worse will be much larger than the last one and you just have to be

ready to catch.

So what strike's do we go with? That is a hard one to pick, so I am

looking for staggered entry points based on the last move which was 6

points. The goal is to always end up ITM by expiration, so if you are

playing the weekly options, then you want to buy closer to the action

$2-3 below; otherwise, buy monthly options and stay no more than $5 out

of the money. Now if you are looking strictly for insurance, then buy at

least 2x the volume of contracts that you hold in stocks and/or long

plays.

The markets had the recover bounce, but until they take out 16,500, they

will be vulnerable to a long lasting side ways move or decline. The M

pattern is the signal to begin the turn for the worse and if 16,200 is

not taken out, we need to be very cautious on aggressive long positions.

===============================================================================================================

12/7/13 - New heights again and again

with no signs of stopping the rest of this year. The DOW, NASDAQ, SPY

and Russell indexes are making nothing but new highs daily which has

investors that play the contrarian side (me being one of them) pulling

out all their hair in disbelief as they just keep getting short squeezed

up, up some more and up up and away. These next three weeks of trading

will no doubt test the resolve of the bears as we have the makings of a

a parabolic move about to happen on the weekly chart. In my last

comments below, I was pointing out the triple M pattern and that did not

produce the massive drop I was anticipating. What was missing was a

clear SGB (solid green bar) signal at each top, so that is what I am

looking for now and until that happens, I am sticking to the bullish

side of trading the rest of this year and into 2014. Now that the DJ-30

has completely wiped out that M pattern, I am marking this triple top as

my major support. Looking over the weekly chart, we need to see the

DJ-30 make a solid move back over 16,200 and the Bear will no doubt give

up for 2013 and drive this market right on through—maybe even hit

17,000!

I will still keep some SPY puts in play

just in case this massive bull run ends. In my experience, moves like

this always turn ugly in a single day and you can miss out on some HUGE

gains if you are not in play. I will just figure my cost of trading puts

and compensate with my long plays to cover it. Once the turn comes (and

it will eventually) I will load up on Bear Call Spreads once the DJ-30

moves back under 15,700 on a weekly chart.

The DJ-30 completed 8 weeks of powerful

highs and this week was the test that appears to have failed the bears.

They will no doubt attempt to bring down the markets this coming week so

if they cannot take out last weeks low, then it's over for them and the

party continues for the Bulls into 2014. With Friday's impressive

unemployment report, I am anticipating the DJ-30 to gap open on Monday

an the squeeze to begin. If that happens, the Bears will just have to

concede defeat and off to the races we will go. For me, the pivot point

is 16,213.00 and my 2013 upside target is 16,790.28.

===========================================================================================================

10/9/13 - Spooky times approaching as the

markets (investors) begin to realize this government shut down

could really mean financial collapse for the US of A. We need a real

capitulation event to drop this market from on high and it won't take

much more to create a stampeded for the exits. Yesterday the markets

started to come to the realization when comments were made by select

republican congressional leaders at a news conference. They (meaning ALL

OF THEM IN the Con-grass-smokers-ass-sociopath-ation up there on high)

were setting up (actually setting the stage) for a real down-to-the-wire

game of financial chicken with the President. If these two really go to

the end, the markets will see the end of this massive rally for 2013. We

are already down now 1,000 points for the third time this year and if

the daily and monthly charts are correct, then we are poised for a

horrible ending to a stellar year.

Taking a close look at the daily chart,

it looks UGLY! But it's always darkest before the dawn right? Well if

you change one letter you get DOWN...lol.

As I pointed out below the DOW was

putting in the infamous "M" pattern indicating the Index was about to

get murdered, but that was postponed as investors bought the bottom of

that test and a massive 1,000 point rally took center stage taking out

the all time highs and setting a newer one. Well, we are back to the

bottom with a second consecutive "M" pattern and this time it may be the

END for the Dow. The only saving grace on the daily chart is the 200MA,

and if that is taken out this week, then we could be in for a massive

crash and burn for the rest of 2013.

Today's trading action was controlled but

a steady decline was going on all day with all the leader stocks were

dropping MORE than the DJ-30; and that is a strong indication that BIG

money is leaving the game table. When you see controlled, consistent,

selling, that is market movers manipulating price action so they can get

out; when you see massive capitulation drops, that is when BIG money has

STOPPED buying. The next couple of days are going to be pivotal—in my

professional opinion—setting the tone for the rest of the years trading.

Of course it's never easy to predict the

final outcome, but if the government political game of chicken does not

get resolved soon, investors will hit the sell (take profits) button and

we are in for a precipitous drop. How do you play this one? It's a

difficult choice in deed because all the puts are not cram packed with

pumped up premium so anything you buy on the short side has a

diminishing of returns effect. The solution is to SELL PREMIUM on the

short side and speculate on the long side because if we get a relief

rally, it will be almost instant and fast. In order to get the maximum

benefits, you have to be willing to buy when everybody want to sell. The

challenge is and always will be getting the perfect timing down. Well my

trading friends. you will never get the timing down so you just have to

buy enough time to let things work themselves out.

The weekly chart also has a multi "M"

pattern, but it still has another 200+ points to go before it's a total

breach of the bottom. More interesting to me is the Fibonacci moves. We

have 34 weeks topping out into this week being the 13th one testing that

"M" pattern bottom. Another support bounce could be the kick off and a

breach the beginning of disaster. Either way, I am expecting a BIG move

to start this week and that could have been ignited today. So long as

the DOW stays UNDER my T1 target on this weekly chart, I am BEARISH.

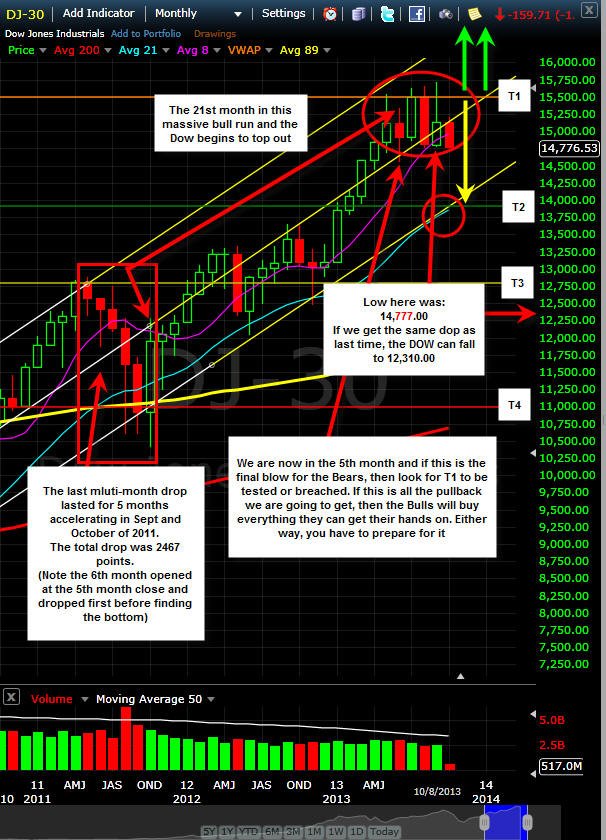

The monthly chart is setting up for

the next massive move and if we get one like last time, we can easily

see a rapid drop of 1,000 or more points in the DJ-30

Looking deeper into a quarterly chart we

have a LONG WAY TO DROP .

The last multi-quarter drop started back

on 12/2009 and lasted for over 2 years resulting in a 7,720.05

decimation—that total move was just under 55%!

Get ready for some exciting trading times

ahead!

Profits UP!

The donFranko

==================================================================================================================

9/3/13 -

The month to set the tone for the rest of 2013. September is known as

the beginning of crash season and with war looming on the horizon, the markets are

certain to be skittish to DOWN. So far T1 has been clearly taken out and

if the current monthly bar turns red then I am looking for T3 to be the

stopping point. My long term trend channel has been violated at the mid

point which is very bearish so we could be in for a pretty big drop in

September. Last year, this month was actually strong and then the

markets kicked into selling down sharply. In 2011 September was the

capitulation month that kicked off a huge multi-month rally so it's

going to be an exciting final quarter for 2013 no doubt. It is becoming

a foregone conclusion that Ben Bernanke is stepping down as the Fed Chief

and the hunt for a new candidate is being floated in the news channels.

Most are expecting

Larry Summers to win the post, but I think if that is the case, we

could be in for a precipitous drop in all the markets!

Taking a look at closer time frame and

both these charts are screaming "M"URDER. The hard part about this

pattern is it's easy to spot and when you can clearly see it, the move

has almost always been completed. In this case, the DJ30 has dumped from

all time highs and is now trading under a very strong psychological

level...15,000. If we go to war, I fully expect this to continue an test

T2. If we resolve the Syrian crisis quickly, then I fully expect the

markets to rebound.

Now if the markets are truly controlled

(and I fully believe they are) then war will bring initial panic selling

and the arbitrage computers will be kicked on and markets will stabilize

and rise. After all, nothing brings the American economy back stronger

than a good war; and if they distract us with a rising market, low

interest rates and improved employment, we tend to forget about the

killing of other people in far off countries. Just give us our fast

food, sports and movies and we'll be just fine.

Well, this time around, the propaganda

machine of warmongers is losing it's ability to fool most Americans and

many armed forces patriots are waking up to bullshit politicians playing

a game of RISK with their lives. They are posting signs they are NOT

going to fight in a civil war for Al-Qaida. After all, aren't they over

there fighting against Al-Qaida? Wouldn't it be nice if politician so

eager to go to war had to actually SERVE on the front lines FIRST before

they could vote to send our youth to their deaths? Let's hope this turns

into a non-event and we can concentrate on educating people to live

together rather than die together.

Be prepared and keep a running tab of

PUTS on the SPY as part of your cost of trading. That way, if this turns

into a disaster, your accounts can be protected from devastation because

the initial drop or plunge will happen far quicker than you can react to

it.

Profits UP!

The donFranko

======================================================================================================================

8/11/13 - July was a strong month

for the DOW testing and closing above the May high which was impressive

indeed. August is typically a down month in the DOW and so far, 2013 is

showing signs of repeating history. The last pull back was a short two

months and started after August of last year, but we may get an early

start this month since earnings have been average. There is wide

speculation and rumors that Fed Chairman Ben Bernanke is ready to

announce his retirement. If that happens in the next month or two, this

will create a tremendous amount of uncertainty; and investors have

massive profits to protect; so it stands to good reason the markets will

start a corrective phase that can easily accelerate.

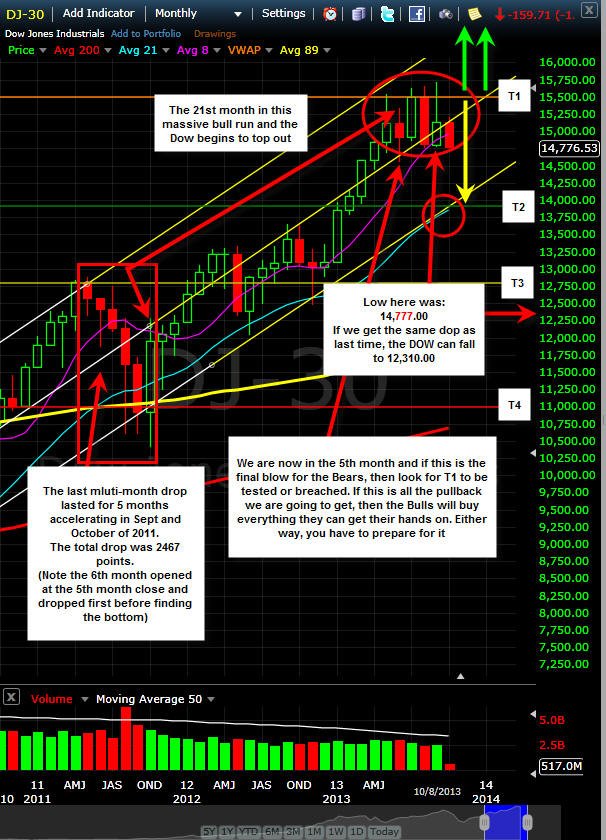

So, how do we determine when that can

happen and how far it can go down? I love to use my Bull 180 strategies

and my world famous T-Targets to (most of the time) accurately predict

support levels; and boy do we have a great set up in place right now.

The DOW has climbed for 8 months since the last mini-pull back and is

currently in the 21st month since the last multi-month correction; which

are both Fibonacci numbers, and you know how I like those Fibo's for

trade signals.

I have been looking over hundreds of

charts this weekend and I can definitely see some cracks in the floor of

many strong stocks. This, to me, is a definite indication that

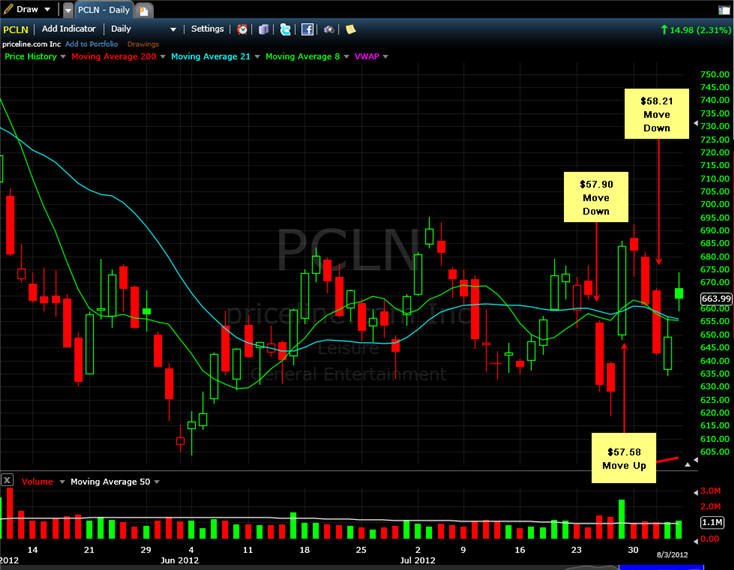

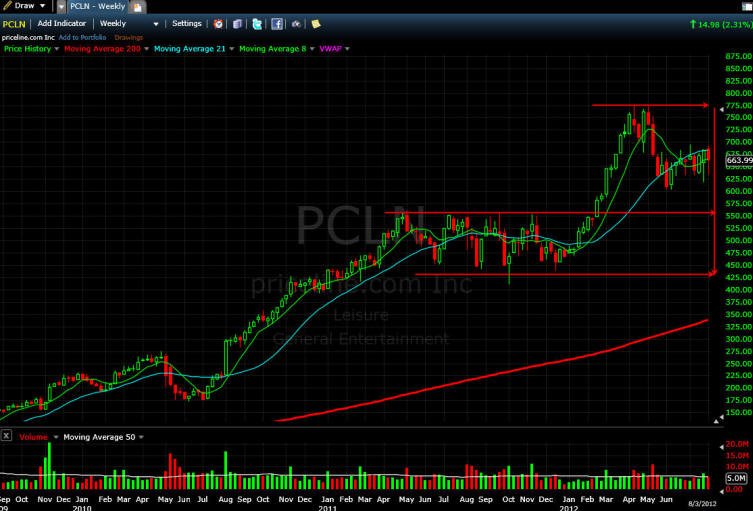

institutional money is lightening up. The BIG tell for me is if PCLN can

take out $1,000, and then GOOG starts to move back over $900 on heavy

volume. I am also looking for AAPL to get back over $500.

If the rumors become truth that Bernanke

is indeed leaving, I will be watching these stocks along with several

others on the MONTHLY charts for confirmation of the next multi-month

corrective phase.

PCLN, GOOG, PCLN, AAPL, NFLX, TSLA, LNKD,

AZO, CMG, AMZN, MA, EBAY, IBM, ICE, V, RL, GS, CELG, WYNN, BIIB, ISRG,

BLK.

When markets correct, some stocks thrive

as money leaves high flyers, it has to be placed in solid companies, so

when you see unusual strength in stocks like: KO, GE, MSFT, GM, F, K,

PM, PFE you know, the bellwether or cyclical type stocks, then you can

begin to trust the correction is going to last for a little bit.

The key level for me is T1. If the DJ-30

falls under this level, then I will become more aggressive on my SPY

puts and start looking at selling call premium on the big stocks. On the

other hand, if the monthly chart for August turns green, then I will be

looking for the markets to head to 1600. I am cautiously bullish until a

clear reversal signal has revealed itself.

Profits Up!

===========================================================================================================

7/11/13 - NICE DAY to be long the

SPY! Congrats if you have my long plays on!! The DOW blasted through

resistance and made a new ALL TIME RECORD CLOSING HIGH today...WOW! If

this holds up, and it most likely will, we are heading to DOW 16,000!!

On the other hand, if earnings are horrible for many of the heavy

hitters, look out below right? Well, that may not be the case with the

Federal Reservoir of cash continuing to be pumped in. Of course, this

story cannot keep playing out forever, and when the change up comes, it

could be so massive we never recover for the next decade.

Markets move, and if you do not learn how

to move out of the way when you are a contrarian, they will crush your

account! I have been a strong contrarian on the SPY for months, and let

me tell you, it has been painful to just keep buying puts week after

week.

When the pull back finally came, it was

for only 5 complete weeks and one partial week for a total of 6.8%

before the bottom was hit. The snap back has taken three weeks to erase

just about all of it, and it's looking very strong for tomorrow to close

wiping out all the intra-day high wicks. If that happens, we are in for

one hell of a ride going forward if earnings are strong.

I am still going to keep buying puts (old

dog) as my account hedge, but I am going to speculate with OTM long

calls a month in the future. For me, the keys to the vault are based on the

DOW not falling back under 15,200.

NOTE: Tomorrow is the 13th day in this

impressive run on the Dow and it happens to be a Friday...hmmm...Friday

the 13th day of trading? Coincidence or the sign of the end? We will

know in the next couple of weeks as earnings roll out.

OK, so let's look over the monthly SPY

charts for my contrarian POV.

As you can see, I have it set up as a

BEAR 180, but so far, it is FAILING now that the SPY closed over T1.

Here is what I see in the Daily and

Weekly charts:

Profits UP!

The donFranko

==================================================================================

7/10/13 - The Bernanke speaks and

the markets appear to like it. The SPY advanced (barely) today, but in

after hours trading its up nicely so far.

With the hope of a strong earnings

season, we could see continued upside pressure into next week. The daily

chart looks like the SPY is climbing a wall of worry with all these

DOJI's so any "bad" news and this sucker is going to crash in 1 to 2

days of trading. I am keeping my put hedges going and preparing for

earnings season as we get going full speed next week.

Profits UP!

The donFranko

=============================================================================================

7/8/13 - The earnings season has

kicked off and the SPY finished the day with yet another long wicked

DOJI. It will take a week for a clear direction to show itself, so get

ready for some shake ups and shake downs. I bought my weekly hedge and

will place my next one on Friday.

Profits UP!

The donFranko

======================================================================================

7/6/13 - The first clear direction

out of the DOJI fest is UP. With earnings season kicking off this week,

we are in for some moves on the SPY, so I am going to start a hedge this

week with puts. I tested the action Friday getting long the SPY and made

a little profit. The daily chart has completed 8 trading days of

multiple DOJI's with 6 of those day being up so do NOT fight the trend

nor the Fed...I am going to just buy weekly some puts at least 3:1 over

my July13 calls on the SPY and see what the week brings.

Profits UP!

The donFranko

==========================================================================================

7/2/13 -

What a DOJI-fest we are having with the SPY. How can you

make any clear direction decisions when the daily chart

looks like this one? All I know is when this ETF/Market

finds itself, the next move will be a definitive one.

The way I find a better

direction indicator is to keep an eye on longer term charts,

and since we just started July trading, we can use the

monthly chart as our best guide. Below, I suggested that if

July starts out with a Red candle that we get short as the

monthly chart is setting us up for a Level 2 Bear 180 from

June's red candle. With two day under our trading belt, we

can not really take a clear directional bias but I think

this earnings season is going to be a move and a shaker for

the SPY.

Ok, so what do we do when the

monthly chart has a Bear 180 and the weekly is in a Bull

180? We sit it out or speculate with a straddle and add to

the winning side. I am going to put on a July13 straddle

tomorrow to start, and wait for earnings season to kick in

before I overweight one side. Of course, I always prefer the

PUT side so we will see how things begin to play out.

I am taking the entire 21

month rally to figure my Bear 180 T-Targets because if this

earnings season is a bust, the SPY is going down for the

count in my current estimation.

Profits UP!

The donFranko

============================================================================================

5/30/13 -

Tomorrow is the big decision day for the markets. Will it be

a delayed sell in May and go away or do we begin the summer

with a blast off?

What

everyone expects is usually wrong, so all you hear right now

is correction, correction, correction and since I am a

contrarian trader, all I want to be is on the other side of

the prevailing opinion.

The problem is, I love to be

on the short side, and there is where I have difficulties

with getting long. Of course, I have been buying puts every

week as the SPY powered higher and higher, but those were

for hedge purposes and a cost of doing my trading business

so I am not crying over it.

The charts are strongly

indicating we are at a massive TOP, but when investing

public is apathetic or overly enthusiastic, what you see is

NOT necessarily whatchya gonna get.

Looking over the daily chart,

we have quite a bit of exchange in the past 5 trading days

showing definite shuffling of money. Notice the very large

wicked engulfing candle back on 5/22/13 that was followed by

two open red candles and then the infamous SGB! Under normal

circumstances, this would be a MASSIVE short signal, but we

are not in "normal" circumstances. We are in NEVER NEVER

LAND and when you are there, fantasy trading is the

nomenclature.

If we have the Federal

Reservoir of Cash still pumping, then you have to just keep

you foot on the long gas pedal...even when the road gets

bumpy.

I am sticking to my SPY puts

as my overall account hedge, but I am long side biased on my

other trades. What I am definitely looking forward to is the

volatility to pick up so I can have much better odds of

getting filled on my White Whale fishing orders.

My best advice for tomorrow

and into next week is to lower your exposure on either side

and get ready for a nice ride. You never "miss" anything as

a career trader, so DO NOT CHASE direction, just work your

trades and manage your winners.

Currently the SPY is in a

BEAR 180 setup on the weekly chart so I will be a LONG buyer

at the green circles and T3 when the SPY pulls back (if it

pulls back).

Profits UP!

The donFranko

=======================================================================================5/27/13 - May

Day! May Day! Is that what the pundits will be ranting about

this week as we head into the final trading days of May? I

have been watching the markets, reading financial intel and

following my trades with optimistic enthusiasm. So far, all

the signs signal calm seas and rising tides—as you know, a

rising tide will lift all ships and that is what is

happening with the the indexes across the board...they are

all rising!

With indexes and stocks

continuing to make new high after new high, this makes

contrarian investors like myself a wee bit nervous because

we keep attempting to get short; only to be stopped out or

wiped out if you are too aggressive. When the markets are in

euphoric mode, you should be extremely cautious when taking

the other side. GREED is the number one emotion that MUST be

killed or the markets will wipe you out!

Just review my charts and

comments below and keep watching my current play sections as

I navigate through these uncharted waters and find the

trades that will make us lots of money!

Contrarian investing can be

the most profitable (short term) trading style, but trend

trading can have lasting increase in your profits. My

strategy is to trade in the direction of the trend and just

keep index puts rolling along as a cost of doing my

business. For the short term, I plan on adding more puts as

I make profits until the SPY shows me a clear topping

pattern. When a pullback happens, I will use that to look

for long opportunities.

The best way to sum up

this concept is to think of the markets as an object in

motion.

We know from Sir Issac Newton

that:

So how can we apply Newton's

three laws to the stock market? After all, isn't the stock

market more like rivers of organic cash flow moving into a

confluence of uncertainty? How can one know for certain what

the outcome of any event is when they put their money on the

line?

In relation to Law 1, we know

that markets have been steadily rising for nearly 8 months.

In relation to Law 2, we know

that all the indexes (m) have been

consistently accelerated by The Federal Reserve (a)

and its Monetary Policy (F)

In relation to Law 3, we know

that as long as Uncle Ben Benanke keeps on printing money

and injecting it into bonds, these markets are going to keep

powering higher!

So, when that inevitable

"greater external force" is applied, we know this house of

cards is going to crumble!

Now if you reverse the

equation, it looks like this:

When the current monetary

policy stops (-m)

Reverse acceleration begins

(- a)

If you are overweighed with

longs then your account can get = Fried

Until this happens, we need

to stay with the trend because it's indeed a true

friend...just cover your assets with protective puts!

Profits UP!

The donFranko

=======================================================================================

5/14/13 - Wow, a

super rally day in the markets and particularly the SPY.

This was the biggest one day move since Feb 2013 and the SPY

has now reached the upper end of my long term channel on the

weekly chart. Things are about to get crazy as we head into

May expiration.

I am going to place a Lotto

trade tomorrow because if this is the topping point, the

drop can start on Wed and last right into Friday.

An interesting statistic to

consider:

CNBC has a guest on today

that said:

"Usually, when we see these types of runs, 178 days or more,

none of them have ended with a bear market," he said.

"They've all ended – whether you looked at the '80s, the

'90s, the 2000s – with a 5 to 10 percent pullback.

On Squawk Box this morning,

comments from Hedge fund titan, David Tepper of Appaloosa

Management was chiming in that stocks are going HIGHER, and

he is definitely bullish! He referenced the movie My Cousin

Vinnie and made a comical comment that, "So like guys that

are short, they better have a shovel to get themselves out

of the grave."

This was the catalyst that

powered the markets higher today. Well, I do believe we are

in the new territory, frontier, never never land, but I also

know there IS going to be a correction, and that can start

this week when May expiration if over this Friday.

It has been widely known that

markets, "sell in May and go away" but that did not happen,

so I think this expiration Friday will be the final delay

and we get that May sell off in in the last week of the

month.

All I know is when CNBC has

the "big guns" coming on pumping things, you better be

looking for the exits for the short term.

I like to trade around the

Fibonacci sequence, so when I heard this news today about

the markets being up 175 straight days,

I did some quick math and

came up with an interesting coincidence.

Markets move, and they move

to the beat of the Fibonacci numbers more than anything

else.

3 + 5 = 8 (most of the time,

markets move around in 3 to 5 day cycles)

5 + 8 = 13 (occasionally the

markets will range trade up to 13 days before taking a

break)

13 + 21 = 34 (when stocks

trade into these ranges, they are extreme and correct in 1-3

days)

21 + 34 = 55 (once they get

into this range, the standard deviation models kick in)

34 + 55 = 89 (getting to

these ranges, it's usually because they are going parabolic)

55 + 89 =

144 (this range has the Bears falling all over themselves to

get short)

89 + 144 = 233 (this range is

where we are now, and this is unprecedented!)

Ok, so if you take 178 away

from 233 and you have

55!

If the markets are going to correct

10% as the CNBC guest suggested, then tomorrow or Friday

would be the perfect beginning. I think it is far more

likely we get a pull back than it is we advance to the next

Fibonacci level.

I know you can torture the numbers

enough that they will confess anything, but I just happened

to do the quick math while he was talking and this is what I

discovered...my hunches are usually right!

The DJ-30 Monthly chart reveals some

interesting things:

Profits UP!

The donFranko

==============================================================================================

4/25/13 - As the markets

make more highs, I am seeing the SPY struggling to follow suit, and it's

currently ready for another Bear 180, so I picked up some AprWk4 Lotto

Puts today, and I will buy some MayWk1 Lotto puts tomorrow for next

week.

It's always tough to take new long

positions when indexes are in sky high territory; everyone keeps harping

this just can't go any higher and yet it still does! As I said in my

recent market wrap, the Bears have pretty much waived the white flag at

this point; however, I do not expect them to jump on board the Bulls

train because they most likely view it as getting on at the caboose.

If you want to get long, then you have to

decide for yourself if you are going to jump on this train if you are

not already on it, or follow up behind this train with protective puts

if you are on it—if the SPY can get over $160, then this bull train is

poised to keep right on moving higher!

The daily chart has a very interesting

pattern to it. The last top was a perfect Bear 180 and now we have

another perfect Bear 180 set up, so look for the next red bar (NOTE:

that is not a gap over the last B180 high) and get short with a

strict stop at $159.90.

Options for next week:

We need to look deeper in time to help us

get a better idea if the current rally will sustain itself:

Looking over my ATR Bear 180 Calculator we can see how accurate my

predictions are:

Bear 180 #1

Bear 180 #2

Bear 180 #1 took three years to pull back beyond target 2.

Bear 180 #2 took only

ONE YEAR!

Bear 180 #3 is setting up,

but we still have up to 8 months for the SPY to show us a RED BAR.

Here is what the action looked like when

broken down to the monthly charts:

Bear 180 #1 Top

Bear 180 #2 Top 1

Bear 180 #2 Top 2

The SPY is currently in a strong up trending channel on all the

long-term charts and has now advanced into the top half. The next

resistance is $180 - $190, but it needs to get over $160 and close over

that into next year to be in a long-term continuation.

Profits UP!

The donFranko

============================================================================================

4/11/13 - Ok, I give

up...it's time to waive the white flag for the bears. The

S&P finally broke over all time highs and is officially in

new territory with nothing but blue sky to determine how far

it can go.

So what is next? Well, every

pundit on TV just sits like the deer in the headlights with

amazement. They just can't wait for the correction,

meltdown, sell off, pull back to happen. Sure, anything can

spark a stampeded for the exits and we are definitely at the

precipice of a continuation or major correction now that

earnings are in full swing.

Tomorrow is the beginning of the

fuse that can ignite or explode as the financial sector

(banks) start to announce. With the Fed hell bent to print

and dump bazillions on the bond markets, you know the stock

markets will just keep heading higher and higher. That means

any pull back will be less than 10% (at least the first one)

and then a snap back rally will ensue.

The only way I know how to gauge

this new frontier is to watch the charts, listen to news and

read a broad base of financial info looking for solid clues

and cues. I can tell you this, stocks have been trading

lofty levels off multiples of earnings; and if the earnings

fail (even slightly) they will fall father and faster than

they went up. Still, you have to trade the trend so just

keep index put protection loaded up as a cost of doing your

business.

I will be on the lookout for

individual trade ideas as there will be plenty of

opportunity on both sides as we power on through into the

new frontier!

Lets look at the charts:

==============================================================================================

3/11/13 - The markets are

about to approach the final hurdle in new index highs when

the S&P 500 reaches its all time high at 1576.09 set back

10/12/2007. Whatever the outcome, it's going to be

explosive—at least I hope it is. Looking over the weekly

chart below, you can see some very interesting things. Last

time the S&P hit its all time high of 1,576.09 was back on

10/12/2007. It put in a classic double top reversal signal

as well as trading into the very top of its long term up

channel. This time we are in the middle of the channel and

the rise has taken longer indicating more upside is

possible. When it rolled over last time, we just elected

Obama and now we are in his second term. Is this Déjà Vu all

over again? Is it coincidence that we are approaching the

all time high in the exact same month the index

bottomed...how ironic is that? Do you really think markets

are random acts? I know from years of trading experience

they are widely manipulated and controlled—especially around

pivot points and major tops and bottoms. With that said, you

have to step back and see the forest beyond the tree if you

want to position yourself in from of the action; and gain

the best possible profits for your trading accounts.

Charts are the guides, but they

are in no way the map to the treasure chests as you have no doubt heard, there

are plenty of charts at the bottom of the sea; and that is a

very poignant statement, so do not get married to "hype"

but

trade with diligent discipline on entry and exit points. As

we approach this benchmark, emotions will run high and so

you need to keep your eye on the VIX to gauge the overall

sentiment. Currently the VIX is approaching lows it has not

seen since 2005-2006 and if it does get down there, we have

the perfect storm setting up...the perfect MONEY MAKING

storm.

Crowd psychology, when it

comes to trading, is more powerful than any chart, technical

analysis or talking head on TV; and many times the crowd is

controlled by a heard mentality based on fear of loss or

greed . These two emotions will result in stampeding type moves up or down

and the investing public is always late to the party or complacent to leave when

they have too much of the spiked profits punch.

This is why we look to the VIX for clues on how the crowds

are getting spooked or emboldened. The higher the VIX

trades, the more fear there is in the crowd mentality and

the lower, the more apathetic or fickle the crowd can be

when it comes to buying. But when you have both firmly in

place, the markets can generate a stampede for the door or

the promised land of profitability—and for me that yellow

brick road is with PUTS.

So, if the VIX

manages to trade down to 10.00 and the S&P takes out the

current all time high, you better get ready to rumble

because this could be the bottom of the biggest run in the

history of the stock markets around the world.

The way I will play this

historic event is to load up on protective OTM puts at 2:1

or 3:1 of your total portfolio you are willing to put to

work and then get LONG. Just keep some cash ammo available

to add to the puts if this stampede turns into a fire sale

type barn burner because I anticipate an explosive move in either

direction is on deck in the next couple of weeks.

=======================================================================================

3/2/13 - As we start the

final month in the first quarter of trading, it's looking

like the markets want to clear the launch pad at DOW 14,000

and never look back. So far, we have had a pretty decent

earnings season with some awesome surprises and dismal

failures. What makes this particular earnings season unique

to me is the failures did not pull anything down and most of

them even rebounded and/or gained back most of their initial

losses. Of course this make everything VERY bullish and so

that is what I am; however, I am not willing to put it all

out there on the long side, I am just optimistically

bullish. What I know from hard learned experience, is

markets move and more often that than, they change direction

in a split second. That is why I will keep a running weekly

set of puts on either the SPY, OEX or TNA. If you have read

my past market wraps, then you know I have a decidedly put

bias because I know that when markets head lower, they do so

twice as fast and as far as they go up; however, markets

tend to rise steadily over a long time frame. As primarily

option traders, we look for volatility and movement to make

our profits. What we try to do is build longer term

positions with stock or LEAPS when we have winning trades.

Lately, I have been on the hunt

for more of my Lotto Trades because they have proven to make

thousands of percent returns that far exceed the cost of

fishing for them. The challenge with any account is do you

have enough money to cover the trading losses until the

winners roll in? If you do not, then you have to be a more

precise trader and look for consistent trading opportunities

to gain profits that will pay for your Lotto expeditions.

Ok, so what type of trades do

you need? You need easy and consistent ones of course; and

you will find those trading slow moving stocks with share

size. That is why I like to trade stocks such as: GE, MSFT,

ORCL, KO etc. These types of stocks have consistent trading

patterns are not subject to wide price swings like the APPL,

GOOG, NFLX, PCLN, CMG's of the trading world.

The next way I like to build my

trading accounts is by compounding my money at 20% per

trade. What I am saying is if you take a small amount of

capital like $1k and pick solid option trades, you can build

a pretty large account over the course of 20 successful

trades.

Both of these methods are

explained in my

training section so I encourage you to get some

education and then follow along as I post my trade ideas.

As this earnings season winds

down, I will be working on my Compounder trade strategy over

the next couple of months until the next earnings cycle

kicks in. Of course there will be plenty of weekly options

lotto plays along the way, so keep checking my current plays

section if you are a member and if not then be sure to

subscribe

today!

So, what is next on the markets

agenda? Up, down or sideways of course. To better understand

the potential next moves, we look to the charts for clues.

This first week of trading for

March is going to be a pivotal one and I will be ready on

both sides to capture as much of the movement as I can.

Profits Up!

The donFranko

============================================================================================

2/11/13 - What an awesome

earnings season so far! Last week we had another massive

opportunity with LNKD blowing the doors of earnings

estimates and launching the stock over 25%...WOW.

Unfortunately, I was not following that stock so I did not

have a play posted and boy do I regret that. I have now added it to my watch list and look forward to making plenty

of profits on this new rocket ride of a stock.

I shorted it today for a quick

profit to test the stock and so far, it's looking like it

just wants to keep moving higher. The stock closed on a

Fibonacci number (55) so that, to me, is code that a

definite direction is going to take place this week. Now

that this stock has entered new territory, we have to use technical

analysis to assist us on entry and exit points. Option

volatility will no doubt be packed in so you have to

carefully find your entry points and put in standing limit

orders for your exit points because if you try to micro

manage options trades, the swings in price will frustrate

you to no end—and any stop loss order you place will be

mysteriously taken out every time.

So far, Feb is turning into the

launch pad for new stock market territory and the bears are

salivating ready to pounce on any perceived correction. It's

always unpredictable when markets make new all time highs,

and most are thinking this just can't sustain itself. Well,

they may be right, but history has proven that mob

psychology is always wrong. The challenge for investors is

having either enough patience to find the best entry points

or enough capital to ride the swings as the markets prepare

themselves for a long term rise into the unknown. All I know

is that you need to be ready to get on board if you are not

already there. I plan on sticking with a long bias and just

adding DOTM puts on the indexes; because if this market does

fail, the drop will be massive and quick and you will just

not have enough time to get in good. It is very difficult, if not down

right impossible, to jump on a moving train or catch a

falling knife...your account will just get pulverized if you

attempt it.

I prefer to just accumulate

cheap put options with size; and if the demise of the

markets happens, I will be there with my nets to catch all

the fish that scramble for the exits!

Now if the markets do power

higher, the shorts will be panic buying and that will make

us solid gains as we are in the front car of this train

instead of the caboose like so many scared investors will

be—fortune favors the bold!

Keep your eye on the VIX; and so

long as it stays under $15.00, this market is going to keep

squeezing shorts higher and higher. I plan on keeping DOTM

puts on the SPY. In the past, the SPY has moved as much at

15 points down in a week, so I will keep weekly options 10

points out of the money. These typically cost .02 cents per contract

week to week and this gives you the opportunity to control a large amount for

a small investment risk; and if the markets crash, you BANK.

Start building positions with profitable trades as we get

bullish on the markets, that way, you

are fully hedged should things change suddenly for the

worse.

===============================================================================================

1/25/13- I am making a

change in my trading plan and primarily looking for LOTTO

TRADE opportunities! I hope my subscribers were able to jump

on the NFLX Mega Lotto ride and bank some astronomical

profits!! After seeing that happen, I am no longer

interested in fighting the markets for wins and losses. I am

just looking for the pot-o-gold trades and will stick to day

trading slow predictable stocks for daily profits to fund my

treasure hunting endeavors!

NFLX was one in a million, but I

know there will be more to come. Maybe not as good as that

one was, but with 1500-250,000% in potentilal returns, you

do not need too many winners to make you RICH!.

Look at what can happen to your

trading account when you hit one of these lotto trades:

NFLX Commentary

Sure these are gambling plays,

but hey, you can gamble in Vegas and make 1:1 may even 30:1,

but that's it and over time you will lose everything you

bring to the tables. Now compare that to what you can make

on these earnings options plays with weekly options and you

can easily see that your win to loss ratio is massively put

in your favor so just start out with small contract size and

build more as you profit!

I learned a valuable lesson this

week when I went back and looked over the JanWk4 weekly

options on NFLX. It was a right place right time opportunity

because nobody, even the market makers, believed NFLX was

going up that much. In fact, on Wednesday, the further OTM

options for the week were the JanWk4 125 calls. Well, had I

been closely monitoring them, I definitley would have bought

at the bare minimum 100 of them when they dropped to .02

cents and even by the end of the day of trading the were

only $0.34 cents each—Look above to see what the possibility

was for a mere $200 risk...WOW

All I know is this type of trade

is possible again, so I am concentrating on finding setups

to capitalize on and this week we have two opportunities,

well three, with AMZN, FB and RIMM. Will they make the kind

of returns NFLX did? Most likely not, but they still can

make you a bundle of cash.

The beauty about option trade

gambling vs. Vegas style gambling is you can play both sides

of a stock. You just buy Puts and Calls and that way you do

not have to try and figure out if you are going to be right

or wrong. All the stock has to do is move enough in one

direction to make you more than enough profit to pay for the

losing trade.

The mystery is what strike

prices do you buy to get the best possible chance of making

a profit? Well, if you want to go through years of

trial and error then start your process, but if you want to

get to the fast track, then

subscribe

and get access to my current plays section and get ready to

RETIRE!

===============================================================================================

1/21/13 - WE have sworn

in our president for his second and final term and what a

ride we are in for with this politician. Will the markets

put on the gas and head off into the skies or will it be a

sunset? Time is going to certainly tell us the whole story

but for now we have to do our best to figure out what the

charts are saying.

If history repeats itself, then

hold on to your seats because we could be in for a very

nasty ride down like we did when he first took office. If

you recall, that drop was over 6,000 points in 14 months.

The markets dumped because investors did not know what to

expect from this administration and times were much worse.

This time, we have had multi-years of Fed interaction

keeping interest rates down, printing money and shifting

policy to attempt a permanent fix for the future—Yeah, the

fix is in alright, financial collapse as we know it if you

listen to some of the pundits out there. I tend to agree

with them because common sense dictates you cannot print

money without backing or 100% confidence of the people to

keep using worthless paper as a means of trading goods and

services. Eventually it will come crashing down, and when it

does, the world is going to change in a big BIG way. For

now, the bias is to get long but you better have put

protection if you have a portfolio of stocks.

==============================================================================================

1/6/13 - Well the

world did not end on 12/21/12 and the Fiscal cliff has now

been abated with a new panic story...the debt ceiling.

With the upcoming presidential inauguration coming on

1/21/2013, we could see the markets make moves higher and if

earnings are solid, this could be the beginnings a new bull

market.

This first week of trading has

put on a strong push higher but managed a stop directly

under my trend lines I drew on the chart below close to a

month ago. This week will be pivotal as the DJIA approaches

a benchmark at 13,500. Until it makes a clean close over

13,700 I am suspect it will be new territory for 2013.

The daily chart shows that 12/21

had no real effect on the markets direction but the Fiscal

cliff sure did. As you can see in the daily chart below,

there was a clear Bull 180 reversal and it powered up

solidly passing the ATR of this setup. I typically consider

this to be very bullish and so long as the DOW holds 13,300

I am bullish on the DJIA.

====================================================================================================

12/19/12 - We are fast

approaching the end of the world this Friday, well,

actually, it would be more like Thursday night for me since

I live in PST and the sun rises in Japan when I am going to

bed. Hmmm, wonder how the Mayans calculated that when they

did not know the world was round...or did they? After all

their calendar symbol is round right?

=

=

=

=

The proverbial doomsday clock is

ticking down and if the world is still turning on

Thurs/Friday, I think we could see a nice relief rally in

the markets.

=======================================================================================

12/15/12 - I have been

very busy trading and have not had time to update my market

wraps but I will do some catch-up today.

Last Post I said GOOG would

indeed hit the 200MA on a pullback and I was 110% accurate!

Next we look at the DJ-30 chart

and see if there will be a repeat of the last presidential

election meltdown.

==============================================================================================

Update: 11/14/12 - As I thought

back when I wrote the GOOG comments below, it will hit the

200MA

DOW JONES Chart Update - read

the full analysis below

Profits UP!

The donFranko

|

=

=

=

=