======================================================================================================

|

Type |

Symbol |

Month |

Strike |

Type |

Signal

Date |

Strategy |

Current

Price |

Target

or

Filled

Price |

Exit

Trade

High |

P/L |

ROI% |

Days |

|

2017

CLOSED FB TRADES |

|

|

FB |

Nov Wk1

11/3/17 |

195 |

Call |

10/31/17 |

Earnings

Surprise |

0.60 |

Buy

0.60

or better |

- |

- |

- |

- |

|

|

FB |

Nov Wk2

11/10/17 |

205 |

Call |

10/31/17 |

Earnings

Surprise |

0.28 |

Buy

0.28

or better |

- |

- |

- |

- |

|

|

FB |

Nov Wk1

11/3/17 |

162.5 |

PUT |

10/31/17 |

Earnings

Surprise

MISS |

0.29 |

Buy

0.29

or better |

- |

- |

- |

- |

|

|

FB |

Aug Wk 1

08/04/17 |

175 |

CALLS |

7/25/17 |

Eranings

Surprise |

1.25 |

Filled

$1.00

|

0 |

-1.00 |

(100%) |

8 |

|

|

FB |

Jul Wk 4

7/28/17 |

155 |

PUT |

7/25/17 |

Earnings

Miss

SGB Short |

0.54 |

Filled

0.30

or better |

0 |

-0.30 |

(100%) |

2 |

|

|

FB |

MayWk1

5/5/17 |

140 |

PUT |

5/2/17 |

Earnings

Miss

SGB Short |

0.34 |

Filled

5/3/17

0.16 |

0 |

-0.06 |

(100%) |

2 |

|

|

FB |

MayWk2

5/12/17 |

160 |

CALLS |

4/30/17 |

Earnings

Surprise

SGB Breakout |

0.60 |

Day Fish

0.60

or lower |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

MayWk1

5/5/17 |

147 |

PUT |

5/1/17 |

Earnings

Miss

SGB Short |

1.08 |

Day Fish

0.20

or better |

No

Fills |

Cancelled |

- |

- |

|

FB |

FebWk1

2/03/17 |

120 |

Puts |

1/31/17 |

Earnings

MIss |

0.34 |

Filled

2/1/17

0.15 |

0 |

-0.15 |

(100%) |

11 |

|

FB |

FebWk2

2/10/17 |

140 |

Calls |

1/31/17 |

Earnings Beat |

0.61 |

Filled

2/1/17

0.61

|

0 |

-0.61 |

(100%) |

11 |

|

FB |

FebWk1 2/3/17 |

136 |

Calls |

1/25/17 |

Earnings Beat |

1.65 |

Filled

1/27/17

$1.65 |

0 |

-1.65 |

(100%) |

7 |

|

FB |

JanWk1

1/06/17 |

118 |

Call |

12/29/16 |

Bull 180 |

0.60 |

Filled

12/30/16

$0.40 |

5.60 |

+5.20 |

1300% |

8 |

|

|

FB |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

2016 Results

|

Trades

61 |

WINS:

26 |

LOSSES:

35 |

WIN/LOSS RATIO:

+42.62% |

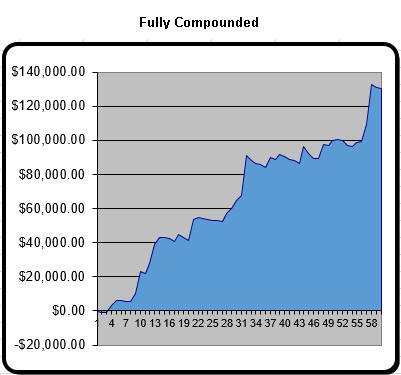

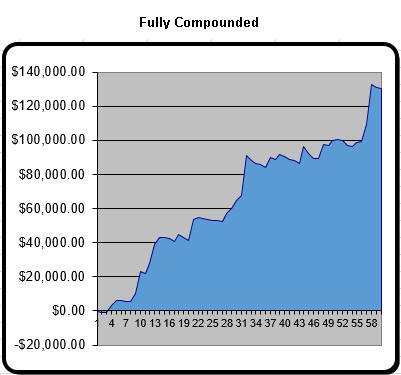

2016 YTD Potential Profits based on

risk tolerance

(commissions added)

|

Trade 1 contract each time |

$5,856.86 |

|

Add 1 contract only after a

winning trade |

$45,496.86 |

|

Compound your profits

immediately by adding one contract with each trade.

(Note: this

takes a lot of capital and a potential high tolerance to initial

drawdown) |

$130,146.36 |

Maximum initial drawdown was

($1,229.46)

|

|

Type |

Symbol |

Month |

Strike |

Type |

Signal

Date |

Strategy |

Current

Price |

Target

or

Filled

Price |

Exit

Trade

High |

P/L |

ROI% |

Days |

|

2016

CLOSED FB TRADES |

|

FB |

DecWk5

12/30/16 |

118 |

Call |

12/26/16 |

Bull 180 |

0.63 |

Day

Fish

0.20 |

No

Fills |

Cancelled |

- |

- |

|

FB |

DecWk5

12/30/16 |

120 |

Call |

12/18/16 |

"W" Pattern 200MA bounce |

1.73 |

Day

Fish

0.50 |

No

Fills |

Cancelled |

- |

- |

|

FB |

DecWk4

12/23/16 |

123 |

Call |

12/18/16 |

"W" Pattern 200MA bounce |

0.28 |

Day

Fish

0.10 |

Filled

12/19/16

$0.10 |

-0.10 |

(100%) |

5 |

|

FB |

DecWk3

12/16/16 |

116 |

Put |

12/11/16 |

200MA

Fail |

0.29 |

Buy

0.29

or lower |

Filled

12/12/16

0.29 |

-0.29 |

(100%) |

5 |

|

|

FB |

Dec Wk3

12/16/16 |

120 |

Naked Put |

11/24/16 |

SGB

Breakout |

2.07

Credit |

Filled

12/1/16

$5.00

Credit |

$1.00 |

+4.00 |

80% |

5 |

|

FB |

NovWk4

11/25/16 |

121 |

Call |

11/17/16 |

200MA Bounce |

.33 |

Filled

11/18/16

0.34 |

2.00 |

+1.66 |

488% |

4 |

|

FB |

NovWk4

11/25/16 |

121 |

Call |

11/17/16 |

200MA Bounce |

.33 |

Filled

1/18/16

0.15 |

0.33 |

+0.18 |

120% |

4 |

|

FB |

NovWk4

11/25/16 |

117 |

Puts |

11/17/16 |

SGB 200MA Failure |

1.05 |

Fish 0.35 or better |

No

Fills |

Cancelled |

- |

- |

|

FB |

NovWk3

11/18/16 |

119 |

Call |

11/13/16 |

Post

Election

Rebound |

1.91 |

Filled

11/16/16

0.10 |

0.46 |

+0.36 |

340% |

1-3 |

|

FB |

NovWk2

11/11/16 |

110 |

Puts |

11/6/16 |

Post Election

Sell off |

0.18 |

Filled

11/7/16

0.10 |

0 |

-0.10 |

(100%) |

5 |

|

FB |

NovWk2

11/11/16 |

125 |

Call |

11/6/16 |

Post Election

Rally |

0.34 |

Filled

11/7/16

0.44 |

0 |

-0.44 |

(100%) |

5 |

|

FB |

NovWk2

11/11/16 |

145 |

Call |

11/1/16 |

Earnings

Surprise

Wildcard |

0.25 |

Filled

11/2/16

0.15 |

- |

-0.15 |

(100%) |

10 |

|

FB |

NovWk2

11/11/16 |

115 |

Puts |

11/1/16 |

Earnings

Miss |

0.40 |

Filled

11/2/16

0.40 |

0.50

sold rest

at break even |

+0.10 |

25% |

9 |

|

FB |

NovWk2

11/11/16 |

115 |

Puts |

11/1/16 |

Earnings

Miss |

0.40 |

Filled

11/2/16

0.40 |

Sold

Half at

1.00 |

+0.60 |

150% |

1 |

|

FB |

NovWk1 11/4/16 |

127 |

Call |

11/2/16 |

WW Post Earnings |

3.50 |

Filled

11/3/17

$0.07 |

0 |

-0.07 |

(100%) |

2 |

|

FB |

OctWk3

10/21/16 |

126 |

Puts |

10/16/16 |

SGB

Reversal |

0.58 |

Day Fish

0.20 |

No

Fills |

Cancelled |

- |

- |

|

FB |

OctWk3

10/21/16 |

128 |

Puts |

10/13/16 |

SGB

Reversal |

1.47 |

Day Fish

0.50 |

No

Fills |

Cancelled |

- |

- |

|

FB |

AugWk4

8/26/16 |

122 |

Puts |

8/21/16 |

SGB

Reversal |

1.97 |

Filled

8/22/16

1.90 |

3.00 |

+1.70 |

131% |

2 |

|

FB |

SepWk2

9/16/16 |

120 |

Call |

8/21/16 |

Bear 180

Pullback

SGB zone |

4.10 |

Fish

0.75

or better |

No

Fills |

Cancelled |

- |

- |

|

FB |

AugWk3

8/19/17 |

125 |

Puts |

8/7/16 |

SGB |

1.55 |

Fish

0.75 |

No

Fills |

Cancelled |

- |

- |

|

FB |

AugWk2

8/12/17 |

127 |

Call |

7/31/16 |

SGB

Reversal |

0.35 |

Day Fish

0.35

or better |

No

Fills |

Cancelled |

- |

- |

|

FB |

AugWk3

8/19/17 |

125 |

Call |

7/31/16 |

Post

Earnings

Breakout |

1.76 |

Fish

0.50 |

No

Fills |

Cancelled |

- |

- |

|

FB |

JulWk5

7/29/16 |

133 |

Call |

7/27/16 |

WW Trade |

0.65 |

0.10 |

Filled

7/28/16

$0.10 |

-0.10 |

(100%) |

2 |

|

|

FB |

JulWk5 7/29/16 |

130 |

Call |

7/26/16 |

Earnings Beat |

0.65 |

Filled

7/27/16

0.55 |

0 |

-0.55 |

(100%) |

3 |

|

FB |

AugWk2

8/12/16 |

110 |

Puts |

7/26/16 |

Earnings

Miss |

0.90 |

Filled

7/26/16

0.83 |

0 |

-0.83 |

(100%) |

4 |

|

FB |

JulWk5

7/29/16 |

124 |

Calls |

7/20/16 |

Pre-Earnings

Run |

2.36 |

Filled

7/21/16

$2.36

|

4.50 |

+2.14 |

91% |

8 |

|

|

FB |

JulWk4 7/22/16 |

122 |

Call |

7/19/16 |

Friday

Lotto |

0.44 |

Filled

7/20/16

0.40 |

0 |

-0.40 |

(100%) |

3 |

|

|

FB |

Jul Wk 5

7/29/16 |

116 |

Calls |

7/17/16 |

Pre Earnings

SGB pullback |

1.71 |

Fish

0.25 |

No Fill |

Cancelled |

- |

- |

|

|

FB |

Jul Wk3

7/15/16 |

110 |

Puts |

7/12/16 |

Negative news, SGB and

earnings miss

speculation |

0.21 |

Filled

7/13/16

0.10 |

0 |

-0.10 |

(100%) |

3 |

|

|

FB |

Jul Wk3

7/15/16 |

119 |

Calls |

7/2/16 |

Momentum

Trade

SGB test |

.34 |

Filled

7/6/16

0.10 |

0 |

-0.34 |

(100%) |

10 |

|

|

FB |

Jul Wk3

7/15/16 |

118 |

Calls |

7/2/16 |

SGB

Reversal |

0.29 |

Filled

7/5/16

0.20

|

0 |

-0.29 |

(100%) |

11 |

|

|

FB |

Jul Wk5

7/29/16 |

118 |

Calls |

7/2/16 |

Pre

Earnings

Run |

3.90 |

Fish

$3.00

if FB starts the week lower. |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

Jul Wk1

7/8/16 |

110 |

Put |

7/2/16 |

SGB

Short |

0.15 |

Buy

Open if

FB trades

under 113.50 |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

JunWk3

6/17/16 |

113 |

Puts |

6/12/16 |

SGB

Breakdown

Gap Fill |

0.30 |

Filled

6/13/16

0.56 |

1.20 |

+0.64 |

114% |

DT |

|

|

FB |

JunWk3

6/17/16 |

116 |

Calls |

6/12/16 |

SGB

Reversal

Speculation |

1.64 |

Filled

6/15/16

0.20 |

0 |

-0.20 |

(100%) |

2 |

|

|

FB |

JunWk4

6/24/16 |

116 |

Calls |

6/12/16 |

Gap

Fill

Reversal |

2.39 |

Fish

0.50 |

No

Fill |

Cancelled |

- |

- |

|

FB |

Stock |

Stock |

Long |

5/30/16 |

SGB

DOJI

Breakout

|

119.38 |

Buy

any

Green open |

Trail stop

$2.21 |

No Green

No Fills |

- |

- |

|

|

FB |

JunWk3

6/16/16 |

-125

+120 |

BPS |

5/30/16 |

SGB

DOJI

Breakout |

3.53

Credit |

Sell

$3.53

Credit

or higher |

Buy

Back

GTC

2.50 Credit |

1.53 |

+45% |

15 |

|

|

FB |

Jun Wk1

6/3/16 |

120 |

Calls |

5/30/16 |

SGB

DOJI

Breakout |

.04 |

Buy

$0.10

or

lower |

NO

Fills

Cancelled |

- |

- |

4 |

|

FB |

AprWk5 4/29/16 |

100 |

Put |

4/25/16 |

Earnings Miss |

0.69 |

Filled

4/26/16

0.55 |

0 |

-0.55 |

(100%) |

4 |

|

FB |

AprWk5 4/29/16 |

125 |

Calls |

4/24/16 |

Earnings

Surprise |

0.24 |

Filled

4/26/16

0.15 |

0 |

-0.15 |

(100%) |

4 |

|

|

FB |

MayWk1

5/6/16 |

95 |

Put |

4/24/16 |

Earnings

Miss |

0.50 |

Filled

4/25/16

0.40

|

0 |

0.40 |

(100%) |

4 |

|

|

FB |

MayWk1

5/6/16 |

120 |

Calls |

4/24/16 |

Wild card

Earnings

Surprise |

1.10 |

Filled

4/25/16

0.80 |

0 |

-0.80 |

(100%) |

4 |

|

|

FB |

MayWk3

5/20/16 |

100 |

Naked

Put |

4/24/16 |

Earnings

Beat |

1.27 |

Sell

$4.00

or

higher |

No

Fill |

Cancelled |

- |

- |

|

|

FB |

AprWk5

4/29/16 |

110 |

Calls |

4/17/16 |

Earnings

Run |

4.35 |

Filled

4/22/19

3.00 |

10.00 |

+7.00 |

233% |

6 |

|

|

FB |

AprWk4

4/22/16 |

110 |

Calls |

4/17/16 |

Earnings

Run |

1.57 |

Fish

0.30 |

NO

Fills |

Cancelled |

- |

- |

|

|

FB |

AprWk3

4/15/16 |

112 |

Calls |

4/7/16 |

Earnings

Run |

1.03 |

Filled

4/12/16

0.50

|

1.50 |

+1.00 |

200% |

1 |

|

|

FB |

AprWk2

4/8/16 |

114 |

Calls |

4/7/16 |

Bull 180

Lotto Play |

0.59 |

Fish

0.25

or

better |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

Apr Wk5

4/29/16 |

118 |

Calls |

4/2/16 |

Earnings

Run |

3.40 |

Filled

4/4/16

$2.00

|

3.50 |

+1.50 |

75% |

26 |

|

|

FB |

Apr Wk3

4/15/16 |

120

115 |

Bull

Put

Spread |

3/19/16 |

SGB

Rally

Point

Earnings Run |

4.00

Credit |

Filled

3/21/16

4.00

Credit |

$3.00 |

+1.00 |

25% |

11 |

|

|

FB |

Apr Wk1

4/1/16 |

115 |

Calls |

3/27/16 |

Pre earnings

run |

0.42 |

Filled

0.42

3/28/15 |

2.00 |

+1.58 |

376% |

1 |

|

|

FB |

Apr Wk5

4/29/16 |

118 |

Calls |

3/27/16 |

Earnings

Run |

2.81 |

Fish

$1.50

or

better |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

MarWk4

3/25/16 |

110 |

Put |

3/19/13 |

SGB

Short

Signal |

.66 |

Fish

0.25

Day Order |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

MarWk4

3/25/16 |

115 |

Calls |

3/19/13 |

SGB

Rally

Point |

0.16 |

Filled

3/21/16

0.10 |

0 |

-0.10 |

(100%) |

4 |

|

|

FB |

Apr Wk3

4/15/16 |

110 |

Naked

Puts |

3/19/16 |

SGB

Rally

Point

Earnings Run |

2.26

Credit |

Fish

$4.50

Credit |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

Mar Wk3 |

115 |

Calls |

3/13/16 |

FOMC

Rally |

0.10 |

Filled

3/14/15

0.05 |

0 |

-0.05

|

(100%) |

5 |

|

|

FB |

Mar Wk3 |

105 |

Put |

3/13/16 |

10% OTM

Hedge |

0.32 |

Fish

0.15 |

Filled

3/14/16

0.15 |

-0.15 |

(100%) |

5 |

|

|

FB |

Apr Wk3

4/15/16 |

110 |

Naked

Puts |

3/13/16 |

Positive

FOMC

Squeeze |

3.65

Credit |

Fish

$6.00

Credit |

NO

Fill |

Cancelled |

- |

- |

|

|

FB |

MarWk2

3/11/16 |

110 |

Calls |

3/6/16 |

Bull 180

Continuation |

0.77 |

Filled

3/8/16

0.25 |

0 |

-0.25 |

(100%) |

3 |

|

|

FB |

MarWk2

3/11/16 |

100 |

Put |

2/28/16 |

10% OTM

Hedge |

0.45 |

Filled

3/1/16

$0.20 |

0 |

-0.20 |

(100%) |

11 |

|

|

FB |

MarWk1

3/4/16 |

110 |

Calls |

2/28/16 |

Bull 180

Continuation |

0.70 |

Filled

2/29/16

0.40 |

1.20 |

+0.50 |

+71% |

3 |

|

|

FB |

ebWk3

2/19/17 |

105 |

Calls |

2/14/16 |

Bull 180

Setup |

0.67 |

Fish

0.50

or lower |

NO

Fills |

Cancelled |

- |

- |

|

|

FB |

Mar 2016

3/18/16 |

105 |

Naked

Put |

2/7/16 |

Bull 180

Setup |

6.05

Credit |

Filled

2/8/16

10.00

Credit |

Stop

Hit

$4.50

2/18/16 |

+5.50 |

+55% |

10 |

|

|

FB |

FebWk2

2/12/17 |

108 |

Calls |

2/7/16 |

Bull 180

Setup |

1.07 |

Filled 2/8/16

0.75

|

0 |

-0.75 |

(100%) |

5 |

|

|

FB |

FebWk4

2/19/17 |

110 |

Calls |

2/7/16 |

Bull 180

Setup |

1.86 |

Filled

2/8/16

$0.80 |

0 |

-0.80 |

(100%) |

5 |

|

FB |

Feb Wk2

2/5/16 |

110 |

Calls |

2/4/16 |

WW Fishing |

1.35 |

Fish 0.10 |

NO

Fills |

Cancelled |

- |

- |

|

|

FB |

Mar 2016

3/18/16 |

110 |

Naked

Put |

2/2/16 |

Post

Earnings

Momentum |

2.80

Credit |

Filled

2/3/16

4.50

Credit |

$2.50

Debit

|

+2.00 |

+45% |

30 |

|

|

FB |

FebWk2

2/12/17 |

112 |

Calls |

2/2/16 |

Post

Earnings

Momentum |

4.10 |

Filled

2/5/16

1.41 |

0.50 |

-0.91 |

(65%) |

DT |

|

|

FB |

FebWk1

2/5/17 |

115 |

Calls |

2/1/16 |

Post

Earnings

Momentum |

1.79 |

Fish

0.80

or lower |

No

Fills |

|

|

|

|

|

FB |

FebWk1

2/5/17 |

117 |

Calls |

2/2/16 |

Post

Earnings

Momentum |

0.60 |

Filled

2/3/16

0.25

|

0 |

-0.25 |

(100%) |

3 |

|

FB |

Jan Wk 5 1/29/16 |

105 |

Put |

1/28/16 |

WW Fishing |

.16 |

Filled

0.05 |

0 |

-0.05 |

(100%) |

DT |

|

FB |

Jan Wk 5 1/29/16 |

112 |

Calls |

1/28/16 |

WW Fishing |

0.20 |

Fish 0.10 |

No

Fills |

Cancelled |

- |

- |

|

|

FB |

Jan Wk5

1/29/16 |

110 |

Multi

Calls |

1/24/16 |

Earnings

Beat

Speculation |

0.18 |

0.10

|

2.80 |

+2.70 |

+2700% |

6 |

|

|

FB |

Jan Wk5

1/29/16 |

100

|

Multi

Calls |

1/24/16 |

Earnings

Beat

Speculation |

2.40

|

Filled

1.03 |

9.00 |

+7.97 |

+774% |

3 |

|

|

FB |

Jan Wk5

1/29/16 |

105

|

Multi

Calls |

1/24/16 |

Earnings

Beat

Speculation |

0.72

|

Filled

0.32

|

5.00 |

+4.68 |

1,435% |

3 |

|

|

FB |

Jan Wk5

1/29/16 |

90 |

Put |

1/25/16 |

Earnings

Miss |

1.26 |

Filled

0.92 |

0 |

-0.92 |

(100%) |

4 |

|

|

FB |

Jan Wk5

1/29/16 |

100 |

Call |

1/19/16 |

Earnings

Run |

2.34 |

Filled

0.80 |

12.50 |

+11.70 |

+1463% |

10 |

|

|

FB |

Stock |

Stock |

Long |

1/17/16 |

Earnings

Run |

94.75 |

Filled

94.50 |

Stop

$98.00 |

+4.50 |

+4% |

7 |

|

|

FB |

Jan Wk4

1/22/16 |

100 |

Calls |

1/17/16 |

200MA

Rebound |

0.45 |

Filled

0.20

0.45 |

0 |

-0.20

-0.45 |

(100%) |

5 |

|

|

FB |

Jan Wk3 1/15/16 |

103 |

Calls |

1/12/16 |

Lotto

Trade |

0.12 |

Filled

0.12 |

0 |

-0.12 |

(100%) |

2 |

|

|

FB |

Feb Wk3

2/19/16 |

100 |

Naked

Put |

1/12/16 |

Earnings

Beat Speculation

Rolled Out Jan |

4.90

Credit |

Filled

$4.95

Credit |

0 |

+4.95 |

100% |

17 |

|

|

FB |

Jan 2017 |

125 |

LEAP

Call |

1/10/16 |

LEAP |

5.20 |

Filled

$3.50 |

$7.50 |

+4.00 |

114% |

25 |

|

|

FB |

JanWk 5

1/29/16 |

100 |

Calls |

1/10/15 |

Earnings

Run |

3.50 |

Filled

3.50 |

12.50 |

+9.00 |

257% |

19 |

|

|

FB |

Jan Wk3

1/15/16 |

100 |

Naked

Put |

12/20/16 |

Pull

Back |

1.75

Credit |

Filled

4.00

Credit |

$5.00

Debit

Rolled to Feb |

-1.00 |

(100%) |

24 |

|

|

FB |

Jan Wk 3

1/15/16 |

100 |

Calls |

12/15/15 |

SGB

Rebound

Positive

FOMC

|

6.50 |

Filled

1.65 |

0 |

-1.65 |

(100%) |

30 |

|

|

FB |

Stock |

Stock |

Long

Stock |

12/6/15 |

Positive

FOMC

over

SGB |

104.55 |

Filled

106.21 |

Stop

103.00 |

-3.21 |

(3%) |

30 |

|

|

FB |

Jan Wk 3

1/15/16 |

105 |

Naked

Puts |

11/5/15 |

Earnings

Beat

Continuation |

3.45

Credit |

Filled

5.55

Credit

|

2.00

Debit |

+3.55 |

63% |

56 |

|

2015

CLOSED FB TRADES |

|

|

FB |

Stock |

Stock |

Short

Stock |

12/6/15 |

SGB |

106.18 |

Filled

104.55 |

102.00 |

+2.55 |

+2.44% |

5 |

|

|

FB |

DecWk3

12/18/15 |

100

105

110

115 |

Multi

Calls |

11/5/15 |

Earnings

Beat

Continuation |

10.10

6.30

3.40

1.57 |

Fish

8.00

4.00

1.55

.55 |

Filled

8.00

4.00

1.55

0.55 |

-4.00

0

0

0 |

(50%)

(100%)

(100%)

(100%) |

43 |

|

|

FB |

JanWk 3

1/16/16 |

+95

-90 |

BCS |

11/2/15 |

Earnings

Miss |

3.90

Credit |

Filled

3.90

Credit

|

2.70

Debit |

+1.20 |

+30% |

2 |

|

|

FB |

Stock |

Stock |

Short

Stock |

11/29/15 |

SGB |

105.45 |

Short

under

104.89 |

Stop

106.13

|

-1.24 |

(1.18%) |

2 |

|

|

FB |

Nov Wk1

11/6/15 |

108 |

Calls |

11/5/15 |

Earnings

Beat

WW Trade |

1.27 |

Fish

0.25 |

NO

FILLS |

- |

- |

- |

|

|

FB |

Nov Wk1

11/6/15 |

110 |

Calls |

11/4/15 |

Earnings

Beat

WW Trade |

0.78 |

Filled

0.25 |

0 |

-0.25 |

(100%) |

1 |

|

|

FB |

Nov Wk1

11/6/15 |

117

110

|

Multi

Calls |

11/1/15 |

Earnings

Beat |

0.16

0.72

|

Filled

0.17

0.77

|

0 |

-0.17

-0.77 |

(100%) |

5 |

|

|

FB |

Nov Wk1

11/6/15 |

95 |

Put |

11/1/15 |

Earnings

Miss |

0.85 |

Filled

0.71 |

0 |

-0.71 |

(100%) |

5 |

|

|

FB |

Nov Wk1

11/6/15 |

105

|

Multi

Calls |

11/1/15 |

Earnings

Beat |

2.01

|

2.11

|

6.00 |

+3.89 |

+184% |

4 |

|

|

FB |

Nov Wk1

11/6/15 |

100 |

Multi

Calls |

11/1/15 |

Earnings

Beat |

4.40 |

4.65 |

10.00 |

+5.35 |

+115% |

4 |

|

|

FB |

Jan Wk 3

1/16/16 |

105 |

Call |

11/2/15 |

Earnings

Beat |

5.00 |

Filled

$4.75

|

8.00 |

+3.25 |

+168% |

3 |

|

|

FB |

Stock |

Stock |

Long

Stock |

10/11/15 |

Pre Earnings

Run |

$93.24 |

Filled

$93.24 |

108.00 |

+14.76 |

+15.83% |

26 |

|

|

FB |

Nov Wk1

11/6//15 |

96 |

Call |

10/11/15 |

Earnings

run $100

Speculation |

2.76 |

Filled

2.76

|

9.00 |

+6.24 |

+226% |

17 |

|

|

FB |

Oct Wk5

10/30/15 |

100 |

Call |

10/4/15 |

Earnings

$100

Speculation |

0.58 |

Filled

0.40

|

5.00 |

+4.60 |

+1150% |

15 |

|

|

FB |

Oct Wk4 |

100 |

Put |

10/22/15 |

WW

Trade |

1.05 |

0.10 |

No Fills |

- |

- |

- |

|

|

FB |

Oct Wk3

10/16/15 |

96 |

Naked

Put |

10/11/15 |

Pre Earnings

Run |

2.99

Credit |

Filled

$2.99

Credit |

0 |

+2.99 |

100% |

5 |

|

|

FB |

Oct Wk 3

10/16/15 |

96 |

Call |

10/11/15 |

Pre Earnings

run |

0.29 |

Buy

0.29 |

1.49 |

+1.20 |

414% |

5 |

|

|

FB |

Oct Wk3

10/16/15 |

90 |

Naked

Put |

10/7/15 |

$100

Speculation |

1.88

Credit |

Fish

4.50

Credit |

Cancelled |

- |

- |

- |

|

|

FB |

Oct Wk2

10/4/15 |

95 |

Call |

10/4/15 |

$100

Speculation |

.38 |

Filled

$0.13 |

0 |

-0.13 |

(100%) |

5 |

|

|

FB |

Oct Wk3

10/16/15 |

97 |

Call |

9/27/15 |

$100

Speculation |

1.05 |

Filled

0.55 |

.55 |

0 |

0 |

19 |

|

|

FB |

Sep Wk4

9/25/15 |

97 |

Call |

9/20/15 |

$100

Speculation |

0.42 |

Filled

0.40 |

0 |

-0.40 |

(100%) |

5 |

|

|

FB |

Sep Wk4

9/25/15 |

90 |

Put |

9/13/15 |

FOMC

Market

Crush |

1.41 |

Filled

0.61 |

.25 |

-0.36 |

(59%) |

8 |

|

|

FB |

Sep Wk4

9/25/15 |

93 |

Put |

9/20/15 |

Weekly

SGB

Confirmation |

0.89 |

Filled

0.34 |

1.75 |

+1.41 |

+415% |

1 |

|

|

FB |

Sep Wk3

9/18/15 |

97 |

Call |

8/29/15 |

$100

Speculation |

0.92 |

Filled

0.55 |

0 |

-0.55 |

(100%) |

21 |

|

|

FB |

Oct Wk3

10/16/15 |

95 |

Naked

Put |

9/6/15 |

$100

Speculation |

8.25 |

Filled

7.00

|

1.00

Debit |

+6.00 |

+86% |

12 |

|

|

FB |

Oct Wk3

10/16/15 |

100 |

Call |

9/6/15 |

$100

Speculation |

0.67 |

Filled

0.66

|

0 |

-0.66 |

(100%) |

12 |

|

|

FB |

Sep Wk3

9/18/15 |

95 |

Call |

9/2/15 |

$100

Speculation |

.65 |

Filled

0.20 |

0 |

-0.20 |

(100%) |

16 |

|

|

FB |

Sep Wk3

9/18/15 |

95 |

Call |

9/13/15 |

$100

Speculation |

.27 |

Filled

0.84 |

0 |

-0.84 |

(100%) |

5 |

|

|

FB |

Sep Wk3

9/18/15 |

97 |

Call |

9/16/15 |

$100

Speculation |

.05 |

Filled

.05 |

0 |

-0.05 |

(100%) |

2 |

|

|

FB |

Sep Wk 1

9/4/15 |

89 |

Naked

Put |

8/29/15 |

SGB

Pull

Back Rebound |

0.27

Credit |

Filled

$2.25

Credit |

0.70

Debit |

+1.55 |

+69% |

4 |

|

|

FB |

Stock |

Stock |

Short |

8/19/15 |

SGB

Weekly

Chart |

95.31 |

Filled

91.89

|

78.00 |

+13.89 |

15.12% |

5 |

|

|

FB |

Aug Wk4

8/28/15 |

100 |

Call |

8/19/15 |

$100

Speculation |

0.18 |

Filled

$0.18 |

0 |

-0.18 |

(100%) |

9 |

|

|

FB |

Aug Wk3

8/21/15 |

100 |

Call |

8/5/15 |

$100

Speculation |

0.89 |

Filled

0.92 |

0 |

-0.92 |

(100%) |

16 |

|

|

FB |

Aug Wk3

8/21/15 |

90 |

Put |

8/2/15 |

Post

Earnings

Breakdown |

0.84 |

Filled

0.84 |

3.80 |

+2.96 |

352% |

19 |

|

|

FB |

Aug Wk3

8/21/15 |

100 |

Call |

8/8/15 |

$100

Speculation |

0.43 |

Filled

0.25 |

0 |

-0.25 |

(100%) |

13 |

|

|

FB |

Stock |

Stock |

Short |

8/8/15 |

Post

Earnings

Breakdown |

94.01 |

Filled

$93 |

$92.00 |

+1.00 |

+1.08% |

1 |

|

|

FB |

Aug Wk1

8/7/15 |

103 |

Call |

8/2/15 |

Breakout

Speculation

over $100 |

$0.10 |

Filled

$0.07 |

0 |

-0.07 |

(100%) |

5 |