LOTTO Plays - 2008-2012

These are the results from trades suggested on our "Current Plays" list.

Note: they are suggested entry and exit points! disclaimer Profits Up!!

----------------------------------------------------------------------------------------------------------------------------------------

LAST UPDATE: 5/21/11

----------------------------------------------------------------------------------------------------------------------------------------

LOTTO PLAYS COMMENTARY FOR LVS

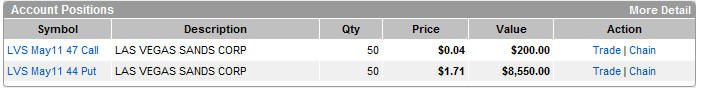

5/20/11 - Took final profits today.

5/18/11 - Took profits on 80% of the Puts today. Hanging onto the rest into expiration tomorrow.

![]()

=========================================================================================

5/16/11 - Selling has begun and if this keeps going my Lotto trade will cash in a nice profit!

================================================================================================

5/13/11 - The last two weeks of trading showed little recovery from the earnings miss and it's looking good to get a dip under $40. This is a very heavily traded stock and one of the top in the casino industry so any good dip will most likely be bought. I have one week left on the options so if things do not get moving to the downside on Monday, the premium left will diminish rapidly. I played this as a Lotto play so I am willing to accept a loss if it comes to that, but for now, I have made a slight profit since the last post for the current trade, so I will stop out of this trade if the options hit $1.00

=============================================================================================

5/6/11 - No real follow through yet on the missed earnings drop, but the action today showed signs of weakness. This stock is currently trapped between the 100MA and 200MA price points. At this time, it could go in either direction so I am sticking with my puts looking for a drop below the 200MA over the next week or so.

================================================================================

5/3/11 - Stock missed earnings and did not do well with Las Vegas revenue; however, the China and Singapore casinos are making gains and its expected that is where the company will continue to grow the fastest. Stock was sold off heavily in after hours trading; and if the selling continues tomorrow, then the Lotto Puts will be a very nice WINNER.

==========================================================================================

5/2/11 - Stock holding ground with bullish anticipation. Call buyers have stepped un and there is a lot of open interest on the $50 strike price. The speculation is they will have a great quarter and the stock will rise sharply as a result. Either way, we are covered and if they miss the puts are going to make some nice gains. If they beat well, our calls will more than pay for the puts and make a good profit too.

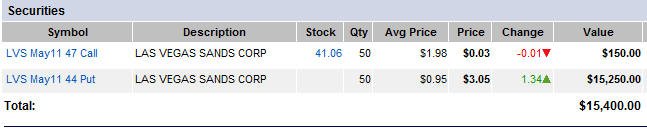

Today's action:

My Trades:

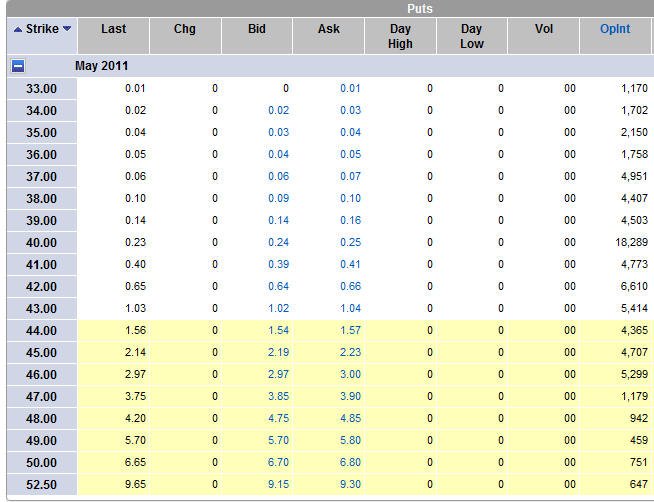

Options as of close 5/2/11

=====================================================================================

5/1/11 - I took my positions on Friday for Teusday's earnings announcement. I anticipate they will be good to better based on the WYNN report. I have been playing my weekly poker tournaments at Venetian and the crowds have been stable so I do not expect any upside surprises for the US casino operations but overseas things should be good to maybe even better. We will find out tomorrow and with this stock, I am taking a straddle position because if they miss, the drop should be a pretty good one.

I set up a virtual trading account at Options Express. - Already have a profit building on the call side.

=========================================================================================

|

LVS is the next potential monster play. They have earnings coming out on May 5th, and if they beat estimates and the whisper, there will no doubt be some serious amount of short covering. Currently, they have 28% of their outstanding shares shorted; which means a whole lot of people will have to cover if this stock beats.

As the economy continues to falter, casino stocks (MGM, BYD, WYNN, LVS, IGT, MPEL) are going to take a financial hit; however, unlike MGM (just now getting into Macao) LVS and WYNN already have strong presence in Macao, and business has been booming there. This is the first full quarter since the Palazzo has opened, so we will get a pretty good idea where things are headed for the rest of the year with LVS.

I live in Las Vegas and frequently visit the casinos to see how things are going; and although things are definitely slower, I still see a lot of gamblers in the Venetian and WYNN.

Estimates are $0.36 per share

----------------------------------------------------------------------------------------------------------------

LVS misses earnings and takes some heat killing our Call Play and unfortunately not enough of a drop to make the puts do anything. The stock is holding up considering the lack of earnings because of the Macao potential and future development of the Vegas strip.

These are lotto plays so we expect to take a total loss....onto the next one!

-----------------------------------------------------------------------------------------------------------------

This play did not produce any profits.

|

Suggested Call Play

Suggested Put Play

|