5/28/18 - Did you see the moves on NFLX this past week? Did you get in on them? I have been harping on NFLX for a couple of years now that they are a strong candidate for AAPL or DIS to make a bid for the happily-ever-after growing media giant; and this week, CNBC was lamenting how NFLX's market cap just exceeded DIS; and how the "acquisition" strategy of CEO Bob Iger has been very good for the Mouse House—when comparing market caps of all three of these companies; AAPL could just flat out buy both of them; and that would make a lot of sense since Mr. Iger is planning on leaving the company in 2019; plus, DIS and AAPL have had a close relationship for years now with content deals they are taking from NFLX.

So let's see how this could play out:

1. The DIS CEO has been on a buying spree in the media space since his reign began; and even though it has been a great strategy; he is going to be leaving the company in 2019?

2. AAPL has been in development of AppleTV for several years, but never quite completes it even though they have had plenty of money to crush NFLX's growth a long time ago—a better strategy is to let a little guy burn the cash and build up the clientele; then just step in and buy their company and inherit the clients—the "Golden Rule" is he who has the gold (AAPL w/ a trillion dollar market cap) makes the rules!

3. NFLX has been on a massive multi-billion dollar spend for years now to successfully infiltrate the on-demand media world with a "burning cash" mentality that is a type "A" strategy if you want to accumulate customers with the intent of selling your company; however, that strategy ended up becoming such a success, CEO Reed Hastings morphed the company into a massive media giant that now produces its own award winning content as if he is now more committed to conquering the media world space than selling his empire to the company that pulled their (Star Wars / Marvel empires) from NFLX's entertainment lineup—which, by the way, DIS is expected to end their content deal with NFLX by 2019 as the CEO is leaving?

4. AAPL does an unusually large 7:1 stock split; and then NFLX copies them with the exact same split, so maybe NFLX also diluted their shares to eventually cut a share swap/cash deal in the future?

Hmmm...something is definitely going on here as these Titans of media/entertainment swing their Thor Hammers and Jedi Light-Sabers against NFLX's Dead Pool type spend and never die cash burn strategy...lol.

This is why I have suggested you ALWAYS have wild card lotto calls up to 20% OTM in play every week on NFLX so you can wake up one day and see that you caught a Moby Dick trade!

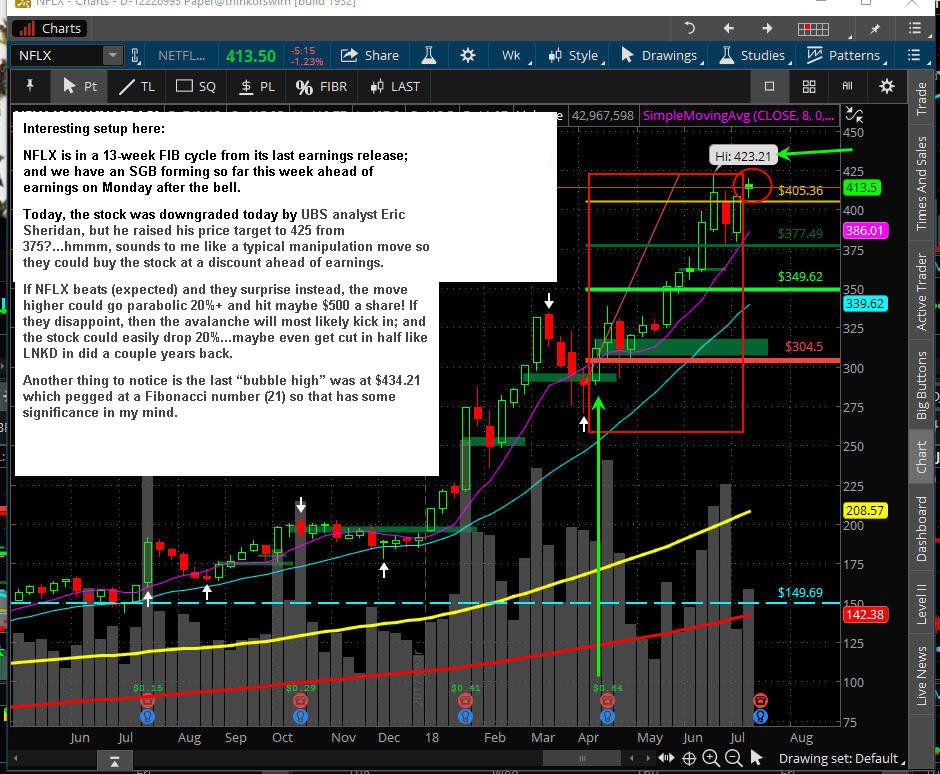

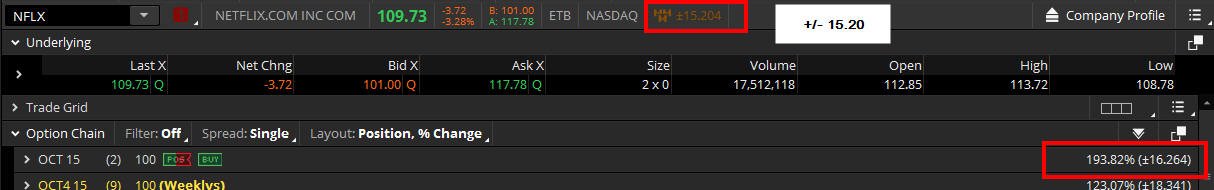

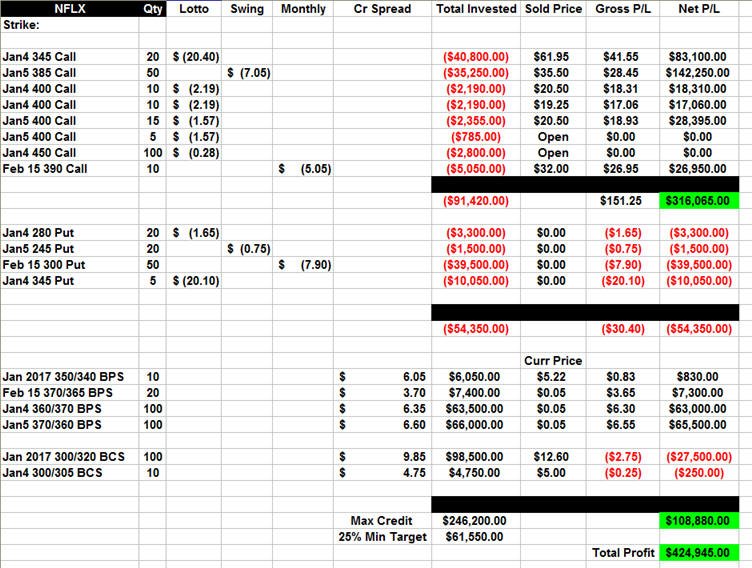

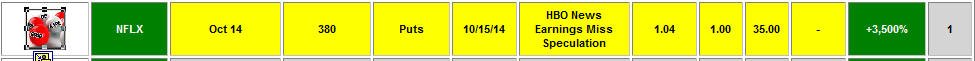

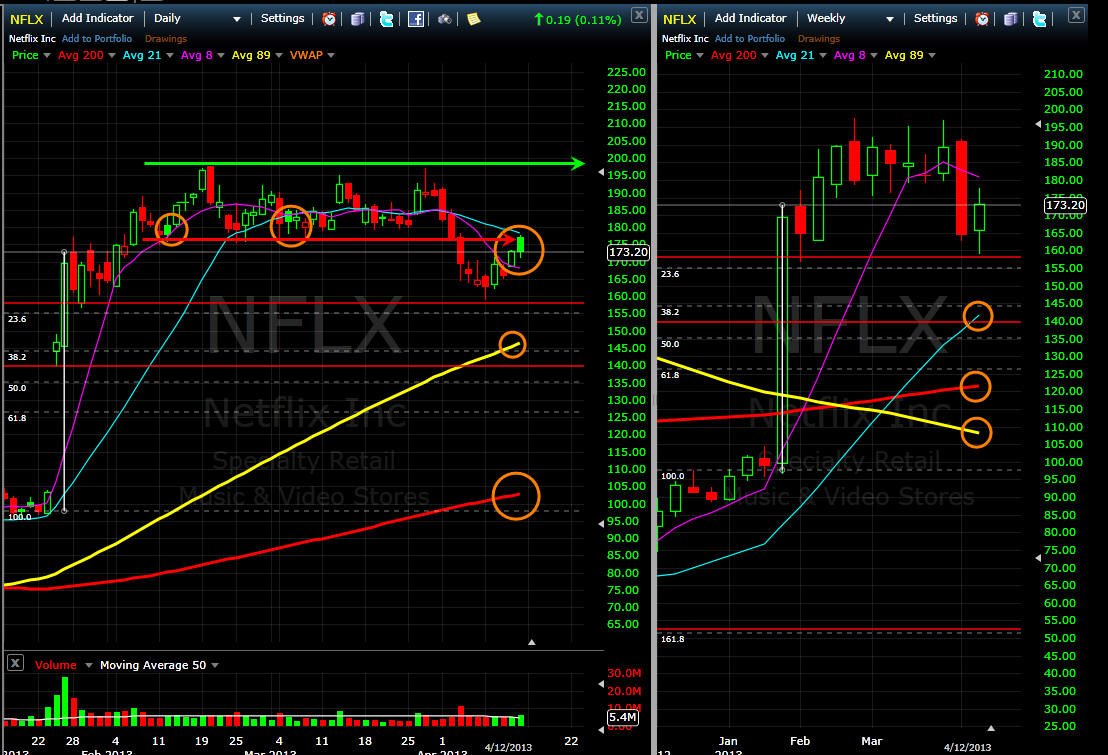

Ok, so here was the action in NFLX this week, and if you were applying the Lotto Trade strategy, then the 345 – 352.50 Calls played out well with a Wednesday morning $0.10 entry point ultimately hitting up to a 70x ROI!—but remember you need to take profits if you are ATM or OTM in the first half of Friday expiration trading.

I was already bought into the 350 calls the week before as part of my on going Lotto Trade buys; which turned into a really nice trade; however, I did not get a chance to post this trade to the site, but if you study these charts, and continue to apply the formula I have taught you, then you WILL catch trades like these whether I post them or not.

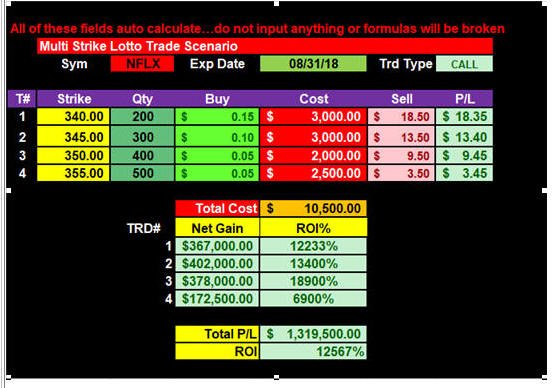

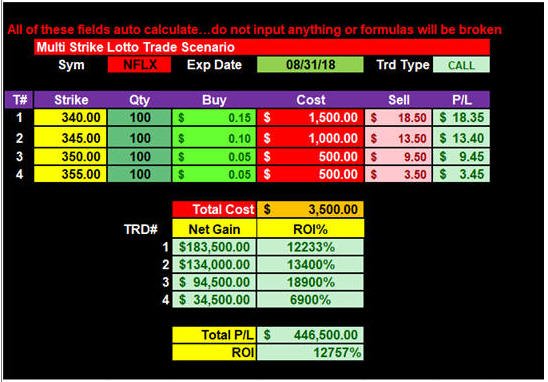

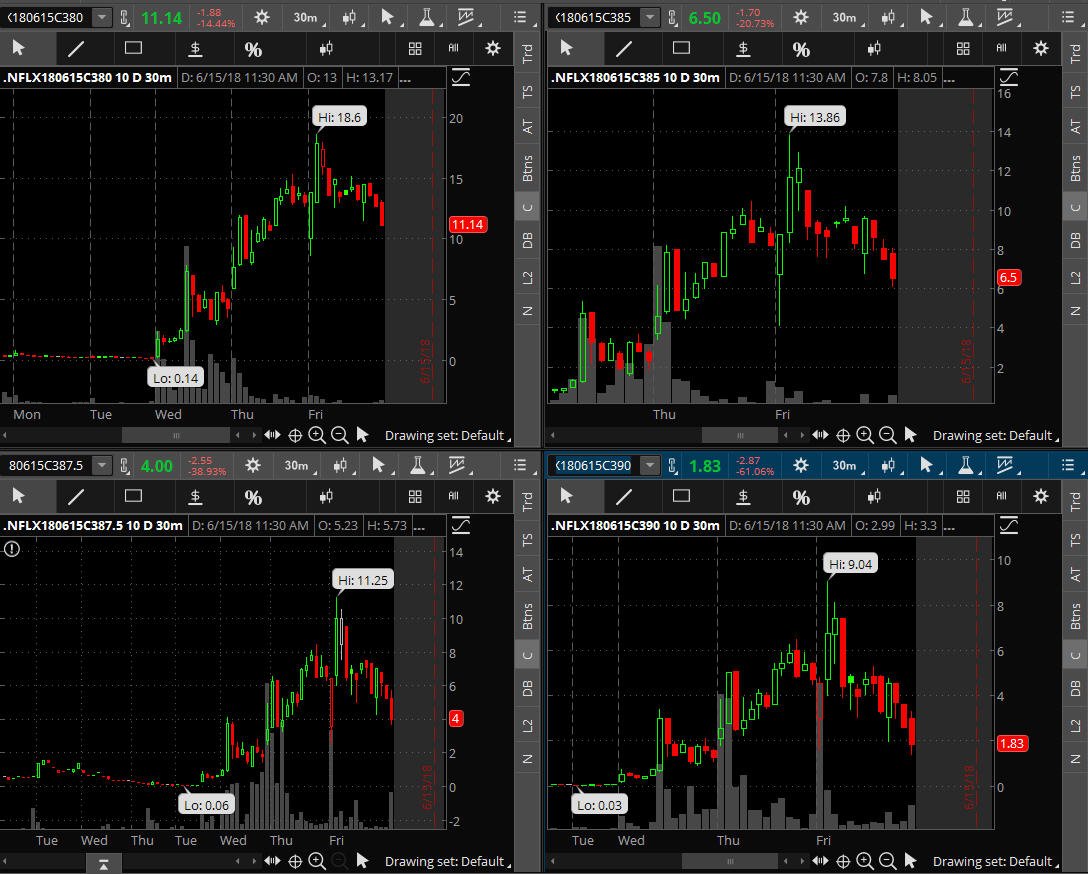

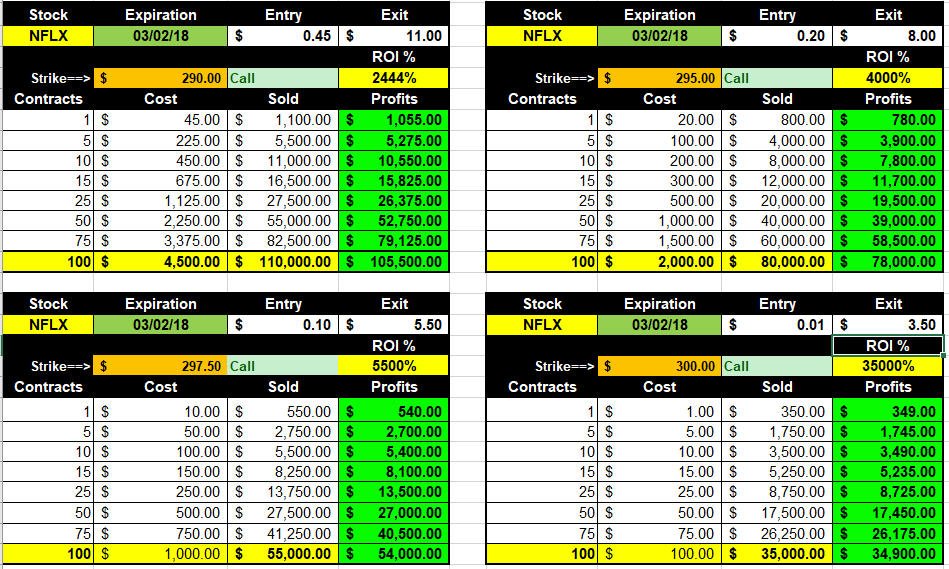

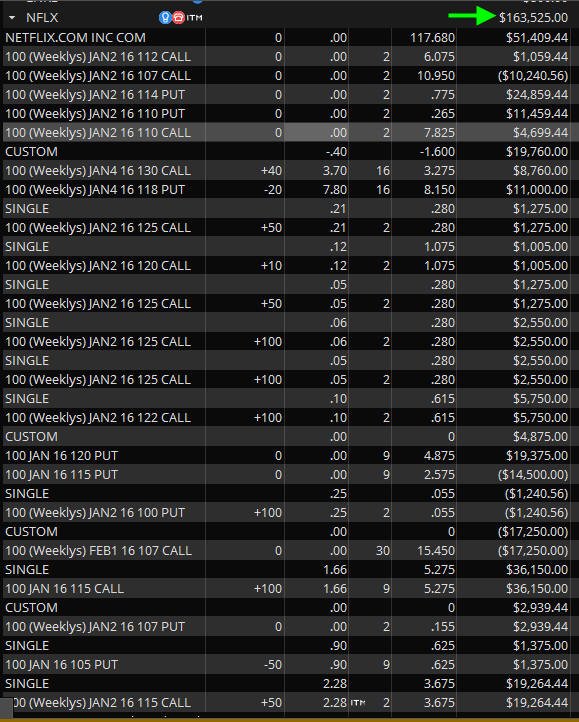

Here are my new trades on NFLX for this week:

If there is ultimately a buyout of this stock, I want to be-in-it-to-win it! However, if there is never a buyout, it does not matter because NFLX just keeps paying off like a 777 slot machine if you are diligently following it with your own trades or trade ideas I post on this site.

Now that NFLX has exceeded the Market Cap of DIS, there is going to be some bigger volatility in the stock, so be sure to "fish" for better entry prices; and I hope you continue to make more and more Profits Up!

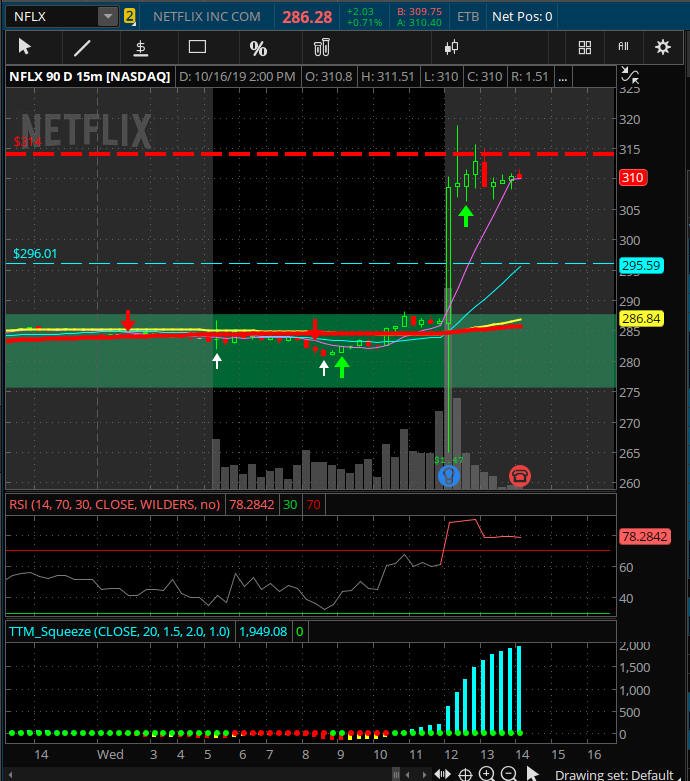

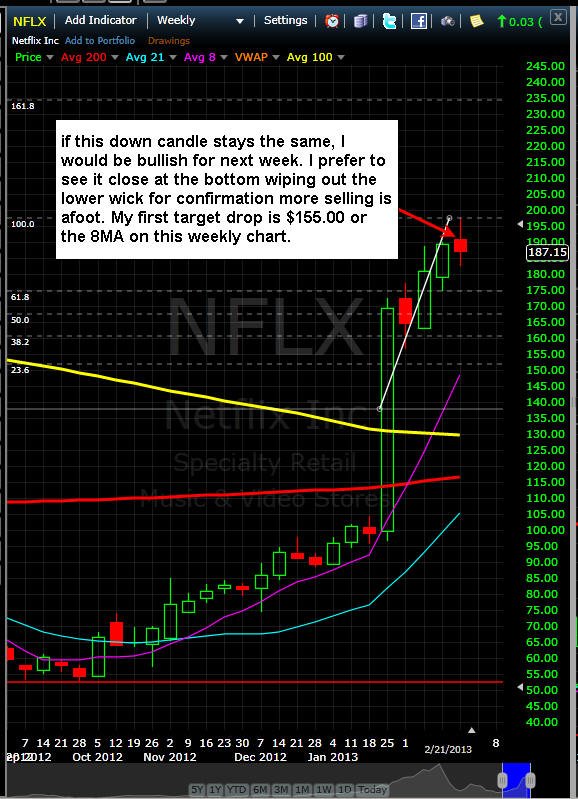

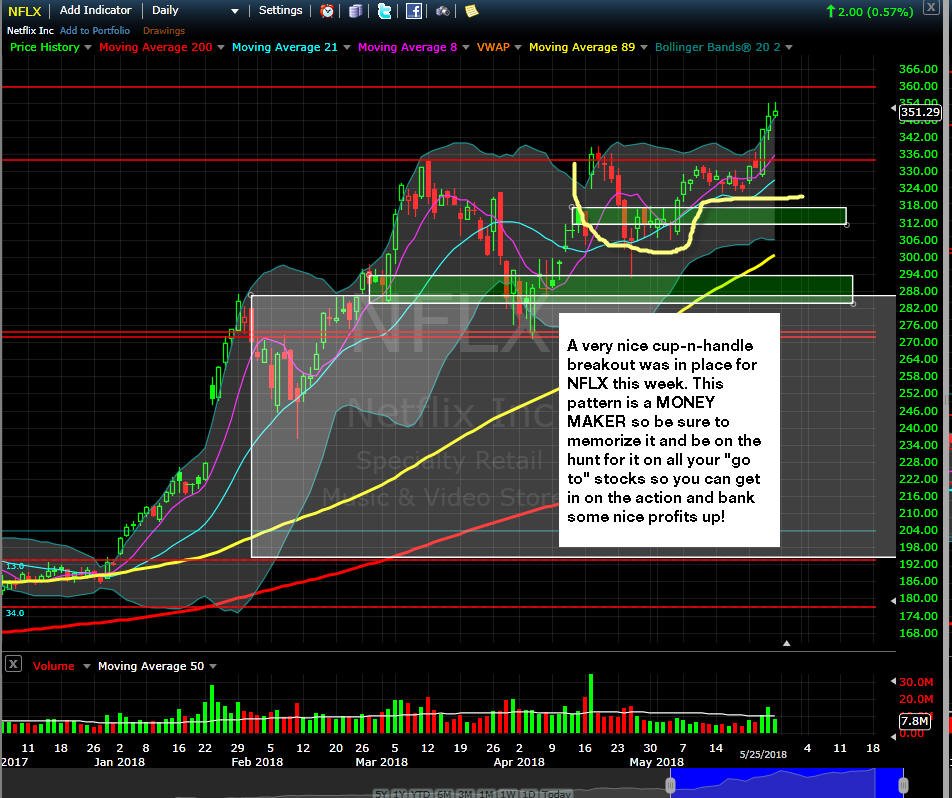

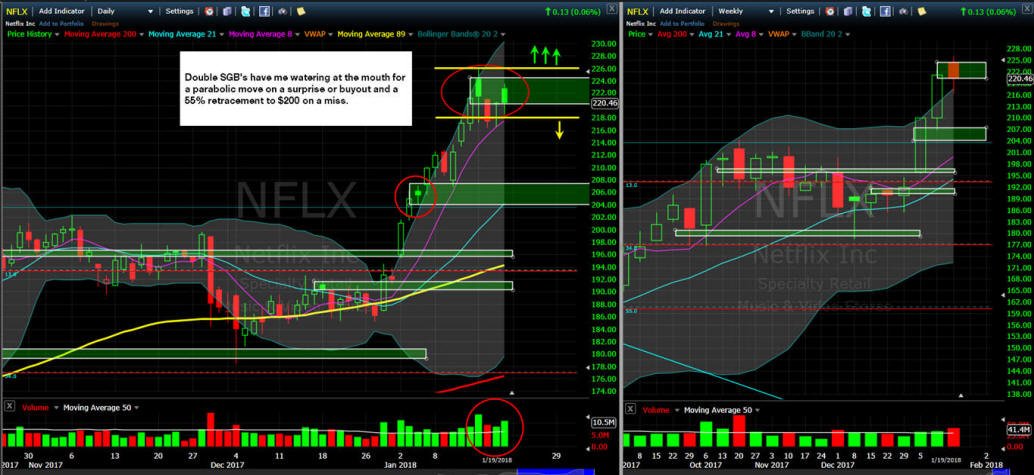

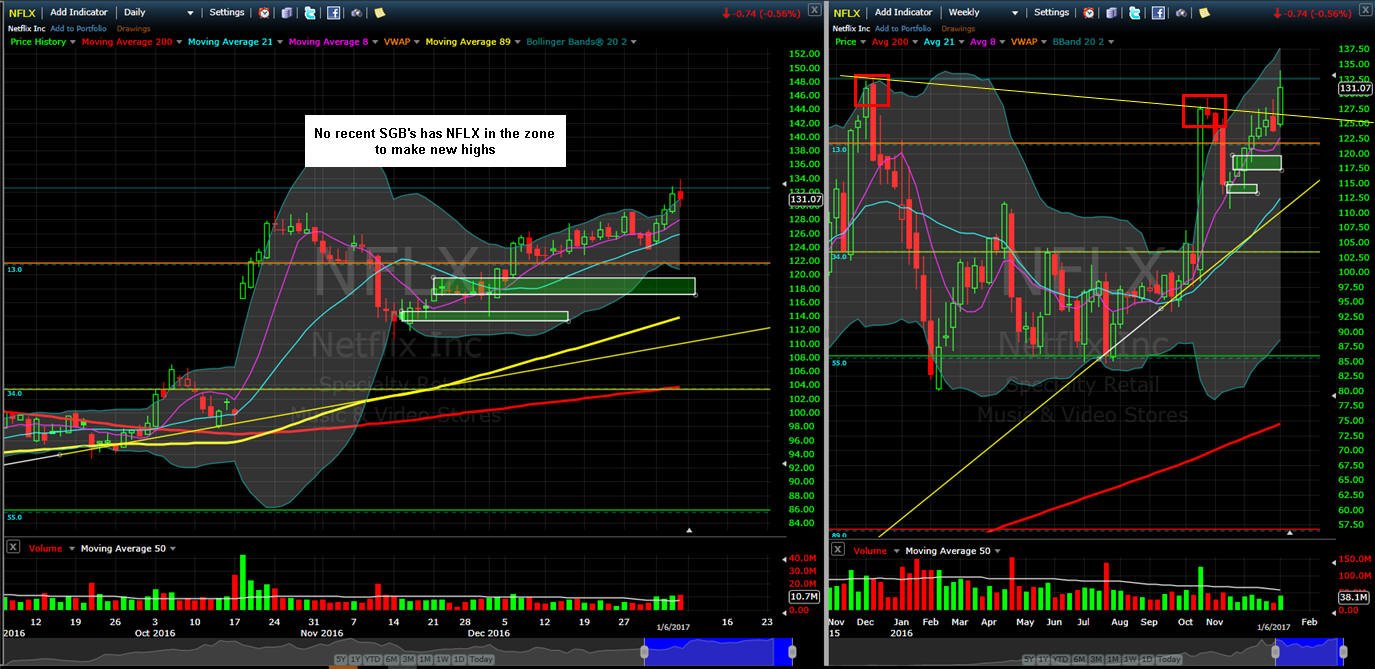

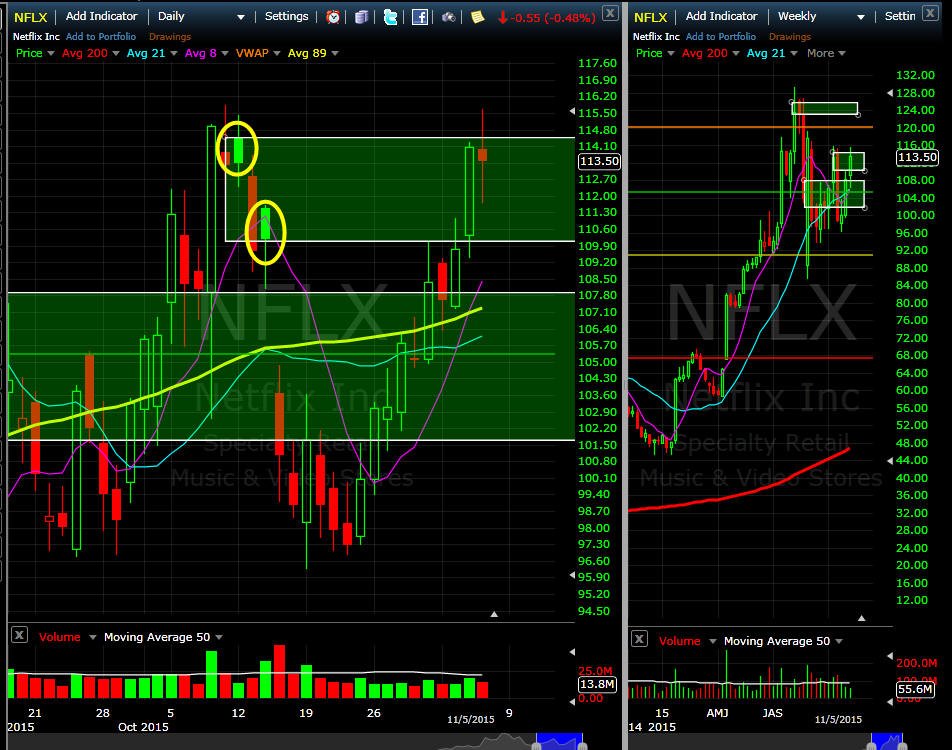

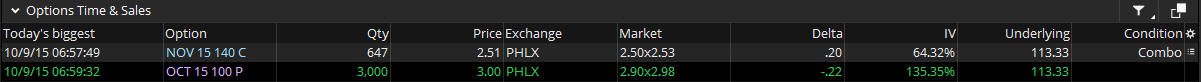

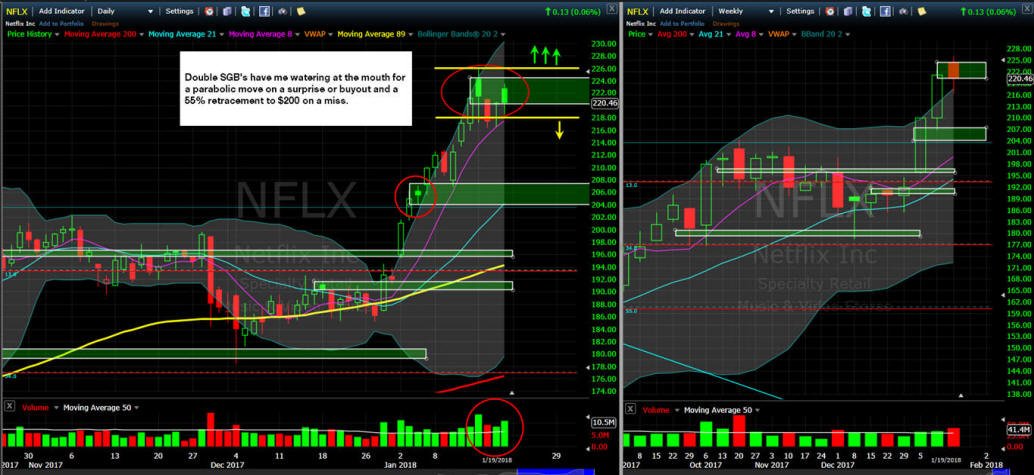

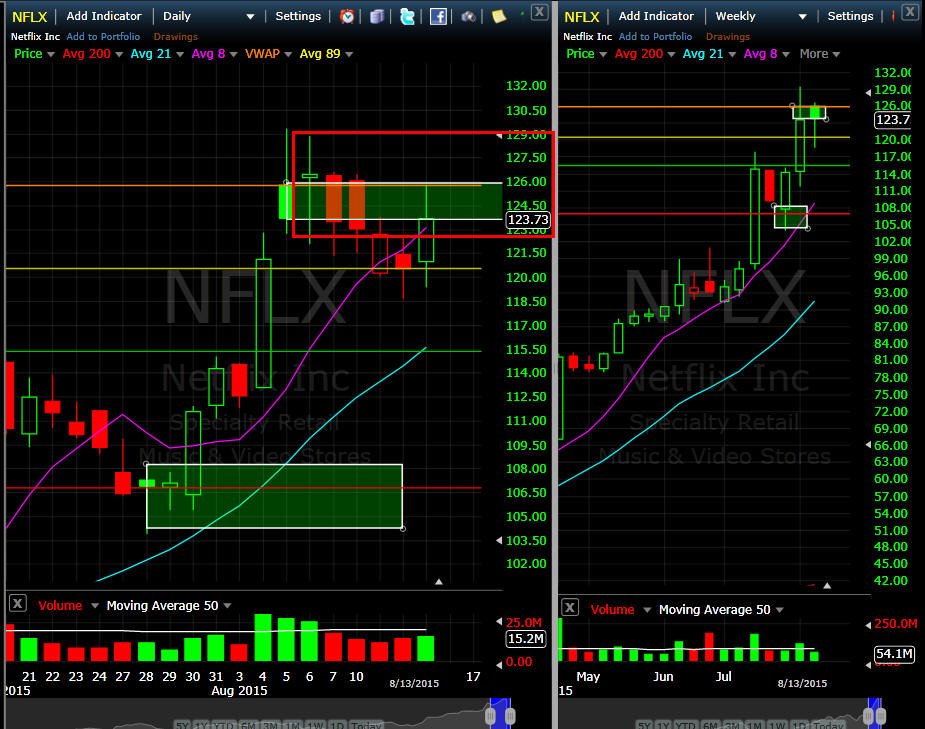

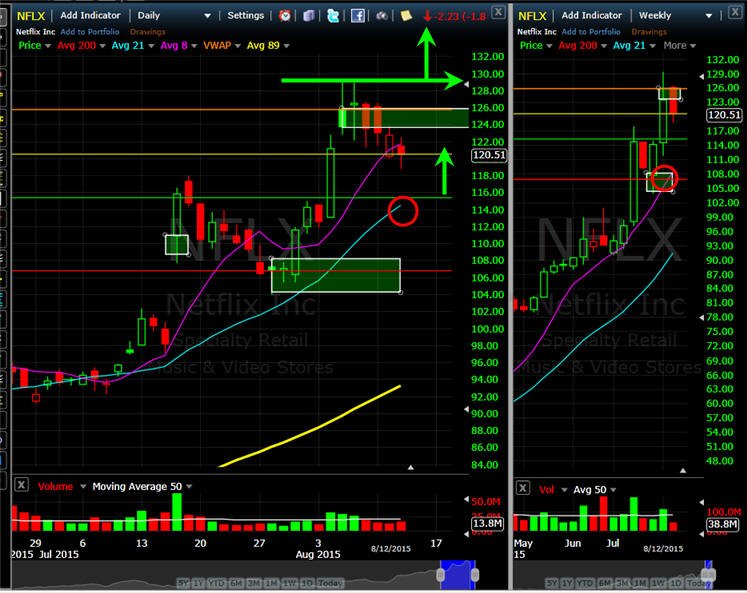

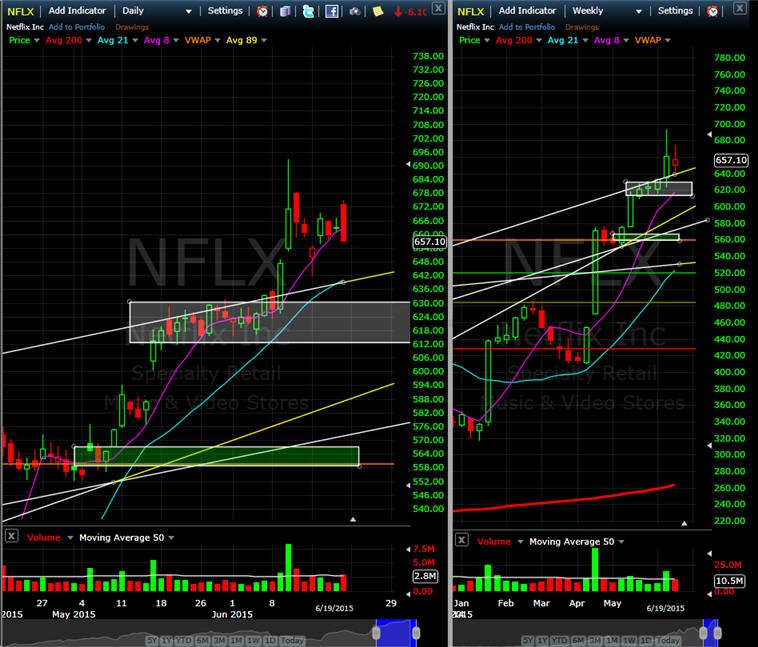

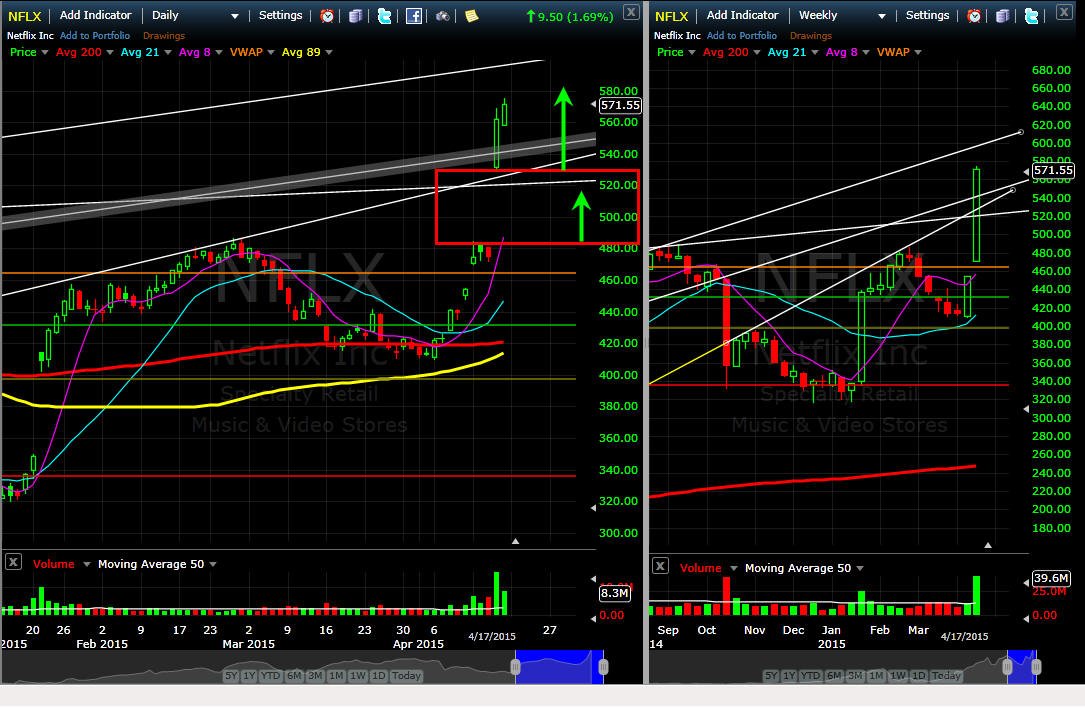

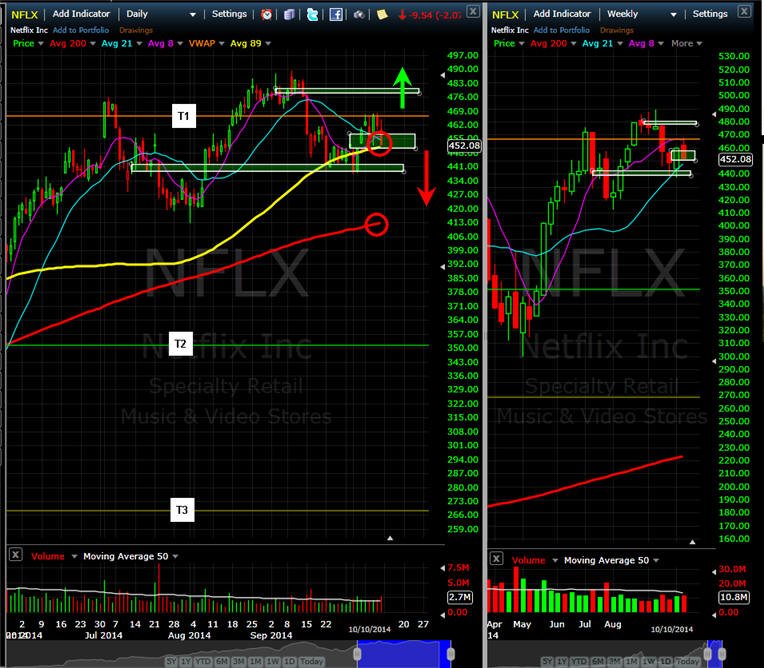

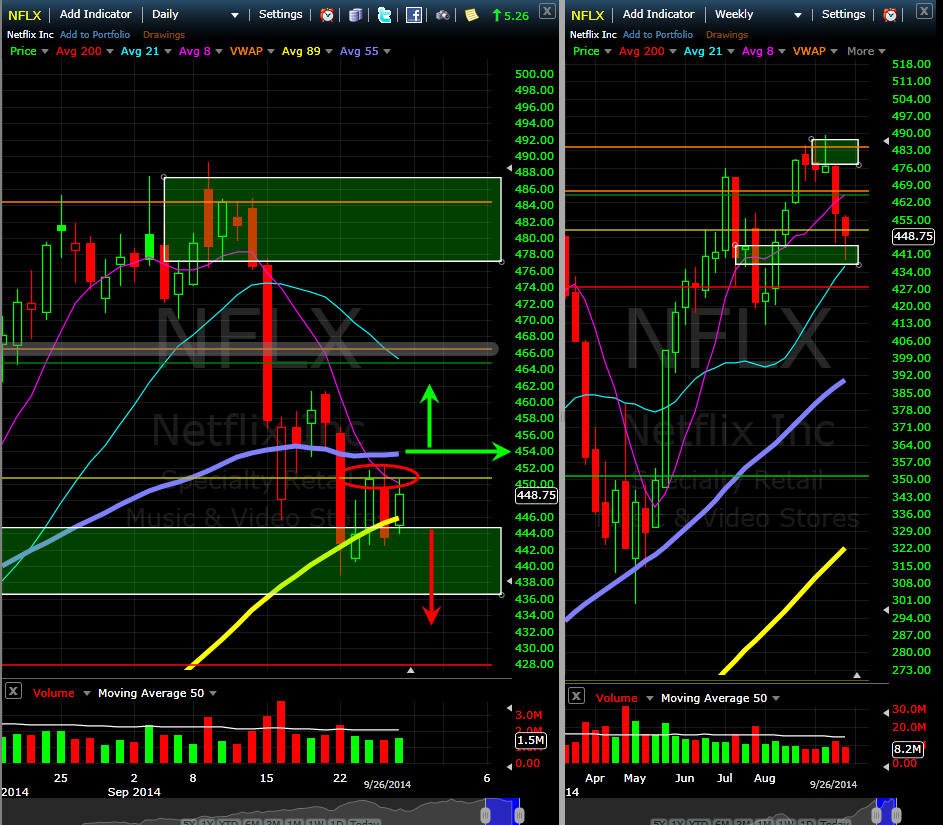

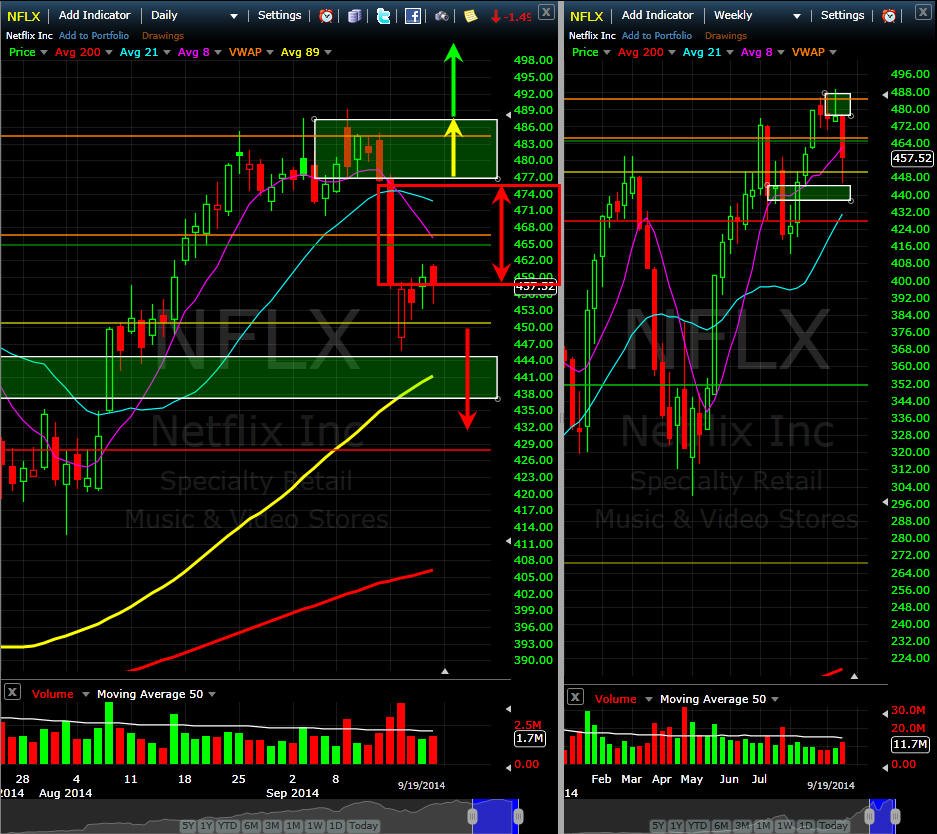

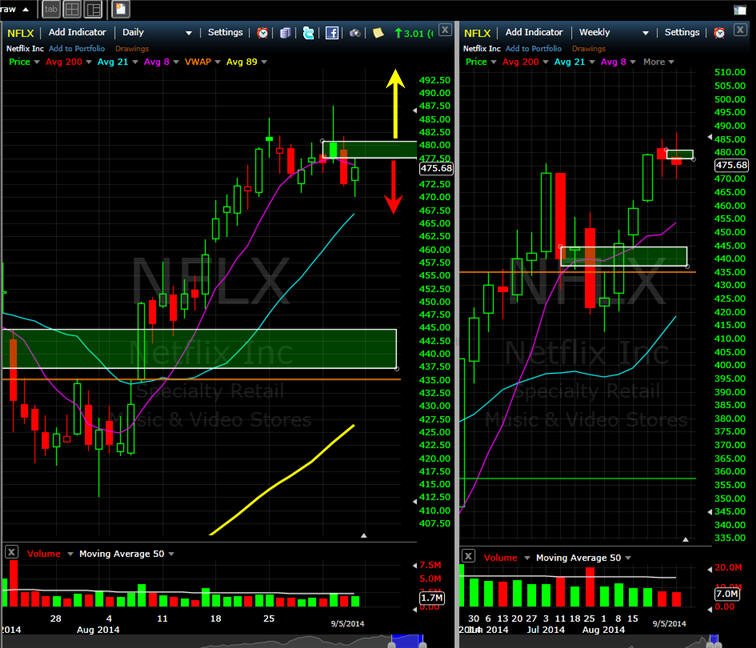

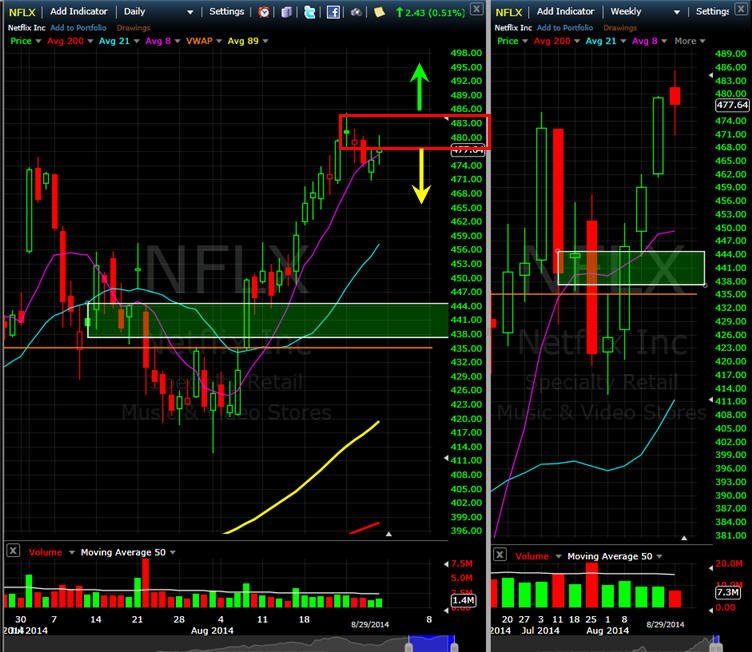

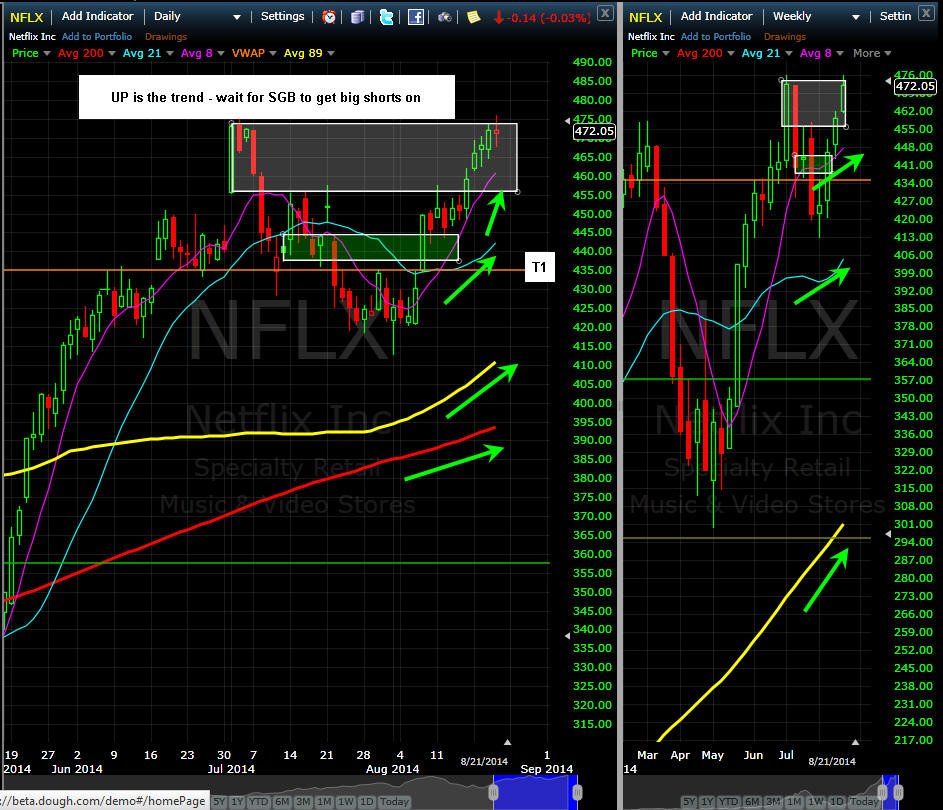

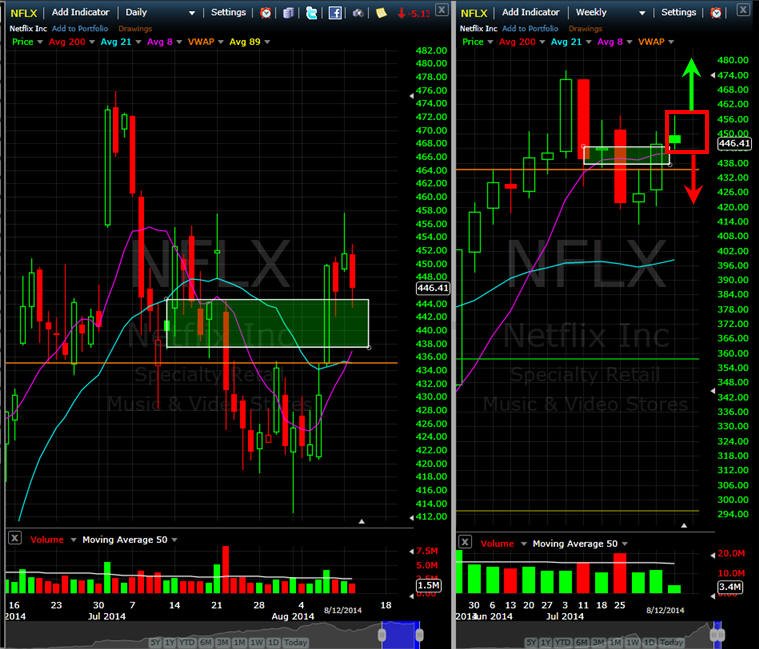

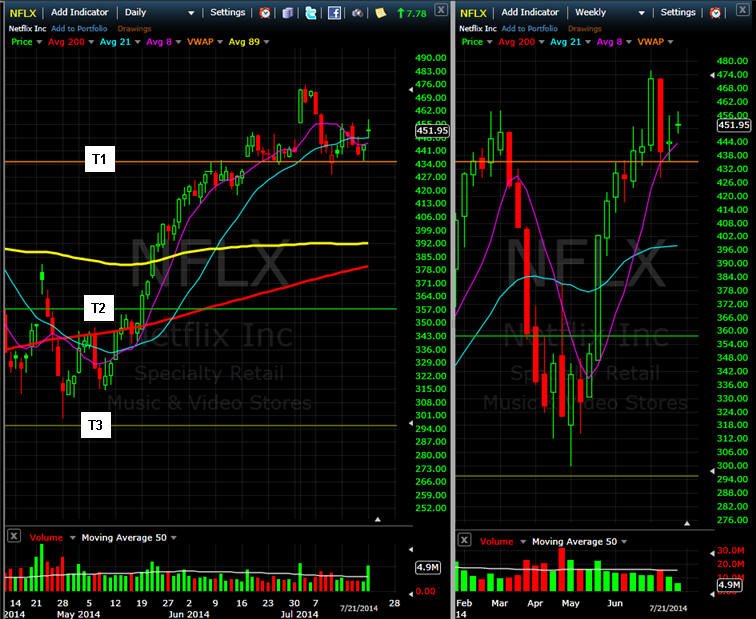

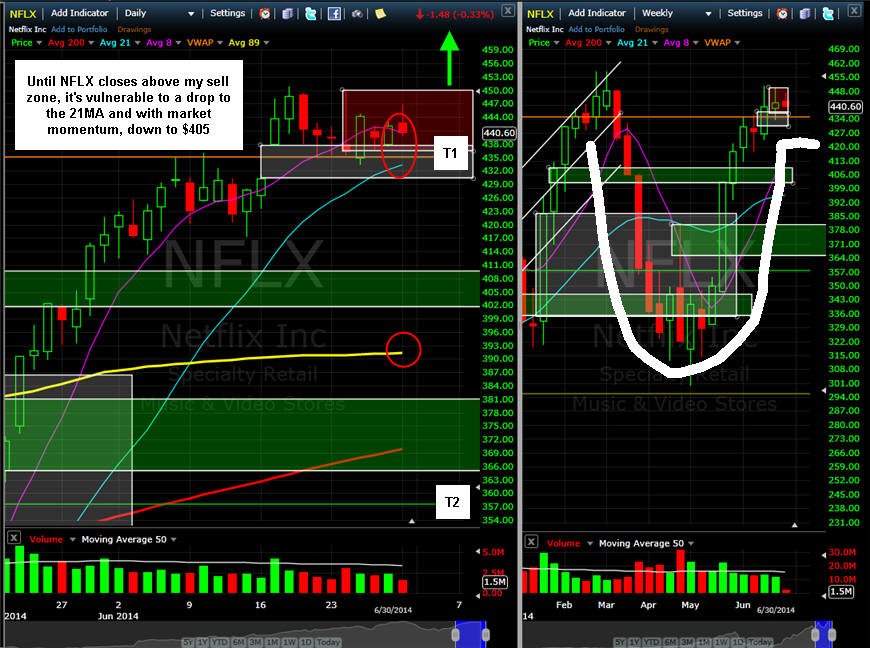

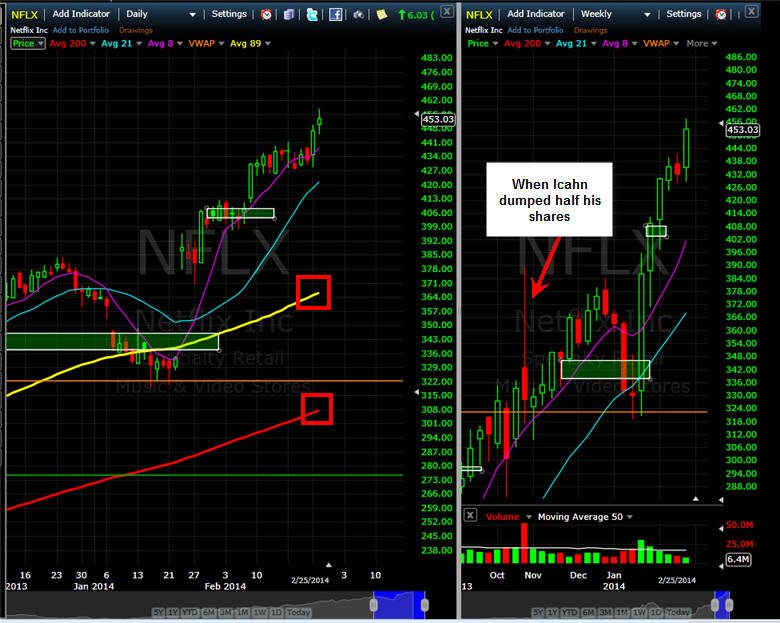

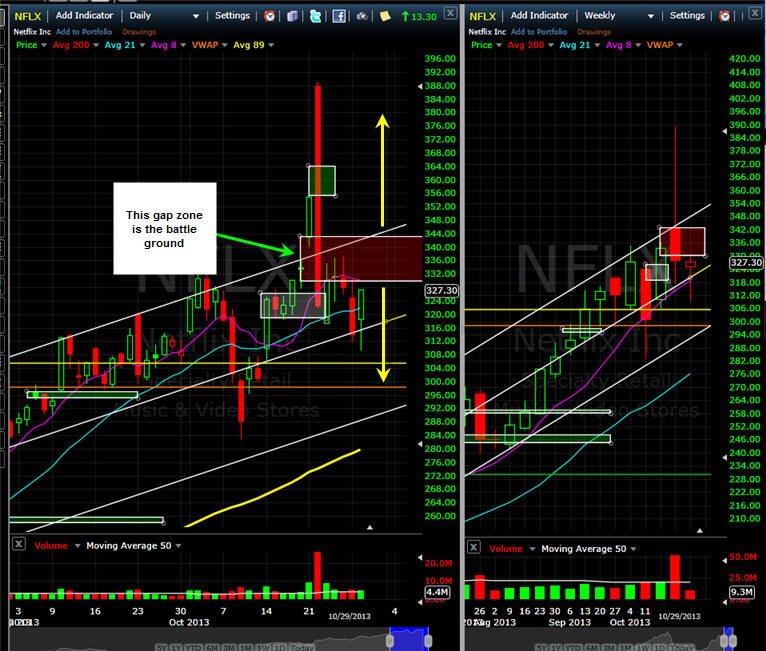

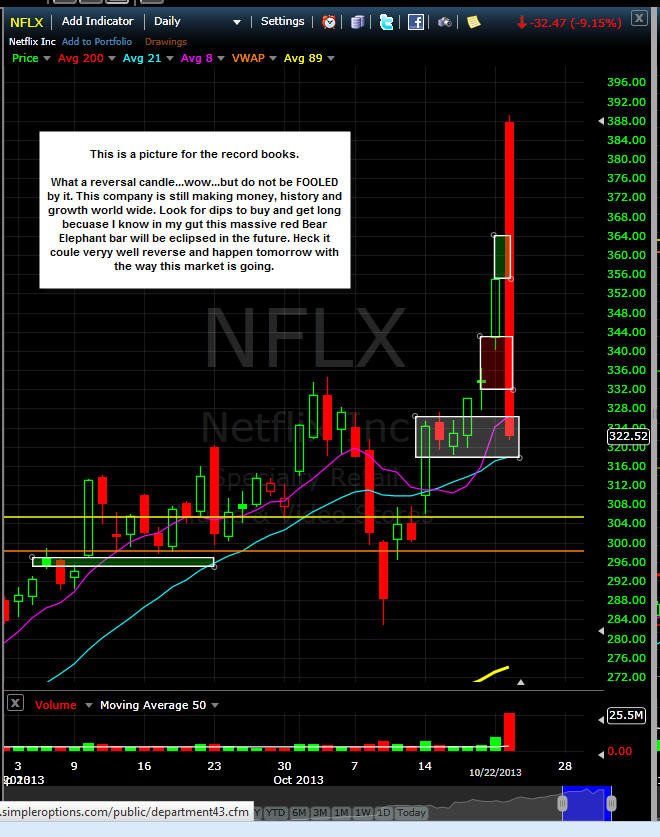

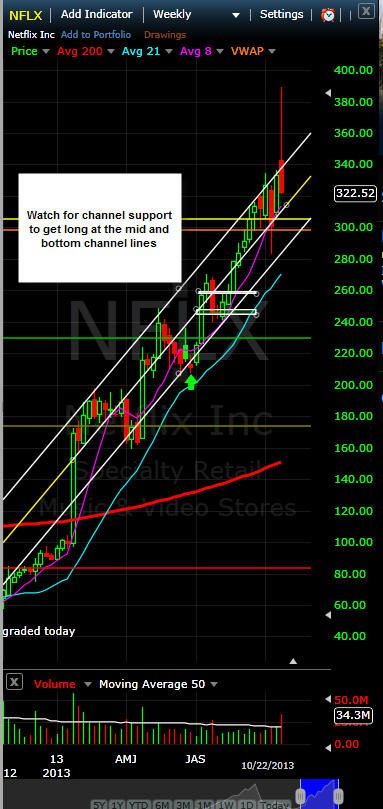

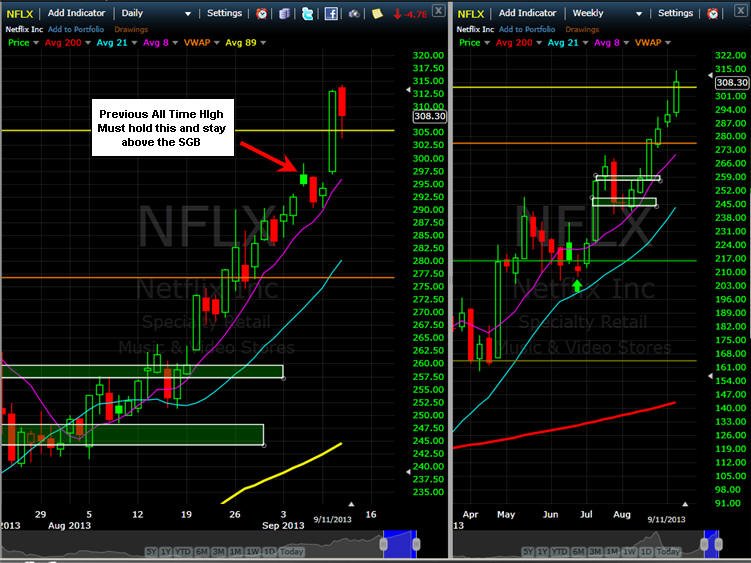

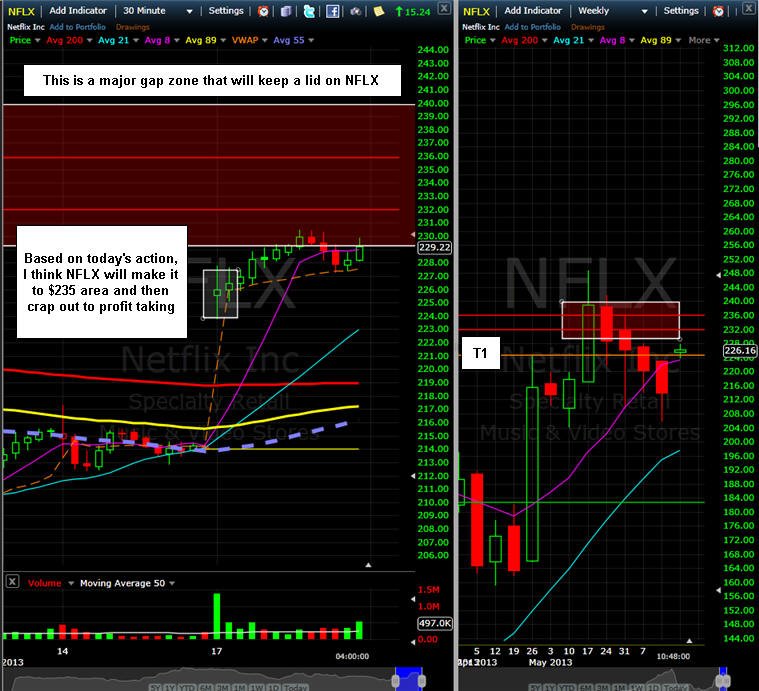

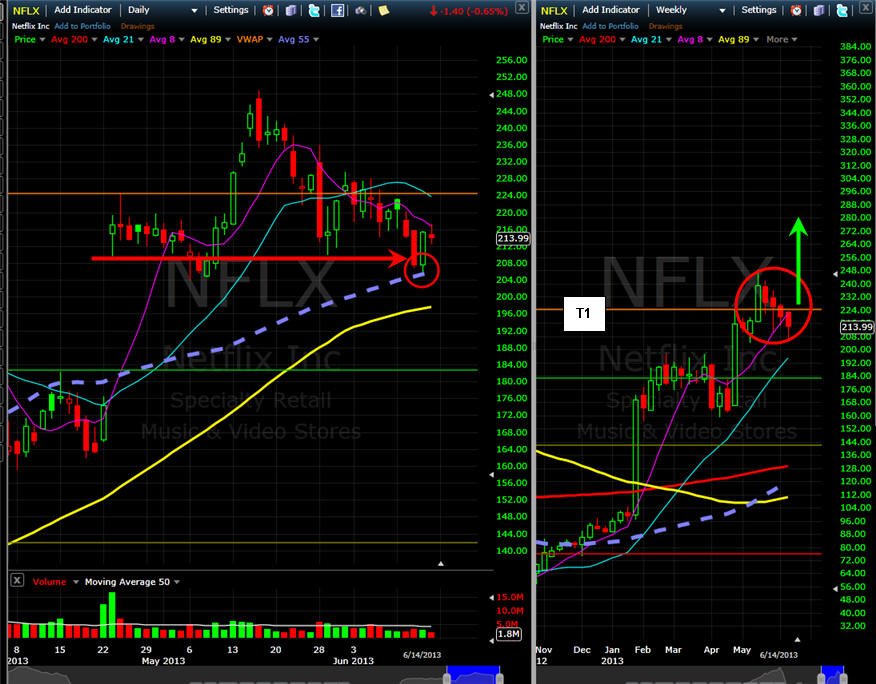

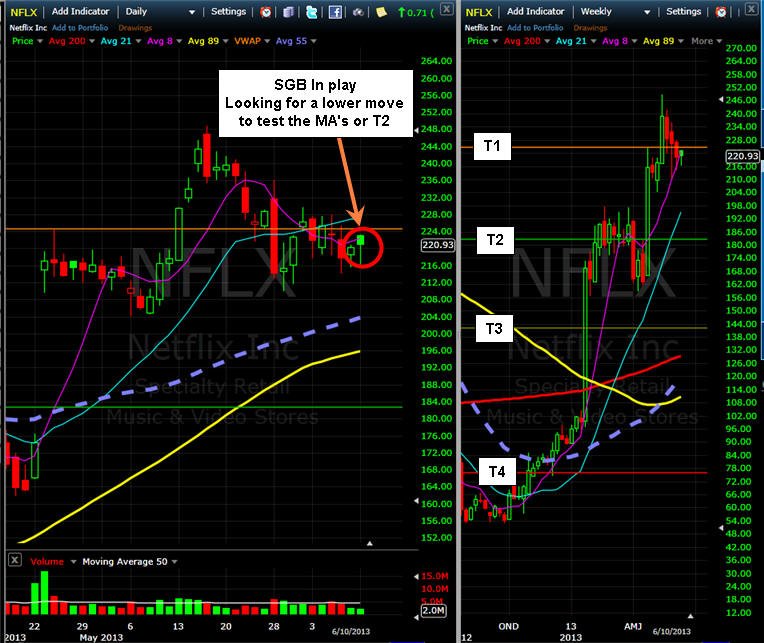

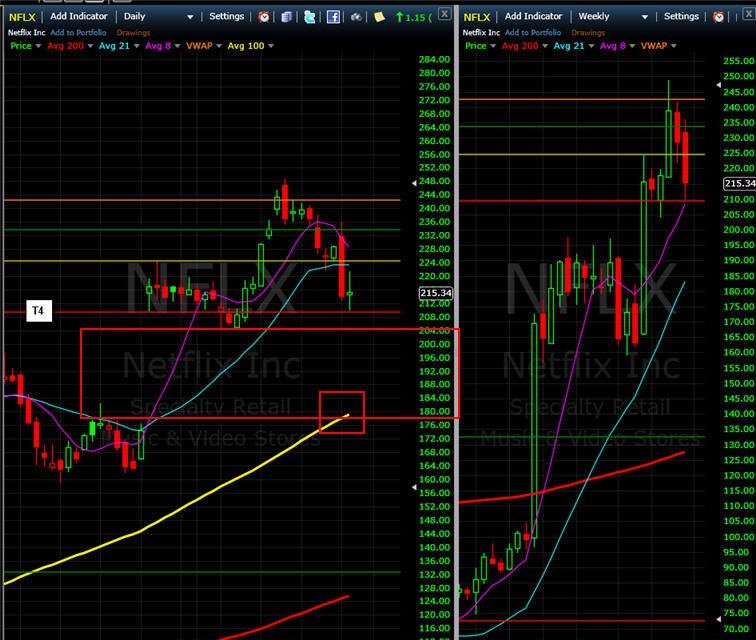

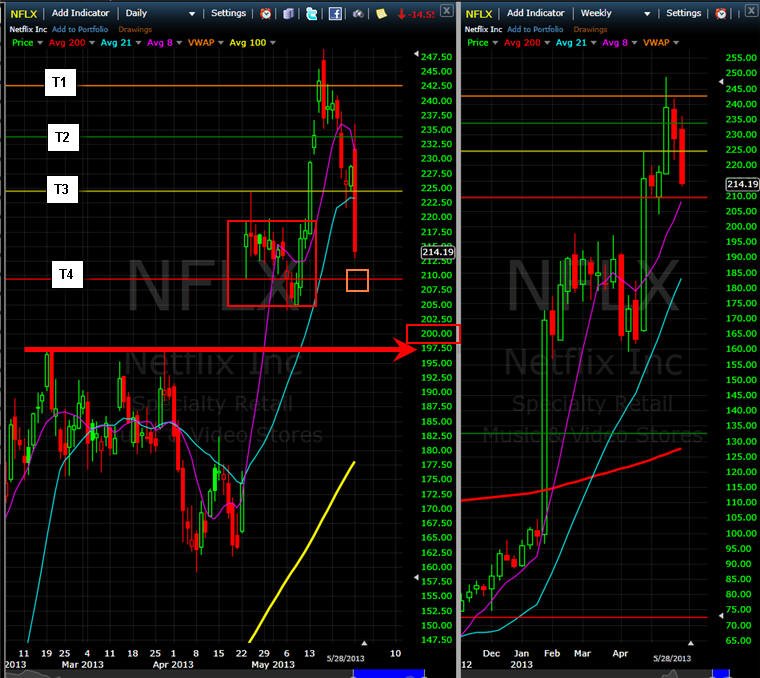

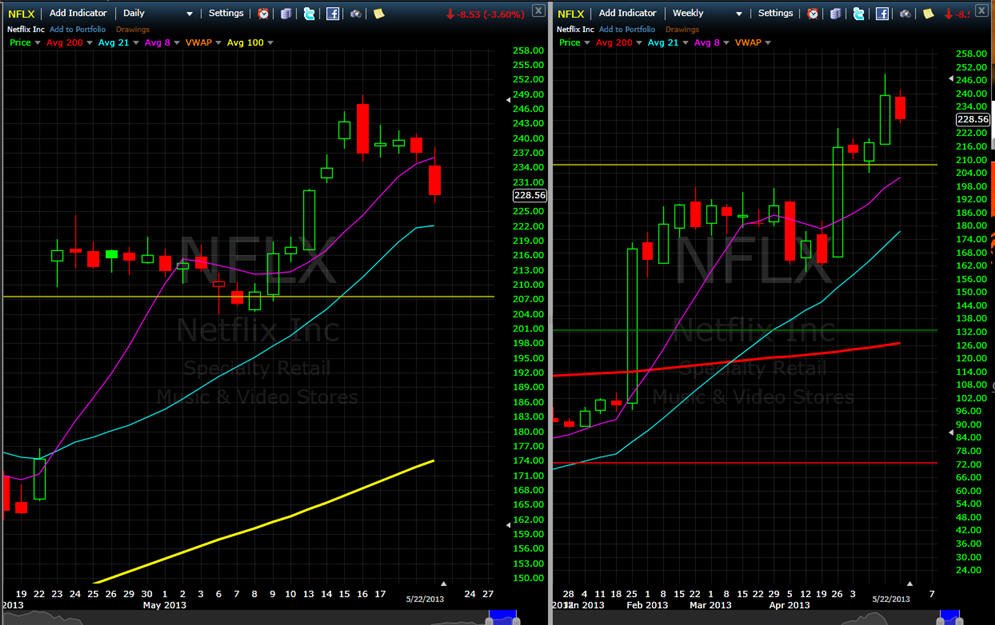

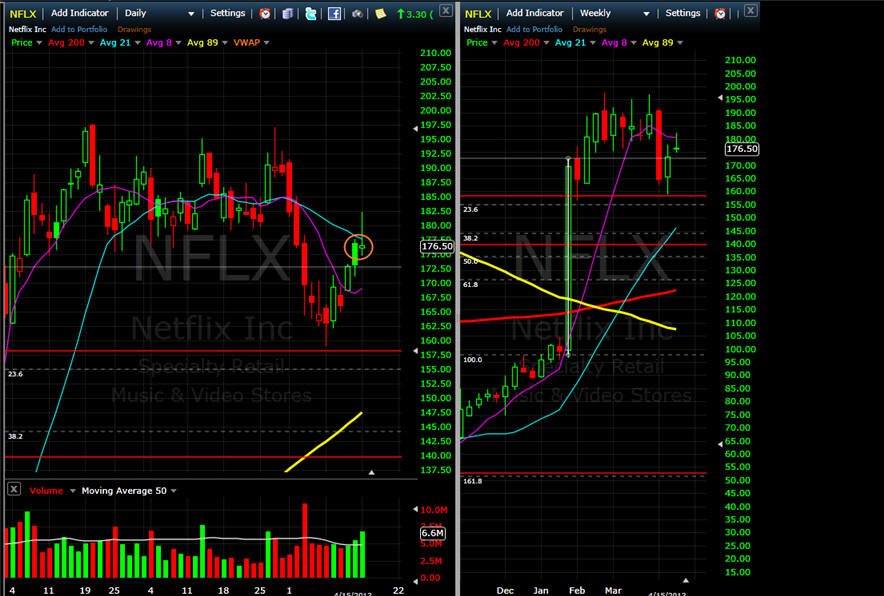

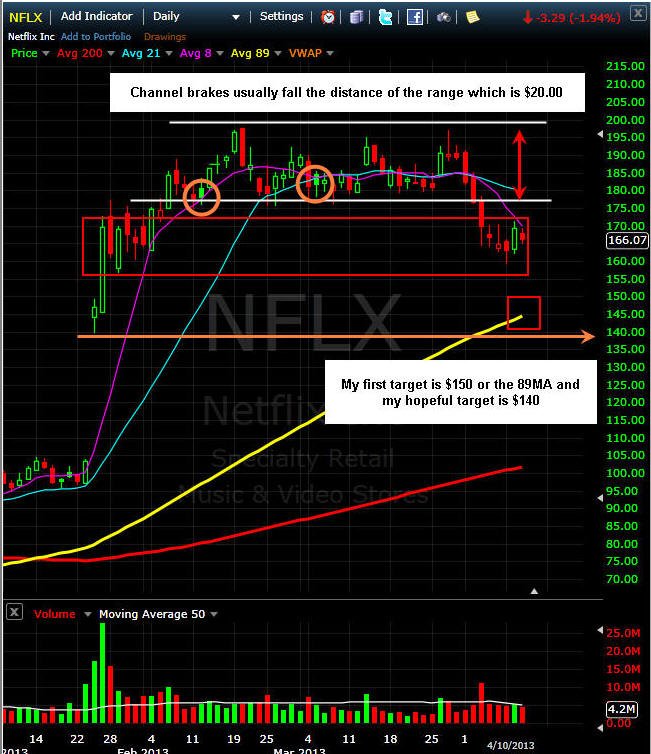

As always, there are clues in their charts for you to study and look for, and with NFLX, it was a classic cup-n-handle breakout setup.

Study this chart below and memorize the pattern so you can recognize this in your "go to" stocks so you too can get your trades on and catch a Lotto or White Whale trade.

==================================================================================================================

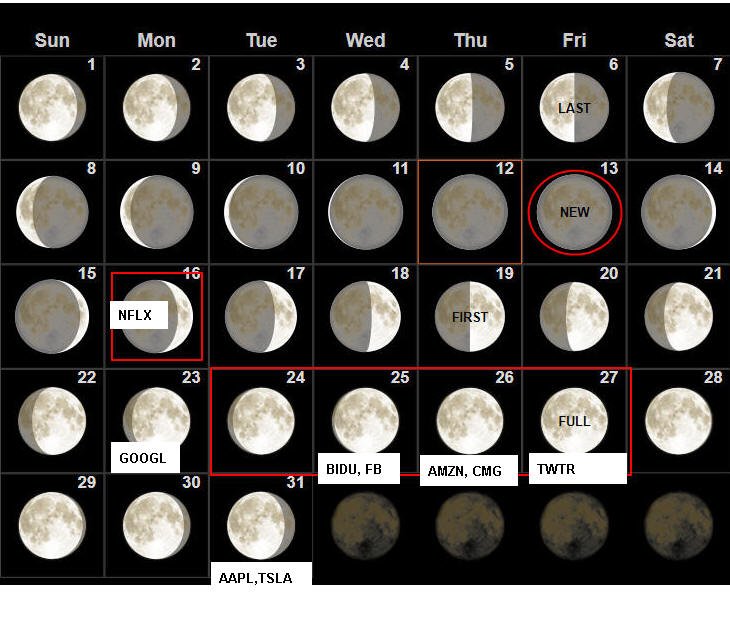

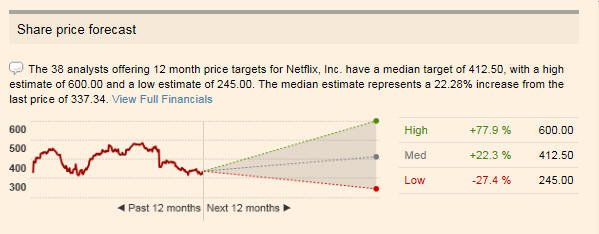

5/1318 - The skies the limit with this stock or a buyout in immanent. Either way, NFLX is one heck of a ride if you bought back with Carl Icahn did and just held on. There have been dozens of Lotto Trades and a several White Whale trades too so keep on fishing in this stock and you will get paid off! I am continuing my wild card lotto calls 20-25% OTM week-to-week and I look for daily moves and swing moves to help finance these trades with spreads, DoubleUP! and naked put selling.

With a current market cap of 141.9B, that would be peanuts for AAPL once they reach 1 Trillion and there are a lot of moves to be made by them in the NFLX space. Heck, AAPL could buy both NFLX and DIS which would transform the the tech giant a world wide media/tech Optimus Prime! On the other hand another candidate would be MSFT since they have NO foothold in the streaming service business.

As for NFLX being a short opportunity like Citron Research thinks, that is always a possibility, but shorting this stock can be extremely painful to your trading capital. The best way to get shorts on NFLX is to play in the direction of momentum; then take some profits and fish for wild card lotto puts 15-20% OTM. Sometimes, you can get into strikes under a 15% move for $0.10 or less and that is when you just buy some because if a correction happens, you need to be in it to win it.

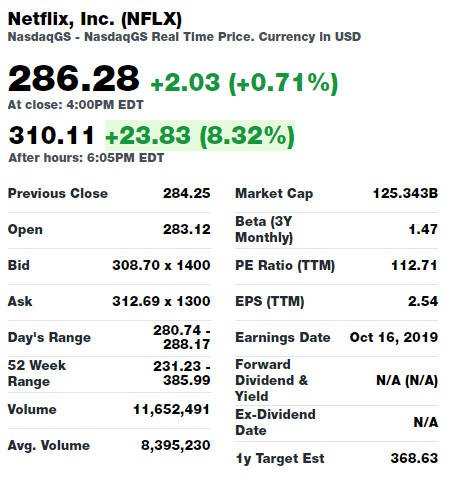

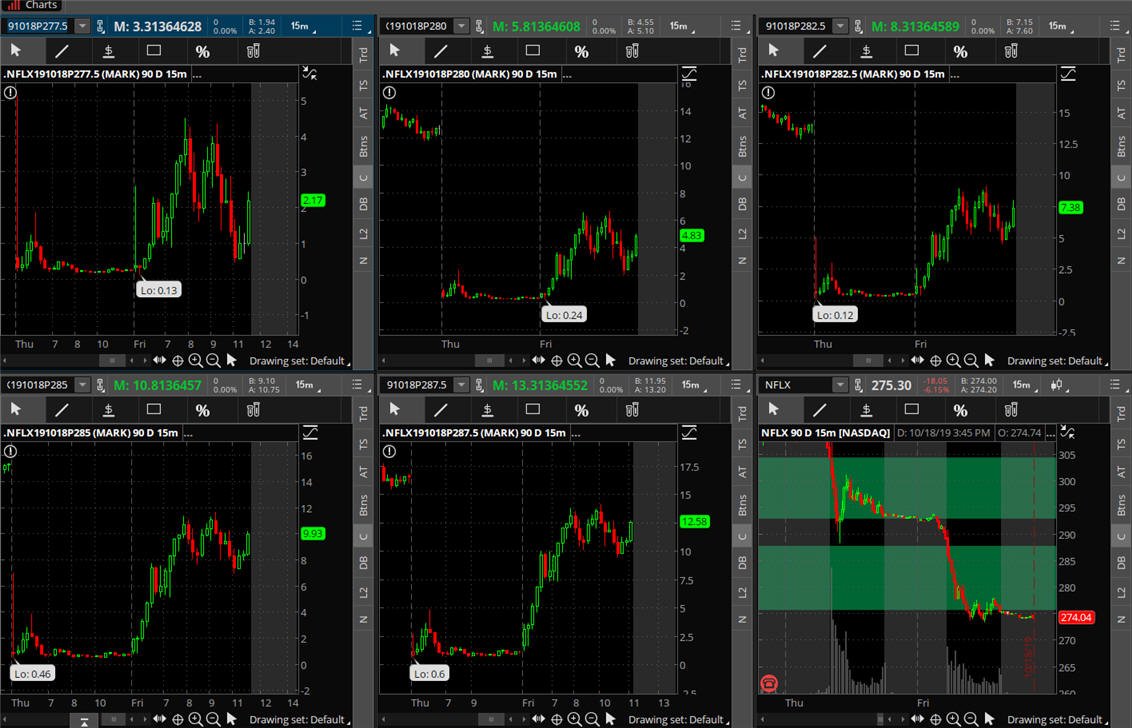

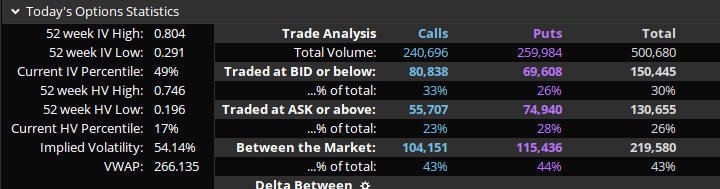

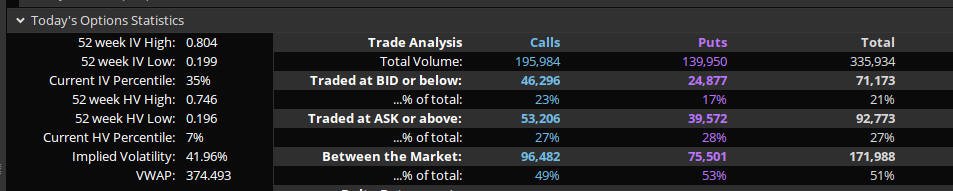

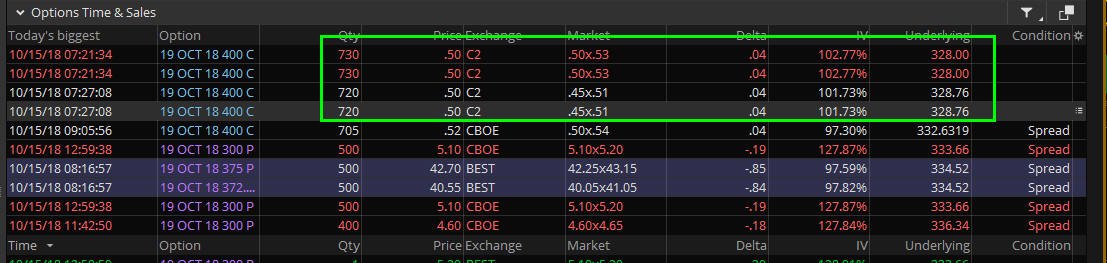

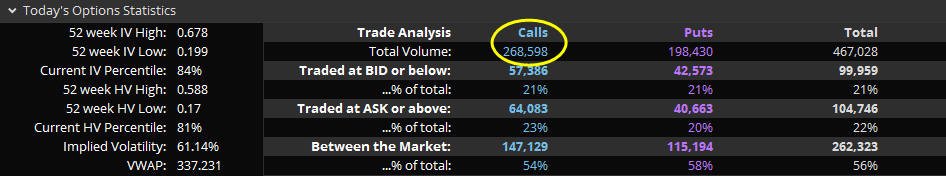

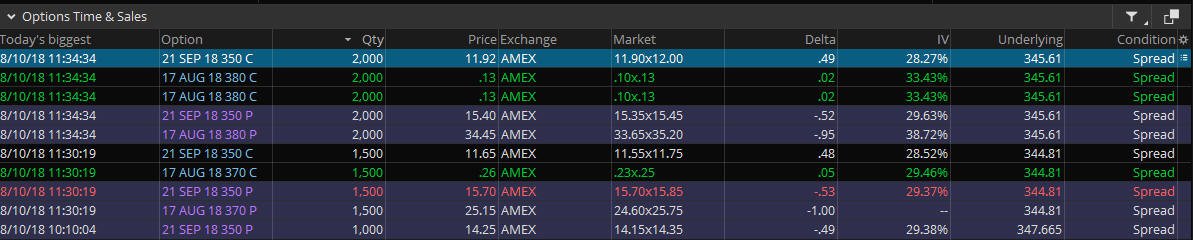

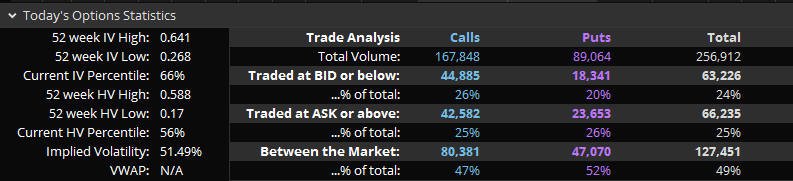

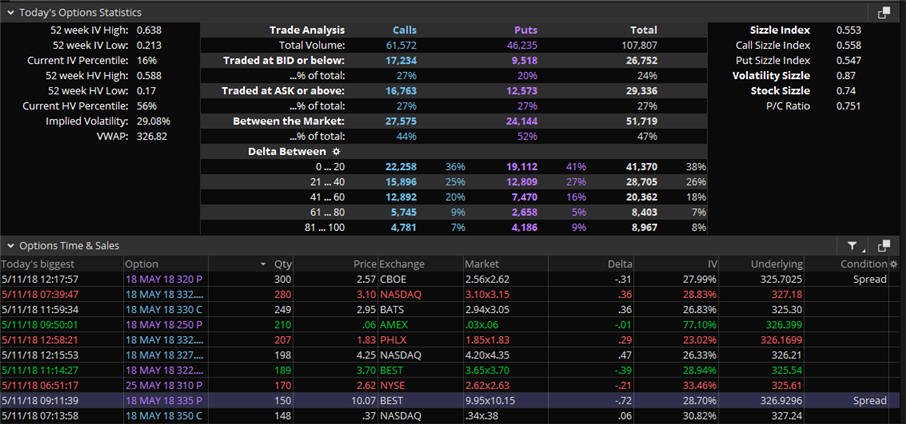

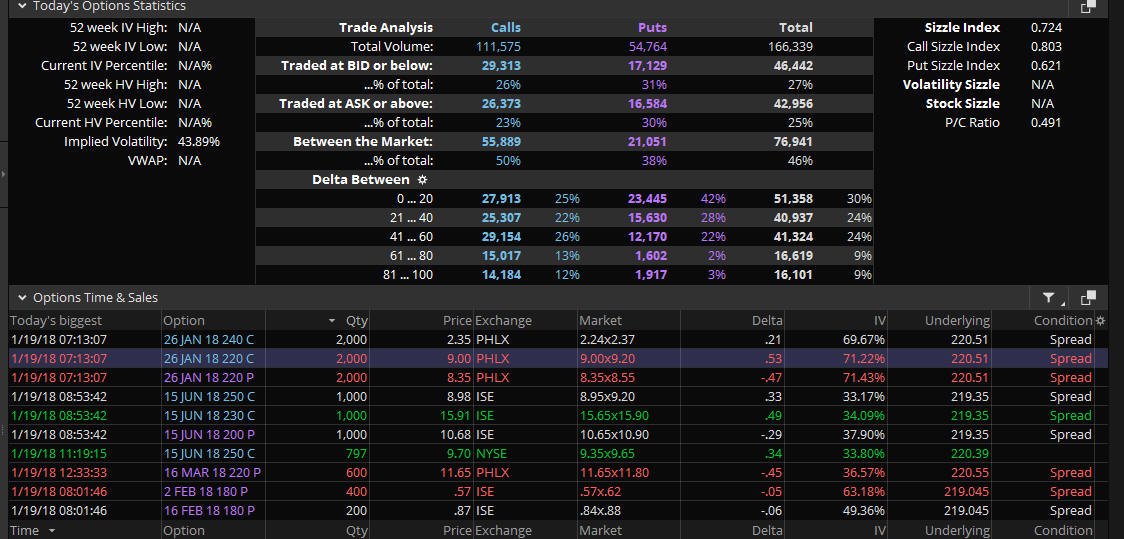

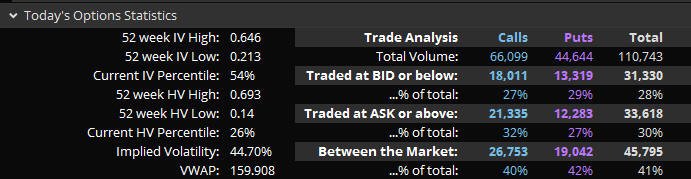

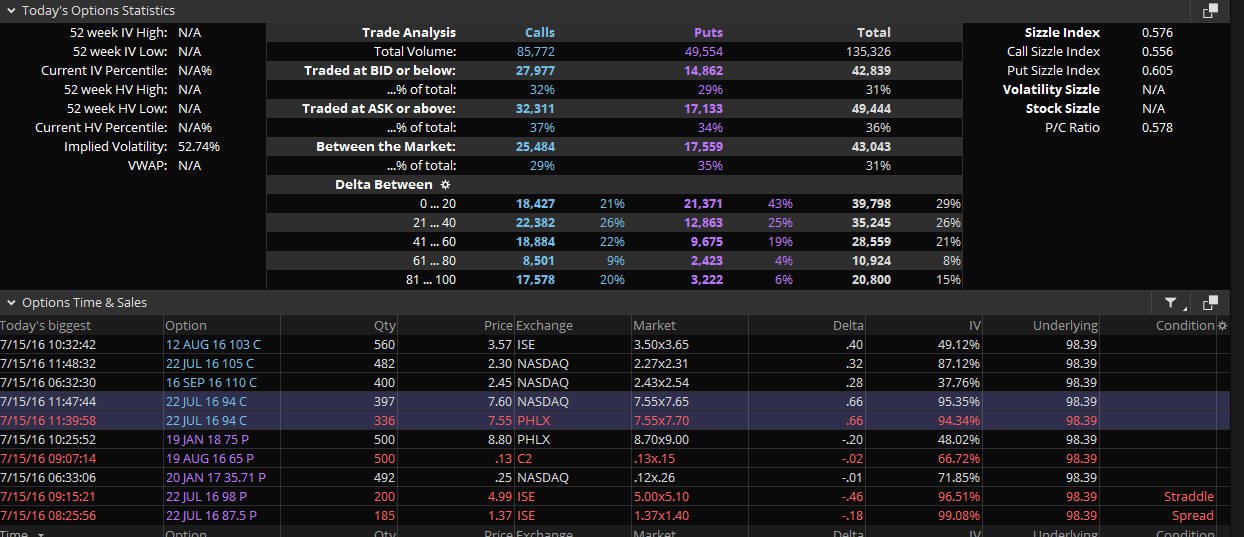

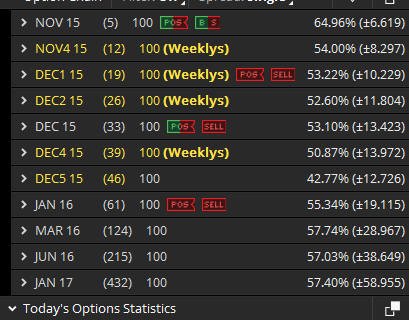

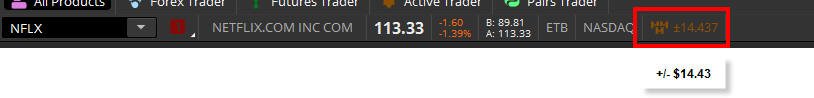

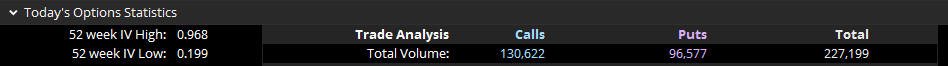

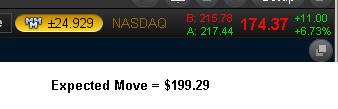

Keeping an eye on daily options stats can give you clues to potential moves in the future.

=============================================================================================

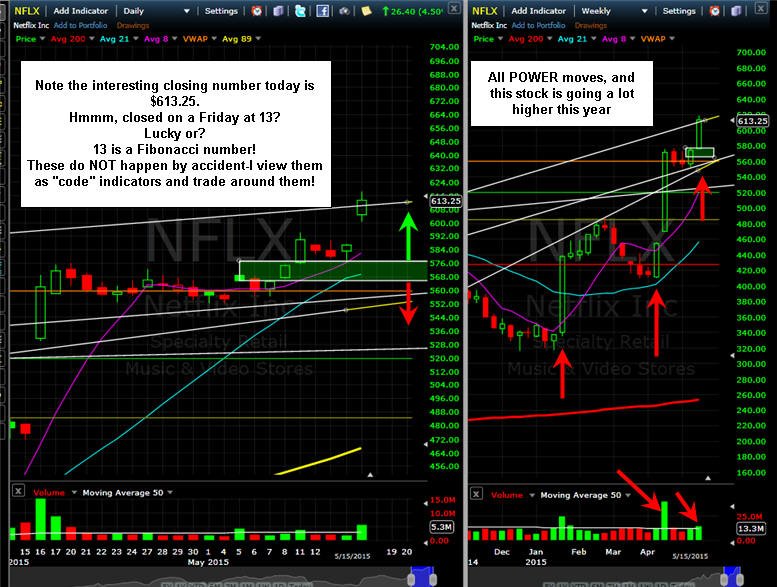

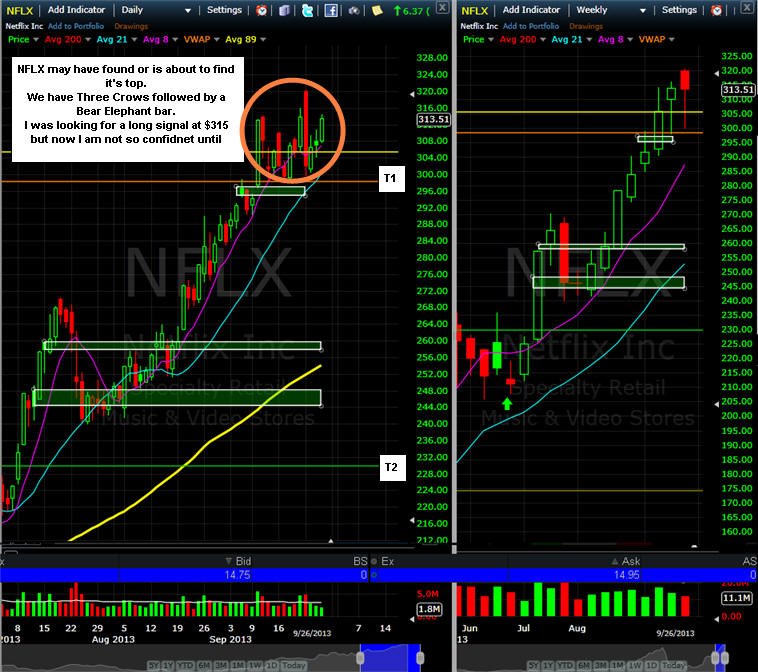

3/18/18 - Nice moves to new all time highs since my last comments and also an interesting price bubble high at $333.98 indicating to me that is the TOP! Last week there was a report from Citron Research that they believe NFLX is over valued and will see $300 or lower before it sees a new all time high again. As you know, I have commented multiple times that stocks closing or bubble high prices at unusual numbers have significance. Particularly, when stocks prices hit Fibonacci numbers they tend to reverse or extend momentum because ALL trading math is fundamentally entrenched in the Fibonacci sequence. When I see stocks price at a number with "33" in it, in my experience, has proven to be very sufficient of an eminent move—you can discount my thesis as superstition or hyperbole, but I have has some very good success trading off these instances; especially around lunar cycles too...lol.

Ok, so what can you expect with this stock in the coming weeks, months and years? I for one, expect to make a LOT OF MONEY trading Lotto Trades!! I don't care what the "news" says about NFLX, all I know is this stock alone can make your retirement account if you get good at timing the moves based on SGB's, Bull/Bear 180's and Bull/Bear Flag patterns. Then there is the potential buyout or unexpected news, so we keep fishing and hope to hook onto a Moby Dick White Whale trade in the future!

==================================================================================================

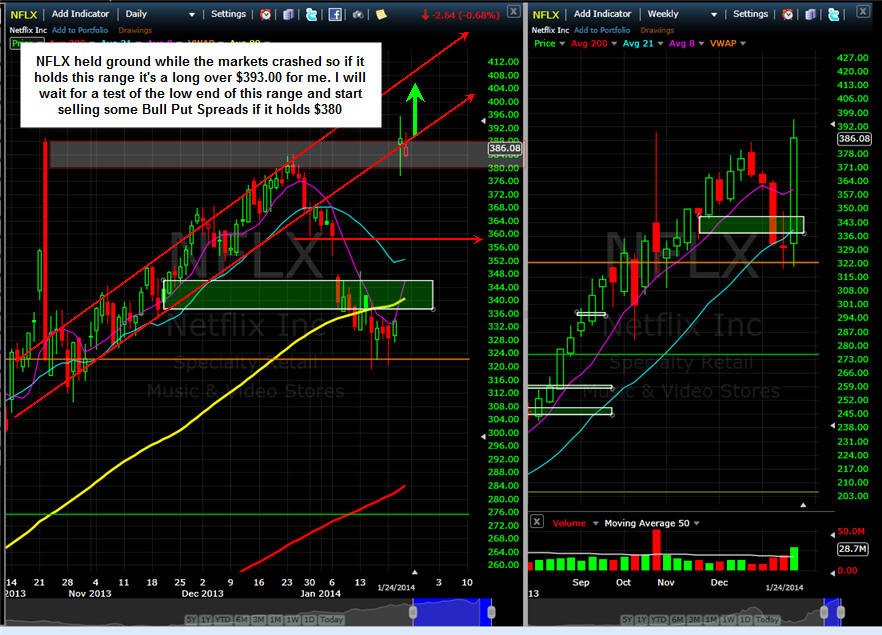

3/3/18 - NFLX is the momentum favorite in 2018, so we need to be diligent in fishing every Wed - Fri for Lotto and WW trades opportunities. The lesson learned this week is when there is a dip in the markets and/or this stock, we need to be laying those orders to see what we can and will catch!

======================================================================================

1/28/18 - What an ocean of wealth this stock has created for investors, buy-and-holders and weekly scalpers. I hope you were able to catch a lot of the action this week as we cashed in on those $250 Lotto Calls, but WOW, if you went for some wildcard lotto calls on the 260-270's, then you hooked up to a Moby Dick! $$$$$$$$$$$$$$$$ !

What I have learned from this week is you MUST put on some wildcard trades each earnings because you just never know what the possibilities can be. The other thing I learned is even if you don't catch the first ride on a Moby Dick you can still FISH post earnings and catch the tail for HUGE gains. I had the 250's as my play which was some 10% OTM and with it being a Monday release, the IV was really pumped in, so typically the profits are not this massive; however, we are dealing with NFLX and in several past posts on this website that is exactly what NFLX has done, defy the odds, make the rules and break the records that all investors say "I can't believe it can keep going up..."

Looking over the options charts and the stocks reaction to earnings momentum, we can learn some good lessons to prepare us for the NEXT round; because there WILL be a next round with NFLX and many other stocks in the markets. My strategies will continue to shine and you can build your account to massive size in a couple of strong quarters, so just stick with the strategy and compound size into the next trades ONLY with winners from previous trades. Also, the lesson to learn here is FISH FISH FISH post earnings for some ridiculous what if prices and you WILL hook a White Whale trade for sure!

Here is what you need to do to catch a Moby Dick post earnings. If the stock make a move that is 2x greater than the projected MMM, it has a very high probability it will have a multi-day continuation move, so the first thing you do it start fishing on the options that are inside a 20% move pre-earnings price and layer orders so you have a higher potential of getting filled. The zone you should be aiming for is less than $0.15 a contract so put in multiple orders all the way down to $0.05 cents and if you get filled, hold on because just hook a Moby Dick and get taken for an incredible ride!

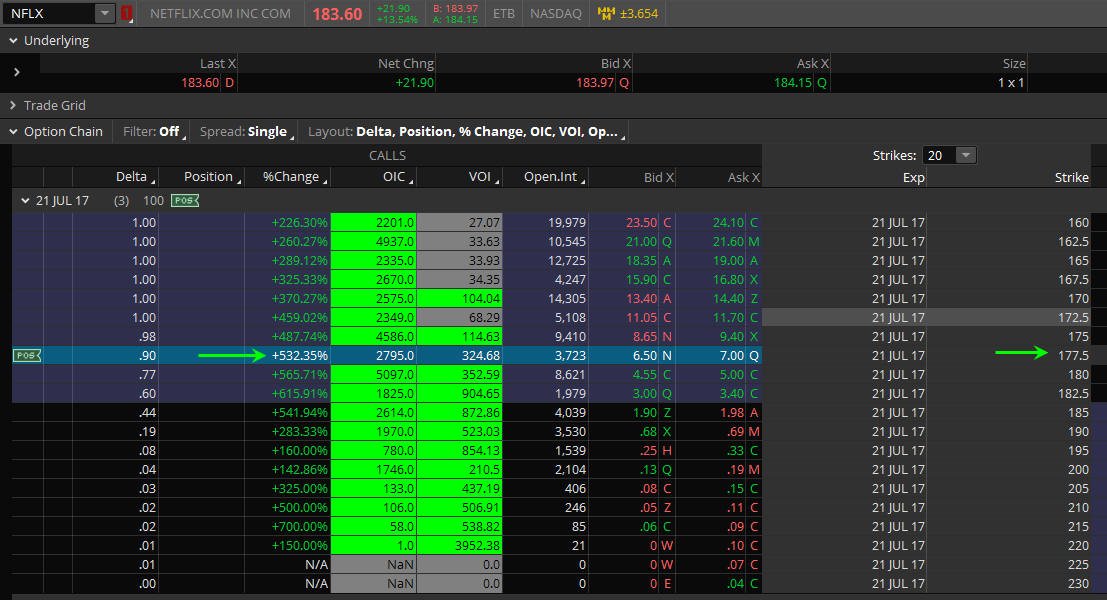

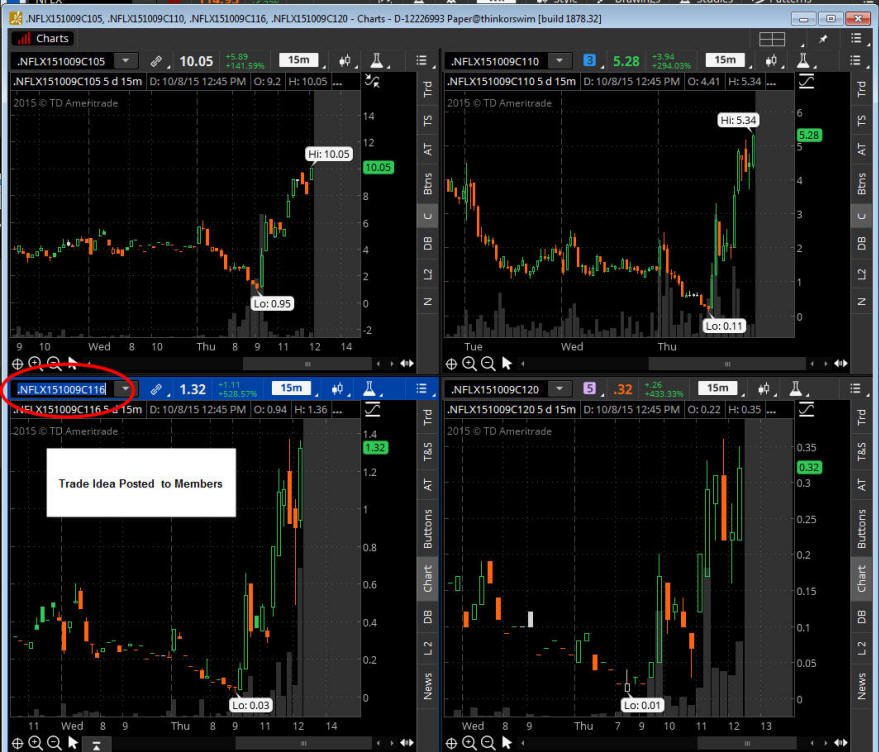

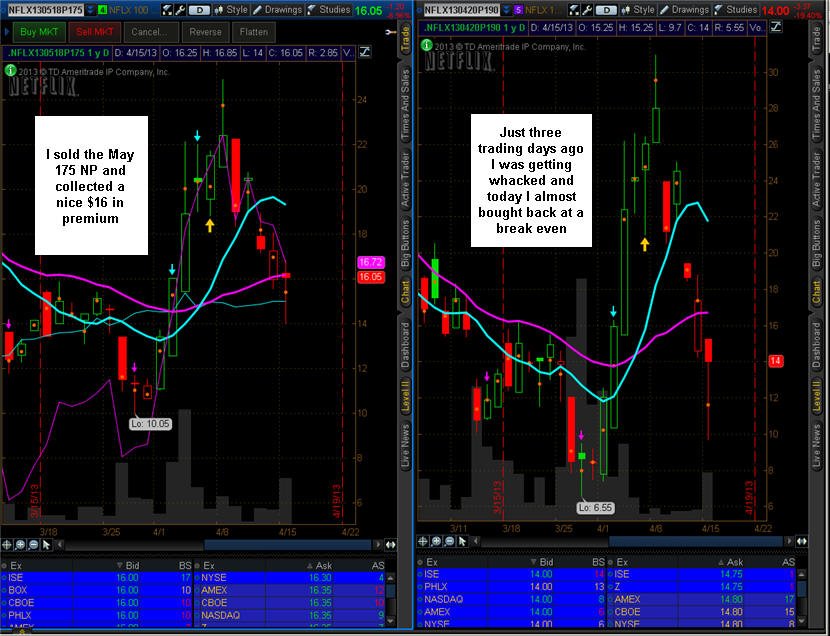

For example, below are the multi-strikes above the $250 10% move I posted and as you can see, they were ALL massive winners by the end of the week.

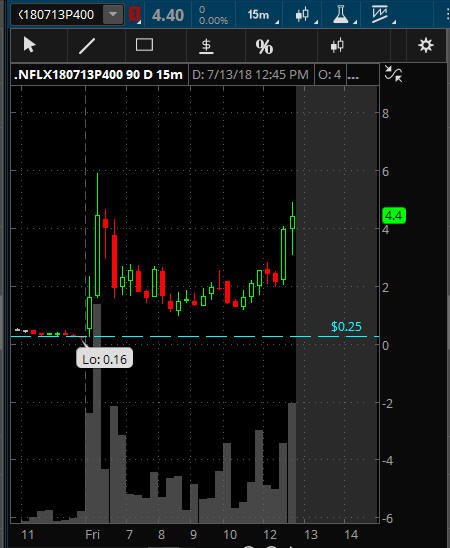

Now lets take a look at the options up to 20% OTM; and see how FISHING post earnings would have hooked you a Moby Dick White Whale trade!!

These two strikes were wildcard trades, and you could have just placed them pre-earnings for around double the low price (which was worth it) but if you were fishing, then you can see the Lo prints and that could have been you (it has been me in the past) and then you would just hold on into expiration Friday with at least half your size and see what the markets will bring you!

I will be doing this for FB, AAPL, GOOGL, AMZN coming up later this week!

========================================================================================================

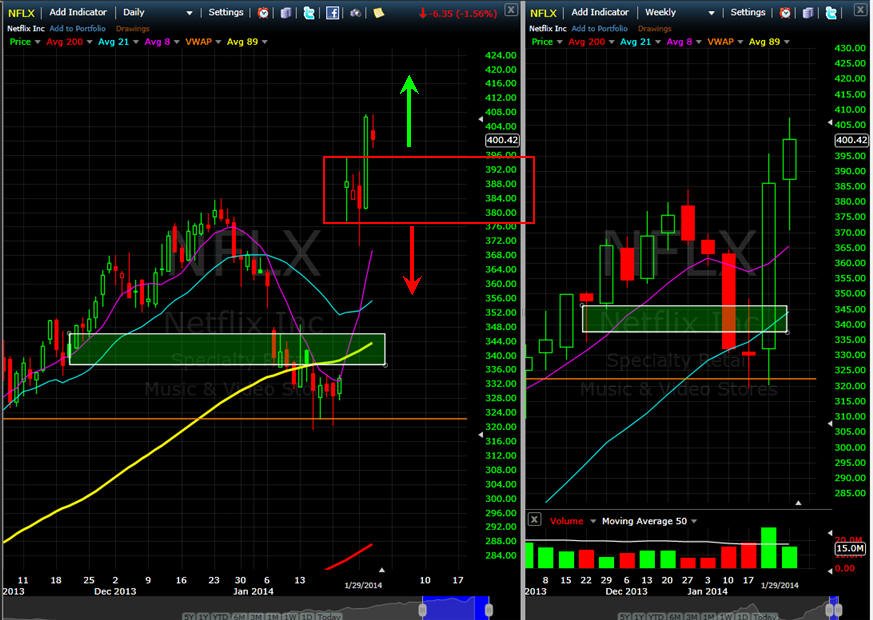

1/24/18 - NFLX blows earnings out of the water, increases subscriber growth abroad and spending BILLIONS on content development. What a quarter again for the media giant, and all the analysts (always after the fact) are out pounding the table with upgrades and huge price targets from $280-$335.00 per share. If you calculate the stocks pre-split price, it now trades at $1,831.97 per share, and with a market cap over 113B, I don't think there will be takeover buyers anymore. So, that means we trade the stock on the merits of its future valuation; and with the current cash burn rate they announced (8Billion); its a total crap shoot at these valuations, but hasn't it always been that way with NFLX?

With all the post earnings upgrades, you have to be somewhat suspect for a continuation much higher in the coming weeks, because that is usually how big funds dump their pre-earnings profits to unsuspecting post news buyers. That is why I took profits on some of my Lotto Calls, because in my experience, I have had profitable trades wiped out by Friday expiration. My new plans are to start selling Bull Put Spreads; fish for DoubleUP trades on strikes up to 3% OTM; and continue with my typical Lotto Trades on Thur/Fri for that potential buyout bid.

Now before you load the boat with post earnings bullish plays, you have to remember that this is a streaming entertainment company that is attempting to morph into a studio conglomerate. This can ultimately create a long term thriving business for them, but that makes investing in NFLX at these heights a total wildcard; and if the company falters on content development (multiple flops); the general public (paying subscribers) are very unforgiving and fickle and those subscriptions are what drives this price higher. When thinking about the long term future for this stock. What goes up, will come down; however with stocks like NFLX and AMZN, the down is more like a pillow filled with soft feathers where the bears have been crushed into a state of hibernation for a long time.

The argument is NFLX is taking the AMZN approach to spend your way to glory, but you need to understand that AMZN got a pass for over a decade because they sell everything and anything by controlling the roads they traffic, but NFLX sells cyberspace entertainment; and they don't control the roads that content travels on; even though the current trajectory of this company has the Bulls on a Yellow Brick Road to the Emerald City where dreams come true and magic happens in their land of Entertainment-Oz—let's just hope NFLX management does not pull back the curtain too much to reveal they may actually have an emperor with no clothes and kill this fairytale story with all their spending.

My bias remains aggressively bullish, but now I am placing wildcard puts 15-20% OTM as I travel this golden road.

=======================================================================================================

1/21/18 - New year and continued speculation that NFLX will be bought out. With all the repatriation bazillions coming back to the US, the rumor mills are churning with speculation that AAPL or DIS are at the top of the list for making a move to buy the streaming entertainment giant. Of course, the market cap of this company is currently at 95.4B, so it will definitely take a behemoth like AAPL or DIS to take that on; and there is where you have to consider who has the money, muscle, and motivation.

I am thinking that the CEO of NFLX has no plans of ever selling because he just keeps on spending billions of dollars on proprietary content development, so any buyout would most likely be more of a hostile takeover, and that could make for some BIG moves for us as we speculate week-to-week with Lotto Trades.

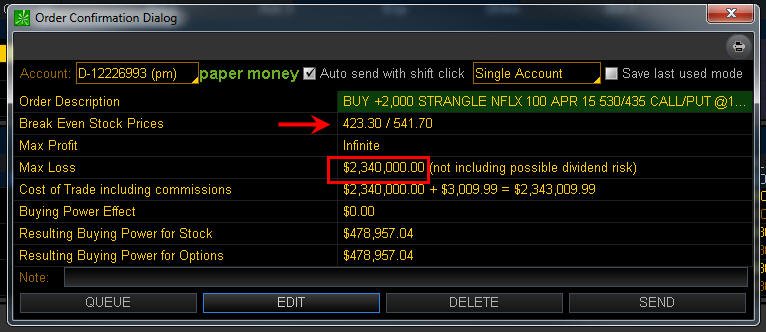

With earnings coming out tomorrow, that makes any options trades very expensive, so getting decent size with an IV already at 77% is not going to happen; therefore, consider some spreads to cut the costs of trading down, but keep a few wild card Lotto Calls and Puts on deck 20% OTM.

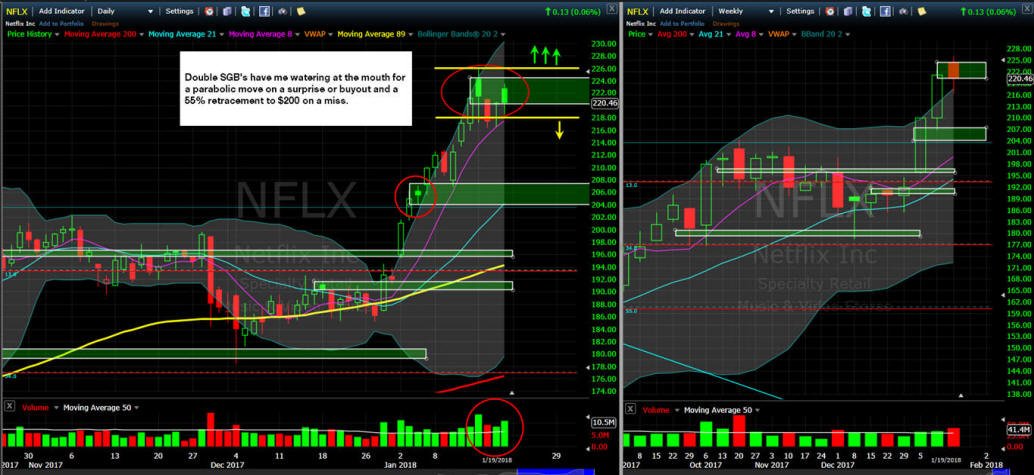

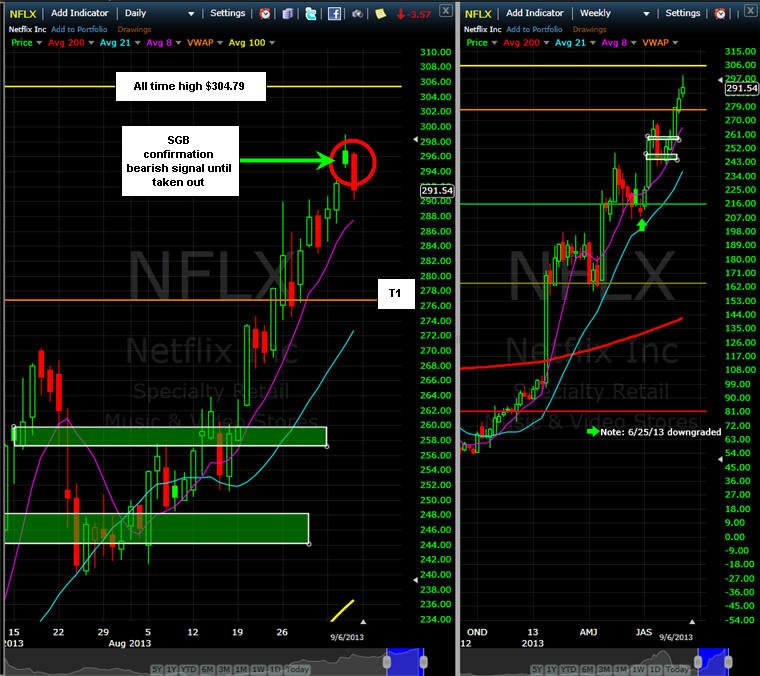

On Friday, the stock put in another SGB below the last one, so we are definitely looking at a big move post earnings in my estimation. The stock has exploded over 18% in the past 13 trading days, so a surprise beat again, and we could see a parabolic move higher over these SGB's; and if they meet or miss, then I expect the SGB's to be the top for this quarter; and the only thing to propel NFLX higher would be a buyout event.

No big directional bets were placed on Friday and it looks like overhead resistance will be at $240 - $250

============================================================================================================================

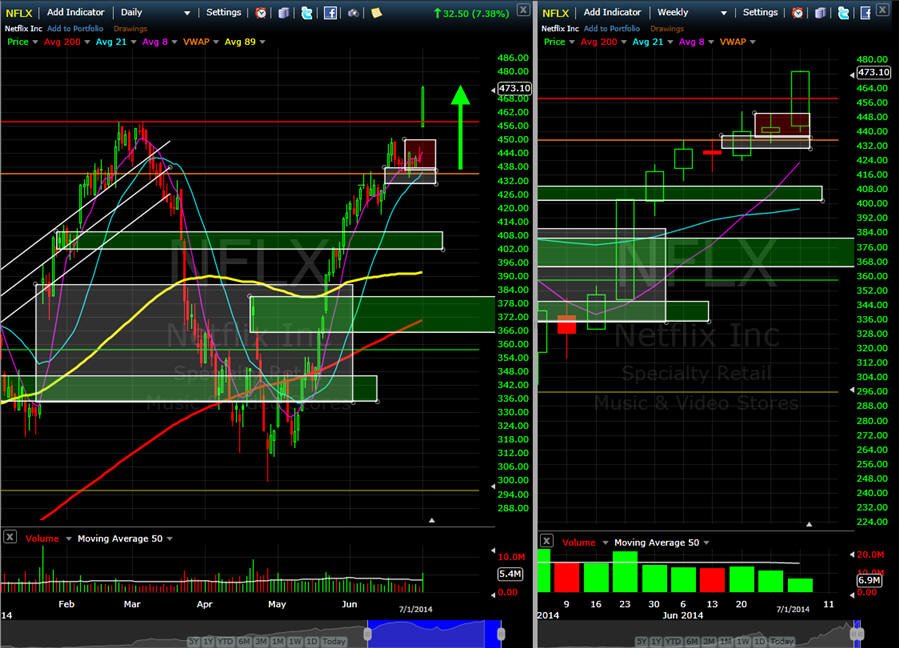

7/23/17 - NFLX finished the week strong and at new all time highs! Will it continue to climb higher? Most of the time, when a stock exceeds 2x the MMM (+/- 11.21 Actual move +$23.30), you can anticipate a continuation for the next 1-2 weeks. Of course there is always profit takers lurking, but if momentum, markets and future compelling news are solid, that is what you can expect when buying directional options. What you should be aware of is the IV is pumped up a lot more, so selling Bullish vertical spread and/or selling Naked puts is a nice consistent way to make some profits to pay for Lotto trades.

When you decide to buy calls on pumped up IV stocks, you should always fish for a better price; and take profits along the way. Look at like this, if you buy 3 contracts at say $1.00, then you sell 2 at a $1.50, you now have a free roll on 1; and can let it ride to potentially parabolic profits. What I like to do is fish for an entry around 50% below the ASK and then sell 2 for a DoubleUP! that way I have a guaranteed profit even if the last one fails to perform—be sure to stick to options no further OTM than 3% when fishing for DoubleUP trades; otherwise, the conservative way is to buy options with a Delta of .70.

My plan is to continue selling Naked Puts / Vertical Bullish spreads and fishing for long call DoubleUP! trades.

!================================================================================================

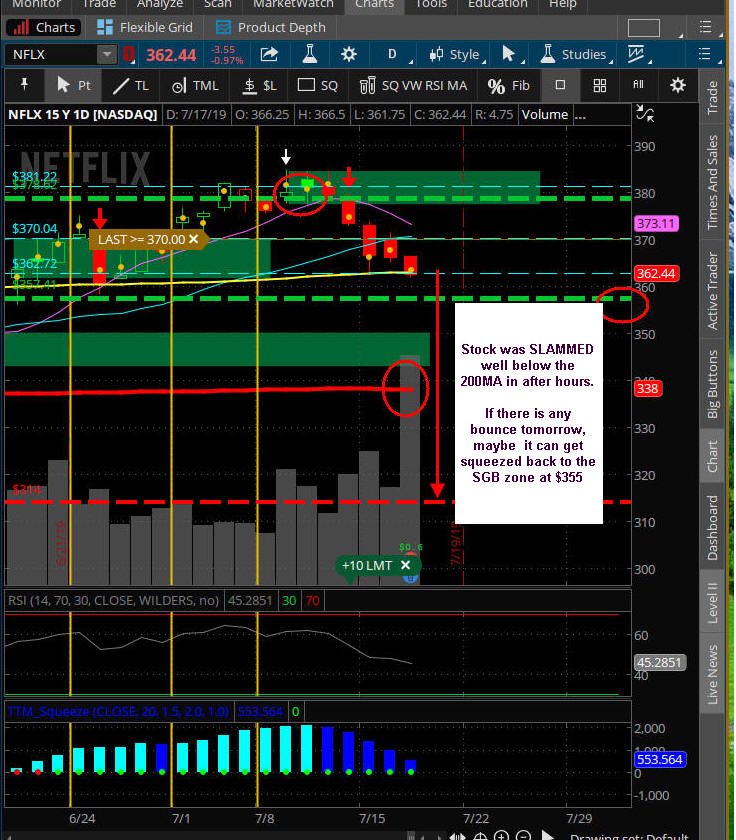

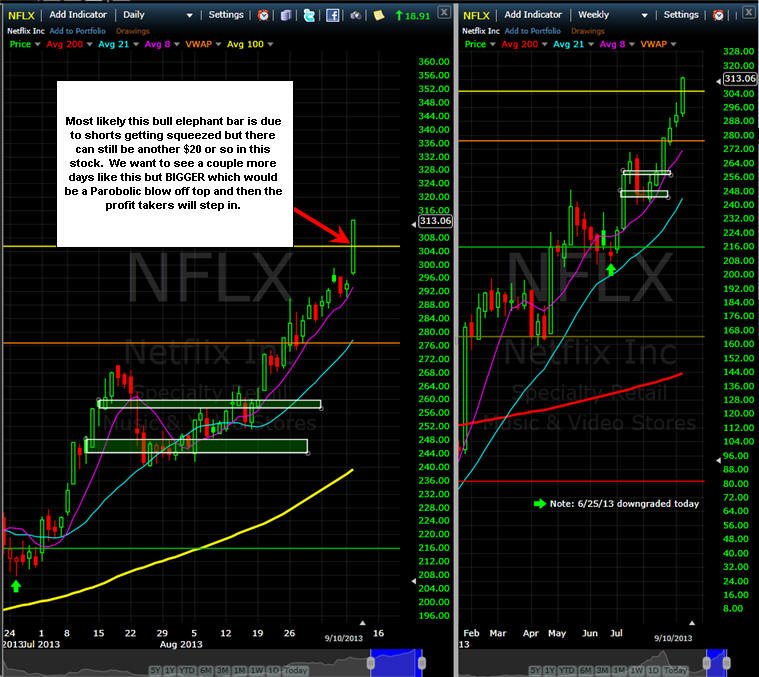

7/18/17 - NFLX knocked the canvas off the ball and blew away all estimates and metrics—the best quarter ever for this stock!$$!!

The shorts were squeezed mercilessly as the stock tacked on an impressive 13% gain closing nears its new all-time-high$$$$$.

If you got in on the Lotto Trade, then you are happy in deed and you should have taken some profits off the table and letting some ride because we still have three more days and NFLX can possibly keep going right on up to $200.

====================================================================================================================================

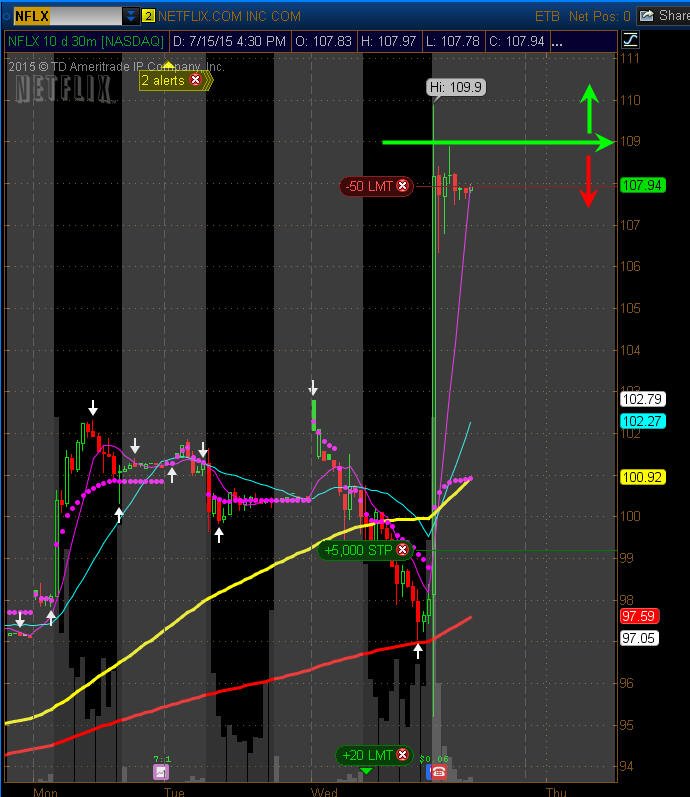

7/15/17 - Earnings are set to release Monday 7/17/17 after the close and I am anticipating some good movement this quarter. There is always the possibility of a buyout, but until the issues with the Trump administration are settled, we will not be getting a clear direction on infrastructure, tax repatriation and congressional spending etc. This gives big fund managers pause on making large investments, so there is plenty of cash waiting on the sidelines.

The expectations for a strong quarter has the IV pumped up pretty well, so making a lotto trade pre-earnings is going to be expensive; therefore, I am looking for small positions in some wild card puts and calls and will see how the stocks reacts post earnings before I do more direction trading strategies.

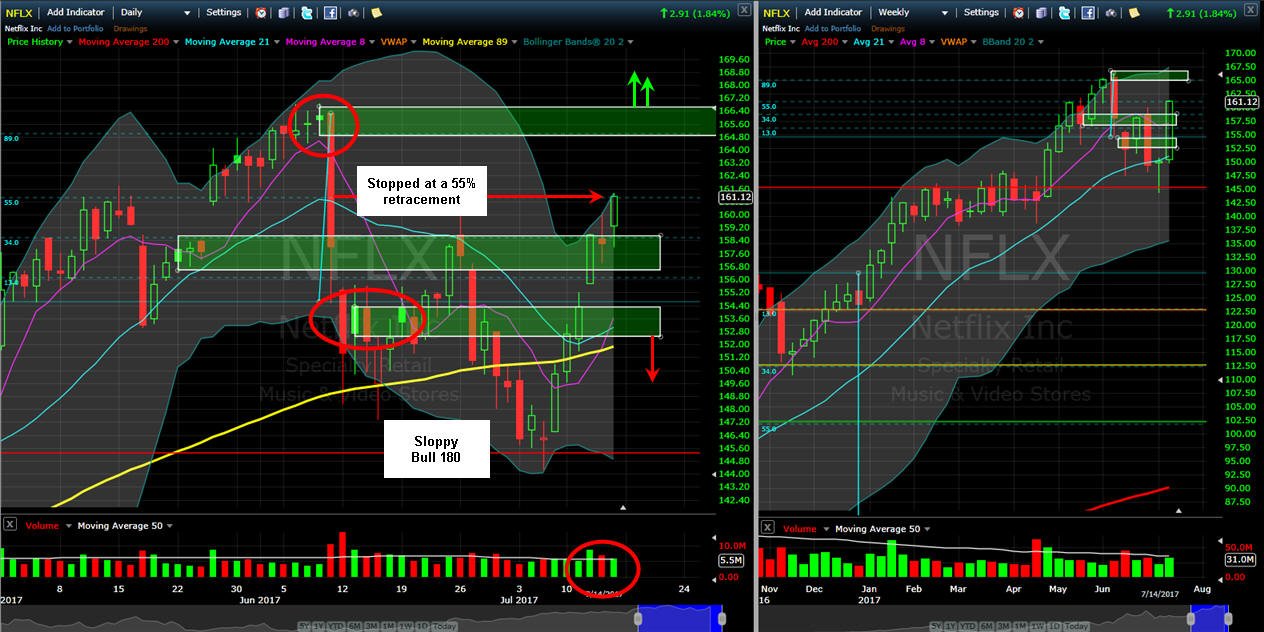

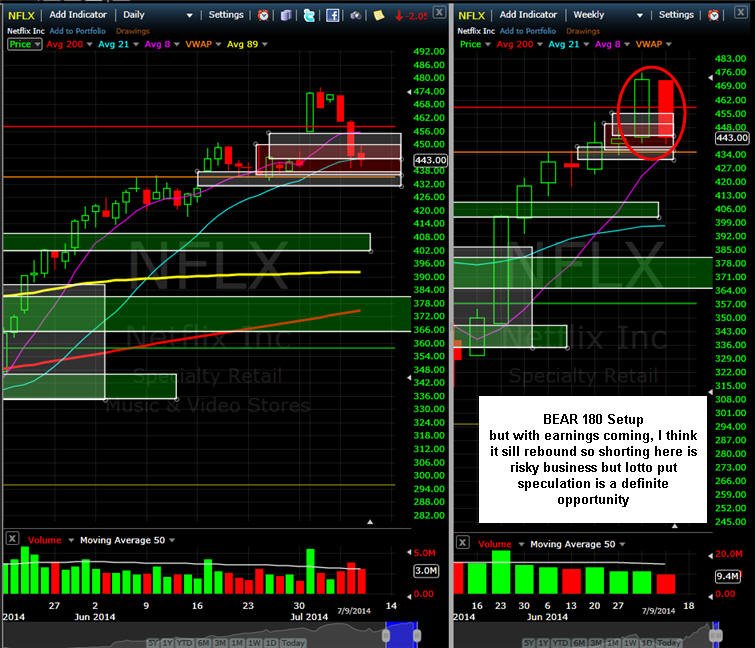

The stock has been on a very strong rally for the past 6 days; and it is setting up for a Bear 180 or Bullish parabolic move to new highs. Yesterday NFLX took off from the SGB zone triggering long strategies; however, it stopped right at a 55% retracement of that big sell off back in June, so if they miss estimates, the drop could easily take out the lower SGB's at $152, so I am looking for put strikes at $150. Unfortunately, with a full week to expiration, there are NO lotto trades, so I am going to look for White Whale opportunities post earnings and maybe pick up a couple 150 puts tomorrow.

Expected MMM is +- 11.65 which is approximately 7%; and that would be a new all time high. (Pre split that would put NFLX around $1,200 per share...wow)

When IV is pumped up, selling Bear call spread premium is a good way to go post earnings if the stock cannot move greater than 2x the MMM.

No big bets placed on Friday.

Bias is still bullish

==================================================================================================================

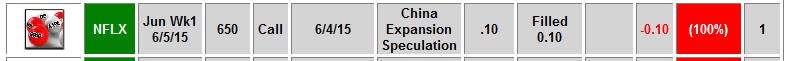

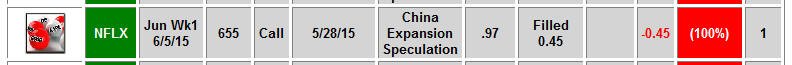

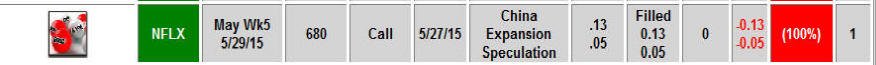

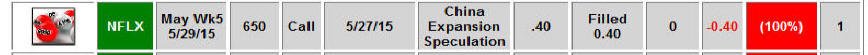

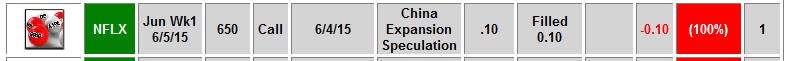

4/25/17 - CHA-CHING! NFLX announced expansion into China and the stock takes off making the OTM Lotto calls cash in for as much at 8,000% ROI...WOW!! As I pointed out in the last comments you should be buying the OTM calls and if you did, well, you hooked onto a Moby Dick trade and cashed in! I had several fishing orders in place and was filled on the 150 Calls for $0.10 cents! Well, today they hit $4.00. I was profit stopped out of 75% of my contracts at $3.25 and now I will see how things end up as we head into Friday expiration.

This trade was not posted to the site because I am experimenting with the strategy to improve winning results like this one in the future. Even though you may have missed this trade you need to remember THERE IS ALWAYS ANOTHER ONE COMING so get ready and start placing fishing orders on stocks like: FB, AAPL, GOOGL, AMZN, CMG, NFLX, TSLA, BABA ETC. because we never know which one is going to have boom or bust news.

As you can see below the returns can be phenomenal and will easily pay back any trades you get filled on that do not work out.

These options got a low as $0.04 cents per contract but I had a fishing order in for $0.10 when it was filled.

=====================================================================================================================================

4/19/17 - NFLX earnings were a bit of a disappointment as subscriber growth came in lower than expected. There was no talk of a buyout and it looks like their business model is chugging along vs. excited growth and expansion. Post earnings it looks like big money is ready to take profits and today the weekly chart is showing a DOJI SGB setting up so far. The initial post earnings drop into the last large SGB zone showed some buyers were waiting in there to buy; however, if NFLX does not hold onto today's wick then I am looking for short opportunities and will continue to keep buying Lotto Calls 10% OTM.

If we do get some selling into this week, then I expect bargain shoppers will be down at the Gap Fill around $134.00; however, there is always a buyout surprise so be ready and keep fishing those OTM calls.

==========================================================================================================================

3/15/17 - Lousy market volatility in the first quarter of 2017 has not made us any Lotto profits and is becoming quite frustrating; however, sitting on one's hands at times is what it takes to be successful options trader. I am going to start fishing for some Lotto calls and swing puts with my bias to the upside. I feel like the markets are about to break loose heading into Q2 so I am want to be ready to catch a move when the action starts. NFLX had an impressive 13 weeks move higher and now 5 weeks of sideways action which tells me the next breakout or breakdown is eminent.

======================================================================================================

2/26/17 - New highs and SGB zone being tested as NFLX begins to turn up some heat on content deals. The Academy Awards proved the NFLX and AMZN are becoming media content giants as a couple of their projects when they won Oscars for independent films they backed or bought. This will no doubt cause a rally this week in both NFLX and AMZN so my plan is to buy some Lotto 150 calls at the open and also sell naked put premium too. I am a strong bull bias as long as NFLX holds over $142.55. If you have a smaller account, you can sell Bull Put Spreads 145/150 for March expiration.

==================================================================================================================

2/19/17 - So far NFLX is holding the SGB zone even though it entered into it last week. IF we get a move over $143 that is long and move under $138.89 is a short bias. Until we get some clarity on Trump administrations momentum towards tax reductions and repatriation, the markets are going to continue to trade in a state of limbo. Will this stock be bought out only the CEO knows so we have to continue to speculate by watching chart movements, volume surges, institutional ownership surges and insider activity. This stock is testing the pre-split $1,000 level and the SGB zone so we have yet another perfect pivot point for holding onto shares or shorting them. As for longer term speculation you MUST FISH for better entry points and take profits sooner. My plans are to work the stock for DoubleUP! trades and compound the profits I make into Thur/Fri lotto trades.

=====================================================================================================

2/12/17 - Is the buyout speculation back on? Could be as we move on down the Trump Gold Brick Road. Once NFLX passed through the SGB zone that was a solid long entry point and I hope you have learned enough on how to execute trades at SGB pivots even though I have not posted anything on NFLX for a little bit—I was sick with a nasty cold the past few weeks so I am have not been fully engaged in the site updates but I am better now and back in action.

NFLX is a leader of the pack stock, so any pull backs are buyable and I will being selling continued Naked Puts and Bull Put Spreads. I will continue with my Lotto Plays up to 15% OTM however, it is getting much harder for any company to acquire NFLX with the stock now trading pre-split over $1,000 per share. In fact, one could make an argument the Lotto Trade is on the puts side because if there is NO buyout, then the stock is trading at all time highs, but remember, investors have probably forgotten about the 7:1 split and think this stock is cheap.

============================================================================================================================

1/22/17 - Post earnings NFLX shows no enthusiastic push higher as investors take profits into the inauguration; however, the stock, although is was a second SGB candle, managed to hold onto a slight positive close on Friday. We did not get any good WW trades or Lotto trades last week (as I expected based on the political events) so now we look to the coming weeks for our next opportunities to make some HUGE profits this year! NFLX is still a buyout candidate but at current prices, I just can't see much of a premium being paid so that will kill any chance for a huge lotto windfall. I plan to keep buying up to 15% OTM calls on NFLX and will start selling more premium to finance those trades. I want to buy shares and sell Naked Puts on any good dips 5-10% lower, but if we kick off this week with rallies, then I will be aggressively jumping on NFLX longs bias strategies over Friday's high. If it turns out this is the "top" for NFLX, the I will be looking for a dip bounce that fails the SGB before I get aggressively short.

===========================================================================================================================================

1/17/17 - A solid beat across the board by NFLX has the stock up 7% in after hours today. The MMM was estimated at +/- $12.15 and that is pretty much exactly where the stock settled the day at. There is a lot of excitement in the stock right now and a ton of IV% to collapse so I am going WW fishing on puts at the open to see if I can catch something.

=================================================================================================================================

1/17/17 - Last Friday NFLX closed at a new all-time-high and tomorrow is the earnings release.

Consensus Q4 numbers to know: Revenue 42.47B, EPS $0.13, domestic streaming additions 1.38M, global streaming additions 3.78M

Q1 guidance expectations: Revenue $2.6B, EPS $0.18, domestic streaming additions 1.72M, global streaming additions 3.5M.

The key to this stocks future in the coming months will be the guidance; and they typically do not put much enthusiasm into their guidance—in fact, the CEO has said things to deliberately drive the stock lower in the past, so a strong beat and positive guidance would put some real fire in the bulls belly and take this stock to greater heights. Last week there was an upgrade at Mizuho (which I am always leery of just before earnings releases) to $150 per share which would take the stock over $1,000 pre-split which is a very large milestone. If the stock keeps climbing higher, then buyout candidates will fall by the wayside as it just gets way too expensive to make the deal. I have been fishing Lotto calls for months on a buyout and nothing has materialized to date and with the stock at all-time-highs I am not so confident a buyout is in their immediate future. The current market cap for the stock is 57.03B and rumors have surfaced the DIS (MC 171.83B) or AAPL (MC 639.88B) are the likely buyers in the future. The one with the most money usually wins and that would be AAPL, but DIS is viable because of the content deals they have with NFLX.

There has not been very much option activity other than spreads and the Call/Put ratio's are pretty much even, so it is going to take a big surprise to get this stock really moving; otherwise, the 121% IV makes for some juicy premium to sell this week. As for Lotto Trades, there are none pre-earnings, so we will have to WW Fish post earnings.

The play will be how NFLX reacts to the MMM in after hours. In my experience, if the stock does NOT take out the MMM is typically sells off so we become short sellers and strategies. If it take out the MMM by 1.5x then the bias is up even more so we sell put premium and do call strategies.

=========================================================================================================================================

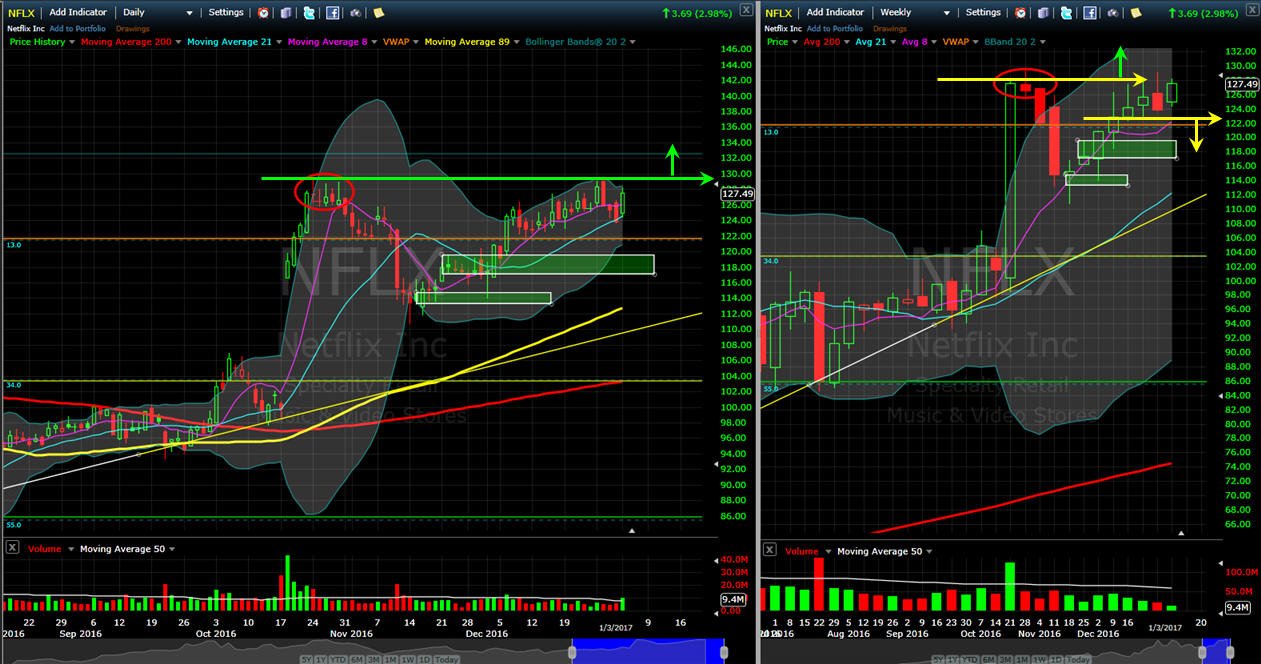

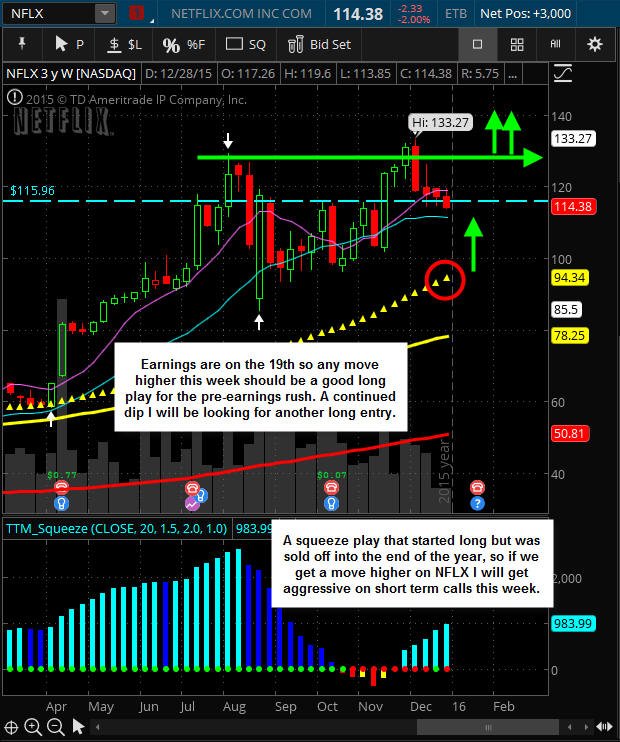

1/8/17 - NFLX finished the week hold close to all-time-highs as we move into the earnings season and presidential inauguration. The daily chart is showing a DOJI Sandwich (DSW) pattern which, if triggered tomorrow is a bullish play with upside to the previous all-time-high 133.27. There is continued speculation that NFLX will be bought out in 2017 so that will keep buyers in play on any dips. I continue to buy Lotto Calls up to 15% OTM and I will be watching close this week to see how the stock trades before I put on some more plays other than my usual day trading of the shares.

===============================================================================================================

1/3/17 - The first day of 2017 trading and NFLX is off to a strong start! Rumors continue to float that this stock is ripe for a takeover in its future and now DIS is the front runner candidate to take over this company. There is definitely some good reason to believe that with their past relationships and today Cramer said he thinks AAPL is no longer a viable buyer but he is expecting maybe DIS or ComCast will be up to it. We did not get it in 2016 but I am still placing my continued bets on NFLX for 2017 and will see how this plays out in the coming months. I certainly do not expect it in the next couple of weeks, but you just can't be sure so having skin in the game is the necessity. I just day trade shares and sell premium to continually finance my Lotto speculation and I am hopeful I will wake up so a 6-figure payday in my future with NFLX. I am expecting some strong volatility in NFLX so I plan to be on the hunt for great Lotto and White Whale trades opportunities especially with the stock in striking distance of the all-time-highs.

==========================================================================================================

12/29/16 - The final day of trading for 2016 is upon us and NFLX is looking pretty strong for a shot at taking on all time highs soon. I am going to add to my $135 Jan Wk1 lotto calls but I am not expecting any buyout news to hit; however, you never know so I want to be in it to win it. I have been chasing this trade for several months now and I have had to day trade shares many times to finance these trades. Overall for 2016 the compounder series in NFLX has been net positive so I am continuing with it for all of 2017 or if/until they get a buyout offer.

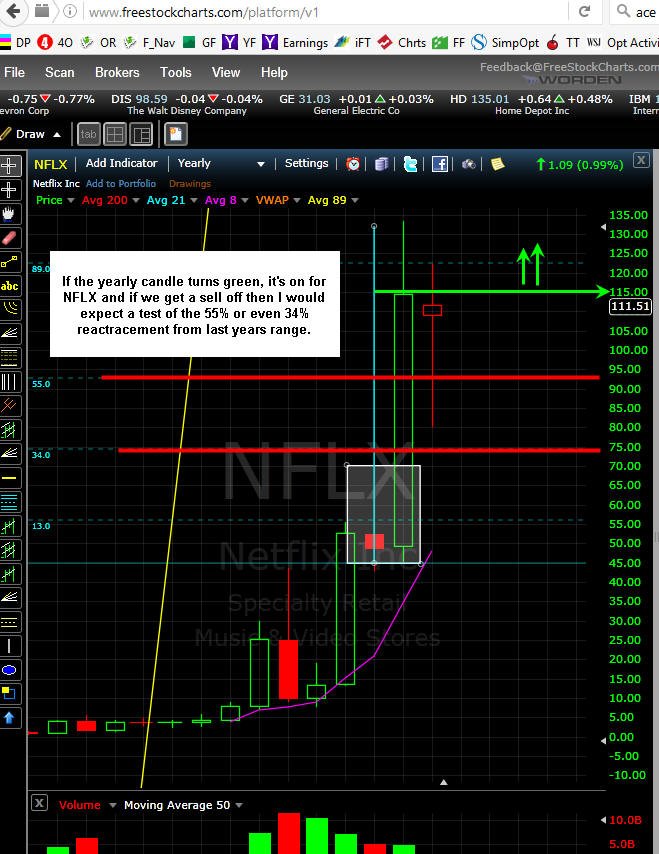

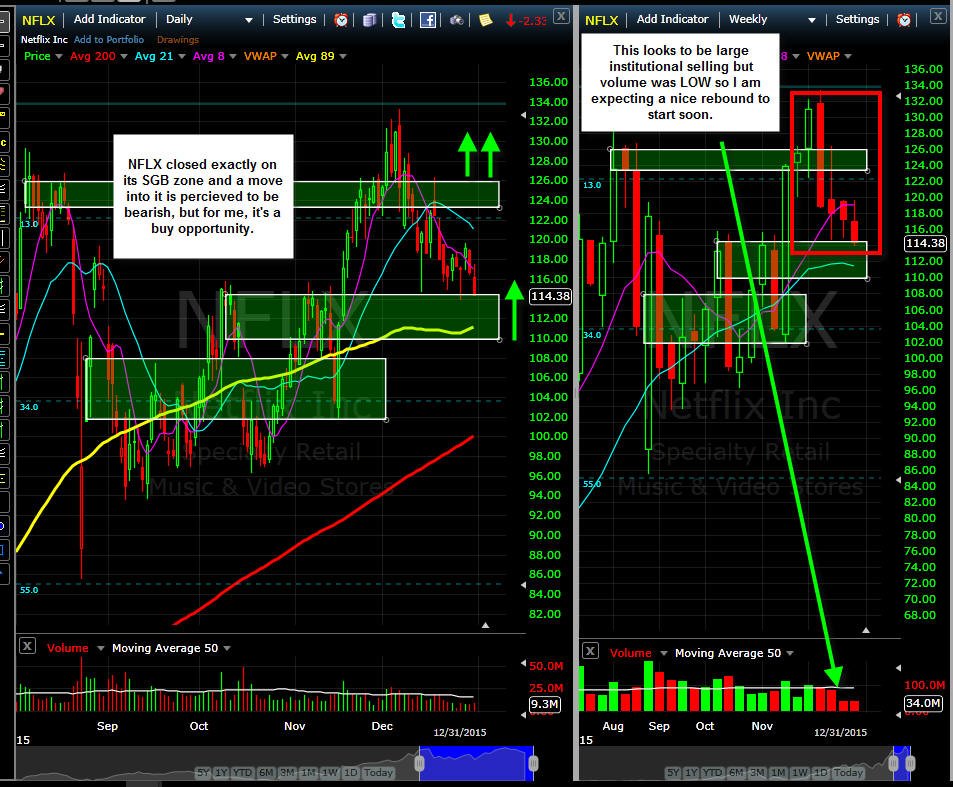

Looking over the yearly chart, 2016 was not nearly as strong as 2015 and it is looking certain NFLX will have its final day closing above last years closing price ($114.38); however, volume for 2016 has been lower. In fact, NFLX has been on a steady decline year-over-year. The all-time-high (post split) is set at $133.27 and it has been speculated on CNBC that NFLX is a good candidate to take this high out soon. It is a pretty easy goal to attain if the markets rally in January and for sure if the company posts a stronger than expected quarter.

If you recall, NFLX split their stock 7:1 back in July15,2015 so I am thinking the bigger funds that buy into this stock are eyeballing a pre-split price of $1,000 or $142.85 as the ultimate top, so that price point is where I will keep my eye on as an initial profit taking spot on a Jan rally.

Long term, you have to remember that NFLX is a subscription based content facilitator that is diligently working on becoming a solid content provider with their growing catalog of original programming; however, you have this is extremely expensive to produce and the cash burn for them will have a high impact on moving the price needle. In addition to that, they do NOT own the networks they broadcast through; and that can always be a deal killer in their future earnings due to price hikes by their vendors; so a buyout from a company like AAPL or DIS would be a huge win for both sides.

We do not know the future, but for now, NFLX is the entrenched behemoth in this space to watch and trade for 2017.

The yearly chart show year-over-year declining volume as the stock grinds higher so caution is expected until see how things start out in 2017. I will continue to buy lotto calls for the buyout scenario and will watch for SGB's on daily and weekly charts as my put buying opportunities and at earnings time.

==============================================================================================================

12/26/16 - Slowly grinding higher this week shows me there is some solid interest in the stock as we head into the final week of trading. With a positive market this week, NFLX is poised to test it's all time highs at $133; and any positive buyout news could start a huge rally in this stock. My plan is to keep my Lotto calls up to 15% OTM and will stand ready to short if the stock fails the last set of DOJI tops as pointed out below. However, I am not ready to aggressively short NFLX so taking daily profits is the game for me.

=============================================================================================================

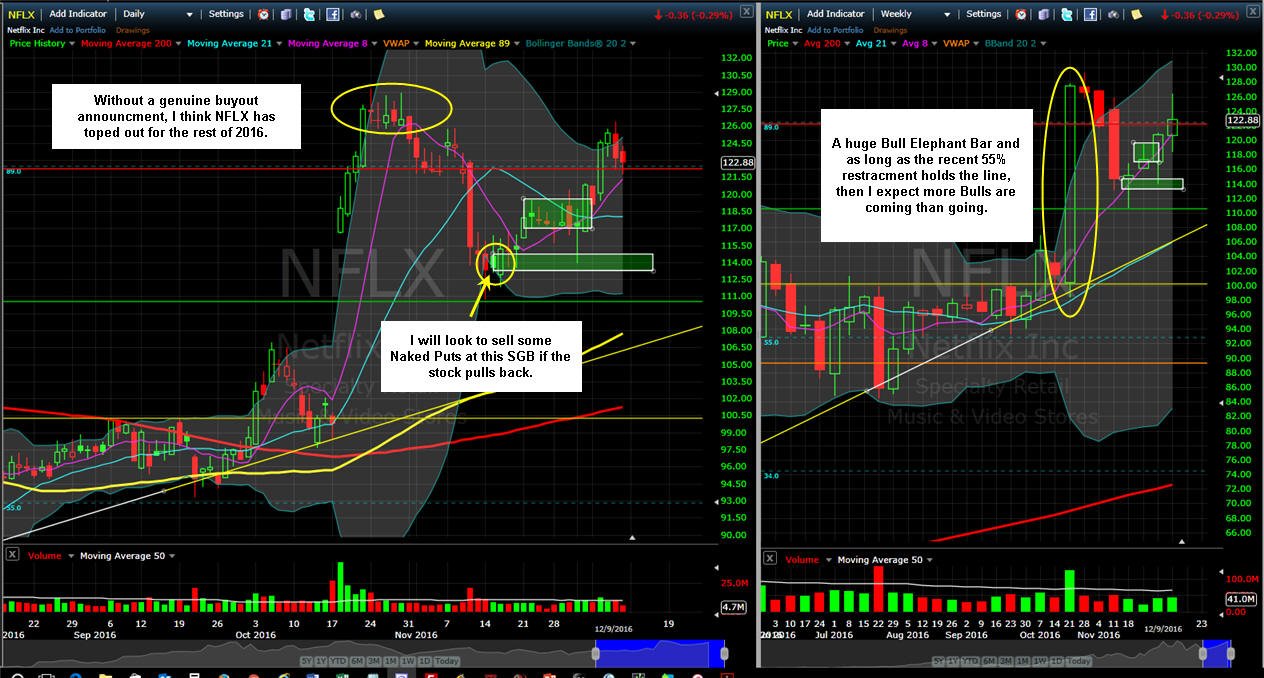

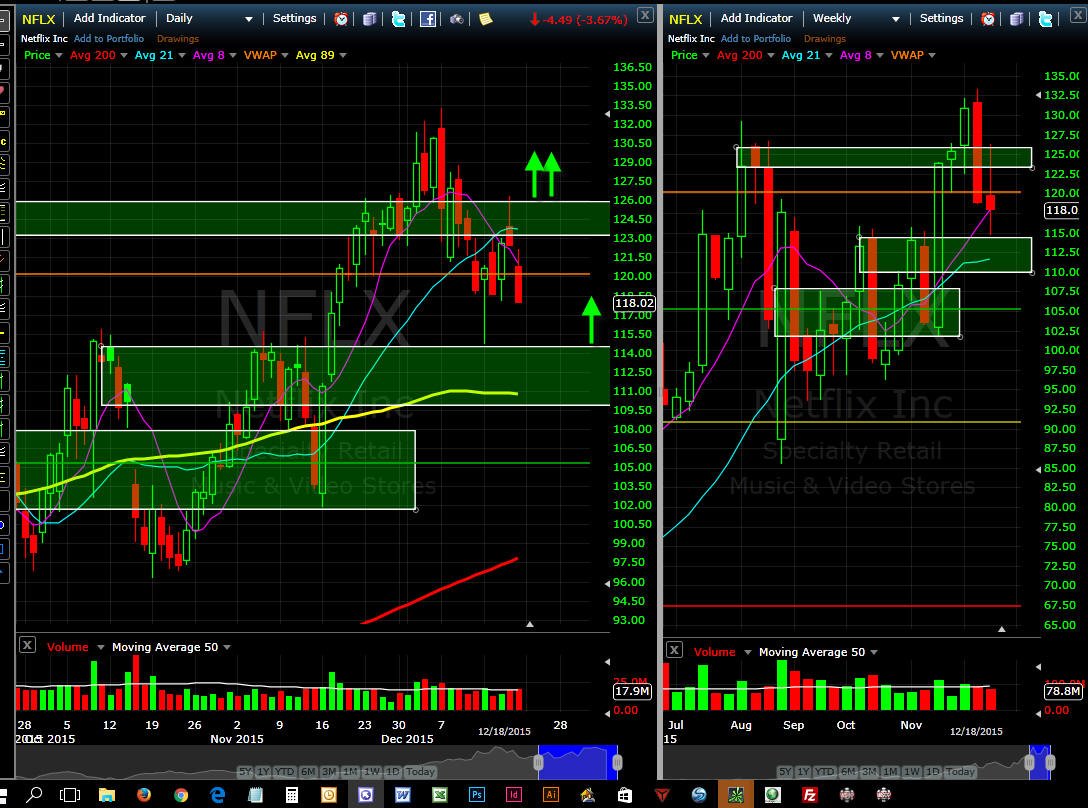

12/18/16 - NFLX is still on the rise testing previous post earnings highs and looking like it wants to make a much bigger move soon. With continued buyout speculation, there should be plenty of support buyers on any dips so I will keep on fishing for my Lotto calls and will look to day trade direction as it plays out. If the stock does make a turn down this week, then I will be looking for a test of the two SGB zones with a bottom target at $112.50 or the 89MA on the daily chart. The weekly chart shows us the stock did test the earnings gap down to 55% which held, so that is the major support at $111.55.

=============================================================================================================================

12/11/16 - The move is on for December and rumors still out there for a buyout of this stock. Will it happen before 2016 is over? I hardly think so, but you never know so I am going to just keep buying my Lotto Calls up to 15% OTM; however, this time I am going to buy some JanWk1 expiration since we are winding up for 2016 and most likely there will be very little movement in NFLX the rest of the year without a buyout announcement. This stock did make a nice move off the SGB bottom and if it can hold onto $120 then I will be day trading some long shares and under $118 I will look at some shorts; however, with a buyout looming, I will not be shorting very many shares. If we do get a good drop back to the SGB zone, then I will look at selling some Naked Puts and Put spreads.

=============================================================================================================================

11/24/16 - The SGB became support; however, this week we had two DOJI SGB's and that tells me NFLX is ready for a measured move as we get going into December trading. There is always a buyout speculation but I am not excepting anything to be announced until we know how the Trump administration is going to deal with repatriation. Still, I plan to always have my Lotto calls in place and then day trade around the stocks movements to pay off my calls plays and add more because if that event happens, I want to wake up to a solid high 6-figure profit! I am going to buy a couple 112 puts tomorrow if NFLX opens lower or fails to hold over $118.50 in anticipation these SGB's will kick in next week.

==============================================================================================================================

11/17/16 - Interesting week as NFLX is holding onto the support buyers from Monday and did not complete the DSW; however, Tuesday was a SGB, so we have a potential larger move down to a full gap fill. News today that AMZN is launching a global streaming business caused a little bit of a dip in NFLX and ended the day as a perfect DOJI inside the SGB wick range. I have been chasing NFLX for a long time as a buyout candidate and I still believe it will happen in 2017 but I know the power of SGB's as short signals so my bias is about change to bearish if this SGB is taken out; however, I will continue to fish for Lotto calls because the cheaper NFLX price becomes the more likely it is a buyout candidate. The weekly chart is now becoming a DSW setup so get ready for some action next week.

=======================================================================================================================================

11/13/16 - Tune it and watch because the next 4 years are going to be potentially VERY bullish for NFLX and others. Initial reactions to the Trump upset was a panic sell on anything tech, but you know that will be short lived if he actually does (when it comes to taxes) what he promised in his campaign and debates. What I am particularly looking for is the corporate tax cuts and repatriation of capital. You have to believe if he makes those moves, then trillions of dollars are coming back and NFLX is definitely on the table to be bought out so KEEP FISHING for lotto calls and lets see if we get paid off in the coming months.

The current daily chart finished the week with multiple DOJI's and we are looking like a strong DOJI Sandwich (DSW) setup will start tomorrow. If NFLX does open down, then I expect the move to be equal to Thursday's drop putting the stock around $105 which is going to intersect with the 89MA and a SGB zone. If we do not get the drop, then a move over $117 that holds for at least 15 minutes is a long for me.

I will continue to fish for wild card lotto trades 15-20% OTM on NFLX every week and I will work other trades and sell premium to finance them. My goal is go make enough profits scalping and premium selling to build contract loads to 100 or more because if this stock gets a buyout, I want to make a fortune on it.

===========================================================================================================================

11/6/16 - The resulting direction was to the downside as investors begin to lighten their bullish enthusiasm on a buyout in NFLX's future; however, the selling is hardly a run-for-the-exits and volume has been very light so I am still looking for long entry points until NFLX can drop below 55% ($111.34) of the post earnings rally. If we get a post election rally, I am confident the NFLX will be a leader of the pack so I am buying some Lotto calls for this weeks election volatility play. Once NFLX can make the move over $129 I am still looking to sell put premium. I did not sell any Bear Call Spreads last week but I will be picking up some puts tomorrow.

==============================================================================================================================

10/30/16 - Sideways trading all week has NFLX ready for the next move. As time marches on, buyout speculators can lose heart and that is opportunity for us. With the company doing well in subscriber growth and content development, these two things will always be wildcards for investors' to place their bets on. Looking over the daily chart we have a total of 5 topping tails with Friday being a tombstone DOJI of sorts. So, if NFLX moves over $129 I will be there selling put premium; and a move under $124.50 that sticks I will be selling some bear call credit spreads and continue fishing for Lotto calls up to 20% OTM.

Looking over the weekly chart, we have a nice post earnings $26+ point move and if it is to hold on any pull back, then it must hold above a 55% retracement or $111.40 which is also a previous high on the weekly charts back 4/15/16. The all time high is still at $133.27 and if you recall the stock split 7:1 last year so that high was actually $932.89 post split and if the stock does continue higher then my upside target is $142.89 and my low side is $73.13.

Remember to keep fishing for weekly WW trades on Thurs/Fri as NFLX will continue to give us some great volatility in the coming months.

======================================================================================================

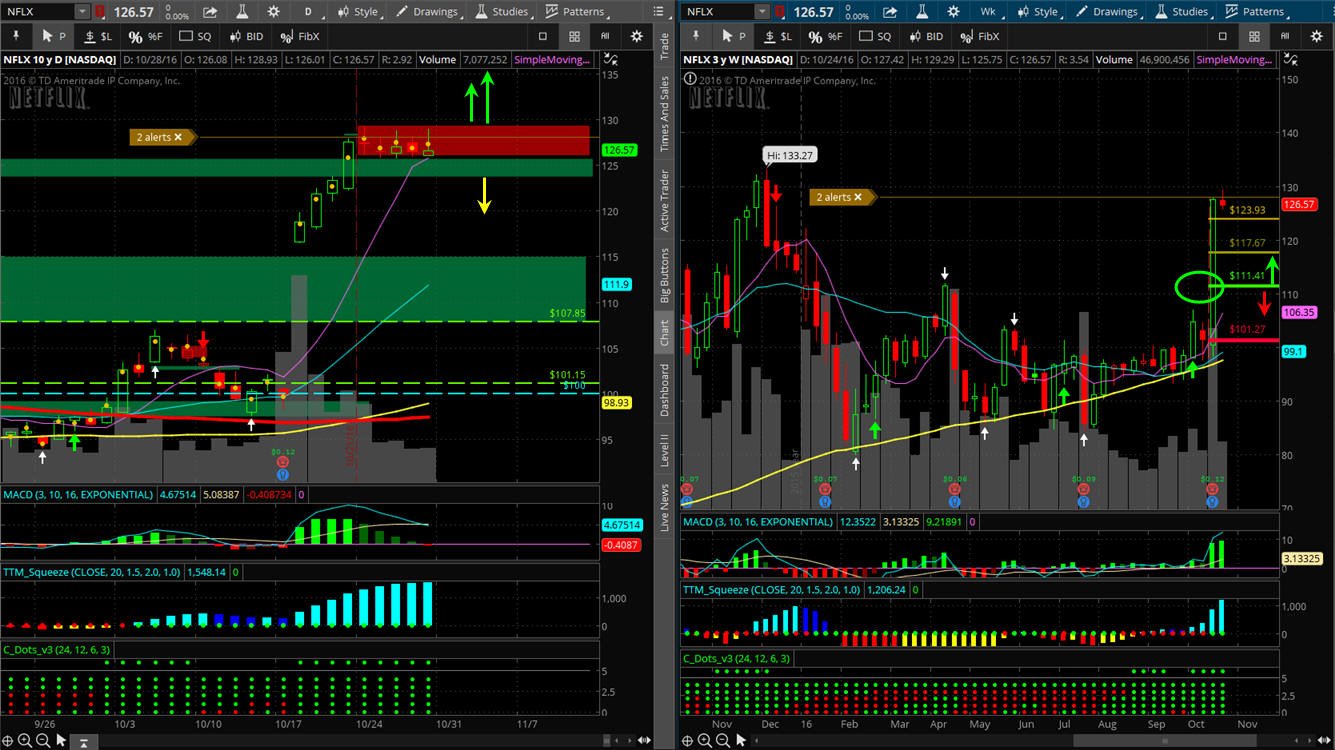

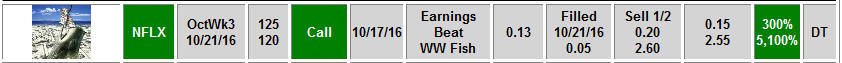

10/24/16 - What a JACKPOT on the 120 calls by the end of trading of Friday if you held onto it all the way...congratulations!!

And if you were doing some White Whale fishing on Friday like I suggested, then you hooked a Moby Dick when the news hit that ATT (T) was buying TWX. This caused a short squeeze in NFLX driving up the stock all day over $127.50 per share$$!!$$

This is to illustrate to you the possibilities if you were to focus on my WW strategy on Friday expiration days. The challenge is these BIG ONES do not come along very often, so you have to be on the hunt and lay orders every Friday on stocks like NFLX, FB, AAPL, GOOGL, AMZN, CMG because you never know when we could hook another Moby Dick—keep fishing my trading friends...you know I am!

As for the future of NFLX, it appears they are on the way to new all time highs with this very strong quarter and a still looming buyout possibility. We may just get an announcement this week from AAPL or GOOGL or?? so upside pressure is still on but will fade quickly if nothing is announced in the next couple of days—probably not likely now that the stock is well over $100 per share. If you decide to fade this stock, you MUST have Lotto Calls in place because you never know what can happen and you do not want to miss out on a potential trade that will set you straight for year(s).

=========================================================================================================================

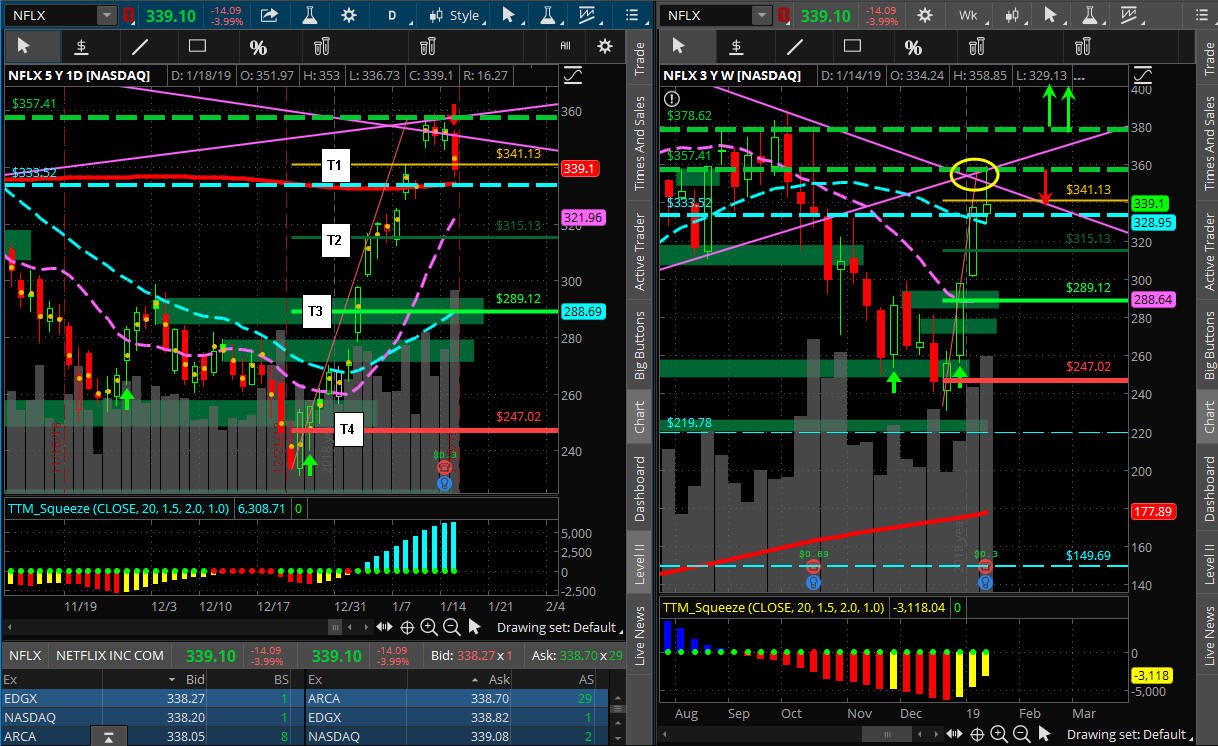

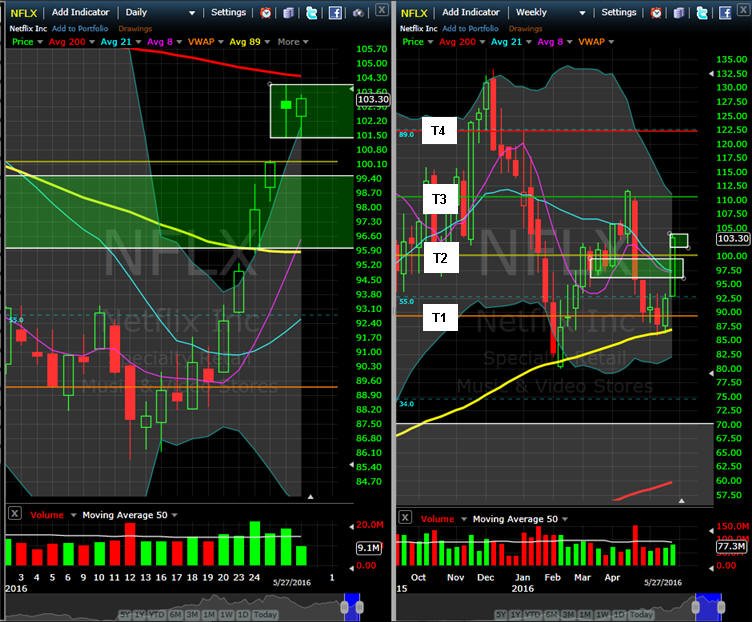

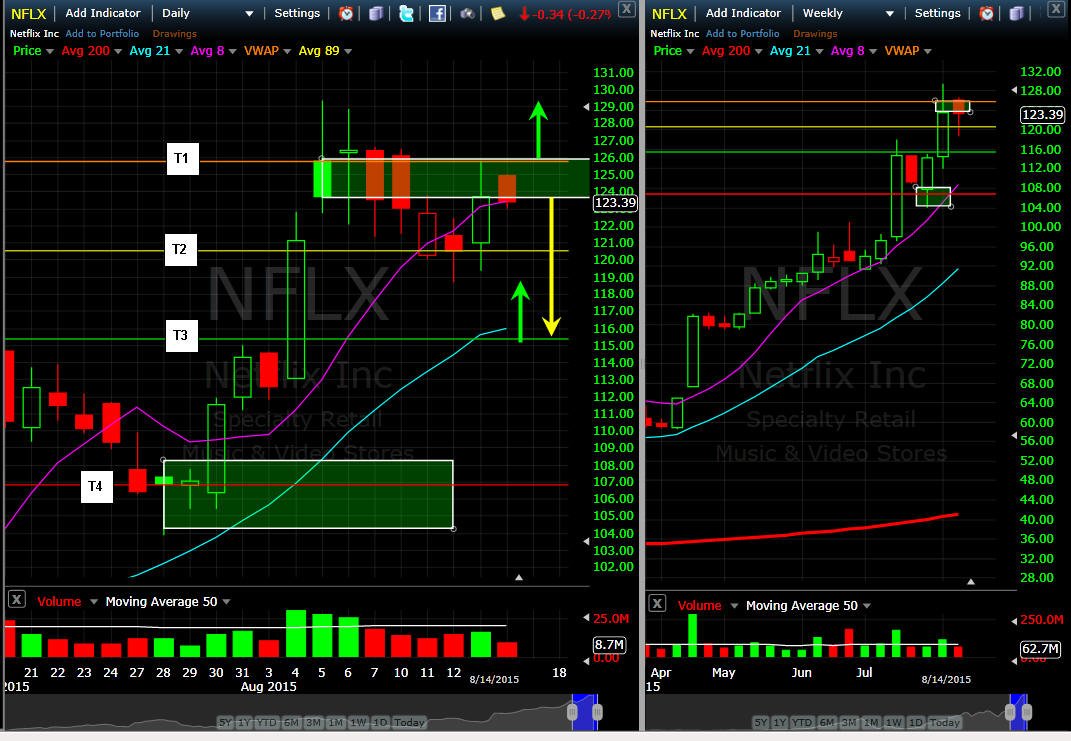

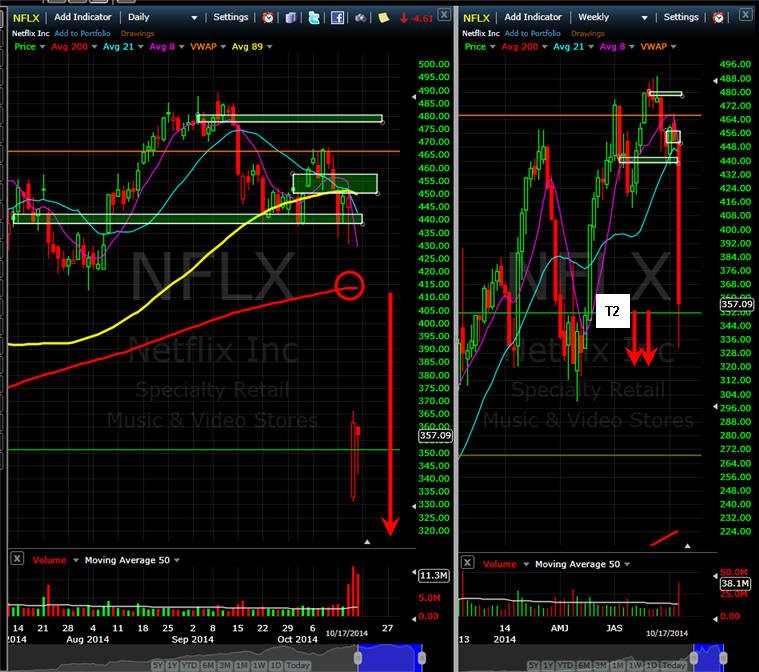

10/17/16 - A surprise beat and guidance higher launched the stock over 20% in post market trading. No mention of buyouts on the call and with the great quarter, it appears the price will be too steep now for a takeover at this time but you never know what a company like DIS or AAPL is willing to do—NFLX is becoming a juggernaut in the on-demand-media world. If we get some continuation tomorrow, we just may see NFLX attempt an attack at all time highs of $133...wow...that would be HUGE for the Lotto trades. During the call I heard an analyst belabor the question of subscriber price increases and when the grandfather discounts will subside. The answers giving by the management were met with some buying in after our as investors must interrupt that customers will have NO problem paying up for quality entertainment—heck you can't go out and see a movie now for less than $25.00 with concessions so why wouldn't you pay up a few bucks more for on-demand 24/7?—times they are a cha-chinging for NFLX and that means HIGHER stock prices in their future.

As for the rest of this week, no buyout gives rise to profit taking with such a huge move so I will be fishing in the morning for WW trades and see what I can catch!

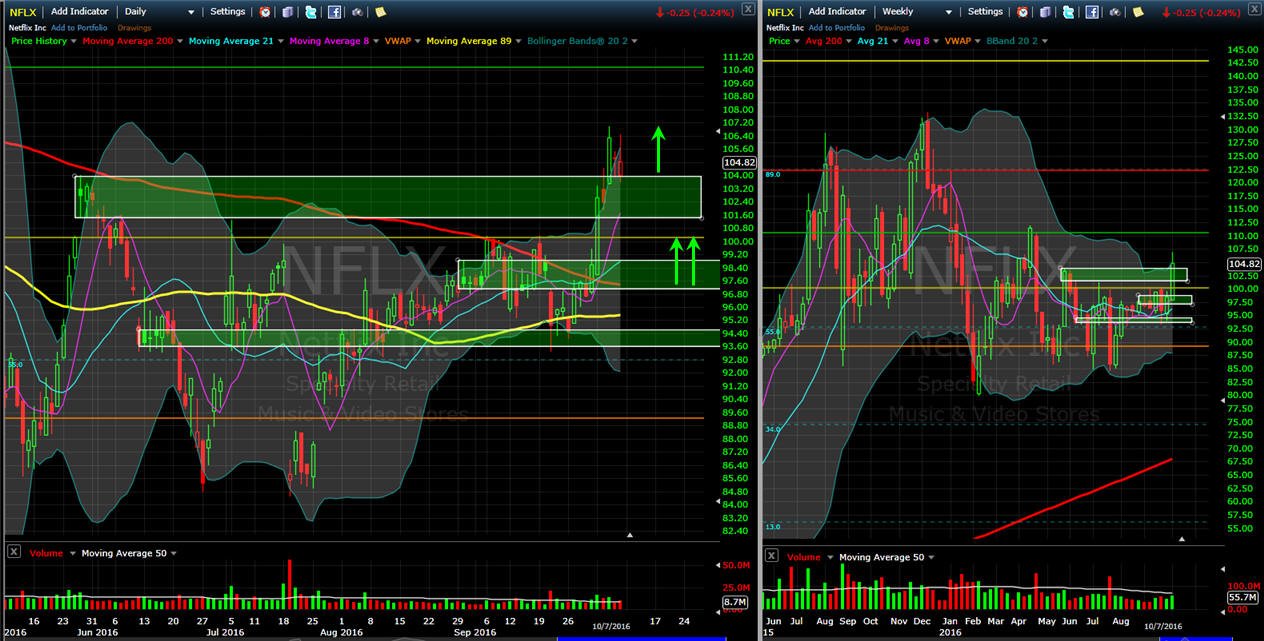

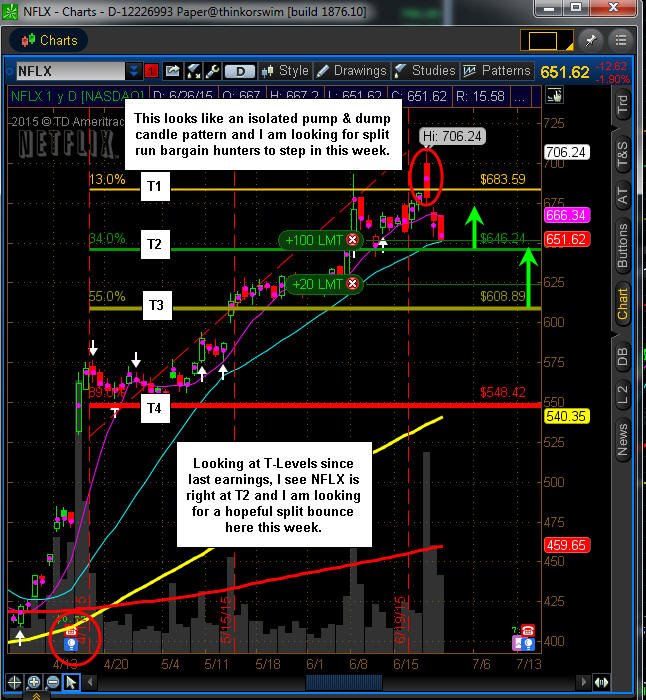

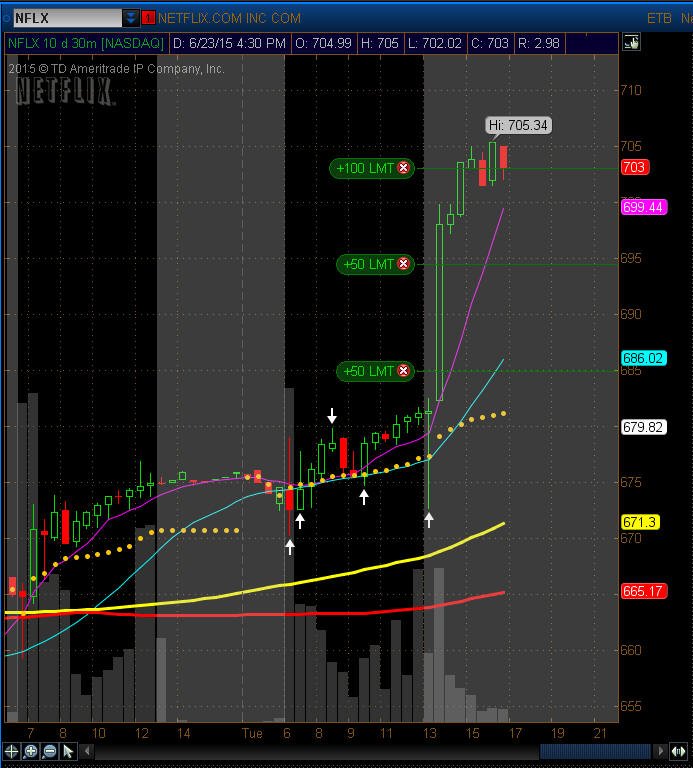

I will be doing some White Whale fishing in the morning around my T-Levels depending on what I see in pre-market. If NFLX is higher than the $121.28 bubble high I will fish for the 113 Puts and if it is around T2 then I will fish for the 120 - 125 call strikes. Remember, if you are not filled in the first 5 minutes of trading you cancel the order.

========================================================================================

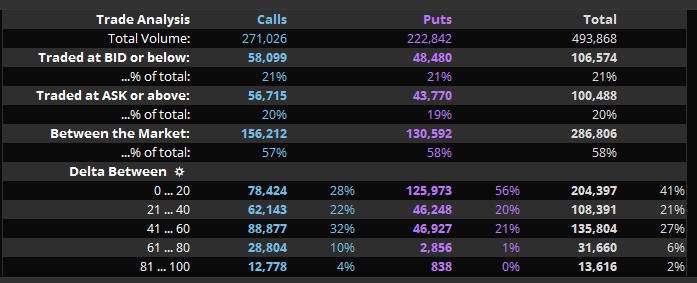

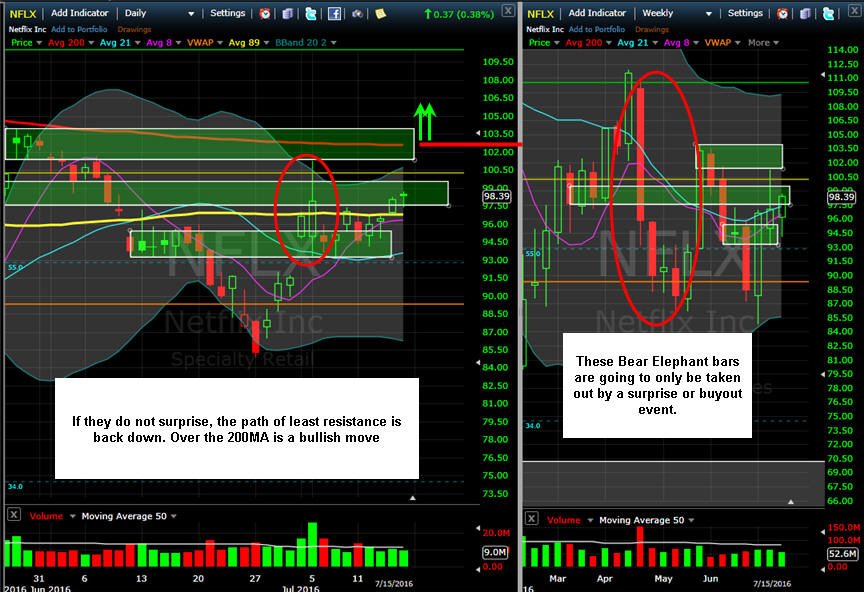

10/16/16 - Tomorrow is the big day for NFLX shareholders as the company is sent to report earnings after the bell. Will they surprise or announce a buyout? Friday trading saw a nice push higher into the close and some large call option contracts (4,000 Oct21 107C) traded but appears to be Covered Calls since they are a BuyWrite trade. There is heavy bullish sentiment at 95k calls to 52k puts so a miss will be a big disappointment and the SGB zone below should easily be taken out. As for upside, the MMM is currently +/- $10 and if they do not surprise, I think we will see the move in that range; however, if there is a buyout announced, we could see a very large move over $120 to ??. Ok, so I was filled on my Lotto plays Friday and will be looking to add some more puts tomorrow before the close of trading. With the election coming next month, I do not see any reason for investors to put large capital to work on any positive earnings that are not a complete surprise and any upset in political circles will have a much larger negative impact so having some puts in play is a necessity.

==============================================================================================================

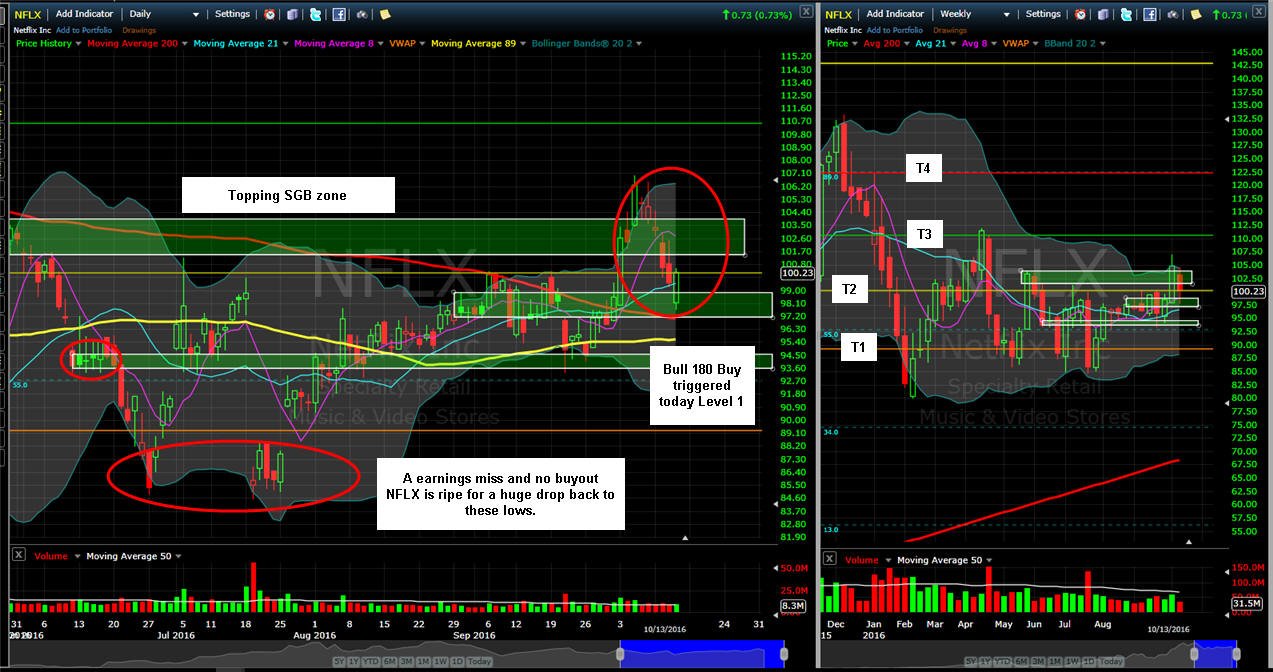

10/13/16 - Earnings are Monday after the bell which is exciting but also a bit of a bummer for Lotto trades because the cost will be a lot higher than I prefer to pay; however, we are dealing with NFLX and it can really move big this time around. The buyout speculation has diminished the past few days which could be the quiet before the storm—I am hoping I wake up to a huge winner tomorrow, but most likely that will not be the case so I am preparing for my trades into next week.

Today the stock triggered a Bull 180, but that is a Level 1 at best with earnings Monday. Looking over the chart, I see the pull back last week had the stock trading into the multi SGB zone and we now have the last topping SGB back on 5/26/16 to take out at the $104 price level. Until the stock can do that, aggressive longs are not recommended. If there is no buyout announced tomorrow and they disappoint on Monday, we could see a very nice drop back to the previous lows under $90 so I am doing to have some puts on for sure.

.

=======================================================================================================================

10/09/16 - No buyout out yet, but the chatter and speculation continues to give lift to NFLX. Will it happen? I certainly think it is a high probability this company will be bought in the future and I certainly hope it happens this week or next, but if it does not, I will continue to buy weekly OTM puts up to the $125 strike price.

If you were watching the news wires on Friday then you heard that the Reed Hastings the CEO of NFLX made some negative comments about China growth at a conference. This instantly caused the stock to plunge 5% in pre-market trading; however, with merger madness going on, investors ignored, what should have been total devastation all day, and bought the stock moving it back up to the previous days closing price.

Ok, it is all well and good to be the ultimate optimist on NFLX (and I certainly have been for months now), but we know investors are a fickle bunch and fund managers are a controlling bunch, so if the stock was plunged to $100.06 in pre-market; who do you think caused the reversal and subsequent squeeze up all day? You have to know that the individual investors out there (even if they were all in unison) would never be able to drive a stock up like this; so it was a "controlled" group that was doing it—hedge funds and algorithm trading firms.

What we have to figure out from Friday's action is if there is conviction in this control group or were they manipulating price so they could get out; because if there is NO merger/buyout announced; then you can bet your bottom dollar this stock is going to go a lot lower than $100; especially if CEO Reed Hastings keeps talking about growth issues oversees. It seems he likes to create volatility in the stock because he has made many statements like this in the past that have cratered the stock.

My game plan is to continue to buy Lotto Calls on dips down to the last SGB zone at $97.50 and if there is no announcement tomorrow, then I will be looking to short shares and buying some $95 puts too.

==============================================================================================

9/30/16 - Chatter that DIS may bid up to $130 for NFLX so I am on Lotto Calls for next week.

==============================================================================

9/11/16 - Big sell off Friday market wide which took NFLX down from a triple touch of the 200MA. There is still the possibility of a buyout in their future, but that will most likely not be until 2016 after the elections are over. If the markets do not rebound in the next couple of days, then I am expecting a lot more selling to kick in and that will of course take NFLX lower. The next SGB zone is down to $93.55 so there is where I will be fishing for some long plays and if it fails then I will day trade some shorts. I will maintain my week-to-week Lotto buys up to 15% OTM now that the stock has shown weakness at the 200MA because puts will get the pumped up IV and calls will get cheaper so we can get closer to the money.

====================================================================================================

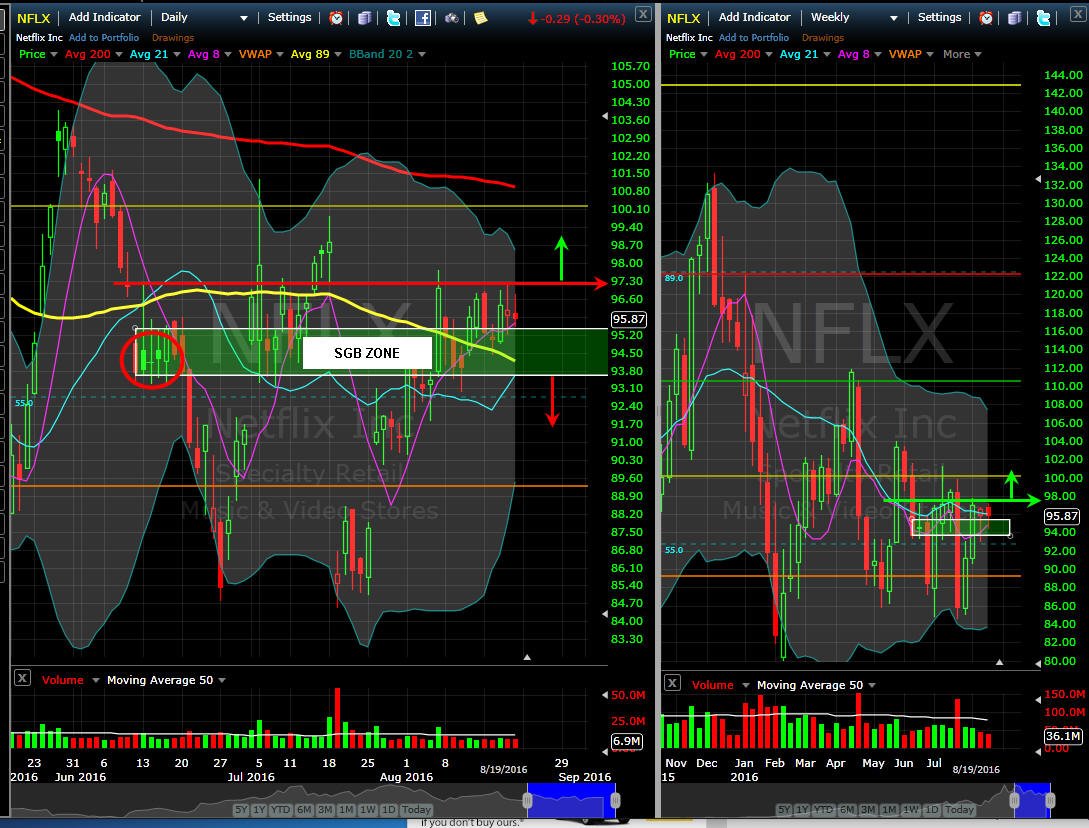

8/21/16 - Still no buyout but interesting movement since my last comments on NFLX. This past week, the stock has been trading at the SGB zone highs holding onto the 8MA but as time marches forward and there is now buyout announced, the stock become more vulnerable to some profit taking so if NFLX falls into the SGB zone, I will do some day trading short strategies and will maintain my Lotto Calls up to 20% OTM.

================================================================================================================

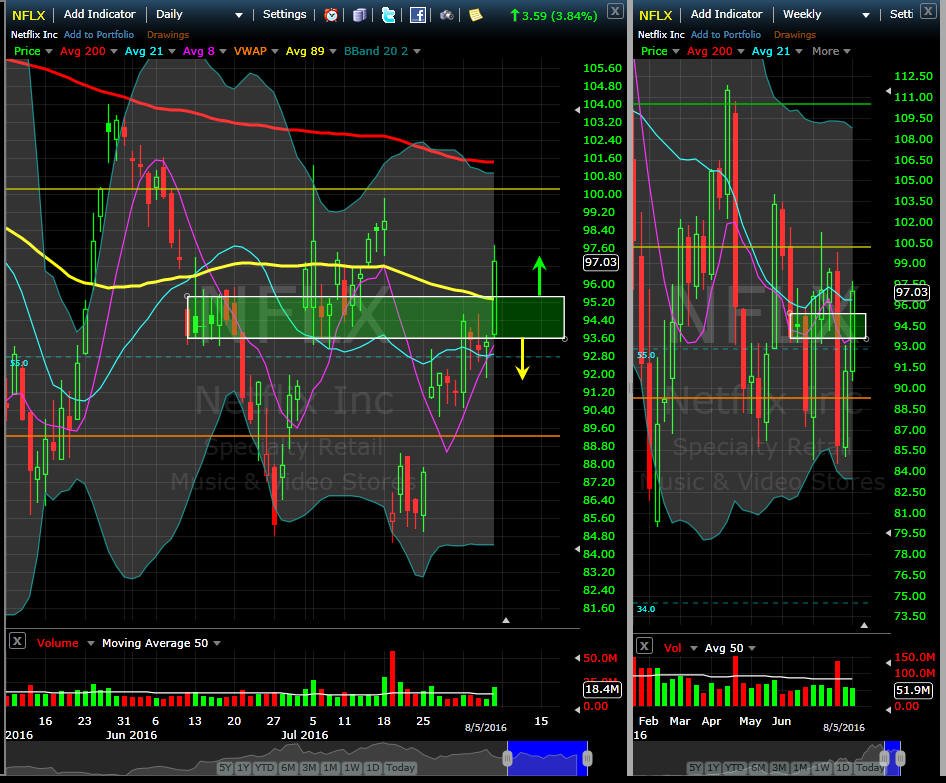

8/7/16 - News on Friday that BABA is putting together a buyout offer for NFLX caused a quick spike and then a sold move all day for the stock. I have been looking for a buyout on NFLX for a while now, but from BABA?? During Fast Baloney halftime report, they did not even mention the news so it could be just a Friday piker play; however, it will be interesting to see what they offer, but I am not thinking NFLX would sell to them not to mention the massive restrictions China has on content delivery etc. Also, for an alleged buyout offer, the move was not very much all things considered. If there is no official offer on the table this week, we will most likely see the stock pull back, but look for that as opportunity to get on some more Lotto Calls because there is definitely some interest in NFLX and maybe AAPL or CMCSA tries to jump in front of BABA. As long as NFLX holds over the double SGB zone on the daily chart I will trade bullish strategies and under it I will look at some bearish; however, I will continue to be long Lotto Calls up to 20% OTM week-to-week.

=============================================================================================================================

7/31/16 - As the week played out on the but insider buy news, NFLX has begun to show signs of weakness but do not let that fool you, just keep buying those OTM Lotto Calls my trading friends. As for short term trades, I will just continue to fish for DoubleUp! trades and sell some put premium on dips for now.

=========================================================================================================

7/25/16 - Looking like the post earnings selling has subsided. News out that NFLX insider Director Jay Hoag has bought 600k shares at $86.43 per share. Maybe he knows they are going to bet bought out....hmmmmm? Keep your DOTM Lotto trades on and we may wake up to a nice 6-Figure day in the near future.

=========================================================================================================

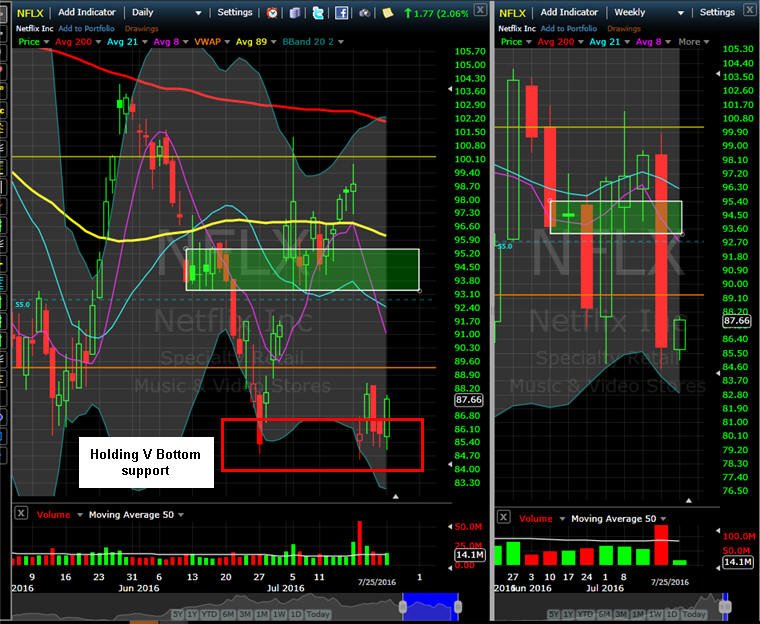

7/19/16 - BIG miss, lower revenue and subscribers leaving produced a trifecta dumping of the stock post earnings. I hope you figured out the typo on the puts play and bought those July Wk4 86 puts or at least go the Aug Wk1 put on. The calls were a total bust but now we are looking for the potential buyout in the future as the stock has gotten a lot cheaper and will most likely slide lower in the coming months unless there is so very good news in the future. My strategy is to continue fishing for Lotto Calls every week at 20-25% OTM and if the stock keeps dropping lower, I will go as much at 30% depending on what strike I can get for $0.05 or lower. Tomorrow will be a critical point in the stocks future and I will be trading short looking for a test of the post earnings low at $81.84. Below that, the next major support is the weekly 200MA around $67 - $70. NFLX has been down this road many many times in its history, but now this exodus of subscribers for a couple of bucks a month is a tell that NFLX is losing it's luster with their customers and many competitors are chipping away at market share. The bears are definitely out in force saying it's "over" for the streaming giant and they are on the slow growth now with uncertainty in Europe etc. My bias has changed to Neutral but optimistic for a potential buyout in the future.

=====================================================================================================

7/17/16 - Tomorrow is NFLX after the close and this should be a significant release as to the longer term trend for this stock. There is still speculation out there that they are a takeover candidate with with recent moves made by Comcast, they may very well be the one to buy NFLX vs AAPL or maybe even AMZN. We will never really know if or when so we just have to always have some DOTM Lotto calls on for that future event. In the interim, we want to trade what the market shows us as the best possible trend and right now it has been very mixed with regards to NFLX.

If they meet the expectation of analysts, then the move higher will be muted and probably not even make it past the expected MMM of $9.77. This will make premium sellers very happy since the current IV is pumped up at 102.82% but for this stock, I have seen it much higher in the past. The biggest concern for this stock is how much subscriber growth can they have in Europe and now the other 300 plus countries they are streaming to. The U.S. is pretty much saturated in the eyes of analysts so it will take continued success in original programming and some future increases in the membership.

The company has already increased membership fees in the last quarter, so this quarter will show if there was a negative impact. There are plenty of Bearish pundits out there and some are saying the stock will easily get cut in half, so buying some longer term Puts are not a bad bet. Now if they do miss and have lost subscribers, that will definitely dive the stock and make it MORE ATTRACTIVE for a buyout.

So, for me, I am continuing with my 20% OTM Lotto Calls and will pick ups some Swing Trade Puts tomorrow. After earnings are out, I will definitely be looking for a White Whale trade the next day.

Option stats have sentiment Bullish almost 2:1 on Calls vs. Puts and on Friday I saw some large contracts bought for Jul 105 and Aug/Sep.

===========================================================================================================

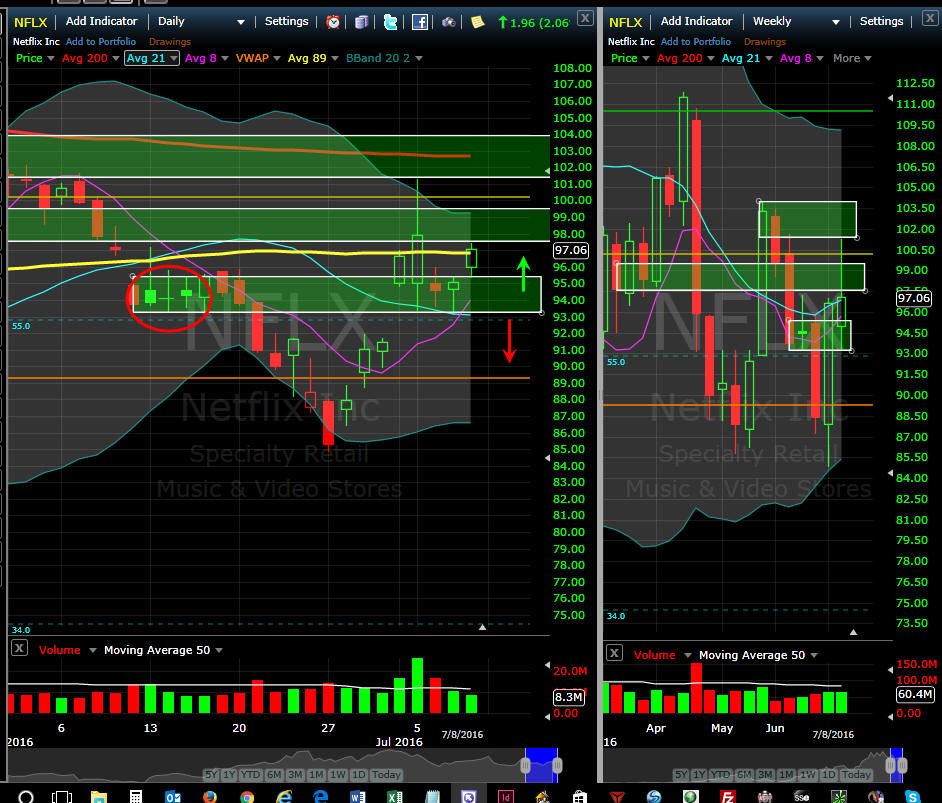

7/10/16 - As we kick off earnings season, I expect investors will bid up NFLX on any good news with earnings only two weeks out. Last week the stock tested the bottom of my SGB zone three times and so there is where my battle lines are draw. Above 94 is long and strong and below $93 I switch to short side trading; however, I will always have my Lotto calls on.

.

=========================================================================================================

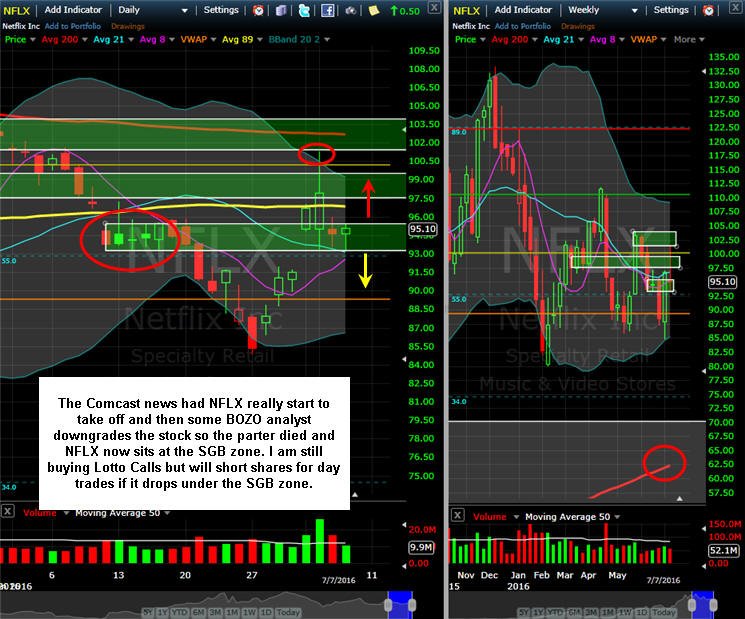

7/7/16 - No buyout announced but news hit that Comcast will allow NFLX to stream on their cable box and that lifted the stock for a short term day trade. There were upgrades and downgrades which has investors confused so NFLX pulled back to the SGB zone. After tomorrow's Non-Farm Payroll is released, and if NFLX drops under the SGB zone, then I will do some shorting with shares and continue to buy Lotto calls up to 20% OTM for next week.

=======================================================================================================

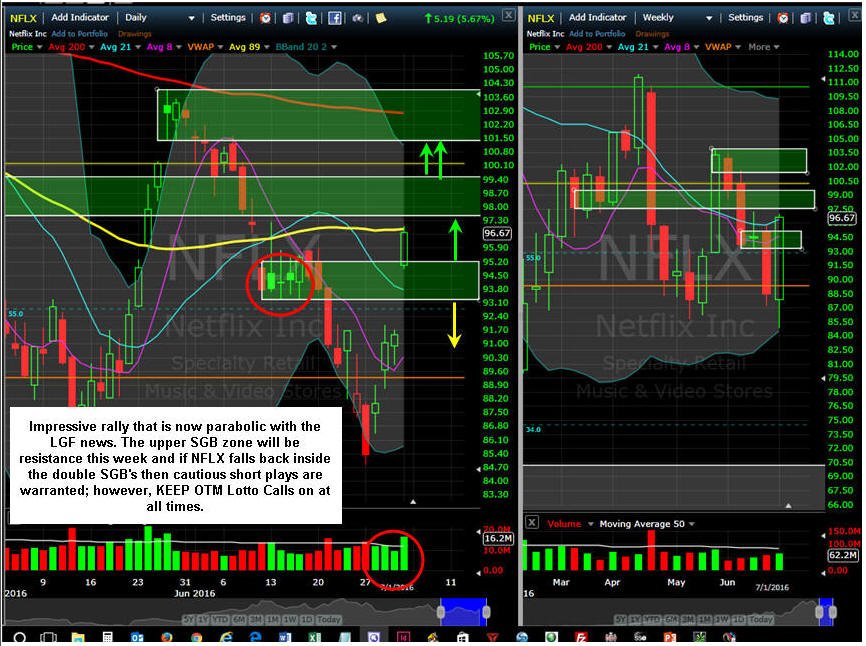

7/2/16 - What a week we have had since the Brexit drop when investors were caught off guard. Once the news was digested, the bargain hunters and shorts were forced to cover and we saw a huge rally in NFLX begin. Then on Thursday, LGF announced they were buying STRZA for 4.4 Billion and that caused a huge rally in NFLX as speculators (me being one of them) are now looking for NFLX to be bought out by maybe AAPL? My plan is to keep buying DOTM Lotto Calls (20% or less) on NFLX for the next 52 weeks in anticipation we do get a bid like MSFT did on LNKD.

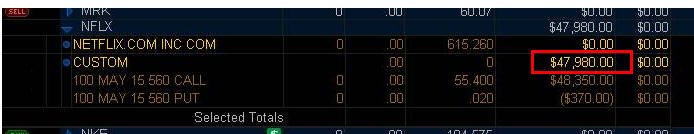

Currently the options 20% out are less than $0.10, so I will keep buying some Tuesday and fishing for lower prices on Wed - Fri for next weeks (Jul 8) expiration. Typically these announcements happen on "Merger Monday" but I suspect that a NFLX buyout would be done on a Wed/Thu so the MM's that facilitate the deal can capitalize on weekly options. Of course this could never happen so you have to be willing to lose 100% of what you put in each week, but for me, I will be on this for the next 52 weeks. I will sell premium to finance it and also do some day trading on GE to make easy money to pay for my Lotto Calls—I plan on buying at least 100 and up to 500 contracts per week.

The interesting thing about the LGF deal is they own the hit show Orange is the New Black that is played on NFLX. This may have a negative impact next week once analysts digest the news as investors may fear that NFLX is going to LOSE dominance in the streaming field if LGF were to "pull" this show from NFLX. So, if there is no buyout deals in the near future, we may see some lower prices on NFLX after the next earnings release.

The daily chart has NFLX trading over the SGB zone so a move back into those SGB's is a short trigger (ONLY Day-to-Day) but that is extreme risk so if you do plan to short be sure to heavily overweight the Lotto Calls.

================================================================================================================

6/27/16 - After a confirmed SGB zone drop, we get the Brexit-pummel to knock the lights out of NFLX and put it on the mat for the count. If you were shorting from the SGB zone, then you have made some HUGE gains. As for me, well, I have been working the stock to the long side bias in anticipation of a surprise merger/buyout, so that is where I have been and will continue to shoot for; however, the shooting lately has been in my feet.

Ok, so the Brexit news is out, the markets have reacted and NFLX is looking really weak so now you have to be thinking the buyout rumors can rally get going because the stock is getting cheaper as it falls. The weekly chart has a classic "M" pattern showing; with a completion around $80 (which is where I anticipated the stock could fall to), so if that fails to hold, I expect NFLX to start a drop-run to the 200MA especially if they show NO growth in European countries, (particularly in the UK/Britain) this earnings release; then a really big drop is in the House of NFLX Cards—the hidden caveat is when people are feeling down, they tend to cocoon and binge watch, so it may actually help NFLX.

There is some speculation that NFLX will cut a new content deal with CW which could spark a nice short covering rally in the near future. The short interest is growing with approximately 4.0 days to cover so when a stock gets around 5-7 days they tend to find support and shoot up. There has not been any big option buys lately , so I will be watching for Open Interest changes daily.

For now, I am going to continue to fish for cheap weekly Lotto Calls up to 20% OTM speculating they may get a buyout offer in the future. If the "M" pattern confirms around $80, then I will start some shorts and spreads. With earnings season about to begin, I am excited about the potential Lotto Trades we will have in stock strike NFLX this earnings season.

==============================================================================================================

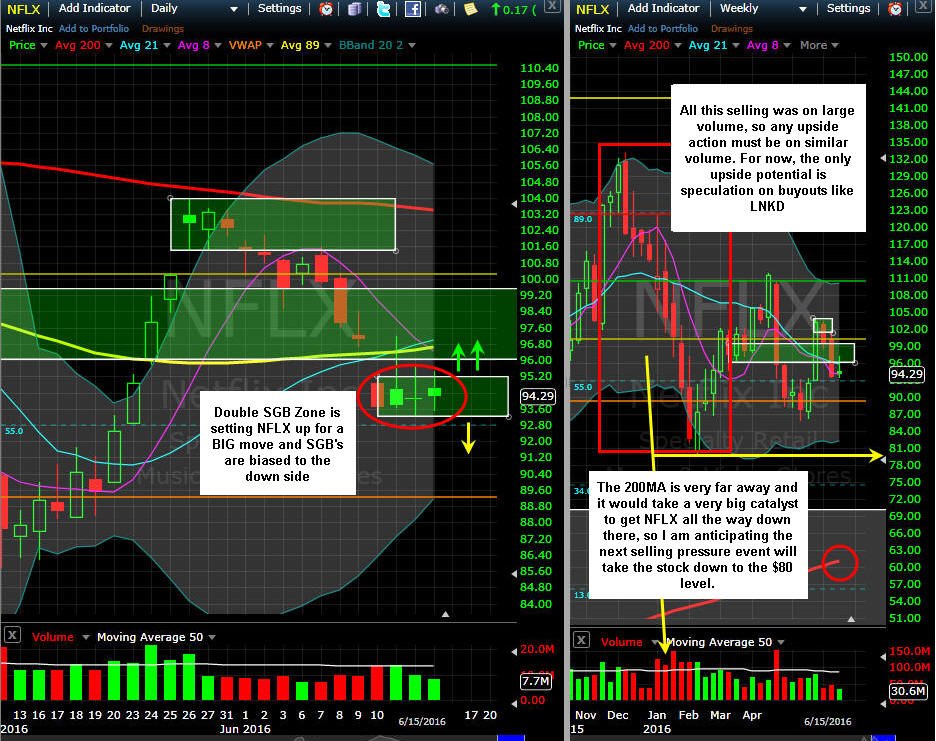

6/15/16 - Nothing exciting from AAPL and WWDC so investors are back to usual bias on NFLX and today the FOMC cause a lat day drop taking everything down with it EXCEPT NFLX which actually closed slightly in the GREEN! This is a good sign and if we get a nice rally going the rest of this expiration week, we may get some good Lotto action going with NFLX.

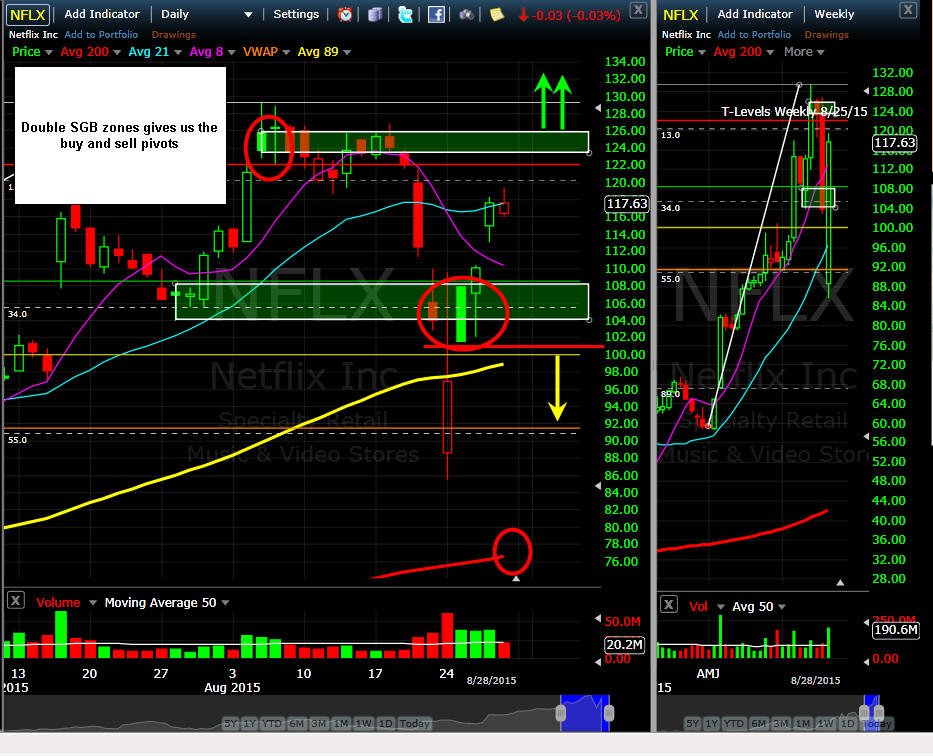

The daily chart has a very interesting double SGB with a DOJI in the middle so I am expecting a very nice move to start any day now. With buyout speculation still out there, shorting shares is risky business so I will buy puts and only be long when I want to get shares on. I will continue to fish up to 20% OTM on Lotto calls every week. These SGB's are at the bottom of a nice sell off from the last one and typically that is the bullish signal so I am looking for a bounce into next week. If it turns into the usual Bearish trigger, then I want to get short term puts no further than 3% OTM.

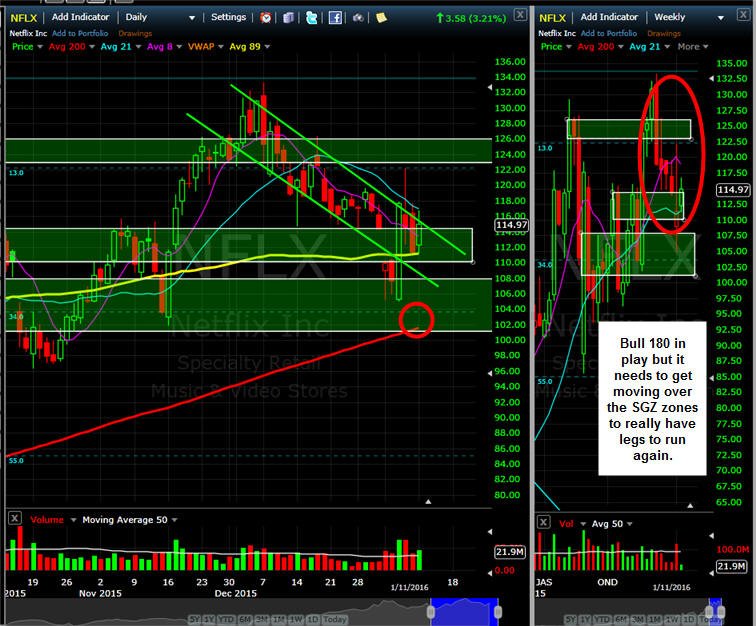

=============================================================================================================

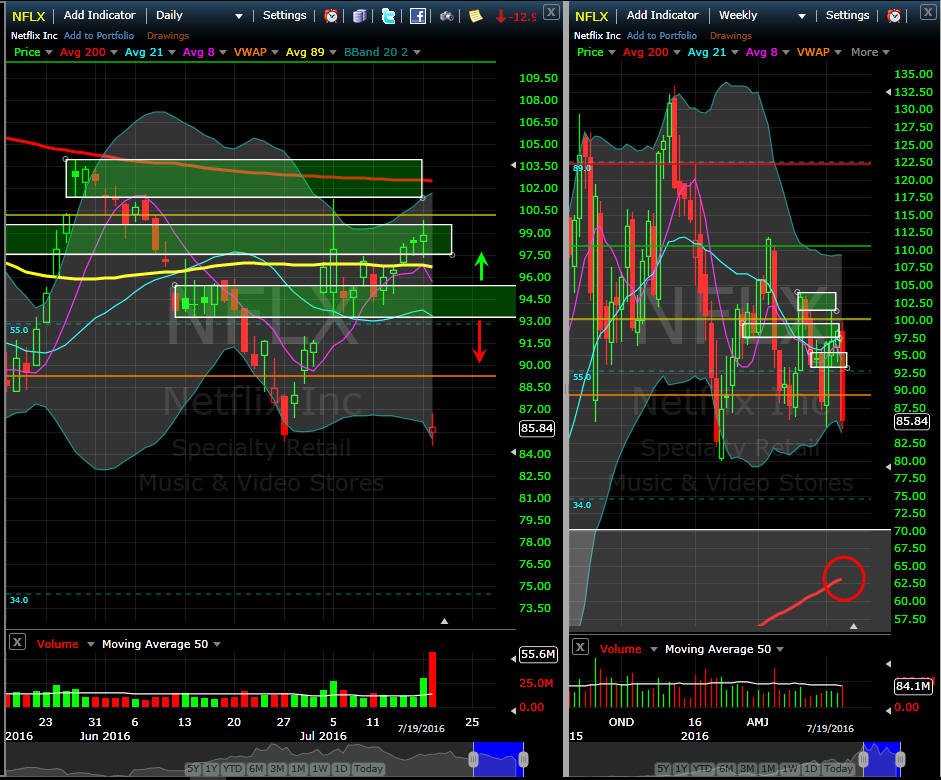

6/12/16 - NO buyout announced and investors gave up on the speculation and sold off the stock all week. This week is the AAPL WWDC and who knows, they may announce a merger with NFLX or a crushing blow with their own version of competition to NFLX with AppleTV. Industry news about cable companies making changes to programming choices may be a good thing for NFLX; however, investors dumped the stock in light of that and now the downside path to much lower prices is looking like the outcome. The stock dropped right into and through the SGB zone so this stock is a bearish bias until it gets back over $99.00.

Now that NFLX blew right through the 89MA, I am still fishing for Lotto calls week-to-week because I know this stock has great potential to surprise or get bought out. In the short term, I will fish for some credit spreads and maybe try some short shares looking for a sub $90 target on a continuation to the downside.

If AAPL delivers a crushing blow this week, we could see NFLX nosedive and the next major support is the 200MA on the weekly chart which is way down at $60.00-65.00 depending on how fast it can get there—that is a lot of pain for the Bulls so we need to do some put side Wild Card speculations.

====================================================================================================================

6/5/16 - Lack luster week of trading in the short week but certainly some excitement. NFLX could not get any momentum and pulled back but is holding above the 55% line from the previous weeks strong gains and that is what we want to see. If we do get some green started this week, then long plays are on and I am still looking for a future buyout of the company so I will just keep on adding in some Wild Card Lotto Calls. Overhead resistance at the 200MA on the daily chart produced a SGB so we have a bias to the downside for now since the stock failed to hold on Wed and has now dead stopped on the top of the previous larger SGB zone from 3/11/16. This stock is a wild card mover and shaker, so taking sides is always a gut tester and not for the fearful trader. You have to remember, the Lotto strategy is a marathon aggregate so keep investing in the low cost plays and one day in the future you WILL wake up to a HUGE profit!!

The daily chart SGB produced the result of a Bear 180, but it was a Level 1 at best, so now I am looking for a move back over $100 or a drop to the 89MA around $95.00 before I put on some more trades.

==============================================================================================================

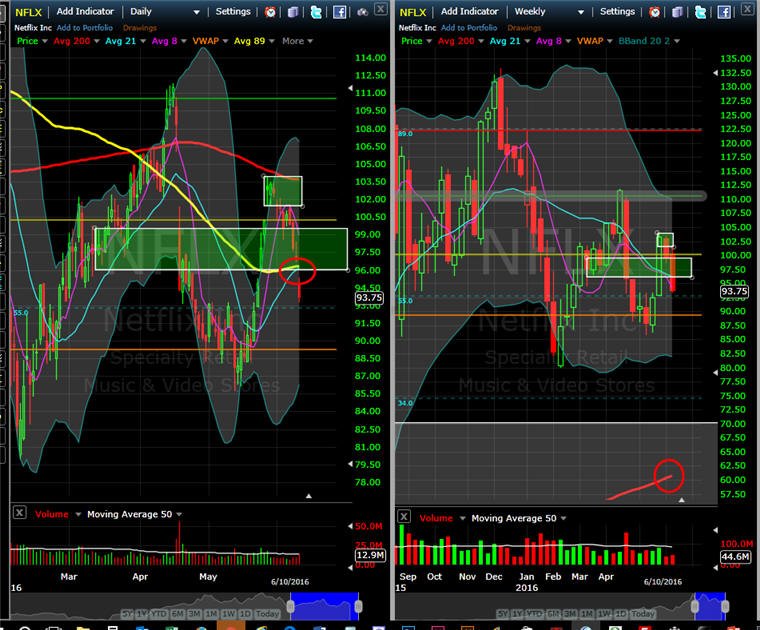

5/30/16 - Per my last comments, if you bought that 89MA Bull 180 back on 5/21, then you are sitting very nicely in some strong profits with this impressive rally in the last half of May that has NFLX trading back over the century mark! News came out that they cut a content deal with DIS and continued rumors that maybe AAPL just buys the company has investors ramping up in speculation plays. Thursday the stock put in a potential Abandoned Baby SGB DOJI but I would be very cautious shorting. I am in some Lotto Calls speculating the company may just get bought out or benefit from another merger of TWX may be the media company AAPL will snap up. I will continue to buy dips on NFLX and sell premium.

With the current Bull 180 on the weekly chart in full momentum, I am looking for NFLX to reach T3 this week and maybe even explode higher on takeover news.

==========================================================================================================

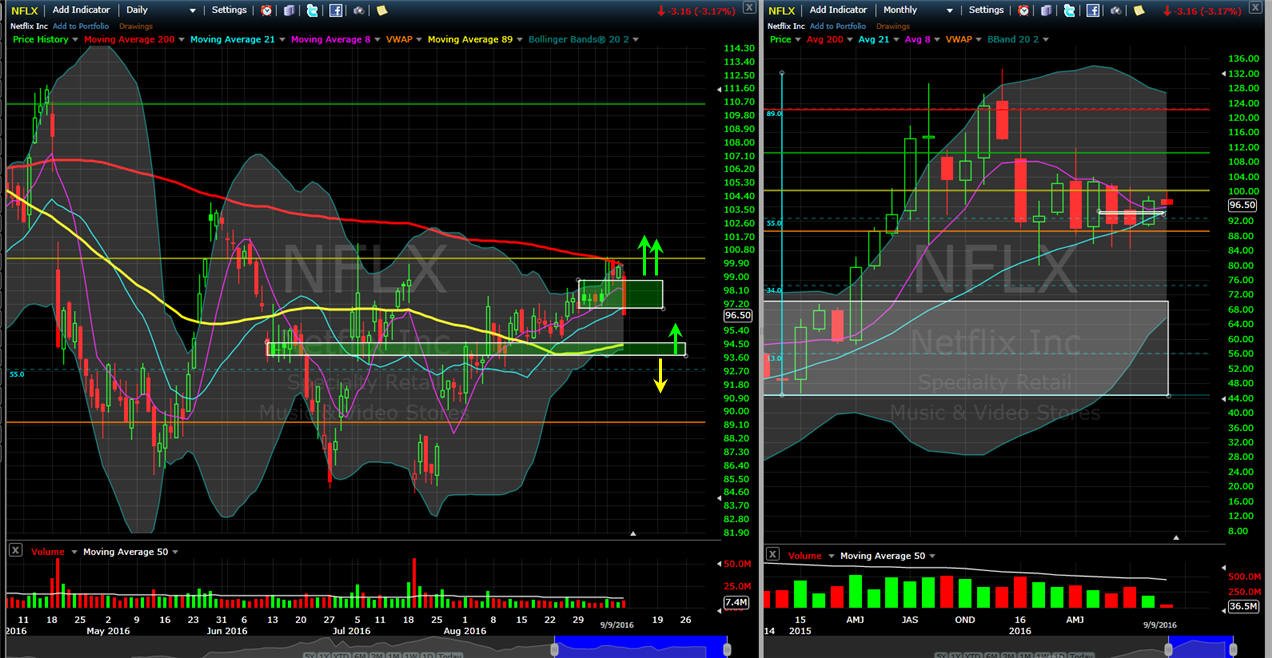

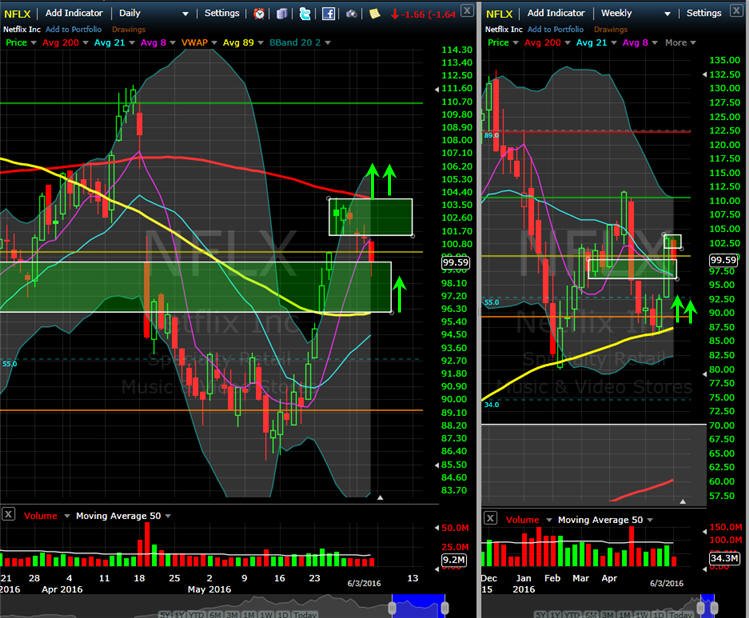

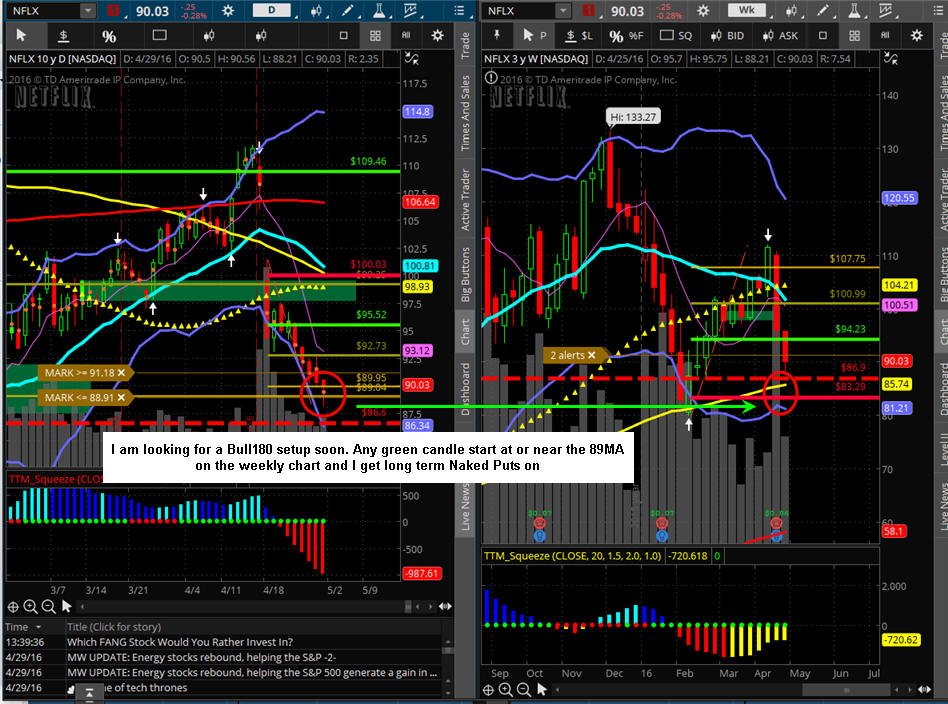

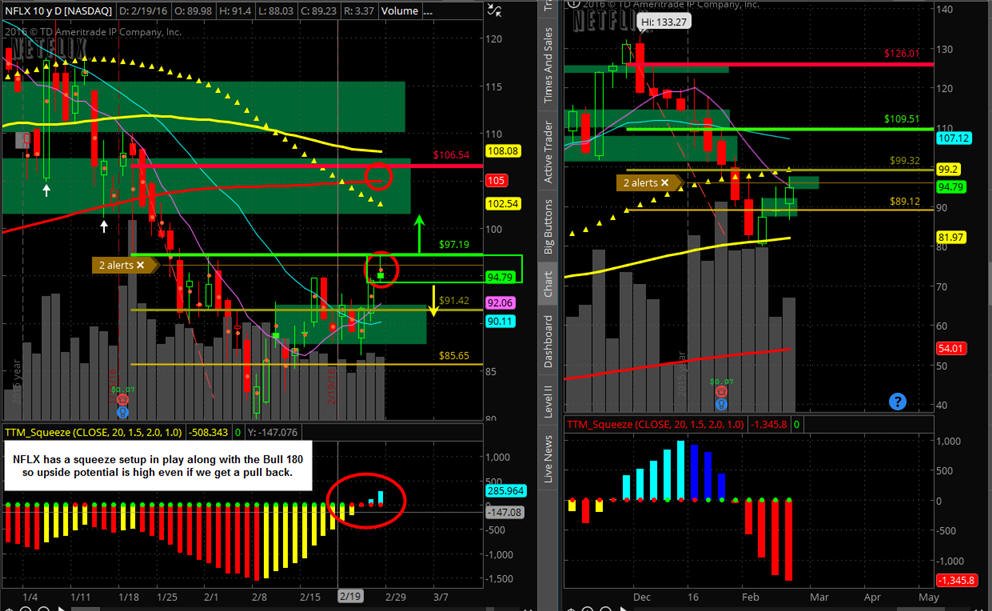

5/1/16 - Is the selling over starting in May or will NFLX suffer from the potential "sell in May and go away" syndrome? So far the stock has found NO love with investors, but I see the beginnings of a Bull 180 setting up so I would like to see one more large red candle close the the size of the on on 4/19. If we get that followed by a green candle the next day, I will get aggressive on long term Naked Puts and buy some weekly calls no further out than 3%.

===============================================================================================================

4/24/16 - It is looking like the major selling is over, but NFLX is still vulnerable to market wide drops so caution on long plays is advised. If you want to get into longs, ALWAYS fish for lower prices and take profits until the stock can clear out the overhead SGB zone at $100.00. If the stock suffers more down side pressure, then I would be looking for a bounce at the 89MA or T4 on the weekly chart.

========================================================================================================================

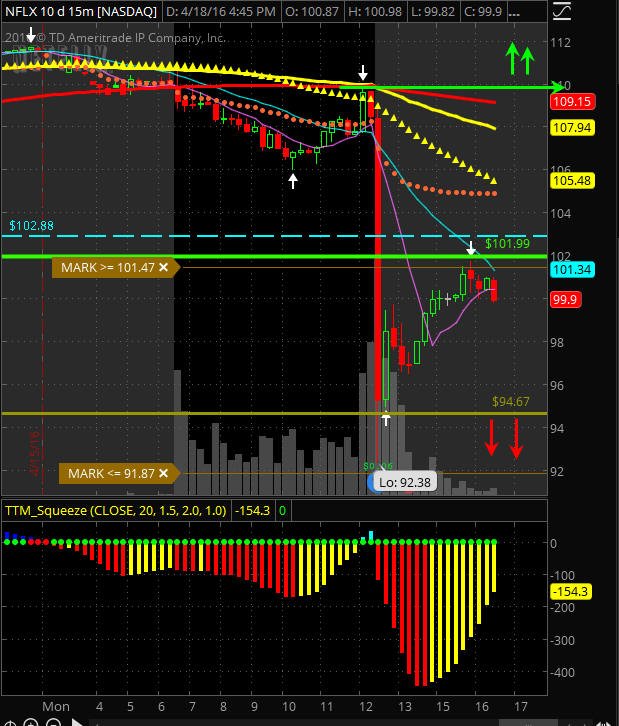

4/18/16 - NFLX beats expectations, subscriber gains; however, revenue was a slight miss at 1.8B vs. 1.9B estimates. This slammed the stock over 13% in after hours, but most of that was recovered so we may get a nice rally going tomorrow if the stock can hold over $100.00. That AMZN news really killed the deal with NFLX and it is looking like we may not get enough of a move in the puts to pay off but we still have the entire week to see how things play out. If the stock fails to get back over $100 then I will be looking to short shares and buy some longer term puts if the stock does not hold onto T1.

===================================================================================================================

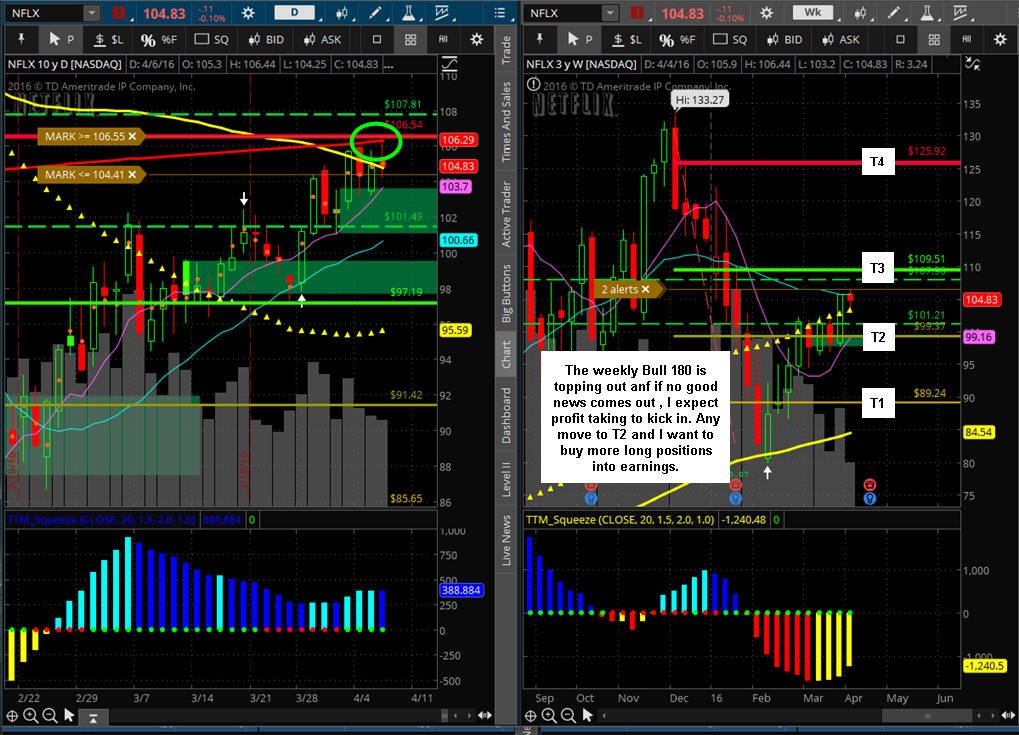

4/17/16 - NFLX has been on a very nice pre-earnings run and looks good for even more heights on a strong quarterly report or will it be the typical "sell-the-news" event. We are certainly going to find out after the bell tomorrow. The news has been mixed the past week with upgrades, price targets and the usual naysayers on the stocks lofty valuation price. You have to remember, this stock was split 7:1 which means it is currently trading at $780.57 in the minds of those types of analysts and investors. That means the stock could get seriously whacked on a bad report. The focus will be on foreign subscriber growth but not a concern this quarter since they only announced last quarter the massive expansion into multiple countries. It will take years before those countries are even up to speed with internet access so I think fund managers will be very interested in how the company is doing domestically in light of the recent price increase. Will they lose more customers than they gain?

I think the price increase is going to be well received and I expect some new content deals in the works too. My bias is still bullish but I will definitely have some puts on just in case. The stock closed above the T-3 level on the weekly Bull 180 so now we have the pivot point and targets. Upside $125.92 and downside $89.24. The MMM is currently at +/- 9.59 and if the stock dropped double that, then $92.00 is the likely target or the 89MA on the weekly chart.

Here is an interesting news byte I found:

Prime Video was previously offered as a value-add to Amazon's $99/year Prime membership, which offers free two-day shipping on products. Now, the retail giant is undercutting Netflix prices with plans to offer customers a separate purchase for $8.99/month, a dollar less than Netflix's recently raised price for its most popular plan.

Along with stand-alone video, Amazon is also offering full Prime membership on a monthly basis, rather than the annual payment. Customers can join in for $10.99/month with no annual commitment, meaning they can still save 25% by paying for the full year at once.

Hulu -- co-owned by Disney (NYSE:DIS), Comcast (NASDAQ:CMCSA) and Fox (FOX, FOXA) -- offers its limited commercials plan for $7.99/month, and a no-commercials plan for $11.99/month.

This may add some pressure to NFLX tomorrow, but there is also rumors floating that the company is a possible takeover candidate by DIS; and since DIS is the co-owner of Hulu, well, that may just happen in NFLX's future.

Another thing to consider is the "pie-in-the-sky" valuation the stock trades at which is currently valued at 393x its 2015 earnings of $122.64m (p/e ratio) with a 1.8% net margin so, putting all that together, you have NFLX only earning 1.8% on all of its 2015 revenues as net profits. This is still a massive growth company which gives way to lofty valuation models, but if you get too filled up on that slice of pie, you may get very sick if the stock gets Jacked if the big funds pull out their investing thumbs.

=======================================================================================================================

4/14/16 - Monday is the big day for NFLX and with the price increase, rumored buyouts and projections now they may be even bigger the cable TV by 1019 has this stock poised to explode higher next week. IV is now pumped up pretty good and I am sure it will just keep rising into Monday. The best strategy now is to fish for lower entry points tomorrow and on Monday we go for some Wild Card Lotto Puts and Calls. 20% OTM in both directions. I am expecting the stock to gap higher tomorrow but find resistance at a double SGB zone capping the action at $115 if it finds momentum.

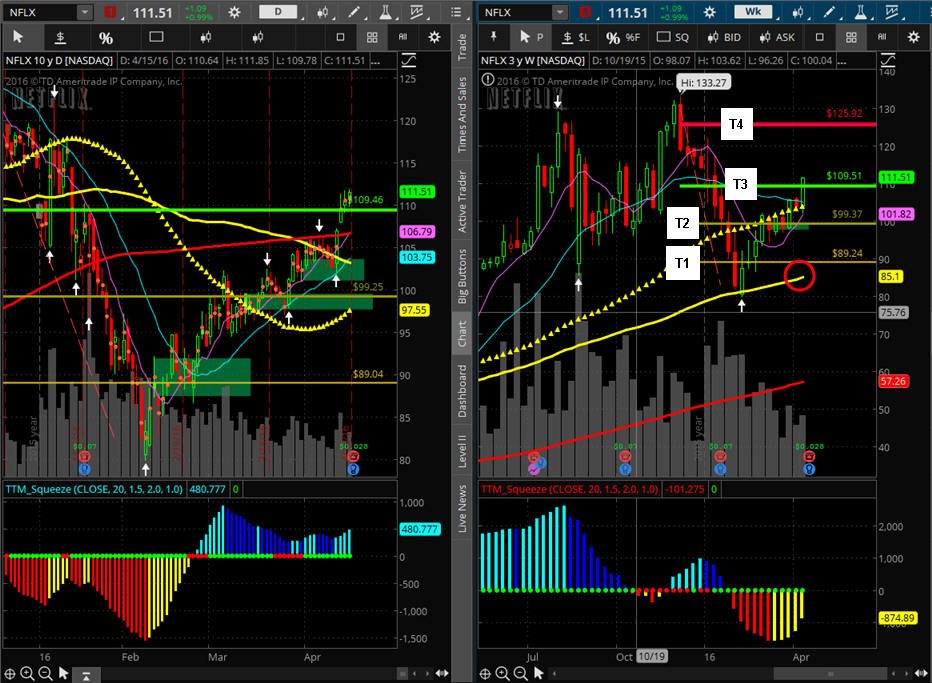

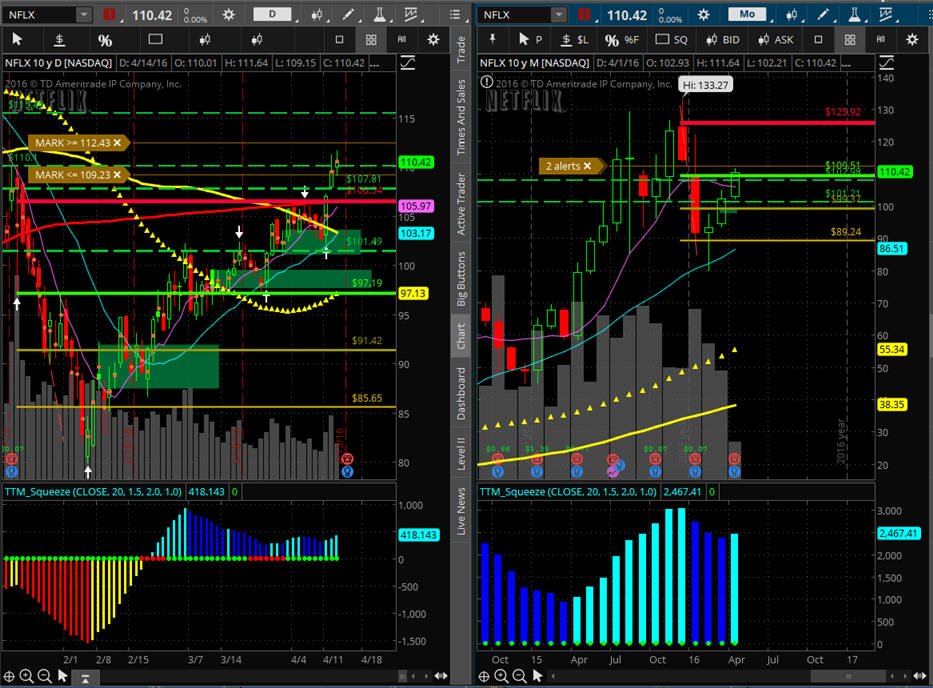

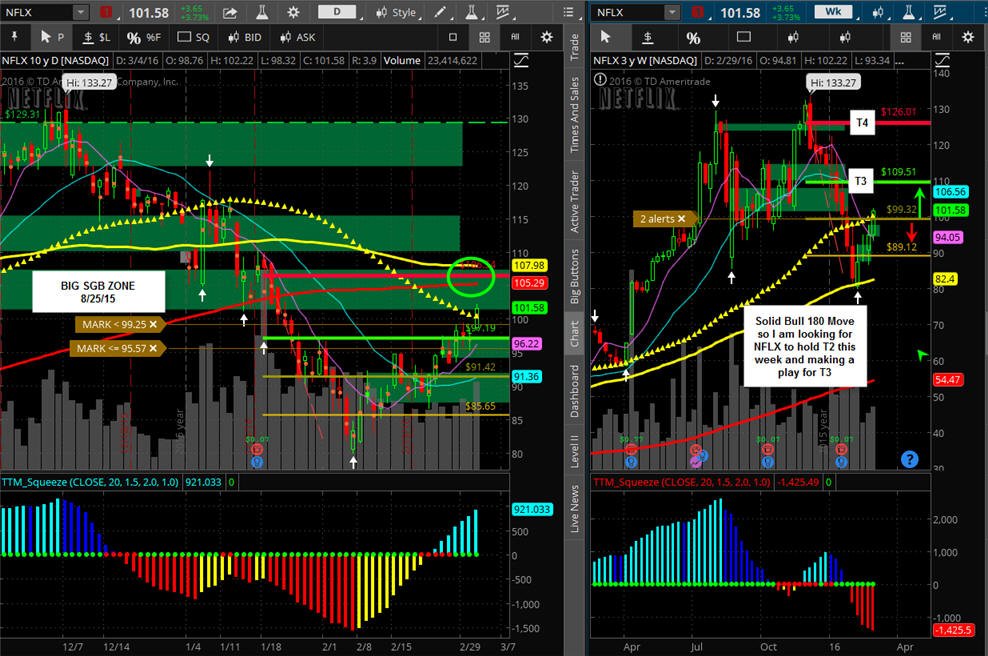

On the weekly chart we have NFLX in a solid Bull 180 retracement and today it closed just over T3. This has been a very nice 10 week rally and there is still T4 up at $125.92. Typically when this stock runs this much into earnings and they are a big beat, it just keep right on going. Watching the quarterly chart, I can see NFLX just explode to new closing highs above T4 on a great quarter so will definitely have those Wild Card Lotto plays in place.

===============================================================================================================

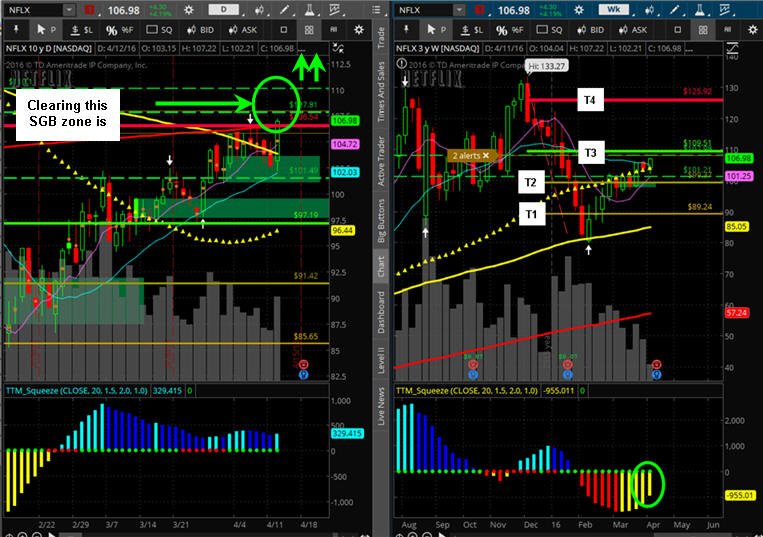

4/12/16 - Bulls are winning as NFLX mad a sharp rebound today and closed above the 200MA. The coming price increase has no doubt enthused big fund managers and the buying stepped up. There are a few rumors circling that NFLX may be a bought by DIS in its future. That does have some merit since the two companies have a large content deal that started to play on demand this year. Now that the 200MA is being taken out, that will be the support going forward so I plan to keep my finger on the call trigger and also selling some Naked Puts and Spreads. All we need to do now is see it clear the overhead SGB zone at $107.81 - 110.10 and its on for a run to the all time highs.

=================================================================================================

4/10/16 - Testing the resolve of the Bulls and Bears as NFLX decides how they will handle the 200MA. With a solid Bull 180 that has now retraced to just under T3 will give us an explosive move on great earnings and a nice solid drop on negative news. What is creating a potential perfect storm is the company will be raising prices again and that can have a negative impact on subscriber loss or maybe an extremely positive impact but we won't know this quarter so speculation is the name of the game. If the stock moves over the 200MA technical buyers will stop in and under it the stock is very vulnerable to big funds dropping out especially if this quarter shows a decline in subscribers. The play here is bias to the long side with Lotto Puts 20% under the 200MA or 85.00

=================================================================================================================

4/7/16 - What started to be a SGB short was cut short the next day when news and upgrades hit the wires creating a nice two-day move in the stock. Today the stock rose right to the 200MA before some technical profit taking kicked in, but I am expecting NFLX to keep moving higher beyond the 200MA into the earnings release. If they beat expectations it will be the subscriber growth and guidance that will lift or kill this stock. I maintain my bullish bias and will keep working trades in that direction. Of course I will have some puts in place at earnings too.

The weekly chart has been a perfect Bull 180 and with continued market support, I expect a test of T3 at or near $109.51. Any dips back to T2 at 99.34 and I am buying some more calls unless the news is negative.

============================================================================================================

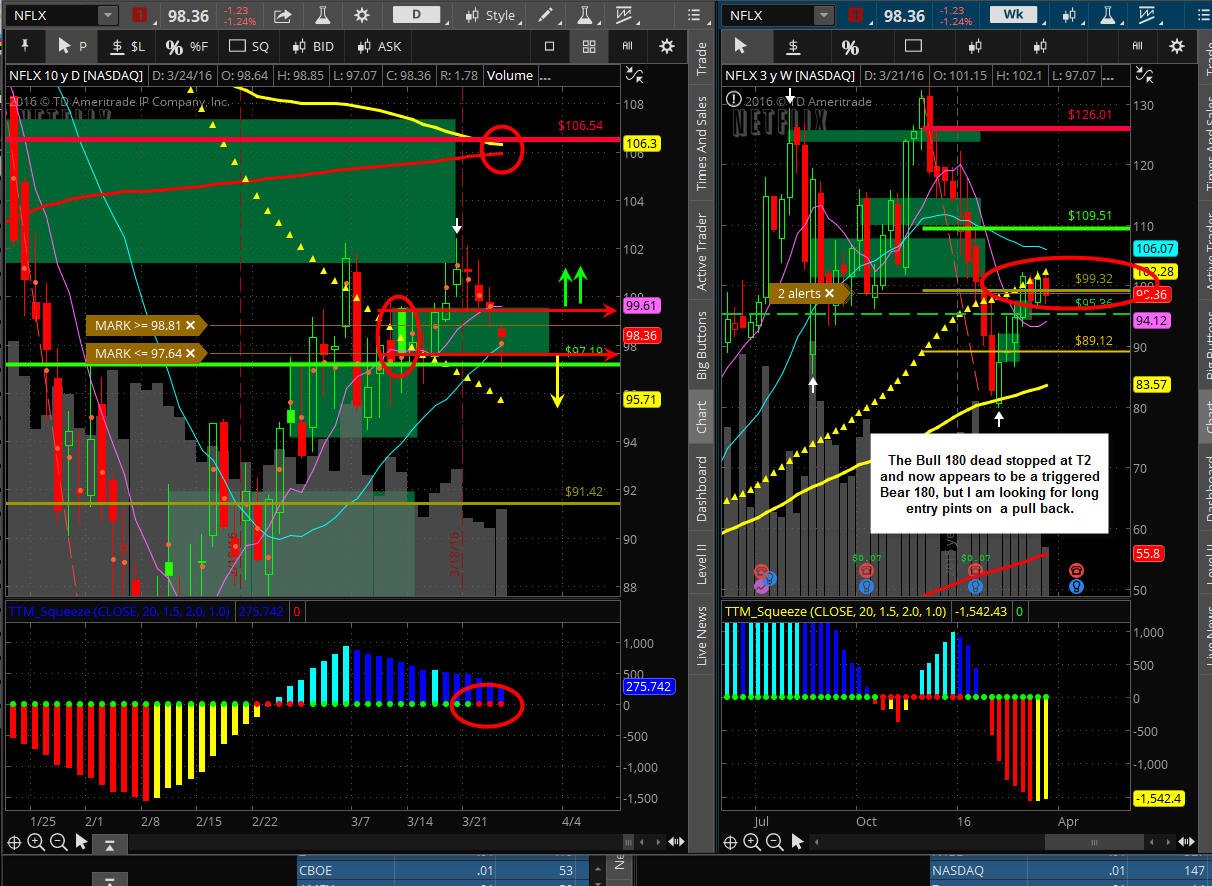

3/27/16 - NFLX has had very little movement for 4 weeks now and not much on the news front either. The current large SGB zone was tested and triggered my short entry. A move back over $100 will be viewed as very bullish and a move under the SGB a solid short with a profit taking target at the 89MA on the weekly chart around $84.00. I am still very bullish biased on NFLX so any dips to that 89MA and I get long strategies going. Earnings are expected on 4/18/16 so I will also be looking for a spark to start an earnings run in the next week or two.

======================================================================================================================

3/19/16 - The SGB zone turned bullish so now we have our short entry in place and we stick to longs. I am looking for a move to the 200/89 MA on the daily chart with a positive market this week as we head into the earnings season again. A move back to the SGB zone and I short shares but will look to buy calls on the cheap up to 3% OTM should that happen.

=================================================================================================================

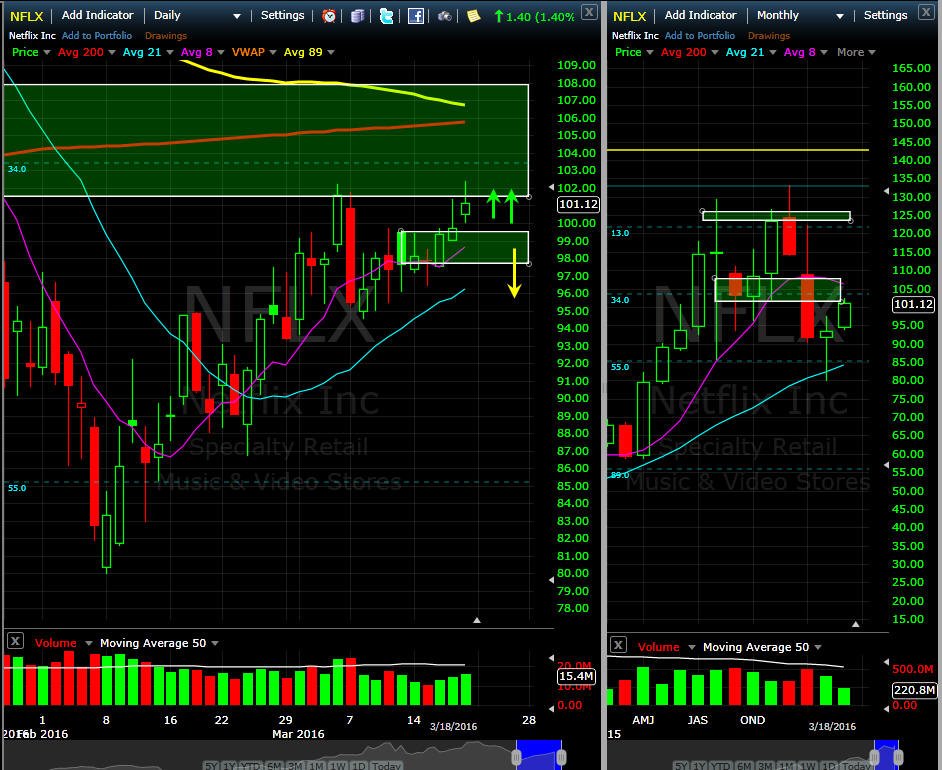

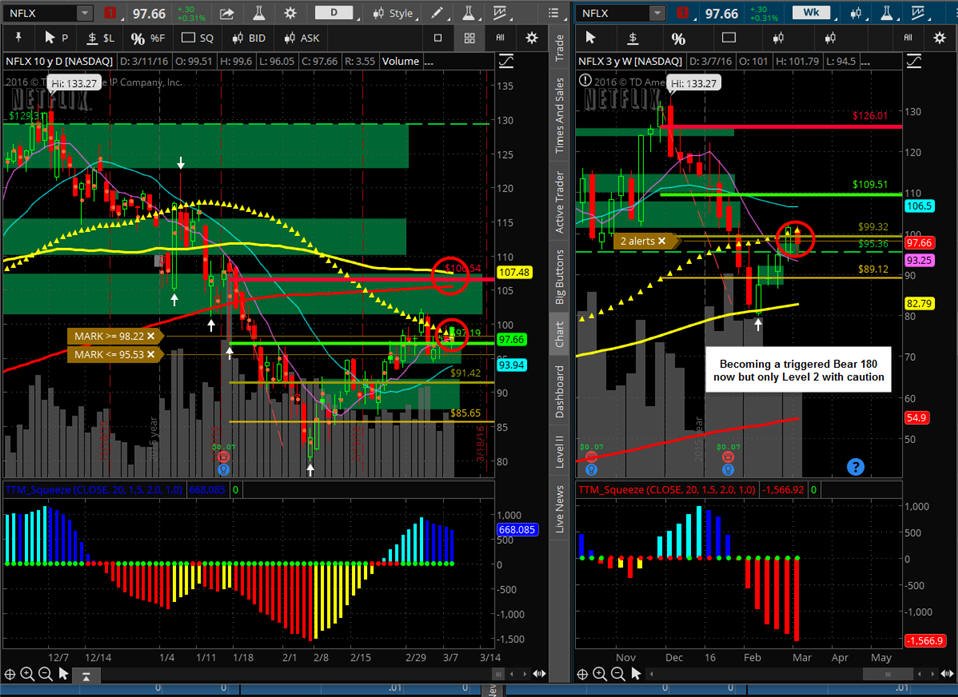

3/13/16 - Tough week for NFLX ending Friday with a big SGB! This gives is the perfect pivot to trade off of going forward so move over $100 is a long and below $96 is a short. Upside is the 200/89 MA at $106 and down side is back to T1 on the current Bull 180 at $89.12. With the FOMC announcement on Wednesday, there should be some good movement in all the markets and NFLX will travel with the trend. Last week was the 5th up week from the Bull 180 and is now looking like a triggered Bear 180 since NFLX stalled at T3 and close right on it Friday as a SGB. I am still bullish biased on this stock so any shorts are with caution and taking profits quickly. As for the SGB on Friday, I will short shares under $95.89 and cover at T2 or $90.00-91.00. If I get filled, then my stop will be at 100.21.

=============================================================================================================================

3/616 - Nice moves higher since my last comments. NFLX dead stopped at the big SGB zone back on 8/215/15 and that will be the test this week. If we start a move lower on Monday then shorting strategies are the way to go and we do not do aggressive longs until it can take out the entire zone so a move over $107.89 is the target; however, I am still looking at long plays above T2 (99.32) on the weekly chart. If the stock surges higher, the expected initial target is the 200MA at or near $105.21 which will also be converging with the 89MA on the daily chart.

===============================================================================================================

2/28/16 - Friday NFLX touched on T3 and pulled back closing the day as a SGB so we are a pivot point going forward. If the stock opens higher on Monday, then I will place my stops at Friday's low and if we continue to move higher after the first 15 minutes, then I will take profits if the stock makes it to the 200 MA on the daily chart.

If Friday's SGB results in a lower open, then I will look for short term shorts under $97.19; however, I am still biased to long plays for 2016 and will keep my DOTM calls in place week-to-week.

===============================================================================================================

2/21/16 - The Bull 180 was off to the races and then it fell short of T2 closing the week exactly on T1 on the weekly chart. We are still in a Bull 180 setup so the bias is still long plays for now. I am anticipating a move over T2 and then it has potential for the 200MA on the daily chart; otherwise, if we fail the current SGB on the daily chart then look out below.

================================================================================================================

2/17/16 - Finally getting some movement in NFLX on this Bull 180. The stock blew right through T1 and is looking good for an attack of T2 tomorrow. If you have long shares then move the stop up and take some profits tomorrow if it does not hold over T2. The stock still has a couple SGB zones that will put upside pressure on it without any news catalyst to propel it higher. If there is any upset in the overall markets then NFLX will surely drop back quickly so I am going to start fishing on some puts as I am making profits on my longs.

=================================================================================================================

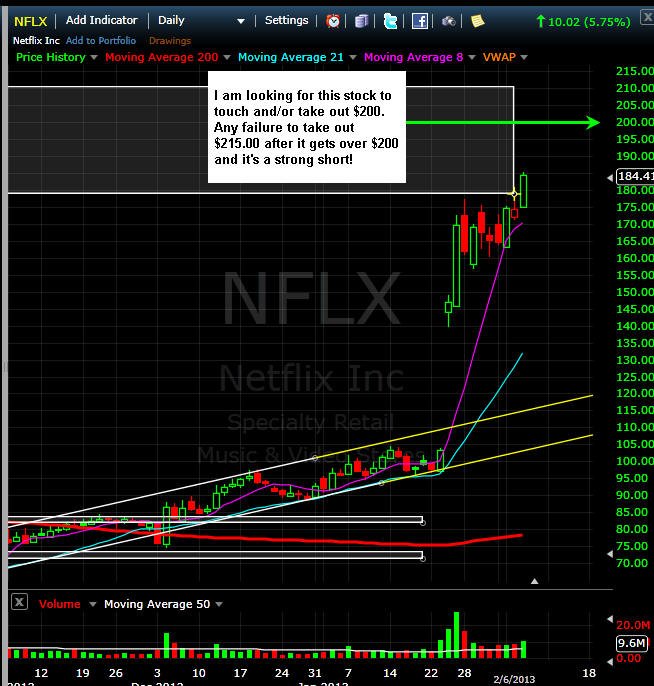

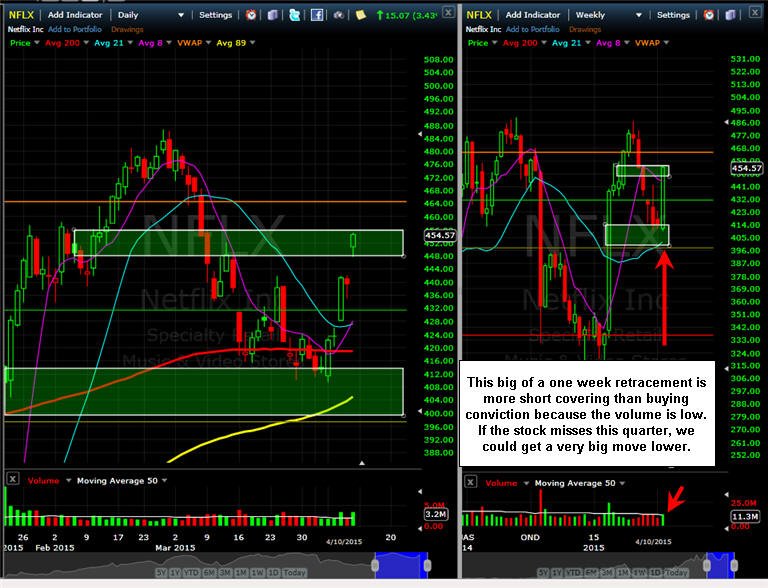

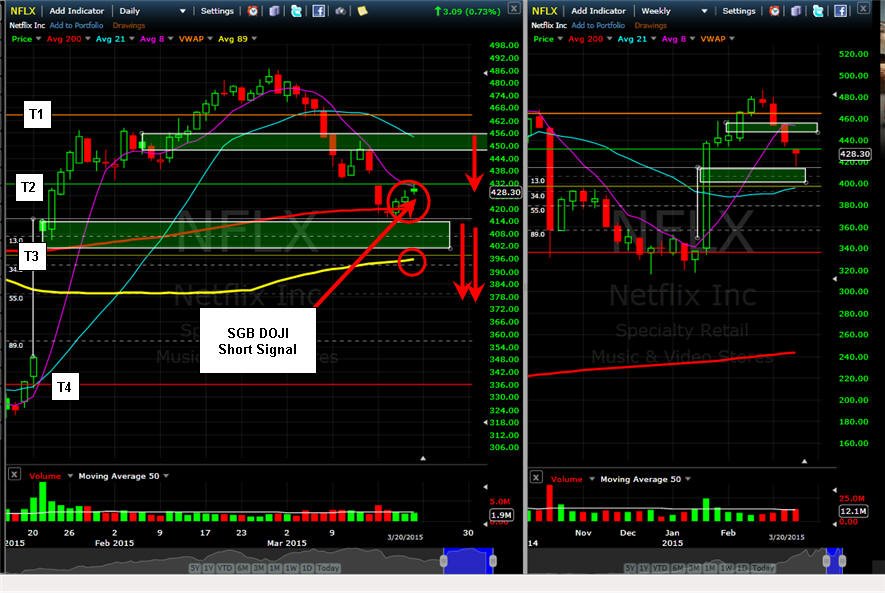

2/14/16 - NFLX is still holding ground on the Bull180 so we stick with longs for now.