2019 SPY Trade Commentary

The trades below are for educational purposes only.

They are not recommendations to purchase any particular stock or options contract.

Note: they are suggested entry and exit points! disclaimer

|

Stock Information Updated 12/25/19 |

|

WEEKLY IV%: 7.60 MMM +/- 1.63

Long Term Bullish |

|

Trade BIAS:

TGIF PAYDAY!: PUTS

HEDGE TRADE: PUTS / CALLS

|

2019 SPY Commentary

2019 Trade Strategies Navigation

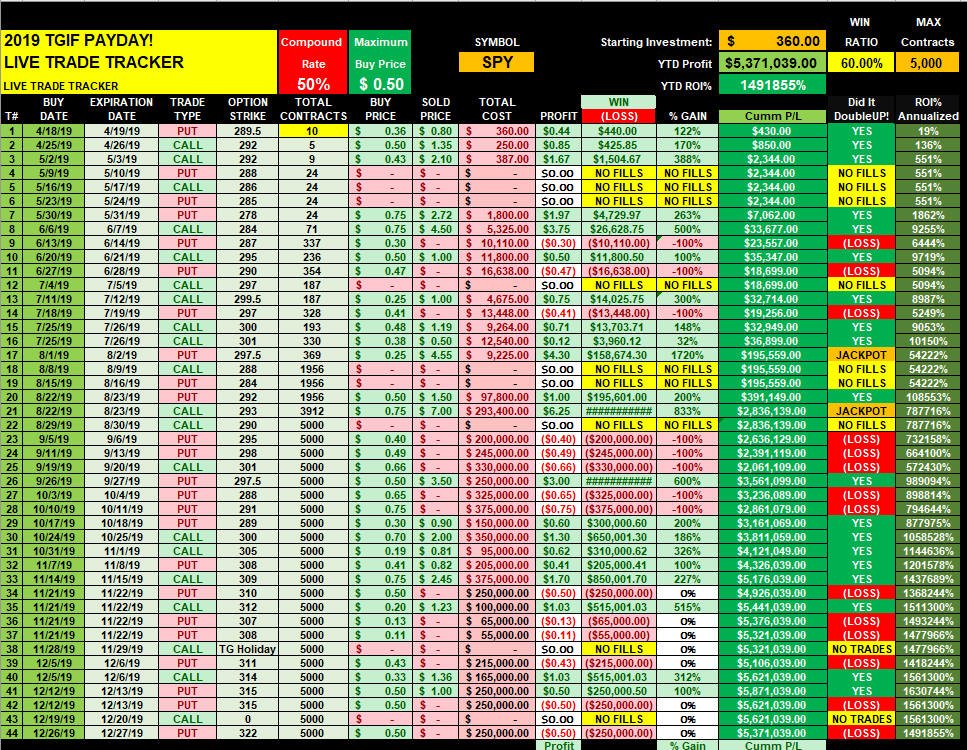

I created this spreadsheet below to help me calculate and keep

track of the TGIF PAYDAY! trades; and if you want a copy of it,

you can email me at: tracker@optionradio.com

Model Portfolio performance:

Risk Tolerance: VERY Aggressive 50% Compound Rate

Here are the final 2019 results of the Model Portfolio since we went LIVE with this strategy. As you can see, if you were to have followed every trade posted

and compounded to 5,000 contracts then you could have made up to $5.3 MILLION starting with $360.00. Now I am going to do this with a "real money" trading

account for 2020 and even if I get half the results, it will be a life changing event for me and anyone who follow along!

NOTE: when applying a compound rate, you need to consider your tolerance to initial draw down until you start to capture winning trades.

Once you have profits building, you can survive multiple losing weeks and still keep building your contract loads into the hundreds and then thousands!

Beginner = Flat bet 1 - 2 contracts each week until you have 5 consecutive winners...then you start to compound your contract size.

Conservative = +1 contract ONLY after a winning trade.

Moderate = +1 contract with each weekly trade regardless of a fill or loss.

Aggressive = 25% of profits from last winning trade.

Very Aggressive = 50% of profits from last winning trade—the Model Portfolio

Any compounding method you choose will get you to a 6 or 7-Figure account, so be patient and CONSISTENT each week, and you will arrive in the land of 7-Figure profitability with me!

SPY Trades / SPY Charts / AMZN TGIF PAYDAY! / 2019 Trade Strategies Navigation

|

SATURDAY 12/28/19 - 8:00 PM - Ok, as I suspected, the market would close the week higher, and it did; however I was trading the weekly trend so I was filled on my final TGIF PAYDAY! trade for 2019 and it was a losing trade...bummer...but I did a much smaller contract load so the loss is acceptable and time to move onto 2020!

Starting next week, I am going to trade a "LIVE" real money account as the model portfolio and hope to achieve 6-Figures by June and maybe even 7-Figures by this time next year! I will be applying the aggressive 50% compound rate and will not stop compounding the contract load until I reach 2,000; and them I will work my way up to 5,000 from there.

==================================================================================================================

WEDNESDAY 12/25/19 - 4:00 PM -

I am layering my orders:

This is the final TGIF PAYDAY! trade for 2019 in the model portfolio.

WOW, what an amazing past 6-months we have had on this journey as we all watched the model portfolio cross the 7-Figure mark starting with $360.00!!$$!!

Starting next week, I will be doing a live stream "real money" model portfolio challenge for 2020; and hope to repeat at least 50% of the performance 2019 did; taking all of my subscribers to the land of 6-7 Figure profitability!

Ok, here are my thoughts for this weeks trade idea:

I have been looking over dozens of charts the past couple of days and there are multiple SGB's and/or in SGB zones across the board.

QQQ, SPX, OEX, AAPL, GOOGL, FB, NFLX, MSFT, QCOM, HD, AVGO, BKNG, AMZN, SHOP, LVS, MGM, CVX, CRM, WMT, DIS, SRPT, JNJ, BLK,

Even though we have a PUT BIAS , my gut tells me we end the year on at an ALL TIME HIGH; however, I am still trading the trend as we know that is our best friend regardless of what happens week-to-week. BUT, I want to have some wild card Lotto Trades in place for next week just in case things go awry at the last minute.

What I am doing is lowering my contract load for this final trade.

If / when then slam down comes, it will be fast and large because investors have been squeezed so much this past month, they have zero tolerance and or money to buy a dip in my estimation.

Timing PUT trades is and will continue to be difficult; however, if you buy then when the SGB's show up, then you can catch a Moby Dick and make MASSIVE PROFITS when others are losing their buts and jumping out of their windows.

NOTE: If you are strictly doing the TGIF PAYDAY! strategy, then no need to add wild card Lotto Trades; however, if you do want to try and catch a Moby Dick, then you ONLY do these trades with PROFITS and NEVER with seed capital!

With the markets at all time highs, it is expected that a correction is imminent; and most likely that will be the case sometime in 2020 with all these SGB's showing up on multiple stocks and indices. In addition to that, we have a major presidential election coming which will no doubt have a lot of nasty and heated emotions amongst the candidates that will increase anxiety in investors and fund managers. Whatever the results next November, it will no doubt change the course of the markets for the next decade—In my estimation, if Trump wins again, we go UP UP AND AWAY; and if we get a Democrat in the presidency, then look out below because the Democratic party (more socialist mentality these days) does not like Wall Street.

Something interesting to point out:

Last week, Congress and the Senate passed some BIG changes to the 401k laws; and this will have a very strong impact in the markets as these changes are implemented.

https://www.nytimes.com/2019/12/19/business/ira-401k-changes.html / https://www.schwab.com/resource-center/insights/content/significant-retirement-savings-law-changes-are-coming-2020

What this means is MORE money will be coming into the markets in the future and that will create demand from fund manages who have to BUY BUY BUY.

For us, it matters not what direction the markets move because we trade the trend, and if the trend is down, we can make even MORE profits FASTER!

Best of trading success this week and may we end the year with Profits UP!

With trend mode turned off you can see the SGB's are actually RED candles:

========================================================================================================================================

FRIDAY 12/18/19 - 4:00 PM -

The 321 Lotto Trade CALLS have been doing great so far. I have sold off 75% of my position and will see what I get on Monday for the remainder.

I did not get filled on the SPY BIAS 319.50 strike yesterday at my MAX of $0.50, but it would have been filled at $075, so if you did that then you could have locked in a DoubleUP! or higher.

Sometimes we are just going to miss out on some winners when trading for a single strike, but once you have your compound building (10+ contracts) you can start to layer strikes around your “core” position to improve your odds of connecting with winning trades.

===================================================================================================================================

===============================================================================

WEDNESDAY 12/18/19 - 4:00 PM -

We have a bit of a dilemma now that the SPY is trading at 52 Week highs; and the past two days have both been SGB's. With only two week to go for 2019, I am definitely NOT going to put on large contract loads.

My plan this week is to stick with the KISS method and trade the BIAS CALLS; however, in light of double SGB's, I am definitely buying some HEDGE PUTS with Monday expiration. Hopefully we get a nice POP into Monday.

I do not expect much action next week since it's Christmas and the markets will be closed and also a half day on the 24th.

The BIG question on the minds of investors is the pending impeachment sham-poop-a-do-no-good for we the people no matter what side of the argument you may be on.

Hmmm...a vote to impeach (expected) should result in a sizable move tomorrow if the SGB's have any significance and so far ANY negative news relating to President Trump has almost always been UP for the markets—the final blow-off-top will be what happens in the Senate and that is expected to be an acquittal.

============================================================================================================================================= SUNDAY 12/15/19 - 4:00 PM - Lessons learned this week...and they will be applied to ALL MY TGIF PAYDAY! trades from this day onward!

Ok, so when we put on a trade for Thursday, we MUST stick to the "core" strategy regardless of what we hear in the news feeds because you never know how markets will react and we do not want to miss out on opportunities to profit so we can keep the compound growing. Besides, losing trades are already figured into the strategy and when we get winners, they more than take care of the few losers along the way.

In fact, you NEVER want to think...react...or try to manipulate this strategy—just be a robot and apply the KISS method every time you trade...putting in the "core" compounded contract loads at $0.50 MAX spend; and once you get filled, place a GTC order to sell at least half at a DoubleUP!.

NOTE: when you are trying to get in cheaper than the MAX spend, then put fishing orders at $0.20 for double your contract loads; and if you get filled at the open, immediately place orders to sell half of those at $0.50; otherwise, cancel the $0.20 orders after the opening bell and adjust back to the $0.50 MAX if the options are trading higher; or just buy in with your regular contract loads if under $0.50.

IMPORTANT: If you are not filled at $0.50 by 7:00 AM, then I would cancel everything and wait until the next week...it is far better to let things happen vs. making them happen.

Here were the results of the 315 PUT strike:

As you can see, the DoubleUP! was reached; however, if you did not have the order already in and waiting, you probably would have missed the DoubleUP! opportunity by the time your brain recognized what was going on...it is always easy to see what should have been when the final results are there and the markets are closed ;-)

Here is what the SPY did post tweet...notice how it was sold off? That increased the IV in the PUTS and they began to gain momentum rapidly; however, if you were just looking at it (like I was) then you most likely would not have made the correct decision to TAKE THE DOUBLEUP!...in fact, had I done it and sent the emails out, you would not have even had enough time to "follow me" on the trade—that is why you must place the orders to sell half at the same time or immediately after you get filled depending on the broker you are using.

Once the news broke, I "reacted" by canceling the rest of my PUT orders and selling off what I thought was a salvage attempt only to see later that it would have been a DoubleUP!

Later in the day, I added to my Monday expiration CALLS...and even those reached a DoubleUP!...so taking half off the table is definitely the way to apply this strategy.

When you are trading a strategy, the number one rule is to ALWAYS place orders to sell half at a DoubleUP! regardless of market conditions, your analysis or any other factors that might influence you to react...BE A ROBOT TRADER!

I know we are on a journey to the land of 7-Figure profitability and we should get there in 2020 with this awesome strategy!

Over the weekend, I was thinking that a winning trade is a winning trade; even when they just DoubleUP!...know what I mean?

Heck, if you do nothing more than double your money with each winning trade; and then compound your accumulated profits at a 50% pace; you have the potential to reach the land of 7-Figure profitability in 1 to 2-YEARS!!!

In fact, I updated my spreadsheet tracker to ONLY a DoubleUP!; stopping the compound this time at 1,000 contracts; and the YTD results in the model portfolio are:

It only took 18 short weeks to get to the 1,000 contract load starting with ONE (1) contract!!!!

...and in 43 weeks, the model portfolio reached the land of 7-Figure profitability!

So, I am thinking about adjusting the strategy to $0.50 MAX SPEND then selling 75% at a DoubleUP! and once I start compounding at 100 contract loads, then I will sell half at a DoubleUP! and keep the compound going beyond 1,000 contract loads—either way you trade this strategy, you are on your way to a very large trading account in 2020!

Profits UP!

Frank

==================================================================================================================================

WEDNESDAY 12/11/19 - 4:00 PM -

If you get filled on the PUTS this week and also want to apply a HEDGE, then consider the 316–317 CALLS that expire 12/13/19 if you can buy them for $0.10 or lower—these would be all or nothing trades.

I am layering my orders for tomorrow morning:

Monday 12/16/19 Wildcard Orders:

Friday 12/13/19 wild card orders:

Another TGIF PAYDAY! trade is ready for us to catch a winner!! Today was the FOMC announcement on interest rates and as expected, they did not make any change, but what they did do was indicate there will be NO changes for all of 2020! The markets reacted in muted fashion and is now set up for a "sell the news" event. The caveat is the trade tariff deadline on the 15th and rumors are swirling there could be a postponement.

The other wildcard is the Demolition squad moving forward with the BS articles of impeachment scheme in the hopes of ousting President Trump so he cannot be re-elected...or so they are hoping. It seems to me that every piece of perceived or announced bad new about Trump is met with a stock market rally, so if he does get impeached, will it be the straw that breaks the camels back and start a spiral down? All I know is if Trump wins...markets UP... and if the Demolition squad wins....markets will IMPLODE! in 2021 (hmmm a Fibonacci year)—either way, we trade trend and it will always become our TGIF PAYDAY! friend!

Something to point out...tomorrow is a FULL MOON and this week is Friday the 13th!

.Over over the years, I have pointed out that when FULL MOONS and significant dates or closing prices are present, BIG moves can come, so this week we have a PUT BIAS with wildcard Lotto Trade CALLS AND PUTS if you are applying "tweaks" to the core TGIF PAYDAY! strategy.

NOTE: I will be fishing for better pricing until Friday on the Wild Card strikes for Monday expiration.

======================================================================================================================================================

MONDAY 12/9/19 - 4:00 PM - I was profit stopped out at the open for $0.78 but still made a little more than a DoubleUP!. I was hoping for a parabolic move today, but it did not happen this time. I am on the hunt for the next Lotto Trades!

======================================================================================================================================= SUNDAY 12/8/19 - 4:00 PM PST -

This weeks TGIF PAYDAY! trade was a "NO FILL" based on the "core" trading formula; however, I decided at the end of the day on Thursday to take a smaller position because the daily chart formed a SGB short signal. Although they have proven to be very reliable, the outcome was not what I wanted due to a surprise unemployment report; which forced the shorts to cover and thus a zero-sum-gain this week :-(

On the positive side, I did do the 314 CALLS for 12/9/19 expiration as a wild card Lotto Trade and those are making fantastic profits; which I sold half for more than a DoubleUP! and will see what I get on the rest tomorrow.

Here are some suggestions for you to consider on your TGIF PAYDAY! trades going forward:

You can review more details in the training section.

Here were the model portfolio trades:

==================================================================================================================

WEDNESDAY 12/4/19 - 4:00 PM PST -

This week the markets got slammed on Monday with a gap down yesterday until today's "green" reversal day off alleged "news" that a trade deal with China will happen "before" more tariffs are set to rise on December 15th.

It seems to me this news is just a sucker-punch rumor and today is more likely a dead-cat-bounce with more downside potential.

This weeks BIAS is PUTS but I will be adding some wild card Lotto Trade CALLS by Friday with Monday 12/9/19 expiration just in case we get a surprise trade deal confirmation or impeachment news.

The VIX spiked strongly on Monday and today it is resting in PUT territory which gives us a good shot at another winning TGIF PAYDAY! trade this week.

===============================================================================================================================================

FRIDAY 11/29/19 - 4:00 PM PST - This week due to the Thanksgiving Holiday, we did not do a TGIF PAYDAY! trade; however, we did do some wild card Lotto Trades on SPY and AMZN that both made Moby Dick White Whale profits!!!

Next week we begin the final trading month for 2019 and it should be a bit of a roller coaster with end of year tax loss trading and wild card political and economic news events. Beginning in Jan 2020 I will start streaming a LIVE REAL MONEY model portfolio for the TGIF PAYDAY! Strategy and expect to arrive in the land of 7-Figure Profitability by this time next year! I hope you take the journey with me and together we can make 2020 our BEST trading year ever!

========================================================================================================================================= SUNDAY 11/24/19 - 12:00 PM PST - This weeks TGIF PAYDAY! trade was busted to a zero sum gain for me. Maybe you were able to salvage some of yours; otherwise, we just keep moving on down the road and wait for the next opportunity!

If you picked up some wild card Lotto Trades for tomorrow's expiration, then we will see what the future brings.

This week will be a short trading week with the Thanks Giving holiday on Thursday; and that probably means we will NOT be making a trade because the markets also close early on Friday.

** Each market will close early at 1:00 p.m. (1:15 p.m. for eligible options) on Friday, November 29, 2019

I hope you have a great Thanks Giving holiday and may 2020 be the year you make 6-7 Figures with the TGIF PAYDAY! strategy!!!

===================================================================================================================== THURSDAY 11/20/19 - 6:00 PM PST -

The markets sold off today testing Friday's gap. If we do not get a positive news story this week, the momentum is definitely building to the down side; and with good probabilities for a bit of a retracement for the rest of this month as investors get ready to digest Thanks Giving; and then decide what the final month of 2019 trading will bring...stockings full of cash or coal from good ol' St. Nick.

When the SPY broke above the SGB zone, it was full steam ahead for the BULLS, but today's move has not set up yesterdays "red" candle as a potential blow off top—notice the new all-time-high was 312.69

Will this ".69" print be the tell the markets are about to get screwed or the signal that investors are still in love with the markets?

We will know that answer in a couple more weeks; however, we are TGIF PAYDAY! Traders; and we like to apply the K.I.S.S. method with this strategy; so we will continue to make the trend our friend and cash in when everyone else figures out they are kissing their cousin...lol.

We need to be "aware" of what the VIX is doing, but know that when the VIX moves higher, it can actually be a two-edged sword.

When everything looks like it's a lock to go down, the crowd (aka heard mentality) shows up at the watering hole and the alligators (Market Makers) are lurking under the water to eat the early adopters.

That being said, you do not have to be first in the water, but you definitely want to be on the edge and ready with Lotto Trades when the stampede starts.

=========================================================================================================================================== FRIDAY 11/15/19 - 2:00 PM PST - Another winning week here at TGIF PAYDAY! Strategy central. The Model Portfolio has now grown to $1.7 MILLION and will reach 8-Figures in the next 12 months!!

I am VERY EXCITED for all those subscribers/students who "get the big picture" here and have either started the journey or will be taking it with me this January 2020 when I start streaming a "real money" portfolio.

I was taking profits this morning at another DoubleUP! and then I placed a profit stop at $1.50 (or so I thought it was a stop); which ended up being the morning low.

Well, by the end of trading today, I could have closed out for a massive profit...aaarrrggghhhh!!! —you can never know what will happen until it happens...know what I mean?

Ok, so here is what I learned and will NOT repeat. When you have a positive momentum going at the open, you should NEVER put a stop at a whole or half number because the algorithms will HUNT YOUR STOPS!

Another thing, when you put in your orders BE SURE you have the correct "SIDE" and "ORDER" type.

========================================================================================================================

WEDNESDAY 11/13/19 - 3:00 PM PST -

WEDNESDAY 11/13/19 2:00 PM PST - The SPY is hanging around record highs with multiple SGB's; which make for some interesting opportunities when momentum kicks in. This week has been quiet as earnings seasons winds down and investors begin to prepare for the Holiday season. Will there be one more push to finish the year in a parabolic move or will seasonal tax loss selling kick in and bring down the house? No one knows what the future brings, but we do know that trading with the trend has been and will be our best friend in the long run.

This week the BIAS is the 309 CALLS ;however, when there are SGB's, we should always have some wild card PUTS in place too.

Last weeks tweak plays expired worthless today, which was a bit of a bummer, but I am trading the model portfolio with a staggering profits, so it is the price to pay to catch another Moby Dick—which will definitely happen in the future and wipe out all losses with huge profits.

There was some China trade war news today that did not have any real impact on the markets yet, but if there is always the uncertainty of Trump tweets that can create stampeded like moves at any time.

Today, there was testimony from Fed Chair Powell that monetary policy is "likely to remain appropriate" and the current economic outlook is favorable. Even this did not move the markets and the SPY basically closed FLAT. Tomorrow is the final testimony on Capital Hill so there is still opportunity for some trading action by Friday.

Tomorrow morning WMT reports earnings before the bell and that could spark a rally or create a stampede in the DJI since it trades on that index. If they miss, then all the big box retailers could fall too; and with NKE announcing today they would no long sell on Amazon; it could be the catalyst to start a stampede on AMZN too—see more commentary on the AMZN page.

Remember, when trading the TGIF PAYDAY! strategy, it does not matter what happens in the overall markets...we just stick to the KISS method and keep build our contract loads regardless of winning and/or losing weeks; because the way to the land of 7-Figure profitability is guaranteed in the compounding of your contract loads!

The VIX is developing a squeeze which resolves in higher prices and that translates into a DROP in the markets so we need to be ready to catch the next Moby Dick trade with wild card PUTS.

One more thing I want to let you know about...starting this January 2020, I will start streaming a "Real Money" Model Portfolio on www.PayDayTrades.com to show the world that you can actually take a small $500.00 trading account and build it to 6 and maybe even 7 Figures in 12-months time with this proven strategy!

Profits Up!

Frank

===================================================================================================================

SUNDAY 11/9/19 2:00 PM PST - The smaller contract load I did on SPY actually made a DoubleUP! in the first half hour of trading, but I was going for a parabolic move since I had this small contract load on; however, when you are just starting out, you should ALWAYS take a DoubleUP! on 50% of your contract loads if you do not get continued momentum in the first 30-60 minutes of trading on Friday.

As I said in my email, I took the capital that was left over and bought a straddle that expires this coming Wednesday, so if this weeks FULL MOON has a "chilling" effect on the markets, I still may be able to salvage a profit on this one.

This was also a demonstration of ways to "tweak" the core TGIF PAYDAY! strategy once you have staggering profits to play around with.

Anyway, we just keep on driving down the road with me to the land of 7-Figure profitability and together we can arrive there by the end of 2020!!!

You are all invited to join me when I buy my yacht!

Profits Up!

Frank

===============================================================================================================================

THURSDAY 11/7/19 2:00 AM PST - News that China and U.S. will "cancel" tariffs in stages has future jumping higher in pre-market so I am CANCELING all PUT orders for now until I see how the SPY and AMZN react to the news and the Monday SGB zone.

WEDNESDAY 11/6/19 - 7:00 PM PST -

Now that the model portfolio has exceeded $1 MILLION...WOW...I will start doing some Layering and Lotto Trades this week to show how you can begin to implement "tweaks" and accelerate your profits when we connect with winning trades.

With today's DOJI and Monday's SGB, the markets are ready to make another move; however, it will be difficult to pick a side; and historically, SGB's are excellent "short" signals—especially at tops of ranges.

When markets are making new all time highs, it takes a few weeks for a solid base to form and give longer term investors confidence to pile in. Until this happens, we can expect continued volatility.

My BIAS this week is PUTS but I am definitely going to split the contract loads with HEDGE CALLS for Friday; and also do some wild card Lotto Trade PUTS and CALLS that expire on Monday 11/11/19.

NOTE: This week, due to the SGB and DOJI, I recommend a MAXIMUM spend of $0.50 or less.

With the VIX holding at recent LOWS, any negative news to the markets can easily create a stampeded so Wild Card PUTS are a a good LOTTO TRADE opportunity.

If you are looking for a wild card Lotto Trade, then you can pick PUT strikes no lower than 304-305 for Monday 11/11/19 expiration; because if the markets implode by then, the SGB at the 300 strike is the likely drop target and you want to be ITM as much as possible to make a nice profit.

=================================================================================================================================

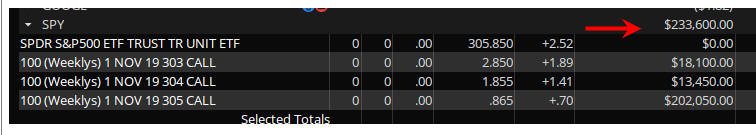

FRIDAY 11/1/19 - 4:30 PM PST - We had another winner and the Model Portfolio crossed the 1 MILLION MARK!!!$$$!!!

If you were still fishing yesterday into the close then you could have gotten filled as low at $0.07 per contract...WOW...and today's gains would have been a Moby Dick White Whale trade!!

We are still on the compound grow and as the markets find their trend again you are 12 months or less to becoming a millionaire trader!!!

=============================================================================================== WEDNESDAY 10/30/19 - 4:30 PM PST -

The Federal Reserve "lowered" interest rate for the third "charming" time and is usually bullish for stocks. The SPY closed today at new all-time-highs; however, the "bubble high" was 304.55 which has a Fibonacci sequence "55" in the number. Whenever I see a Fibonacci number in a "high" or "closing" price, that has proven to have significance and is evidence that a measured move is imminent.

The BIAS is CALLS this week and with the VIX moving towards lows, any negative news can cause a stampede of selling; therefore, we should be adding some "hedge" PUTS with Monday expiration if you are so inclined or have the capital to deploy—if not, sticking to the TGIF PAYDAY! strategy is still the way to go.

I am going with the 305 CALL strike which is slightly OTM as of today's close, but with AAPL and FB beating earnings, I anticipate the future will be higher tomorrow and price the 304's beyond our $0.75 max buy price. If futures are not higher in the morning, \I will adjust strikes.

As for some PUTS, I will be buying the 300 PUT strike that expires on Monday 11/4/19.

==============================================================================

SUNDAY 10/27/19 - 2:30 PM PST - Another WINNING week for the SPY TGIF PAYDAY! strategy and the compounding is back on!!

Here were the model portfolio trades:

Shortly after I took the first profits, news hit the markets regarding the China trade deal and exploded the SPY higher, so if you were sticking around, then you got a nice PAYDAY.

The upcoming week is going to be very volatile with earnings announcements from big stocks like: GOOGL, AAPL, SPOT, BABA, along with the FOMC rate decision too.

Post earnings WW fishing is good right now but if you are just a TGIF PAYDAY! trader, then keep on the journey EVERY WEEK so your compound grows and you reach the land of 7-Figure Profitability in the next 12-24 months!

================================================================================================================== WEDNESDAY 10/23/19 - 2:30 PM PST -

This weeks TGIF PAYDAY! bias is to the CALL side; however, with the VIX trading under 15 any volatility spike will create a nose dive; and since the SPY is hanging around all time highs and there is a couple SGB's I am anticipating a BIG move in the near future. If you do the HEDGE play, stick to a maximum buy price of $0.50; however, if the markets open higher tomorrow look to move UP your PUT strikes to the next price closest to $0.50.

===========================================================================================================

SUNDAY 10/20/19 - 2:30 PM PST - This week the TGIF PAYDAY! bias trade on the PUTS had a short-term swing; however, you had to take those profits or the trade went to ZERO!

I exited way too early in the morning session for basically a break even.

======================================================================================================================

WEDNESDAY 10/16/19 - 2:30 PM PST -

NOTE: Hedge plays are optional.

Here comes another TGIF PAYDAY! trade opportunity.

We have an interesting setup this week with TWO RED DOJI candles; each inside a previous SGB zone. The markets are about to make some moves, and with earnings season kicked off, the expectations are high for positive results. The China trade talks news has been quiet since last weeks "phase 1" announcement and today was NFLX earnings which were mixed—they beat on revenue, but missed on subscriber growth; however, the stock still went higher in after hours and I looks to be a gap-n-crap tomorrow so WW Fishing is definitely a possibility.

As for this weeks TGIF PAYDAY! trade, I am going with my FULL contract load on PUTS since the VIX is under my trigger point of 14-15. However, since the markets are still in bullish mode; and the SPY is trading right around the 300 whole number; I will also buy some CALLS as a "hedge" but this is optional if you are just starting out.

VIX is in the PUT BUYING ZONE zone; therefore, you can either stick with your FULL compounded contract loads and/or add a few CALLS as a hedge since we have double DOJI candles and are trading at the whole number of 300.

================================================================================================================

SUNDAY 10/13/19 - 4:30 PM - The PUTS went bust but if you had the 292 HEDGE CALLS in play, then you banked a nice profit after the news from Trump hit the markets.

No big news about China over the weekend and so far, future are indication a higher open on Monday so my wild card PUTS are most likely going to be a bust trade on Monday but I still have some for Wednesday.

=====================================================================================================================

THURSDAY 10/10/19 - 7:30 PM - If you kept you orders on all morning, then you got filled on the 291 PUTS.

I also bought some wildcard Lotto Trade 287 PUTS and for Monday Monday expiration in anticipation of a big move over the China trade talks tomorrow.

I bought some wild card Lotto Trade 297 CALLS for tomorrow in case the trade news explodes higher.

I will also pick up some MONDAY expiration calls tomorrow.

===================================================================================================================================== WEDNESDAY 10/09/19 - 11:30 PM -

NOTE: Hedge plays are optional.

What will the market bring us this week?

I am seeing a lot of potential for a winning trade!

The news of the week is China is in town to talk trade deals tomorrow and Friday; and that has had the market swinging around 300 points in both directions the past couple of days causing any trader to pull their hair out! It is good we do not trade until Thursday, so we have a BIAS to guide us, but even with that, we have been struggling with the strategy the past couple of months; and I am thinking this will be the case the rest of the year as earnings season is about to begin.

This week will be the kick start or kick off as news rolls out on a deal or no deal with China—I am on the opinion there will be NO DEAL until the elections are over as China definitely wants to play the game of elections; and if Trump is impeached and/or loses the election, they have ridiculous leverage over trade deals; and if he wins again, they are gonna feel some real pain because Trump will be even harder on them in the future.

Yesterday, Fed Chairman Powell announced NO rate cuts in September, but willing to do what is necessary when need be....“policy is not on a preset course,” Mr. Powell said, the Fed will “act as appropriate to support continued growth.”

The other thing he did say was they were going to increase their balance sheet... “That time is now upon us,” Mr. Powell said. He added that the Fed “will soon announce measures to add to the supply of reserves over time.” However, as much as this sounds like "Q.E." it was expressly said by Mr. Powell "This is not Q.E."

With a market that just swings hundreds of points every news story, it is practically a zero sum gain to trade either side effectively...especially with headlines like this almost daily:

Dow futures slip in wild overnight trading after report that trade talks have stalled...

This week the SPY is still in PUT BIAS but remember what happened last week? Things were going our way and then the surprise employment report reversed the markets into a squeeze causing the CALLS to exploded higher.

This week the IV is pumped up on both sides again which makes it more difficult to get in at our maximum fill price of $0.75, but anything can happen as you have seen.

So, you have a few choices with the TGIF PAYDAY! strategy:

1. Stick to the KISS method and just put in your order for the MAX buy price of $0.75 as a GTC and do not cancel until Friday at 7:30 AM looking for that all-or-nothing filled order.

2. FISH for $0.20 at the open, then adjust to $0.50 MAX for the day and if not filled, repeat the process on Friday morning canceling all orders at 7:30 AM.

3. Play both sides each week with GTC orders at $0.50 MAX and take the trades as they come; however, each side should be compounded on their own merits.

If you decide to apply "tweaks" then I would not deploy more than 10-20% of your contract load on the hedge trades.

The 200 MA is down at 284, so any wildcard Lotto Trade PUT strikes should be there or higher.

The weekly chart is still bearish but forming a Bull 180 pattern which will play out in one more week.

The stock markets always wants to go UP and for the better part of 5+ years, any dips have been vigorously bought and investors rewarded; however, all good things do come to an end of sorts, and with an election year coming, trade wars, impeachment wars and heck maybe a real shooting war, we may finally be in for a serious correction. Therefore, you have to be ready if you are making traditional trades and keep fishing for those Lotto Trade strikes up to 20% OTM on PUTS and 15% OTM on CALLS on STOCKS but on SPY no more than 3% OTM either side.

If you are only doing the TGIF PAYDAY! strategy, then keep on placing your orders each week based on the proven formula and you will ERASE ALL losses in just a couple of winning weeks!

========================================================================================================== SUNDAY 10/6/19 - 3:30 PM - No profits this week, but it was expected since the markets were already slammed down and unfortunately, we did not get the continuation move lower because the employment report was unexpectedly strong; which created a squeeze on Friday. If you were fishing for some Lotto Trade CALLS, then you may have benefited; however, the TGIF PAYDAY! bias was PUTS and this time we missed out on a Moby Dick winner—by sticking to the rules of the game there will always be setbacks, BUT when the winners come (like last week) we ERASE multiple losers and can continue the compound!

NOTE: If you are starting out, then you can LOWER your barrier to entry by controlling your initial spend rate and only fishing for $0.50 or lower entry prices; however, when you do this, you should always place those orders as GTC and see if you can get filled by Friday at 7:30 AM before you cancel and wait until the next week, but if you do get filled, be sure to take half off at a DoubleUP! to preserve as much capital as you can so you are able to get your compound working sooner.

What pains me the most is a few weeks back I was placing straddle orders because of all the volatility; and yet they were not working out so I stopped doing them only to see this week would have been the MOBY DICK...arrrggghhhhhh :-(

So, as long as the markets are in the current volatility mode, my suggestion is you continue trading the strategy with BIAS as your "CORE" trades, but consider lowering your contract loads. Then, once you start compounding, you should take 10%-20% of your contract loads and just BUY the opposite side on Thursday mornings for $0.75 or better based on the VIX.

HOWEVER, when you get profits from the straddle trades, you should NEVER take any of those profits and apply them to the TGIF PAYDAY! BIAS contract loads—the straddle profits should always be kept separate and compounded on their own merits.

When the markets get back on trend (most likely in Jan 2020) the TGIF PAYDAY! strategy will accelerate your trading account at a parabolic rate!

When I developed the TGIF PAYDAY! strategy back in Mar-Apr of 2019, I was looking for a way to make profits inbetween earnings quarters when volatility is lower—because it take a lot of volatility to make profits with Lotto and White Whale trades.

As I developed the TGIF PAYDAY! strategy, my suspicions were confirmed and I "saw-the-light" when I applied the now proven formula to the SPY—I was blown away at the velocity it can build profits by compounding contract size.

Of course, it was primarily based on back testing and the benefit of hindsight; however, when I applied the formula to "LIVE" trading in late April, it was still making massive profits for the first 4-6 weeks because volatility was still on the decline. Then, in late May, the volatility kicked back in; and since then, we have been struggling getting back-to-back winning weeks—which accelerates the compounding and makes parabolic profits in a short period of time.

Well, now that I have several months of "LIVE" trading in place, I can see now how the volatility (VIX) has a definite impact on the TGIF PAYDAY! strategy.

Below is a daily and weekly chart of the VIX; which now shows us a much clearer picture of when and how we should be trading the TGIF PAYDAY! strategy—Jan - Jun aggressive compounding and Jun - Dec low to moderate compounding with straddle plays week-to-week based on the VIX and Lotto Trades at earnings cycles.

My thinking now is when we are trading the BIAS, we need to look at the VIX chart each week to determine our aggression level on contract loads and when to apply "tweaks" to the strategy—if the VIX is under 14, we add LOTTO TRADE PUTS and over 20, we add LOTTO TRADE CALLS to our core TGIF PAYDAY! trades.

The Oct-Dec quarter is typically a very volatile time in the markets since it is the Holiday season, final quarterly earnings reports and end of year portfolio shuffling for the big hedge funds, 401k and mutual funds. This makes for some EXCELLENT LOTTO TRADE opportunities with earnings season about to begin; however, the TGIF PAYDAY! strategy will most likely continue to struggle until the declining VIX returns—and that is typically in the first quarter of the trading year.

Why? Because that is when all the 401k, mutual funds and hedge fund managers get the biggest influx of capital and are tasked with putting BILLIONS of investment dollars to work for the coming year. When the money comes in, they never put all of it to work immediately...that would create massive volatility. Instead, they systematically infuse that capital over a 2-3 month timeline and that creates a declining volatility environment.

When this happens again, the TGIF PAYDAY! strategy profits will grow at a parabolic rate in 3-6 months time!

Here are the VIX charts to show you what I am talking about:

The weekly chart shows you are better picture of what a decling VIX environment looks like:

Remember, we are on a journey to the land of 7-Figure profitability; and I must emphasize, this strategy takes 1-2 years to work out the bumps in the road. The best part is you do not have to risk "tens of thousands of dollars" and struggle for years like I and so many traders do trying to build long-lasting wealth—we just need some time and eventually the compounding of our contract size when the VIX is declining to get us all to the land of 7-Figure Profitability!

====================================================================================================================================== THURSDAY 10/3/19 - 11:30 AM

I was filled on the SPY after the dramatic comeback in the afternoon session.

==============================================================================================================================================

WEDNESDAY 10/2/19 - The next TGIF PAYDAY! trade is upon us and with the markets taking a beating so far this week, it will most likely be difficult to get filled; however, we still place the orders and see what happens.

Monday was the day to get in on these 288 PUTS; and look at the return today...WOW! I do not expect to see a fill on the PUTS tomorrow; however in light of the recent moves, I will be cutting my contract loads in half.

The SPY has been beat down for two days now and is fast approaching the 200MA where it would be expected a bounce will happen. If there is any positive news tomorrow, we could easily see a short covering rally and that may drop the BIAS PUTS we are attempting to buy back into our price range; however, if we do not get filled tomorrow, I will be looking at some CALLS for a Lotto Trade once I see the 200MA touched.

The weekly chart has a double top "M" pattern and the markets could take a real tumble until earnings season kicks in after the15th. Also with the Trump impeachment wrangling, there will continue to a lot of uncertainty in the markets; however, if President Trump "cuts a deal" with China to bolster the markets, the rally (short squeeze) would likely be parabolic—and we know Mr. Trump loves to tweet (manipulate...wink...wink) the markets.

Therefore, you play the BIAS, but keeping wildcard Lotto Trades on are always a good bet and I am looking at fishing the 292-293 strikes for $0.10

==================================================================================================================================== FRIDAY 9/27/19 - We have a WINNER...finally!!

If you stuck with the BIAS or bought in with me at the end of the day for a lower strike, either way, you had a nice profit today!!!

The model portfolio has ERASED all the losses of the past three weeks and gained MORE profits so now I will start up the compound again and hope to hit 7-Figures in 1-3 more trades!!!$$$!!!

This is EXCITING to see this strategy unfold right before our eyes and you can feel confident the Model Portfolio will be YOUR LIVE trading account in the next 1-2 years or less.

WEDNESDAY 9/25/19 -

The SPY had quite the sell off last week killing our BIAS CALL trades; however, this week may turn out to be a winner—at least I certainly hope so.

With three straight losing weeks on the BIAS, if we get filled this week, I would definitely be taking 50% off at a DoubleUP! because it can be frustrating if you are just starting out and have to endure a few losing weeks; however, we keep on trucking down the road and in time all losses will be wiped out by the compound and your account will explode your profits once a solid trend develops again.

With the recent political news that congress is launching an impeachment inquiry, the markets are definitely going to be skittish until more definitive news is released, so we should be anticipate increased volatility.

Earnings season is about to begin, and it appears to me the markets are pulling back in anticipation for a potentially BIG move over the next couple of months and if reports come back weak along with a confirmed impeachment proceeding, markets are poised to drop a lot more.

I am currently at 1K contract loads on the model portfolio and will remain there until I catch a winning trade before I start the compound again.

I am only posting BIAS trade ideas, but if you want to apply "tweaks" (see training page) to your trades, then I strongly suggest you separate your capital for each tweak; keeping the core strategy starting capital separate so you can get a consistent compound started; which will quickly wipe out any accumulated losses you incur.

=============================================================================================================================================

MONDAY 9/23/19 - Another busted trade this past week on the TGIF PAYDAY! SPY trades, but the AMZN was a BIG WINNER!; however, if you are just starting out with the SPY, I know it can be a little bit frustrating to not have profits every time you take on a position. The constant here is knowing the strategy works and time is on your side, so keep applying the proven formula and your compound will begin to build.

This week I did not post the straddle trades and, of course, the PUT side would have been a winner; however, looking over the past years performance, I determined sticking to the KISS method is the best way, so I am NOT posting straddle trades and only doing the core BIAS strategy from now on. If you want to do straddle trades, then that is up to you. My suggestion is you should divide up your trading capital into different strategies and play them separately. In other words, when you have a winner with a strategy, then you use those profits ONLY on that strategy for the next trade.

The TGIF PAYDAY! strategy was designed to give you a massive edge over time; and that is what takes to realize the potential...TIME. If you are looking for instant gratification every week, then you should consider moving to Las Vegas and work over the casino's for your fortune....roflmao....I KNOW that is a zero sum gain because those casino owners did not invest BILLIONS to build if they knew YOU had the edge—YOU DON'T!

Earnings season is about to begin, and there will be some great Lotto Trade opportunities coming; and if you hook onto a Moby Dick, then you can kick your TGIF trades into high gear and accelerate your compound, so stick with the core strategy and make the trades each week win-lose-or-draw. Once you have profits built up, then you can expand into stocks like AMZN and meet me in the land of 7-Figure profitability faster!

Looking over the daily SPY chart, we can see the SGB zones kept the lid on the rally, and if earnings season has a rough road, then we could see the SPY drift or slam down to the 200MA if it cannot hold the line at the lower SGB zone around 295.

================================================================================================================= THURSDAY 9/19/19 -1:09 PM - No fills at the open so I waited it out and bough in after 12pm only to see the 301's close on their low of the day. I hope you got filled lower than I did.

I also bought my PUTS just in case we get a "war" cry from the President over the next few days.

I will be fishing for the remainder of my weeks contract load in the morning and probably move down to the 300 CALL strike for MAX $0.20

===================================================================

WEDNESDAY 9/18/19 -

Bias this week is CALLS and with the FOMC cutting rates a second time, we may get the breakout move and close at new all-time-highs this week! The wildcard is the Saudi Arabian oil refinery attacks and now it is believed to be done by Iran and this could become a "HOT WAR" and President Trump could make a move on that front at any time. Historically, when the US gets into military conflicts, the markets tend to move higher, but initial news may have an initial negative impact, and with the SPY at all-time-highs and testing the SGB zones, so we have to be a little cautious this week. Also, since we have had two consecutive losing weeks, I am hoping for a winning week so I/we can get the compounding back on track; however, so long as the volatility is strong, we will continue to have a bumpy road. The past couple of weeks, I have been attempting to "tweak" my trades, and so far, it has been a dismal failure; however, looking over the model portfolio, you can see the impact has been negligible to the massive profits gained; and that is a GOOD thing to see when you are at very large contract loads. In fact, it would take several more consecutive losing week to make a large dent in the the accumulated profits. On the other hand, when you have compounded into the thousands of contracts, you can always make the "executive decisions" to back off from the aggressive compounding; and that is exactly what I will be doing until I get a couple positive weeks going—my plan is to drop down to 1,000 contracts for now, and once the trend returns, I will ramp up rapidly again just as you have seen from the back testing and initial live trades. A note about tweaking the strategy. Sure, you can do many different trades around the base strategy when you are at hundreds or thousands of contracts, but you should always have the basic strategy in place, and continue the compound at a consistent pace win-lose-or-draw; because it takes an aggregate of winning trades over several weeks to months to leverage your contracts into those hundreds and then thousands before you can arrive in the land of 7-Figure profitability. So, from now on, I am posting ONLY the BIAS and STRIKE for the TGIF PAYDAY! trades each week. As for any other trades I do, those will be considered LOTTO trades based on that proven formula and any contract loads I take form the TGIF PAYDAY! I will reduce them from the next weeks trades even if they become winners. That way, my winning tweak trades can slow down the losses over time and keep the compound going at a faster pace. For the wild card "war" play, I am looking at buying the MONDAY 9/23/19 295 PUTS for $0.50 or less.

============================================================================================================================================ SUNDAY 9/15/19 5:00 PM -

No Friday the 13th action in the SPY or AMZN and the TGIF PAYDAY! model portfolio BIAS trades have their first consecutive losses....bummer, but part of the process.

Volatility has not been our friend during the past 6 weeks, so now I am backing off the aggressive compound and will regroup until I get some momentum going.

I did several trades this week as listed below, and had a few small winners but overall the losses accumulated.

If you were following along on all the trades I emailed out, then you are probably as frustrated as I am this weekend, but you have to remember, this strategy is a 1-2 year journey, and it is PROVEN to be most effective in a trending market.

When trading multiple strikes and price points, you have to keep in mind the core strategy is a single strike trade based on the BIAS win or lose and that is where you stick to the compound method.

Once you start to grow your contract loads, then you can expand with the "tweaks" to hopefully gain some extra profits; however, it may just end up compounding losses—applying the KISS method is always the best way to avoid bumps in the road.

When I am applying tweaks to the strategy, I will focus on fishing for $0.20 or lower, and if you do not get filled, then you can buy in spending no more than $0.50. When I do get filled, then I will always put in a GTC sell order for half at a DoubleUP!. The main goal is to compound contracts, and when we can get a few extra bucks, that will lighten the load on losses.

Once the trend returns, it only takes 3-6 months to grow an account well beyond 6-Figures!

Now that I have had back-to-back losing weeks, I am going to reduce my contract loads to 500 in the model portfolio even though I am still at the maximum of 5,000 until I get a couple winners; and then I will ramp back up to 50% of the profits model and increase back to normal size.

The 302 CALLS I bought on Thursday made it past a DoubleUP! profit if you were watching it ever minute of the day. If you can't then you should always have sell orders in for half your contract loads for that DoubleUP!.

Once you start compounding, then you can apply more tweaks to the strategy like layering price or adding multiple strikes.

What you do not want to do is let a profitable trade expire worthless like these did if you did not take your DoubleUP!.

====================================================================================

THURSDAY 9/12/19 11:00 AM -

Here are my SPY trades this week:

================================================================================

WEDNESDAY 9/11/19 12:45 PM UPDATE - I was filled on the TGIF PAYDAY! 298 PUTS

I also bought in on the CALLS, but moved up to 301 strike. as a hedge.

WEDNESDAY 9/11/19 8:00 AM UPDATE - NO fills on SPY so watching for end of day to buy in at 25% of my contract loads

=============================================================================================== TUESDAY 9/10/19 -

Comments:

This week I am starting early with 25% of my contract loads in the direction of my BIAS and 10% in the opposite direction as a hedge.

The SPY has two SGB's, and today was lower; therefore, I am going with the PUTS

My optional play is the 300 CALLS as a hedge, but remember, a hedge is not part of the TGIF PAYDAY! strategy and should only be implemented when you are trading large contract loads as a "tweak" (see training module).

If I get filled on the PUTS, then I will monitor the action and decide to add another 25% at the close, or if I do NOT get filled, then I will BUY IN 25% of my normal contract load at the close.

On Thursday morning, I will be implementing the usual TGIF PAYDAY! formula and see how things go down by Friday.

This is also Friday the 13th and a FULL MOON so be prepared for some potential explosive volatility this week.

We KNOW that when SGB's appear, BIG moves happen; and with the markets in skittish volatility, there is the potential for a HUGE profit this week.

======================================================================================================================= SUNDAY 9/8/19 - Big momentum ended the week with a busted trade on the PUTS; and what a bummer, since it was my first week of trading the model portfolio at max contract load; however, I suspected this would happen and I cut the contract load down. Good news is I still have massive profits overall, so I am not too concerned as I continue the road to the land of 7-Figure profitability in the next few weeks!!!

Even though the BIAS was skewed because of the holiday, I took the PUT side because that is what showed up on my charts; however, one of my new students pointed out on his charts it was a "GREEN" day majority and CALLS were the direction??

After reviewing his settings vs. mine, I discovered that I am set up for SGB's on ThinkorSwim and his charts on TastyWorks do not do that setting. In this scenario, we both were right on BIAS; however, it would have produced a NO FILL trade this week had I went with CALLS vs. a losing trade going with PUTS.

BUT, if we started on Wednesday with CALLS, then the trade would have been a BIG winner so I am thinking we need to make some adjustments to the strategy until all this volatility calms down. .

When I developed this strategy, I had the benefit of hind sight originally; and once the live trading started; things were on track until all this summer volatility showed up. Because this is a new strategy, we have to learn to roll the punches and figure out how to either minimize or exploit current market conditions.

Looking over the past few weeks, I am seeing that Wednesday was the best day to start; and we would have had continued success and already reached the 7-Figure goal in the model portfolio.

My thinking is we should adjust a little bit until the trend returns; therefore, I am will be starting some of the contract loads on Wednesday and will also buy a couple in the opposite direction of the trend on Thursdays until the volatility normalizes.

NOTE: If you are just staring out, then I would recommend you stick tot he original plan and be patient until you connect with a couple winners and start your compounding.

================================================================================================================================================

THURSDAY 9/5/19 2:14AM PST UPDATE -

Overnight news about US and China resuming trade talks has the future up and the SPY is indicating a 296-297 Open. This will most likely put the 294 PUTS in range of getting filled for $0.20 or lower; however, with the potential for upside momentum to continue into Friday, I am adjusting my strike to the 295 PUTS and will pay a MAXIMUM of $0.50 or lower. If you stick to the 294's, then pay no more than $0.20, and cut your contract load in half.

I am also moving my wild card Lotto Trades to MONDAY 9/9/19 expiration.

========================================================================================================================

WEDNESDAY 9/4/19 -

Volatility continues this week post TARIFF wars between he US and China. Markets initially sold off Tuesday morning only to rally right back today. This has created a lot more IV in the option prices; and will make this weeks TGIF PAYDAY! trades difficult to get filled. In addition to that, we do not have any data for Monday since it was a holiday, so we have to look at Friday's action to give us a potential bias; and that says PUTS are the direction we trade this week.

My plan is to fish for PUTS this week and place a few wild card Lotto Trade CALLS in case we get a Trump Tweet or other surprise news to bust a move higher by Friday.

The SPY closed today at 294 and so the TGIF PAYDAY! strike I am going with are the 294 PUTS currently trading at $1.33—my maximum buy price is $0.75.

As for the wild card Lotto Trade, I am going with the 297 CALLS currently trading at $0.25 cents.

Let's take a deeper look into this SPY charts.

It has been in a very volatile Bull 180 for 20 days reaching the T3 target in the first 2 days then quickly sold off back to the trigger zone only to rise once again. The volatility has been ridiculous making trades for most strategies a hellacious gut check for any trader. The Market Makers got us coming and going like a cat playing with a mouse. Soon, the KILL is coming and with everything suggesting we are going to head higher, you have to be cautious because that is when they will whack you the hardest.

This daily chart is showing us technical's for the upside, but if you look closer without all the technical's in place you can see a "BEAR" FLAG has formed.

September is historically the "CRASH" month and Oct-Dec are the "BEST" months to trade; therefore, we can expect a lot of continued volatility in the next 30-60 days; and potentially make some HUGE Lotto Trade profits!!

Bearish flags tend to make higher tops and higher bottoms and have a tendency to slope against the trend. Also, their trendlines run parallel as well and when the resolve to the downside, the moves are quick and violent making for some VERY profitable Lotto Trades!

The weekly chart is also in a Bear Flag setup and each time the SPY was at these levels it moved lower testing the 89MA and 200MA. If we get another "crash" scenario, you can expect a much harder and faster drop or a very powerful move higher testing the all-time-highs.

Either way, you have to keep those Lotto Trade fishing orders on and if you are just sticking with the TGIF PAYDAY! trades then ALWAYS make the trend-your-friend and be patient when we do not get filled.

===============================================================================================================

9/1/19 - NO fills on Thur or Fri because the markets jumped higher off the China trade news—we needed to be in the 290's on Wednesday morning.

Even though it seems frustrating to miss out on trades, you cannot get anxiety or allow the impulse to "gamble" and/or over trade a proven strategy especially when you are just starting out. This strategy is proven to work over time and missing a week now and then has not negative impact on your trading account.

BUT, if you just need to feed your greed impulses, then you can apply some tweaks to the strategy and start fishing on Wed morning and if not filed, buy a couple contracts at the close in the direction of momentum; and then implement the full strategy for Thursday and Friday mornings. That way, if the momentum just keep climbing, like it did this past week, you are in-it-to-win-it.

IMPORTANT!: If you are just starting out DO NOT "force" the trades, just be patient and let the compounding begin BEFORE you apply the tweaks I teach in the training module.

I know everyone wants to make the "BIG BUCKS" every week, but you know that is just not going to happen and being patient is the BEST way to get to your trading goals with this strategy.

This week is the beginning of the final quarter of 2019 trading and it is typically the most profitable time to trade the markets too. I am looking forward to having a 6-Figure quarter trading this strategy and I hope you do too!!

======================================================================================

WEDNESDAY 8/28/19 -

Don't' look now but the Model Portfolio is PRINTING MONEY!!! and soon you will be too as you continue to COMPOUND your journey with me to the land of 7-Figure profitability!!!

It is amazing to see that since I went "LIVE" posting trades with this strategy back in April, the model portfolio is now at 5,000 contracts...WOW!!!

Last weeks stellar trades on the PUTS were amazing and needless to say, I am bummed that I did not get those PUTS on in my "live" account last week because I was working the trade for $0.50—I was even watched it hit $0.72 and did not pull the trigger...aarrrggghhhh!

From now on, I am 100% bought in each week whenever I can get filled for $0.75 or less; and you should be too as we progress into the coming months; because the last quarter is the "BEST" one for trading stocks and options!

I am confident I will achieve 6-Figures by the end of the year in my real money account and I hope you do too!!

This week the BIAS is CALLS

The SPY is still in a triggered Level 2 Bull 180 setup and if we get a continuation to T3 by Friday, then we will have another BIG WINNER if we get filled!

The markets are still in "SELL THE RIP" mode which make for some volatility; and this is also the last week of trading for August so expect some movement again.

It has been 5 day since President Trump has tweeted, so I am sure he is getting itch fingers and wants to make some waves in the markets....maybe a tsunami like last week.

Here is a cool website to keep track: https://www.bloomberg.com/features/trump-tweets-market/

Although I am not a big fan of buying CALLS , the strategy has been right 80%, so we do NOT THINK and just follow what has been proven to work.

HOWEVER, there is nothing wrong with applying some tweaks now and then, so Lotto Trade PUTS are good to do if you are compounding past 10 contracts by now.

SPY CLOSE = 288.89

290 CALLS is the strike I am targeting with initial orders in at $0.20 and then adjusting to $0.50 by 6:45 AM PST.

If they open HIGHER than today's close, then I will adjust my price to $0.75 and cut my contract load in HALF adding more later if the price drops to $0.50 or lower.

ALL ORDERS ARE GTC and I will reassess the strike for Friday if not filled.

NOTE: Be sure to read the updated training page and learn the strategy so you can apply the proven principles to your trading and benefit whether I make trades or not...become fishers of the sea of cash!

ProfitsUP!

Frank

==================================================================================================================== SUNDAY 8/25/19 - Well, look who showed up this week...it was MOBY DICK!!!!

WOW, do these DOJI and SGB's have you convinced yet?

This week was one of the most volatile moves I have seen in long time and the profits were staggering on the PUTS in both the SPY and AMZN!

There is MORE to come as we head into the final week of August trading; and then start the final quarter of 2019; so strap in and get your orders placed because you few months away from reaching the land of 7-Figure profitability!!!

What is even MORE exciting for me is how FAST the contract load has compounded from 10 to now 5,000 on the SPY!!! So, no matter what level you are at, you can now see this strategy is the GAME CHANGER for all of us and you are in the right place at the right time!!!

One thing I need to point out is in the training module, I suggest the "sweet spot" for the SPY trades is $0.20 - $0.50 MAXIMUM, but I also pointed out you need some wiggle room and added the (+/- 0.25) making the absolute maximum buy price of $0.75; and also it was (+/- 1.00) for AMZN making that absolute maximum of $6.00.

Well, this week we had to employ those variables to catch these MOBY DICK trades, so from this day forward, I have updated the buy price ranges to include those variables; and will ALWAYS take a trade every week on a Thur and/or Friday morning with GTC orders place on Wednesday.

My only suggestion is if we have to buy in on Friday, then consider lowering your contract load to minimize any losing trades. We do not have to hit home runs each week, we just need to keep the compound increasing; and that will take care of everything when we have weeks like this one!!! CHA-CHING!!!!

AMZN was the BIGGEST winner to date! See comments here

======================================================================================================== WEDNESDAY 8/21/19 -

One for the money...two for the show...three to get ready...and will four be the show me the money week? We shall find out my trading friends as we prepare for tomorrow's opening action.

Today the SPY finished the day as a DOJI SGB, so we can expect a move soon, but for this week, the BIAS is CALLS.

Because we have two DOJI's that are parallel to each other, so I am going to fish for both CALLS and PUTS and dividing up my normal contract load for between them.

The SPY closed at 292.45 and my strikes will be the 293 CALLS and the 292 PUTS . I will be fishing for $0.20 with a maximum spend of $0.50-0.75 for this week.

I am going to also place some wildcard Lotto Trade on the both sides for Monday expiration because we have identical DOJI's this week and one is an SGB so we are in for a bigger move soon...maybe this week!

There is always the Trump card hanging in the balance; which creates a lot of volatile moves making directional bets difficult; therefore, you have to keep placing straddle orders to be in it to win it.

NOTE: if you have a small account, then STICK to the TGIF PAYDAY! strategy for now; and once you have profits built up; then you can expand into Lotto Trades etc.

Crowd bias is PUTS today:

Biggest contract loads were on PUTS:

============================================================================================================

MONDAY 8/19/19 - The third week in a row and no fills yet. It is far better to be patient and catch winners then force trades and absorb losers. Remember, this race is a marathon and takes 6-12 months to get to 2,000 contract loads. Once August is over, and we start on the final quarter of 2019, I expect the markets to continue with volatility; and our current rocky road trip to the land of 7-Figure profitability will continue to be sporadic—this strategy works best when markets are trending; and that typically happens between Jan - Jun; so for now, we just roll with the punches and work our trades as best we can until the winners come...and they WILL BE COMING!

===============================================================================================================================

WEDNESDAY 8/14/19 -

All roads point to more downside moves as many investors who were squeezed in the past couple of days have now been wiped out; and most likely the sting is too much for them to re-engage the rest of this week. With all the volatility the past few days, the IV has increased substantially pumping up the option prices well beyond our buy range for this weeks TGIF PAYDAY! trade.

The closing price today was 283.50 and the closest ITM strike is the 284 PUTS; which is where I am placing my initial orders for $0.20 per contract. If I do not get filled in the first 15 minutes after the open, then I will adjust to a $0.75 MAXIMUM buy price; and if not filled by 7:30 AM, I will cancel the orders and wait out the day to see if the SPY holds onto that SGB zone at 280 and rallies back up the rest of the day.

Even though the bias this week is PUTS, I am NOT expecting any fills because the current price for the 284's is $2.64; and it will take a large rally higher at the open to get anywhere close to our buy range; however, what we do NOT do is chase price with this strategy—if we do not get filled, then we simply wait until next week.

If the SPY does continue lower and bounces off 280 tomorrow, then I will consider buying into the 284 PUTS or a lower strike if I can get filled at $0.20 at the end of the trading day; however, I will cut my contract load in half because a snap back rally large enough to get the 284 PUTS at $0.20 could easily become a losing trade—in addition to that, I am fishing for Lotto Trade Calls if the SPY does make it down to 280 and holds.

My maximum CALL strike will be the 289's or lower, and I am going with a Monday 8/19/19 expiration.

Let's take a look back farther on the spy daily chart for Lotto Trade clues. As you can see from the last SGB zone, the SPY sold off hard and then bounced putting in a new all-time-high; however, when it failed to hold that SGB the drop accelerated creating a multi-day sell off fueled by the FOMC, Trump tweets and China trade war news. Then we get a nice Level 2 Bull 180 that hit T3 before profit taking kicked in...then the The Trump tweet created a short squeeze that failed to take out T3; and today's Bond news cratered the markets over 800 points, but notice the drop stopped at the SGB zone; and has yet to take out the Bull 180 pivot.

Will the SPY be able to hold this SGB zone is anybody's guess, but all I know is if that it fails to, the next likely drop is the SGB zone at 280; which is where I expect a bounce to happen and this is where I will start fishing for the 289 or LOWER CALLS that expire on MONDAY 8/19/19; because if we get the capitulation drop tomorrow; then I want to be in CALLS by Friday just in case big news announcements hit over the weekend and power the markets back up.

====================================================================================================================================

MONDAY 8/12/19 - Nice moves on Thursday for the SPY; however, we did not get filled on Thursday morning, so I cancelled the trades and will wait until this week.

======================================================================================================

WEDNESDAY 8/7/19 -

Here we GROW the compound again!! What a NICE trade we had last week; however, the trade was headed to the losing side and the Trump tweets saved the day reversing the markets and creating the huge sell off the rest of the day.—this is why we DO NOT try to figure out the markets direction or strike prices...we simply trade with the trend, because some weeks, it can be our BEST FRIEND!$$!

This week, the markets have had some massive moves; and volatility with the China currency devaluation over the weekend creating a 1k point drop and then again today, there was more news creating, what appears to be a a potential capitulation day when the DJI dropped over 580 points at the open; and then snapped another "V" bottom rally all day almost closing in the green.

The SPY had another 6 point move from the "V" bottom and closed in the green changing the bias from PUTS to CALLS at the end of the session.

Most likely we will NOT get filled this week since the ATM CALLS are currently at $2.00. If they open even higher and the markets turn lower, then I will ADJUST my strike price LOWER in the afternoon because the momentum is still biased DOWN and I do not want to be more than 3 handles away heading into Friday.

The closing price on the SPY is 288.00, so the closest ITM strike is the 288 CALLS ; however, they are IV pumped up over $2.00; and the only way they get even close to the MAX buy of $0.75; is a big upset in the markets tomorrow; which will reverse this rally today and can easily take out the SGB zone below.

That being said, I am still going to stick to the TGIF PAYDAY! formula and "fish" for the 288 CALLS ; however, I am also going to "fish" on two more strikes because of the Level 3 Bull 180 as a LOTTO TRADE.

288 - MAX 0.75 (TGIF PAYDAY! contract loads)

289 - MAX 0.50 (LOTTO TRADE) 290 - MAX 0.20 (LOTTO TRADE)

If I cannot get filled on any of these strikes at the MAX spend, then I will CANCEL by 7:00 AM PST and see what if available at $0.50 MAX spend or less by the end of trading.

NOTE: Anytime you are buying in at the end of trading on Thursday, you definitely need to buy strikes (ITM) and never spend more than $0.50 per contract and HALF or lower of your TGIF PAYDAY! contract loads; otherwise, just sit the week out and wait for the next setup.

Another thing I want to point out was when I was watching the SPY DAILY CHART in the last hour of trading today; I noticed the candle was a HOLLOW red until the end of the day; and then it turned GREEN by the close of trading. This seemed a little strange to me because a RED candle is usually SOLD RED on my charts as it rises, so I am thinking there was some strong selling pressure going into the close; and a possible "set up" to sucker LONG players in; therefore, I am going to buy some wild card PUTS for Monday expiration just in case news hits again and we get another slam down Monday—the 282 PUTS which were the SGB bottom today.

Today's large contract volume:

Crows Bias = BEARISH

==================================================================================================================================== WEDNESDAY 7/31/19 -

Rates cut only 0.25% vs. 0.50% expectations; and when chairman Powell started the news conference; the comments he made caused a bit of a nose dive in the markets; and then after it was all over, cooler heads prevailed and the markets rallied back well off the lows—now we have to wait and see if we get a full recovery or completed meltdown into Friday.

The week has been RED all three days, so the bias is PUTS for this weeks TGIF PAYDAY! trade; however, since we have a very disruptive news event, counter trend moves are a strong possibility.

My plan is to stick with the strategy parameters and work the 297.50 PUTS for $0.20 at the open; however, if they open higher tomorrow than the close tonigh, I will NOT spend any more than $0.50 max OR I will adjust my strike HIGHER ONLY if I can get filled for $0.50.

If I do get filled, then, at the end of the day, I will be looking at some Lotto Trade CALLS on the 300-302 strikes for Monday 8/5/19 expiration to hedge my PUTS.

All signals say we are going DOWN from here, so we pay close attention to the SGB zone and trade with those pivot points.

===================================================================================================================