|

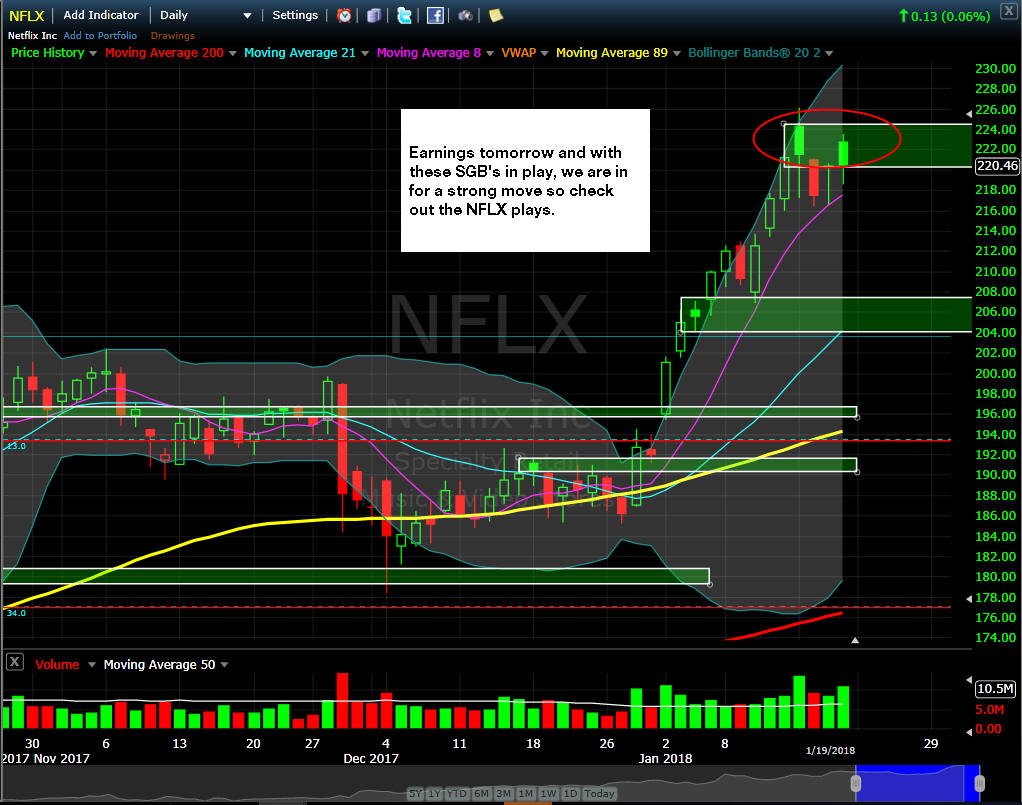

SGB Chart Watch Below are charts of stocks I am watching for SGB trading opportunities.

Last Updated 10/13/19 3:00 PM PST

============================================================================ Updated 5/12/19

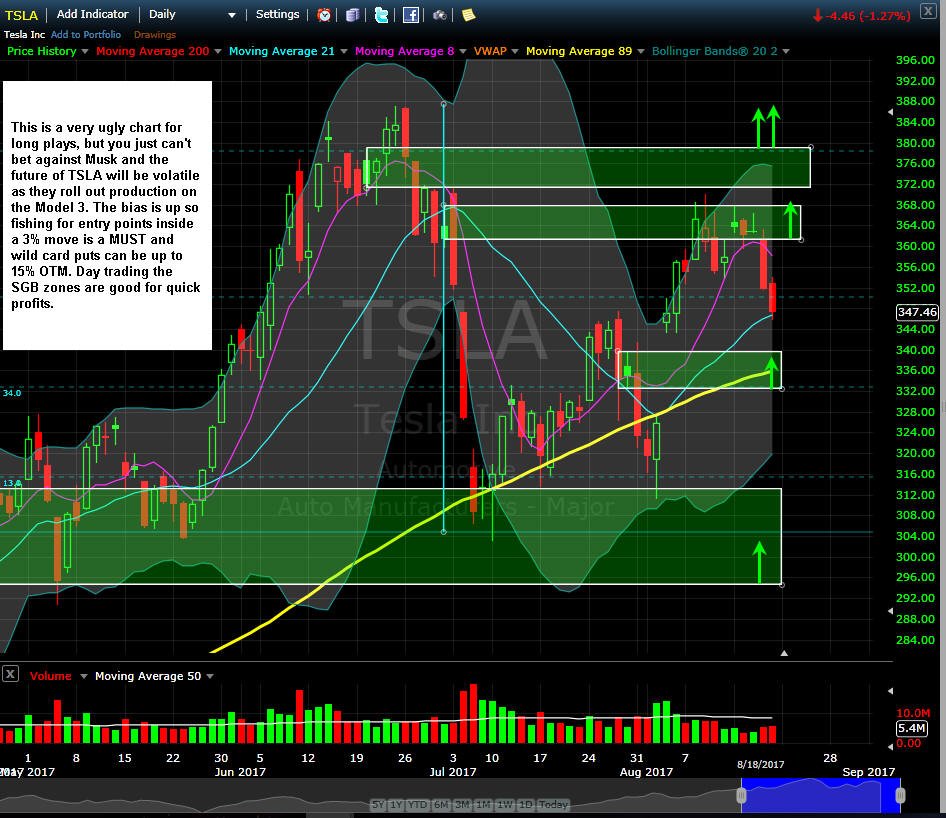

TSLA is always unpredictable but the sentiment seems to be shifting to more bearish bias and if these last two DOJI's are the signal, then short now, cover at 245 and long strategies over 245.

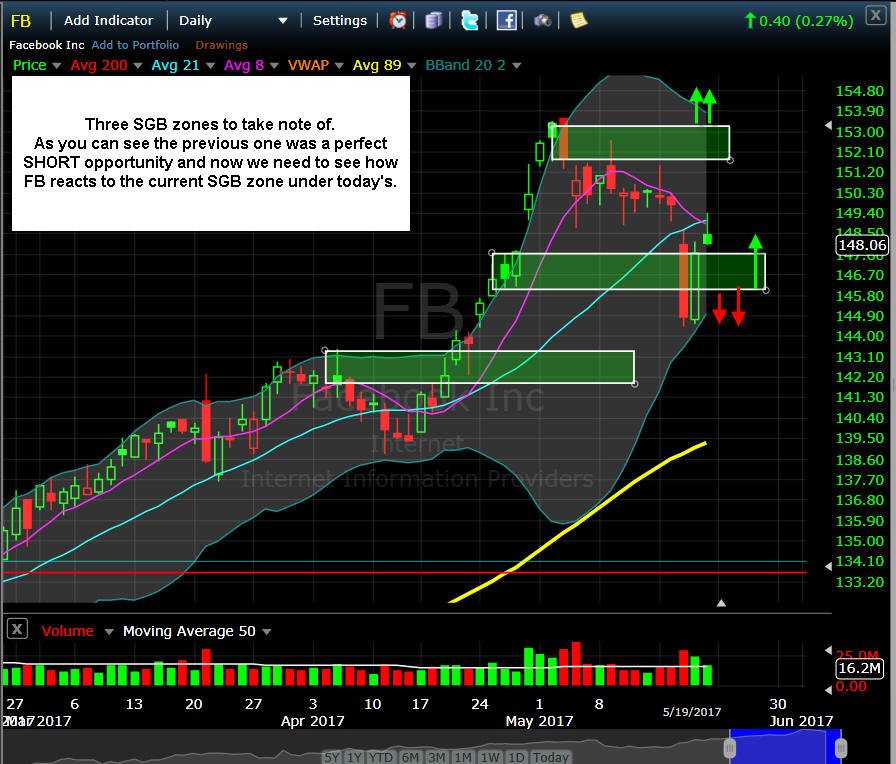

With continued regulatory issues pending, FB is likely to languish a while and slip lower towards the previous SGB zone that kept a lid on the stock for months. Until the stock can take out the last SGB zone, the bias is PUTS/SHORT on any bounce to 192.50

=====================================================================

Updated 4/11/19

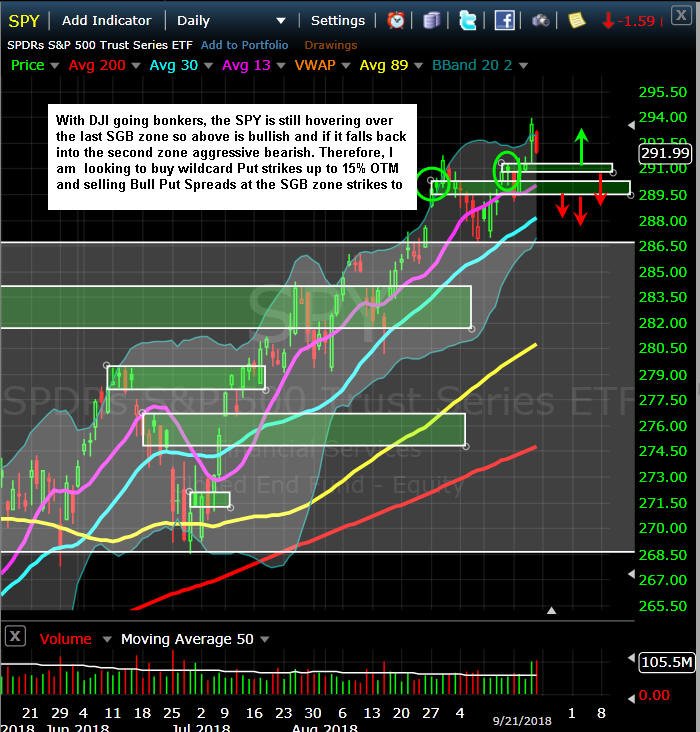

SPY tacking on two more SGB's since my last comments indicating the markets are ramping up for a very large move. Most likely from the coming China trade deal so expect some wild moves and that is why I am continually in a straddle week-to-week. You can now use the SGB zones below as your strike price targets too.

=====================================================================

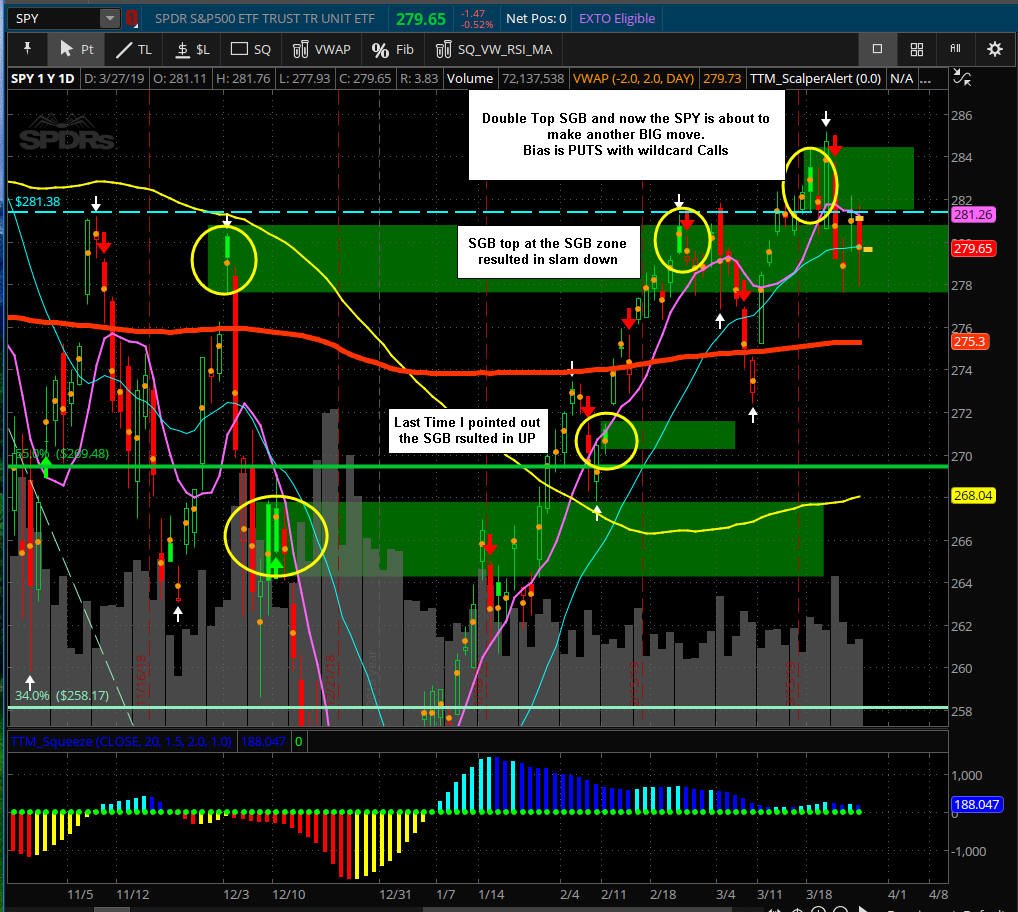

Updated 3/27/19

Month end SGB's has the SPY ready for a measured move. Current Bias is PUTS until the SPY clears 284 so I am buying PUTS for this week and fishing CALLS for next week then on Friday I will buy some wildcard PUTS for next week to.

=====================================================================

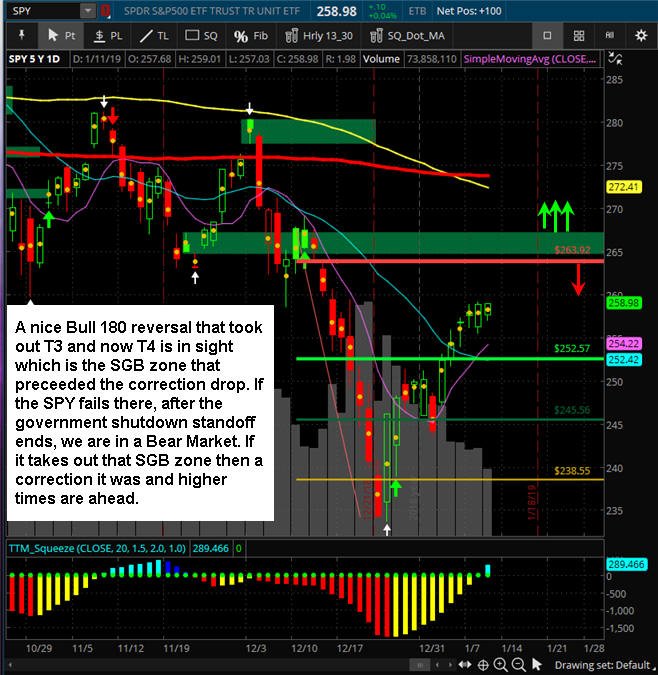

Updated 1/23/19

======================================================================

Updated 1/21/19

=======================================================================

========================================================================

Below is a batch of stocks I watch and have pointed out SGB's for you to look at on their DAILY charts.

=============================================================================

=======================================================================

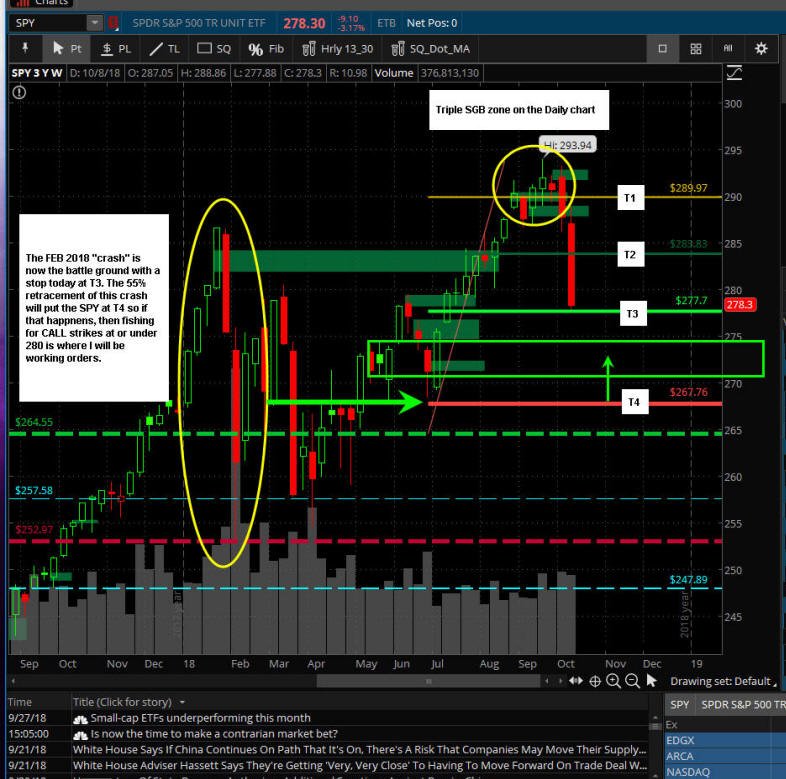

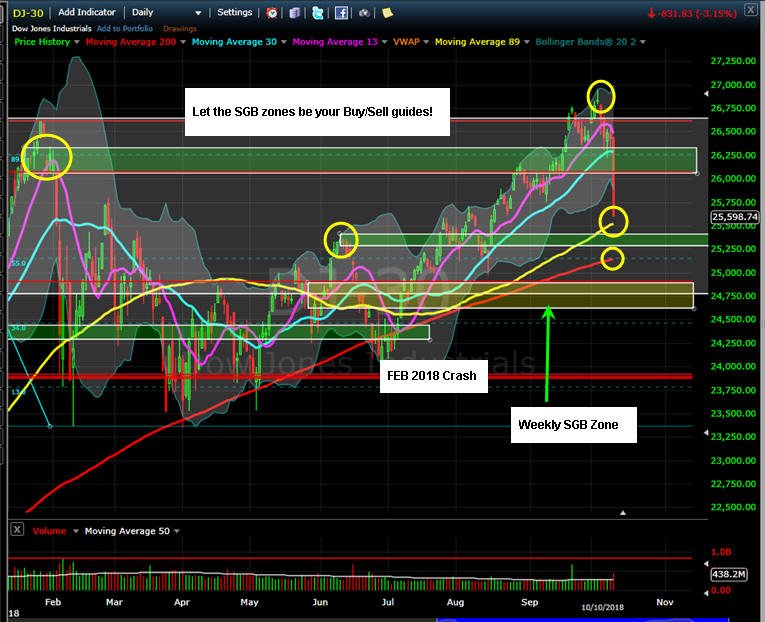

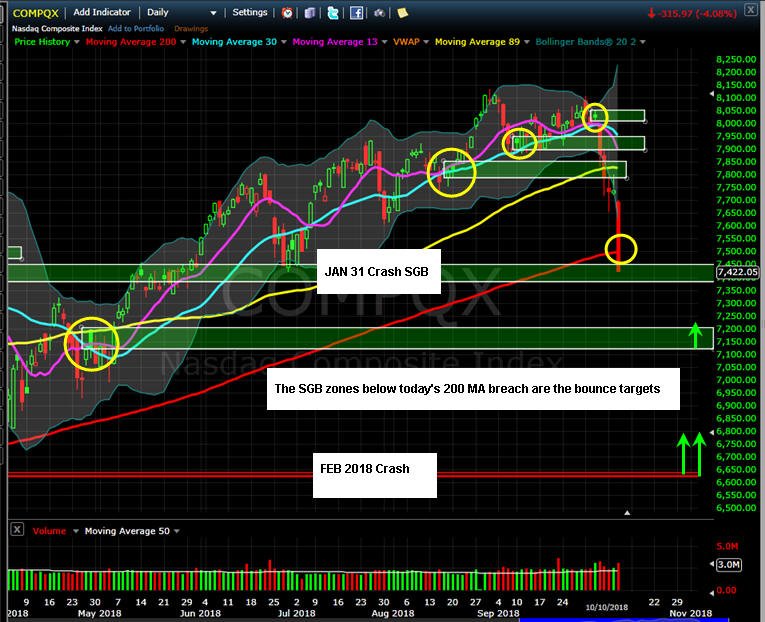

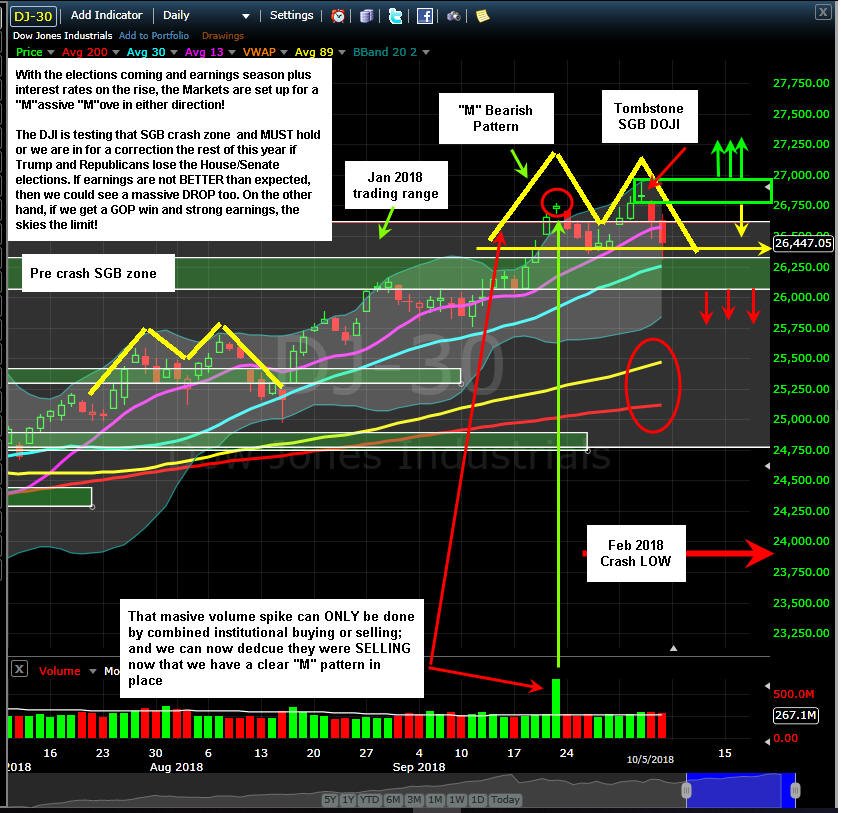

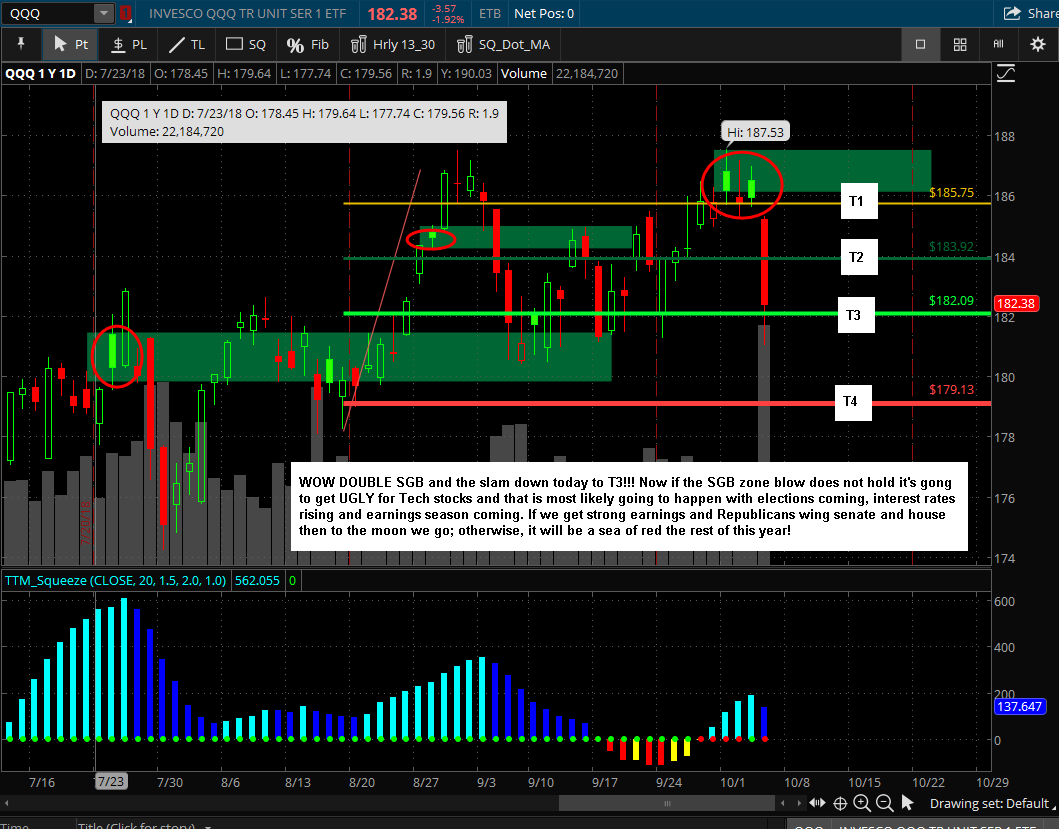

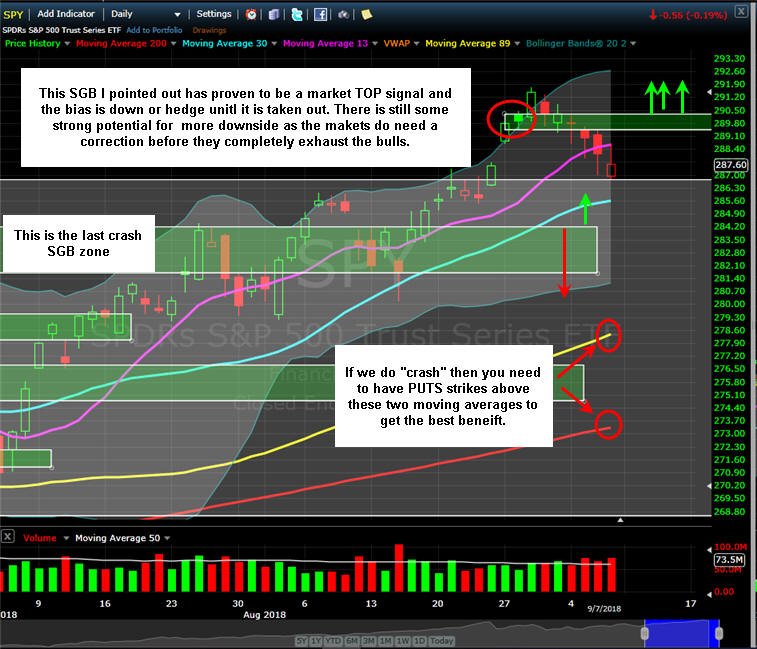

The Markets will most likely correct 10% from the bubble high on the SPY since there was a triple SGB zone that I pointed out last week.

That would put the SPY at $264.55 and the Feb “crash” low was $252.97; which the SPY has now entered that zone.

Things can continue to get a whole lot worse as we are coming into a very NASTY election; and when the markets and/or stocks correct around 10%; then margin calls kick in and we get another “crash” type day and this time, if it happens, that "crash" could be even BIGGER than the last one!

If you are not already in PUTS, then the IV is too pumped up to get a huge Lotto Trade started, but there is still room for 5-10x opportunities with next weeks expiration dates...you just need to stick to the T-Levels to have best chances.

The Nasdaq breached the 200MA today and did not even show a bounce so the next drop could be HUGE; so time to start fishing for CALLS at strikes up to 15% -20% OTM with $0.10 orders because we could get that morning slam blowout and then a massive BTFD scenario again on your "go to" stocks. If you are not in SPY or QQQ Puts as an account hedge, then you missed this boat but you can still do some fishing on a bounce back if the markets do not take out 55% of this weeks range.

================================================================================

It all looks like doomsday is here right? Well if you step back from the tree and see the forest, then you may just get a different perspective and that is where the MONTHLY charts may come to the rescue.

==========================================================================

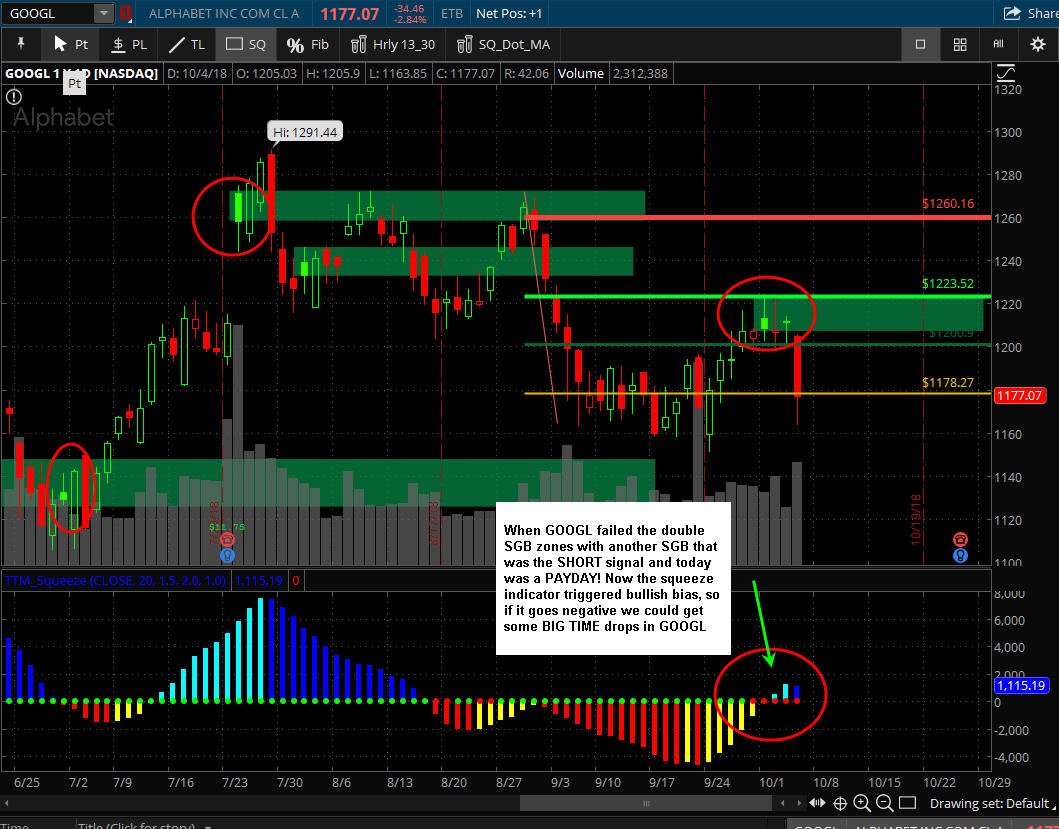

Last Updated 10/4/18 3:00 PM PST

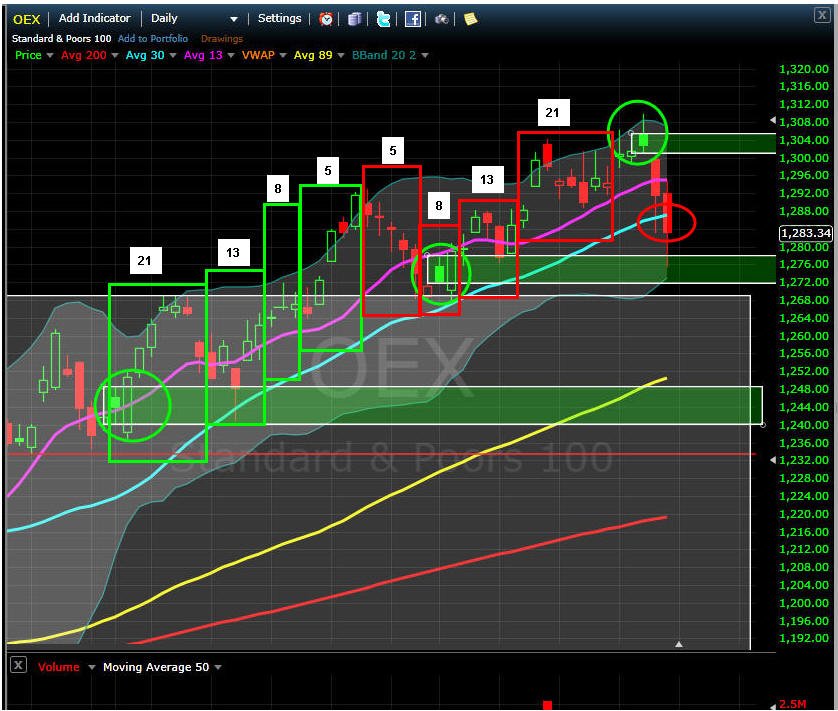

More confirmation the SGB is a strong SHORT signal when they appear at tops of ranges or momentum, and LONG bias when they appear at support.

If you were/are keeping some PUTS in play as I suggested a couple of weeks ago, then this week may turn into a very nice PAYDAY!

==========================================================

Last Updated 9/23/18 5:00 PM PST

===========================================================

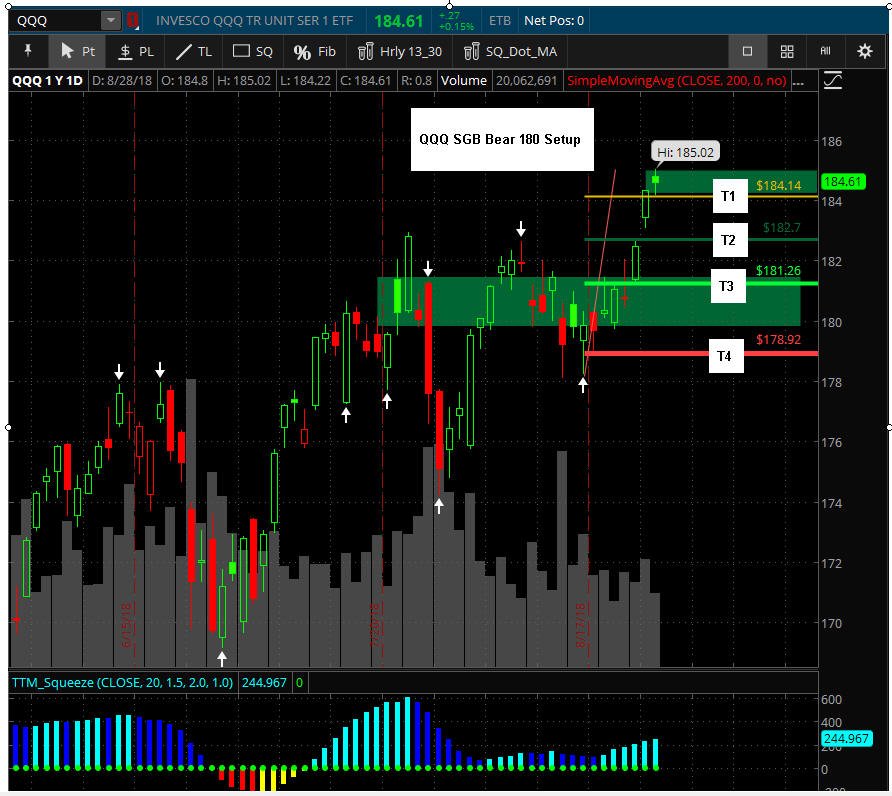

============================================================================ Last Updated 8/28/18 1:00 PM PST

I am seeing SGB Bear 180 setups in these indexes, so it is time to start fishing for PUTS up to 10% OTM or just above T3 for this week and into next weeks expiration.

If you are trading your "go to" stocks then start looking/fishing for some PUTS up to 15% OTM there too.

If the options are not $0.20 or lower, place fishing orders or consider spreads to get cheaper entry prices; however, the profits are fixed at the value of the spreads.

=============================================================

Last Updated 8/19/18 11:00 PM PST

============================================================= Last Updated 8/12/18 3:00 PM PST

========================================================================

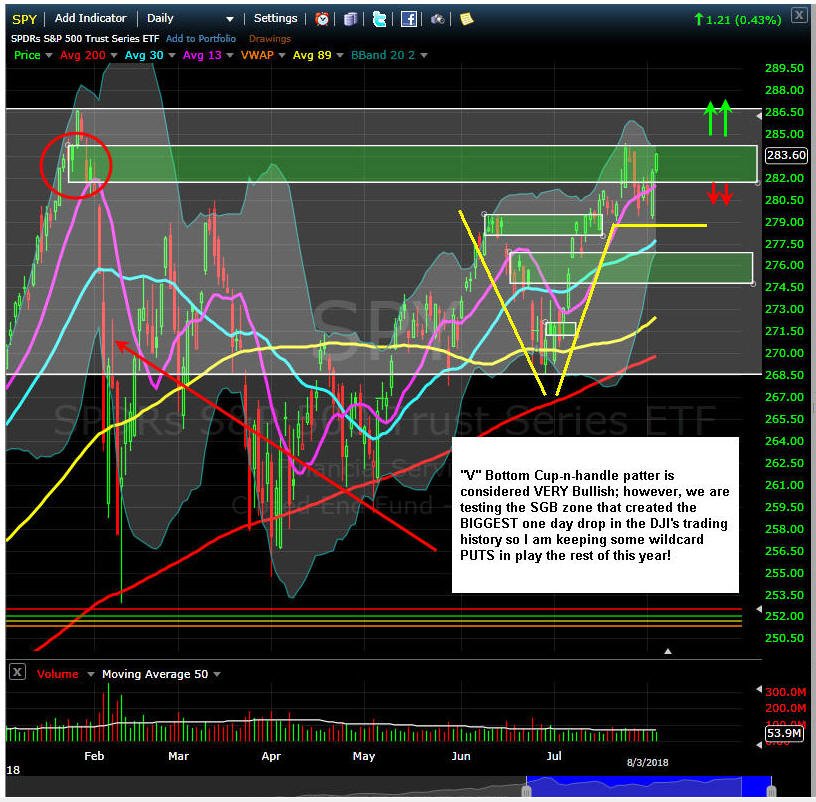

Last Updated 8/3/18 7:00 PM PST

=================================================================================================================================================

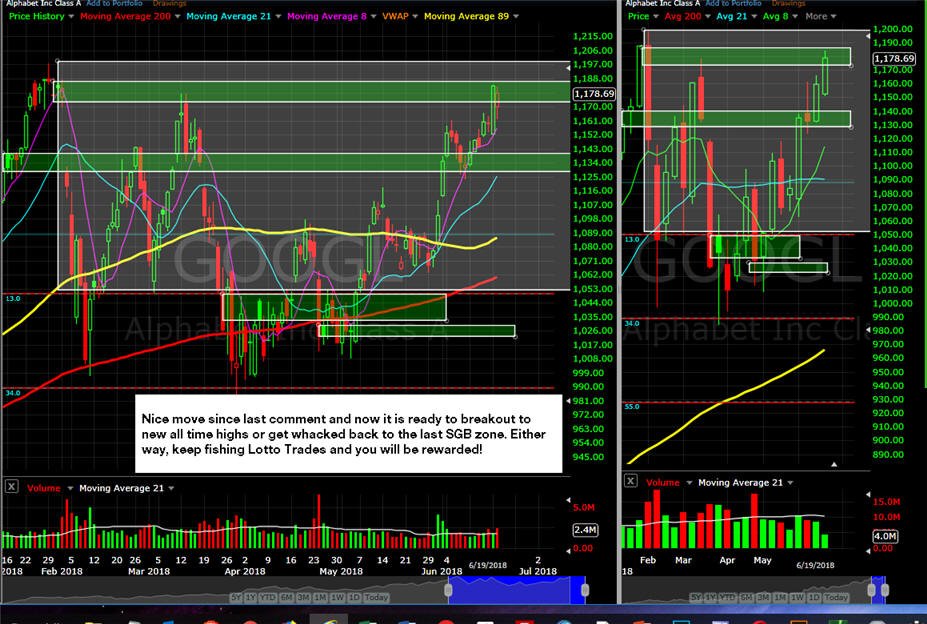

Last Updated 6/19/18 7:00 PM PST

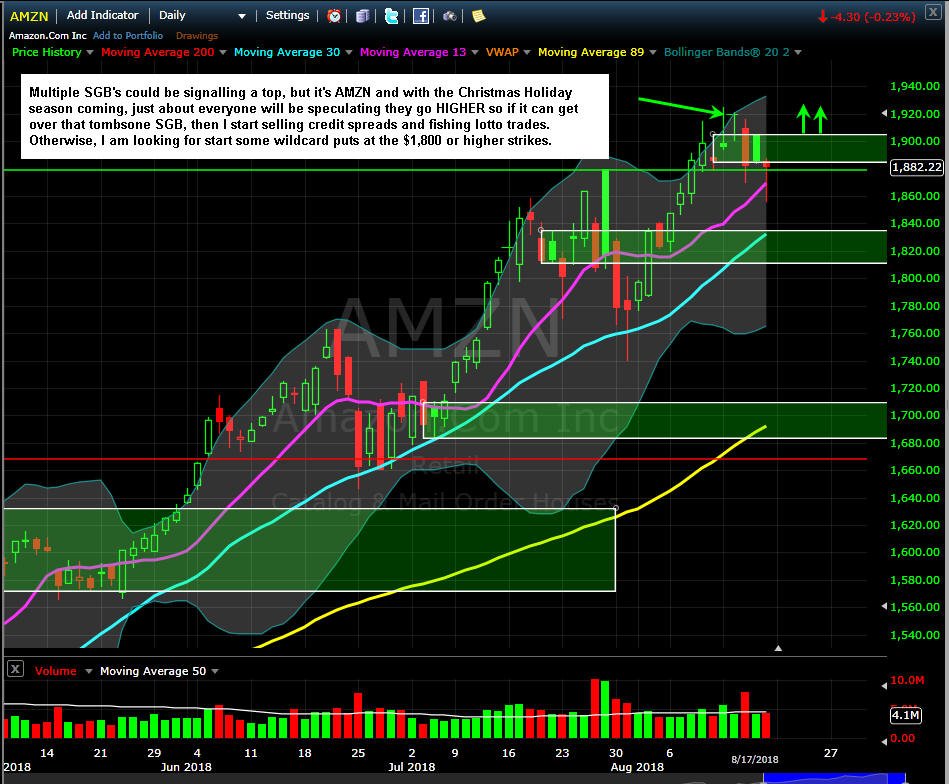

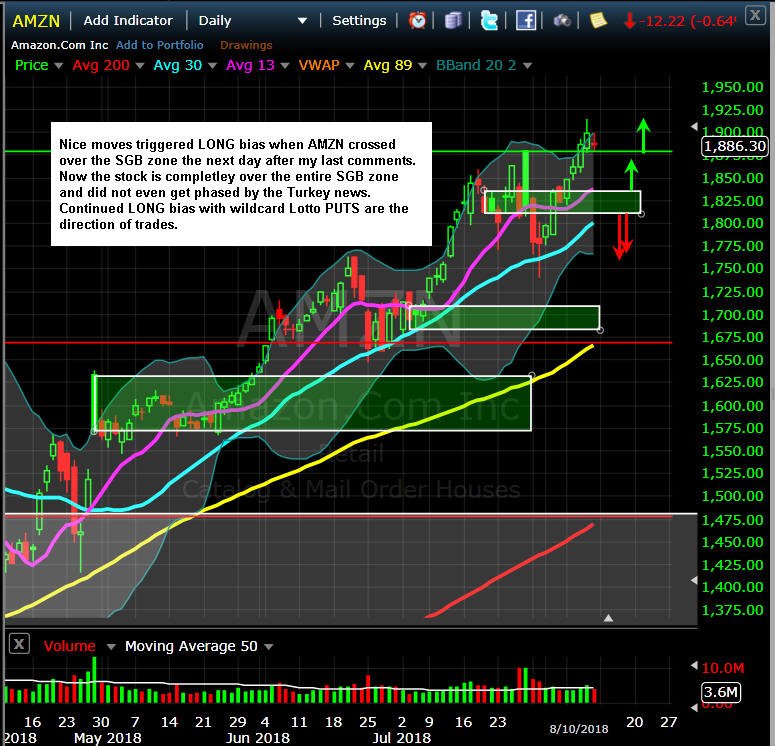

Another new all time high and what a ride this stock has been for Lotto Trades. If you have applied the formula every week then you got a massive reward since my last comments and it will continue to print money for you! Be sure to follow along and ALWAYS apply my Lotto Trade formula to your own trades whether I post them or not.

======================================================================

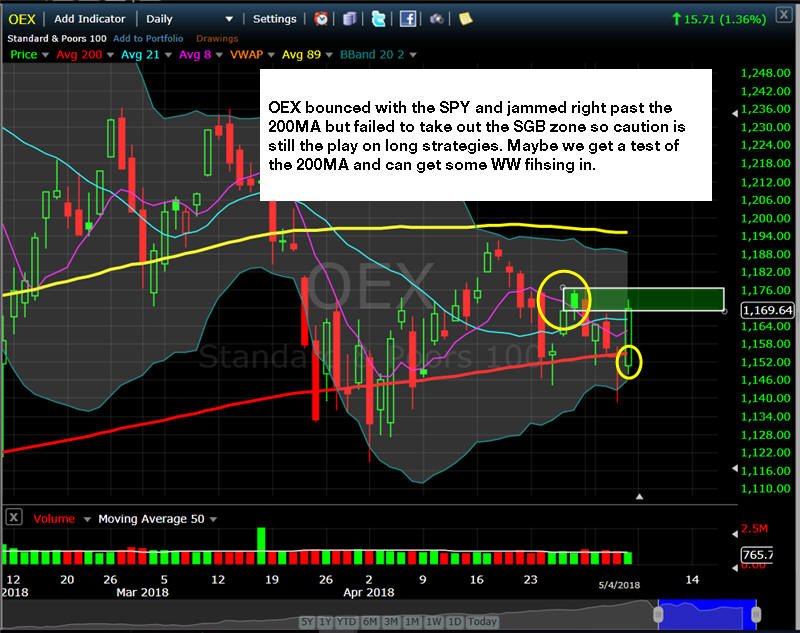

Updated 5/6/18

============================================================================================

Updated: 4/29/18

===============================================================================

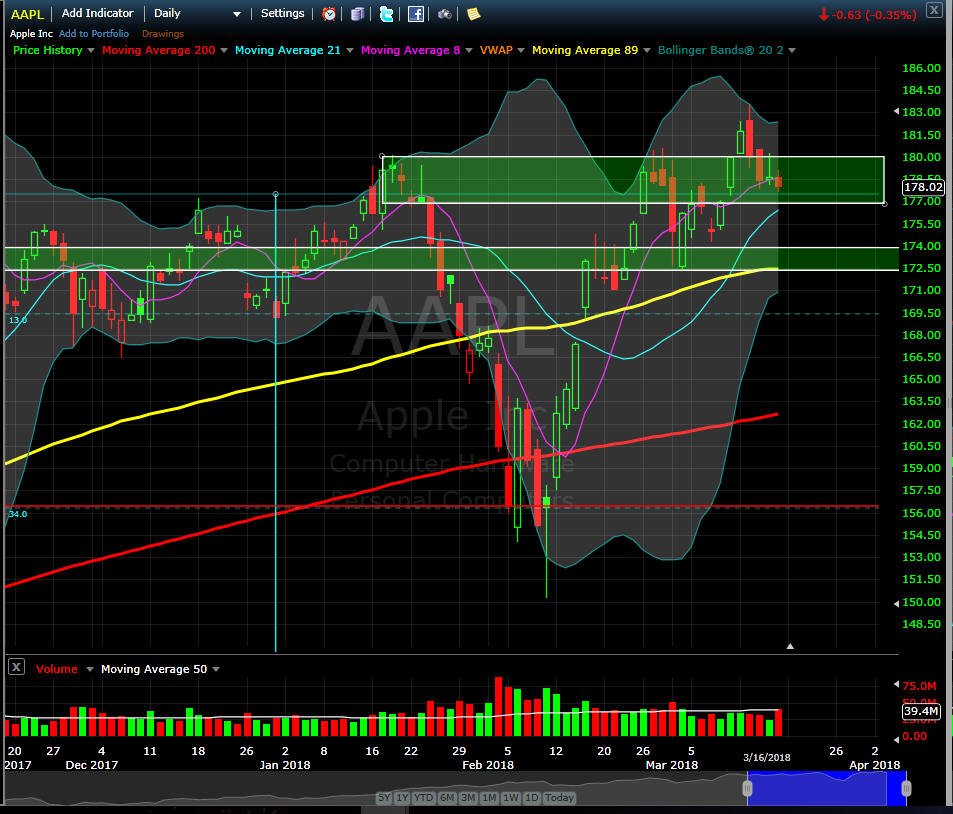

Updated: 3/18/18

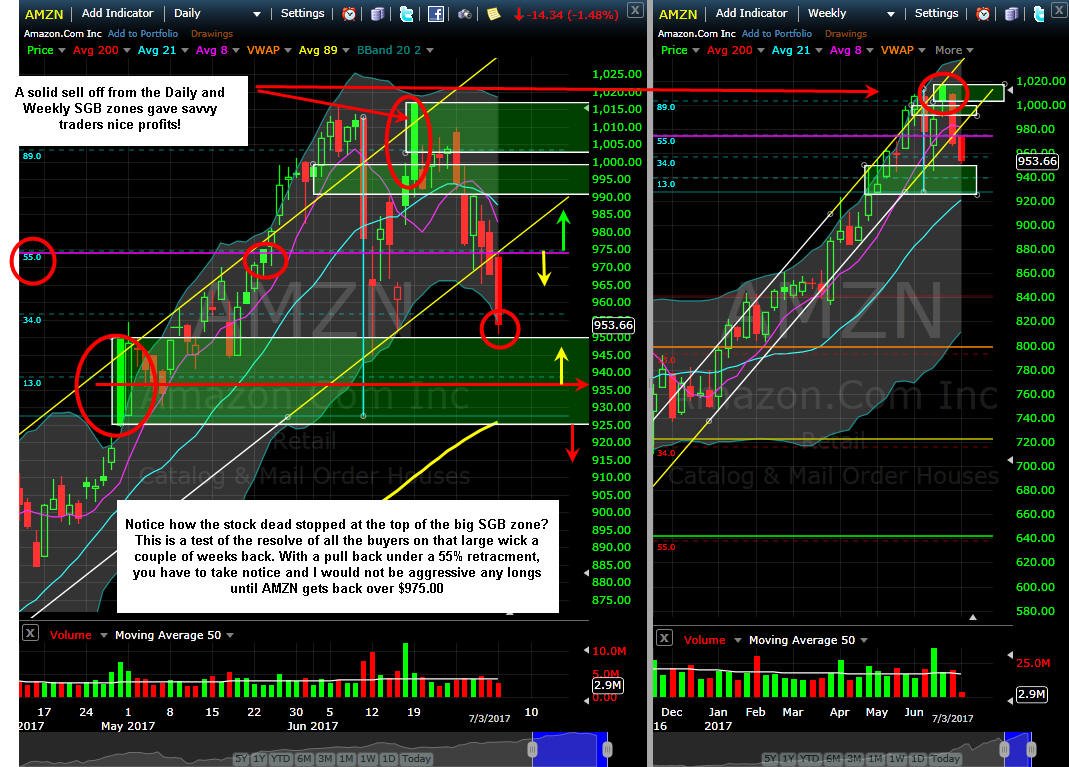

AMZN is trading under a small SGB, so I am looking at that closely this week and will lay orders for a potential move in both directions.

NFLX is consolidating and digesting the news jabs the stock is overvalued and expected to see sub $300 vs. higher prices according to short speculator Citron Research. If you believe that, puts down to $290 are the strike zone and fishing calls up to $330 and under if the stocks starts to drop on Mon/Tue.

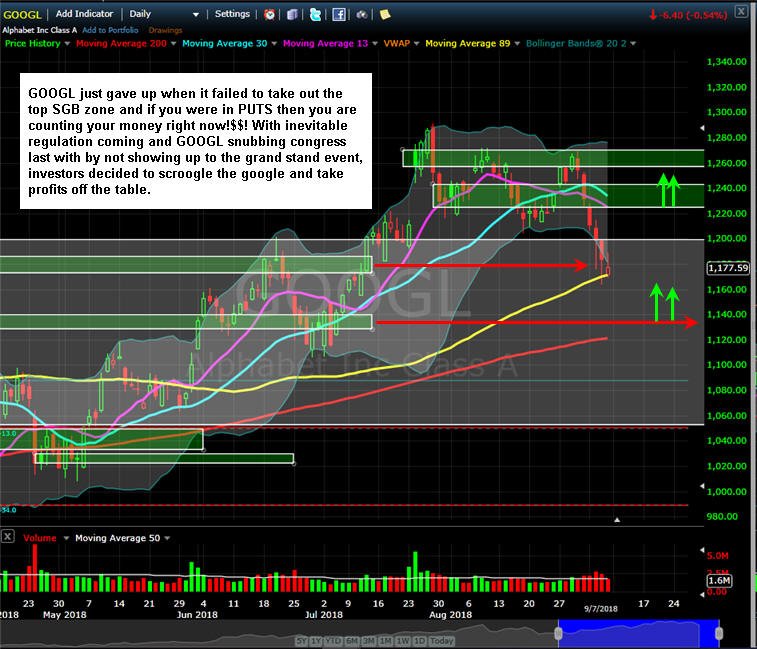

GOOGL is testing a SGB zone, so a move back over $1,155.00 is a good time to try some $1,200 calls; otherwise a market wide drop could take this stock down to the lower SGB zone at $1,057.00, so I will be looking at some put strikes above that.

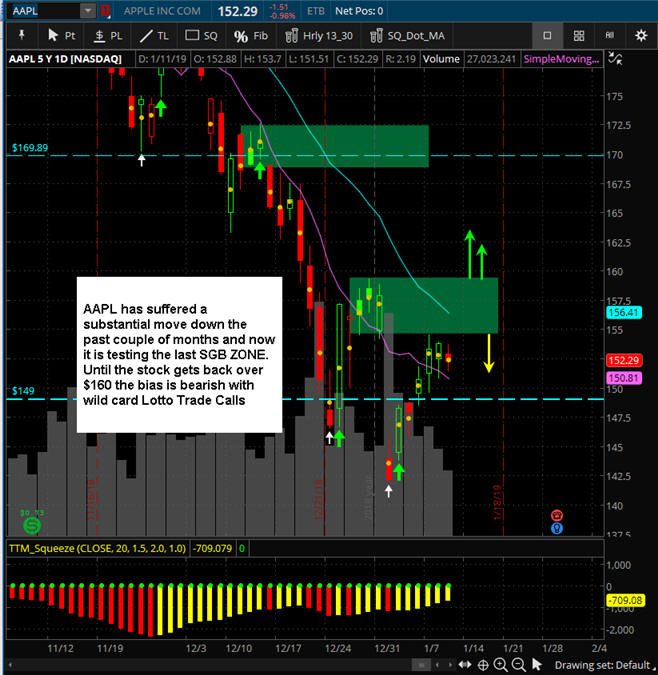

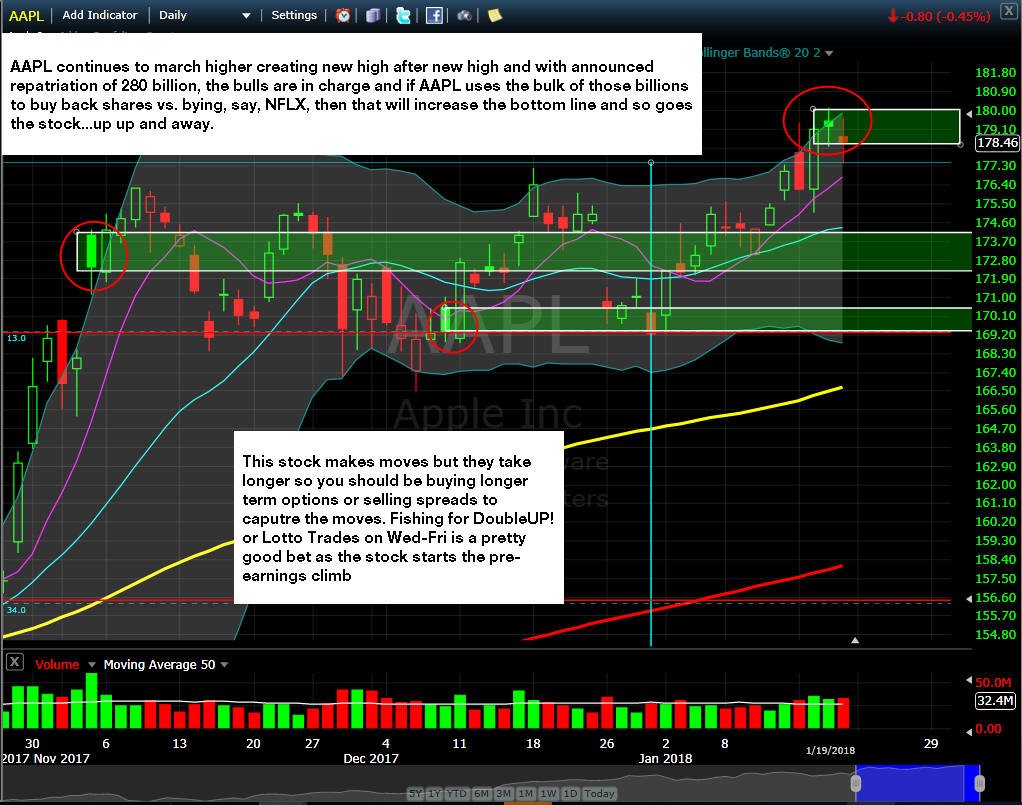

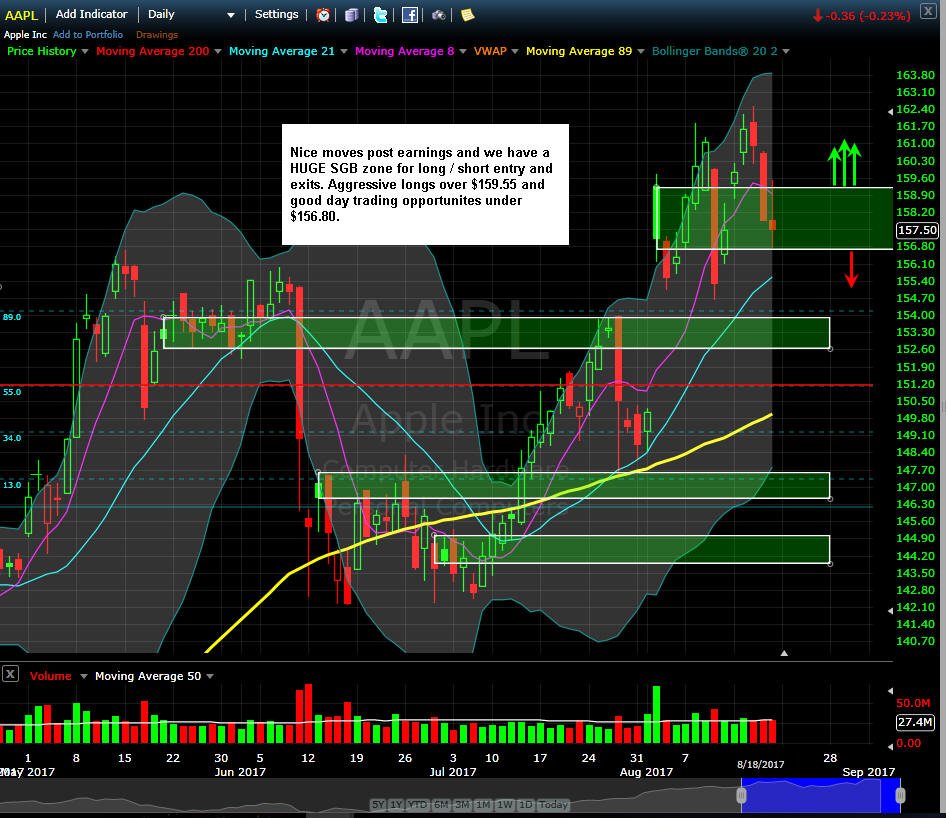

AAPL is testing all time highs at the previous SGB DOJI top back on 1/18/18. I am looking to fish calls over $180 and puts under $177.

FB has been very choppy with a lot larger down days than up days which signals distribution biases with large investors. The SGB zones are at $187 for longs and $180 for shorts, so for now, this stock is trading in limbo and I would be fishing strikesinside a 10% move and/or at SGB zones.

NVDA put in two DOJI SGB's testing new all time highs, so a big move is immanent soon. I am looking to fish for put strikes inside a 15% move and calls inside a 10% move.

===========================================================================================================

Updated: 1/21/18

===========================================================================================================

Updated: 8/20/17

===============================================================================================

Updated: 7/23/17

================================================================================================================== Updated: 7/3/17

=============================================================================================================

Updated: 6/25/17

=========================================================================================================================================================

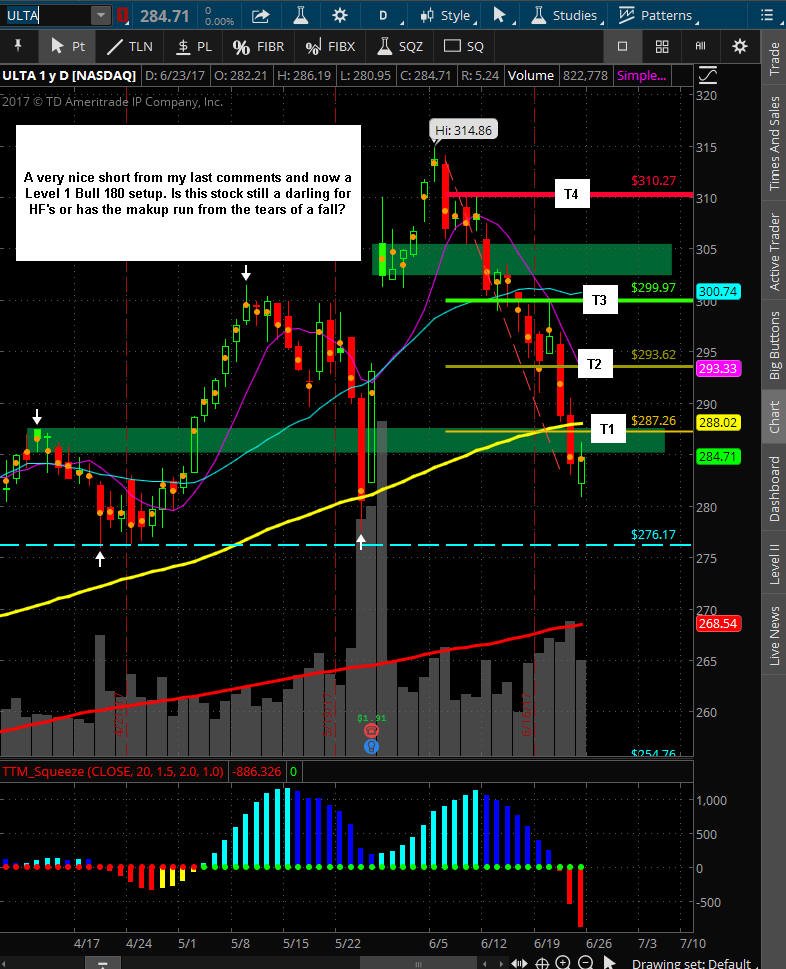

Updated: 6/3/17

==============================================================================================================================

Posted: 5/18/19

|

|

|

|

© 1999-2018 OptionRadio.com All Rights Reserved.

Reproduction without permission is prohibited.

U.S. Government Required Disclaimer - No profitability nor performance claims of any kind are being made on this entire website, email distributions or recorded content. All information provided herein is for educational purposes only and should not be construed as investment advice. Site visitors are advised that trading is a high-risk, speculative activity and that generally expected customer results are that all traders will incur trading losses, regardless of the training they may receive and will not become profitable. You accept all liability resulting from your trading decisions; we assume no responsibilities for your trading results. All sales are final for all products and services sold and no refunds are offered. We are not an investment advisory service, nor a registered investment advisor. No individual advice nor trading management services of any kind are provided, therefore no member nor subscriber should assume that their participation in the services provided herein serves, nor is suitable as, a substitute for ongoing individual personalized investment advice from an investment professional chosen by the member/subscriber. Nothing in our website shall be deemed a solicitation or an offer to buy nor sell stocks, currencies, futures, options or any other instrument. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on our site. Also, the past performance of any trading methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY, SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Site visitors, email subscribers and customers hereby agree to all terms found in our complete disclaimer, terms of use and privacy policy pages. Every visitor to this site, and subscriber (or prospective subscriber or customer) acknowledges and accepts the limitations of the services provided, and agrees, as a condition precedent to his/her/its access to our sites, to release and hold harmless OptionRadio, its officers, directors, owners, employees and agents from any and all liability of any kind (including but not limited to his/her viewing of this sites' content, emails, subscription to services and/or purchase of any trader training product or service herein). Trade with discipline and you will have smarter, winning trades. |