Weekly Lotto Trade Commentary - AAPL

These are the results from trades suggested on our "Current Plays" list.

Note: they are suggested entry and exit points! disclaimer Profits Up!!

----------------------------------------------------------------------------------------------------------------------------------------

LAST UPDATE: 10/26/12 - Closed

----------------------------------------------------------------------------------------------------------------------------------------

Also see Play 19 for more commentary

|

Play Recommendations: Play 20 (closed)

|

|

|

Lotto Weekly Options:

OctWk4 - 670 C (Expired) OctWk4 - Put 585 (Expired)

OctWk4 - Call 600 (Closed)OctWk4 - Call 590 (Closed)

OctWk4 - Put 590 (Closed) OctWk4 - Put 605 (Closed) OctWk4 - Put 630 (Closed) OctWk4 - Put 615 (Closed)

Stock: (scalping)

|

Monthly Options:

Nov (pending) |

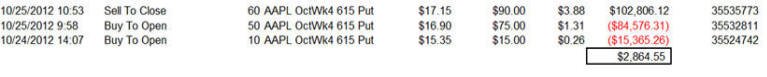

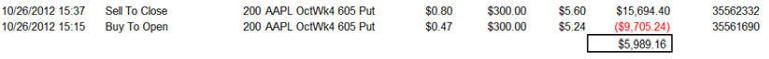

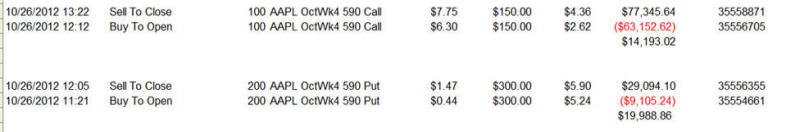

My final trades

| 10/26/12 - What a day of volatility

with AAPL and the weekly options. If you were quick on the trigger and

watching a 30 minute chart, then you saw the nice drop and perfect Bull

180 reversal at 12:30! The calls and DOTM puts were a bust thanks to total manipulation of the stock yesterday in after hours. Some of the put plays did well, but the real opportunity today was the Bull 180 at noon and the 600 Calls...WOW. I am going to have to start looking for expiration day long shot trades. I have seen too many in the past few weeks to not start trading them. The moves are more than enough to pay for the loses.

Look at what the OctWk4 600 Calls did on this Bull 180 - WOW.

Sold these way too early

Here are what the options plays did:

Profits Up!

The donFranko

========================================================================================== Some of my plays heading into earnings:

The weekly Calls just got real cheap today!

10/25/12- O.M.G what the heck is happing with the stock markets? What a pile of crap I have witnessed these past two weeks of trading. First it was GOOG pre-release (I am convinced was planned) that botched up trade opportunities if you were waiting until the end of trading to put on your positions. But even if you did, the move was totally controlled and since they stopped the trading for hours, market makers had plenty of time to get all their orders matched up and computers programmed to arbitrage the panic selling thereby propping up what should have been a freaking melt-down! Now comes my long anticipated trade on AAPL that I KNOW I WOULD HAVE BANKED but noooooooooo, this stock misses across the board, but trading was immediately stopped so they could, once again, set up arbitrage and put the screws to us put buyers. Come tomorrow, I am more convinced the stock will languish not dropping anywhere near the 10% projections I had and it SHOULD HAVE! Well, its looking like I have to just hunt for a lotto trade in the morning hopping for a sell off to kick in or a big rally to come. I do not think this stock will sell of anywhere near a 10% move, but you never know until the days trading is closed. With the GOOG bust and now that AAPL manipulation, my two most anticipated earnings Lotto Plays were a bust!! Not to worry, there will continue to be plenty of trading opportunities to make up for what should have been a massive winning trade.

Profits Up!

The donFranko

=========================================================================================== 10/24/12 - Tomorrow is the BIG day for AAPL. I am positioned on both sides and so all I need a 10% or greater move and I am ready to catch a whale. I will scalp some more stock tomorrow and add to my positions before the close.

Options volume picked up on the call side and the upside resistance for November is $700.

Weekly Call volume was strong around $630-$650

Weekly Put volume strong at the $600 - $620.

Profits Up!

The donFranko ===============================================================================================

10/23/12 - Dah-dah-dah-dahhhh! And the winner is...missing in action...huh? The news conference was a smashing un-success to Apple's stock price today—unless you were shorting it!!. They announced several new products for devoted Apple dorks to gobble up including a new iPad, iMac, Mac Book Pro and the much anticipated iPad-mini with a retail price starting at $329.00. The price was expected to be under $300, but you know that AAPL always charges a premium for their products because, well, they're Apple dang-it!— and they always get away with a higher price. Even though this will translate into MORE profits down the road, the first reaction to the news was the price is too close to the iPad and might "cannibalize" sales; however, that was not the news that started a panic driving the stock rapidly down $15 in 10 minutes. That news was the announcement that Apple has sold 100 million plus iPads since their debut in Apirl of 2010. This number (although its not official yet until Thursday) equates to a potential revenue miss for this quarter and so the selling began. The stock was quickly snapped back up, but that did not hold and they slammed it down closing just above the low of the day. The line in the sand is going to be $610.00 tomorrow and when when the actual numbers are released on Thursday and if they surprise, I believe we stand a very good chance of getting a massive rally since the stock has been beaten down $100 from its all time high. On the other hand, if the numbers are indeed short of expectations, this stock could easily fall more than 10% on Friday.

The charts below are all looking like a big drop is coming:

The Tombstone/Gravestone Doji is typically bearish, but it's more reliable when it happens at the top of an over bought rally. When it's at the bottom of a sell-off, it can be the signal that a reversal to the upside is about to begin. So, if they beat, up we go and if they miss look out below. Here is a good explanation of this candlestick pattern.

Option action today: (my trades are posted above.)

Profits Up!

The donFranko ============================================================================================== 10/22/12 - Ok the markets polished up the AAPL and hope to be taking it to school for an October treat. Let's hope the earnings release will be a blowout so we do not get schooled for getting long this stock. As always on a stock like this you have to straddle it and based on the results with earnings so far, I prefer to overweight puts but with AAPL anything can and will happen. Plus, with all the selling pressure it has suffered the past couple of weeks, I think all the sellers are potentially cleared out. What concerns me a little bit is the result of the daily chart. I was day trading AAPL today because the market makers are committing criminal robbery on the options premiums if you ask me. The risk reward is just to high for me to play the options until Thursday. I am pretty confident there won't be a disaster early release like we had with GOOG but I think I will still take my positions at the open vs. the end of the day. The big news conference will be tomorrow, and this may be the spark that ignites a massive fire again on AAPL. The weekly OTM call options are getting very expensive

Ok, here is what I see in the charts: AAPL put in a very strong day erasing all of Friday's selling, If the news conference is not well received, you can expect selling to resume.

Profits Up!

The donFranko

============================================================================================ 10/19/12 - Oh what a mess it was today. The markets took a turn for the worse right out of the gate. The botched up news from GOOG really put a damper on everything, and AAPL was sold hard all day long...it even dropped more than GOOG on the day. If you went for Puts you were handsomely rewarded. This drop has the potential to make an earnings surprise the biggest success I have seen to date with my Lotto strategy. Next Tuesday is the big news conference where AAPL will announce the release of the new iPad Mini and, according to them, "a little more" news release. Thursday is the big day, and AAPL really needs to knock it out of the park after all the disappointing results we have had so far in the Tech world. This stock is still the most loved stock out there, so with this much of a discount off the all time highs, tens of thousands of investors will be looking for their piece of the Apple Pie. You have to play a straddle on this one unless you just want to gamble; however, the bummer to this round is the cost of the options will be VERY expensive since we start a new month next week. Even the weekly options will be packed with premium now that AAPL has moved so much in a short period of time. Because of the news event happening two days before earnings, I will have to enter early when AAPL opens up for trading on Monday, and I will start my first position in the direction the stock moves. For my Lotto Play I will go with call options that are no further OTM than 10% of AAPL's close on Wed. As of today that would be the $670's and currently they are quite expensive at $2.30. If AAPL does start the week off higher, this will only pump more premium into all the calls. On the Put side, I will pick up 10-15% OTM and also get some Dec puts approximately 20-25%% OTM Dec 470's because the first major push higher was at $450 back in Feb. Now of AAPL were to give up all of its stellar 2012 gains by the end of the year then that would bring the stock back down to $410.00

Here are the charts for Friday:

Daily Chart

Next week we could get a nice Bull 180 setup. If AAPL opens up or gaps up and holds it after 7am, then I will start a call play, get long the stock with a strict stop at Friday's close. If the news event is well received, the stock WILL GO UP. If the earnings are a crusher, look out below; however, if they are a blow out, I expect a potential new all-time-high.

MONTHLY CHART

Options Tacking: Interesting that the Calls actually picked up open interest today.

Profits Up!

The donFranko

============================================================================================== 10/18/12 - What cooked the goosel is good for the Appler. With the earnings BIG miss on GOOG, AAPL was swinging all over the place during the GOOG meltdown. The news put the brakes on AAPL all day, but it managed a close at the 21MA on the weekly chart; however, it did close below my Fib $634.00. This stock needs to get back over this price tomorrow and close at the top of its range too. With that news conference coming, I suspect the stock will languish around unless GOOG just bucks up with buyers in the morning. Unfortunately, we did not get the massive winner I was hoping for with GOOG, but I did make some nice profits and paid for all my other plays. Next week will be Apples turn at the chopping block, so let's hope they surprise, announce something huge like a split and the markets are racing up for the final week before the Presidential elections.

The options open interest has been pulling back on both sides this week.

Profits Up!

The donFranko

=============================================================================================== 10/17/12 - No follow through today, but I am sure that is due more to profit taking and GOOG earnings tomorrow. All the buyers went to GOOG and bid up the price while AAPL pulled back. If GOOG blows out, then AAPL should rise with it as investors anticipate the same will happen for AAPL next week. With the news conference coming, there could be some wait-and-see over the next couple of days. I am hopping that GOOG and CMG both pay off so I can roll up those profits into the AAPL play and finish out October with a Halloween treat bag full of cash!!—no tricks allowed!

Options: Call open interest still beating out Put but puts have been climbing while calls have been pretty flat.

Profits Up!

The donFranko ============================================================================================= 10/16/12 - Apple looks to have shaken off the selling and the race is on for higher ground! Apple announced a media invite for next week on 10/23/12. This ignited the stock today with a solid +$15.00 gain on good volume. I would have rather seen the volume well above average, but the buying was good and pronounced at every pull back on the 5 minute chart. What really got the stock going was a quote saying, "We've got a little more to show you." This is the kind of news that can really get this stock going and with earnings coming out next Thursday, we could have a massive explosion to the upside if that little more were say, a stock split! I will have to pick up a call on Monday just in case the announcement is spectacular and launches the stock ahead of earnings.

Options are picking up a lot of activity today

Profits Up!

The donFranko

============================================================================================ 10/15/12 - So far, $623.55 is holding it's ground as a my suspected bottom signal. AAPL bounced all around VWAP today, but started the day off up only to be sold off most of the day. I did a lot of trades today looking for a real bias and it appears up from here may be the direction heading into the rest of the trading week. So long as $623.55 holds, I will stay long. Notice how the stock closed today at $634.76? 34 is a Fibonacci number! I know, I may be trying to make something out of it, but I just watch close with a stock closes or pivots and a Fib number is involved.

Here are what the options are up to. The OTM Nov calls are picking up more and more open interest.

Profits Up!

The donFranko

|