LOTTO Plays - 2012

These are the results from trades suggested on our "Current Plays" list.

Note: they are suggested entry and exit points! disclaimer Profits Up!!

----------------------------------------------------------------------------------------------------------------------------------------

LAST UPDATE: 2/7/12

----------------------------------------------------------------------------------------------------------------------------------------

2/10/12 - Profit Stopped Out!!!

2/7/12

More profits building

2/5/12

Updated Plays: My calls are making nice profits and I have my stops in place.

===============================================================================================

My weekly plays

1/25/12

![]()

My monthly plays

1/25/12

| 2/5/12 - Apple still moving up but in a tight

pattern and Friday's trading shows the trading is getting very tight.

This translates in to a measure move coming. Question is, will that be

more upside or a nice bout of profit taking? The future of Apple still

looks very promising but it's going to take the next quarter to

determine that and with no real catalyst (for the time being) to push

this stock higher, it's going to be much harder to go higher.

I will be watching daily volume on the options for signs of direction heading into the next expiration week

==================================================================================================== 1/25/12 - Apple had a flat day after the big jump from yesterday's earnings surprise. This might be a good sign the stock will start another leg up as the year rolls out. My put plays are a bust by my call plays are taking up the slack.

1/24/12 - APPLE kicks butt and beats by a wide margin. The stock rockets up in after hours and the potential for continued growth is looking good? I am not so sure they can "sustain" these lofty prices as competition keeps coming with same technology and much lower prices. Eventually, consumers will look at their wallets instead of being "popular" and besides, there are just too many analysts touting this stock as a long, so I am a big time contrarian and will just bide my time for put opportunities. As you can see in post market trading, there is NO conviction in the initial gap up and instead, the stock is selling off. If the stock does not take out $470 tomorrow, then its a short for now. Remember, this quarter is the last under the leadership of Jobs, so going forward there will be a substantial amount of scrutiny on the the new management in the future quarters. If these prices hold up tomorrow, I should get a break even on all my plays. If they hold $450 Apple will have the largest market cap of all stocks in the market...WOW!

==================================================================================================== 1/23/12 - Tomorrow is the big day for Apple. Earnings are due out after the bell so the volatility tomorrow could be interesting. Today the stock did put on a good day to the upside with decent volume. Could this be the sign of things to come? Let's look into the details and see if we can find some profit opportunities. Typically stocks traded on the S&P 500 move around 10% at earnings announcements unless there are other circumstances to make a greater impact on the stock—e.g. large short interest, split announcement, very unexpected news, strong market movement in conjunction etc. Looking over this chart below we can see that Apple has had quite a nice run up on price heading into this earnings announcement. Notice how today's action stopped short of closing at the high from last quarters earnings; however, the patterns is looking more bullish this time. Because Apple put in a new all time high last week, we may be in for a "party" rally on any good news, and a new uptrend on strong earnings, but if they miss, I think this stock could see more than a 10% drop. So, upside price targets would be $465-$470 and downside $400 to $380.00 with really bad news driving price down to $350 or even lower depending on sentiment and market conditions.

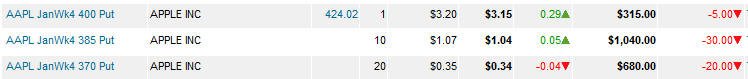

Next we will look at today's closing options prices for clues where the money is heading: On weekly options there is a lot of volume at the $425-430 calls and $485-390 Puts On the Monthly There was a lot of puts bought at the $400 Strike. As you can see, there is a lot of premium pumped into these options so you are going to be "gambling" with any of these picks if you play Apple earnings tomorrow. This time I am going to spread my plays out to help me better cover my risk and if the stock gets whacked then my "lotto" DOTM puts will be icing on the profits cake.

====================================================================================== 1/20/12 Apple Earnings are coming next week on the 24th after the market closes. Will they be able to beat estimates of 10.03 per share or disappoint like GOOG did today? GOOG's earnings could be a clue to things to come since they are losing revenue and over spending. Will Apple suffer the same drastic price drop? Well, I certainly hope APPL has a big move in either direction. I believe this quarter will be given a lot of "grace" if they miss since its the first full quarter after the death of Steven Jobs. A lot of investors will be hoping the reigns of the company transferred into competent hands before they continue to buy up shares at these very expensive prices—Apple is a VERY loved company, and people will buy and buy some more long into any bad news just because, its Apple! Last quarter AAPL came up short of estimates, but that did not slow down the stock one bit. In fact, they hit a new all time high of $431.37 today before profit taking came into play ahead of big earning announcement from other tech companies. Looking over some of their comrades in tech: IBM had a good quarter easily surpassing Wall Street forecasts. Sales were just below analysts' expectations mainly due to a slowdown in mainframe sales. In after hours the stock traded over $5 higher. MSFT which beat estimates, but that was primarily based on Xbox games sales over the Christmas Holiday season. The stock traded higher in after hours but not enough to get excited about. INTC also beat estimates and sees its revenues rising this year in the "high single digits" based on a percentage basis. They are making more and more chips and a lot of those chips end up in Apple's computers which can be an insight to the future of the Apple. However, looking over some of the comments about Intel's conference call, it appears they are doing more "chip" business with smart phone and laptop style computers and Apple does not use Intel chips in their iPhones or iPads...hmmm...that could be a clue that PC sales are not going to be as strong which means profits are going to be lower which means the stocks price will head LOWER. Question is, will that be after this earnings release or later down the road? Looking over the charts we may be able to see some clues:

On the Daily chart we see in the past earnings quarter there was a pretty good gap down and sell off from the last earnings quarter but that was short lived until the passing of Jobs then things got a little dicey for a few days. After all the expected news wore off, the stock resumed and rushed to new all time highs. Question is, was that out of genuine belief of long term growth, or more of sympathetic payment of homage to a great and loved innovator? This quarter will be a critical decision bar for many investors and if the charts below are an indication, you might be placing bets on the long side but I, for one, am not so confident this stock can sustain these prices. After all, if Ma and Pa can't afford to buy junior a shiny new iMac, how the heck can they afford to buy shares that cost over 1/3 the price of an Apple computer.

Looking at a longer term chart we see the following: 1. These type of candle sticks are indicative of an exhaustion in buyers and are very good times to short a stock as was the case for about a week. Of course, timing is everything when it comes to trading short-term and this few day drop could have made you a very nice profit. 2. This is the range trade that apple can fall back into if there is a turn for the worse after earnings. 3. Looking at the volume from the exhaustion bar, we see the "selling" volume was greater than the buying volume heading into and out of the green bar. 4. Finally, this current rally has NOT been support by increasing volume which is a clear sign the stock is losing momentum.

Looking over the stats we see that 70% of the shares are held by institution and since they are the only ones capable of "moving" a stock, we can see there is not a lot of interest based on the volume. In addition to this, the short interest is less than the average daily volume so even if the news is "good" there is not enough short shares to cause a major squeeze. With that said, a miss will be a surprise and the stock can fall farther than usual since there are not a lot of shorts waiting to capture profits and propping up the stock and normal price drop intervals.

On the options front there are more optimists with calls so puts can be picked up cheaper next week.

Profits Up!

The donFranko

|