3/2/13 - A nice earnings report and the stock took off to new all time highs giving my Mar 180 calls a real nice profit! So long as CRM stays above the abandoned baby candle back on 1/28/13, it is a long play. I will see if the stock pulls back to $178-179 and then I will get long again.

=======================================================================================

|

Lotto Weekly Options:

20 MarWk1 $180 Calls Bought: $0.50 Sold $3.24

5 MarWk1 155 Puts Bought: $0.15 Expired |

Monthly Options:

Pending |

2/27/13 - Finally some pre-earnings action! We are in for some fireworks tomorrow when CRM reports earnings. If they beat in a big way, this stock is poised to take off and with the markets making all time highs again, that could be the catalyst to really move this stock higher. Then again, if they miss it could be a massive winner on the put side, especially if today's reversal rally is a turn and burn event. I bought my calls at the open and have not bought the puts yet. I will pick them up tomorrow before the close of trading.

==============================================================================

2/26/13 - Just what the trade doctor ordered and I am ready to get in on the potential action. Earnings are Thursday and now that CRM has dropped over $10 since I started watching it will now give me some really low priced Lotto Calls. The weekly chart has the stock bouncing off the 20MA today and the basically flat close is a good sign this stock has some buyer support. According to my TOS platform, the expected move over earnings is $11 so I am going to get some options below that move and some beyond for the Lotto Play.

Volume on the MarWk1 175 Calls was 1,648 contract today indicating some big bets are being placed on a beat. The Mar13 had similar large volume on the 175's and 195's but a large 2,555 on the 150 Puts. This could be spreads, or insurance puts so wont really know until the stock plays out after earnings.

Bottom line, I am gong with overweight calls and some OTM puts just in case its a bust. Because this stock has pulled back quite a bit, the premium in puts will be pumped up so the way I like to play it is to buy the OTM puts inside the expected move which means, based on today's close, I will be looking at buying the 155's and I will Lotto Play with the MarWk1 180 Calls.

===========================================================================

2/20/13 - I suspected there was something amiss with this stock and today's reversal of the market showed CRM has NO love heading into earnings. This can be a great opportunity for us because if they do sell off, the premium in calls will become dirt cheap. Once earnings come out, and if they beat, we could see a very nice short covering rally similar to NFLX. I will be watching for some cheap prices on Mar13 $170 - $175 calls.

=========================================================================================

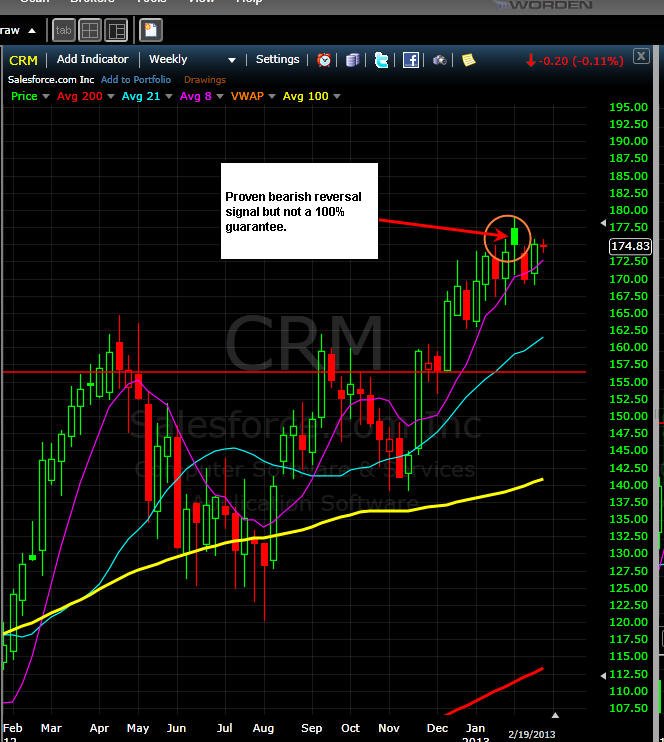

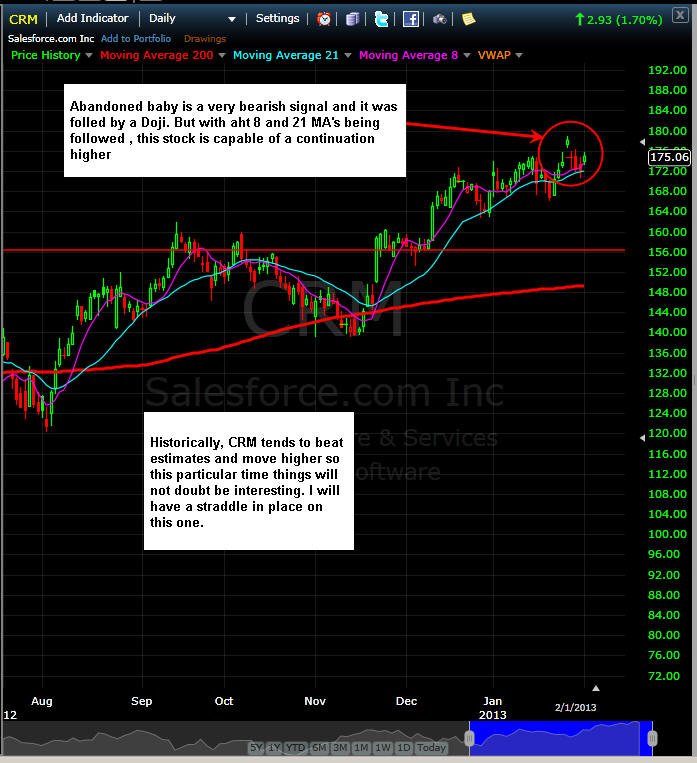

2/19/13 - So far this stock is not making an earnings run but that might not happen until later this week. From the chart perspective, it's looking like CRM will continue to pull back. That abandoned baby pattern is going to make it very difficult for this stock to make any real run into earnings, so we could be in for another Mega Lotto play if they miss or surprise.

=========================================================================================

2/13/13 - I was looking to get in a call play today but with the markets pulling back, I am waiting until next week.

=======================================================================================

2/11/13 - Time to start looking for earnings run entry points later this week. CRM needs to get back over $171 before I put on a long call play. That abandoned baby definitely proved to be a good short opportunity and CRM has now pulled back enough to make an upward test into earnings. I will be watching for a new opportunity to get in on the MarWk1 170 calls later this week.

===================================================================================

2/6/13 - So far this stock is showing more signs of selling off into earnings; however, they do not report for three weeks, so any rise in the DOW will most likely lift this stock up. I am looking for a short-term put play and on earnings a Lotto play.

==================================================================================

2/3/13 - CRM is looking like it wants to trade lower and if they do not beat earnings in a big way, we could be seeing the top in this stock for the rest of the year. The challenge with that is they have beat most quarters and the stock has moved hither each time. Looking over the weekly chart we see the sold green bar reversal signal so you need to have a straddle in play with a longer time frame on the put side in case this turns out to be an accurate signal as it has been in the past.

Earnings are set to be released on 2/28/13 so there will be a lot of time for this pattern to work out. If CRM trades above the abandoned baby, then I will get long for an earnings run with a strict stop at $170.

Profits Up!

The donFranko