LOTTO Plays - 2010 - 2012

These are the results from trades suggested on our "Current Plays" list.

Note: they are suggested entry and exit points! disclaimer Profits Up!!

----------------------------------------------------------------------------------------------------------------------------------------

LAST UPDATE: 8 / 8 / 11

----------------------------------------------------------------------------------------------------------------------------------------

HOME Past Plays: Play 2 / Play 3 / Play 4

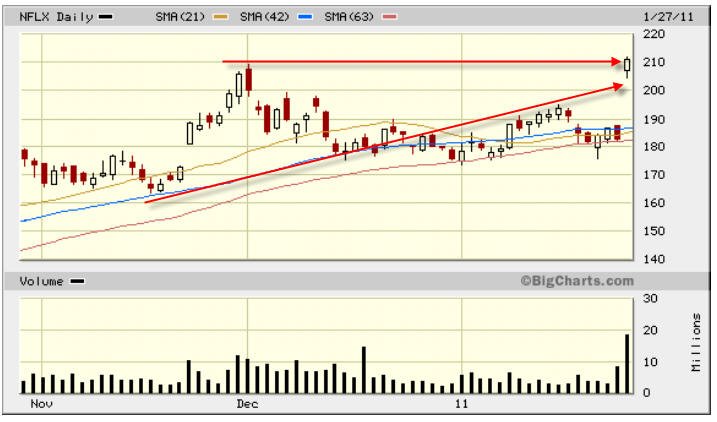

NFLX Commentary Play 1

8-1-11 Market meltdown today and NFLX getting whacked with it making my OTM put a HUGE SUCCESS!!! Profit Stops in place.

=========================================================================================

7/26/11 - NFLX put on some buying today so my options took quite a cut in price. I am going to need the next three weeks if I hope to make some profits on some of them. In the meantime, I will do some day trades to mitigate these Lotto Plays. They did not work out this time, but that's the way it goes. I certainly know there will be plenty more that do down the road!

=================================================================================================

7/25/11 - As I expected, NFLX disappointed and the stock took a very nice beating in post market hours. Problem is the drop is not going to be enough to make my OTM puts any profits for now. I still have 3 weeks for the play to gain some momentum so we will see. I fully expect the calls to expire worthless so its time to manage. the rest of the puts and maybe do some ITM day trades to make up the losses.

==============================================================================================

7/23/11 - Monday is the big day for NFLX, and with recent news that they are raising rates up to 60% has caused quite a backlash from their loyal customer base. Will this be a death nail in the companies meteoric rise? Probably not in the near future, but next earnings reports will be the tell-tale sign of this announcement.

NFLX briefly took out an all time high of $300 per share back on 7/13/11, and once the price increase announcement was made, the stock has sold off since. Of course the stock is substantially over-priced, but people buy and pay a premium because of FUTURE projections that NFLX will continue to grow millions of "new" customers; however, once they top out—and they will top out due to attrition, competition and operating costs—this stock will fall hard and fast and my Lotto Option Trades will be there waiting to bag that White Whale and catch a boat load of cash too!—For now, any trades done on stocks like this have to be straddles unless you are just willing to gamble and pick a side.

My plays are heavy on the put side with enough calls to pay back the puts purchased should the stock rise to new heights. Speaking of rising, the stock was upgraded by a major brokerage with a price target of $315+. I for one am always suspect when there are upgrades on stocks that have speculated growth.

Looking over the facts on this stock, you can see their actual book value (Book value is the "real value" of a stock if you liquidated all assets and paid all debts) is %52.54 and NFLX Forward P/E is $41.59; however, the balance sheet Book Value Per Share says they are worth $5.25 per share.

This stock is a "loved" stock, but 85% of the shares are held by institutions, so if the love dies, the stock dives!

Get ready for some price action Monday!!

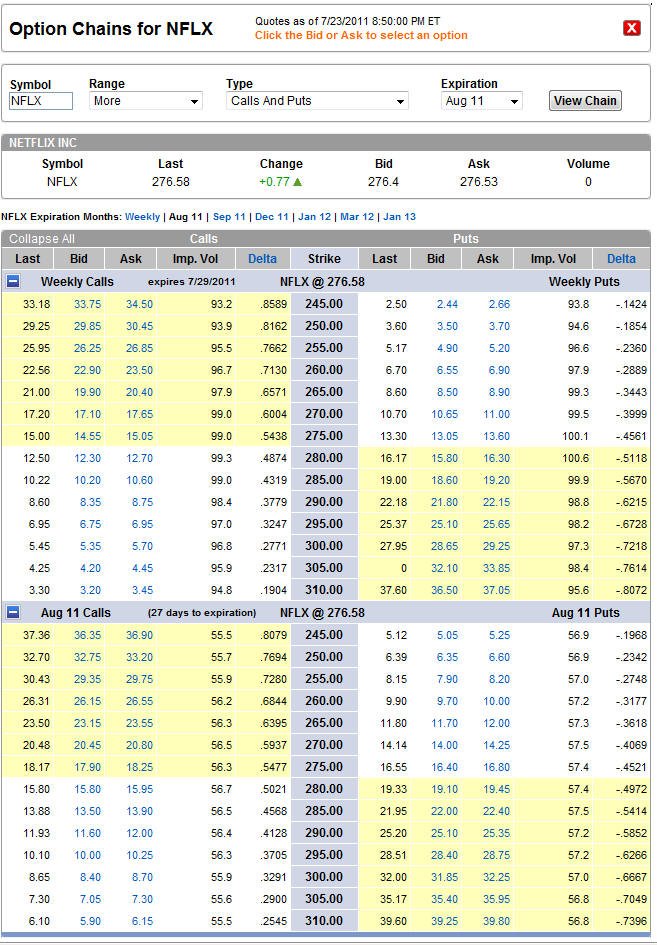

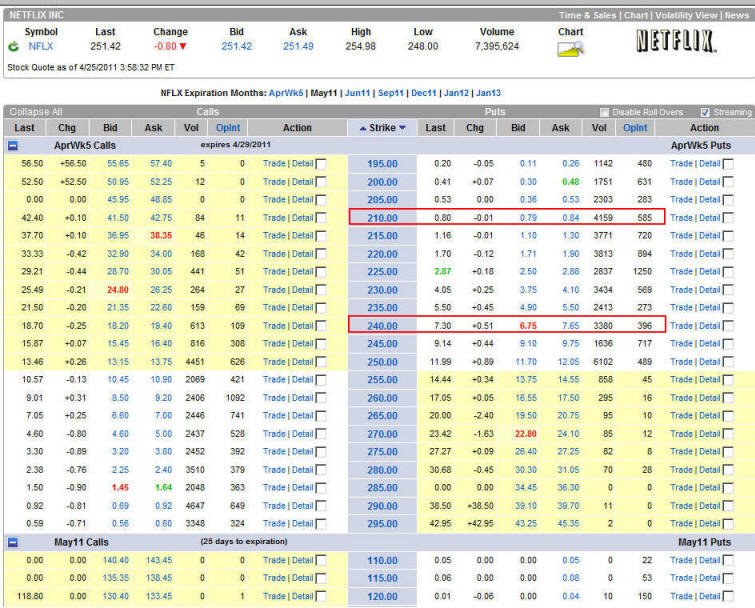

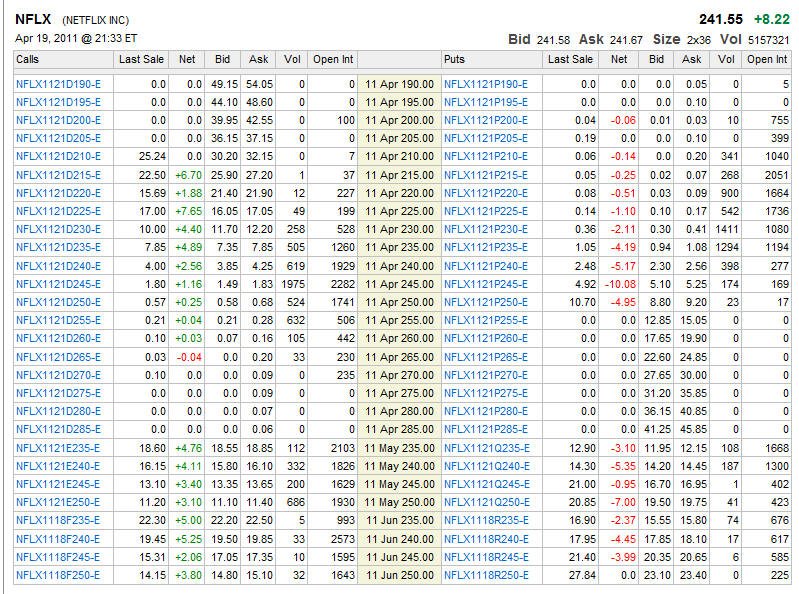

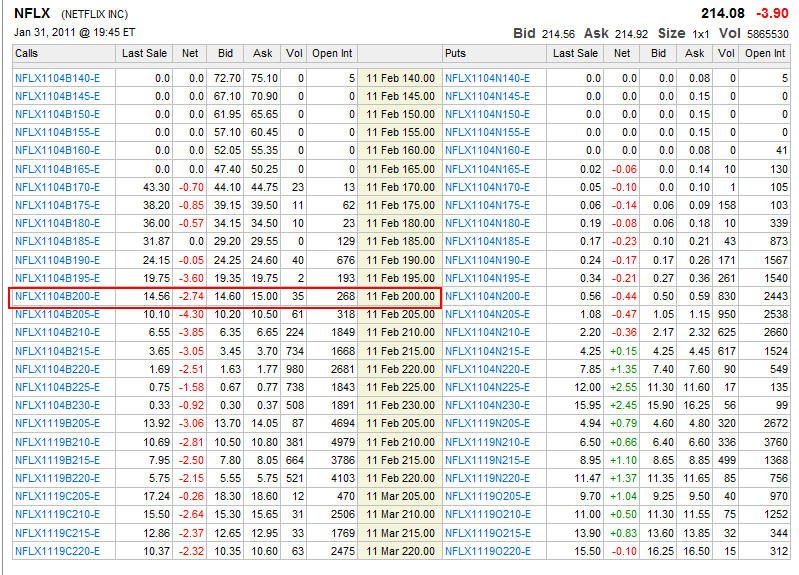

Here is the chart and options:

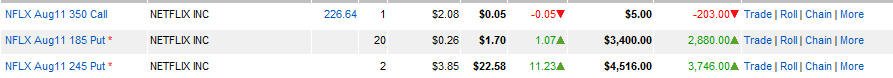

Here are the option orders I placed:

Friday's closing option prices:

=======================================================================

4/27/11 - Took profits on the weekly options for another WHALE of a profit!!

No I am looking to see if yesterdays high will be taken out, but if the stock resumes to the down side, I will short and place my stop at $246.50.

================================================================================================

4/26/11 - NICE NICE day of profits booked in and looking like more coming, but I think it will take some market down to keep it coming. These options expire on Friday so time decay will be quick and profits taken fast. If the stock shows strength in pre market I will close this trade out at open and look for another entry with May puts.

======================================================================================

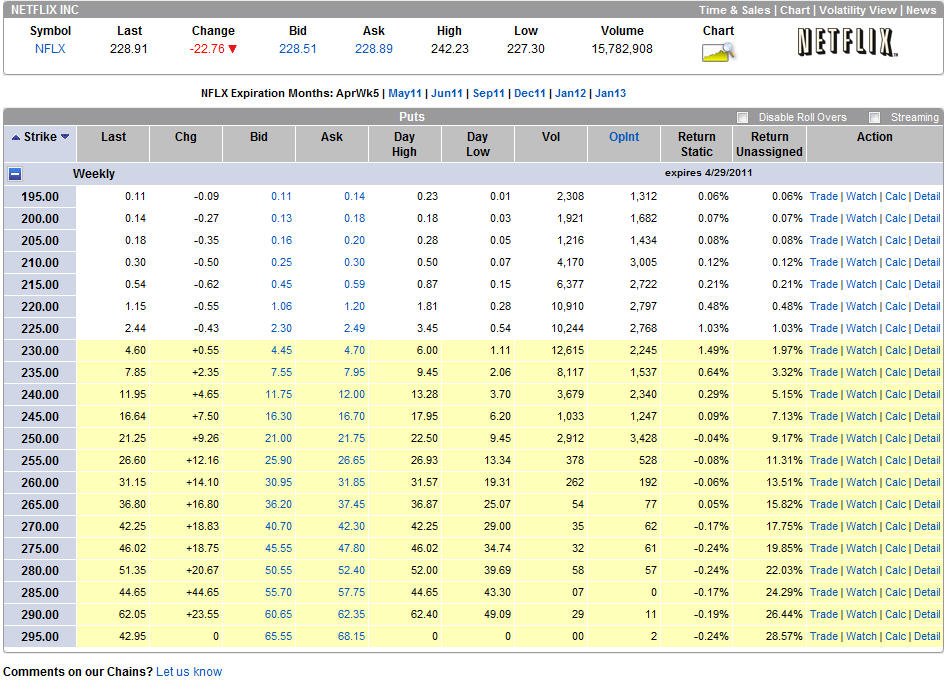

4/25/11 - NFLX beat earnings but the response was lack luster and with the CEO lamenting that new subscriptions could be on the decline coming up the stock was sold in after hours. This is a classic "sell the news" event that should continue for a couple of days to maybe even a week. If the overall markets take a turn down the NFLX will accelerate into the 100 MA and possibly the 200 MA at $180. The Lotto put plays listed will make profit, but certainly not the massive ones had NFLX actually disappointed.

May Options

Weekly Options

============================================================================================

4/21/11 - New all time high hit today! Tomorrow is the time to take the Lotto Put positions. The calls have a very nice profit in place so I will bank them Monday at the open and pick up some OTM weekly calls and put options for the earnings announcement.

====================================================================================

4/19/11 - Finally we get some ACTION with this stock. The price action was strong in the morning but tapered off into the close as the buys and sells tightened up. I am definitely bullish; however, if AAPL disappoints tomorrow you can be assured NFLX will stumble if not pull back. We still have three more trading days for this stock to position itself so I am looking for it to hold $240 and take out $245 on strong solid candles into the close by Friday.

================================================================================

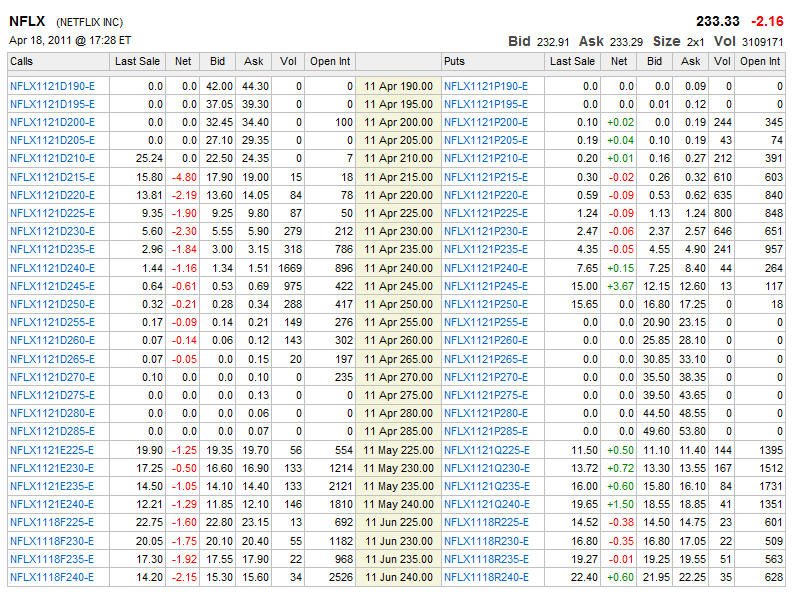

4/18/11 - Chart showing no clear decisions being made. Several DOJI candle patterns the past couple of weeks indicates there is not a lot buying interest. I much prefer to see elephant bars like we had last Tuesday but with GOOG missing things in the overall market tapered off. The potential news today is the markets were down quite a bit and NFLX held its ground just above that elephant bar. I am very much liking the put potential on this one with a possible drop under $200 should they disappoint. I am definitely taking a straddle on this stock with a PUT first tomorrow then adding in calls later in the week if that elephant bar continues to hold up.

=====================================================================================================

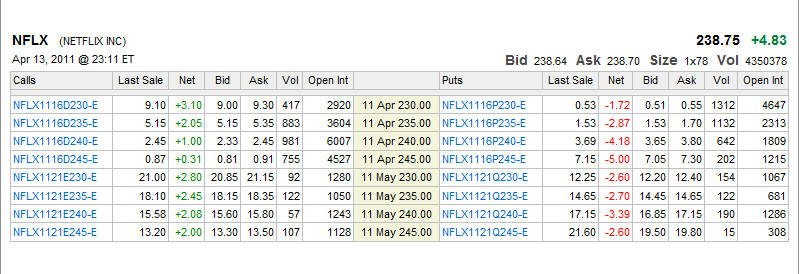

4/13/11 - It's been a couple weeks since I commented on this one and we can see that $230 started to fail and was immediately snapped up. This is now the definite proving ground and the chart is looking very nice for a big breakout if the earnings are excellent.

Notice how the stock double topped and then had a few days of selling? Well with yesterdays solid reversal bar, that shows the big money is in the game to stay. This is a very good looking "elephant" bar indicating there will be more buying; however, If you go long you MUST place stops just below this elephant bar; and If this bar is taken out, then shorts will get a very profitable trip back to the very large gap-up back in Jan.

This earnings report is going to be a very definitive conclusion for the the direction of this stock for the next few months. I will definitely have a straddle play going on this one.—We could get a very nice Lotto Put play going if they miss earnings estimates.

Earnings are coming out on the 25th so I am looking to take my positions a couple of days before. I would go with some calls right now to get started but take the bigger position a couple of days before the actual earnings.

===============================================================================================

3/31/11 - NFLX still hanging tough with three Doji daily candles in a row. The last time I saw this, the stock shot up quite a bit, so the big question of the day is will it do this again? The catalyst this time around is upcoming earnings, but looking at the past couple of weeks worth of trading, one could make an argument that the price action has been booked in and we are in the wait and see mode. Tomorrow is Friday, so most likely there will be jockeying for positions more than upside improvement in my opinion.

Looking at the chart below, we can see the gap up back in Feb has now been tested, but it's definitely a weak test with low volume, so for now, any bets on direction are nothing more than pure speculation. I would say that so long as $230 holds, its a long, and below $230 its a short down to $200.

I am looking forward to a nice lottery play on this one in a couple more weeks.

==========================================================================================

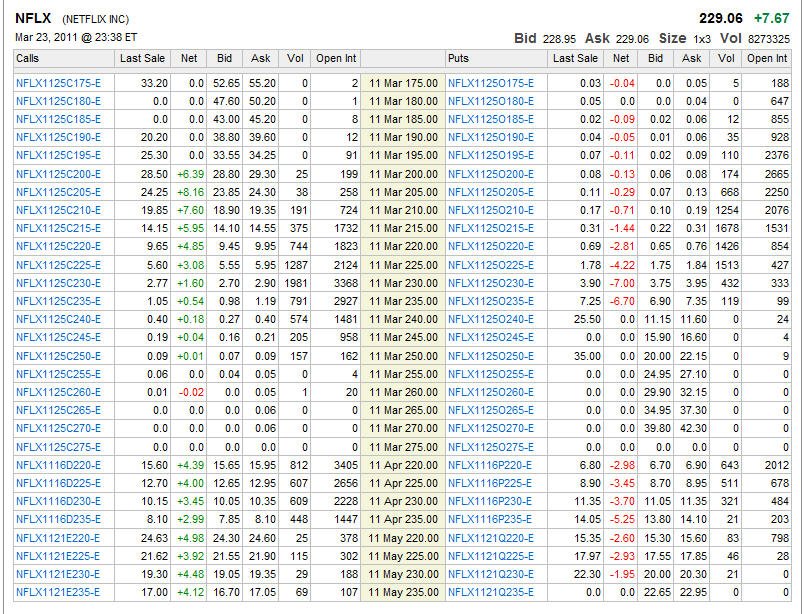

3/23/11

NFLX is HOT HOT HOT and even Cramer is liking this stock at these price levels. Notice how the gap from Jan was tested and held indicating the bottom of the price range will remain here. With earnings coming up in a month, I think NFLX will make a very strong attempt to take out it's all time high and if results are great, the sky is the limit. If results are a disappointment, it's going to be Christmas in April.

My next entry on this will be any pull back that holds onto $220 and should we get a gap up tomorrow, I will jump in on any pull back that holds 55% or better of today's range.

========================================================================================

1/31/11

Stopped out today with a VERY nice profit on this Lotto Play. NFLX could keep going up so I am watching the action close to see if I want to re-enter as a standard call play.

==================================================================================

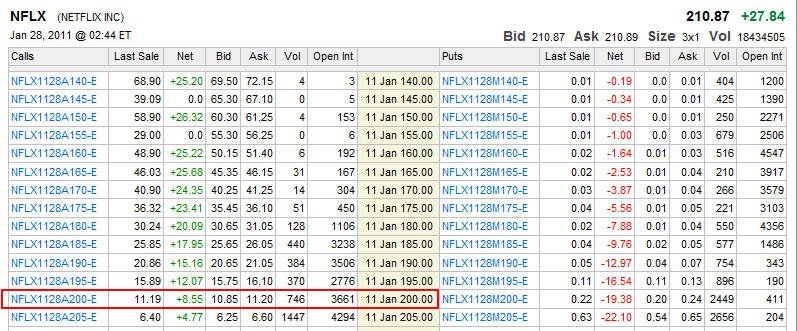

1/28/11 - Just keeps getting better! Wow...market gets crushed and NFLX goes UP!! STRONG STOCK!!! Stops in place $2 under bid.

=====================================================================================

1/27/11 - Blast OFF to the land of milk and money!!

================================================================================================

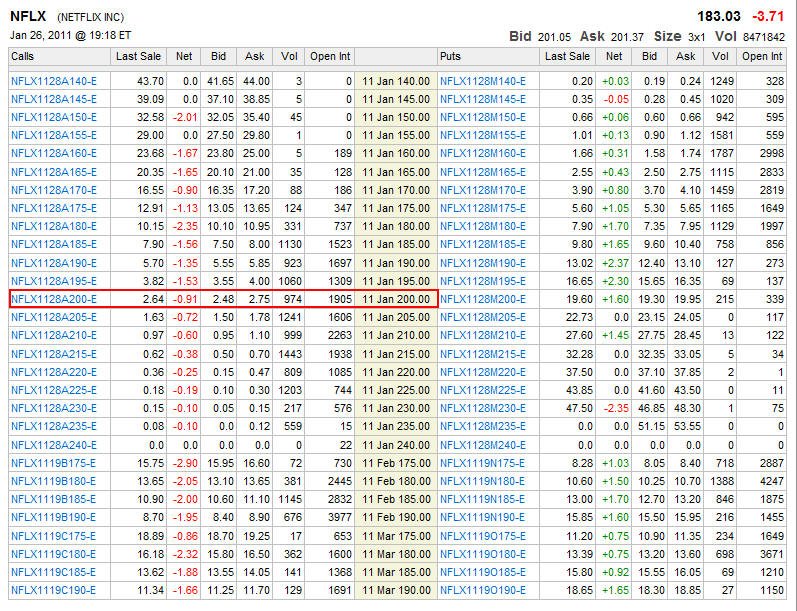

1/26/11 - Cha-Ching!!!!!!$$$$$$$ NFLX increased subsribers and revenue

Currently trading over $200 as I type this!!!!!! If this holds into tomorrow, my option calls are going to BANK!!!!!

===============================================================================

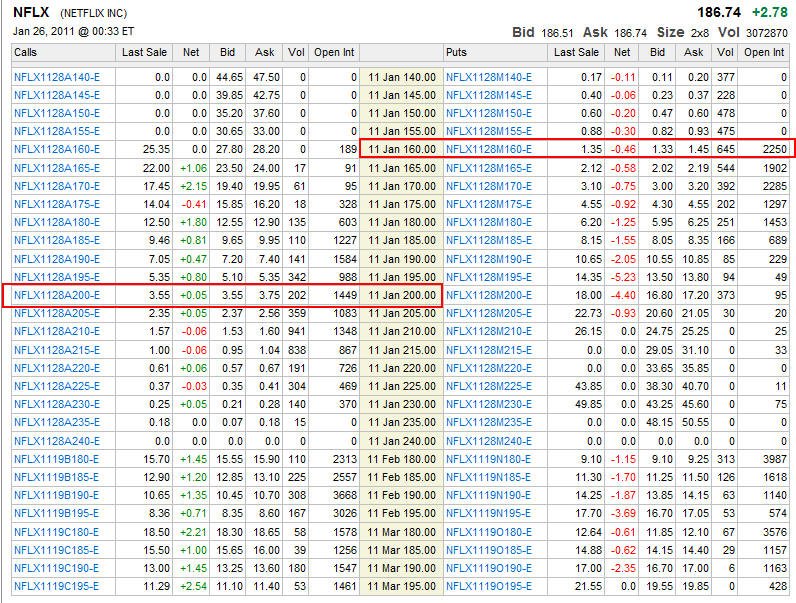

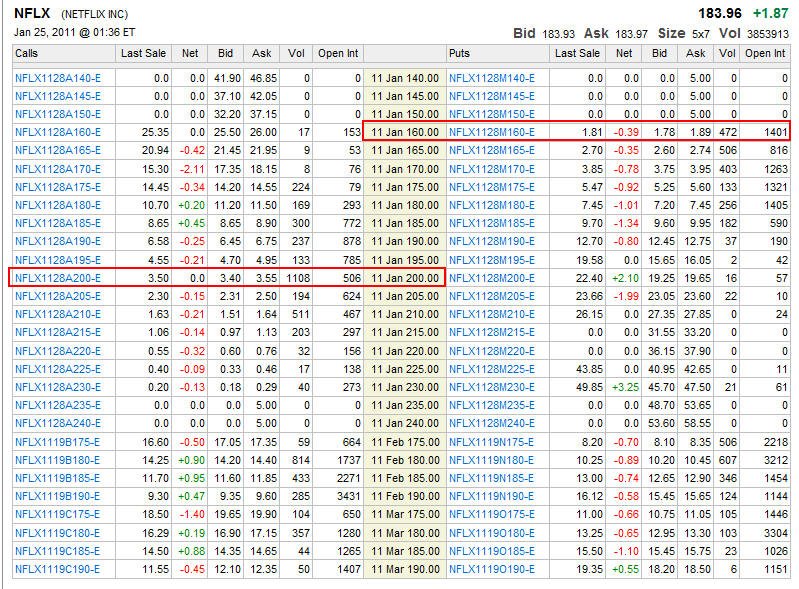

1/25/11 - Tomorrow is the big day

===============================================================================================

1/24/11 - Time to start the straddle play tomorrow and lets see what we get.

==================================================================================================

1/21/11 - NFLX succumbed to the CEO announcement and appears to be heading down into earnings next week. I will put on a straddle the day before earnings.

============================================================================================

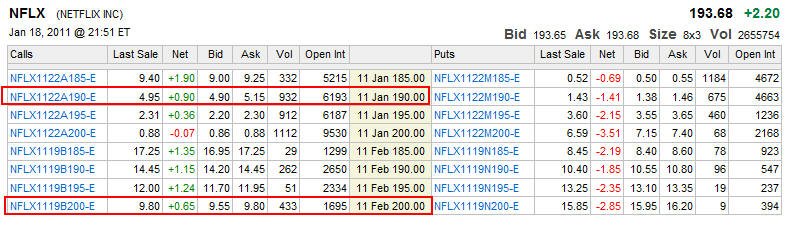

1/18/11 - My compounder play is up over 100% to date and so we are off to a GREAT start for Jan. I will be putting on a straddle Lotto play just in case NFLX does not make the cut at earnings. And if they happen to miss, well, we should be in line to catch a lotta dough.

NFLX is putting on some upside as we head into earnings season. AAPL knocked it out of the park today which bodes well for NFLX since Apple sold 1 million more iPads than projected. This means there are potentially tens of thousands more subscribers for NFLX on demand packages since the iPad can play streaming content on WIFI and/or G3.

=====================================================================================================

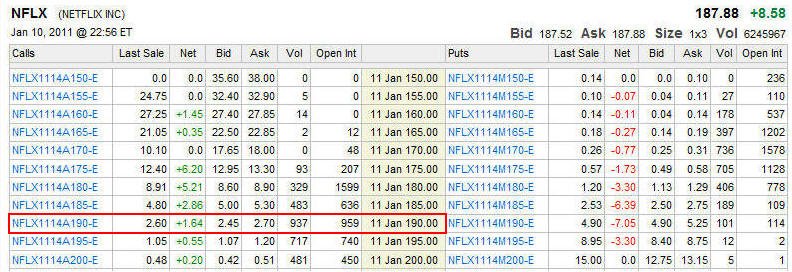

1/10/11 - Today the lagging stopped and NFLX put on some nice gains. There was a bullish report from Goldman Sachs analyst Ingrid Chung most likely giving fuel to the fire today.

Netflix earnings are set for Jan 26th after the close, so this could be the beginning of the earnings run. I am definitely going to get long with calls because the anticipation will be there with this news story and the 80 plus iPad type devices and tablets coming out of CES show in Las Vegas.

Even though Apple has the market cornered for the foreseeable future; on demand movie providers like NFLX will benefit as more and more people have the chance to access wireless broadband. The biggest question is will their servers and broadband providers be able to handle the bandwidth demands?

With more and more demand coming down the pike for streaming, NFLX will certainly be there to capture market share; however, competition will be coming on strong, so any slowdown in subscribers will have a very negative impact on this stocks already high price.

I am bullish in the short-term, but overall looking for that "lotto" put play in the future. My strategy is to trade with the trend and lay my nets for the future.

Today could be a possible elephant bar buy opportunity; however, I would have preferred to see volume much higher than the average which leads me to be cautious of any follow-through.

I would like to see some profit taking in the morning so I can get started on some call options but after hours was up .57 cents so we will have to see. There is now a lot of premium packed into any call options so do not get too crazy early on. Its much better to buy on dips so long as the stock holds onto $179.00.

Here was the action on the options from Friday and Today

Today 1/10/11

I am looking at the Jan 190's and Feb 200's

Friday 1/7/11

==================================================================================================

1/7/11 - New year and NFLX is lagging with the market. Looking like it may make another attempt at the all time high since the bap from Nov is holding up; however, I am not a total fan of continued upside as competition continues to come on line. I even cancelled my subscription today because I am just movie burned out and they raised my rates to offset continued bandwidth demands with the online viewing. There are more and more movies coming on line to watch so we will have to see in the next earnings report if the price increase helped or hurt subscriptions. I can assure you that when subscriptions suffer this stock will pay us off with puts!!!

I am going to start looking for DOTM puts as well as some calls as we move forward.

====================================================================================================

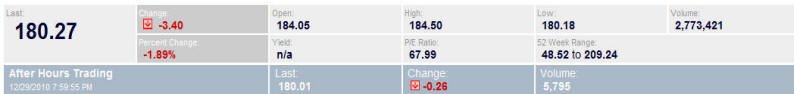

12/29/10 - As we approach the end of the year for 2010, it's looking like NFLX will take down some of the profits and sellers will continue to step in and lock in those profits they have enjoyed for some time now.

=================================================================================================

12/17/10 - Selling started again today but it was not enough to make these OTM options profitable. We will look for the next opportunity.

===================================================================================================

12/15/10 - Selling stopped for today and as you can see, without more downside selling these OTM options are losing any value they have quickly.

========================================================================================

12/14/10 - More selling today and my first target was hit. The 170's are making money and if this selling keeps up, we should see a potential double.

====================================================================================

12-13-2010 - Expiration week and already NFLX is getting a lot of selling pressure. I am looking to speculate this will continue into the end of the week.

|