LOTTO Plays - 2012

These are the results from trades suggested on our "Current Plays" list.

Note: they are suggested entry and exit points! disclaimer Profits Up!!

----------------------------------------------------------------------------------------------------------------------------------------

LAST UPDATE: 2/27/12

----------------------------------------------------------------------------------------------------------------------------------------

Priceline.com PCLN

|

Suggested Play: |

Calls: Pending |

Puts: Pending |

|

2/27/12 - PCLN Beats estimates and rises only a modest 7% in after hours. It could have been a lot more had it not already had a pretty good run up on for the past couple of weeks. According to talking heads on CNBC, PCLN is touted as a strong stock with a price target up to $680; however, there was a ton of weekly options bought at the $650 expecting a bigger jump in price. My guess is the stock will drop to profit taking and if the markets sell off too, then PCLN will head lower for the next month or so. I would definitely be looking for short-term short opportunities as we move forward. Honestly, the Price/Book on this stock is only $12.30 so when this sucker starts to turn and burn, you better be ready to churn your money and make a bucket full of creamy profits...lol.

If you bought a straddle on this, you are most likely not going to make a profit unless you picked up options ATM or 1 strike OTM. If you gambled on the long side, then maybe you can get some profit tomorrow if the open is strong to the upside. We will see what the market gives us tomorrow.

Had this stock not already run up into earnings, today's move could have been well over 10% .

Here are the closing option prices:

Here are some of the OTM weekly options - Notice how the 650 strike has a ton of open interest.

2/26/12 - Updated: Earnings are tomorrow after the bell

==================================================================================================================

2/23/12 - As you can see, PCLN is edging right up to the $600 benchmark and the past three trading days have basically been Doji's and most likely in part due to the large contract load on the March 600 calls. Also I see that the volume has been dropping off today too.

I believe this stock is poised to make a big move once earnings are released next week. For the most part, large cap stocks like this move around 10% on good earnings and can move upwards of 20% on very disappointing news.

Last quarter, PCLN had a very nice surprise and the stock moved over $40 per share or just over 8%; however, the previous quarter to that, they also surprised even larger and the stock fell almost $45 per share. Taking this into consideration as PCLN's range potential, you need to pick up the bulk of your options at a strike that is inside this range. The challenge this round is there is a ton of time premium built into all of these options so we can't expect a massive home run play here; however, if the market turns south and PCLN disappoints, there is a lot of time for the stock to keep moving down. Back in 2009, the stock had it's usual surprise but sold off for two months more than $90 per share.

================================================================================================================ 2/17/12 - A nice day today for options expiration. Looking over the daily chart, PCLN has put on a couple of Bull Elephant bars which indicates more upside is coming. I am not so sure what will happen next week, but if you look at yesterdays Doji, we could see some nice price action next week ahead of earnings. With the new March expiration starting on Monday, I suspect PCLN will edge higher to take out $600 a share. I will definitely have a straddle play on this by Friday and as usual, I will lean to the PUT side because if they miss, it's going to be a large drop in price the the bottom line—and we have the entire month for the play to build profits.

================================================================================================================= 2/14/11 - No love for PCLN today. The stock took a break in the recent run up and traders took some profits driving the price down ($5.35) per share. Is this the sign of things to come heading into earnings in a couple of weeks? I think its going to be really tough for this stock to continue any higher with options expiration coming on Friday. With all the action going on in the sector, we certainly could see this stock hit that $600 benchmark price. Is there any reason why this stock is worth $600 + per share? It's amazing to me these types of stocks can get this high in price, especially when their book value is only $6.20 per share???? HUH??? All I know is when this stock falls from popularity (and it will) then there will be tens of thousands made on puts!!!!! Just like there was when NFLX died!

In the meantime, there is a lot of opportunities to scalp short term profits with a stock this volatile. You just need to be very patient and wait for the correct setups to get your best odds of making profitable trades.

Looking over this weeks options we can see volume ins picking up on the put side today.

Looking over March there was a lot of volume today on the 600 strike which means there is going to be a lot of resistance at this price.

What you want to see if more puts being bought if you are bullish because you want the short covering rallies to propel a stock higher than the open interest on the calls.

Remember, we will have a ton of time premium to deal with in these March options. For example:

You are gambling big time at this point.

Typically high beta stocks move around 10% to the upside on earnings reports unless there is a substantial amount of shares short or the company does something un expected like announce a 2:1 or 3:1 stock split.

There is approximately 3 millions shares short and it would take around 3.8 days to cover that so if they do surprise, we could see a solid 10% rise in price.

Looking at at based on today's price if the stock were to move up 10% then the Mar 600 Call options would be worth at least $33.00 per contract.

===================================================================================================== 2/10/12 PCLN has been working its way up heading into earnings. I suspect profit taking will start next week as we head into options expiration. Earnings are going to be announced on Monday 2/27/12 so we will unfortunately have very expensive options on this one, but if they miss, its going to be a very punishing drop and sell off below $500 a share. The nice thing here is the 100 and 200 MA's are within a 10% drop, so we could be ITM if things get ugly for PCLN!!

================================================================================================================ 2/5/12 - Earnings are coming on the 27th, but this stock really took off early way ahead of the typical pre earnings run that usually starts a couple of weeks before the announcement date. This could be a clue into the stocks potential. If they beat earnings estimate, we could certainly see a new all time high and if they miss, its Ferrari time on my Lotto Put plays!

The bummer is earnings are reported the Monday after options expiration so the March cycle will start making options very expensice and filled with the full months time premium.

Currently there are not large amounts of open interest on calls or puts for march. The only strike with a large amount is the Mar 600 calls at 1,253.

I will start Monday with a couple of Mar 525 Puts =========================================================================================================== 1/19/11 - Looking like the earnings run is starting up early this week. I have not been paying much attention to this stock since earnings are a month off, but I just might have to see if I can grab a few bucks sooner than expected. I do like to see this stock head higher and the faster the better, because if they miss the fall is going to be HUGE.

I will watch tomorrow action to see how it reacts to the GOOG disaster since they are an internet based company and GOOGLE missed mainly on revenue shortfalls that could mean companies such as PCLN are strapped for cash and cannot afford to ADVERTISE.

Looking over a Weekly Chart we can see there is a LOT of resistance at the $550 price level and the 200 MA is very far down the road so I would have to look at the 100 MA for my potential target plays.

================================================================================================== 1/9/11 - Starting the week of on the downside and looking like its putting in a base

The new year is finally here and with it, first quarter earnings reports. I am getting ready to start my Lotto Play sequence on this stock so stay tuned and you may just hit the jackpot again this quarter!!

Next earnings date is currently set for Feb 20 but time is not supplied. http://biz.yahoo.com/research/earncal/p/pcln.html

The "buzz" is already starting to form around this stocks future; and that means there is some potential for BIG swings in price! Here is a headline from Fortune Magazine that was posted today: Can Priceline extend its five-year rally?

January 4, 2012: 10:11 AM ET This year could begin a third act for Priceline's stock, a period of more moderate growth along with the challenges in navigating a shaky global economy.

Looking at the charts

Notice the stock peaked back in May of 2011 at $555 the stock has failed at lower highs three times and we know that three times is a charm so if they get an expected earnings run back up to the $540 range and the earnings are missed or perceived topped out, you can bet your bottom dollar that this stock will take a HUGE drop!

I will be watching the action over the next 4 trading weeks for opportunities to start accumulating my positions.

=====================================================================================================

12/23/11 - Not much of a rally today but there was a strong volume spike in the last hour of trading that could prove to be another opportunity.

Taking a closer look we can see the volume spike was NOT in the final hour of trading today. It appears there are some sellers still present in this stock.

=================================================================================================== 12/22/11 - Ok, we are looking good for another round of profit taking heading into the end of 2011 trading.

Volume has spiked in the opening hour and dropped off throughout the trading day.

================================================================================================================ 12/21/11 - As I predicted, PCLN was sold off today! If there is more market weakness, you can be assured this one will keep heading down

I would have preferred to see a true Bear 180 pattern today with a solid close on the low, so now we need to be cautions and if $481 is taken out with large volume, I would kill any put plays and wait for the next entry setup.

Option activity was active on the Call side but most likely due to stopping out investors.

============================================================================================================== 12/20/12 Here is my latest high beta stock I am targeting for massive potential profits on the next earnings release on 2/20/12.

would have preferred to see a true Bear 180 pattern today with a solid close on the low, so now we need to be cautions and if $481 is taken out with large volume, I would kill any put plays and wait for the next entry setup.

Today, PCLN put in a very nice Bull Elephant bar, BUT if you look at the volume, it was not one with conviction. Notice this stock closed at the high of the day today, and in my experience, this usually results in a false breakout close by profit takers; especially when its been in a long downtrend and had a couple of up days before it happened.

The volume indicates there could be more sellers present than buyers; and since this stock is primarily owned by institutions, you can anticipate they will be looking for profit taking as the week goes on—especially because this is the end of the year and fund managers like to show their "public" investors they own popular stocks to on the year end annual reports. Then those managers typically dump them in the last week of trading especially if they have had a great year of trading profits.

I would look for this stock to make a push for the 100 or 200 day MA and then strong selling will kick in for the end of the year. Caution: Since this stock is a very high priced one, there will be lots of volatility packed into the option prices. If you trade this particular stock, you MUST be able to watch it daily to capture any short-term pops or drops in price.

Ok, here is my analysis on this stock:

Looking at today's action, we can see there was the initial gap open on good volume, but the rest of the day there was not much action as the stock trickled higher all day; however, notice how to volume was accelerated going into the close, but the trading range for the last few 15-minute bars was compressed. The final 15-minutes give you insight into the stocks next potential move. Most traders view this candle as a very bullish one; however, it needs to be ABOVE all the preceding candles or at the bottom of a multi candle downtrend to make a strong case for continuation to the upside. The previous 15-minute candle indicates there were a lot of sell orders waiting at the $480.00 price; and profit taking was very strong in the final minutes of trading and into afterhours. I suspect this could be the top and we get a reversal in price on any market weakness.

Here is closer look on a 1 and 5 minute chart.

Notice on the 1 minute chart heading into the close, trading was gapping up and down with tight spreads with a very large green volume bar at the close. But next to that one was a massive red bar after the close on what appears to be NO volume...hmmm. So, if you we look at a 5 minute chart we now see that huge volume spike was a red bar; here is where I suspect this is a profit taking event and price will move LOWER!

spreads. |

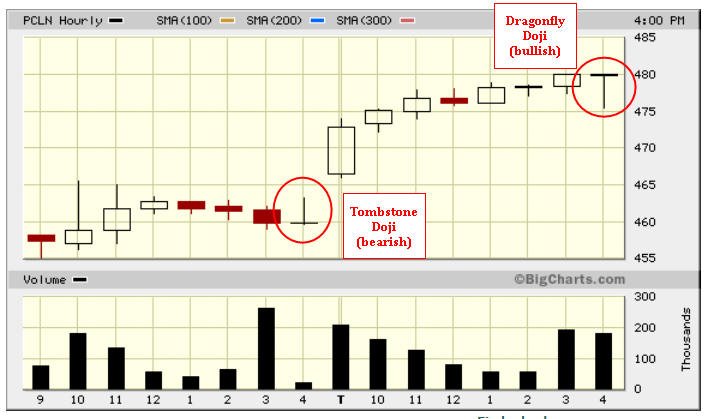

Here is a two day chart the has an interesting counter trend to their perspective candlestick patterns. Typically its widely known that a Tombstone Doji is a strong bearish signal, but notice today the price gapped to the upside rather than continue to the downside. Why? Because the "market" dictated upside movement and the shorts were caught off guard and had to cover...initially. Had this been a "real" rally in this stock, there would have been more upside candles with increasing volume, but instead, we have decreasing volume showing NO conviction this will continue higher.

Now we look at today's final hour of trading and we have a Dragonfly Doji formed. This is typically know to be a very bullish candle, but this one is at the "top" of the days trading range which, to me, indicates a strong probability for downside price action if the "market" does not continue to rally.

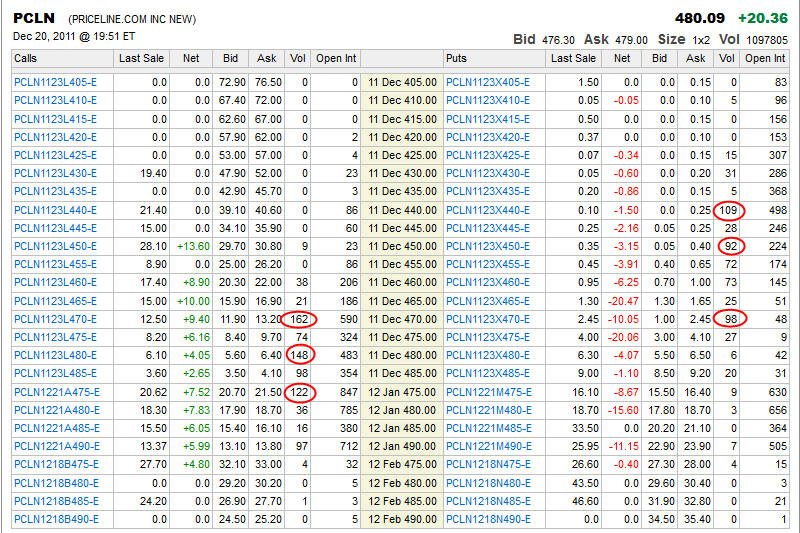

Now we look at the options activity to see if there are any final clues to the price direction.

Notice today's volume indicates there are more bearish investors than bullish in the short term. Overall open interest is almost dead even with Calls at 5,197 and Puts at 5,112

Options are a great indicator of where heavily traded stocks by institutions is headed. When you do not see a lot of activity close to the money, you can rely on the charts reversal signals for more accuracy.

When there is a lot of OTM action, you can better gauge where the general public is thinking; and we know they are typically WRONG more than they are right.

The Calls ATM and OTM show there are way too many optimists in this stock and today's put volume indicates to me there is building potential for downside action because the put volume was not large indicating these contracts were bought vs. sold off or stopped out.

My bias is to short on any weakness in the markets.

Profits Up!

The donFranko

|