|

Updated:

12/1/21 8:00 AM PST

Greetings Traders!

Markets are very volatile this week with the FOMC chair

Powell testimonies. Yesterday, he made the comment that

he was removing the word "transitory" and confirmed we

are in an inflationary period that was "faster" than he

expected...duh <8-0.

Well, that caused a panic and the markets dropped

dramatically only to be bought again and now breaking

out to new all-time-highs.

With the economy on the comeback trail, and the FED

getting ready to ease off the money printing machine,

stocks will most likely pull back NEXT year; however,

for this month the markets are looking like they just

want to grind it UP into the end of the year!

I do not anticipate Powell will say anything today to

upset the markets again so be ready with your fishing

orders and may the rally continue!

I will have more updates later in the week.

Profits UP!

Frank

The don-Franko

Updated:

6/19/21 4:00 PM PM PST

Greetings Traders!

I

did not get filled on last weeks fishing orders, and as

I suspected, the SGB zones I have been pointing out the

past few weeks proved to be the SHORT opportunity as the

markets were slammed this week and today was a big gap

down right to the first three SGB’s zone.

Take a look at the SPY

daily chart below and you can clearly see how the SGB

zones are the pivot points for trading action and price

targets. Today is also triple witching expiration and

that is the catalyst that created the gap down action

today. Going forward from here, we will see if next week

these SGB zones are the final test and a bottom gets put

in place for the rest of the year (we be rich by

December if that is the case!) or all these SGB’s are

the “TOP” and we just keep diving lower and have to

change the SC bias to PUTS.

All the “technical”

indicators the masses use are loudly proclaiming a much

bigger drop is in the future, and if you take note of

that triple-gap starting on 3/31/21, then you can assume

those will be filled in the future; because it is widely

disseminated that

ALL GAPS GET FILLED eventually.

So, where can the SPY

ultimately drop to? For me, that answer is always in the

SGB zones and the next one is around 390 on the weekly

chart (noted by the dashed green lines on the daily

chart) and if we end up there in the next few weeks, it

will be blood-in-the-streets time for whales like Buffet

to BUY BUY BUY!

What I am planning on

doing is “fishing” for lower strikes and prices on CALLS

looking to hook on to a Moby Dick if/when the SPY hits

the GAPS and/or SGB zones below.

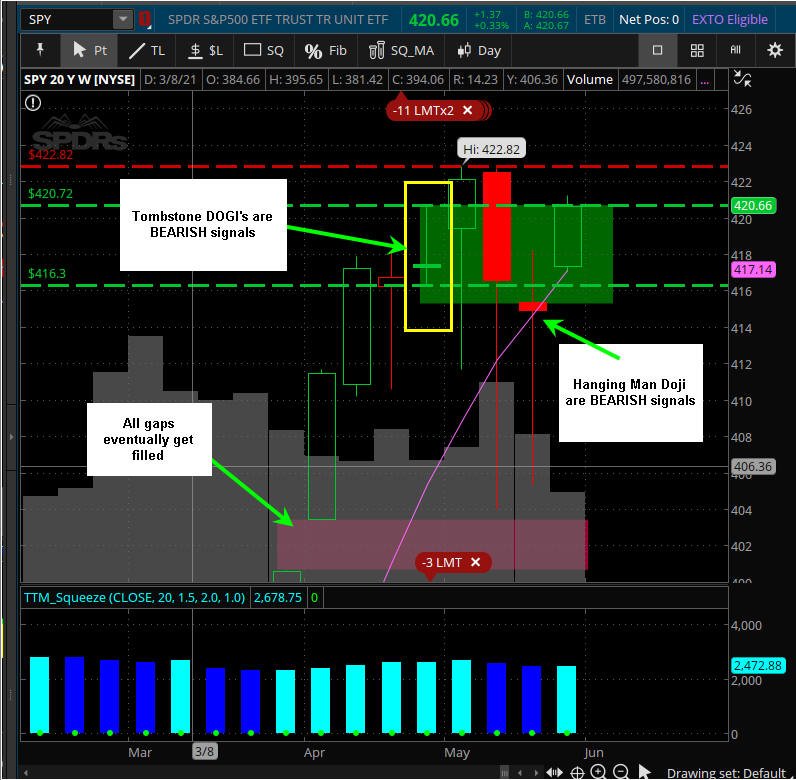

I also look at the WEEKLY

chart SGB zones as target strikes when I trade Butterfly

spreads:

Updated:

6/1/21 3:00 AM PM PST

Greetings Traders!

Wow, this past week has

been quite interesting as there has been a lot of bounce

activity within the SGB zone on the SPY daily chart so I

did not initiate any SC trades.

Some things to point out

here is the unusual trading activity I spotted

yesterday. If you take a close look at the SPY daily

chart, you can see the hanging man (SGB) DOJI back on

4/29/21 that started all the selling put in a “high” of

$420.72. Well, yesterday, we get another SGB and the

“high” was also $420.72—when you see anomalies in prices

like this…they are “code speak” to insiders in my

experience and I have seen some of the biggest moves in

price shortly after these happen.

The weekly chart also has

some interesting things going on which is why it has

been very difficult to get any trades to work out with

all this whipsaw volatility.

The tombstone SGB DOJI

from the week of 4/26/21 is being tested this week, and

if it holds, then we should see new all-time-highs next

week. On the other hand, if these SGB zones are the

market TOP for the rest of the year, then we may see a

very large implosion back down to the gap at 400-405.

These are very pronounced

candlestick patterns indicating a large move is coming

soon. The question is, what will that move be? Well,

history has shown us that SGB’s in up trends and

channels are predominantly SHORT opportunities, but you

have to realize that the Federal Reserve is “buying” up

the markets, so any downside action will definitely be

mitigated; making it very difficult to get short trades

to work out so you need to have reasonable profit

targets and GTC orders waiting.

All week I have been

attempting to short trades with NO success; even my long

trades have been lacking any real

meat-on-the-profits-bone so you need to have fishing

orders in at least 50% below the current price you think

you should be trading at and let the volatility work in

your favor with profit taking orders at 100% ROI.

Going forward with the SC

strategy, until I see a clean bounce off the current SGB

zones, I am sticking to (1) contract loads and will

lower my MAX spend to $2.00; buying strikes no further

out than 2 handles from the current price—if the prices

are higher than the max spend, then you place GTC

fishing orders.

Profits UP!

Frank

The don Franko

=========================================================================================================

Updated:

4/25/21 3:00 PM PST

This week is

going to be BIG earnings with all the major stocks

reporting:

TSLA, AAPL,

EBAY, FB, AMZN, GOOGL, SHOP, SPOT

Tomorrow is a

FULL MOON, and I have seen some of the BIGGEST moves in

stocks during the Full Moon cycle, so get your wild card

Lotto Trades on and we may just hook onto a couple Moby

Dick trades this week!$$!

Some of the

the things I have noticed as I previewed the charts over

this weekend, is most of them are at all-time-highs and

the markets are trading sideways; which indicates a

measured move is coming soon.

This past

week, the Biden administration announced plans to raise

capital gains taxes, corporate taxes back to at least

pre-Trump drops and a lot of regulation changes to

support the usual agendas of "were all gonna die"

climate propaganda.

If PBJ's

proposals are adopted by Congress, and they hike taxes

(duh...that's what Dems do), then it is going to have a

negative impact on stock prices overall because many

valuation models are based on corporate tax rates and

fund managers will be forced to adjust their multiple

calculations; therefore, they must sell and/or do some

heavy rotation from high flyers to bellwether stocks.

I believe

that is why we are already starting to see a change in

upward momentum on the tech and COVID runners as they

have been trading in a sideways movement across the

board. Also, if you are looking at your daily charts,

then you want to keep a very sharp eye on how your

stocks are reacting to the 12/31/20 close; as that will

be the pivot point for the movers and shakers in most

stocks—the portfolio managers, fund mangers etc.

control.

We do have to

keep in mind that the Federal Reserve WILL continue to

support the markets, and there is no doubt PBJ and the

Democratically controlled government will just keep on

printing money to shore up any potential panic

scenarios; however, what they cannot control is

inflation, and that is what's coming. Once it does

arrive, it will rapidly start compounding and WILL CRUSH

your wealth if you are a saver—YOU MUST BECOME AN

INVESTOR TO SURVIVE INFLATION.

Because there

has already been trillions of dollars distributed in the

first quarter, and soon the government will start

spending, along with the economies opening back up, a

lot of money will come into the hands of Americans and

they will be looking to spend or invest it. In the past,

the average investor would buy real estate, but that

market place has hit parabolic levels and is pricing

average Americans out of the game, so the only place

left to take some risk and get some rewards is the stock

markets—where do you think a lot of that stimulus money

is headed?

The other

place that the younger generation investors will

stampede into is crypto, but that requires an iron

stomach if you are older, and the risk reward there is

all but maxed out for the major crypto assets; leaving

only the tokens for total Vegas style gambling

trades—young investors can afford to take ridiculous

risk, and their meme is YOLO (you only live once), so if

they die in their investing speculation, they have a lot

of years to recover.

Over the

weekend, I have seen info that Wall Street Bets is

attempting a coup move on squeezing (GME style) Silver.

Now if they can get a a very large following to actually

buy SILVER FUTURES and DEMAND physical delivery, then

SLV, /SIL, /SI will go parabolic and explode silver

prices to the moon!

I have been

trading silver and gold futures for years, and I can

confirm that these markets are 100% being manipulated,

and prices are artificially being held down; therefore,

I plan to start accumulating some Futures and ETF's

because I want to be way ahead of the potential tsunami

if the squeeze begins in May.

https://www.reddit.com/r/wallstreetbets/comments/l71rdv/silver_biggest_short_squeeze_in_the_world_slv_25/

Ok, so what

are you going to do if you are in the older generation

or approaching your senior years like I am? You are

going to be in the land of 7-Figure profitability with

me if you are following along with the

Stimulus-Compounder and TGIF PAYDAY! strategies!

If you are

looking for some quick action trades, then we do the

Lotto and White Whale trades during earnings and on Thur

and Fri expiration.

Soon I will

be releasing my new SUPER SPY X strategy that

will blow your mind$$$$$$.

I developed

the strategy a couple months ago, back tested it, live

traded it with a simulator, and now I am currently

trading it with a live REAL MONEY account. So far, I am

running at a 100% WIN rate and making 150-250% ROI 3

times per week!

Here are the

live trade results to date:

Here is

the projections at my current trajectory:

At current performance, I anticipate reaching 6-Figures

in 15 more trades!

Details on how to implement this will be coming soon!

Profits UP!

Frank

The don Franko

=============================================================================================================================

Updated:

4/11/21 2:00 PM PST

Earnings

season begins this week and that provides for some great

Lotto Trade opportunities!! I am expecting some solid

moves in many stocks now that the stimulus money has

been distributed, states are aggressively opening up

their economies and several large spending bills are

coming our way. All this activity means a lot of money

will be moving around and the bulk of it will be in or

end up on Wall Street; which translates into higher

stock prices!

Top stocks to

watch are: AAPL, AMZN, GOOGL, FB, SHOP to name a few as

well as transports, tech and post pandemic sectors like

retail, staples and travel et al.

Be sure to

review the training module on Lotto Trades so you are

prepared to get those orders in and catch some Moby Dick

White Whales this season!

If you are

trading the Stimulus-Compounder strategy, the "core"

strategy is finally back in the green and the 50% ROI

has been running on all cylinders motoring its way down

the road to the land of 6-Figure

profitability—potentially arriving in the next 18-25

week$$$$$

I have some

exciting news coming as I have been developing a new

day-trading strategy I will call SUPER–SPY–X!

This strategy

is the TGIF PAYDAY! on steroids and literally has the

potential to make 6+ Figures in less than 3 months;

starting with as little as $55.00!!!

I have

completed the back testing, live simulated trading and

now I am finishing up on "real money" trading before I

release the full details in on how to execute this new

strategy in a few more weeks.

Profits UP!

Frank

The don Franko

======================================================================================================================

Updated:

3/12/21 11:45 AM PST

What an amazing week we

had for the strategy and what a BUMMER I put in a profit

stop loss and was ROBBED because the next day the news

of the stimulus bill passing congress came out and the

markets roared to new all-time-highs exploding those

options to over $9.00 bucks! If you were still in your

trade I hope you took those Profits UP!

Even though I missed out

on a HUGE winner this week, I still made an over profit

on both my trades so as long as I keep doing that I will

arrive in the land of 6-Figure profitability anyway! The

challenge for now is the main Model Portfolio is still

at 1 contract so I do not have the ability to take half

off and let the rest ride for the time being; however,

the 50% ROI Model Portfolio is starting to compound

today!

Now that we have the

stimulus bill signed into law and the 1.9 TRILLION (fake

fiat) money will be hitting bank accounts starting next

week, we should see continued upward momentum in the

markets; however, you can never be 100% sure of anything

with trading, so I am still going to pick up some PUTS

as a “hedge” for next week. If we keep moving on up, the

compounding will wipe out all the PUTS that have been

bought in a few weeks and exciting things will begin to

happen with your trading accounts!

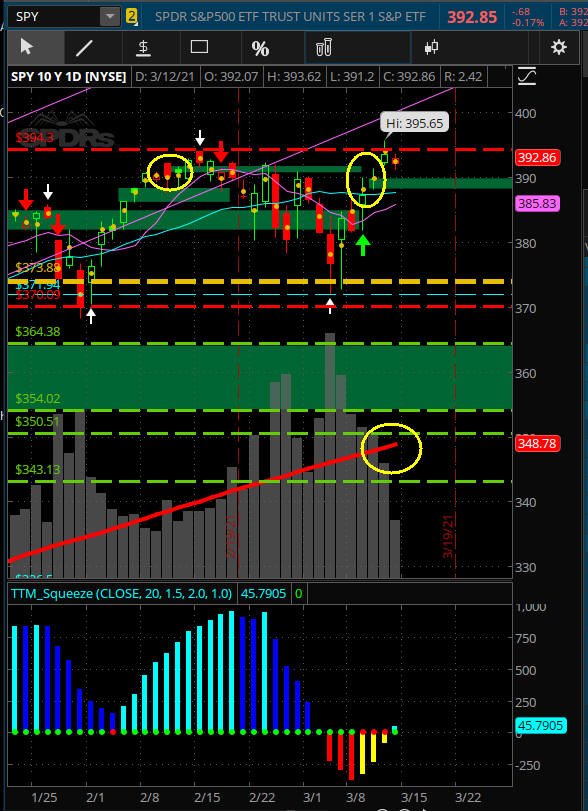

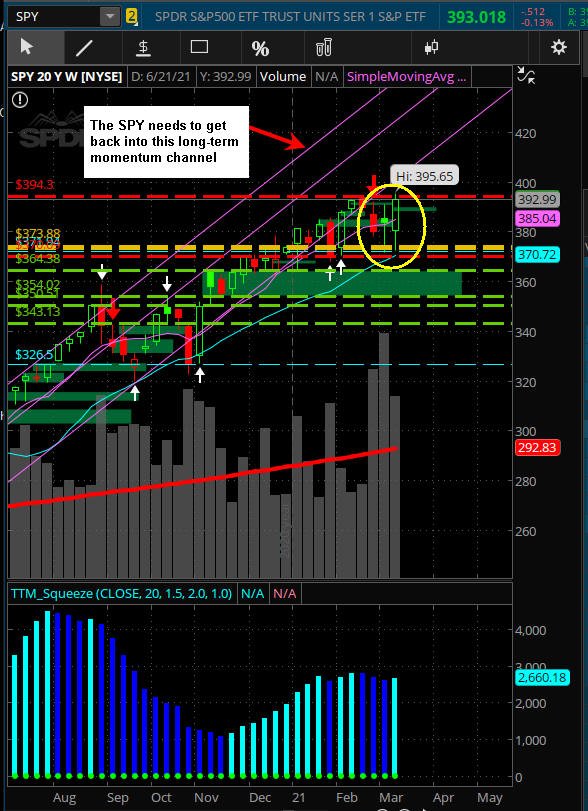

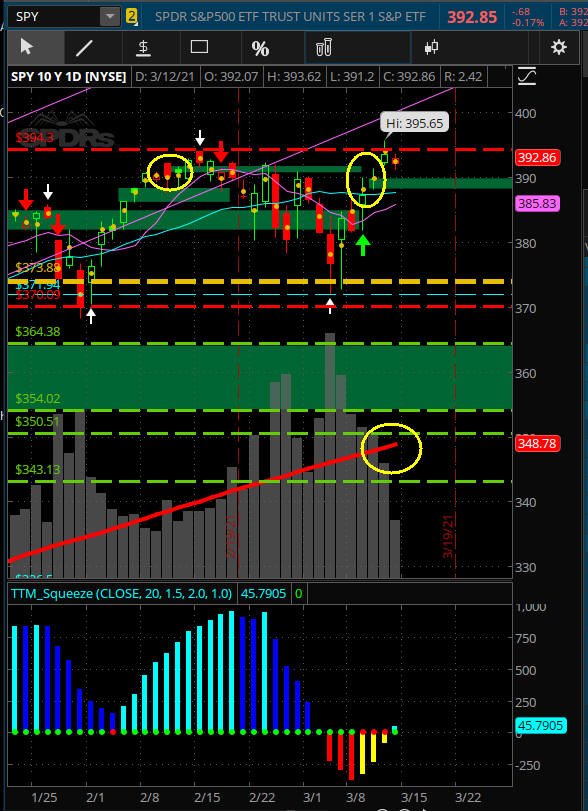

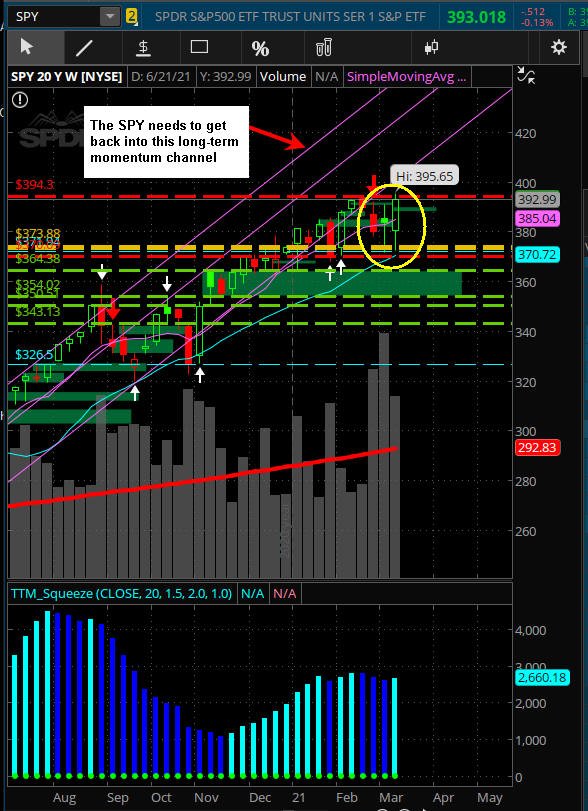

The weekly chart tells a

different story with that DOJI SGB and the solid bounce

off the 12/31/21 close. Until we get back into the

long-term momentum channel, the SPY is vulnerable to

more downside potential so that is why I am keeping my

PUT hedge plays on.

Have a great weekend!

Profits UP!

Frank

The don Franko

=============================================================================================================

Updated:

2/19/21 11:00 AM PST

Greetings Traders!

Earnings season is winding down and also the increased

volatility. The past couple of weeks we have had some

smaller moves in the SPY; which is making it difficult

to get some larger gains going and therefore, it will

extend the amount of time it is taking to get the

compounding started.

Since my last comments, and the adjustment I made, we

have had two successful trades at the 50% ROI, so if we

can maintain this trajectory, then good things are going

to happen in a couple of months!

The SPY is still holding onto it's up trending channel;

however, I have some concern with all this sideways

trading since the last SGB was put in back on 2-11-21.

Since markets are at all time high's, there is always

the possibility of a correction and/or profit taking;

and earlier in the week it was announced that Warren

Buffet and other large hedge fund managers were taking

some of their profits on AAPL and other holdings. That

is most likely the reason we are seeing diminished

momentum this week.

I am a little bit concerned to see AAPL trading below

the 2020 close; and as you can see, there was an SGB

before it began selling off. Do not ignore SGB's on

daily charts when you seen them at highs...they are

proven to be significant indicators of coming moves.

The coming stimulus is going to be a strong bullish

catalyst for the markets, and that is expected to pass

in a couple more weeks, which should continue to put

some support under the markets. Once we know exactly how

much Americans will receive, and when it will be

disbursed, the markets should have a strong upward

reaction; therefore, I am still trading with a CALL

bias, but this week I am going to add some hedge PUTS

since the SPY is stuck in a SGB zone.

I also want to buy ATM strike prices whenever possible

only looking for the 50% and 100% ROI exit points with

each trade. When you are just starting out with 1

contract, I strongly suggest you stick to the 50% ROI

exits and always place your GTC order to sell after you

are filled so you can catch any potential price spikes

on a given day—there is no need to try and maximize any

single trade with this strategy because the power is in

the compounding, and that is when you can begin to layer

entry, exits and multiple strike prices; which will

accelerate your journey to the land of 6 and then 7

figure profitability!

When you are picking PUT strikes, it is always the best

idea to be at or slightly above a previous SGB zone

because most of the time, when a stock pulls back, it

will head right into a SGB zone and on the daily chart,

the best strike is the 385-387's.

==================================================================================================================

Updated:

1/31/21 2:30 PM PST

Greetings Traders!

What a crazy first month of trading for 2021 with

ridiculous volatility due to massive short squeezes with

AMC, GME, KOSS and others has kept the SC strategy on

the ropes for the time being; however, once a trend is

put back in place, we will forget all about this first

month.

The first two week of PBJ's administration has created

some uncertainty as he has literally gone off the rails

with executive orders in his fervor to change all of

Trumps executive orders and install democratic draconian

policies. As their policies roll out, we will have a

definite move in the markets and then some consistency

should kick in with the SC strategy.

In the past 8 months, the strategy was producing well

over 100% ROI each week but now with the turmoil and

possible change in bias, we may need to back off our

target ROI and just go for 50% until we get some profits

built up. Once we start compounding, then we can

diversify with layering and multiple exit points each

week. In fact, if you were to capture a 50% ROI each

week and compound at the 50% rate, you can potentially

achieve 6-Figures in 26 trades! Of course, that is

predicated on having a successful trade every week, and

based on last years results, the strategy hit 50% every

week!

So, for now, I am going to start buying in with 2

contracts and put in a GTC order on 1 for a 50% ROI and

compound that on a separate spreadsheet so I can start

build up some profits and accelerate the process until

the full compound at 100% ROI or higher kicks in. If you

have limited capital then stick to the basic 1 contract

and just compound at 50% ROI because, as you can see,

even that gets you to $10k in as little as 15 weeks.

Then you can diversify and increase contract loads and

exit points.

Another thing to point out is if you are doing HEDGE

trades with PUTS, then you should compound those trades

on a separate spreadsheet too.

Profits UP!

=============================================================================================

Updated:

1/17/21 12:30 PM PST

Greetings Traders!

Are you ready for a new president? Come Wednesday, we

are either having a new one or potential revolution

erupting... NOT gonna happen in DC with 30,000 US

Troops. Hmmm, sure appears those "elected" politicians

must really fear the people ;-)

Ok, so once Biden is officially "the Prez", then the

money printing will begin and that should fuel the

markets higher; hopefully keeping the bullish trend

going, and if we are fortunate enough for this to

happen, then I fully expect the Model Portfolio to reach

6-Figures by June!!$$!!

As the political turmoil progresses, there should be

some continued uncertainties; therefore, I would

definitely keep some PUTS and PUT SPREADS on with strike

targets at or just above any SGB zones on the daily

charts.

Earnings season is starting and there should be some

wild moves to make some excellent Lotto Trade

opportunities. My plan is to have wild card PUTS up to

20% OTM on my basket of stocks I like to follow and I

will post those trades when I place them.

First up is NFLX on the 19th, then AAPL, FB and TSLA on

the 27th then AMZN on the 28th which are all during a

Full Moon cycle—you can keep an eye on the

earnings calendar

for trade ideas.

I am working on updating the training material for the

Stimulus-Compounder strategy and will be adding more

ways to capitalize on it as we begin to compound the

contract loads. The amazing thing about this strategy is

how quickly you can get up to speed; and once you reach

your desired contract loads; the profits just keep

growing and growing; easily eclipsing any potential

losing weeks the come our way.

January is looking to be a very unpredictable and the SC

Strategy is struggling; however, once the markets find

their lane, we can accelerate our journey to the land of

6-Figure profitability so stick with the strategy and

keep your initial contract loads to a minimum until we

start catching the coming winners!

Profits UP!

Frank

The don Franko

==============================================================================================

Updated:

1/10/21 12:30 PM PST

Greetings Traders!

Crazy town has arrived at the Capital of the United

States and something is amiss indeed! If you were

watching the MSM, then you are definitely NOT being told

or shown the whole truth of what happened in DC with the

MAGA rally and the disastrous chaos the unfolded—it

definitely resembled a classic

False Flag scenario in my estimation!

Once the president began his speech, the massive crowds

(easily 750k - 1M, but the MSM never did wide shots or

aerial coverage) were upbeat, cheering and excited about

their support of the president and this historic event.

After president Trump finished, he asked the crowds to

march (in peaceful fashion) to the capital building as

show of solidarity over the coming electoral college

confirmations, but then chaos was already afoot as

detractors (ANTIFA, BLM, Insurrection activists et. al)

were already there, very organized, and acting in

precise unison as they began to infiltrate the (LACK OF

POLICE STRONGHOLDS) capital building and occupy the

halls of Congress.

I watched several news sources and noticed a definite

(pre-planned) effort by the DC / Capital Police to

literally stand down and actually "OPEN" the fenced

barricades and encourage people (alleged Trump

supporters) to enter the Capital inner ground and then

the building? HUH???

Once these mixed-brood of both legitimate Trump

supporters and malicious operatives entered the capital

building and halls of congress, the mayhem both inside

and outside started to go parabolic. There were several

people literally climbing the walls, breaking windows

and attacking police etc.

No matter what side of the political spectrum you are

on, it was indeed a sad day in our Country; and I can

only hope cooler heads prevail; because this can easily

escalate into a very bad situation for all of us in the

long term.

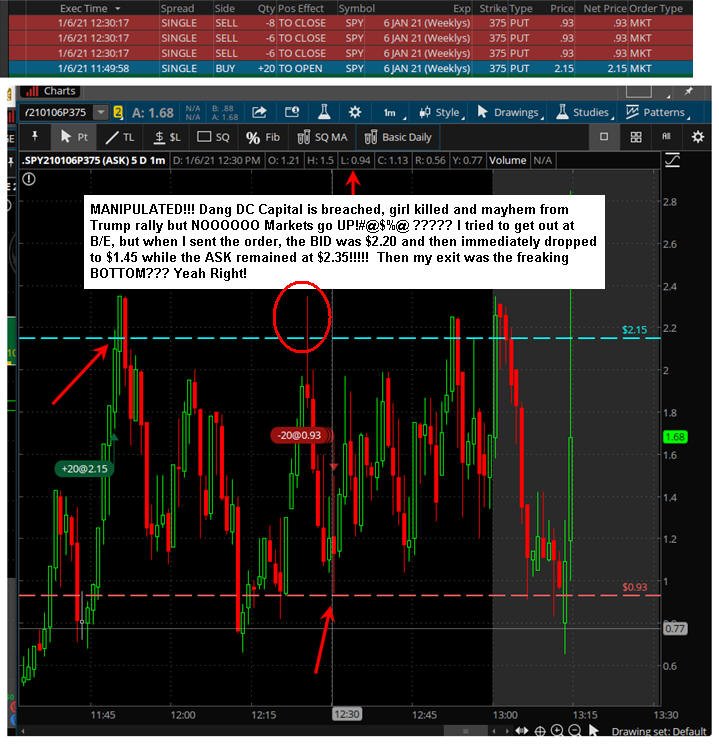

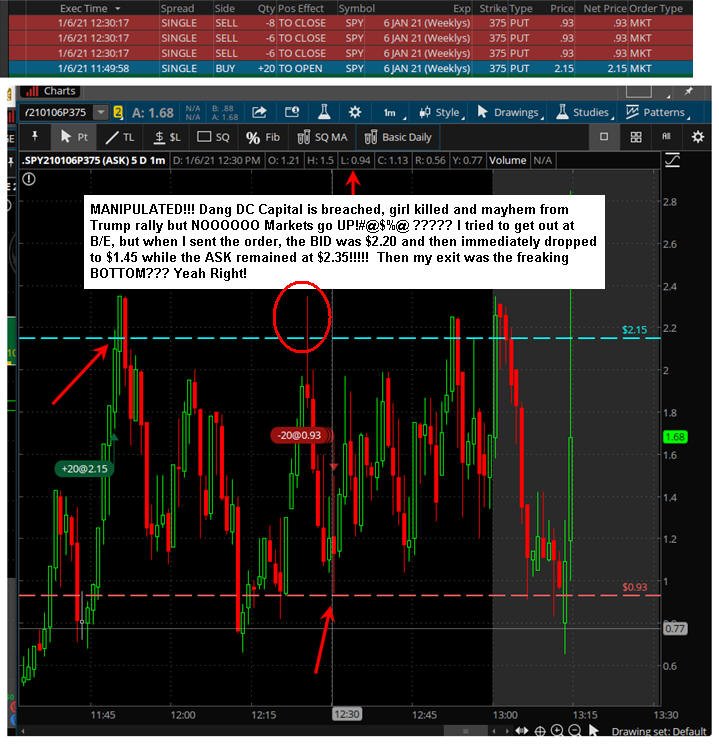

As the events of the morning began to unfold, the

markets were basically trending sideways and slipping

lower, so I jumped on some SPY PUTS, and then, as if I

controlled the stock market universe, all selling

STOPPED, and the market started to edge higher???? This

clearly shows you that markets are 100% CONTROLLED and

MANIPULATED!

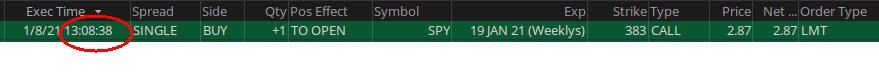

Here were my trades:

I initially stuck to my convictions and held the

position; even though it was literally cut in half in

minutes; but I could not imagine the markets would not

implode with what was going down in DC... I was

definitely WRONG on this one!

Then, once I heard the news of gunshots erupting, the

selling kicked in and I was looking to cash in on this

trade, but NOOOOOOOOOOOOOOOOO, I am the king of trading

and the options literally peaked at the high just after

I bought. I attempted to exit this trade at that peak,

but TD AMERITRADE (TOS PLATFORM) MANIPULATED MY POSITION

dropping the

BID $0.50 and I could not get filled on my limit order!—this

is why placing market orders on options can be a

disaster as they WILL slam bids and take you out MUCH

lower!

Once I realized the markets were not going to drop, it

was too late in the day to recover, and the BID was

racing back to the lows so I capitulated

taking a hefty loss on this trade!!!

In fact, by the end

of the trading, those options even closed EXACTLY where

I was trying to exit???#@#!#$@#%@#%$!!!

I MUST say, I have been in literally thousands of trades

just like this, and YES, the trading platforms (ALL OF

THEM) will manipulate your orders, increase spreads and

flat out TAKE YOU OUT to their benefit!—it is all part

of the game of day trading so you just have to suck it

up and keep in the fight or flight—BEWARE and learn from my EXPENSIVE

experience!

As the events continued to unfold, the markets ended up

closing HIGHER??? I tell you, NOTHING is going to bring

these markets down!

The GOOD news is just before all this mayhem hit, I was closing out the

first SC Trade for the DoubleUP!, and by the end of

trading, it closed at nearly a 200% ROI...WOW... and if

we gap open on Monday, it can be even higher. If you

are still in this trade, then you could have a massive

gain; however, anything can happen, so if you

concentrate on taking DoubleUP! profits in the early

stages, then, as we begin to compound, we will "layer"

our entry and exit prices and catch these moves with

some of our contract loads; because they will happen

several times in the coming weeks!

If you got filled on the next SC trade idea at the 382

strike, then you have profits already building too!

I did get filled on the 382's in one of my accounts at

$3.00, but I was unable to get filled in my others and

had to move up one strike and bought in the after hours

session.

I also attempted to buy them in my Robinhood account

after the close, but was never filled...most brokers

will trade SPY option until 1:15PM, but Robinhood

doesn't, so be aware of that if you trade there—once you

start compounding, I would NOT trade at Robinhood... it

will potentially cost you thousands to save a few bucks

on commissions.

We still have 10 days to the inauguration ceremony and

CRAZY TOWN could snowball as the political mud slinging

has turned into a surreal Knives Out movie scenario;

with the DEMS, MSM and Social Media all out for blood

with anyone who doesn't buy into their narrative.

I fully expect the markets to just continue rising, but

I will also have PUTS in place just in case BAAAADDDD

things happen in the next 10+ days and markets actually

run for the exits.

I pray the next 10 days are peaceful, and all of us as

Americans can come together and begin to rebuild our

great country, ideals and futures.

Profits UP!

Frank

The don Franko

=================================================================================

Updated:

12/30/20 5:30 PM PST

Greetings Traders!

Are you ready to make 2021 you BEST YEAR EVER!?!

Tomorrow is the first STIMULUS-COMPOUNDER trade and I am

very excited to see how things progress in the first

quarter of 2021. There is still a lot of turmoil with

the elections, COVID and the economy, so be prepared for

some wild swings as we get started. Also, the Jan

earnings season will be starting up, and that is sure to

have some impact; however, if we get similar results in

the first quarter like we had in the last quarter of

2020, then we may very well be at 100 contract loads by

April–which means life changing profits week-to-week.

Now that we have the new stimulus package confirmed and

signed into law, there should be continued momentum in

the markets which means we are sticking to the CALLS

as the core BIAS for now and adding hedge PUTS as we

begin to compound.

Over the weekend, I was able to review all the trades

from this year, and I will be applying some adjustments

now that I have the data to confirm my suspicions.

First off, we will still maintain the MAX spend at

$3.00 on the initial trades; however, as the VIX

comes down, we can also get filled at LOWER prices too.

In fact, based on the data from 2020, we could have been

filled for $2.00 74% of the time and at $1.50 44% of the

time. That means, we can effectively "layer" our orders

and begin to maximize the compounding as we build up

contract loads going forward.

You need to remember, this is a momentum based strategy

week-to-week, so once you start, you should stay in the

game every week to maximize the compounding and catch

the BIG moves from time-to-time—even if you have to

re-invest a few times... it will be worth it a year from

now!!$$$!!.

Besides, where else can you take a few hundred

dollars and build it to 6 maybe even 7 figures in 1-2

years or less?

The average profits over the past 32 weeks were

approximately 135%+ EVERY WINNING TRADE! and an 80%

WIN RATE...WOW...and a few times we got a Moby Dick

of 400% -778%!!! Therefore, we need to just

concentrate on the DoubleUP! in the first few

weeks, and once the compounding begins, we can sell 75%

and let the rest ride.

For this year, as I build up the contract loads (10+), I

will start implementing my other strategies like: Lotto

Trades, Spreads, Hedging, Strike and Price Layering to

increase profits and accelerate the journey. I will be

using a portion of the profits to keep wild card PUTS in

play each week up to 15 handles OTM; as this will

protect the CALL trades in the event the markets implode

(if they ever do) and break even if not make even MORE

profits.

For example, the SPY closed today is at 371.00, and when

you look at a weekly chart, it has dropped as much as 20

handles in 1-2 days. So, if you were to buy some wild

card PUTS 15 handles OTM with 5 days to expiration, they

would cost approximately $0.17 per contract... cheap

insurance!

Now if you want to go the full expiration cycle with the

CALLS, then it begins to get expensive because those

options are $1.18 per contract. The remedy with these is

to do a $5 wide BEAR PUT spread for a $0.34 debit to

lower the cost down, but maintain enough of a spread to

at least break you even on the CALL trade should the

markets implode by expiration.

My plan is to always invest the entire $3.00 each trade;

however, I want to try and divide the money up and buy

my CALL strike for $2.75 or lower and spend the

remaining $0.25+ on the directional PUTS that

expire 5 days out. I want to have at least 2:1 in PUTS

over my CALLS, and after I am at 10+ contract loads,

then I will start doing the BEAR PUT SPREADS for the

full expiration cycle too.... paid for by PROFITS.

Ok, so now you have to decide what compounding method

you want to go with that best fits your risk tolerance

level. Any one of them you choose will ultimately get

you to the land of 6-Figure profitability; however,

based on the first years results, the +1 each trade or

50% compounding of profits has the potential to get you

there in 2-4 months.

FOR ME, I AM IN THE CALLS ALL-OR-NOTHING STARING WITH

1 CONTRACT AND INCREASING +1 CONTRACT EACH TRADE

UNTIL I REACH 10; THEN I WILL BEGIN COMPOUNDING AT 50%

UNTIL I REACH 1,000 CONTRACTS!

If you are just starting this strategy with a limited

bankroll, then you can put in GTC orders for 1

contract at $2.00; canceling by Wednesday if

not filled. Otherwise, you need to commit to the $3.00

max spend to assure you are filled each week and begin

compounding after a couple of wining weeks.

Of course there are NO GUARANTEES this strategy

will perform at the same or even similar results going

forward, but all systems are GO, and we will let the

trend be our friend to the end!

I hope all of you benefit from this awesome strategy in

2021 and build your accounts (at your pace) to new

heights.

Profits UP!

Frank

The don Franko

|