|

WEDNESDAY

– 4/21/21 6:40 AM PST – UPDATES

Lotto Trade Ideas for NFLX

Greetings Lotto Traders!

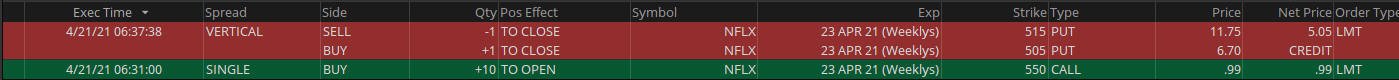

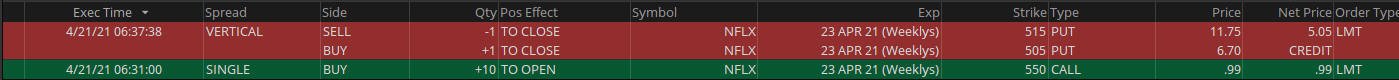

I was filled on the

following:

Sold my Put Spread

Filled on my White Whale

Trade lookin for a minimum 300% ROI on the 550 CALLS.

Holding on the 470 PUTS

Profits UP!

===========================================================================================

TUESDAY

– 4/20/21 11:50 AM PST – UPDATES

Lotto Trade Ideas for NFLX

Greetings Lotto Traders!

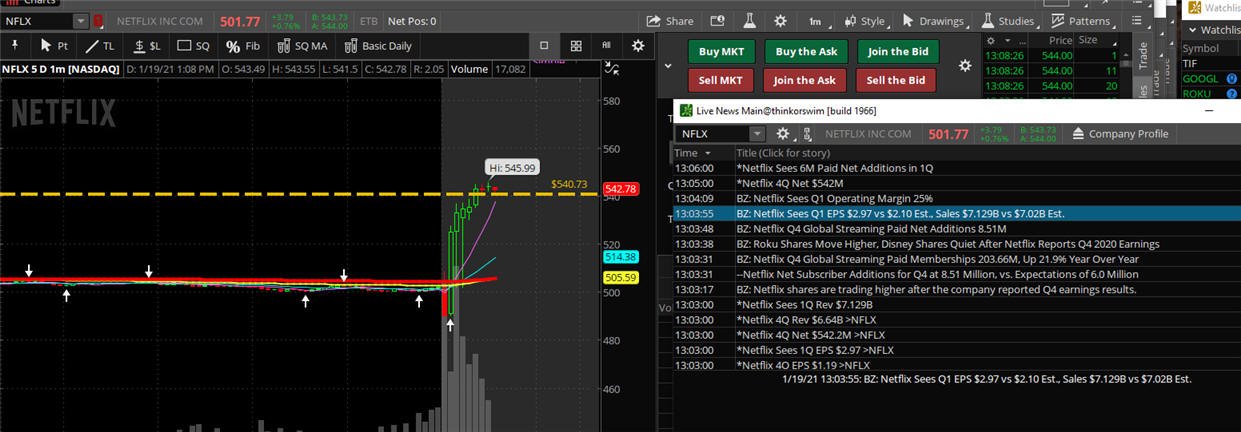

NFLX beats earnings

estimates but disappoints on subscriber growth by a wide

margin compared to the previous quarter:

Netflix

shares fell as much as 11% in after-hours trading after

reporting a large miss in subscriber numbers in its

first-quarter earnings report.

The

streaming giant on Tuesday reported 3.98 million net new

paid subscribers in the first quarter, down from 8.5

million reported in the previous quarter and well below

the 6 million the company predicted three months ago. In

the same quarter a year ago, Netflix reported the

addition of a record 15.77 million paid subscribers

(https://

www.marketwatch.com/story/netflix-adds-more-than-15-million-new-subscribers-stock-rockets-higher-2020-04-21).

So, depending on how the

markets are trading at the open, NFLX could find buyers

at current levels and possibly get squeezed back to the

SGB zone at $550.

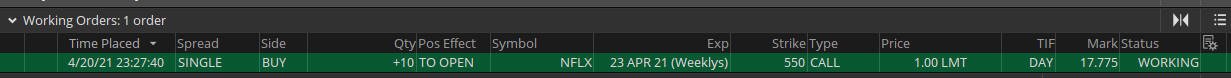

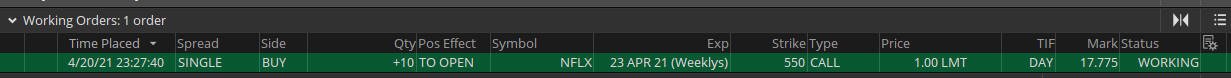

My plan is to put in a

White Whale fishing order on the 550 CALL strike for

$1.00 and see if I can get filled; maybe catch a short

squeeze back up to $550 by expiration.

On the other hand, if the

stock continues to sell off and opens below $500, then I

will be looking to take profits on the PUT spread;

however, if you do not take profits on the spread, then

you need NFLX to close at $505 or lower by Friday to

lock in the full value of the spread—since I have the

470 PUTS I will take what I can get out of the spread.

Now if the the stock holds

ground at current levels, and does not make enough of a

move either way, then I will salvage what I can on the

spread and work on selling more credit spreads over the

next couple of months to recoup as much of the

expenditures from these trades.

There are a lot more

earnings releases coming up and there is sure to be some

BIG winners too!

Profits UP!

Frank

The don-Franko

==============================================================================================================================

TUESDAY

– 4/20/21 10:37 AM PST – NEW LOTTO

TRADE IDEAS for NFLX

Greetings Lotto Traders!

Today

is NFLX earnings release (after the close) and we could

see some good movement because there is a good sized SGB

ZONE on the daily chart, and the stock has wicked down

today under the zone.

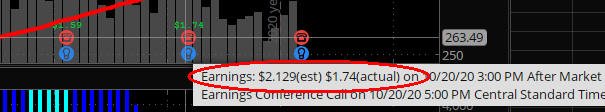

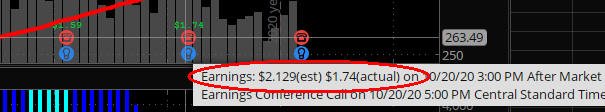

Last quarter, I had a nice

540% WINNER on the CALL side with a sold $93 move the

next day!

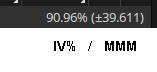

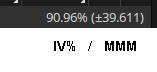

The MMM is +/- 35.00, and

NFLX is more than capable of moving 2x that, so if the

stock gets whacked, wild card Lotto Trade PUTS at 455 or

higher (since we will have a couple days to expiration

and the markets are already in a selling mode) and I

want some Bear Put Spreads at or just above the expected

MMM move.

Now if they surpirse

again, then it could easily move 2x the MMM higher, and

could also be the catalyst to get the markets back on

track for higher ground, so I want to have CALL SPREADS

strikes no further out than the MMM range and wild card

CALLS at 2x MMM or lower.

When stocks drop or pop

post earnings, they tend to gravitate to a whole or half

number, and with NFLX currently trading around $450 (the

half), you can target your strikes at the whole (500 or

600) when speculating the move—especially when 2X the

MMM is in that range, then you have a lot of potential

the stock can make it to the whole/half price points.

Of course, there is always

the possibility it does not make any move, so you can

NEVER bet the farm on these Lotto Trades!—the strategy

is best traded in the aggregate (over a years time) with

compounding of contract loads AFTER winning Lotto

Trades!

Here are my trade Ideas:

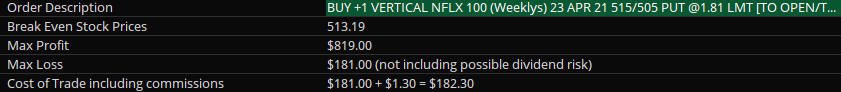

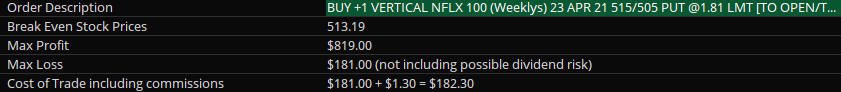

Spreads:

BUY 515 PUT / SELL 505

PUT (1.85 DEBIT) MAX profit is $819.00 (440%) if

NFLX drops below 505.00 by expiration.

BUY 590 CALL / SELL 600

CALL APR 23

expiration for (1.50 DEBIT) MAX profit is $850 (567%) if

NFLX rises to $600 or higher by expiration

Wild Card Lotto Trades at

2x the MMM:

BUY 470 PUT APR 23

expiration for: 0.55 MAX

BUY 620 CALL APR 23

expiration for: $1.40 or lower

Here are my fills:

(note: trade only the

size/direction you are prepared to lose 100% of the

money invested)

The other way to play

earnings is wait until tomorrow and fish for White Whale

trades after you see the reaction in post and pre

markets.

Any questions, review the

Lotto Trade training module or email me.

Profits UP!

Frank

thedonFranko

========================================================================================================================

SATURDAY

– 1/30/21 3:30 PM PST –

What a crazy

week of trading we have had, and, unfortunately, this

round of earnings Lotto Trades are going to fail except

for SBUX due to

the massive short squeezes that caused major sell off's

on all the top stocks. Well, those are now at a bargain

in comparison and should start to see some upward

momentum. Once I see the get back over their SGB zones,

then I will start selling some credit spreads to get

back the losses on the Lotto Trades.

===================================================================================================================================

FRIDAY

– 1/29/21 7:30 AM PST –

What a crazy

week of trading we have had, and, unfortunately, this

round of earnings Lotto Trades are going to fail due to

the massive short squeezes that caused major sell off's in

stocks as fund managers/investors had to most likely raise capital to cover and/or chase stocks

like: GME, AMC etc.

Also, the news from the Fed on

Wednesday was not very motivating, and PBJ has been a

busy beaver playing King-of-the-Hill with his

unprecedented executive orders!

All this

crazy action, combined with a Full Moon cycle, has

created a massive storm of confusion installing fear

with investors that has practically KILLED off the long

bias momentum as many stocks I am looking at are all

about to break down through their bullish channels.

As much as it

pains me to see multiple losing Lotto Trades at the same

time, I know

that in the aggregate, we will catch more than enough to

wipe out ALL the losing trades and advance our accounts.

Although we

had some great earnings reports from AAPL, MSFT, FB and

TSLA, they all sold off initially, and appear to be

losing some more ground as we close out the first month

of 2021 trading.

As you can see, they ALL had SGB's in play and until

those are taken out, the bias is Bearish strategies;

however, I do expect some good week-to-week Lotto Trade

action, so I will be keeping a close eye on all of these

stocks and placing orders on Thur/Fri.

Once we start to get a bounce move over the SGB zones,

then I will be selling credit spreads to get back

the money I spent on the earnings trades.

Remember: Lotto Trades are "speculation" and most

of them fail and cost money to start, but when the

winners come (and they do) you will wipe out ALL losses

over time. If you do not have the capital to expend,

then stick to the Stimulus-Compounder strategy and soon

you will have plenty of speculation capital to lay

multiple Lotto Trade orders and catch some Moby Dick 5+

figure winners!!

Have a great weekend!

Profits UP!

Frank

===================================================================================================================================

TUESDAY

– 1/26/21 11:30 PM PST –

I was filled

today on everything but the TSLA CALL spread and will

get that on tomorrow.

MSFT had a

great quarter and the stock launched nearly 1.5x the

MMM, so if this hold up tomorrow, the spread should be

close to full value and I will take my profits on this

one. On the other hand, SBUX is a DUD but we have until

Friday to maybe salvage something from the trades.

SBUX did beat estimates

and the stock was sold off but not even close to the MMM

expectation so it will most likely result in a zero sum

gain... will just need to sell some credit in the coming

months to get the money back.

The real excitement was GME when Elon Musk tweeted

something in after hours about the stock and the shorts

were absolutely decimated as the stock squeezed up to

$248.90... OMG—this is probably NOT over yet and we

could very well see this stock go even higher tomorrow.

GameStop shares,

already on a historic tear, spiked in after-hours

trading after a one-word tweet from Tesla CEO Elon Musk.

"Gamestonk!!" Musk

tweeted Tuesday afternoon, linking to the Reddit threat

r/WallStreetBets.

We will see, and if you are trading it, ONLY put in what

you are 100% willing to lose, because eventually (if not

tomorrow), they will wipe out the BULLS even faster than

they are wiping out the BEARS.

==================================================================================================================================

TUESDAY

– 1/26/21 2:30 AM PST –

BIG

earnings releases this week with AAPL, FB, TSLA, MCD and

there is sure to be a BIG mover in one of them. Also,

GOOGLE is setting up for a very big move with triple

SGB's the past three trading sessions.

When trading Lotto Trades at earnings, we are

SPECULATING hoping for the parabolic move like we just

had on NFLX last week. Many times these trades end up

going bust, so you MUST have a high tolerance to draw

down and PROFITS capital to stay in the game long enough

to catch and then start compounding!

Typically, I prefer to get in on Lotto Trades for less

than $1.00 per contract, but with the current IV Pumps

in all stocks, that will be more difficult; therefore,

you may have to consider spreads to get you in the game

under $1.00 per contract—although spreads do cap your

upside, they offer you an opportunity to get in much

cheaper.

The

challenge is what strike do you sell to assure the best

odds of cashing out at the full value? This is where I

say, "let the DAILY chart SGB zones be your guide." I

always want my sold strike just below for CALLS and at

or just above for PUTS on the closest previous SGB zone.

That way, when a stock hits that zone, you are at the

full value of the spread and can maximize your profit

potential.

Here are my

trade ideas for this week earnings plays:

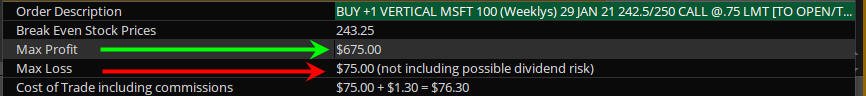

MSFT -

Last quarter, they beat but the stock still sold off and

then took off post earnings. This time, the stock is at

all-time-highs, so upside is unknown, and since the MMM

is +/- 9.23, your CALL strikes should be no further than

$15.00 above in case the stock goes parabolic and hits

the $250 psychological lever and the PUTS strikes the

SGB zones at $215.00 or higher.

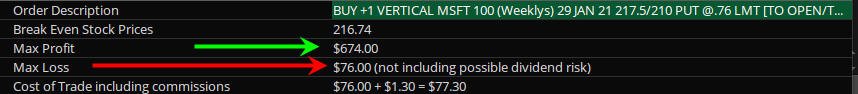

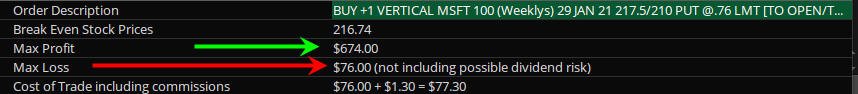

Here are the BULL CALL and BEAR PUT Spread examples:

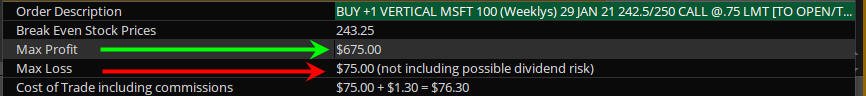

BUY 242.50

CALL x SELL 250

CALL

$75.00 Debit

Profit up to $675.00 (900%) if MSFT surprise beats and

hits the psychological $250 level.

BUY 217.50

PUT

x SELL 210

PUT

$76.00 Debit

Profit up to $674.00 (880%) if MSFT falls to the SGB

zone.

=====================================================================================================

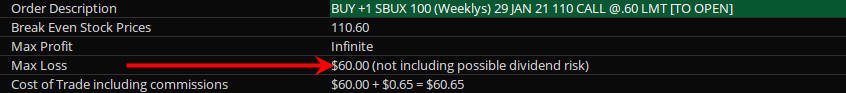

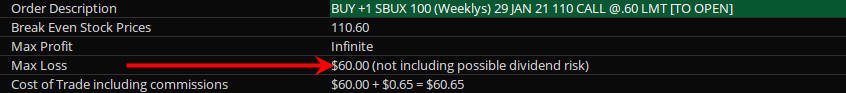

SBUX -

Investors appear to

have some caffeine jitters with SBUX as the stock has

been trending sideways in a triggered squeeze for the

past couple of weeks. If they disappoint, all signals

indicate a BIG drop is eminent. The likely first target

is the SGB zone at $95.00. However, I think it will take

a surprise beat to launch the stock to all-time-highs so

I am going with a wild card Lotto Trade CALL on this

one.

BUY 110.00

CALL

Debit $60.00

Profit UNLIMITED

BUY 100.00

PUT

Debit $87.00

Profit UNLIMITED

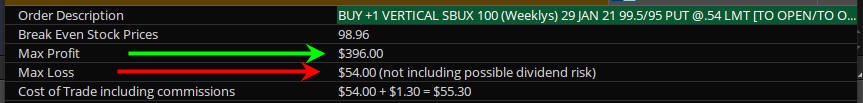

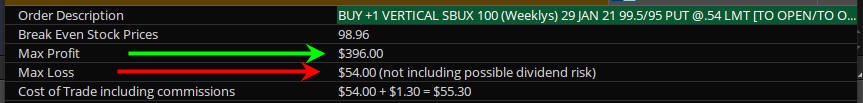

OR

BUY 99.50

PUT

x SELL 95

PUT

$54.00 Debit

Profit up to $396 (730%) if SBUX falls 2X MMM WHICH IS

THE SGB ZONE.

=====================================================================================================

HERE ARE MY THOUGHTS ON

WEDNESDAY EARNINGS.

NOTE: THE SPREADS ARE

EXAMPLES AND WILL MOST LIKELY WILL BE ADJUSTED ON

WEDNESDAY.

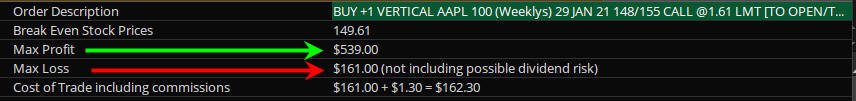

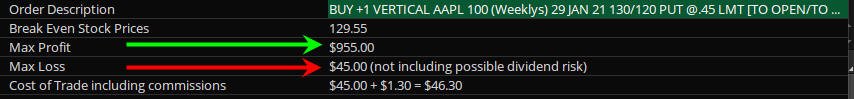

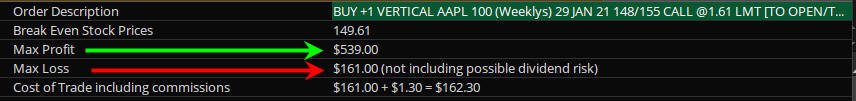

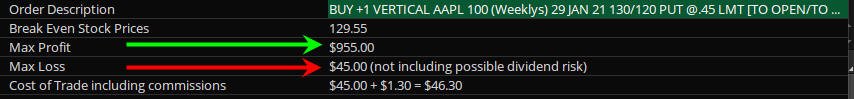

AAPL -

The

stock broke out today closing as a DSW at new

all-time-highs. Expectations are high and analysts are

most likely looking for growth numbers on the company's

services vs. iPhone sales. For many years, it was

believed they were a one-trick-pony only selling

equipment; however, the company reinvented itself and

moved aggressively into services, entertainment and

maybe even EV and Smart Homes in the coming years;

especially since the new PBJ is gung-ho for ZERO

emissions and willing to spend BILLIONS to get that ball

rolling. The skies the limit and since the company is

the largest market cap in the stock market, EVERY

investment fund, manager and anybody trading wants a

piece of the APPL pie. Any dips have always been bought,

so I have not doubt that even if they disappoint, the

stock has a permanent bid under it. In fact, today, the

markets took a tumble after PBJ spoke and AAPL snapped

right back moving in a $10 range! WOW now that is some

BULLISH conviction.

The

daily chart has a triggered squeeze to the upside and

the 200MA is clearly trending higher with converging

8/21 MA's, so all signs say UP is the path of least

resistance; however, with today's Dragonfly DOJI

candle, you have to be ready for an upset and buy some

wild card PUTS too.

Twice the MMM puts the

stock at $130 which happens to be the SGB zone so that

is where my PUT strikes will be waiting.

BUY 148.00

CALL x SELL 155.00

CALL

$161.00 Debit (IV is pumped up and CALLS are expensive)

Profit up to $539. (330%) if AAPL rises twice the MMM

and hits the $155 Fibonacci level.

BUY 217.50

PUT

x SELL 210

PUT

$45.00 Debit

Profit up to $955. (2,100%) if AAPL drops twice

the MMM.

=====================================================================================================

FB

-

The

all-time-high on FB is 304.67 set back in 8/2020 and put

in a SGB two days later that was tested on 11/5

confirming that was indeed the top for FB. Today the

stock dipped with the mini-market crash and was quickly

bought and closed at a Dragonfly DOJI EXACTLY in both a

weekly and daily SGB zone. The last quarter, FB beat

estimates by a wide margin but the stock barely moved

higher and ended up selling down a couple days so BIG

money could get in cheaper. I have always had difficulty

trading FB at earnings and I am sure this time will be

no different. The weekly chart has been in a long term

triggered squeeze with the stock basically trading in a

sideways range for most of it. If they beat again by a

higher margin, then I anticipate the stock will easily

test all-time-highs so my strikes will be at $310. If

they disappoint, the drop cold be a dramatic drop to the

200MA at $250. Because FB tends to be fickle at

earnings, you may want to consider buying an extra week

of time.

IV is pumped up so there are NO cheap Lotto Trades here

and if you have a small account... sit this one out

because my win ratio with FB is pretty LOW.

Also, we may get an opportunity post earnings with a

White Whale trade on Friday.

BUY 292.50

CALL x SELL 302.50.00

CALL

$200.00 Debit

Profit up to $800.00 (400%) if FB rises 1.5x the

MMM and hits the $305 all-time-highs.

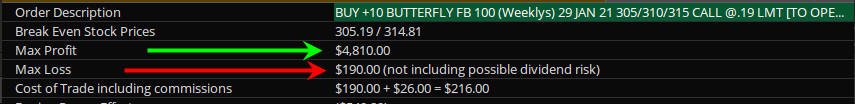

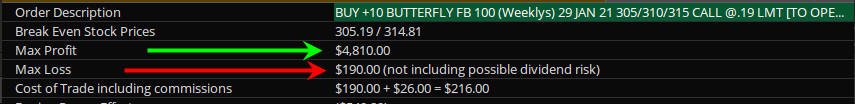

OR — the Wild Card

CALL BUTTERFLY

$190.00.00 Debit

Profit up to $4,810.00 (2,500%) if FB rises 2x the

MMM and hits NEW all-time-highs.

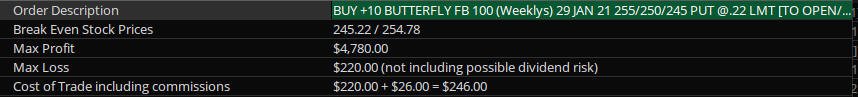

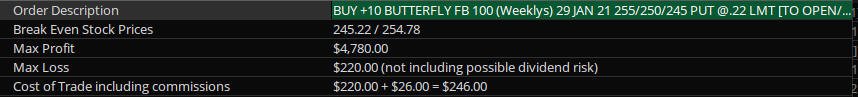

BUY 255 / 250 / 245

PUT

BUTTERFLY

$220.00 Debit

(10-Contracts)

Profit up to

$4,780.00 (2,100%) if FB drops 2x the MMM>

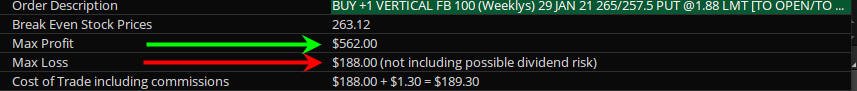

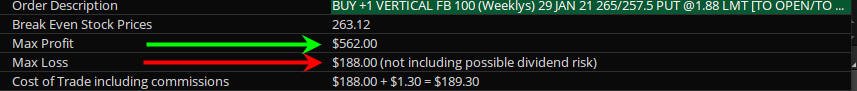

OR

BUY 265

PUT

x SELL 257.50

PUT

BUY $188.00 Debit

Profit up to $562.00 (298%) if FB drops the MMM.

=====================================================================================================

TSLA -

ALWAYS

the wild card stock and VERY

expensive to play... even for Lotto Trades, but when you

catch on this monster, you EAT like a KING! and with

PBJ's proclamations for 100% EV government spending, you

can bet that TSLA will play a HUGE role in getting a lot

(if not most) of that money spend.

The

stock topped out at $900 today and then it was slammed

with the markets down to $840, but recovered only half

that drop by the close indicating a possible buyers

fatigue.

There is just no way to give any solid technical

analysis on this stock, and you just have to spend ONLY

what you are 100% willing to lose if you trade it at

earnings. If they surprise, then I do not see any

reason for the stock not to hit that $1,000

psychological barrier; which actually puts the stock

price at $5,000 per share pre-split... BONKERS right?—in

fact, they split this stock 5:1, and in less than 3

months, it more than Doubles????

Where can this stock go is anybody's guess, but looking

at the WEEKLY chart, we have some clues with previous

SGB zones from the DAILY chart before the

split.

The current DAILY

chart shows a SGB zone at $850 and then 683; which

happens to be at the T4 of my Bear 180 reversal if the

stock gets whacked.

NOTE: THIS STOCK IS TOO EXPENSIVE FOR SMALL ACCOUNTS AND

SHOULD NOT BE TRADED DUE TO THE HIGH PROBABILITY OF 100%

LOSS.

THESE SPREADS ARE SUGGESTED AND DEPENDS ON TOMORROW

WHICH WILL ADJUST THE STRIKES HIGHER OR LOWER TO

MAINTAIN THE THE BUY PRICE RANGES.

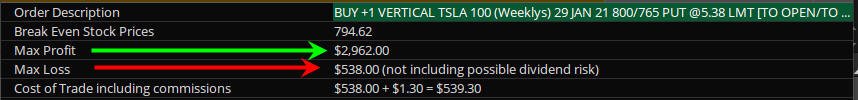

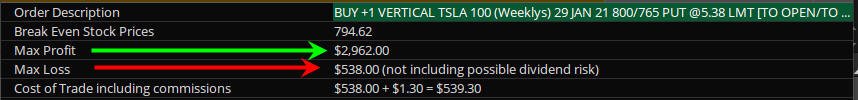

BUY 950

CALL x SELL 1,000.00

CALL

$780.00 Debit (IV is pumped up and CALLS are EXTREMELY

expensive)

Profit up to $4,220.00 (540%) if TSLA hits the $1,000

psychological level

BUY 800

PUT

x SELL 765

PUT

$538.00 Debit

Profit up to $2962.00 (550%) if TSLA drops 1.5x

the MMM.

=============================================================================================================================

THURSDAY

– 1/21/21 4:30 PM PST –

I

closed my first LOTTO

TRADE for 2021 with a HUGE ProfitsUP!!!

If you did

the spread, you made a nice 400-500% ROI but if you did

just the CALLS those made over 1,300% ROI...WOW!!!

Not to worry

if you missed out on that one because there will be

plenty more and once you start compounding your contract

loads, then you can "layer" strikes and entry prices and

always have some contracts in the game to catch ALL the

potential!!

I did the 540 / 555 CALL SPREAD

If you just bought the CALLS then you caught White Whale

profits!!!

===================================================================================================================================

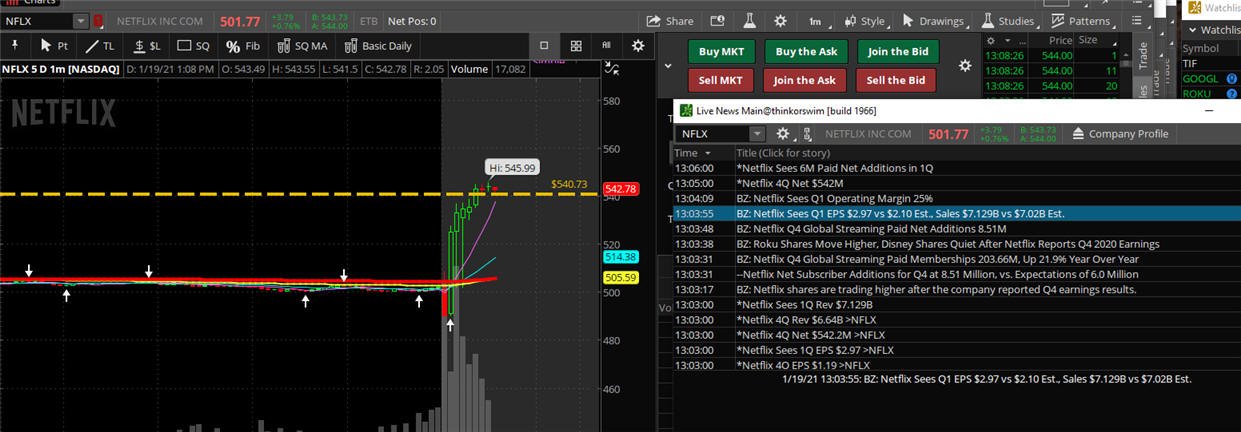

Updated: 1/19/21 1:15 PM PST

NFLX has a BIG earnings

release and stock is up nicely in after hours. If this

holds up tomorrow, we should see a nice WIN with the

Bull Call Spread Lotto Trade.

Of course, the PUTS will

be worthless, but once we cash in on the Call Spread, I

will assess the over p/l and sell some credit spreads

going forward to get it all back over time.

Next week is several HOT

stocks and so the Lotto trade journey continues!

Updated: 1/19/21 10:30 AM PST

Here are my fills for

NFLX:

These are 100%

SPECULATION and typically expire worth less several

times until we catch so limit your size and capital

expenditure.

Below are my NFLX Lotto

Trades; however, the cost to enter is much higher than

usual so either do SPREADS or wait until tomorrow and

see if we can catch a White Whale opportunity.

NOTE:

DO NOT FOLLOW MY SIZE unless you have a lot of capital

to tolerate initial draw downs. You should start with

ONE (1) contract loads and compound with profits.

Updated:

1/18/21 9:30 PM PST

Get ready to catch some LOTTO TRADES! as earnings season

kicks off for 2021. Up first will be NFLX tomorrow and

the stock is poised to make some moves, but could be

stifled by the presidential inauguration the next day, so

control your size before and lets see what happens

after.

Next week will be AAPL, AMZN, TSLA and there is

sure to be some great opportunities there too.

This year, I am applying the compounding methods from

the Stimulus-Compounder strategy to my Lotto Trades, and

when we catch some winners, the contracts are going to

build rapidly as the profits go parabolic!

Get

ready to have some 6-Figure days in 2021!$$!

Here is the Daily Chart for NFLX and it looks like the

stock has topped out. They missed estimates last

quarter, and with a potential economy startup coming,

this stock has to post well above estimates this time or

I think we see a sell-the-news event. The first likely

stop is the SGB zone at 440 and potentially even lower.

On the other hand, if they beat, surprise or give the

Bulls a big carrot to gnaw on, the upside is 540-560.

Since we are trading this tomorrow, I recommend doing

SPREADS to get in a lot cheaper.

The weekly chart paints a different picture with a

triggered Squeeze indicating a larger move in either

direction is imminent.

Last quarter the company missed estimates and dropped

about $40 in after hours trading.

Before earnings the stock had TWO SGB's and those proved

to be excellent SHORT setup opportunities.

This time there is another SGB in play but they are DOJI

candles so I expect some reaction for sure.

At 10% drop will put the stock directly in the big SGB

zone and that is where you want your strikes to be at or

slightly above.

My target strikes:

Premiums are pumped up so Spreads can get you in

cheaper:

Bearish Bias:

PUTS: 440/410 Bear Put Spread. Jan 22 Expiration

Wild Card PUTS 415/400 Bear Put Spread. Jan 22

Expiration

Bullish Bias:

CALLS: 540 and/or 540/555 Bull Call Spread. Jan 22

Expiration

Profits UP!

Frank

The don Franko

|