|

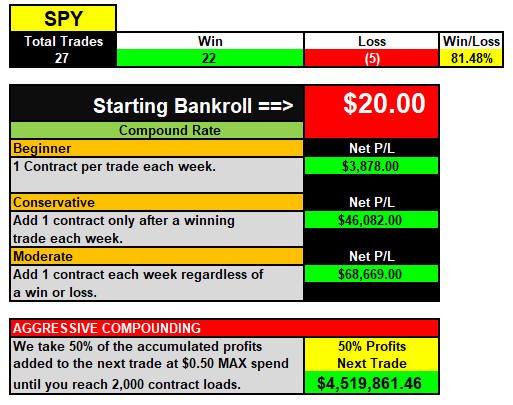

Session 2 – How you trade the TGIF PAYDAY! strategy

Back

to Top

Every trading system that has ever been created has the potential

to win...well...sort of. The reason many traders (me included) struggle

having consistent success is trying to figure out which stock to trade, and what option strike price to

buy.

After all, if you pick the correct stock, but you buy the wrong strike price,

then your trade ends up being out-of-the-money (OTM) by expiration and will expire worthless.

Even if you pick the right strike price, and only end up at-the-money

(ATM), you still expire worthless because you have NO

intrinsic value—you MUST be in-the-money (ITM) PLUS the

cost of your option to make at least a break even or profit at

expiration.

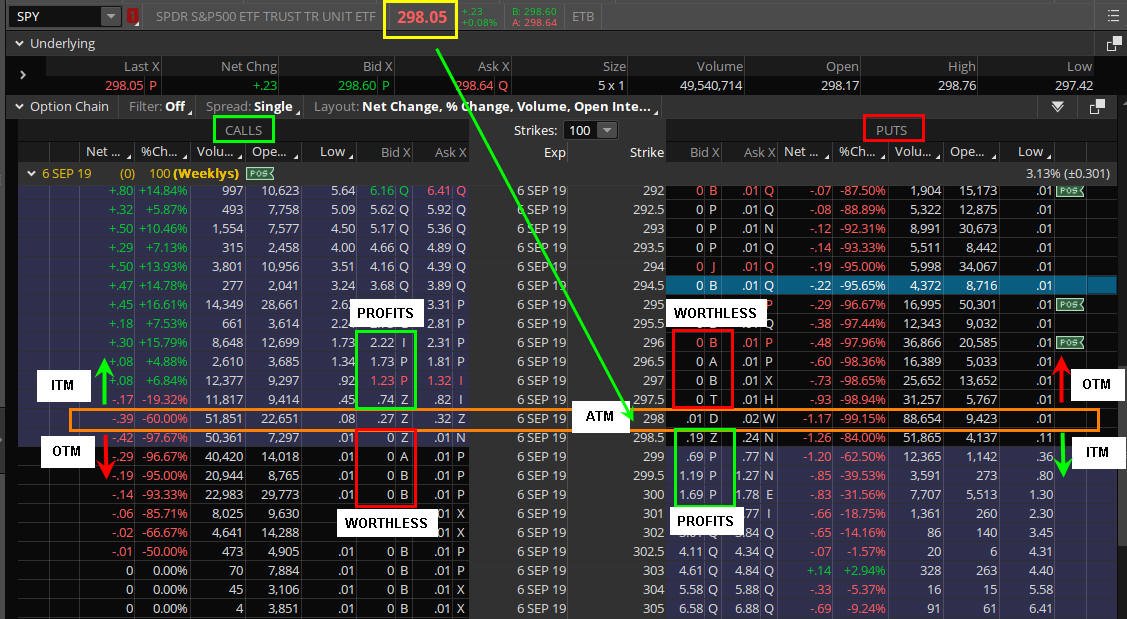

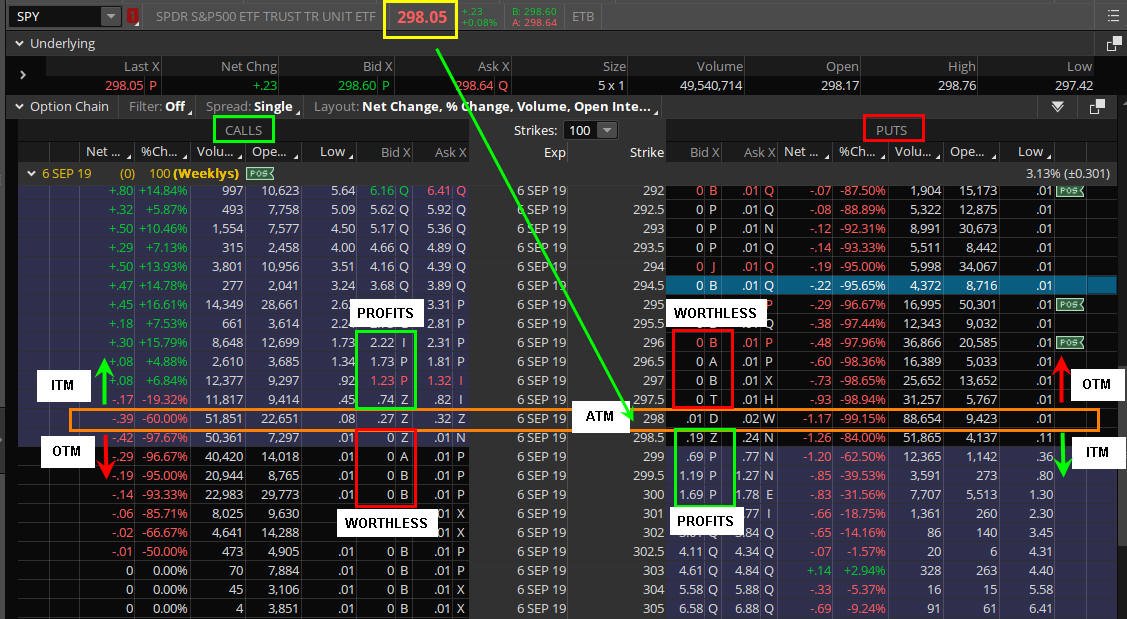

Below is an example of an option chain on a Friday expiration for

the SPY.

I know the picture below probably looks very confusing at

first glance, but once you understand the layout, it will become easy

because every option chain, on any trading platform or brokerage, is

laid out pretty much the same was as shown below.

Here are the things you need to concentrate on:

The center columns are the expiration dates and the

strike prices.

Left side is always

CALLS

(you expect price to go UP) and the

Right side is always

PUTS

(you expect price to go DOWN).

The ASK is what you pay when you BUY

and the BID is what you get when you SELL a trade.

As you can see, there are so many choices...how do

you know which STRIKE PRICE has the best opportunity to make a

profit by expiration?

In the options trading

world, it is said that 90% of all options bought expire worthless; however, according to the Chicago

Board Options Exchange (CBOE), the actual statistics are more like this:

-

10% of option contracts are

exercised

-

55%-60% of option contracts are closed out prior to expiration

-

30%-35% of option contracts

expire worthless (out-of-the-money with no intrinsic value)

Not matter what the statistics shown above say,

picking the correct stock, and then buying the right strike price is

the only way to break through the wall and get on easy street to

consistent long-term success.

Entry is Key...Exit is

Everything! TM

Are you ready to change your financial and trading life?

Then I am about to reveal the secret to my proven formula, and if

you can follow these simple steps below, then you have the potential to

reach above and beyond your trading and financial goals in 1-2 years!

STEP 1

Back

to Top

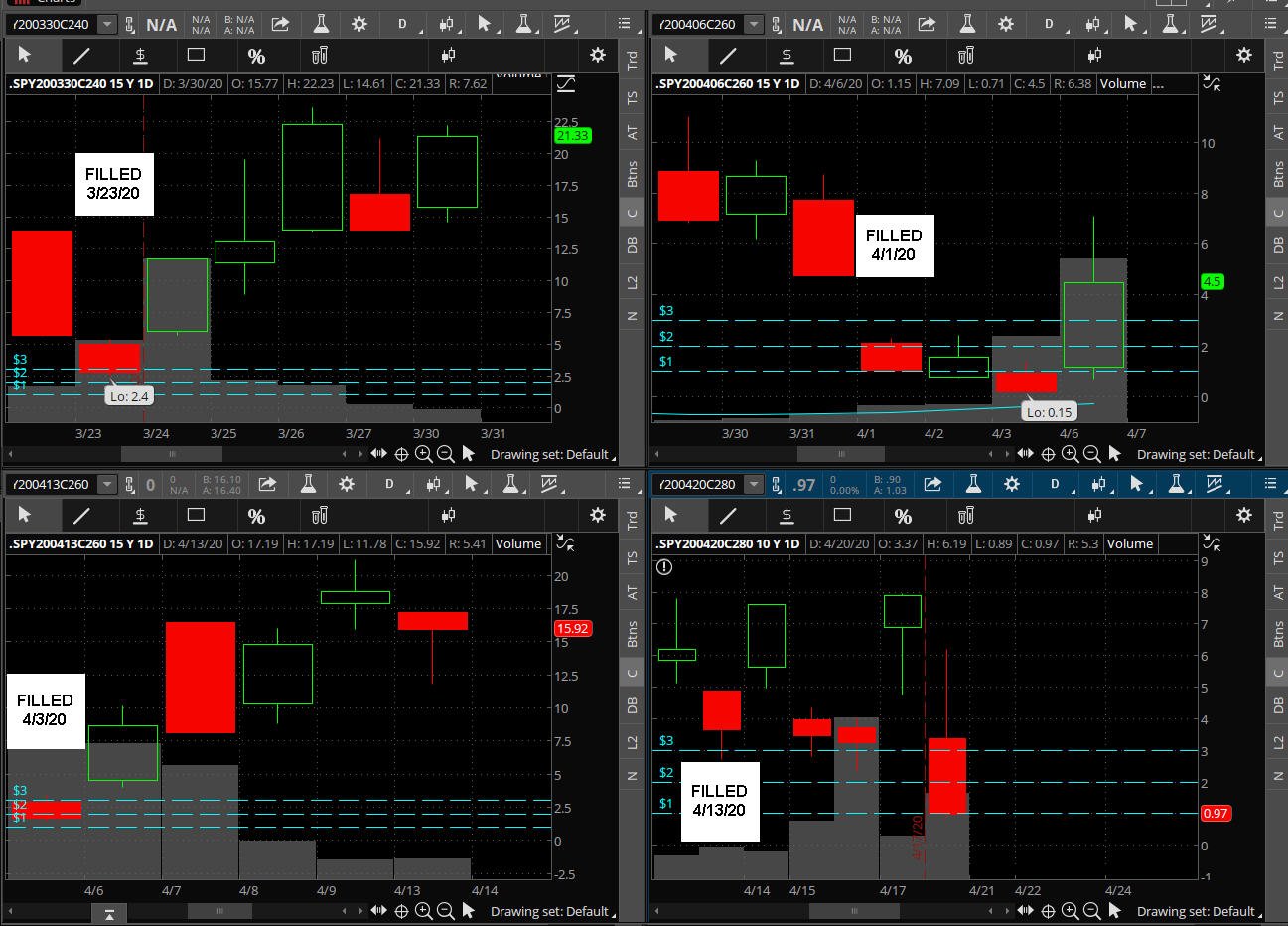

Each Wednesday evening, after the markets are closed, you look at the CLOSING price

of the SPY or any stock you want to do this strategy with.

STEP 2

Back

to Top

When trading the SPY, you will pick the first available strike price, as

close to the days closing price, that is

either (ATM) or slightly (ITM); however, you can go 1 to 2

strikes (OTM) when trading individual stocks and

2 - 4

strikes (OTM) when trading AMZN because individual stocks will move enough to compensate.

Ok, here is the breakdown:

Wednesday SPY Close = 298.05

The closest ATM or ITM strike is:

298.00 for

PUTS and

the same for CALLS

Note:

when the closing price is closer to a half number, then I

pick the next whole number that is (ITM) as my strike price.

The reason we do not go (OTM) on

the SPY is because it takes approximately 100-120 Dow Jones 30 ($DJI) points to move

the SPY 1 point (a.k.a. 1 handle), and since we are typically looking for a

100-300% ROI on each trade, we need to stay close to the previous

day's closing price to achieve our goal. Besides, if you are too far

(OTM), it would take an unexpected news story to come along and move

the ($DJI) more than the typical range of 100-300 points on a Friday;

therefore, since the SPY has

a typical move of 1-3 handles day-to-day, we need to be close to the

action to hit that minimum DoubleUP! target and keep the compound

going.

Here is a large move in the ($DJI)

The SPY moves around 10% +/- in direct correlation

to the ($DJI)

When volatility is low and the moves in the ($DJI)

are minimal

The SPY will move even lower than a 10%

correlation of the ($DJI).

Therefore, if you are trading short-term weekly

options (OTM), then your odds of expiring worthless on Friday are

very high.

With all that said, I pinpointed the best strike zone

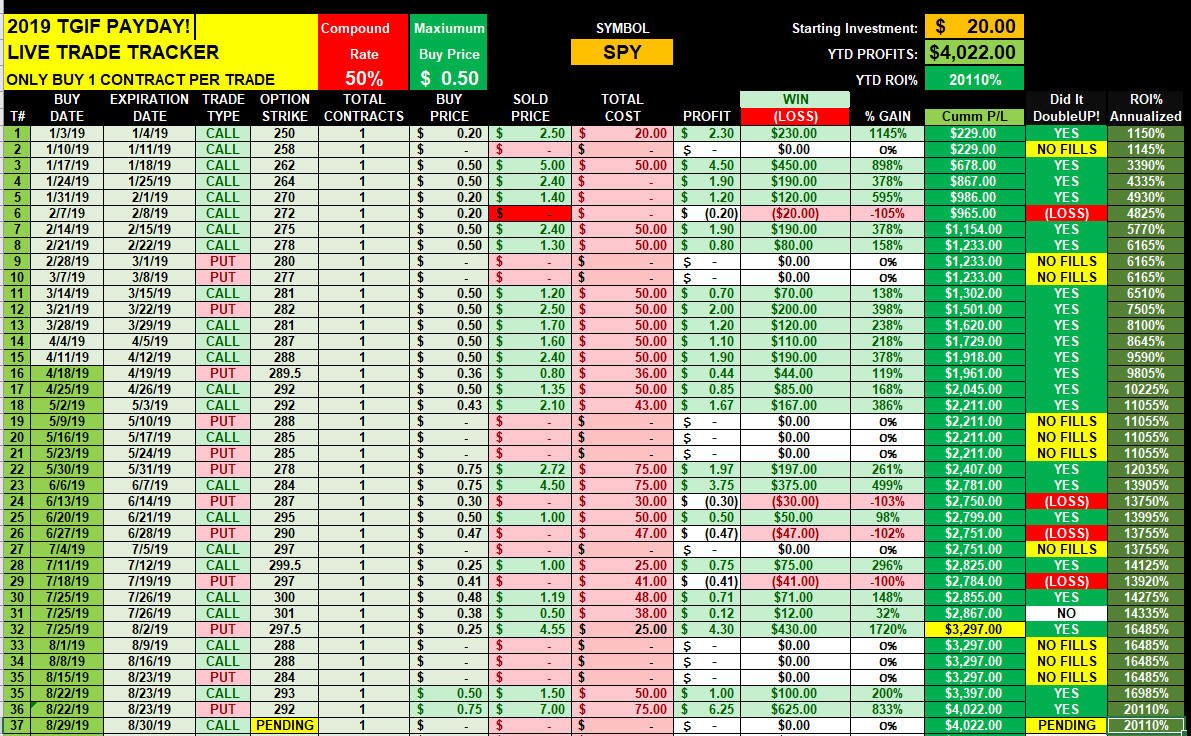

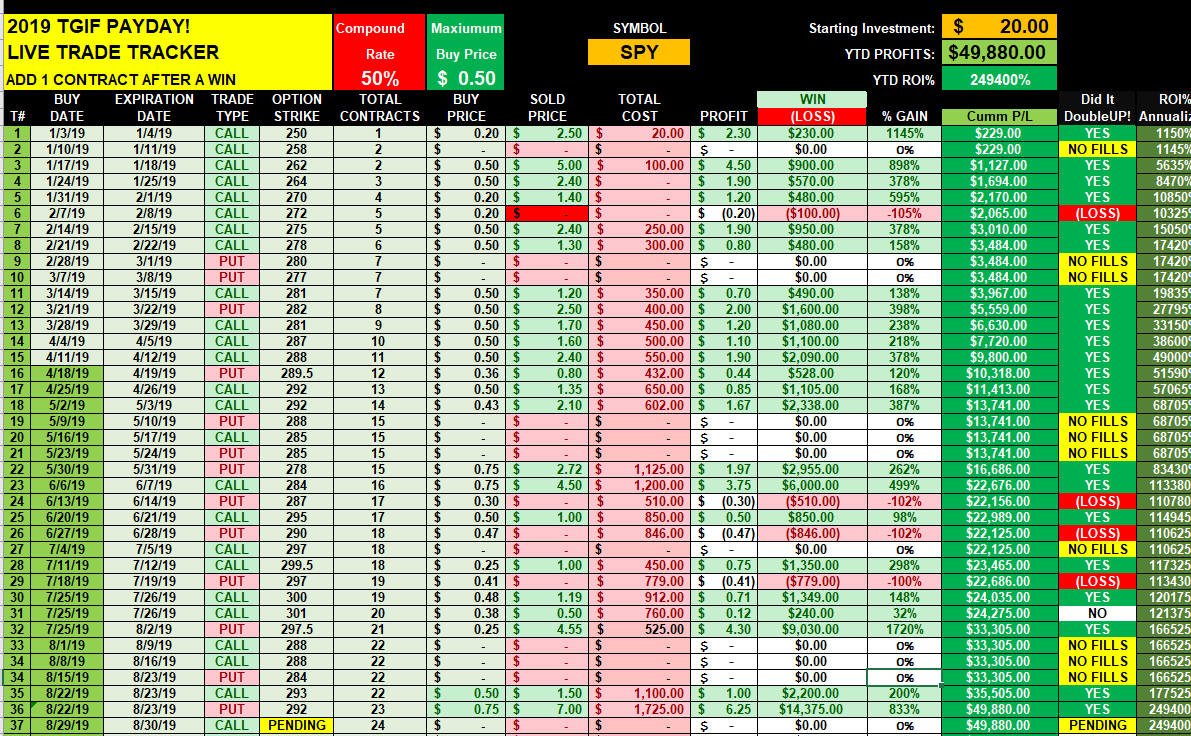

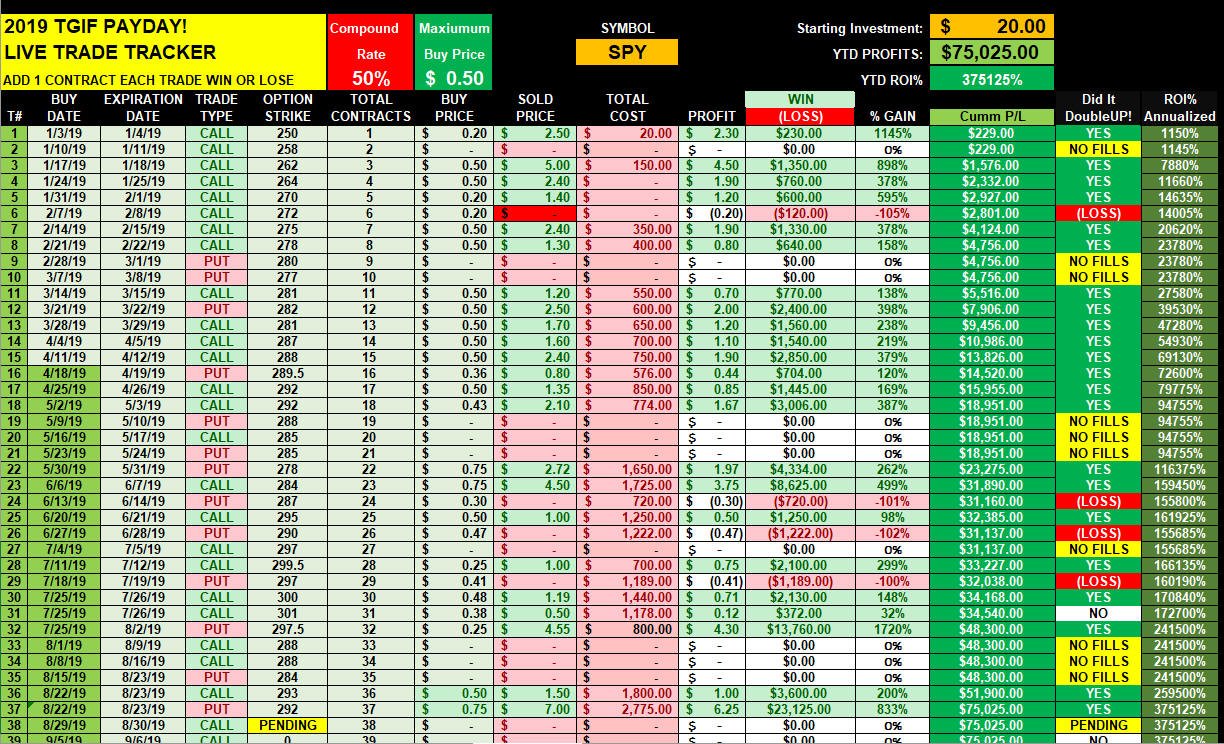

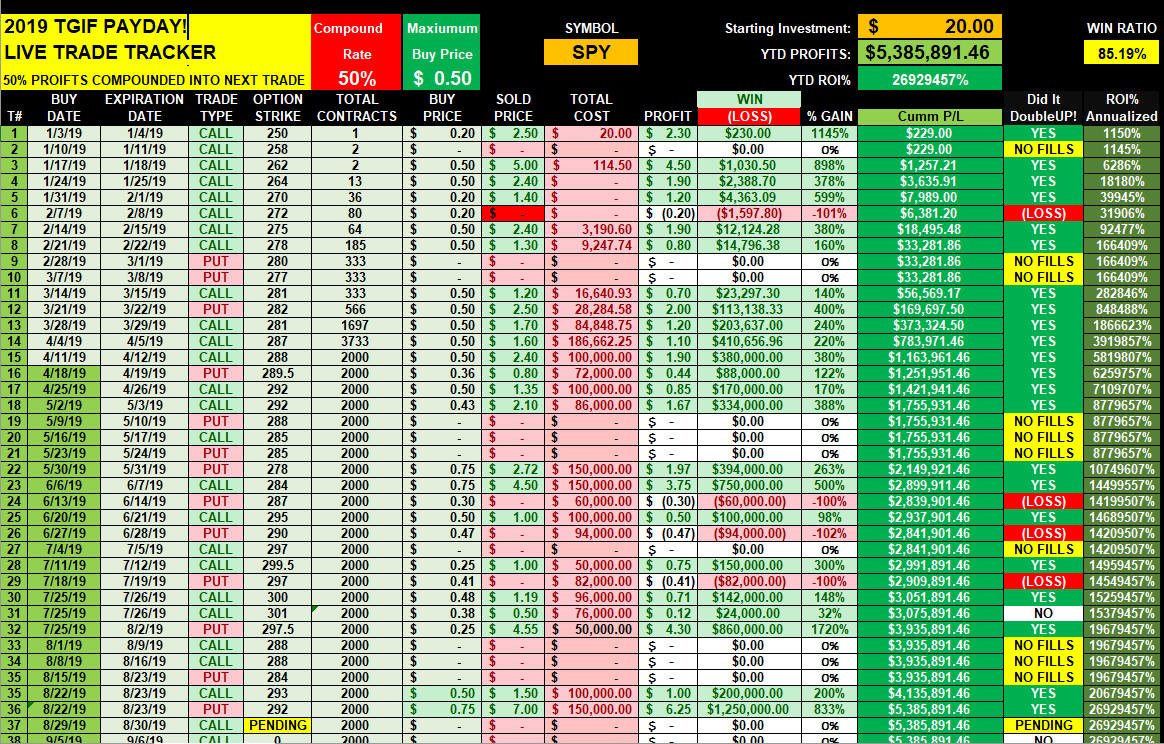

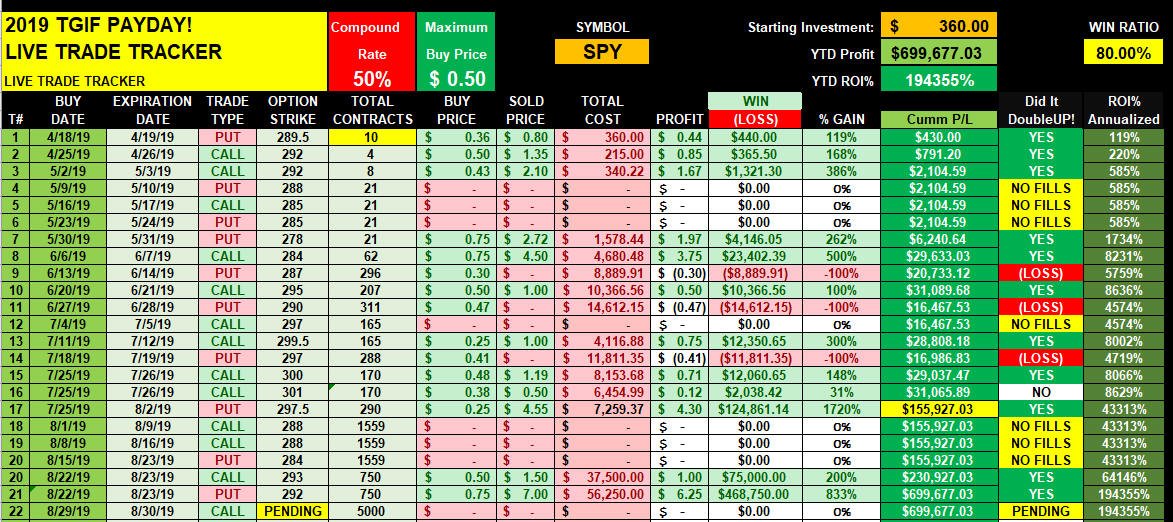

to buy based on the back testing, and with the "LIVE" trades

for 2019 YTD and the reason that we initially buy (ATM) or (ITM) strikes

is

because they have proven to be the best potential to make the

profit ranges we are seeking when we get a move in our direction.

Sometimes, we will get a news release that can move the

($DJI)

over 500 points; which can accelerate the SPY option profits

5-10X+; but that

scenario typically happens maybe once a quarter, so if you are buying options (OTM),

then your win ratio is going to be a lot lower which will take you

longer to build your contract loads—remember, we are on a 1 - 2 year journey to the

land of 7-Figure profitability and are not going to get there on a single

trade.

STEP 3

Back

to Top

What is the direction we trade in? –

The next step in the process is to determine our BIAS for the weeks

trade and how do you know if you should be buying a

CALL

or

PUT

is the magic question any trader asks. Let me

tell you, it

is a daunting task to figure out when you start trading... heck, it's even

difficult when you have been trading 20+ years like I have.

In fact, the

more you try to figure this out, the harder it seems to get because NO ONE

KNOWS THE FUTURE— especially in 1-2 days before an expiration

From this day forward, even if you are a seasoned

trader like me, I want you to FORGET all you think you know about

trading if you want to do the TGIF PAYDAY! strategy, and if you are new trader just

beginning, NEVER START down the road of trying to figure out the

markets, technical indicators and chart patterns because it becomes a

mental mind-trap and nothing but mass confusion that will

create loss-after-loss and ultimately analysis paralysis.

|

|

The more I studied, the harder I tried and the

bigger the losses I experienced. In fact, my most successful trades were

the ones I placed and "LET HAPPEN" vs. trying to make them happen!

— the don Franko |

What I have also learned in my 20+ years of trading, and

literally tens of thousands of trades placed, is no matter what I did,

how long and hard I studied and who I listened to (including me, myself,

and I), I discovered we basically have a 50/50 chance to be right or wrong with each trade...less commission,

spreads, slippage and Murphy's law...lol...then it's more like 40% or

lower.

The whole reason I developed this strategy was to

make things EASY to follow, take practically NO TIME, and

give me consistent wins that I could compound into a MASSIVE success

over a short period of time—I wanted to put the odds in my favor and

gain that "edge" all traders want!

Are you ready for the secret to picking the right

trading bias?

Then you MUST learn to apply the "KISS"

method!—you know, Keep-It-Simple-Stupid!

MAKE THE TREND YOUR FRIEND!

It took me many years of ups and a lot more

downs than I care to reminisce before I got the (KISS)

method firmly planted into my thick skull, and let me tell you, I have

learned this lesson the HARD AND EXPENSIVE WAY, so take it from

me and ALWAYS make the TREND YOUR

FRIEND!

Here is how you determine the "trend" to set

your trade BIAS

for the week:

We take the first three trading days of the weeks (M-T-W) closing prices

and simply follow this rule:

MAJORITY GREEN YOU WILL BUY

CALLS

MAJORITY

RED BUY YOU WILL BUY

PUTS

YES! It is as simplistic as it sounds... a no brainer

right? Well, sort of, until you try to figure out how much to pay for

your option strike price... then things can get more complicated.

STEP 4

Back

to Top

So many prices... too many choices –

Remember the option chain example I showed you above? Well, here is

where you learn the next piece of the TGIF PAYDAY! puzzle... figuring out what

price to pay for the option strike you choose. If you try to buy too low, then you

won't

get filled and miss

out on a lot of opportunities, on the other hand, if you pay too much, then you

increase the odds of NOT gaining at least a DoubleUP! so you can

keep a steady compound building—if too many trades expire worthless,

then your compound rate slows down considerably; increasing the time it

takes to achieve your trading goals.

Over the past decade, I have been teaching and trading

my Lotto Trade strategies, and although I have had 5 - 6 Figure

winning trades posted to this website, I have always struggled to accumulate wealth like the

TGIF PAYDAY! strategy will build in 1-2 years!—the

KEYS to this kingdom are knowing what price to pay and then compounding

your way to trading bliss.

Here is what price points I discovered work best:

NOTE:

When you are fishing for $0.20 at the open, you can

increase your contract load based on the target spend of $0.50 to maximize gains

if filled and momentum shifts into your direction.

For example:

If your contract load is 10, then you are committed

to investing up to

$750.00 based on my recommended MAXIMUM buy price of

$0.75 per contract; however, when you are trying to get filled for

$0.20 at the open, then you can increase the contract load to

give you more leverage—I always do

the extra contract calculation based on

$0.50 per contract.

The Math: $0.50 x 10 = $500 / $0.20 = 25 contracts.

This now gives you more than twice the regular contract

load

(leverage) to accelerate profits even faster and/or you can now sell

half at a DoubleUP! sooner and let the rest ride into Friday's

expiration.

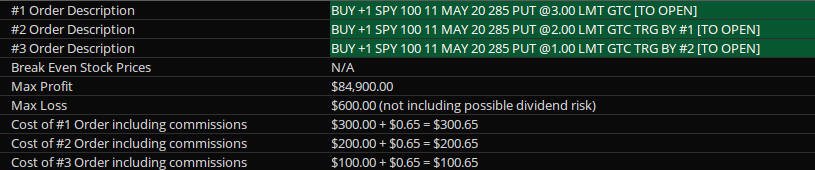

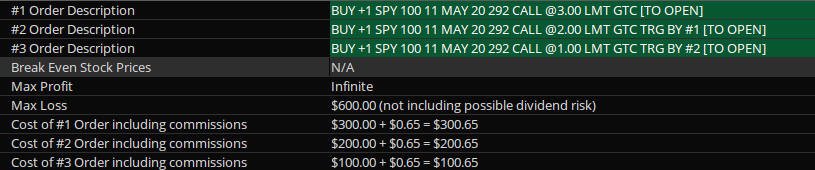

STEP 5

Placing the orders –

NOTE:

All orders are always set as "LIMIT" and

the time

duration is "Good-Til-Canceled (GTC)" with a target price of

$0.50 and a MAXIMUM price of $0.75.

Ok, now we are ready to place the "LIMIT" orders on Wednesday night OR Thursday

morning before the markets open at $0.20 and see if we can get

filled in the first 5-minutes

the markets start trading.

However, if you are not filled at $0.20 in the

first 5-minutes, then you adjust your

order (and contract size if you increased) to the target LIMIT price of $0.50 until 7:30 AM PST.

If the options are still trading higher than $0.50

at 7:30 AM PST (on Thursday) and under our MAXIMUM of $0.75, then you

just "BUY IN" for your full contract load and see what happens on

Friday.

Otherwise, if the option price is HIGHER than $0.75,

you will set the

price at the MAXIMUM, and either leave it on all day, or you can

cancel and wait until next week—at

this time you should adjust down you contract load down by 50%, and if

you

DO get filled later on, then you can wait and see how the whole

trading day goes. Finally, I would recommend you pay no more than $0.50 by the end

of the day if you add more contracts.

IMPORTANT!

We are not trying to force a trade for the sake of making one—especially when you are just starting out. If the options open up much

higher than $0.75 and show no signs of coming back down, then it would

be better to cancel the order and wait until next week.

Based

on the back testing and live trades YTD, it has been proven to just

LET THINGS

HAPPEN vs. making them happen.

Sometimes, the pre-market news is so strong, the SPY

will open up or down much higher causing the BIAS strike we wanted to buy to also

open much higher than our maximum buy price of $0.75 cents.

If this is the case, then you can adjust the strike price 1-2 handles higher for

CALLS or lower for PUTS; otherwise, cancel the order and wait until next

week.

The main reason we

are fishing for that lower price (of $0.20 at the OPEN) is because we are hoping a

news story causes a temporary reversal move against our BIAS; giving us a

chance to get filled on more contracts; however, negative news can be so

compelling overnight, that it will actually drive the SPY price well

beyond a minor move in our favor, so you should adjust the strike price

based on the pre-market indicated price or just cancel the trade and

wait for next week.

If you do get filled after adjusting your initial trade, and the SPY ends up reversing trend, then your

trade can end up expiring worthless. This is part of the process

sometimes, so you just have to

roll with the punches from time-to-time because the wins will erase the

losses and the compounding will make you rich!

NOTE:

If you have enough initial capital and tolerance for a

potential drawdown in the beginning, then put in your orders on Wednesday night as GTC for $0.75 and make the

spend every week until you connect with a winning trade and start your

compounding; however, if you have limited capital to start,

then begin with 1 contract for a minimum spend of $0.20 and maximum of

$0.50 - $0.75, then you can start your compounding after a

couple winning trades.

Once you have built up your trading capital with

profits, then you may want to expand your universe of stocks to

apply this strategy to.

Here are a few that I have determined MINIMUM and

MAXIMUM buy prices should be:

STEP 6

You get filled...now what?

Here is the final step...knowing what to do when you get filled on Thursdays.

Sometimes the momentum is so strong that your trade quickly reaches a

DoubleUP! profit on Thursday. When this happens, I strongly suggest you take

half your contract load off the table; which will give you have a free roll trade

that

you can take into Friday—the best part of taking that DoubleUP! is if the trade

goes bust on Friday, then you still have all your capital to trade again

next week.

NOTE:

When you are starting with 1 - 2 contracts, and you get filled on Thursday, then you should just

let the trade go into Friday all-or-nothing until you are

compounding 5-10 contracts, then you can start taking half off at

a DoubleUP!, layering multi-expirations and exit prices etc.

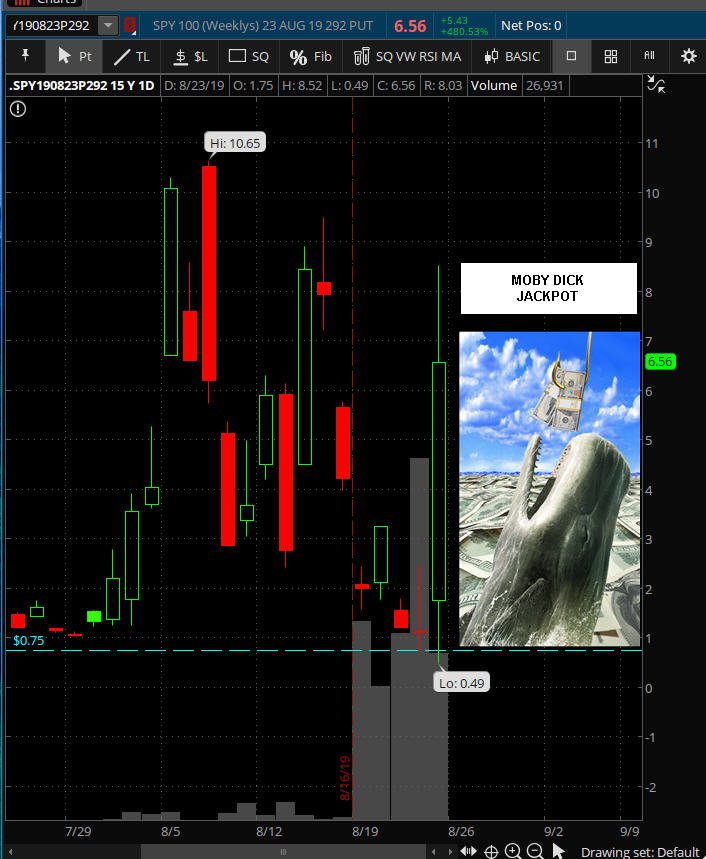

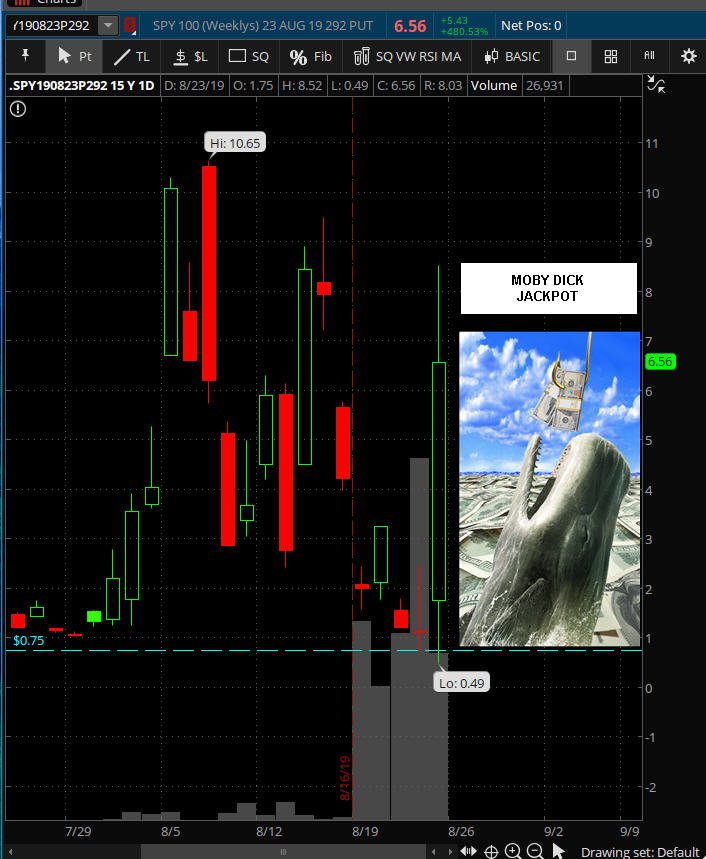

Once the markets start trading on Friday, and your

position has continued to go up even more, then trail your stops at another DoubleUP! and let the rest ride into

the Friday close for a

potential parabolic move; because sometimes, we hook onto a Moby Dick like we had on both

the SPY and AMZN on 8/23/19!!$$!!

See more details on taking profits below.

AS EXCITING AS THESE CHARTS LOOK, THE SECRET TO

THIS STRATEGY IS IN THE COMPOUND VS. CATCHING A FEW MOBY DICK TRADES; HOWEVER, IF

YOU WORK ON COMPOUNDING AND CONSISTENTLY TAKE PROFITS AT 100-300% ROI

EACH TRADE, THEN ONE DAY IN YOUR

NEAR FUTURE,

YOU WILL HAVE HUNDREDS, IF NOT THOUSANDS OF CONTRACTS ON, AND WHEN MOBY

DICK SHOWS UP, YOU WILL MAKE 6-FIGURES IN A SINGLE TRADE!!—THEN YOU CAN

KICK BACK AND COUNT YOUR MONEY UNTIL NEXT WEEK WHEN YOU SIMPLY REPEAT

THIS PROCESS...CHA-CHING!!!!

You are going to need both of these in the coming

months!!

IMPORTANT:

Each week, I send out to my monthly subscribers' email

alerts of the trading BIAS and strike price I am personally trading;

however, you need to be proactive in learning, and then apply this strategy for your own

account future, whether I make a trade or not... I would rather teach you

how to fish than feed you the fish... know what I mean?

Besides that, once I reach the land of

7-Figure profitability in less than 1-2 years, I am going to be on

permanent vacation, so you better get this strategy down because I am

not always going to be around every week for you to follow all of my trades ;-)

|