|

Option Trading College

Subject:

No Risk Day Trading |

Entry is Key...Exit is Everything! TM |

|

Session 1 - This months No Risk stock: MCD

This month I will record all the activity of MCD to show you how this strategy can make you a lot of money with little to no risk. McDonalds had a decent quarterly earnings report but did not impress investors enough to keep the buying momentum going. Of course it could be recent bad press they received about the, among other things, absolute CRAP they put into their meat: Goodbye, Pink Slime: McDonald’s to Change Burger RecipeThe company will now stop using meat treated with ammonium hydroxide, an additivecommonly used as a bacterial toxin in household cleaning products in its U.S. locations.

I certainly hope my readers are smart enough to not eat food that is barely above DOG FOOD GRADE!

At least if you are going to eat dog food, you should buy it by the can at the super market....ITS CHEAPER...lol! Talking heads on TV are calling it a short; however, UBS and Goldman Sachs raised their price targets? Well, in my experience, when the big brokerages say buy you better be looking for opportunities to SHORT!

I will set up to trade 500 shares and sell the Feb 100 Calls Naked to collect premium to buy the Feb 105 Calls for insurance. Since they are so cheap, I will actually be able to purchase 30 contracts so if MCD decided to head higher, I will make a huge profit on my insurance policy!

|

|

|

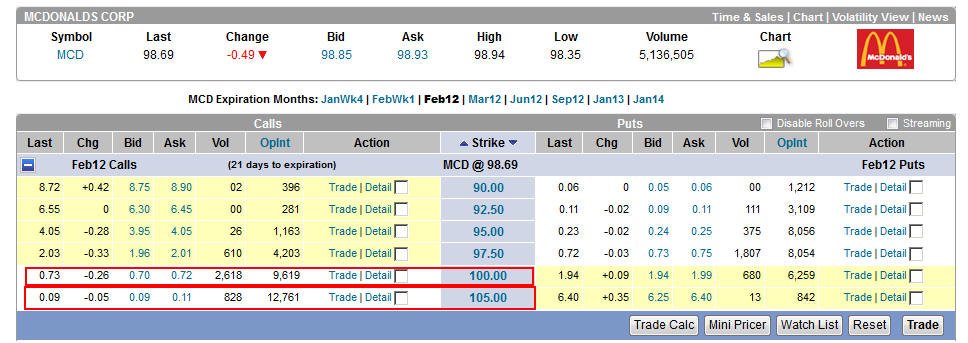

Session 2 – Options Here are the options prices for the month of Feb. I would sell 5 contracts of Naked Call on the Feb $100's to collect $.70 cents per share; then buy 30 contracts of the Feb $105.00 strike for $0.11 cents or $330.00. I will have NO out pocket expense this trade and my insurance calls are 6 times greater than the 500 shares I am on the hook to buy should MCD head higher this month so I would be more than happy to take on the heat.

Next we look at the ATR of MCD for the past 10 trading days to get a baseline of expected movement each day:

As you can see, the stock has a daily average of $1.00 which is more than enough to make profits.

Next we look at our cost of insurance and our total risk to determine our daily profit needs to assure we are covered.

As you can see, we only need to make at least .07 cents per day to cover our maximum risk. Our stop will be placed at $103-$105 because we will need the capital in our accounts to meet any broker requirement to take delivery of the stock should MCD stay above $100 per share before Feb expiration. Each day, as we rack up profits, we will take some to purchase more OTM calls and puts depending on how the stock is trading as the month goes on.

Here are the results for this trade strategy : 1/30/12

1/31/12

2/1/12

2/2/12

2/3/12

======================================================================================================== 2/10/12 - MCD back under $100 and looking like it's going to head lower next week. We will be there to capture the daily profits!!

Next we will keep track of the OTM options we buy with some of the profits we make day trading the stock:

Have not bought any more options yet. ====================================================================================================== 2/14/12 - Starting to show more weakness but definitely needs to hold under $100 by Friday or I be buying 100 shares. The stock closed at $99.99 so I did not have to take delivery of the stock and I got to keep the premium I took in! |

|

|

More No Risk Day Trading Plays

Profits Up!

The donFranko

|

Charting | Covered Calls | Leaps | Spreads | Training Home

©1999-2016 Option

Radio.com

All rights reserved.

Privacy Statement Terms of Service Disclaimer