|

Option Trading College

Subject:

No Risk Day Trading |

Entry is Key...Exit is Everything! TM |

|

Session 1 - This months No Risk stock: NFLX

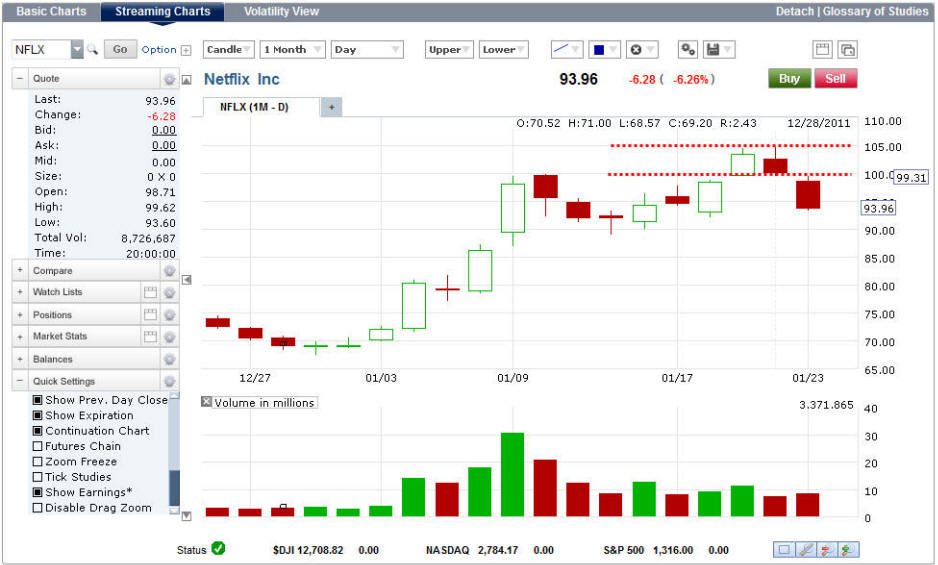

This month I will record all the activity of NFLX to show you how this strategy can make you a lot of money with little to no risk. Because this stock is so beaten down, my bias is to get short and stay short under $105.00 per share. If they stock rises over this price on good volume, then I will change my daily bias accordingly.

For this example, I am going to trade a position of 500 shares and hold 250 overnight to capture gaps. During the trading day, I will add shares up to my full margin if I see opportunities to exploit for more profits.

|

|||||||||||||||||||||||||||

|

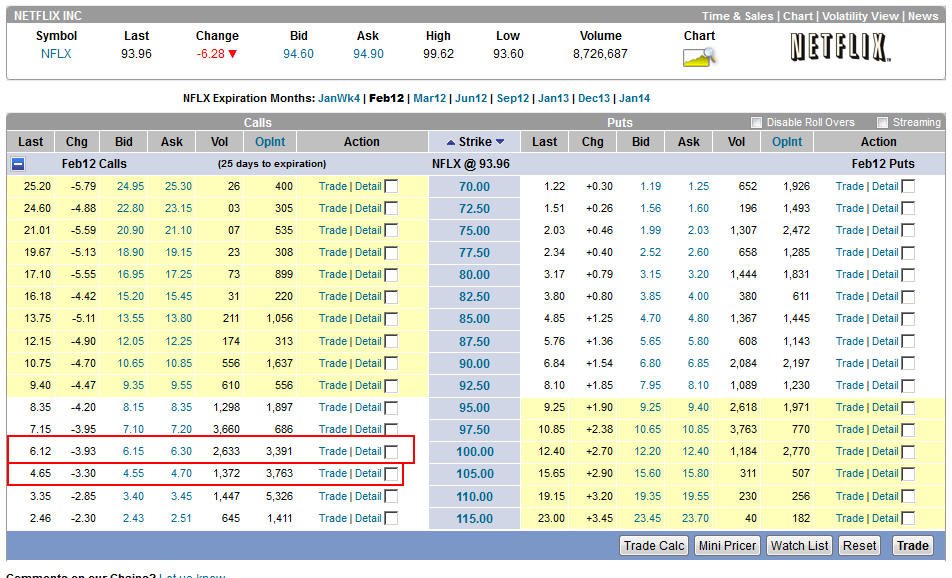

Session 2 – Options Here are the options prices for the month of Feb. I would sell 5 contracts of Naked Call on the Feb $100's then buy 10 contracts of the Feb $105.00 strike. Because I am taking in $6.15 per share or $3,075.00 I will only need to make an initial capital investment of $1,675 to insure my trading activities going forward.

Next we look at the ATR of NFLX for the past 10 trading days to get a baseline of expected movement each day:

As you can see, the stock has a daily average of $6.00 which is a very good amount of volatility for us to capture profits.

Next we look at our cost of insurance and our total risk to determine our daily profit needs to assure we are covered.

As you can see, we only need to make .37 cents per day to cover our maximum risk. Our stop will be placed at $101-$102 because we will need the capital in our accounts to meet any broker requirement to take delivery of the stock should NFLX stay above our $100 sold price; however, if NFLX trades back below this, we just resell Naked calls. Now if NFLX continues to trade higher, we should be able to make enough profits on the calls to cover any losses we make incur. In fact, if NFLX were to see a substantial rally, we would benefit greatly because we have 10 contracts (1,000 shares) vs. the 500 shares we were trading. Remember, our bias is to stay Short on NFLX so long as it trades below $100 a share. Each day, as we rack up profits, we will take some to purchase more OTM calls and puts depending on how the stock is trading as the month goes on. Normally, I would NOT recommend you start this type of strategy the day before an earnings announcement, but I am going to do this to show what can happen if an unexpected event were to arise. Also, you need to be able to actively trade with this strategy because there can be several opportunities during and after trading hours to maximize your profits. The best part about this is you do not need to panic because you are fully hedged with calls. (Update: As you can see below, the $105 calls more than covered out max loss and made us a huge profit!)

Here are the results for this trade strategy for the next month:

Next we will keep track of the OTM options we buy with some of the profits we make day trading the stock:

Keeps getting BETTER!!!!!!

POSITION CLOSED OUT ON 1/30/12 Profit: $26,385.00

This play is now closed out but I am watching the $120 price area and if NFLX trades below this on a close, then I will SHORT this stock.

|

|||||||||||||||||||||||||||

|

Profits Up!

The donFranko

|

Charting | Covered Calls | Leaps | Spreads | Training Home

©1999-2016 Option

Radio.com

All rights reserved.

Privacy Statement Terms of Service Disclaimer