|

Option Trading College

Subject:

The Basics of Day Trading |

Entry is Key...Exit is Everything! TM |

|

Disclaimer: Trading (especially pattern day trading) is extremely risky. It's not for everyone and you could lose money up to and including all your deposited trading capital. OptionRadio, it's editors, employees and subsidiaries are not in any way offering investing or trading advice of any particular securities, options or stocks. These lessons are for educational purposes only and we highly recommend you consult your own professional advisors before you attempt to act on any of the examples we show you. These lessons are designed to provide the reader an accurate and authoritative level of education/information in regard to the subject matter covered herein. All training material on this entire website is designed to offer you a basis of knowledge and in no way is it directing you to buy or sell any stock, commodities, options or any other financial instrument. These lessons are examples of time tested systems developed by the authors own trading experience and knowledge. Any performance results listed are for educational purposes and do not represent actual trading. Many of the trading examples you will see have not been executed and the results may have been over compensated for the impact. No representations or guarantees are being offered that will produce the results that are described or illustrated. For a more detailed explanation of our policies and disclaimers click here. |

||||

|

Session 1 - What makes a stock tic?

It's been said by many that, "The 'Opening' is Everything!"

It's been said by me that, "Entry is Key...Exit is Everything" TM

Starting a trade is one thing, keeping your cool in the face of adversity is another; and knowing when to quit or take a profit is the way to trading bliss.

Let's look at how a stock makes its move and learn how to properly exploit or anticipate those moves so you can take full advantage of the trading opportunities that will be presented to you every trading day.

There are three directions a stock can take:

1. Up 2. Down 3. Sideways

The hard part for an active day trader is figuring out what direction a stock will move in while trying to make accurate entries and consistent profits—it's almost a lesson in futility.

There are several ways to analyze a trading opportunity, but in the end, all your analysis boils down to the luck of the draw; however, to gain that edge, you will need discipline to make the necessary decisions once you pull the trigger.

It's not about getting into a profitable trade that makes you a winner; it's how you handle a bad trade once you are in it that proves you are professional.

The vast majority of home based traders are novices thinking they are professionals. They hit the buy button with enthusiasm based on stale news they get fed off the TV outlets like CNBC, Bloomberg or Fox Business News. Sadly, these sources are always late to the party; and if you try to act on their information, then you are destined for inevitable financial ruin.—they do not know that they do not know.

So, if you want to learn the ways of a professional trader, then read on and I will enlighten you with insight that has taken me years to learn, more years to understand and will take the rest of my life to master.

Trading is a life long journey, and today if the first day of the rest of our trading lives!

|

||||

|

Trading for a living can be a daunting task. Many people entering into this field are mesmerized by the allure of fast money riches, and then become hypnotized by the overload of information and data presented to them.

If you want to become successful, then you have to master your mind and more importantly, your emotions. Next, you have to learn how to look at the markets in a different way in order to see past the information overload being presented to you—you have to learn how to use the FORCE!

Trading is almost a spiritual ride, and all too often we approach this organic flowing river of cash with a black and white analytical mentality only to find out its a very emotional roller coaster for your mind and body.

The greatest traders we hear about are an eclectic band of Marauder's to some; and even considered trading God's to others. Only a few put themselves on the forefront of attention, and usually, they are selling something to the naive masses in return for the illusion they too can become a wealthy trader like them. Unfortunately, 98% of would be traders never learn the true nature of the market and instead, become emotionally discharged and frustrated traders who chase the dream; never realizing it because they lack proper vision.

I hope to show you a path to enlightenment and you, like me, can find solace in a new way of thinking about trading the markets, but before we begin your first lesson, I want to address the psychology of trading by illustrating a couple of images.

If you do not learn how to look at the market in a different way, then your account will dry up and you will look like the first picture from the stress this trading life will bring to your door.

Now look at this image below:

If you can see the word hidden inside, you are ready for the lessons below.

|

||||

|

Session 3 - Lesson 1

The best way to illustrate how I make trading decisions is to use Japanese Candlestick patterns. These have proven to be a superior resource; and also happen to be the most popular method of keeping track of and anticipating a stocks movement. Because of the popularity of candlesticks, you will find that most novice traders never get a full understanding of them; and therefore make ridiculous mistakes that savvy investors like me, and now you, can exploit.

Shall we begin?

Look at it this way. How do you eat an elephant? One bite at a time....

Have you ever seen an elephant get into the water without making its presence known? How about when they exit the water? Since you and I cannot move a stock, we have to learn how to move with the elephants of the trading world. Then, and only then, can we become consistently profitable and build our accounts to wealth.

We, as day traders, must master the patterns that appear after the elephant enters the water and then we can catch a ride with those market movers and shakers....the elephants.

So, the question is, how does one recognize the elephant?

The way to this inside knowledge is about to be revealed to you below.

|

||||

|

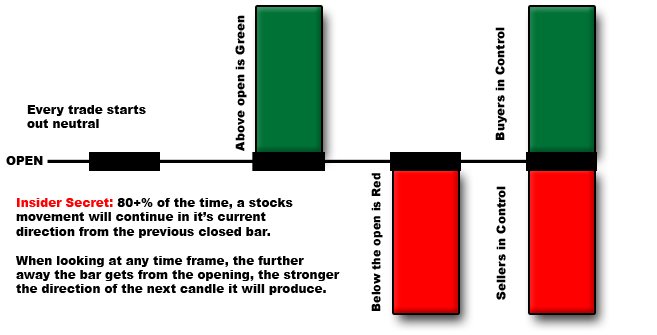

Understanding the candles sticks:

Below is an illustration of the basic

candlesticks.

Every green candle you see is confirmation the Bulls are in control, and every red candle the Bears are in control. This is true for every time frame you are looking at be it 1 minute, 5 minute, 15 minute or even a daily chart. The key is recognizing how to exploit the potential movement a stock will make for it's given time period—all too many times a novice trader will concentrate on a 1 minute chart because of the "action" it produces. The problem is, all that action gives rise to a reaction, and that is the last thing a savvy trader wants to do...react to what they see.—The professional trades from a pre-determined point of view, that is to say, they already anticipate the next move and are in line ahead of the novice to exploit it!. With each bar (section of time) a stock moves inside of, there is a battle that rages between buyers and sellers making biased decisions, and along the way, there are hidden forces (aka Market Makers and Specialists) who exploit the moves and trading accounts of those who just don't understand. There are 10 primary candlesticks we use to day trade a stock.

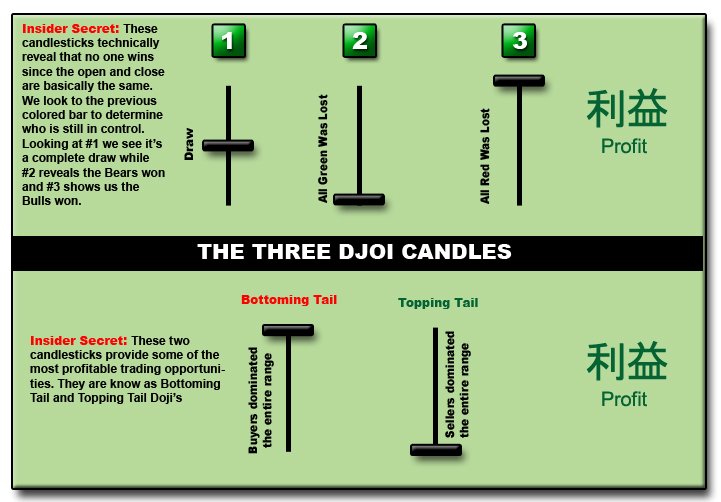

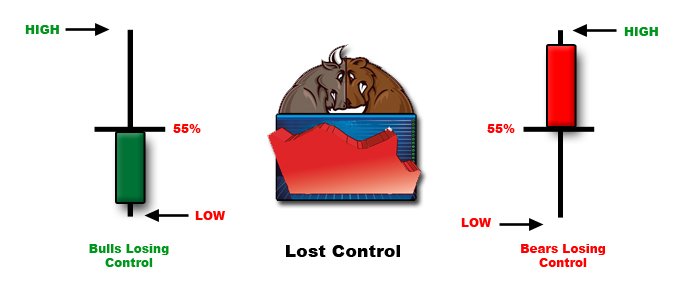

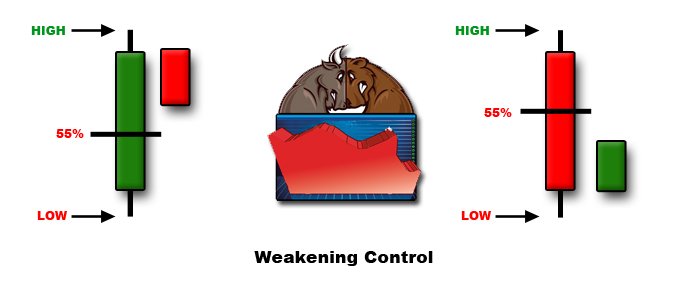

Working from left to right we can see how the Bulls are gaining strength and the Bears are losing strength. The more solid the body of the candle the better it is for the side of the trade you are on. Learning how to recognize the candle stick patterns is your fist goal; learning how to trade on them, well, is a completely different story. These patterns below are the three game changer candles that can make you a lot of money!

Learning how to master the candlestick patterns can take years, so I strongly suggest you buy the books that Steve Nison has written to get a massive head start on your understanding.

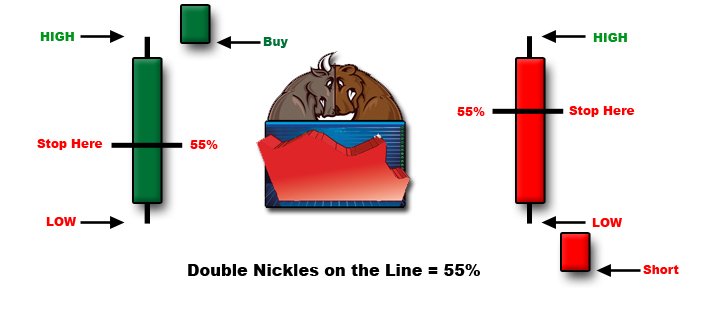

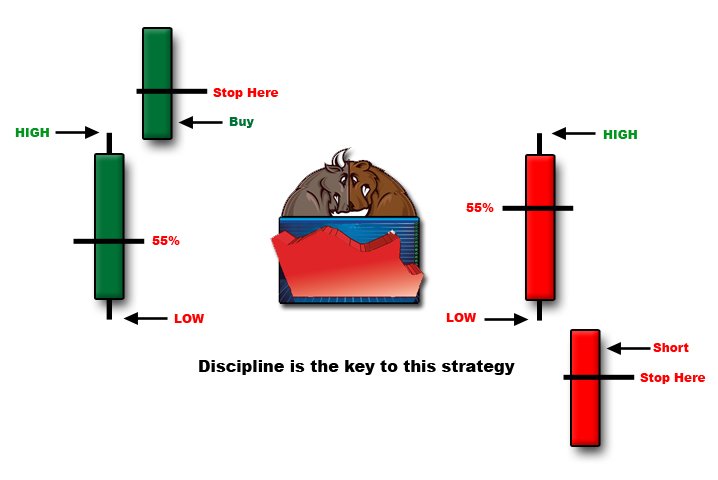

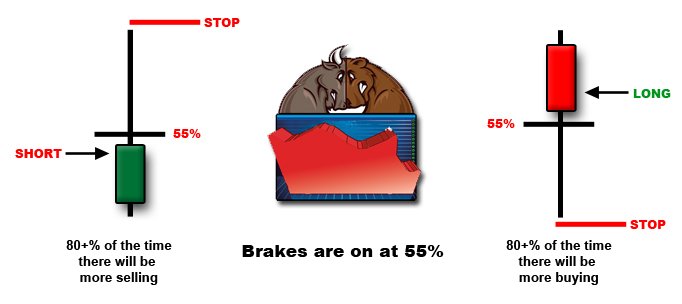

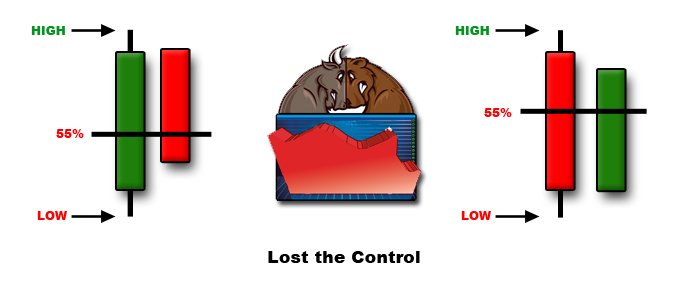

NOTE: Below are the setup candlestick patterns you must master to become a profitable day trader. As you start your trading journey, you would be well advised to apply these patterns below to a 15 or 30 minute chart. If you choose to trade in the 1, 2 or 5 minute realm, then you are going to feel a lot of pain for a long time; just take the slow road so you can learn how to navigate the market, your chosen stock and most importantly, your emotions. Every individual bar will represent a battle fought by traders who are either bullish (buyers) or bearish (sellers). When that particular bar closes (for its time frame) above the last one, the Bulls win and if it closed below the last one, the Bears won. Although you may have a green vs. a red bar, it's not enough information; you have to look for a wider distance to confirm a stronger bias for that direction. When day trading for profits, the best way to decide on your entry or exit is to wait for a 55% retracement.

Waiting for a proper retracement is how you get into the fast lane for profits. Sadly, the novice trader still has trouble learning this simple discipline and hits the gas on the buy button way too soon—they can't drive...55!

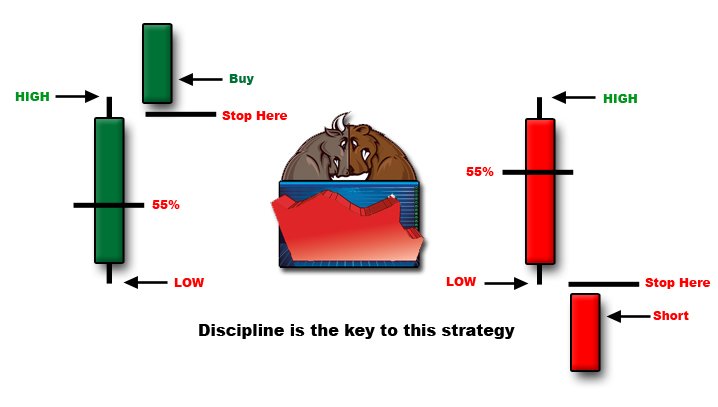

Once the 55% retracement has been confirmed, you will take a position on the next open of that bars direction. Your stop is placed just under the 55% retracement to protect your entry and you are now off to the races. Insider Secret: This entry method works best on a 15 or 30 minute chart. If you try this on a 1, 2 or 5 minute charts (especially a fast moving stock like AAPL or GOOG) you will be stopped out way to many times and lose trading capital not mention paying a lot of commissions.

Once you are filled, and the stock is moving in your direction, you simply move your stop up three pennies below or above the last bars close—discipline is critical here. Never second guess this entry/stop method....it works 80% of the time, so the stop is NOT to be violated.

As the bar progresses, you move your stop to the 55% line to protect the gains you are beginning to make. The wider the distance each successful bar makes, the sweeter the profits become! Insider Secret: If any successful bar is quickly erased, Newton's law of motion will take over more often than not. This is why its imperative you stick to the 55% retracement mark as your, "line in the sand." Insider Tip: If you plan on going against the trend, then you better start eating a lot of Fig Newton's because you are going to need them...lol.

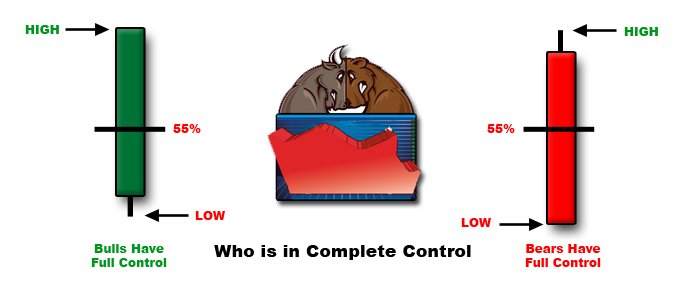

When you see the bar trading at the very top of its range, you can begin to feel confident the Bulls are in complete control of the direction of the stock. When the stock is trading at the bottom of its range, you have the Bears in full control.

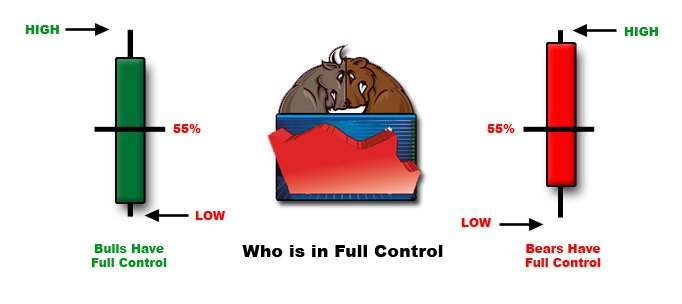

When you see the bar pulling back just slightly from it maximum high, the Bulls or Bears are still in Full Control. Remember, the extreme ends of the trading range are what determines the overall strength of the move for the color currently trading.

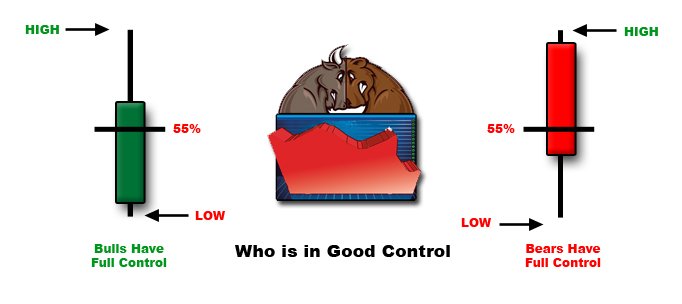

When a stocks extreme bar has pulled back, but still maintains above the 55% retracement, that bar is still in Good Control by the Bulls or Bears. Insider Secret: These types of moves can shake out a novice trader. You should remain cautious, but typically this is the quiet period before the blast off to a new power move in the direction of the current candles color. Remember: these candle patterns perform best on 5 or 15 minute charts—especially if you are trading a volatile stock.

If the stock continues to lose momentum and pulls back to 50% of its range, then you can start to consider the Bulls or Bears may be losing their battle for control. This represents weakness or being on the ropes, but do not give up hope just yet. Your stop is the final arbiter of your decision. Insider Tip: When a stock retraces back to 50% of its extreme, you can begin to realize a change in direction for that bar can happen—especially if the overall market is behind the pull back.

Once the bar has fallen below the 55% line, you should have been stopped out regardless of your opinion as to the direction of the stock. Your next decision is to wait for another set up rather than chase your entry thinking you were right—the counter move to this is now your new bias. Insider Secret: If a stock continues to fall to its open, then you switch sides. Insider Tip: Successful trading is not about being right...its about having discipline to stick to your plan.

Once this event occurs (especially with market support), you need to act on it with a counter move. Do not wait for the bar to erase all of its direction, take your new position with a strict stop (typically 1 - 5 cents above or below the current wick) depending on the volatility of the stock you are trading—this tactic is commonly referred to as: Stop and Reverse. Insider Tip: Stop and reverse trading is a more advanced type of trading and is not recommended for new day traders. You should just stick to the stop and wait for a new set up until you are a seasoned trader.

When you see this turn of events happen, you have to believe the Bulls or Bears lost the battle for that bar and a change in direction is inevitable.

Once a stock has actually reversed direction on that wide range bar and starts a drive beyond the open for that bar, you now look at this event as a permanent change in direction—In other words, it has lost control forever!

We are now back to the beginning scenario for the new direction and the 55% rule firmly applies.

Once a change in direction has been confirmed, a stock will often attempt a retracement, testing the water if you will. So long as the 55% retracement is in place, you can consider the new direction for Bulls or Bears to be in good control of the action. Insider Tip: If the stock starts to pull back from its new direction, you have to take note of that; however, so long as the 55% retracement is in tact, you stay on track. Do not assume too much here because if you remember, the direction was opposite at one point, and the stock could easily snap back to its previous direction. Insider Secret: It's critical that you keep your eye on the overall market direction for continued confirmation the trend has indeed changed.

Many times a stock will attempt to recover a change in direction. Maintain your strict stop and watch for market support to keep the new direction alive. Insider Secret: The best timeframe to play stop and reverse trades are with 5 or 15 minute charts.

If the stock reverses direction on you yet again and moves back over the 55% retracement, then you have to consider this a failed attempt and take your lumps. Insider Tip: Do not revenge trade...ever! There is always another trade that will work and wipe out any losses you take on a given trade—trading is a journey and not a sprinters race.

If the stock does snap back in its previous direction, then you consider this turn of events the new direction—forever!

|

||||

|

ATR - Average True Range and Managed Risk. Ok, now that you have a good understanding of the best time to place day trades, your next lesson is learning how to manage your risk. We call this your "R's" as in: Risk Units. Day trading is a form of statistical gambling; however, you can stack the odds massively in your favor vs. a typical gambling scenario like a Casino where the "house always wins" in the long run. Stacking the odds in your favor with stock trading takes some effort and a lot of discipline—you must to learn that protecting your trading capital is the number one goal! When trading any stock, you have to determine what your risk unit will be. For example, if you are micro-trading a stock that moves, say, $0.25 cents in a 5 minute period, then for every 5 minute bar you would risk no more than $0.25 cents for the shares you are trading—we call that your "R". The goal is for your trade to make a profit, so you will initially put in a hard stop at $0.25 cents below your entry point to keep your maximum risk at one "R". To illustrate this, lets say the stock is trading at $55.00 and your "R" is $0.25 cents, so you would place your first stop at $54.75. Every time the stock moves up a full $0.25 cents, your "R" would in turn move up. If you achieve one "R" of profit, then you turn your hard stop into a trailing stop and see where your profits take you. At the worst, you will have a break even it the stock falls back down; however, if the stock continues to rise, you are locking in profits penny-by-penny with your trailing stop. If you work a small universe of stocks, then you will be able to effectively win more than you lose trading this methodology. NOTE: this is not a good strategy on HIGH BETA stocks with wide price swings such as: GOOGL, AAPL, NFLX, AMZN, MSFT, TSLA, META etc. If you trade these ultra fast moving stocks, you must increase your "R" range by a minimum factor of 3x and be ready to ride an emotional roller coaster. When starting out, I strongly recommend you play with slower moving stocks like GE, K, UBER, LYFT, KR, QCOM AA until you are very comfortable with micro trading. If you are in this game for the consistent profits, then you need to be selective on your stock picks; precise on your entry points; and decisive on your exits. Thus, as I always say, "Entry is Key...Exit is Everything! TM How does one determine the correct universe of stocks to play? The best way I know is to look at the amount of bankroll you have to play with, that is to say, your trading capital. It's been widely disseminated that if you plan to be a full time "day trader" then the minimum trading capital you need is $50k if you expect to have any chance of success at day trading. The number one reason back in the day was the cost of trading had commissions of $6-8 per ticket order, and then there was a cost per share which consumed your capital very quickly if you are an active retail day trader. Eventually that turned into per share commissions and now we have brokers offering "free" stock trading...lol...believe me, NOTHING is "free" when it comes to trading in the stock markets. Although the brokers say "free", they actually control your order flow and you get skewed on price, fills and hidden moves called slippage. Understand, that when you get offered something for free, there is always hidden cost aka a devil in the details and you better be aware of this and make necessary adjustments by adding a lot of patience vs. overtrading because it's allegedly free...NOT! The second reason is the SEC rules for active day traders requires a minimum of $25,000 in liquidity at the beginning of each trading day; otherwise you are restricted to 3 round trip day trades in a 5-day period and then you are blocked from trading until you return your balance to $25,000 each starting day. There are ways to avoid this but each has it's pro's and con's. 1. You can open a "cash account" and trade as many times as you have cash to cover. Basically if you have a $10k account and only spend $100 per trade, then you can buy and sell up to 100 times in a trading day. What you cannot do is use unsettled profits until the next day. Most broker platforms will control your spend so you cannot violate the PDT rule and if you trade large stocks, then you can easily consume your available capital thus limiting how many time you can trade in a day. Also, you cannot "short" stocks in a cash account and you do not get broker margin typically 4:1 daily and 2:1 overnight. 2. You can consider becoming a member of a pooled source of trading capital (Prop Firms) vs. going it on your own. That way, you can trade with less than $25k and use leverage to buy more shares. However, they charge platform fees, have restrictions on what, when and how you trade firm capital, oh yeah, they take minimum of 10% of your profits and typically do not offer option trading. They do provide up to 20:1 leverage; however, that works as a two edged sword, and if you are on the wrong side, they will force liquidate you and wipe out your capital. 3. Trade Futures vs. Equity socks. There are no PDT rules; however, futures are a very volatile market place and much easier to get wiped out in minutes if you do not know what you are doing. A good source to learn and trade futures for low monthly membership is www.topstep.com where they provide you the opportunity to learn futures trading with NO risk of capital loss and you can earn your way to a funded account and share up to 90% of the profits! If you want to trade stocks, then I recommend you stick to lower cost slow moving stocks until you build profits and become consistent at winning trades. By trading lower priced and slower stocks, you can control larger size and risk is minimized because they have low price swings. In my early years of trading, I was peddle to the metal and got schooled, tooled and ruled by the system; which ultimately wiped out several trading accounts. I eventually decided I had enough pain, and I started to look for smaller (widely traded) stocks that I could control size with. My goal is to make my consistent daily profits and then take some of those profits to do my Lotto and White Whale options strategies. That way, I am working as a professional and only gambling with profits on the volatile stocks using options. Slower moving stocks give you a level playing field with very low risk to sudden price drops allowing you to use larger size / margin with less risk of having your trading capital crushed. If you watch a couple lower priced stocks for a week, you will begin to see they run in consistent trading patterns that you can begin to exploit and capture some nice gains every day even with a cash account. Now lets explore "Average True Range" or ATR. Trading is a group participation sport. Every stock is traded by people, but controlled by Market Makers and Specialists who are obligated to set price and make trades available every minute of the trading session. You are trading against and/or with them, but most of the time they have special software, assistants and tools to make them much more profitable than you. In fact they have quite the edge over you so do not think you can go to battle with them and win or have the upper hand...YOU DON'T! In today's trading technology, you have an even bigger challenge out there and that is algorithm program trading. These professionals (firms) have millions of dollars in capital and the latest computers to place micro trades down to tenth of a penny in price movement. Many times, if not all the time, their computers will step in front of your offers and steal away your profits so it is HIGHLY recommend you trade off 15 and 30 minute charts so you do not get pennied by them. When you are trading in the markets against other investors, you know they trade primarily by emotions vs. Market Makers and Specialists who trade with precision based on very stringent rules. if you learn how to adjust your trading style to take advantage of others emotional reactions, then you can gain a very strong edge over other retail traders in the arena. Remember, every buy order has to be matched up with a sell order, but in the world of open book trading, you can even gain a short term edge over a market maker or specialist...occasionally. How does one get an edge? Learning a stocks movements is more of an ART than a mechanical decision. The best way to gain an edge is to have specialized knowledge or information that is not widely disseminated. Of course, if you were trading on "inside information" then you are playing with fire and there are SEC regulators looking for unusual activity because insider trading is illegal and carries heavy jail sentences and fines—if you happen to be a member of the con-grass-smokers-association or the Senate, you get an inside-trader-pass and can trade (break the law in my opinion) on inside information....yes its true! For the rest of us, we have to learn how to gain that edge the old fashioned way...due diligence! Here is how I figure out how to gain an edge with stocks I trade: Lets look at General Electric (GE) because it has a very consistent movement throughout the day, so you can have great success trading a particular direction once you establish it. I like to trade GE on a 15 or 30 minute chart since its a relatively slow mover and you can clearly see the ebbs and flows of the stock; which allows your entry and exit points to be much clearer and defined. If you watch GE for any length of time, you will find the ATR of the stock typically runs around $.15 to $.35 cents per day with an occasional $.50 cent or more move in a single trading day. The best thing about trading GE is it practically follows the DOW's direction every single trading day. That is to say, if the DOW is up for the day, GE will end up and if it's going down, then GE will end down for the day. Here is an example of what I mean: 5 Days of trading activity on GE

5 Days of the DJIA

One month of activity on GE

One month of activity on DJIA

As you can see, they follow each other very closely which makes it much easier for us to make our daily profits with minimal risk.

The next thing I do is record the ATR of the stocks I trade. I keep a running record of the past 10 daily highs and lows as well as the 30 minute intraday highs and lows. This gives me a solid foundation to place my trades on and keeps my emotions in check if the stock tends to bounce around. Here is a spreadsheet I put together to help me keep track of the ATR

The top one is for the last 10 trading days, and as you can see, GE has an average ATR of .30 cents on a daily basis. Next I break it down into 30 minute time frames, and you can see, GE's intraday ATR was around $0.12 cents. What this means is I can have an expected value (EV) of $0.10 cents profit within a trading day and a maximum risk of .30 cents. What I look for are the wicks at the tops and bottoms of a 15 or 30 minute bar. This is where the large buyers or sellers were and that gives me the edge I need to make my trades and capture my profit targets.

I check the overall market trend and trade with that direction most of the time. Once I see where GE has put in a trading wick on the first 15 minute bar, I will wait one more bar and place my order with a stop loss .10 cents above or below depending on the direction I am trading. My goal is to make at least .05 cents and once I achieve that, I move my stop accordingly until I reach my desired profit target. If I am watching it throughout the day, I will let the stock move around more inside my profit range adjusting my "R" as the day goes along. Sometimes the market gets going and GE just trails along up or down for the entire trading day giving me a very nice profit! For example, if you look at today's activity, you would have placed your short around $18.72 and by the end of the day you would have locked in at least .20 cents. In fact, if you were working the trade, you could have traded it twice today and made as much as .35 cents. Once you take the time to record and manage the ATR of your stocks, your trading profits are going to grow much faster.

Profits Up!

The donFranko

|

||||

|

The BEST pattern to trade for consistent profits!

|

||||

|

Learn how to day trade with practically zero risk

Profits Up!

The donFranko

|