|

Option Trading College

Subject:

No Risk Day Trading Revised 5/3/20 |

Entry is Key...Exit is Everything! TM |

|

Session 1 - Introduction If you are "Day Trading" then you know you need a minimum of $25k in liquidity every trading day to avoid the Pattern Day Trading (PDT) rules. However, if you want to be effective at this strategy, then you need at least $50 - $100k in today's markets because most of the "hot" stocks like: AAPL, NFLX, AMZN, CMG, FB, NVDA etc. are very expensive now. How would you like to be able to day trade the BIG stocks and capture consistent profits with zero fear of taking a big loss? One of the biggest challenges of a day traders life is fear of unforeseen circumstance whacking their trading account and/or hitting stop losses—this is especially damaging to your account if you are using margin. The best way to make money in the markets is to pick a very small universe of stocks and trade them consistently; however, you do not want to trade several at the same time because you will not be able to adjust fast enough to swings in the market that will ultimately eat up trading capital. This tactic I am about to teach you will change your day trading life forever. You will be able trade

fast moving stocks like

This style of trading can be quite exciting because you are trading a high beta stock virtually risk free once you know how to do this easy technique. |

|

|

Session 2 – Insurance Options are set up for speculators to place bets with less capital needed and/or a fixed loss. The biggest challenge to option picking is limited time since all options expire—and most statistically will expire worthless. This is why so many novice traders lose money up to and including their entire account because they speculate with too short of time or gamble with OTM option strikes that rarely work out to be profitable—unless you are doing my LOTTO TRADE strategies!$$! There are several strategies with the potential to make you small consistent gains like: credit spreads, strangles, straddles, condors, butterflies etc., but these come with high commission costs and have fixed limits to the profits you can make so being a consistent winning trader takes years and large capital if you want to make a high 5 figure living at it. Most day traders want to get in on the daily action of volatile stocks like: AAPL, GOOGL, AMZN, NFLX, FB; however, these stocks are very expensive and require a large account to buy them, but most traders are under funded, so they like to buy short term options and hope their timing is right; while others just try to day trade these stocks, but lack the experience and discipline to be consistently profitable. And then there are those who use the brokers money (margin) and attempt to day trade these fast moving stocks with disastrous results; because you are using 4x the leverage; and when things go your way, you look like a genius, but when things go against you, the damage to your trading capital can be total devastation. How would you like to be able to trade a fast moving stock every day with no fear of getting your account decimated? Below are two popular types of "insurance" trading you can do to accomplish this: 1. Trading one stock against another to minimize exposure. This is called Pair Trading, but it takes a substantial amount of trading capital to carry enough shares to make a statistical profit. If you want to do this type of trading, then I highly recommend you work with www.pairtrader.com; however, they recommend you have a minimum of $50k in risk capital and you are required to get your series 7 stock brokers license to trade with them. 2. Trade a given stock married with PUTS for protection from large price swings. If the stock you are trading gets a sudden price drop, then your PUTS can lessen the loss and possibly make you a profit if you are controlling more contracts than the shares you are trading; however, you are spending money first to buy the PUTS before you start to day trade the stock—which creates a deficit before you even start to make profits. Then there is my way to day trade a stock: Rather than spend money for insurance, why not get paid to buy that insurance! The technique is called "selling premium" and what that does for you is put CASH into your account; however, there are a few things you need to understand. When you "sell" premium, you are obligated to invest in a stock or cash out a buyer because if you do not already own the shares of the stock you sold premium on, you are considered NAKED and therefore 100% liable to act if things go awry.

1. NEVER sell premium on a stock you are not 100% prepared to own. 2. NEVER sell premium on a stock that is releasing an earnings report or has a corporate event announced. 3. NEVER sell more contracts than you have the capital to buy those shares using a MAXIMUM of 50% of your buying power. 4. The "cash" you get paid is held by the Broker until you either exercise the option, get the stock put to you or buy back the puts and end the obligation. The safer side of selling premium is NAKED PUTS because if the stock is put to you, then you will own the shares vs. selling NAKED CALLS where you have to settle in cash. Find a fast moving stock like AMZN, AAPL, TSLA, NVDA, NFLX, CMG, FB etc. then, depending on your bias, you will you either sell a Naked Put or Naked Call one or two strike prices away from the current price. This will give you premium (rent) income, but you are not "keeping" this premium, you do this so you can capture the premium to pay for your protective calls or puts—be sure to sell at least 1 full month of time so you can collect enough premium to pay for most of the protective calls or puts you are looking to sell. Once you are filled, you take that premium and purchase regular CALLS or PUTS within 5%-10% of the stocks current price; however, be sure you are above the 100 day moving average on a daily chart for the protective puts you buy; and if you are going with calls, then stay under a 10% move higher. Be sure to buy enough calls or puts (even if you have to invest a little money) to cover at least 2:1 of the number of shares you plan to day trade. Caution: when buying your protective calls or puts as weekly options unless you can get 3:1 insurance protection and you are only looking to do this strategy for the week. Now that you are fully hedged, you can trade the stock very aggressively with zero fear of getting stopped out and taking a big loss because you have your protective calls or puts ready to make a nice profit, or at the minimum, recover any loss you may take from a stop should the stock make an unexpected move in price. Note: When selling "naked options" most brokerages require you to have at least $50k in your account; however, we get around this requirement because we create a spread by purchasing the next strike price under our Naked Puts. If we are bullish then we are doing a Bull Put Spread. If we are bearish then we are doing a Bear Call Spread. Once you have your strike prices set, then you add up the spread cost plus any extra cost of the calls or puts you bought and divide that number by the total shares you will trade day-to-day in order to get your daily minimum profit to cover the costs of the spread. Now you are ready to trade the stock daily with no fear of taking a big loss; and once you build profits, you can take some of them and continue to add weekly or monthly contracts for even more protection. Since you are now fully hedged, you can end up a winner because your puts have 2:1 or more leverage over the shares you are trading and at the minimum, you can recover most if not all the loss you may take on the stock if you are stopped out. (Note: only place your stop at the sold put price) Lets look at an example: GOOG is a very fast moving and volatile stock to trade; and if you do not have a solid game plan; lots of cash and tolerance to drawdown; then you will always trade this stock from a position of fear; however, with my strategy, you are going to trade from a position of complete confidence! RULE 1: NEVER DO THIS STRATEGY AT EARNINGS TIME. The stock must be moving in a solid UP or DOWN trend. Our bias for this lesson is for GOOG to go up, so we need to do a Bull Put Spread for this example. Below are three charts I look at: Daily, Weekly and Monthly.

I would use the Weekly chart to determine where I will sell my naked options and buy my protective put options. For Naked Puts, I like to sell my naked options two strikes or 5% away from the current price; and then I look for the closest major moving average (89,100 or 200) as my initial spot to buy my protective PUTS; and if you are doing Naked Calls, then buy your protective CALLS at a maximum of 10% OTM—on puts, be sure to buy the strike just above that moving average line so you have the best probability of being ITM if the stock gets whacked. Once you start to build profits trading the shares, you may want to keep adding some more protective puts to give you a greater insurance and confidence. When I do this, I like to build up my insurance puts to a ratio of 4:1 for the shares I am trading, that way, if GOOG takes a sudden price drop you will end up making a profit and fully cover any stop out you have to take on the stock.

I use the Monthly chart for trend reference to help me determine where to place my safety net puts.

|

|

|

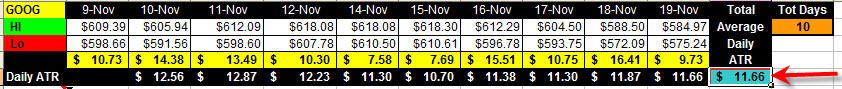

When you become a day trader, its imperative you understand the markets dynamics, the effect news has on the stocks you trade and everything you can about the particular stock you apply this strategy to so you know what you need to do when large price swings come—and they always come usually at the least expected time! Next we establish the ATR (Average True Range) for Google on a weekly basis so we can anticipate what movement in price we can capture during the trading day.

As you can see, the last 10 trading days of GOOG have an ATR of $11.66 per day. When you start trading this way, you should work your day trades to capture 50 - 75% of this move per trading day. I like to keep track of 5 days and 8 weeks then I drill down to Daily 30 Minute ATR's. Assuming you can trade 100 shares of GOOG, you should work the stocks ATR anticipating you will make $200 - $800 per day—I highly recommend you use proper charting techniques and day trading tactics to assure your trades are able to make the most profit. When you are day trading very expensive and volatile stocks, I always work with 15 or 30 minute charts because you will get a lot of whipsaw on shorter time frames. It's much easier to see the bottoming and toping tails for more precise entry and exit points—I mostly prefer to trade my favorite pattern, the Bull or Bear 180's —if you see these, then load the boat because they are profitable 80% of the time! If you do not want to trade off Bull/Bear 180's, then use Topping or Bottoming Tails as your entry and exit points.

|

|

|

Next we will look at the Naked Option choices: RULE 1: Never trade more shares than you can afford to buy without using margin. ONLY use margin once you have enough protective puts to cover those shares should you get stopped out. Your main goal is to day trade the stock

with protection, so I would t Here are today's Put premiums:

With the stock currently trading at $580, I would sell the $560 Puts because that gives me enough premium to pay for 2 contracts of my protective puts creating my Bull Put Spread. So, if you are trading 100 shares then you would sell 1 contract of the 560 Puts and take in $940.00 of premium. Next I would take that money and purchase 2 contracts of the the closest strike this money would buy so long as it's within 10% of the current stocks price. In this case it would be:

Now that I have my initial insurance in place, I am not concerned with having GOOG put to me at $560 per share because I am hedged 2:1 in puts at the $540.00 strike price. As I start day trading GOOG up to 100 shares per day, I am virtually risk free because in order for GOOG to get put to me, the stock would have to trade under $560 per share by expiration. Now if GOOG were to suffer a sudden drop in price, my safety net puts would appreciate in price giving me more protection as I exited the shares that were stopped out. My bought puts would potentially make me a lager profit than any stopped out loss because I am covered at a minimum of 2:1. If I happen to get a call from the Broker informing me I have to take delivery of the stock, then I would either sell a covered call or just sell the stock and see where my protective puts go—once things settle down, I would repeat this process and start again. To make things even more lucrative in the

event of a disaster, I would continue to

This strategy is not about making money on the options; they are there to protect you while you day trade GOOG for your daily profits. NOTE: I would never hold 100% of my max shares over night; however, since I am protected with puts, I would definitely hold some shares if the stock is moving in an uptrend so I could capture the gaps in the mornings.

Now we look at actual trades done with this strategy

As you make profits you will be able to start accumulating money to load up on my Lotto Plays or White Whale Trades and never give a second thought to the ones that do not work out while cashing in on the ones that do! In fact, look take a look at the profits my Lotto or White Whale trade strategies can do for your account when you layer multiple trades:

|

|

|

Profits Up!

The donFranko

|

|