Updated:

10/13/19 3:30 PM PST

Earnings season kicks off and this Wednesday we have NFLX which should make some impressive moves if they miss subscriber growth estimates. Now if they actually beat them, I would look for at GAP-N-CRAP post earnings...more in the NFLX commentary.

With the presidents announcement of a "phase 1" deal with China, the markets took off lifting the DJI over 319 points and killing the TGIF PAYDAY! PUT bias; however, if you had the hedge CALLS in place, then you should have at least broke even this week. Although it has been a tough couple of months for the TGIF PAYDAY! strategy, we just keep on going down this rocky road; and when the markets smooth out and start that trend; all losses will be erased and this turmoil forgotten as we relax in the land of 7-Figure profitability in the next 1-2 years!

As for the "trade-deal" and its overall impact on the markets day-to-day, that remains to be seen how good or bad things will be when it is all done; and with this new "multi-phase" plan, you can be assured the impact will continue to be volatility in the markets—sell the rips...buy the dips and place wild card Lotto Trade orders.

Hopefully, this round of earnings releases will take the focus off the trade wars as investors try to focus on the next 6-weeks in anticipation of a robust final quarter of trading for 2019.

Next year is the presidential elections cycle and it will no doubt be very heated with lots of twists and turns for us to watch, listen and profit from. If President Trump is impeached, then we can expect a very large drop in the markets; because a left-bent government is definitely BAD for stocks; therefore, keeping some wildcard PUTS in play on any quick moves higher is a good bet—especially if those moves are SGB's.

Speaking about SGB's, Friday trading was robust indeed, but the fade came in the afternoon session creating some SGB's on several daily charts of the stocks I watch:

AMZN, CMG, NFLX, GOOGL, SHOP, ROKU, DIS, MSFT, NVDA

When you get SGB's showing up on several high profile stocks, you have to take notice and prepare for some aggressive moves in the near future and if earnings go bad, we are in for a serious DROP across the markets. The best way to trade SGB's is historically PUTS; however, in this market, anything keeps happening and trading has been VERY frustrating now matter what side you are on.

As earnings season rolls out, I expect a couple stocks I watch will have explosive moves so I will keep laying more orders on strikes up to 20% OTM for PUTS and 15% on CALLS. Also, I plan to be fishing for White Whale short squeezes on any stocks than drop no further than the MMM with strike prices at the closing price the day of earnings.

Profits UP!

Frank

=============================================================================================================

Updated:

10/6/19 3:30 PM PST

Last week the TGIF PAYDAY! trades went bust again...what a bummer indeed but it only takes 1 - 2 winning weeks to recoup all losses and keep the compound journey going!$$!

Markets were on the slam down all week from the impeachment news, but an unexpected positive employment report created an aggressive short squeeze across all markets.

Question is, will it hold or will investors fold in light of the political upheaval. The whole impeachment thang is ridiculous (retribution for Clinton's) and way overblown by the Democrats scratching for any reason to impact the presidency of Donald J. Trump vs. actually working with him to do the business of the people. Hmmmm, seems to me they (Pelosi et. al.) are doing EXACTLY the same thing they accuse the president of doing...influencing an election by abusing political power.

Yeah, I have to agree somewhat that the Prez made a massive faux pas with his comments to the Ukrainian president (or implied comments), but if you dig into the actual transcript, you would have to reach much farther to come up with the current conclusions the adversarial political party is pursuing.

I have no political ax to grind here, but I would prefer to see these "elected" people actually honor their oaths of office and do the RIGHT THINGS for the American people who, after all, are the boss of these folks, but our politico's have a viewpoint they are the sovereigns and they run our government more like a monarchy...they act like they are our "Kings and Queens" and we are serfs to their creeds and dictates.

Ok, so let's learn to use this turmoil and make some $$$$$$$$$$$$$$$$$ in the next 3-6 months so we can just be surfing!

and cashing in on the coming Lotto Trades!!!

Ok, earnings season is about to kick off and there will be some excellent LOTTO TRADES out there on a number of stocks. You should be looking at the DAILY charts of your favorites for SGB's and SGB zones to target your strike prices. When you go for wild card Lotto Trades at earnings, you can pick strikes up to 15% OTM for PUTS and 10% OTM for CALLS.

As for the TGIF PAYDAY! strategy, we continue the journey and play the BIAS every week; however, with all the volatility, you should consider adding back in the straddle plays based on the daily VIX chart—See the full details in the SPY commentary.

Oh, almost forgot. there is a BIG shakeup in the trading world with brokers when TD Ameritrade announced they are going to a commission free basis....sort of. Remember, when a stock broker is giving you something for free, it will come at a COST somewhere along the line and that is probably going to be via slow order executions and skewed pricing so freebie beware...you will only GET what you paid for know what I mean?

See, not actually "FREE" just not pumped with servicing fee's...you still PAY $0.65 per contract with them on the BUY and SELL.

Tastyworks is still a better place to trade my strategies once you start compounding.

Profits UP!

Frank

==========================================================================================================

Updated:

9/9/19 2:00 PM PST

Last week the TGIF PAYDAY! trades went bust and expired worthless...aarrrggghhh...it figures it had to happen when the model portfolio reached the max contract load on the SPY trades; however, I suspected things could go bad, so I lowered my total contract load—I know this is somewhat frustrating, but it is expected and accounted for in the compounding.

Even though we had this losing week, it will be a good observation lesson for you to see how losses affect the compound rate; and how things quickly get back on track when the next winning trade comes. The model portfolio is still at the maximum of 5,000 contract and can absorb this hit; however, I am backing down some more this week and will not increase until the next winner kicks in—I still expect to reach 7-Figures in the next 1-2 months!

When I developed this strategy back in April, I only had the benefit of hind sight statistics to apply the formula to; and if you look at the chart below, the SPY was on a solid upward trend until MAY and now it has been in a very volatile trend. Needless to say, this strategy is going to have some difficulty in current market conditions, but you can rest assured an up or down trend will develop in the future (probably after Jan 2020); and when that happens, we will achieve 7-Figures in less than 12 months!

Since we are still in "new" territory with this strategy, I was reviewing the past few weeks charts and I am thinking we can make a slight adjustment by fishing for trades on Wednesday morning; and then buying in at the close on Wednesday night if not filled in the first hour of trading.

I would start with no more than 50% of your contract load; and then on Thursday, you implement the regular strategy for the remainder. However, if you are just starting out, then you buy in on Wednesday and take the ride into Friday all-or-nothing—once the volatility calms down, then we can get back on track and trade Thursdays.

The other thing I am going to start doing is layering three strike prices; and also buying 10% of my contract load in the opposite direction as a hedge. Of course, this requires you have a larger contract load to do this, so sticking to the basic strategy would be best until you compound to 20 or more in my estimation.

Now that September is underway, we have a couple of weeks before earnings season kicks in, so expect some continued volatility; which makes for some great Lotto Trade opportunities.

Profits UP!

Frank

==================================================================================================================

Updated:

9/1/19 5:00 PM PST

No fills this on the TGIF PAYDAY! trades this week so we just sit back and see what happens next week. On Tuesday, we head into the final quarter of 2019 trading and you can expect to see continued volatility; which makes for some great Lotto Trade opportunities; but makes things a little bit more difficult for the TGIF PAYDAY strategy.

October is also the final quarterly earnings, and historically, that has been the BEST month for trading too—my personal best Lotto Trade was back in October of 2013 on GOOGL earnings where I made over $72k the next day!$$!

I am excited to see how far we can get with the TGIF PAYDAY! strategy by the end of December. I am expecting to reach 6-Figures myself and Model Portfolio should advance well beyond 7-Figures too—which is EXCITING because that will be our future too!!!

Even if you are starting out this week with the strategy, and the trades perform around the same pace and magnitude they have in the past four months, then you can expect to see a minimum of 5 and maybe 6+ figures by the end of this year; then it's only a matter of 6-12 more months to make it to 7-Figures based on the compound rate of 25% or 50% of profits each winning trade!!!$$$!!!

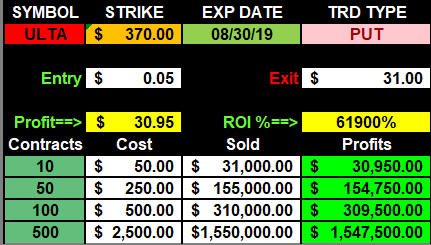

This last week the stock that got wiped out was ULTA; which dropped over 29% due to missed earnings and lower projections. This can have some definite trickle down impact on retail and maybe even tech stocks because the company is in the higher end boutique makeup space; and if they are suffering from lack of sales, then female consumers (the real spenders) are getting cautious and pulling back on what else? The next earnings releases are definitely going to have some stocks making similar HUGE moves...so get ready!

Take a look at this Moby Dick trade below.

Even though we missed out on this one, you can rest assured...it WILL HAPPEN AGAIN AND AGAIN as I have pointed out and posted trade ideas over the years on this website. All you need to do is start laying those orders for $0.10 on PUTS 15% OTM a day or two before earnings; and BUY IN if it's a Thursday release because that is when you can catch one of these MOBY DICKS—the more stocks you can do this on, the more times you are assured to connect with 1-3 like this every year if you are putting in the orders.

It only takes 1 of these to pay for 52 weeks of fishing trips on multiple stocks; and you are practically guaranteed to catch a couple more times and compound to MILLION DOLLAR WINNERS!!

The BEST way to get the capital to buy these is with the TGIF PAYDAY! strategy; and then we have PLENTY of money to buy several of these trades with 100+ contracts in the future!!

As we head into the final quarter of 2019 and the last earnings reports, we should expect to see another stock or two get a beat down like this. So, if you have the capital, then fishing for wild card Lotto Trades up to 15% OTM can produce a similar Moby Dick for you in the next couple of months.

The political turmoil continues to make markets more volatile and with congress coming back from vacations and we can anticipate even more shenanigans with the Democrats and Republicans jockeying for position on Trump, Russia and China trade issues. The president is a wild card indeed for the markets, because he loves to tweet and that made some HUGE moves this last month...so I am anticipating that will continue giving us some awesome Lotto Trade opportunities.

The SPY charts is looking ready for a DROP since it failed to take out the SGB zone at the Bull 180 T-3 line; however, the SQUEEZE indicator is showing a HIGHER move is about to be released. This will take some positive China news along with some solid earnings reports in October, so for now, my bias is to PUTS until the SPY can et over 296.

The $DJI is "LOOKING" like higher prices to come; however, Friday was a SGB at T-3 on the Bull 180, so if the China news over the weekend has any impact, we are looking at a re-test of the 200 MA; otherwise, the technical squeeze indicator is pointing to a move UP and if earnings are strong, we get a move back to the all-time-highs by years end once the SGB zone is taken out. Either way, we should see some really good Lotto Trade opportunities, so I am continually putting in fishing for PUTS under SGB's and CALLS above them on indexes and stocks.

Profits UP!

Frank

============================================================================================================

Updated:

8/25/19 4:00 PM PST

BIG MOBY DICK TGIF PAYDAY! WINNER THIS WEEK ON AMZN!!

This the Thur/Fri the volatility was off the charts with Trade War news from China, and then tweets from Trump, and FOMC comments by chairman Powell. It was a real knock down drag out fight between the Bulls and the Bears that drove stocks all over the place and crated a Moby Dick winner on the AMZN TGIF PAYDAY! 1815 PUT trade!$!

In addition to that, the SPY 292 PUT trade was also a massive 833% winner and now the compound in the Model Portfolio has exploded from 1500 contracts to the 5,000 maximum starting next week!!—what is even more exciting is it only took 22 weeks to go from 10 to 5,000 and from a starting investment of $360 into $699,000!!!!

The model portfolio is a few weeks away from reaching the land of 7-Figure profitability!!!

I am soooooo EXCITED to get there and bring as many of you as I can with me!!!!

No matter where you are in your journey with me to the land of 7-Figure profitability, you can rest assured you will arrive there and together we will all change our financial lives and destinies!!!

This week is the last one for the month of August and then we start down the final quarter of 2019 and there is sure to be continued volatility. What I am doing from this day forward is buying every TGIF PAYDAY! trade idea to the maximum price of $0.75 for the SPY and $6.00 for AMZN on Thur or Friday morning boom or bust!

Once you start to compound, then you can even diversify your trades and increase the number of strike prices you buy by picking up OTM contracts on the PUTS side because; as you witnessed this week; a Trump tweet can produce massive moves to the downside and we will make 5-6 Figure profits on Fridays!!!!!

BE SURE TO STUDY THE TGIF PAYDAY! AND LOTTO TRADE TRAINING MODULES so you are prepared to make the correct trades and capitalize on the next MOBY DICK winners!!!!

Profits UP!

Frank

===================================================================================================

Updated:

8/4/19 5:00 PM PST

BIG TGIF PAYDAY! WINNER THIS WEEK!!

This week was a very volatile week with the FOMC, economic news and President Trump getting investors all riled up with his barrage of tweets on raising more tariffs on China et. al.

If you were following the TGIF PAYDAY! strategy, then you had a massive winner with the SPY and AMZN trades.

The SPY failed to hold the SGB zone and down it went blasting through the lower SGB zone with strong volume. Now it has become a Level 2 Bull 180 setup and we are going to see if this market can get back on track and resume a trend...up or down is fine with me...I just want to see that trend happen.

We also had a really good Lotto Trade on AAPL and some SPY too and as earnings continue this week, I am looking for some more opportunities to capture Lotto Trades!

Now that the BIG news is over, we basically have little to go on for August; other than Trumps tweets and a few more earnings announcements. I would suggest you keep some wild card CALLS in play and just continue with the TGIF PAYDAY! road to riches!

Now that all the indices have take out their SGB zones, markets are going to be skittish with itchy trigger fingers taking profits on any bounces. If you are looking for options trades, be sure to ALWAYS fish for better pricing because the Market Makers will have a lot of implied volatility and slippage priced in.

Profits UP!

Frank

Updated:

7/28/19 3:00 PM PST

TGIF PAYDAY! winner for this week has the compounding back on track!

Now that the SPY has held over 300, maybe we can get the upward trend moving and our journey to the land of 7-Figure profitability will be upon us much sooner than we think!

This weeks earnings produced some dramatic moves in AMZN and GOOGL with the later being the Moby Dick Lotto Trade...unfortunately...I did not have the correct plays in place nor did I have any Lotto Trades on, but I am hopeful some of my students/subscribers were able to apply the Lotto Trade formula and catch a Moby Dick winner on GOOGL!!$$!!

I am currently 90% focused on the TGIF PAYDAY! strategy the rest of the year; and as things progress, I am pretty sure all my subscribers will be too. The nice thing is, once we do compound beyond 1K contract loads, then we will have the capital to load up on multi-strike Lotto Trades and have our MILLION DOLLAR winner in the future on stocks like GOOGL, AMZN, NFLX, CMG etc.

In fact, here is what happened (and will happen again) with GOOGL this week:

I know it takes a lot of moxie to buck up $25k, but when you are already making $100k or more per week with the TGIF PAYDAY! strategy, then trades like this will become reality in all of our futures!

This week is the FOMC rate decision on Wednesday at 2:00 PM EST, and it is expected they cut by 0.25%; however, if they surprise and cut by 0.50% we could get a massive rally; otherwise, it is looking more like a sell-the-news setup in the charts—looks are always deceiving in the stock markets...lol.

What if they actually do NOTHING? Well, that could create a panic sell off and maybe drop the DJI over 1,000 points...nice thought eh?...but most likely things will just linger as usual. My bias is BULLISH, but I am definitely going to have wild card PUTS in place, so check out my comments on the SPY page and watch for LOTTO TRADE ideas to be posted.

This weeks earnings to watch will be AAPL on Wednesday; and with a positive FOMC and AAPL BEAT, then UP we goooo.

We may not be able to get a TGIF PAYDAY! trade on this week with all the IV pumped in, but that does not matter...I would rather have no trade then a busted one...wouldn't you agree?

Be sure to review the Lotto Trade entry guidelines and place your orders whether I post trade ideas or not—I hope some of you caught the Moby Dick on GOOGL last week, and if not...THERE IS ANOTHER ONE COMING!!

As for the botched spread trades I posted, we will adjust them to a profit after the FOMC news is out.

Profits UP!

Frank

================================================================================================================

Updated:

7/21/19 3:00 PM PST

No TGIF PAYDAY! profits this week, well, it could have been, but I picked the wrong strike and learned a valuable lesson...see SPY commentary.

This week is a BIG earnings week and we should see some nice moves in several stocks I follow including: CMG, GOOGL, TSLA, TWTR and FB.

This past week we had a massive move with NFLX; as the stock was whacked from missing subscriber growth numbers....hope you had some Lotto Trades on.

All indices pulled back from historic highs as investors try to decide on their market bias. With the looming FOMC rate decision coming on 7/31/19. Here is a great resource I use to see upcoming news events. https://www.forexfactory.com/calendar.php?day=jul31.2019

Always be on the lookout for SGB's on the daily charts and use them as your strike zones and short / put bias at tops and long / calls at bottoms of ranges. That being said, let's take a look at some charts to see how we can get prepared for a solid move:

We keep working our way down the road with the TGIF PAYDAY! strategy and this week I am hoping to catch a few Lotto Trades. Be sure to review the training pages, apply the Lotto Trade formula to your "go to" stocks and we will all meet together in the land of 7-Figure profitability!

Profits UP!

Frank

=====================================================================================================

Updated:

7/14/19 3:00 PM PST

The markets close the week at new all-time-highs and now the stage is set for a massive brake out or break down with earnings season and a pending FOMC rate cut coming most likely this month!

The question is, will it launch the markets or become the typical buy-the-rumor-sell-the-news event? We just can't know that outcome, but with earnings starting up again; and the China trade deal still looming; we can expect volatility to continue—and that is the perfect recipe for Lotto Trades!

Another winning SPY TGIF PAYDAY!, but the first "live" AMZN trade was a loser...bummer...for now. (see details in AMZN commentary)

Monday is Amazon PRIME day, and it will definitely move the stock around, so I am confident the next TGIF PAYDAY! trade will be a winner!!

Earnings season kicks off this week with stocks like: JPM, GS, MS, BAC, MSFT and NFLX which could be a HUGE LOTTO TRADE opportunity!

Another potential mover this week will be FB because they are headed to Capitol Hill on Tuesday and Wednesday for testimony before the Senate Banking and House Financial Services Committees. The concern? Will their "Libra" crypto currency be launched or perceived a real threat to the US and other Government currency monopolies. It is clear the US Government is "scared money" and even President Trump does not like the idea, so if the rhetoric is expounded on, then FB could see some real downward movement this week; however, the stock is looking very bullish at the moment.

We also have a FULL MOON cycle starting and that usually has some impact on individual stocks and/or markets, so this week you should be placing wild card Lotto Trades on strikes up to 15% OTM on your "go to" stocks.

Whatever your strategy, just be consistent and keep "compounding" your contract size after winning trades and you will be hanging out with me in the land of 7-Figure profitability!

Profits UP!

Frank

=============================================================================================

Updated:

7/7/19 5:00 PM PST

No TGIF love this shortened week of trading as I anticipated.

I did not do the normal contract load on the SPY which was a good thing because it would have been another bust out...whew.

This week we have the FOMC Charmin testifying at Congress; and I am sure a battle of words between him and Trump will continue on Twitter. Will the rates be cut in July with the surprise upside employment report on Friday? Well, with the economy still in boom mode, the consensus on the news outlets is NO rate cut is needed; however, you have to consider long-term impacts of a rate cut or even hike; and if Trump gets what he wants, the stock markets will explode higher; however, if Powell does an about face and slams the president with a hike, then the TOP is in and down we goooooo—investing around these meetings is always a crap shoot, but if you keep watching for and trading around the SGB's, then you can get an edge over other traders and make some Moby Dick profits with wildcard PUTS if the markets get slammed.

Earnings season is about to start up again and that should give us some momentum on stocks that performed better than last quarter. If we get a continuation of current trends, then I am sticking with the long side bias on the stocks I like to trade: AMZN, NVDA, FB, NFLX, AAPL, TSLA, AVGO, GOOGL

This weekend I was doing some more back testing and updating of the TGIF PAYDAY! strategy with AMZN, and I was blown away by the YTD results.

It is simply AMAZING when you consider the POWER compounding can have on your trading account with this strategy if you apply it to AMZN !$$!

I am going to start a TGIF PAYDAY! Live model portfolio on AMZN this week.

On July 15th, Amazon will have its "PRIME DAY" and that should put some upside pressure on the stock this week; as the stock looks ready to break out higher on the weekly chart. Of course, it is always a stressful trade with this stock—especially being at all time highs again—so if you do not have the capital to take on this whale of a stock, just stick to the SPY TGIF PD, and in a few weeks or couple of months, you can start another one on AMZN!

This past week we saw the $DJI make a new ATH's closing the week above the last SGB zone. The stage is now set with the strong employment report on Friday, and if this weeks FOMC Chairman testimony is positive, we should see a solid move higher.

If you are buying into any options trades, you MUST bid for a better entry price as the IV will be pumped up; and you do not want to over pay for your speculations.

As the indexes all hit new ATH's, we need to keep some wild card PUTS in play for those "upset" news events like the FOMC giving the "finger" to Trump and actually raising rates—now that would cause a short-term crash in my estimation.

Otherwise, Mr. Powell does "nothing" which should still keep the ball bouncing higher in the markets. BUT, if they actually lower rates, well, to quote the President:

“Our most difficult problem is not our competitors, it is the Federal Reserve,” Trump said in a Twitter post late Friday. The Fed had “raised rates too soon, too often” and “doesn’t have a clue,” he said. Trump has repeatedly accused Powell of not doing enough to bolster the economy.

Growth “would be like a rocket ship” if the Fed eased, Trump told reporters at the White House on Friday.

My plan this week is to stick to the UP trend with CALLS; and have some wildcard PUTS in play up to 15% OTM on stocks and 10% OTM on indexes just in case Powell upsets the BULL cart and takes a whack at the Presidents overtures of incompetence with regards to rate manipulations.

Profits UP!

Frank

The donFranko

PS. I found this site interesting: https://www.bloomberg.com/features/trump-tweets-market/

if you want to see all the Presidents tweets and their effects on the DJI.

=========================================================================================================

Updated:

6/30/19 11:00 PM PST

A tough week for the TGIF PAYDAY! strategy but it's just a bump in the road and the model portfolio is well on its way to the land of 7-Figure profitability. If you have been on the trip since we went live, then your account is on the grow so stick to the strategy and adjust contract loads according to your tolerance of drawdown. Remember, it will only take a couple of winning weeks to put you back on the parabolic growth!

With the Trump / Xi Jinping compromise over the weekend, we should see some stability in the markets as investors await the anticipated FOMC rate cut; and that should continue the trend higher all summer; however, anything can happen so be on guard with some wildcard PUTS if you weighted long in your trades.

Since the Dragonfly SGB Doji all-time-high (ATH) on the SPY, the ETF took a 5-day dip and rallied back slightly; however, it stayed under the previous ATH's from May. Until that SGB zone it taken out, any longs are suspect and profits should be quickly taken. Once we get past 296.13 and the QQQ, DJI, SPX, OEX all take out their ATH's, then I would be looking for more aggressive trades and selling PUT premium.

Profits UP!

Frank

The donFranko

==============================================================================================================

Updated:

6/23/19 5:00 PM PST

The S&P 500 closed at fresh ALL-TIME-HIGHS powered by the FOMC statement; and we also had another TGIF PAYDAY! WINNER; however, you had to take your DoubleUP! profits on Thursday to maximize the trade opportunity which is why I strongly suggest you take a DoubleUP! on 50% of your contract load (especially when you are starting out) so you can keep the profit train moving down the track.

With the FED in dovish mode and a rate cut expected in July, investors hit the RISK ON button and piled into their favorite stocks this week. There was positive China trade news from Trump saying the Xi Jinping will meet with him at the upcoming G20 summit in Osaka, Japan. Although there is no significant "deal" yet, investors are definitely climbing a wall of worry based on FOMO, so if this deal goes bad, markets are poised for a BIG DROP; however, if things go good, we may already be priced in UNLESS there is a simultaneous rate cut announced. Either way, we should expect some volatility in July and keep placing those wildcard Lotto Trades.

Looking over the charts, the DJI has been in a massive BULL run for15 days; however, if you look at the weekly chart, the DJI closed EXACTLY at the tippity-top back on 9/17/18 and DID NOT make a new all-time-high; nor did the QQQ's, IWM, DJT, just our old TGIF PAYDAY! friend the SPY.

The fresh all-time-highs on the SPY chart paint an interesting story of mixed emotions:

I have been watching and day trading the very volatile BYND stock and wanted to point out the weekly chart now has TWO SGB's in place. This stock may have finally run its crazy bull course and is about to get chopped up. There is always a lot of angst trading stocks like this, but if you want to take a swing at it, then wildcard PUTS 20% OTM could be very profitable trades; however, if you buy in, then it is ALL OR NOTHING trading—and be sure to fish for a better price because the IV is PUMPED UP!

Profits UP!

Frank

The donFranko

===========================================================================================================

Updated:

6/16/19 3:00 PM PST

A good week of trading but a busted TGIF PAYDAY! ended my week on a downer; you can see my comments in the SPY section.

When AVGO posted a very negative earnings report; and we had that Iranian issue in the Gulf; one would think the markets should have taken a health dip, but this time (as usual) investors just held ground and nothing happened ending the day as a DOJI on the SPY.

With the SPY posting a SGB at the 10/2018 SGB big sell off zone, I was looking for some action Friday; being it was also the start of a Full Moon cycle; but instead, it was a NOTHING day and now we have two DOJI's which means the markets are definitely poised to make the next big move soon!

If we get the drop this week after the FOMC announcement, the 283 strike is the target; which is also T3 on a Bear 180.

Should we get positive trade news, FOMC rate cuts or other compelling situation, then 295 is the CALL strike is where your should be targeting trades..

Earnings season will begin again in mid July; and that is where the biggest opportunities will come for some good trades; however, if you are applying the Lotto Trade formula to your "go to" stocks each week, then keep your hand on the wheel and I will see you in the land of profitability in the future!

This weeks TGIF PAYDAY! trade will be back on track with ATM or slightly ITM strike prices based on the Wednesday close.

Profits UP!

Frank

The donFranko

===========================================================================================================

Updated:

6/9/19 3:00 PM PST

What an exciting week of trading we had!

First off, we got another WINNER on the TGIF PAYDAY! strategy; and continue to compound contract size on the way to 100+ contracts and 6-Figure winners!!!

Next the Fed Chair Powell injected dovish comments which crated a buying frenzy as investors enthusiastically piled in and bought the dip once again.

Next we had President Trump throw a monkey wrench into the mix when he announced trade tariff on Mexico over border issues; however, that was just a glitch and the launch continued; because investors may no longer considering tariffs as a "thang" to be reckoned with.

This week was also an amazing Lotto Trade opportunity with the hot stock Beyond Meat, Inc. (BYND) reporting better than expected earnings; causing a massive short squeeze higher (like EA last quarter) and taking this stock just under $150 per share for an amazing +39.35% gain on the day...wow...if you were fishing for Lotto Trades on this one post earnings...you landed a Moby Dick!

On Friday, President Trump announced that he cut a deal with Mexico and the tariffs will NOT be implemented; which should take markets higher this week.

With the summer months upon us, momentum would usually fade, but with the FOMC about to LOWER interest rates, we just may never look back regardless of what happens with the China trade war; and should Trump cut a deal with China, well, you better be zipping up you G-Suit because the after burners will kick in and take this market-rocket to new all\-time-highs in 2019!

Ok, am I too optimistic? Probably, but if you do not have some wildcard Lotto Trades in action, then you will miss out on potentially the BEST trades of 2019 in the coming weeks to months.

The KEY indicator to watch for is SGB's on the daily charts in all the stocks and indexes because that will be the pivot points to start laying your wildcard Lotto Trade orders up to 20% OTM.

With the great success we are having with the TGIF PAYDAY! strategy, I have backed off most Lotto Trade activity until earnings; however, you should still be implementing the Lotto Trade strategy on your "go to" stocks.

Profits UP!

Frank

The donFranko

==============================================================================================================

Updated:

5/26/19 3:00 PM PST

The final week of May trading is about to begin and the action has been very volatile in the markets. What I have noticed this year is trader sentiment has definitely been living up to the adage: "sell in May and go away."

With all this volatility, we have struggled with the TGIF PAYDAY! trades; however, we have not had any losses either! So, being patient is KEY to this strategy because once the markets get back on the trend-track, we will be rolling in the profits and arriving in the land of profitability!

Earnings season is all but over and I will be focusing on trading around SGB's, SGB zones and laying my weekly Lotto Trade orders on my "go to" stocks.

Profits UP!

Frank

The donFranko

===========================================================================================================

Updated:

5/19/19 3:00 PM PST

Another interesting week of FULL MOON trading as the markets gyrated around post China trade wars. Last week President Trump raised tariffs to 25% Friday night; and on Monday, China retaliated by raising theirs too; which put the markets into a skittish mood and investors into scare mode. Ah, but as usual, it was a BTFD mentality and a nice bounce off the 200MA. Of course, the manipulation of the markets continue; and this time it came by way of tweet from the President that

this no doubt caused a nice rally on Wednesday pumping up the markets. Any news of the trade deal and if FOMC actually lowers rates would create a massive rally in our markets if this weeks action is any evidence of investor sentiment.

As for the TGIF PAYDAY! trade this week, we did not get filled; however, patience is a virtue in trading if you want to get to the land of profitability!

Earnings season is pretty much over, so now we just watch the daily charts for SGB's and news for bias trades as the summer doldrums are coming.

The Lotto Trade opportunity this week was with TSLA; which took a slam down over (7.58%) on news from CEO Musk calling for 'Hardcore' Cost-Cutting. If you were implementing the Lotto Trade strategy, then your 3% OTM strike would have been the 220 Puts; however, because TSLA is both expensive and volatile, you would have needed to up your price range above the normal $0.20 Lotto Trade target. That being said, you need to fish TSLA around $0.50 - 1.00 which would have resulted in a very nice profit by Friday.

I have been 100% focused on the TGIF PAYDAY! trades the past few weeks, and until I get a solid compounded profit going, I will be laying off posting Lotto Trade ideas; however, if you pick 1 or 2 "go to" stocks; and keep laying your orders every week; you are assured to catch trades like this one on TSLA making some very nice gains!

Profits UP!

Frank

The donFranko

===============================================================================================================

Updated:

5/12/19 5:00 PM PST

A week of extreme volatility as investors wrangled with positions over the China trade talks that failed to make a deal and President Trump implemented a 25% tariff on certain goods.

Now that the news is finally out, it will most likely be business as usual and the markets can resume their trends...or so it appears for now. Once the news hit, the DJI made a solid bounce off the 200MA daily chart, but only tacked on a meager gain of 114 points.

The QQQ still has a lot more downside potential with its 200MA at 175, so I am thinking investors will be watching closely how the markets react this week and if China will wage its own tariff war on US good (likely); which will continue to create another round of uncertainty.

Even though our markets are still very Bullish; and can take a lot of hits before fund managers would consider a Bear market is here to stay; we need to be diligent looking out for SGB's to give us confirmation they are exiting positions.

With earnings season all but over, we will most likely be heading into the typical summer doldrums; however, if the DJI holds the 200MA on any pull back, then the Bullish bias is still intact and markets most likely will continue to make a run for higher ground.

We did not get a TGIF PAYDAY! filled this week, but I am excited to see the strategy continue to play out as I start to compound the model portfolio into 6-figure profits later this year!! Once you get profits building, you can expand your strike prices or raise you MAX buy price, but if you do, I strongly suggest you adjust your contract load based on $0.50 to make sure you do not overheat on any losing weeks that will happen from time-to-time.

When markets are changing tone, it usually revolves around the 200MA, so if your stocks are below it, then slow down on long positions; and when above it be on guard with your long positions. If price is touching, bouncing or gyrating at the 200MA, then you should go neutral on that stock and fish for Lotto Trades up to 10% OTM on Thur/Fri.

On the IPO front, UBER had a lousy opening day Friday (5th worst in the past quarter-century) basically finishing the day under its IPO price of $45.00. This is most likely due to bad timing and pressure from the weak LYFT performance; and investors will probably look at this price as an opportunity to start some accumulation going forward. However, I am not so eager to buy into UBER or LYFT and look forward to trading PUT options on them in the future.

Profits UP!

Frank

The donFranko

=======================================================================================

Updated:

5/5/19 2:00 PM PST

We have another winner on the TGIF PAYDAY! strategy; and this time it was almost a 400% ROI!!! I Hope you got in on that action and now you should be starting to compound your way to a 6-figure account!!

Earnings for the week was exciting with good movement from GOOGL and AAPL, but the White Whale trade this week was on AMZN when the news hit Friday that Warren Buffet was investing into the company's shares. That news exploded the stock up over $60.00 and launched the OTM CALL options into multi-thousand percent ROI Profits UP!

If AMZN was (and it should be ) one of your "go to" stocks; and you were applying the Lotto Trade formula; then you woke up to a Moby Dick White Whale trade Friday morning!!! CHA-CHING-A-LING!!!

Even though I did not have any trade ideas posted, you MUST learn from this because it will happen again on any stock...especially stocks like: NFLX, FB, AAPL, GOOGL, TSLA, NVDA, CMG.

The KEY here is to keep laying those Lotto Trade order and you are sure to hook onto a Moby Dick trade in your future!

This chart should get you VERY excited! Because, if you follow pretty much any of the High Beta stocks for 52=weeks; placing orders on Wed/Thur/Fri with the proven Lotto Trade formula; then you will have massive White Whale winners a few times per year!

Here is the potential as you build your contract size:

Even if it took you an entire year of losing trades at $0.20, you would still have a FAT profit just catching 1 of these White Whale trades, so pick your stocks and place your orders whether I have trade ideas posted or not.

Profits UP!

Frank

The donFranko

========================================================================================

Updated:

4/28/19 9:00 PM PST

I am shifting my focus to the TGIF PAYDAY! strategy because it just keeps getting better and better as I work out the compounding rates (see the training module) and realize you can build yourself to a 6-7 figure trading account in a few short months if the markets keep doing just half of what they have already done in the past 4 months...WOW!

Ok, so if you are still looking to earnings for some Lotto Trade action, then we have GOOGLE tomorrow and AAPL on Tuesday which should give us some opportunities this week for maybe a White Whale or Lotto Trade.

The hot action right now is in QCOM and AAPL since they agreed to disagree and exchange money for patent infringement lawsuits. This has put a fire under QCOM and it looks to be well on its way to $100 so selling some Bull Put Spreads should be some easy money .

As for trading GOOGL or AAPL, those options are going to be priced too high for a Lotto Trade, so you need to wait and see what the results are post earnings and lay some fishing orders on Thur/Fri. for a potential end of week profit taking or parabolic move.

Another one that could make some good moves is SPOT which reports BEFORE the open on Tuesday.

Profits UP!

Frank

The donFranko

=========================================================================================================

Updated:

4/14/19 9:00 PM PST

Earnings season kicks off this week with NFLX and it's going to be a potentially WILD mover this week now that the DIS news started to crush it on Friday.

I am ready to catch a Moby Dick if the stock gets crushed; and I am thinking any pop is a definite short; so I will be doing some White Whale fishing post earnings too—See all my comments on the NFLX page.

What is REALLY EXCITING is my epiphany I had on Friday after reviewing my day trades on the SPY and NFLX that should have worked out much better for me than they did, but I was too nervous getting in late on the NFLX news and took profits way too early—I know, you can't go broke taking profits.

Well, when the pressure comes, you either shine or die; and I think I have discovered a strategy that will open the floodgates of profits for us in the coming months and I am sharing it with you.

I am calling this the TGIF PAYDAY! strategy.

When we start to implement this new strategy, you will be calling me from your favorite beaches of the world because this one is going to make us ALL WEALTHY!!!

It does not matter if the markets are going up or down, we just need movement week-to-week and we will be CASHING IN!!

In fact, you're going to need to buy these soon:

Learn the basics here and then FOLLOW ME to the land of profitability!!!

Profits UP!

Frank

The donFranko

=============================================================================================

Updated:

4/9/19 8:00 PM PST

Earnings season is about to begin and things could get very exciting as we attempt to hook on to some Moby Dick trades post earnings.

If you recall, last earnings season, I spotted what could have been some massive opportunities with a couple of stocks I have never followed (EA, AVTI) ; however, I observed the action and took copious notes to get in on the next time it happens.

What happened? Well, they were slammed down post earnings; and then a massive short squeeze started the next day that drove the stocks all the way back and beyond their previous days closing price; making those who bought the calls at the open a massive White Whale style profit!

I am confident this will happen again, but you just can't pick which stock so you have to lay those orders on any stocks you follow and hope to catch onto a few winners and a Moby Dick!

The key factors to remember for catching a Moby Dick are:

1. Look at the stocks overall trend, is it up or down?

2. Do the charts have any telling signs like SGB's, DSW, B-180, Bull Flags etc.

3. Are there any SGB's in the past couple of trading days or is there a SGB zone—which is a perfect target strike.

4. Check the lunar calendar and if there is a Full Moon coming or on an earnings day, it can increase the odds of success in my experience.

5. Did they just miss estimates or beat estimates? What is important is the revenue numbers and guidance; as that will keep the big funds in the stock for the future.

6. These work best on Wed/Thur as the options get very cheap at the open when stocks get slammed down.

7. You place orders on strikes at the previous days close and/or 1 higher.

8. Put in limit orders and stagger your contract size at $0.20, $0.10 and $0.05

9. Take profits on half at 300% - 500% ROI and let the rest ride to see what it can turn into.

10. If the the stock does not fall more than the MMM, we have a good chance of a squeeze happening post earnings if all the criteria I have mentioned lines up—and as corny as it may sound, if there is a FULL move you should consider increasing your contract size on the $0.05 orders.

Once you hook onto a winner, then you can rinse and repeat on the next trade(s); compounding your contract size as you go; and you just might take a small amount of capital and turn it into a nice 5-6 figure week as I have done in the past on this website!

Profits UP!

Frank

The donFranko

=========================================================================================================

Updated:

3/31/19 4:00 PM PST

March is over and earnings season is coming again! This time, I am employing a new twist on the Lotto Trade strategies based on what I learned from last earnings season. When we see a stock get a missive pump or dump post earnings (no further than the MMM), we want to place fishing orders on strikes at the previous days closing price or slightly higher OR if there is a SGB in the past couple of days, we want strikes just under/over that SGB zone; because if there is a pump-n-dump or drop-n-pop squeeze, we have good probabilities the stock will return to previous closing prices and we can cash in!—the key here is to layer a couple of strikes and FISH for entry prices at $0.20 or lower.

This past week the markets were a bit lack luster as fund managers were shuffling portfolios for the end of quarter trading.

Most of the stocks I follow finished up LOWER than the previous quarter, but well off the lows from the end of year volatility.

Some notable stocks I follow that made a full recovery taking out the previous quarterly highs were: FB, SHOP, SNAP, CELG, BABA, ETSY, CRON, EBAY and the rocket ride was CMG—which I somehow just missed all the action??? <8-(

Other strong stocks that almost made it back to the top were: AMZN, NFLX, GOOGL, AAPL, BA, OEX, QQQ, SPX, SPY, ADBE, CGC. ACB

If the overall markets can continue the momentum, then you can anticipate all of these stocks listed will have some more momentum and that is when we can get in on some good DoubleUP! trading opportunities while we prepare for the upcoming earnings season.

The best way to capitalize on the potential is to draw in my Fibonacci retracement lines from the quarters high to the low and if these stocks drop back to the 55% line and hold, that is when you take your shots on DoubleUP! trades with options 1-2 strikes OTM.

What you want to be on the lookout for is SGB's on the daily charts; and if they appear at when these stocks reach the previous quarterly high's; then you have a Bearish bias; and if they come in at the 55% retracement; then you trade long over the SGB zone and aggressively short UNDER that SGB zone.

Now, speaking of SGB's let's take a look at the SPY and use this as the benchmark for our trade bias in the next couple of weeks.

The quarterly chart looks STRONG at the moment right?

However, when we take a look at the Daily chart we now see a SGB zone and what we want to look for is if the SPY can hold onto T1 and continue to trade above this daily SGB zone.

If it does fail here, and cannot hold the SGB at 280, then our bias changes from Bullish to Bearish for short-term trades.

We also have the same setup on the QQQ's

Profits UP!

Frank

The donFranko

==========================================================================================================

Updated:

3/24/19 4:00 PM PST

Wow, another week of extreme volatility had you on edge or over it...depending on what side of the trades you were on.

The markets were on the move after the dovish FOMC meeting; giving investors a reason to get long with no indication of rising interest rates the rest of this year.

However, like all good things in trading, the profit takers showed up on Friday and slammed down the Bulls heyday with a whopping (500) point drop—I was long 100 contracts of the SPY 287 Calls looking for a 500 point rally; and instead, it was a 500 drop...arrrgggghhhhh!—another Moby Dick opportunity that got away.

What can we learn from this and be ready to profit on the next one?

When you are biased to one side and within a point or two of being ITM, then you should buy some options in the opposite direction just in case a reversal scenario happens. That way, you have the opportunity to profit in the other direction; otherwise, if your trade does go your way, you still make huge gains even though you invested a little more into the overall trades.

Ok, so here is the plan of attack when we see this type of scenario setting up is:

1. When the SPY is in rally mode; and has moved more than 10 points from a recent drop or vice versa; and is now at previous resistance/support levels; you start to fish for options on Wed and Thurs a couple strikes above / below the pivot point.

2. If there is a SGB within a couple of days on the daily chart, then you get more aggressive on size.

3. If there is/was FOMC or economic news, you buy a couple contracts ATM and fish the OTM strikes.

4. If there is a FULL MOON you get more aggressive.

5. You lay orders on 4 strike prices at $0.20 to give you the best possible odds of getting in on the action and if the options are already prices in at $0.15 or lower you BUY IN and see what you get by expiration Friday!

It is best to do this on the SPY because these options are cash settled and the volume is massive so getting filled on large contract loads is much easier than stocks; however, this scenario can be applied to any stock you follow, but many times the option prices are going to be higher so you would have to adjust your minimum buy price to $0.50 on the higher strikes—especially on stocks like AMZN, GOOGL, NFLX, CMG etc.

Below are some examples of what can happen when you are fishing for Lotto Trades:

AMZN

NFLX

TSLA

The goal here is to keep laying those orders and compound your size AFTER you connect with winners so we can wake up to a Friday like this past one and CASH IN!

Now that we have two SGB zones on the SPY, this could be the Bear Trap TOP for the top and therefore, we are biased on the PUTS until the SPY can take out the last SGB zone.

My plan is to fish for PUTS on any rallies, and if the SPY drops 10 points, I am buying CALLS for the Moby Dick Lotto Trades!

Profits UP!

Frank

The donFranko

========================================================================================================

Updated:

3/17/19 2:00 PM PST

Movers and shakers are still continuing as earnings season is all but over...until the smoke clears tomorrow with TLRY earnings and a few others this week.

What we need to be looking out for is some overall market action because we have a FULL MOON coming and markets and/or individual stocks tend to make some moves at this time of the lunar calendar. Be on the lookout for SGB's on the daily charts and monitory your SGB zones for strike price opportunities when you are placing your fishing orders.

The SPY traded over it's SGB zone this week, but just couldn't get enough momentum to really move. Most likely because it was March options expiration and investors were winding down positions to raise capital ahead of the coming confiscation day on April 15th.

Potential market moving events this week will be the tentative Parliament Brexit Vote on Tuesday and the Fed Funds Rate FOMC Statement on Wednesday which happens to be the day before the FULL MOON that will be on a the 21st this month and that happens to be a Fibonacci 21 too!

Start fishing for some wildcard Lotto Trades on the SPY and QQQ and lets see what we end up with on Friday expiration!

Here is a good link to see upcoming news events: https://www.forexfactory.com/

Profits UP!

Frank

The donFranko

================================================================================

Updated:

3/10/19 2:00 PM PST

An interesting week of trading and a slam down on Friday from an unexpected employment report gave you plenty of Lotto Trade opportunities with more to come!

Once the DJI failed at the last SGB zone, the selling all week accelerated and now the index is poised to test the 200MA where we should expect a bounce.

Will this be just another (needed) pullback, or the beginning of a sustained Bear market? Of course we can only speculate and will know know the result for weeks, but what you can do is prepare and trade off my PROVEN patterns and SGB's!!!!

So, what pattern do you see setting up on the DJI? It's a BULL 180 and we are waiting for the next daily candle to turn GREEN to start in on some bullish bias.

When we are looking for targets, we focus on the SGB zones so I looked further back to see where the DJI SGB showed up and once again, I my SGB's are confirmed again!

Now we extend that SGB sell zone to today and amazingly we see how these ARE the ONLY signal you need to make bias trading decisions! Then you can enhance with the Squeeze, MA's and volume signaling.

I am expecting the $DJI to touch down on the 200MA this week, I am using that as my initial Fib T-Levels and will be looking to take profits on my SPY and Futures plays at T2 and T3; however, I will be keeping wild card calls in play week-to-week on the SPY because if we get that massive rally of a trade deal, then I expect the $DJI to take out T4.

The weekly chart is VERY Bearish and now a triggered Bear 180.

If markets do not get a positive China trade deal, then we are set up for a very big DROP in indexes, so keeping some PUTS in place with wild card Lotto Calls is the play for me this week.

Profits UP!

Frank

The donFranko

=====================================================================================

Updated:

3/3/19 9:00 PM PST

A new month and new opportunities to find some Lotto Trades as earnings season is all but over for the most part. There will definitely be some of usual suspects (AMZN, GOOGL, TSLA, AAPL, FB, NFLX, NVDA) that will have some movement in the coming weeks, so be on guard and ready to lay your Lotto Trade orders Wed - Fri.

Speaking of laying orders, did you see the movement AMZN made on Friday? This stock has been in sideways channel for a few weeks with multiple SGB's and then on Friday the stock took off as news was released they are opening up multiple grocery stores that will offer food and other items to compete with the more mainstream food stores like Vons, Smiths, Sprouts etc. See more at: AMZN

With the Trade Tariff deadline moved and Trump back from the N. Korean summit, the markets are most likely to keep the upside pressure going in the event of a positive announcement. Also the Fed Reserve meeting in congress concluded with a dovish tone for rate hikes and that means higher stock prices for now.

The SPY closed Friday with a DOJI at the SGB zone and if it opens higher Monday (likely) then the bias is long above $277.

For the week, I plan to work my usual day trading tactics and get ready to lay more Lotto Trade orders Wed-Fri.

There may be some good continuation with AMZN and I am liking the way AAPL is setting up to move above it's SGB zone too and so are several other stocks I watch so keep your eyes on your go to stocks and trade in the direction of momentum and SGB's!

Profits UP!

Frank

The donFranko

========================================================================================

Updated:

2/17/19 7:00 PM PST

Did you see the absolute whack job they did on STMP?

Well, of course you did, who didn't see that happen.

The chart looks like they split the stock but NOOOOOOO it was a completely decimated!

This is getting to be a ridiculous rant of mine about "missing out" on yet another Moby Dick Lotto Trade!!! arrrrgggghhhhh!!—I just want to blow my brains out right now AND I am soooo sorry I did not see this earnings date on STMP when I was updating the site last weekend; because I dang well would have posted and played a Lotto Trade on this particular stock because I have had some negative trading history with it in my past!

When they announced earnings and the news broke they lost their exclusive contract with the US Post office, and cut 2019 guidance in half, the stock was destroyed over 65% in after hours—and it freaking HELD into Friday expiration.

What I found amazing is NONE was talking about STMP post earnings on CNBC, Fast Money and even Cramer was silent! Huh??? Hmmm, I bet they were all told to go silent because BIG money was getting destroyed (along with small money getting wiped out no doubt) and they needed the stock to hold the line while they dumped and/or settled margin calls etc.—lesson learned, the talking head shows are ALL full of bullshit and are there to sucker you in!!!

If you were applying the Lotto Trade formula to this stock—something I, unfortunately did not—then you woke up to a grand daddy Moby Dick on Friday.

When stocks get whacked, the potential is astronomical and can be life changing financial windfalls; which is why I started this website and continue to search, learn and implement my proven Lotto Trade strategies!—the hard part here is finding the stocks that will have this happen again in the coming earnings quarters. Here were some that have done similar drops in the past 5 years since I have been posting Lotto Trade ideas: STMP, LNKD, TSLA, NFLX, EFX, CMG.

The plan is to do the following:

1. Carefully review ALL earnings dates on high profile stocks (if you found something I missed—like STMP—please let me know) and be sure to FOCUS on Wed/Thurs release days.

2. Place wildcard PUT orders 20-30% OTM; and if the options prices are $0.20 or lower BUY in and place more orders on multiple strike prices at $0.01 - $0.10; ESPECIALLY if the earnings releases are on Wed or Thurs.

3. If there are SGB's involved, then BUY MORE wildcard strikes and also get a couple of contracts inside a 15% move and/or sell credit spreads.

4. Check the lunar calendar and if there is a FULL MOON at earnings time BUY MORE!

Look at it this way, if you were to have bought just 10 contracts of the 130 Puts for $80.00, then you banked $45,000 in guaranteed profits on Friday!

Now, if you divide that up by the $80.00 you invested, then you would have 562 more chances to catch another one; and since we do this on earnings quarters, that would give you 140 quarters (35 years) to do it again—and we know from the history on this website, there have been over a dozen winning Moby Dick earnings Lotto Trades I have posted in the past 5 years!!$$$!!

If you want to have the best possible odds of connecting with these massive White Whale trades, then you need to start placing orders on EVERY high beta stock at earnings—which is exactly what I will be doing from this day forward.

As you build your profits, you can expand your orders into multiple strike prices and sizes to increase the potential of having a million dollar winner in your future!!

This is EXCITING and I KNOW that this will happen again in the coming earnings quarters, so I want you to be ready, and together, I hope to find us all a 7-Figure White Whale winner!

Profits UP!

Frank

The donFranko

====================================================================================================

Updated:

2/17/19 7:00 PM PST

The SPY calls eased some of the Lotto Trade model portfolio sea-of-red, so I took some profits on some of my contracts and will see what happens on the rest with the markets open on Tuesday. Hopefully, the markets rally and I can salvage more of a lousy week of Lotto Trades.

Going forward, I will be working on some DoubleUP! trades to make up some deficits we are experiencing in the model portfolio, but rest assured, there is another LOTTO TRADE WINNER coming and that will erase all the negative trades too!

All week I was anticipating some good movement since it was February options expiration and we had another potential major market mover with the government shutdown deadline; however, everything flat lined and it was a real disappointment.

Now that President trump has "declared an emergency" his hopes of building ALL of the wall will not begin until the courts haggle out the details as the Democrats have already filed a lawsuit; which puts a stay on the extra funds the executive order releases. Once the third branch of government chimes in with their steal of approval, the full money train will flow or blow.

What will be the next catalyst for the markets now that earnings season is pretty much over? Well, tomorrow the markets are closed for Washington's B-Day; and then Tuesday is a full moon, so anything can still happen this coming final week of February trading; especially with the DJI, QQQ, IWM all about to fully retrace their entire "corrections"; and that should bring some more volatility this week.

The weekly DJI chart completed 8 weeks closing at the high which indicates investors are putting the buy pedal to the metal, but the daily SPY chart still has that topping SGB zone to clear so keeping some PUTS at strikes around the lower SGB is a good hedge bet.

Is there a potential "crash" coming in the QQQ? We have 2 SGB's this past week on the daily chart and Friday was a SGB close at the 200MA; therefore, I am definitely going to have some wildcard Lotto Trade PUTS in play this week on the QQQ's; and will be ready to trade in the direction of momentum if the markets take off from here.

With March Madness coming up, I am sure Market Makers are looking to slam dunk a few stocks in the coming weeks, so we just need to keep laying orders and see how many 3-point shots we can make in March!

My plan is to start placing some Lotto Trade and DoubleUP! orders on the indexes and select stocks and or course, always be on the look out for SGB's; trading strikes in the direction of momentum for the best odds of catching some BIG opportunities!

Profits UP!

Frank

The donFranko

=================================================================================================

Updated:

2/3/19 11:00 PM PST

A nice week of earnings moves and FB was a nice Lotto Trade WINNER!

On the other side, AMZN was whacked even though they had good numbers and if you were watching the after hours trading, then you may have noticed the oddball high print at $1,777.77! HMMM...I have pointed out multiple times on my site that there is SIGNIFICANCE when you see oddball prices...they are "code" to insiders if you ask me!

I was anticipating a larger upside move on the SPY once the news hit over the weekend that President Trump opened up the government again; however, that rally was diminished since he basically put a 21-day "stay" on his touting he will use "emergency" powers if the Congress does not approve funding. Therefore, we can continue to expect some caution as we approach that deadline. In fact, if you looked at how investors reacted to AMZN earnings (-90+), you know BIG money is NOT interested in committing large capital at this time.

On Friday I saw the SPY starting to SGB so I bought a straddle for Monday expiration as a test. We still have the 200MA on the daily chart at $274 and the SGB drop zone at $264-$268. If you are planning on making any trades on the SPY, be sure to have strikes at the SGB zones and pick up some wildcard PUTS/CALLS because the president is going to have a meeting with the Chinese president around 2/27/19 unless other circumstances change beforehand. We know that if they do "cut a deal" the markets are ready to explode higher; and if things go negative, we could be in for one hell of a drop and long-term correction.

The bulk of the stocks I like to trade / follow have reported earnings, and this week the last of them are lined up, so if they do not pick up the pace, the only thing left is the trade war meeting at the end of the month.

My plan is to continue to make some earnings trades, and keep laying my weekly Lotto Trades on my "go to" stocks!

Profits UP!

Frank

The donFranko

==================================================================================

Updated:

1/27/19 12:00 PM PST

This week is a BIG earnings release on several popular stocks including: FB, AAPL, AMZN, TSLA and BABA and I am hopeful there will be a couple solid Lotto Trades for us to profit on!

President Trump announced a 21-day "re-opening" of the Federal Government and will be in negotiations with the con-grass-smokers-association on the funding battle for the "wall" to end all walls. Well, that may or may not happen, but it could give us a nice wall-of-worry in the markets this week and that typically means UPSIDE pressure.

If we get some strong or negative earnings reports, that should also add some fuel to the fire-sale or lift-off as investors decide their bias for 2019.

All I know, is a 21-day stay from President Trump, can still become a Humpty Dumpty event for the stock markets if he shuts it down again; and/or declares a national emergency ("everyone knows I have a very powerful alternative, but I did not want to use it at this time...hopefully it will be, un-necessary") to force the funding of his wall—of course, this can create a lot of Lotto Trading opportunities for us as volatility should still be very strong all year!

There are several SGB's on many stocks that should be your pivot points and bias trading directions. The SPY has recovered all of the December slamming and if it opens over $266 tomorrow, we should expect a rally to at least the 200MA and/or the topping SGB zone!

Keep your fishing orders on, and may you hook onto a Moby Dick soon!$$!

Profits UP!

Frank

The donFranko

===================================================================================

Updated:

1/19/19 12:00 PM PST

What an exciting week of trading we had with NFLX earnings; and then the Moby Dick trade opportunity with TSLA on Friday...WOW! (see TSLA comments here).

The government shut down has lingered on; and that makes for an interesting market; as there seems to be a large BID holding things up; because you would have thought this scenario should have had a very negative impact dragging down the $DJI, SPY, QQQ and several stocks; however, there is pretty much NOTHING that will crush the stocks markets anymore—just correct things from time-to-time.

There was a news story on Wednesday that a potential China deal was going to be cut and that spiked the markets higher; however, quickly faded but showed there is plenty of interest for investors to jump back on the BULLS wagon. Many times, when you see this type of action, it could easily be manipulation for BIG money/funds to SUCKER in investors to sell off their positions. And if you are watching the SGB zones on the SPY and QQQ, then you definitely want to be fishing/buying wild card Lotto Trades on the SPY and/or QQQ.

The $DJI has now retraced the two SGB zones and just about closed at the 200MA on the daily chart so now you want to start fishing for wild card Lotto Trade PUTS on the SPY until the $DJI can take out T-4 on the weekly chart.

You may want to also do the QQQ too because if earnings season goes bad (NFLX had mixed results) then the QQQ could easily resume the correction.

We are now under way with earnings season, and since NFLX had a mixed report, investors are more likely to be cautious on the FANG stocks which may give us a chance to get in on the cheap. I have some trade ideas going on FB and AAPL and will be looking for more, but be sure to keep your fishing orders place every week on your "go to" stocks and may you hook on to a TSLA Moby Dick trade in your future!!

Profits UP!

Frank

The donFranko

================================================================================

Updated:

1/13/19 12:00 PM PST

The battle of minds vs. matter of fact as the 2019 trading year begins. This past week the DJI completed a nice T4 Bull 180 retracement (back through the SGB zone) since it "technically" bottomed the day after Christmas; giving investors the "Santa Clause" rally we have not seen for a couple of years. Now that we have that ZONE in play, that is where our bias will be going forward. If the DJI holds above 23,500 we remain bullish and a move back under is a potential slam down back and beyond that bottoming low.

It pretty much will hinge on earnings and whether the battle of Trump vs. everyone else continues to linger in the ongoing government shut-down. Of course, once the angel dust the dems are sniffing subsides, the markets have the potential to explode higher because the Trump administration is poised to spend BILLIONS on a "wall" and infrastructure projects. The two clowns purporting to represent all Democrats are probably clamoring for their "cut" of the Trump spending pie before they acquiesce to the "wall" that Trump campaigned on and will deliver in one form or another.

Here is a breakdown of what Trump wants to spend for 2019:

$80B on Defense

$21B for infrastructure

$10B for Opioid treatment

$2.2B Nucliear Security

$600M Increase for Commerce

$47.5B (a 5.1B Increase) for Homeland Security ($1.6B for the wall with a total of $18B over 10 years)

$6.8B for Veterans Affairs

$1.5B fund for Wildfire suppression

This type of spending wont trickle down into the economy, it will SPILL OVER and increase the American workers paychecks because money in is money spent with today's gotta have it consumers.

Now that the markets have had a nice (much needed) correction, they are poised to make another sustained move; however, will that move be UP or DOWN is the big question. Most news outlets I am monitoring pretty much say we are now in a bear market; and historically they last on average 1.4 years with a cumulative loss of 41%; but that is just statistics and not the future.

I for one would welcome a long bear market because that increases volatility and that is exactly what we need for massive winning Lotto Trades!!!

If this is just a "correction" then get ready for a substantial move higher once the political bickering is done and the checkbook is opened for business!

For now, the "HOT" sector to keep an eye on is the cannabis stocks; and TLRY (my new "go to" stock) is the leader of the pack. Other ones to consider are: CGC, ORHOF, WEED, IIPR, ACB, APHA—the GREEN rush is on and there will be plenty of highly-profitable-opportunities ahead!—pun intended...lol.

As we move forward this year, I hope to find us some excellent Lotto and White Whale trades and may we all have the 6-figure Friday this year!!!

Profits Up!

Frank

The donFranko

===========================================================================

Updated:

1/8/19 5:00 PM PST

A new year of opportunities are about to begin as we enter into the first quarterly reporting season that will build a catalyst for investors to gauge their investing appetite this year. With a very tumultuous final quarter, the markets are definitely on the skittish side; which gives us EXCELLENT Lotto Trade opportunities because volatility is when we can CASH IN!!$$!!

My plan this year is to focus on a new twist to my proven Lotto and White Whale strategies by placing multi-strike fishing orders on my go to stocks (FB, NFLX, SPY). I will be placing orders on 4 strike prices inside a 10% move from Fri - Mon, then 5% move Tue - Wed, and finally 3% move Thur and expiration Friday.

I will place bids at 10-15% of the previous days closing price; and place them as GTC orders with the full intent on getting filled—win, lose or draw.

I will start with (1) contract loads; and once I do get a fill; I will look over the chart, news and overall momentum and decide to add or adjust my strikes from there.

Next, I will keep my eye out for SGB's and will apply the new formula to those stocks as that has PROVEN to be an excellent signal of pending doom or boom on any stock!

Finally, I am starting a new page for my DoubleUP! strategy where I will post trade ideas with the goal of making a 100% profit in a single day. I will start with 2 contracts, and once I connect with a winner, then I will increase the contract load on the next trade by 50% with the goal of taking a small account ($3,000) and growing it into a 6-figure account in 2019!!

I hope all of my subscribers have their best year of trading success as we begin a new journey together!

Profits Up!

Frank

The donFranko

====================================================================

Updated:

12/3/18 11:00 PM PST

Today the markets had their best day in weeks when news a trade deal with China was settled...well actually its more of a temporary truce.

Saturday’s working dinner between President Donald Trump and Chinese President Xi Jinping at the G20 summit in Buenos Aires was a “highly successful meeting,” according to a statement released by the White House. Trump agreed to leave the U.S. tariffs on $200 billion worth of Chinese goods at 10%, effective January 1, 2019. The two leaders have agreed to begin negotiations on reforms and set a 90-day deadline.

This is the catalyst that could ignite a massive rally in 2019; however, it looks to be more of a gap-n-crap scenario that is being SOLD today; and if that is the case, then we have an abandoned baby DOJI setup on the daily chart.

The other news that is giving pause to what should have been a very nice sustained rally is an inversion of the Treasury yield curve; and that typically indicates a possible recession is in our future.

We are now in the final month of trading for 2018, and this last quarter has been quite the roller coaster ride. Will the markets finish the year in the green or red? Nobody knows for sure, but now that the congressional elections have basically "split" government, that means more uncertainty in 2019; and until major fund managers see how the Dems will react with Trump; you can pretty much be assured no big bets are gong to be placed for at least 1 - 2 quarters—all indicators appear that the $DJI will finish in the green for 2018.

Looking at the monthly QQQ chart, we can see December is starting out as a SGB; and is currently testing the Jan 2018 high. If this continues to be a SGB by the end of the month, we better be fishing for PUTS, especially if the SGB (from the daily chart) zone above is not taken out.

The SPY is also a SGB today on the daily and the monthly charts, but we have a whole month of trading before we know if this is significant; however, keeping your wildcard Lotto Puts in place on the SPY and QQQ's would be a good bet for December as a hedge if you are long stocks.

Profits Up!

Frank

The donFranko

==============================================================================

Charts Udated 11-27-18

Updated:

11/25/18 11:00 AM PST

WOW, what a CRASH cycle we have been in all of November. If you were buying PUTS on the QQQ and SPY as I have been suggesting, then you have protected yourself and/or made HUGE profits!! Now we have another SGB on the SPY and QQQ this week EXACTLY at the last SGB zone that started a HUGE rally on the QQQ, so that MUST hold here or the Bears are still going to continue to eat the BULLS Breakfast, Lunch and Dinner!

What I plan to do is start fishing some CALL strikes up to 15% OTM, but put in super low bids at $0.10 and if I get filled, then I will be looking to add to my positions when the QQQ's move over the current SGB zone.

I will continue to keep PUTS in play on the QQQ and SPY as this market is now scared money most likely for the rest of this year; and could see some HUGE continuation moves down to the 200MA on the weekly chart if that SGB zone does not hold.