9/12/12- Bought my two positions at the open:

Unfortunately CMG could not keep the morning momentum going and these trades are now expired. Next week is earnings so I am hopeful there will be a big move in either direction.

============================================================================================

9/11/12- Ready to eat at the profits trough? Next week will be a highly anticipated earnings release on Thursday. If CMG beats in a big way, then the shorts are sure to cover and we could have another MASSIVE winner here at OptionRadio.com!!!

With all the negative, news, downgrades, short sellers and negative-commentators, CMG is poised to teach 'em all a lesson...or will it be a case of earnings poisoning and the woodshed will be teaching the lesson. with YUM kicking in a good quarter, it sprang some hope back into the stock that was quickly sold the past couple of days; however, volume was only average, so there are still some buyers lurking about. With the stock now testing the support at $280 for the third time, this stock must beat or it will be beat down down and down some more.

There appears to be more long bias on the calls for next week.

Short interest is still very strong and

climbing ![]()

With 4.8 days to cover, a blowout will bring a HUGE move on Friday. With a miss then look out below for the rest of the year.

I plan on getting a straddle on next week and picking up a Nov put in case they miss, which is expected across the financial commentary I have reading. Oh but this type of crowd psychology is what makes for the White Whale trades!

The daily chart is showing more downside potential coming, espeically if CMG closes under the Hammer from 8/3/12 at $277.00 with a target price at the 200MA.

The 15minute charts shows that CMG has been hugging VWAP all week. This usually means big money is getting OUT when a stock is beat down.

Now will tomorrow be a repeat of last Friday?

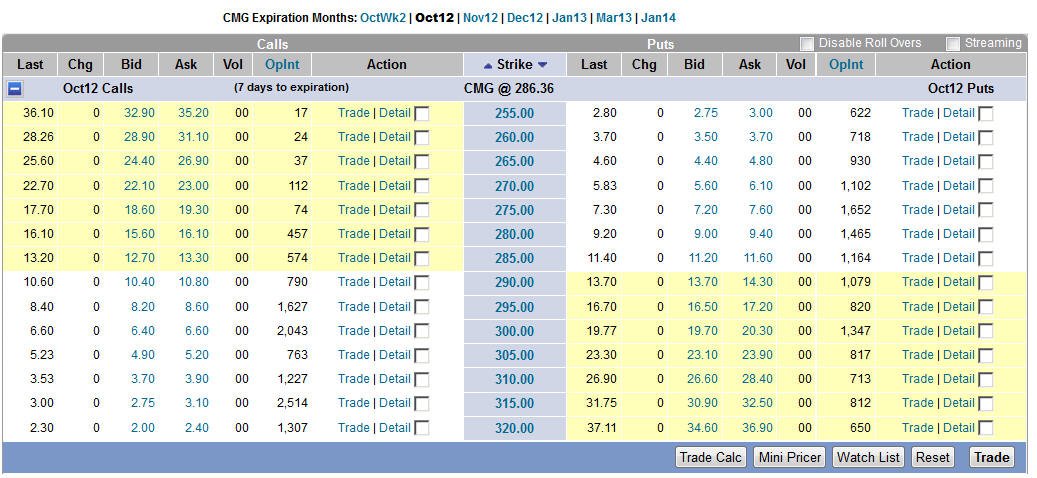

Looking over the Puts that are $10 OTM they cost .45 at the close today:

![]()

The $10 OTM calls are .35

![]()

With CMG at a triple bottom, a failure could bring a nice drop yet again. My hope is the stock opens flat tomorrow and that way I can get on board both sides and see what the day brings.

Profits Up!

The donFranko

=============================================================================================

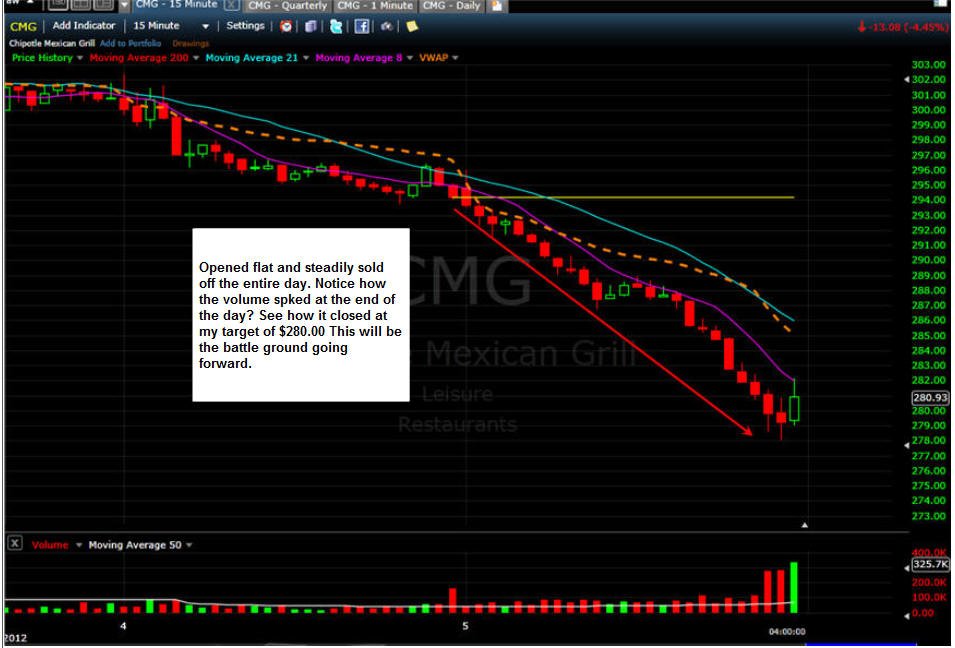

9/5/12 - WOW what a day to be short CMG and if you were looking for a trade today, then you got the chance to make a bundle.

Unfortunately for me, I was not looking for a trade and missed out on this one 8-(

This does not mean we missed the boat, it just brings us closer to a massively profitable trade when earnings are released on 10/18/12. That has the potential to make a move of 10% or more! If they beat estimates and surprise, you know there will be a massive short covering rally in this stock. Currently the short interest is 3.2 millions shares which means it would take 3.1 days to cover. After today, I expect this number to increase so we will keep an eye on it here.

Here was the action today on the Puts:

I will be looking for the dead cat bounce next week.

Ok so what is the potential if you are on the right side of a stock like this for the entire week?

This was the $300 Weekly put chart. You could have bought on 10/1/12 for $.50 cents and had you held to today your profits would have been $20.00 or 5,000% ROI off a $40 drop!!!

The KEY to this is picking a strike price that will be In-The-Money (ITM) by Friday. Trading options (especially puts) around benchmark prices like $300, $200, $100 etc. can get you a very nice profit when the stock sells off!

I am on the hunt for the next winner like this one became!!

Here is the chart for the OctWk2 $310 Calls. These options can be bought for $0.25 cents per contract today. I will pick up a couple of them on Monday and lets see if CMG can recover all of this weeks losses. There was 236 contracts traded today and open interest is 174. If CMG can rally back up 10-15% next week, these could be worth $10 - $20.

Now if the selling continues, I would say CMG could fall another 10% before it finds major support around $250 - $240 so here are the OctWk2 255 Puts currently at $1.00 per contact

Profits Up!

The donFranko

====================================================================================================

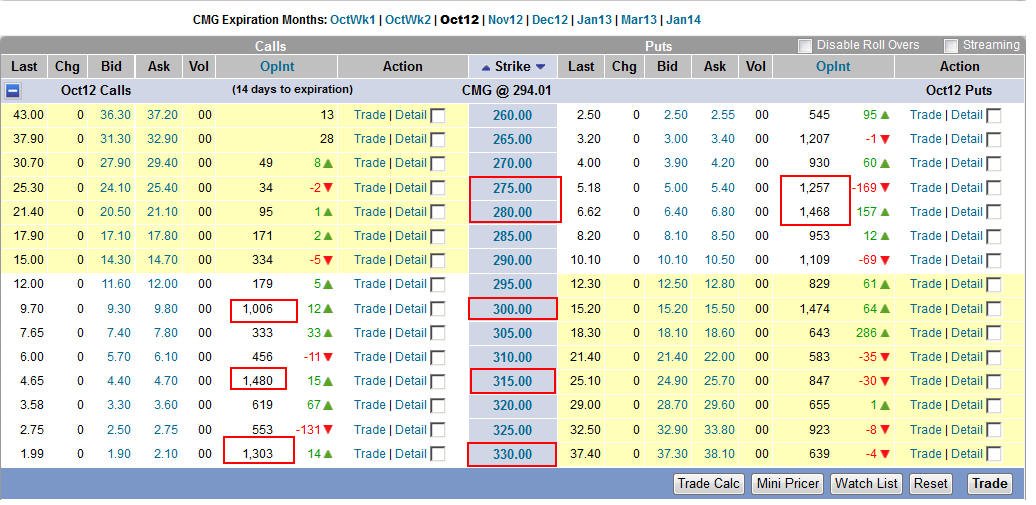

9/4/12 - I have been watching CMG since I stopped out of it a week ago. This stock received a negative news report and downgrade by an influential short seller David Einhorn said the valuation of CMG is just outrageous. He said it was way over valued and to SELL it SHORT. This caused the recovery rally that was under way and now the stock has headed back to the bottom of the barrel. Today's close at $294.01 which happened to be down ($6.66). What a very interesting number to be down and what's with the .01 penny close? All this is looking to be very fishy to me. In all my years of trading and watching stocks, I have to say that when you get oddball pricing like this, that is definitely somebody "telling" someone something.

Can I confirm that? Of course not, but I am merely pointing out this is not typical. So how can we determine if it's a hidden message? Well, the best way I know is to watch the options open interest. Of course, once this stock plays out, we will be able to look back at this days close and say, yup, I knew it!

Looking over the options, we can see there is definitely some speculation that CMG will head back over $315-$330 but will it happen? Well, this is still a much loved company by the hedge fund manager types, and the company is still on the grow, so it certainly could be a possibility. Earnings are coming out on 10/18/12 which happens to be the day before Oct expiration, so if they miss or surprise, we stand a very good chance to make a huge profit on Friday the 19th!

The selling has been consistent for the past 12 days. Tomorrow will be the final test of the stocks resolve a the $280 mark. If they miss again when earnings come up, it's going to most likely going to drive this stock back to the low 200's.

So, is Einhorn right? Let's take a look at some stats:

Looking over this information you can see the company is a multi-billion dollar heavyweight, but the PE Ratio says the stock is only worth $26.97 per share going forward?? Oh, and if you liquidate the company, the stock is only worth $7.39 per share. So why is this stock trading in the $300's?

Well, it certainly is not because ma and pa are buying the stock. It's simply because fund managers a.k.a institutions control this stock.

As you know, I am an opportunistic PUT buyer and if Mr. Einhorn is correct, the Lotto Puts I am going to place before earnings are poised to make a lot of profits. BUT, if the company winds up surprising, the Calls will potentially make a new record for my Lotto Trades! Either way, I am looking forward to a big winner coming up!

In the meantime, there could be some good day trading opportunities as we head into earnings season. I will be watching for some solid chart patterns to jump on some traded with.

Profits Up!

The donFranko