Option Plays - CMG

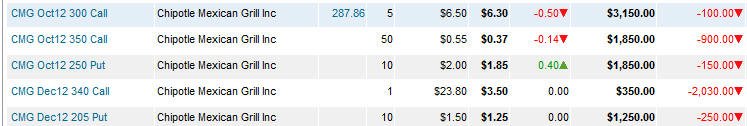

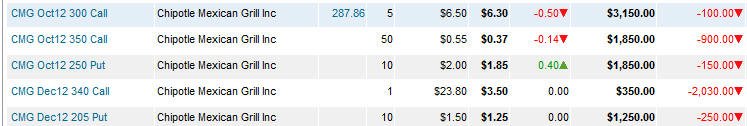

These are the results from trades suggested on our "Current Plays" list.

Note: they are suggested entry and exit points! disclaimer Profits Up!!

----------------------------------------------------------------------------------------------------------------------------------------

----------------------------------------------------------------------------------------------------------------------------------------

LAST UPDATE: 10/19/12

----------------------------------------------------------------------------------------------------------------------------------------

Previous Plays: 1 / 2 / 3 / 4 / 5 / 6 / 7 / 8

|

Play Recommendations: Play 7 |

|

|

Lotto Weekly Options:

Oct12 (expire Friday)

250P (Closed) (My Bias) 300C (Expired) 350C (Expired) (lotto trade) |

Monthly Options:

Dec 205P (Open)

===============

Dec 340 C (open) (see play 5) |

|

10/19/12 - Cha Ching on the PUTS - CMG continued to sell of today making my Lotto Trade another Success!!! It was not the massive success I think it could have been had is not been for the botched up early release of GOOG yesterday, but this one still made a nice profit. The Dec12 205P have nearly doubled, so we will have to see how those come along as CMG starts, what I hope, is a long term decline. Even though this stock has missed twice now, it's still a viable growing company so there will be buyers along the way. If they miss the next quarter too, then it could be a long-term decline for the stock.

MY OCT12 250P LOTTO PUTS BANKED!!!

The DEC12 205P have already doubled but CMG still has a ways to go so we will see what happens.

============================================================================================ 10/18/12 - CRUSHED CMG missed earnings estimates, had lower revenue and weak comp sales. This was expected and the after hours trading proved it with an 11% drop. I need it to continue to drop a little more tomorrow to get my Put contracts ITM for a guaranteed profit. At this time, if we are still OTM at the open then you have to take what you can get. With all the drama around GOOG today, the impact on CMG looks like it will be less than I expected, but we still have to wait and see if it can make the drop to the 200MA.

Here are the highlights:

Well I pegged the drop at $250 but CMG managed to pull up in after hours trading. I need it to make another leg down in the morning or my play will most likely result in a zero. Thanks to the GOOG mishap, all my plays were negatively affected and I we should have made a boat load of cash had things gone the way they were supposed to. We shall see what the market brings tomorrow.

I am going to get whacked on my calls, but I will just trade around the stock over the next couple of months to get that money back.

============================================================================================= 10/17/12 - Tomorrow is the big day!! CMG has been trading in a $10 range since the last drop to support on less than average volume. This indicates there is not that much buying interest and the selling will be hard if they miss. Today, the stock closed on a whole number. Remember, when I see Fib numbers or whole number closes, I view that as "code" type signaling a change is about to happen. All stocks are controlled by Specialists on the Dow and Market Makers on the NASDAQ. It's possible to be a coincidence on the NASDAQ, but not on the Dow. What we have to do is figure out what the significance of a whole number close could mean?

I look at charts, OTM options volume/open interest and past earnings reactions to help me choose a bias.

Ok, so lets start with the Charts:

First up the 15 minute chart is where I look at the Candlestick wicks on the largest volume spikes. The past couple of days indicates the selling is stronger and the last 15 minutes of trading today shows me they were exiting this stock.

The daily chart shows the institutional love for this stock may be over because every time it rolled over the volume was very heavy. The last earnings quarter resulted in a massive 24% DROP in one day. This can only be accomplished by institutional investors, and when they stop buying the bottom can be endless. The only saving this stock may have for the short term is a massive short covering rally should they beat estimates by a wide margin and have an extremely positive future projections...which does not seem likely. Then again, with YUM and DPZ having strong quarters, there just may be some surprises coming for CMG.

Weekly chart for targets:

Monthly Chart

If they miss and guide lower, the long term target for me will be $160

Here are the options:

My bias is to overweight the stock with puts and pick up a couple OTM calls for the Lotto play in case of a short squeeze surprise.

Profits Up!

The donFranko

============================================================================================= 10/16/12 - We are almost there!! Big increase in the calls showing sings that more investors are thinking short covering rally is about to happen.

Profits Up!

The donFranko

==========================================================================================

10/15/12 - CMG started out of the gates running for higher ground. This week is going to be a game changer for CMG when they announce earnings on Thursday. I can cant wait to see how Friday turns out, and I sure hope its a day to celebrate!

The options are picking up some volume on both sides, but the charts below look a little deceiving so keep an eye on the numbers more than the graph.

Profits Up!

The donFranko

========================================================================================

10/14/12 - CMG needs to keep holding the $280 price range heading into Thursdays earnings report. If they beat, and surprise, we could get a very strong short covering rally on Friday. Of course, if they miss (which is expected by many analysts) I am not so sure there will be a massive drop, but I am confident the trend will be a long drop under $280 for the next couple of quarters. The first stopping point will be at the 200MA around $220-$225 and then $150-$160.

Weekly Options Tracker:

Profits Up!

The donFranko

|