|

2/13/13 - CMG lost it at the 200MA yesterday and the selling continues today. I think it will definitely continue down if the markets do too. I am flat for now.

====================================================================================== 2/11/13 - The party is losing momentum unless CMG can clear the 200MA. If it does, I suspect it will be a gap over it and if that is the case, it must hold that gap. A simple rise through it leave the stock vulnerable to a sharp pull back.

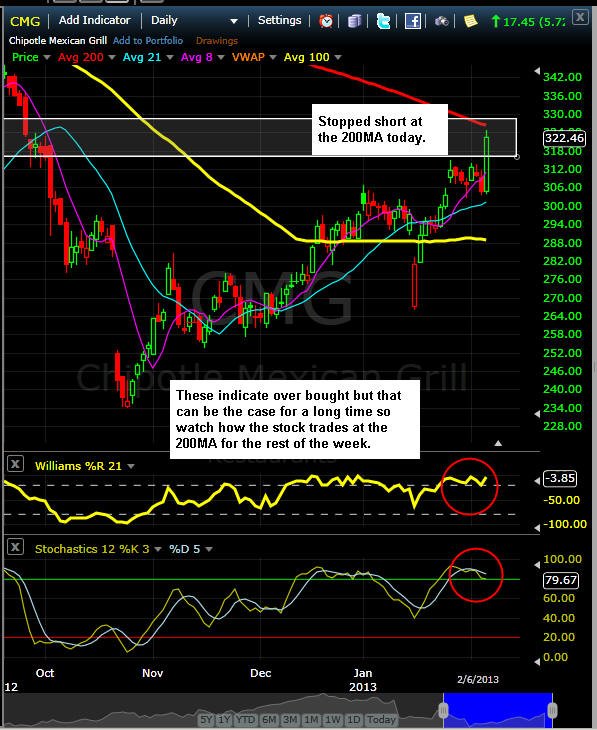

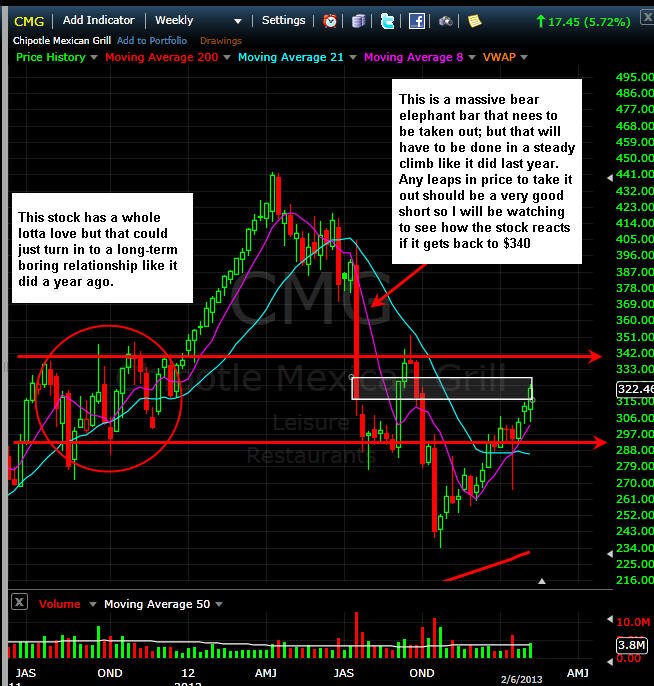

============================================================================================== 2/6/13 - The love of institutional investors seems to be back on track now that CMG earnings have been released and the bad news was leaked over two weeks ago—a brilliant move by the CEO to keep his stock moving forward. With the stock stopping today just under the 200MA, that will be the final test of the bullish resolve and if it fails, you can jump on shorts for a retest of $300.

=================================================================================== 2/3/13 - CMG made a decent move higher in unison with the DJ taking out 14,000. So long as the DJ keeps moving higher, CMG will too. I am sticking to my Long stock and will short if CMG falls back to my entry price for now. First level of resistance is $317.00 - $329.00

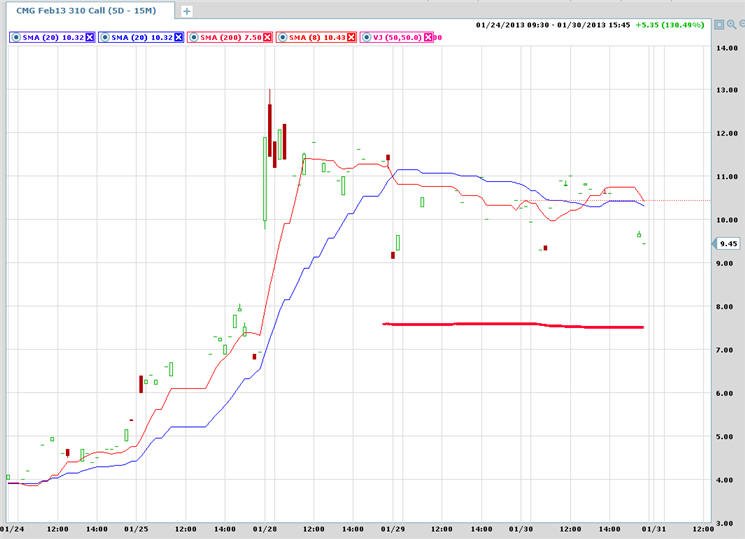

========================================================================================== 1/31/13 - My call play was profit stopped out today. CMG is pulling back and I will wait to see if my short side is triggered or wait for $314.55 to be taken out for longs. Trading options in this stock is difficult and heavily priced in with premium. You need to wait for a clear signal and buy extra time for the trade to work itself out. For me, I just prefer to do my weekly lotto trades looking for a sudden move up or down, so I will be doing that tomorrow.

============================================================================================ 1/30/13 - Struggling to keep the breakout going but I am still optimistic CMG can go higher with market support. I may get stopped out of my options tomorrow and if that happens then I will just keep working the shares.

====================================================================================== 1/28/13 - Ok, the breakout has started and I am now long stock and options. I will stop out of my options at $7.00 and stock under $300. My target price for CMG is $320 - $328.00

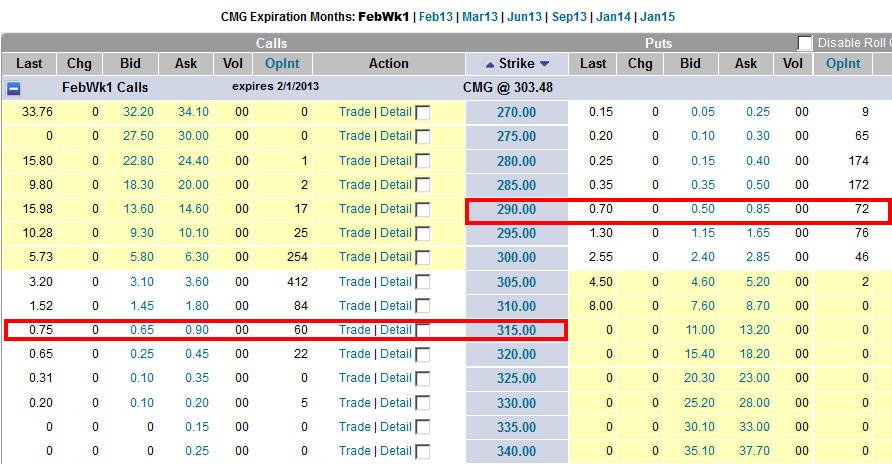

================================================================================================ 1/27/13- As we approach the month end, CMG is now in the final test at $300 which has proven, so far, to be strong resistance. This stock still has a lot of analyst love so it could still be on a growth path for 2013, but in the short term, I will be shorting under $298 with a stop at $305. CMG still has upside range to $345-350, so if the markets push higher, CMG will most likely rise with the tide. Now if that be the case, then taking a long position on the stock with a stop at $298 would be in order. So here is how I plan to play this stock with options next week. I will buy 1 weekly option contract two strikes OTM in the direction of the stock each week. That way, if CMG were to catch a bid and rally, I will make some profits along the way. I much prefer to buy puts because they improve in price must faster than calls so if CMG fails to take out $305.00 then I will be looking for puts. Why would I only buy week to week vs. month to month? Simple, the implied volatility in longer term options is packed with premium, so why pay for all that time when you are just looking for sudden price movement. If you were to buy the Feb13 315 Calls then you would pay $5.40 for the next three weeks of time vs. .90 cents for the next week. So, if you divide $5.40 into 3 then you would be effectively paying $1.80 or twice as much. Weekly options tend to have larger swings in price movement because you are not cannibalizing the moves in the short term with excessive premiums. Once I start making profits, I will build larger contract loads to compound my earnings over time.

=================================================================================================== 1/24/13 - Final test at $300 coming tomorrow or early next week. If CMG fails to get back over $304 then I will short it with a strict stop.

================================================================================================ 1/22/13 - No follow through today and I suspect the three day rally was nothing more than short covering. If this stock does not get over today's high then I will get short.

Profits Up!

The donFranko

|